✍️ Maverick Charts & Markets - October 2024 Edition #22

Nvidia, BlackRock, Ackman & Netflix, Tesla, TSM, S&P 500, JP Morgan, Hermes, Gold, Carvana, Alibaba, Uber, On vs Nike vs Hoka, The Trade Desk, Taxes, Wealth, Patents & Innovation

Dear all,

there you go with October’s 20 charts + 5 bonus that I carefully cherry picked.

Report structure is as always:

📊 Maverick Charts & Insights

👍 Bonus charts: Gold, Taxes, Wealth per Person, Patents & Innovation edition

Delivery is in typical Maverick fashion, via charts that say 10,000 words covering Macro, Stocks, Bonds & more which also naturally connects the Geopolitics dots.

📊 Maverick Charts & Insights 📊

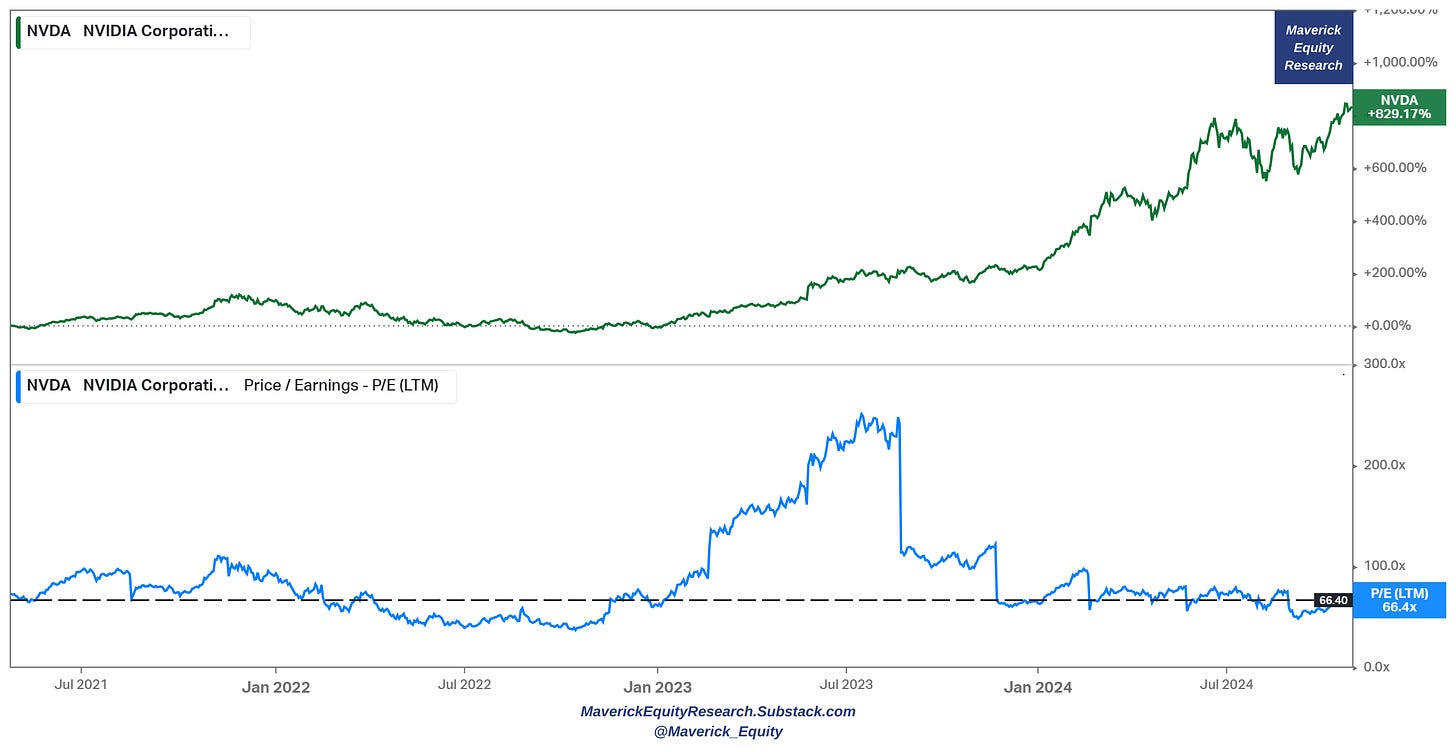

Nvidia (NVDA) valuation fun fact:

👉 after a whooping 839% return since Q1 2021, it trades at the same P/E of 66x as back then … let that one sink in!

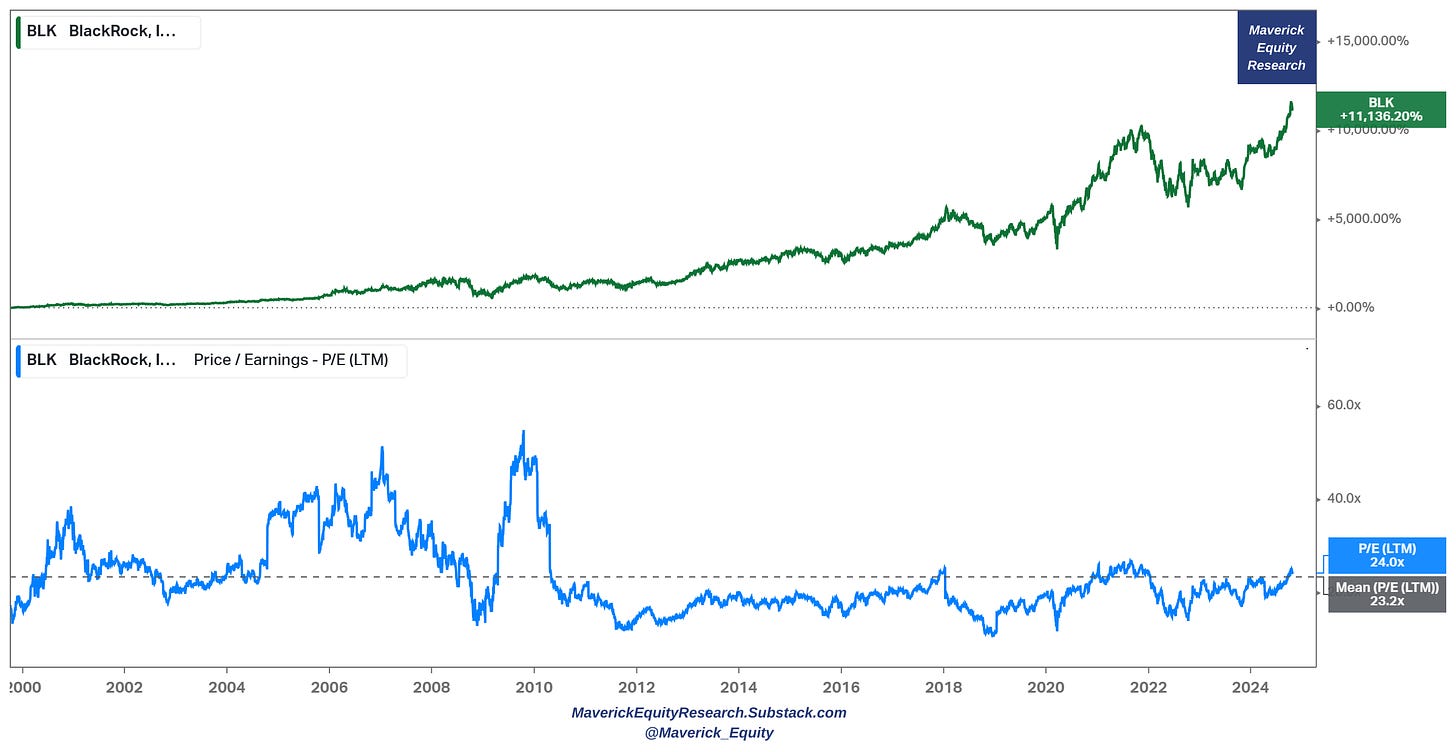

2 & 3. BlackRock (BLK) with a record $11.5 trillion in assets under management

👉 has compounded like no other with over 20% CAGR since their 1999 IPO

👉 trades at a 24x P/E (LTM) which is just around its average, and it is materially below the market’s (S&P 500) 29.6x P/E (LTM)

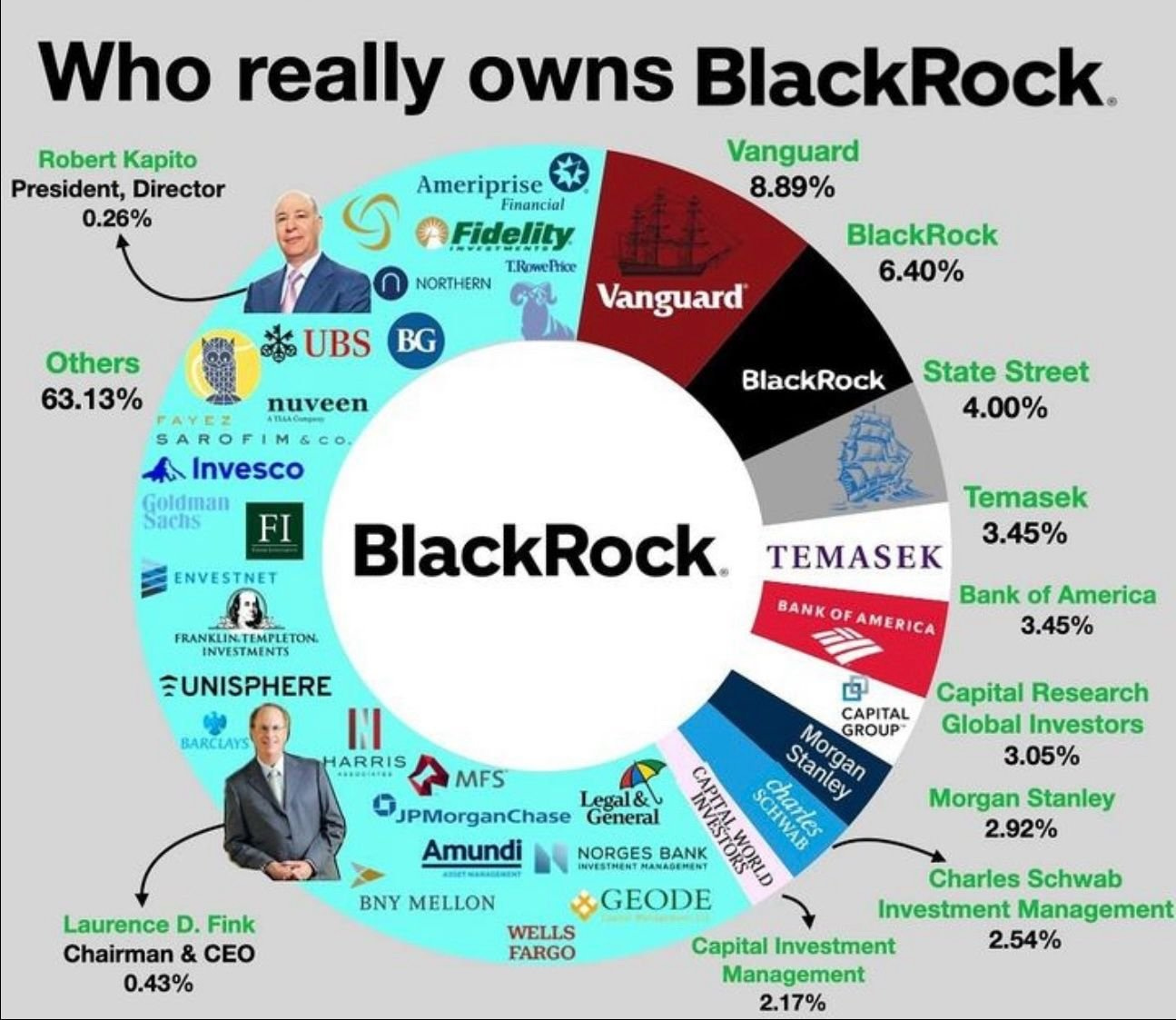

But who really owns BlackRock? It's a but like owning the owners ... the managers of the owners of capital ;)). Meaning: it is mostly institutional investors ... investment firms and asset managers, (similar to BlackRock) which manage and hold financial assets on behalf of their clients ...

Bill Ackman likely not ‘Netflix-ing & Chill-ing’ these days …

👉 in January 2022 Ackman’s Pershing Square Holdings acquired 3.1 million Netflix shares, previously worth around $1.1 billion. Less than three months later, the firm sold the entire stake — resulting in about a $400 million loss on the investment

👉 not only that, but since then the stock rallied more than 300%

Maverick’s take & joke:

👉 this is not at all me dunking on Pershing Square Holdings (not my character at all), it is simply a reminder how these things happen even to the top chaps in the industry, hence no worries when you get yourself one of these episodes …

👉 while the joke is, we can be very certain there wasn’t any insider information around the entire journey of the trade …

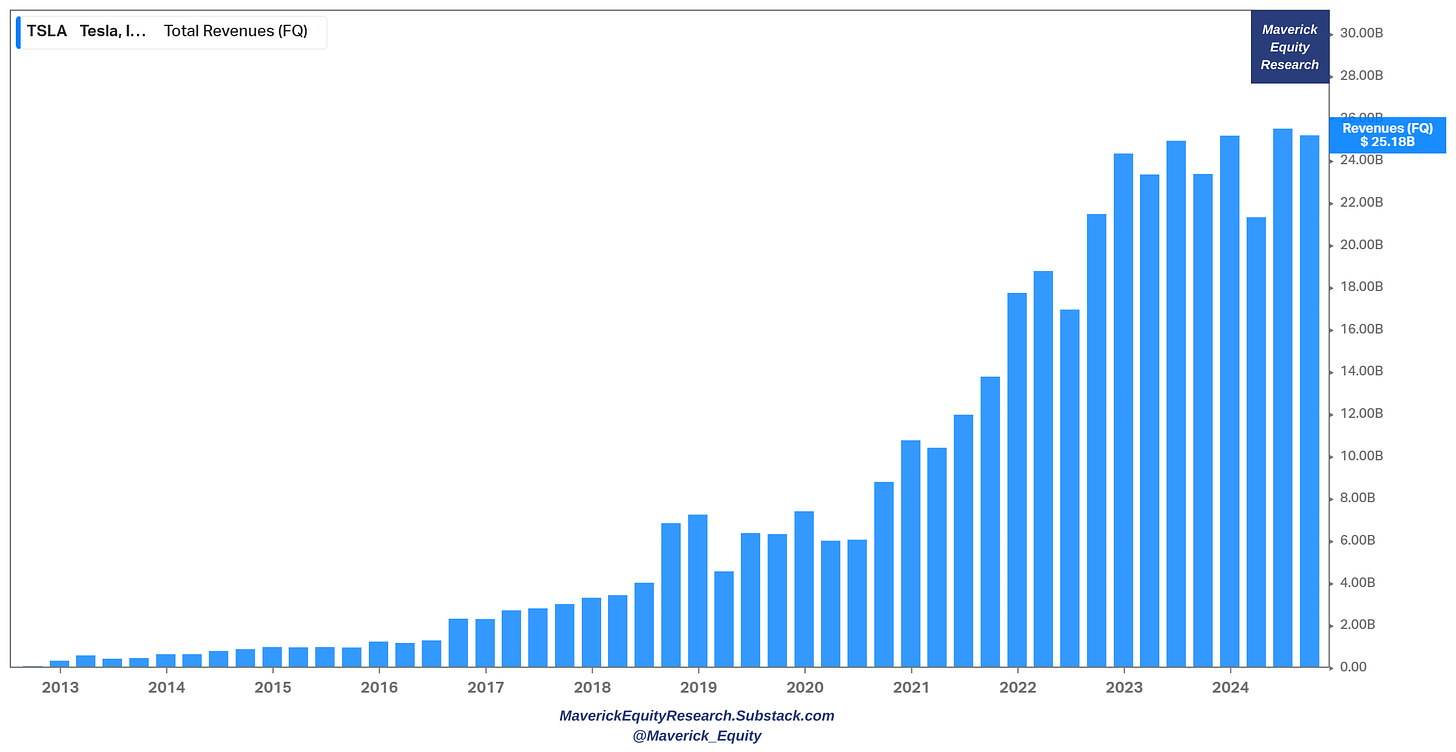

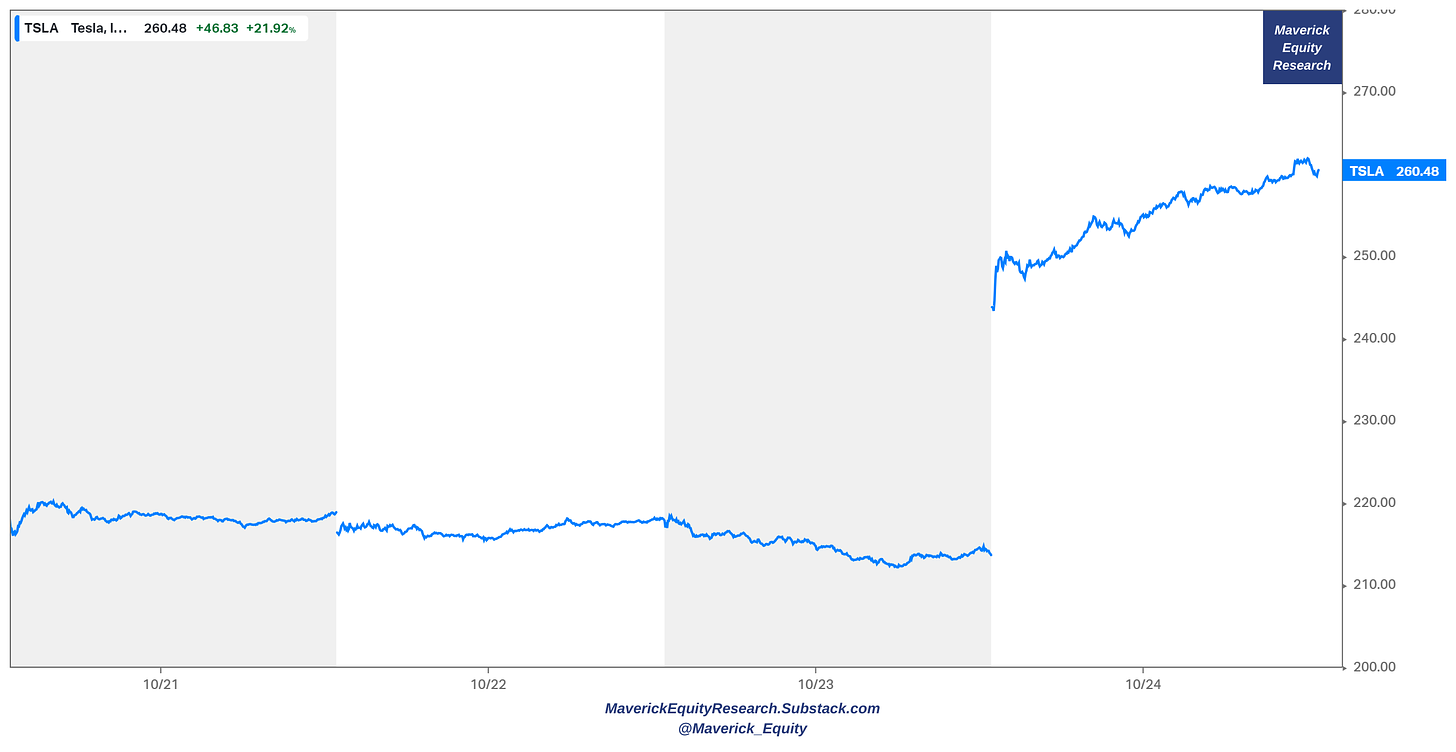

5 & 6. Tesla, let's get visual with their quarterly revenues since 2012: remarkable to see how far they've come since then. 3rd quarter 2024 earnings were quite some:

👉 Revenues of $25.18 billion (an 8% jump over Q3 2023) while Earnings per Share (EPS) of $0.72 beating analysts’ estimates of $0.59

👉 Tesla expects vehicle deliveries to increase by the end of the year. Specifically, Elon Musk predicted vehicle deliveries will grow 20%-30% in 2025. A big milestone reached on October 22, namely Tesla manufactured its 7 millionth vehicle

👉 Tesla is confident on reaching volume Cybercab production in 2026. They’re aiming for 2 million vehicles per year with no ramp for a price of $25,000

The market liked it as the stock price jumped 22% … let that one sink in!

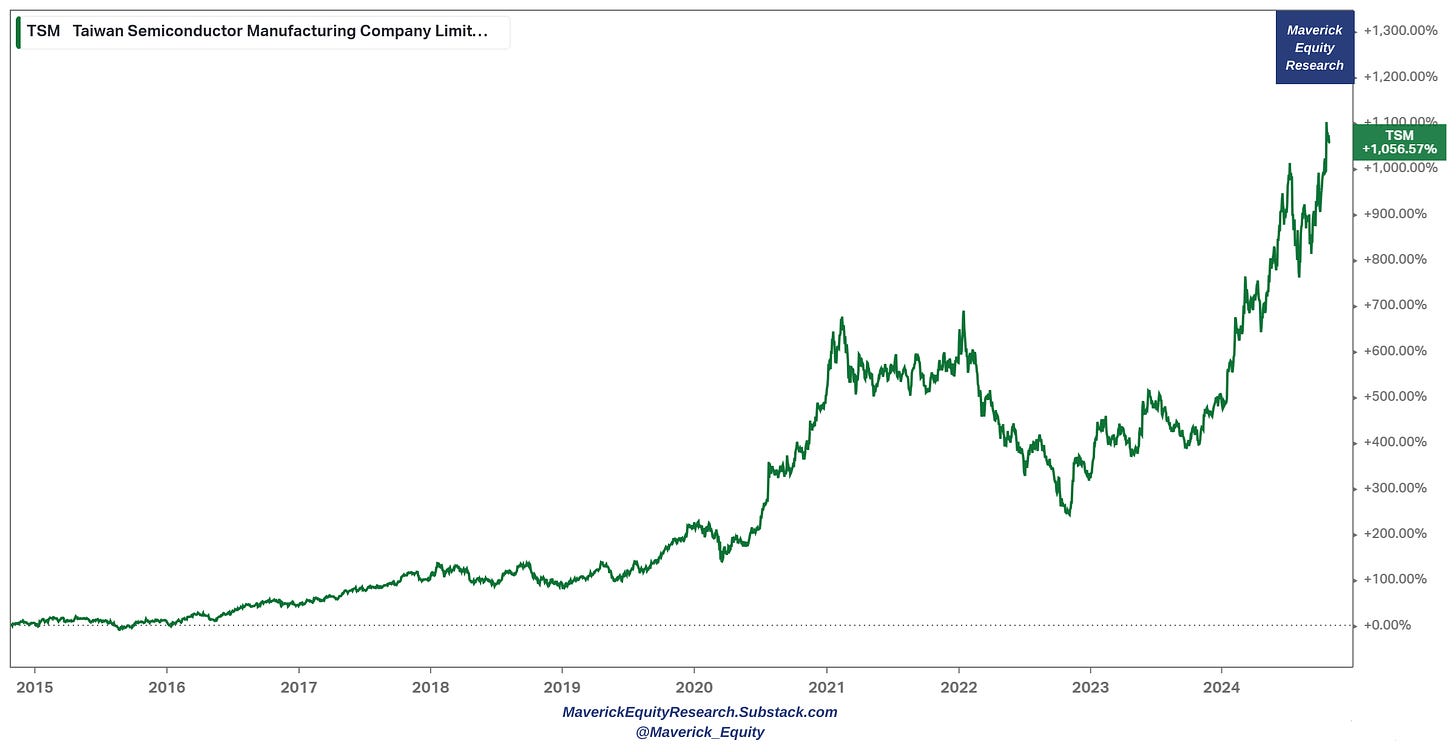

Taiwan Semiconductor Manufacturing (TSM), the world's largest contract chip manufacturer reached rarified air after their 3rd quarter earnings: it is the ninth company in the world to reach a market value above $1 trillion

👉 the geographic diversification a key point: new factories are in the process of being built outside of the Taiwan home market - investors and customers have been aiming for this point for quite a while in an attempt to ease their worries on a single checkpoint for their semiconductors supply. That is given the Chinese government's military rhetoric around the island, hence now an alleviated geopolitical risk.

👉 Three fabrication facilities are being built in the U.S in Arizona, and as well facilities in Japan & Europe to further its geographic diversification. The Arizona chip production yields even surpassed Taiwan’s one, 4% higher which is remarkable.

👉 recall that Warren Buffett in 2022 unusually bought and sold shortly his TSMC holdings citing geopolitical tensions as the reason given its location - other than that, he believes there's nobody in their league in the chip business, and also that it is one of the best managed and important companies in the world

👉 the stock returned more than 1,000% in the last 10 years, let that sink in … the tech boom and now the AI overlaid on top makes things happen fast …

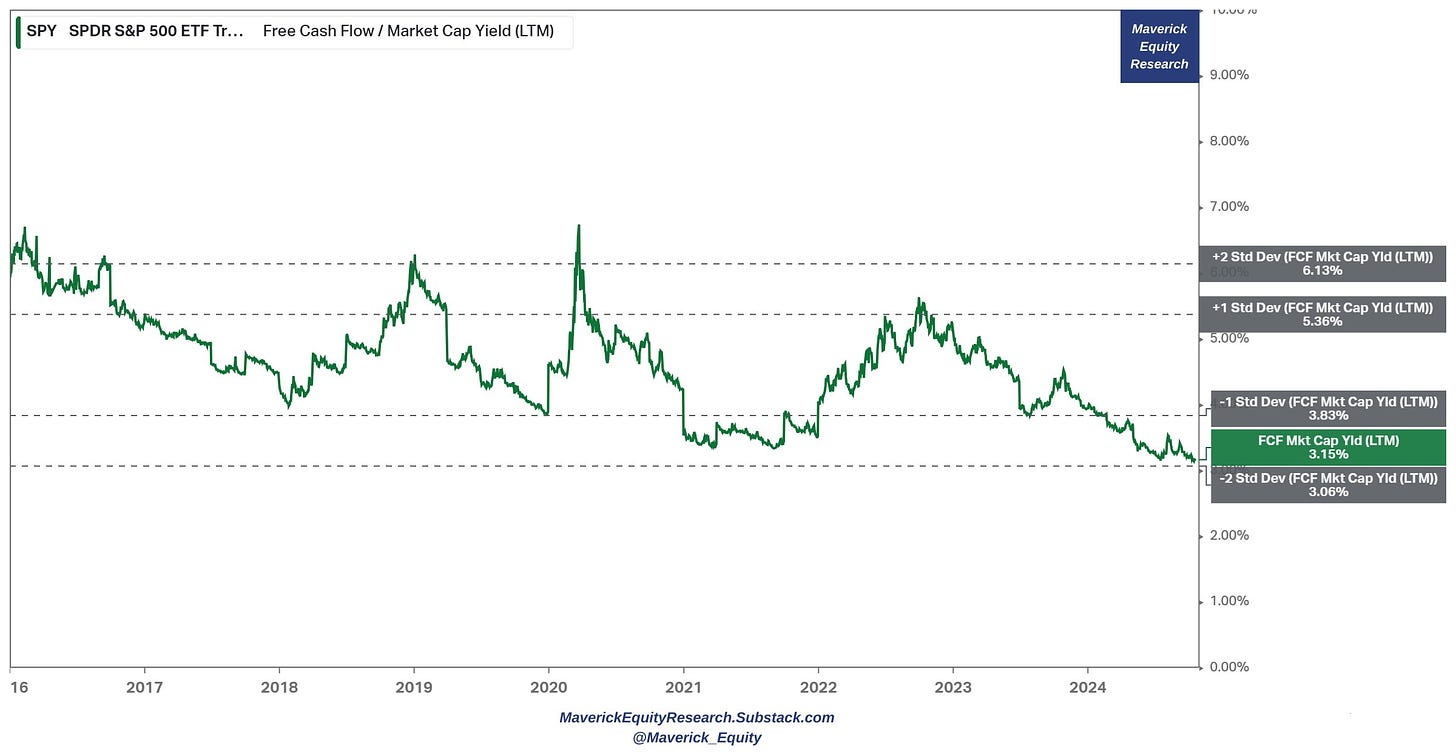

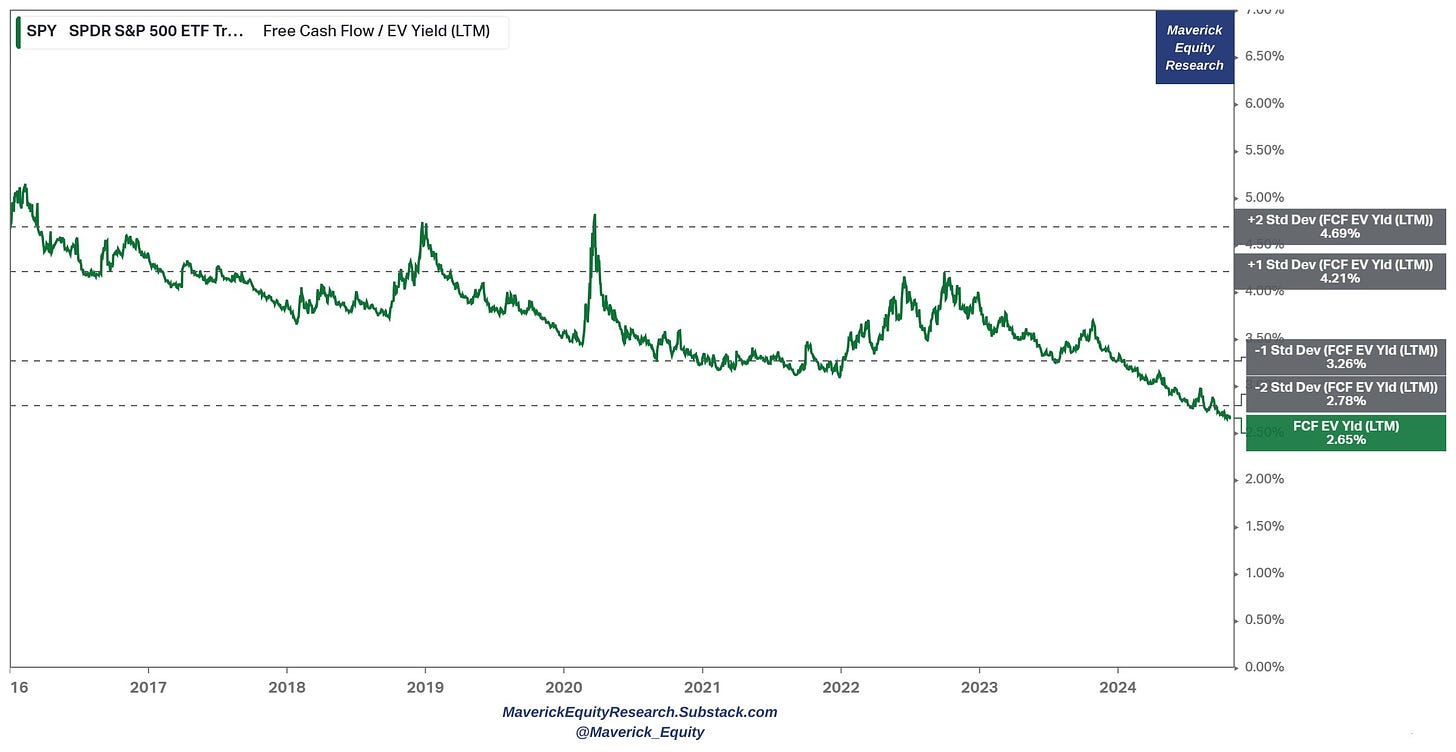

8 & 9. S&P 500 valuation via 2 lenses:

👉 Free Cash Flow yield (FCF/market cap) at 3.15% = very close to the negative 2 standard deviations ... food for thought ...

👉 Free Cash Flow yield (FCF/EV) at 3.15% = via this angle already below the -2 standard deviations … food for thought ...

N.B. more on the S&P 500 valuation in my upcoming S&P 500 report which is currently work in progress, previous editions:

✍️ S&P 500 Report: Valuation, Earnings & Fundamentals + Special Metrics #Ed 5

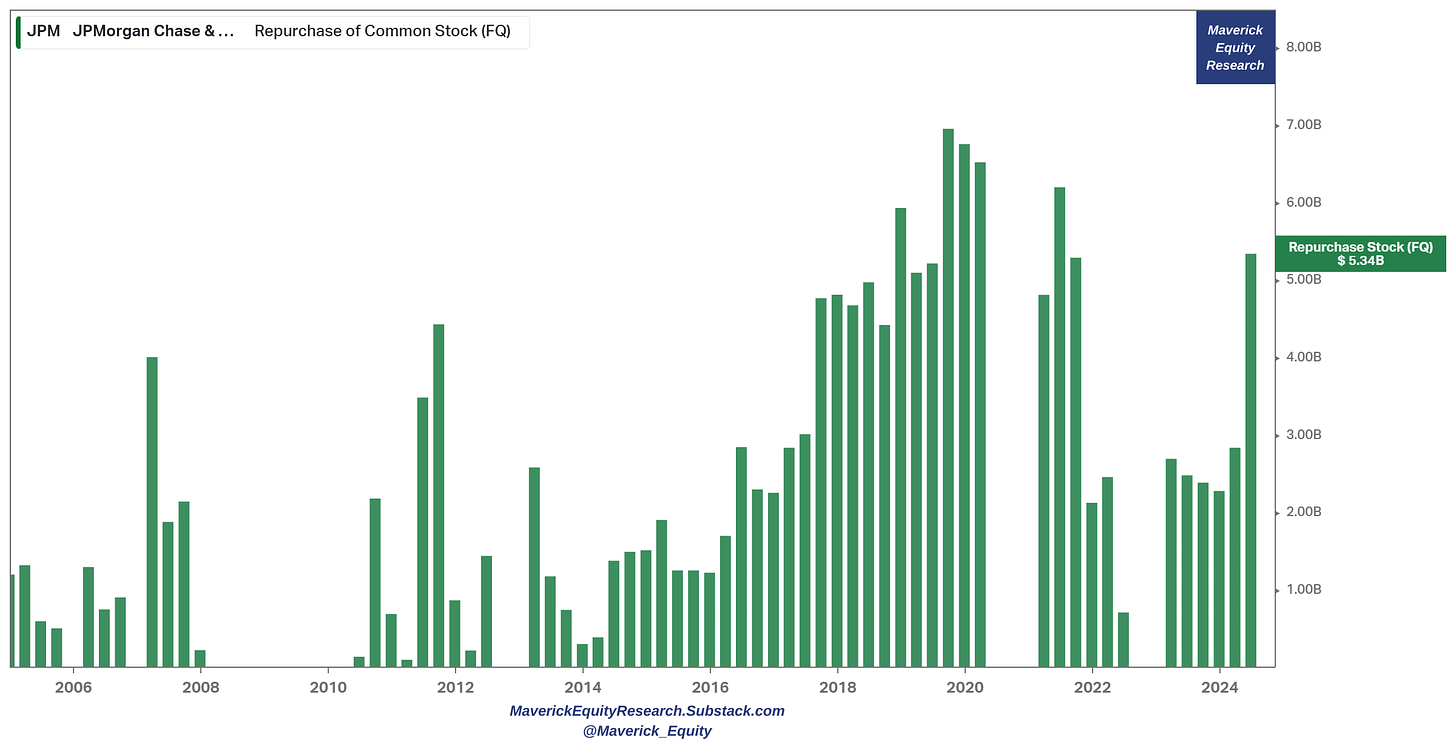

10-13. You might know that most companies destroy shareholder value when they buyback their own stock. I think that many CEOs do not really know how to value their own stock, hence without considering valuation properly, stock buybacks programs are mostly destroying value.

‘Ok Mav, do you know who does consider that and likely does a good job?’ Yes sir!

JP Morgan’s CEO Jamie Dimon is built different which is very refreshing to see.

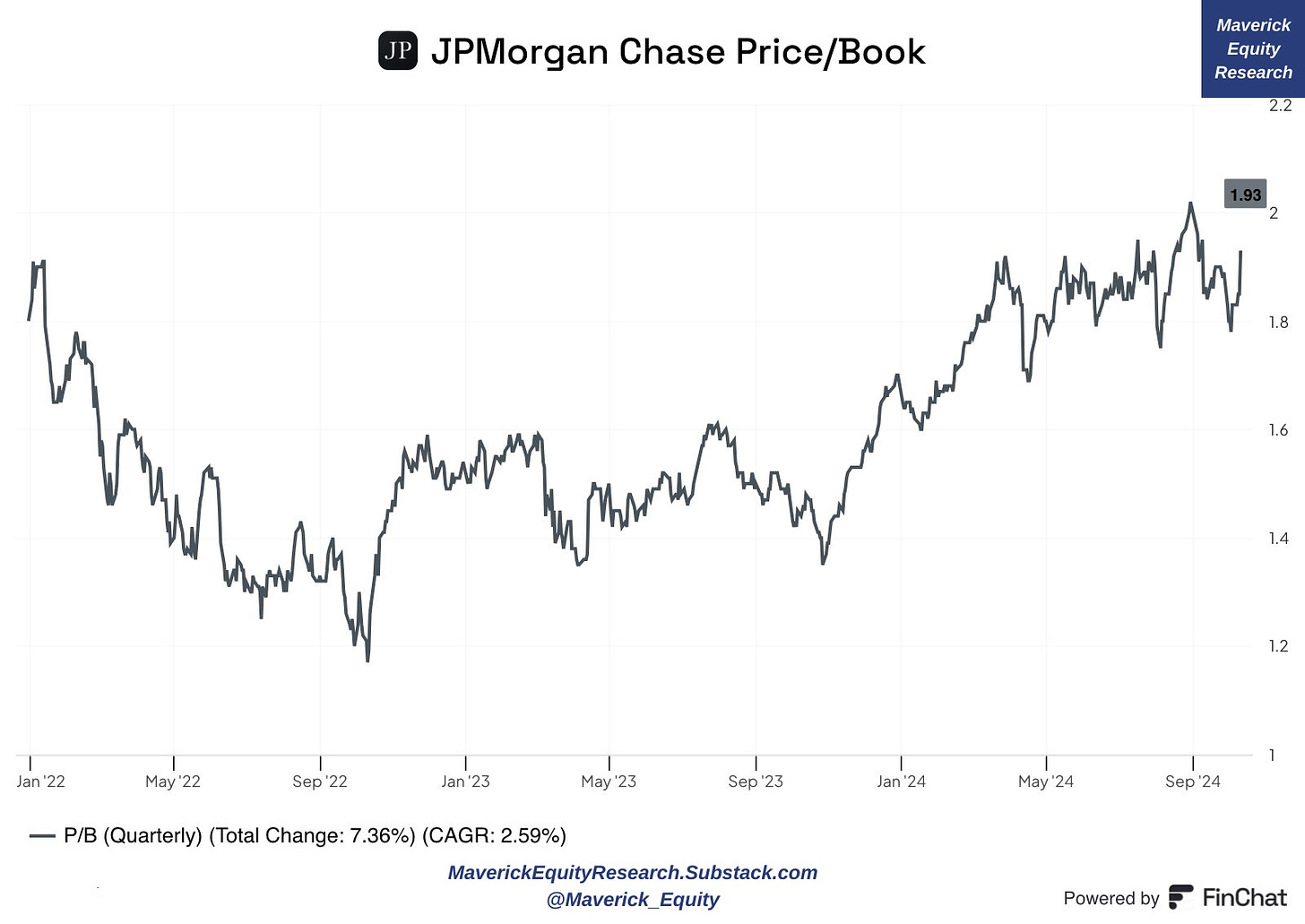

👉 from their 3rd quarter earnings report: ‘We do talk to a lot of shareholders, and they understand that buying stock back at more than two times tangible book value is not necessarily the best thing to do, because we think we'll have better opportunities to redeploy it or to buy back at cheaper prices at one point. Markets do not stay high forever’

👉 JP Morgan’s Price/Book is these days at 1.93x … hence unlikely stock buybacks are a good use of the current excess capital

“We’re not going to buy back a lot of stock at these prices” … “We’ve been very, very consistent” … “When the stock goes up, we’ll buy less and when it comes down, we’ll buy more”

👉 note how JPM’s stock buybacks amount are not peanuts at all across time

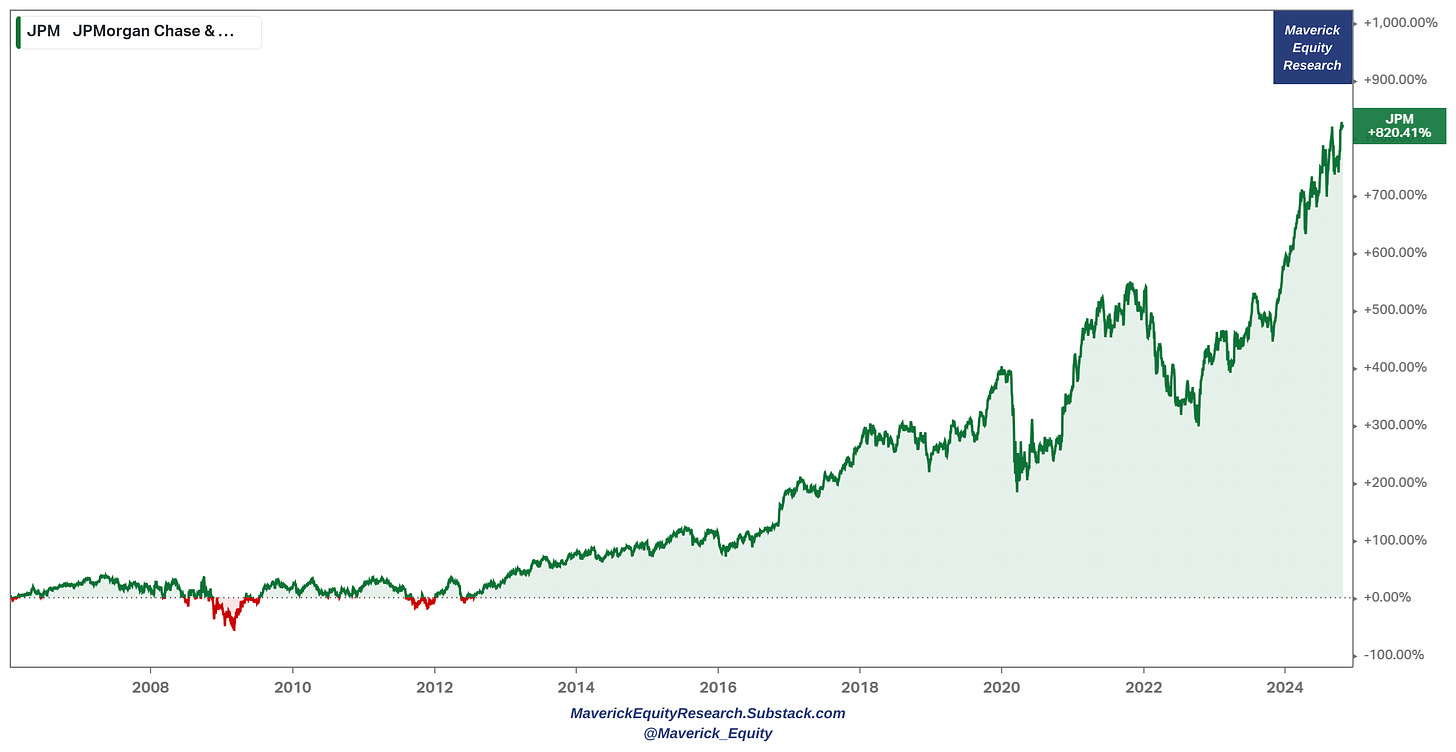

👉 not only JP Morgan is among the few that does a good job with their stock buybacks, but it is one of the not many banks that earn their cost of capital, hence delivering to shareholders

👉 not by chance that the stock returned a whooping 820% since 2006 when Jamie Dimon become CEO, while for the last 12 months a great 62% total return …

N.B. Berkshire CEO Warren Buffett takes a similar approach to Jamie Dimon.

“In no way do we think that Berkshire shares should be repurchased at simply any price. I emphasize that point because American CEOs have an embarrassing record of devoting more company funds to repurchases when prices have risen than when they have tanked. Our approach is exactly the reverse,” Buffett wrote in the company’s 2020 annual letter.

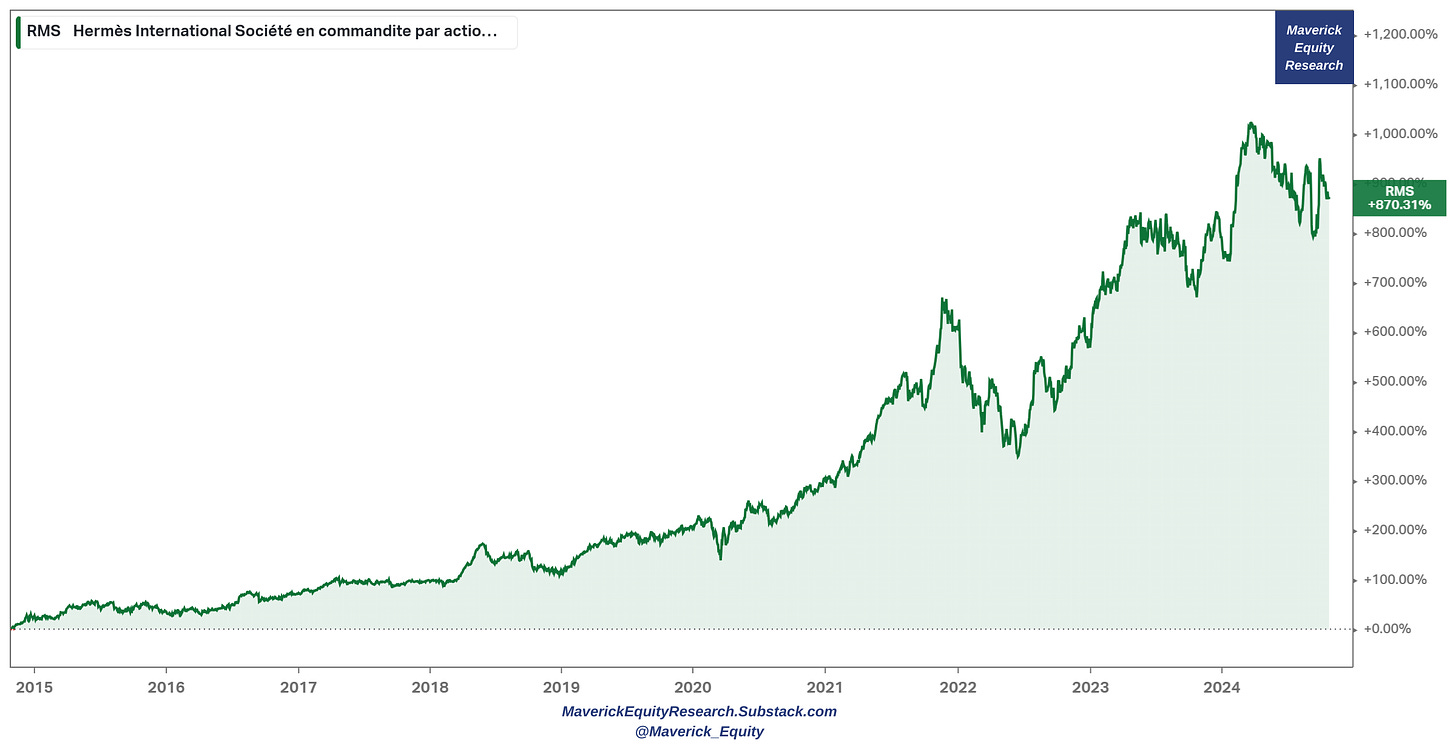

Another company that really considers valuation aspects? Yes, Hermes (RMS)!

👉 their CFO is one of the few that openly provides commentary on the stock’s terminal value (TV) and how it drives their valuation

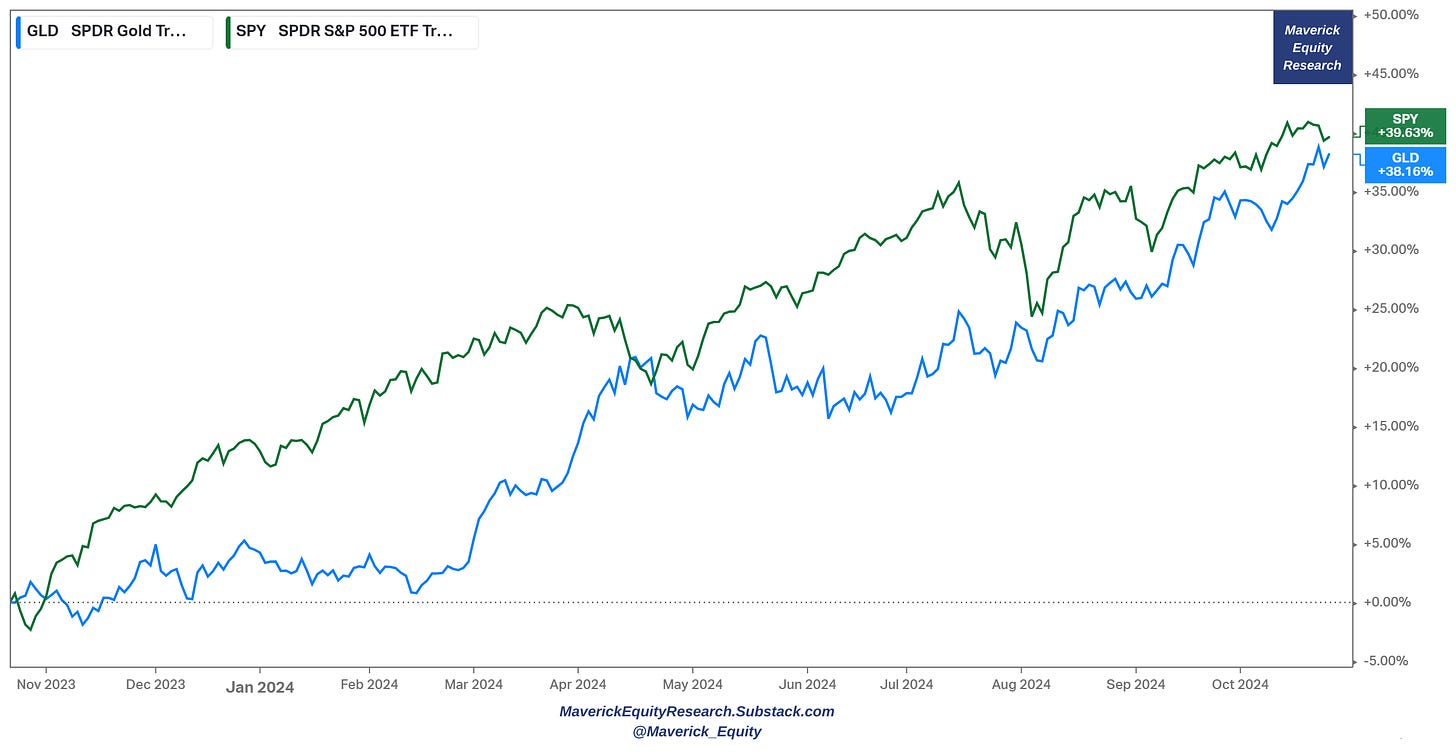

Gold time:

👉 it is very unusual for both gold and stocks to rally this massively in the same time: Gold (GLD) is up 38% and the S&P 500 (SPY) is up 39% in the last 12 months - this did not happen in the last 50 years (some short stints together in the 70s) …

👉 central banks buying heavily since 2022, diversification, geopolitical angles …

N.B. there is a lot going in behind the precious metal these days, quite a decoupling … one day a deep dive shall happen from my side

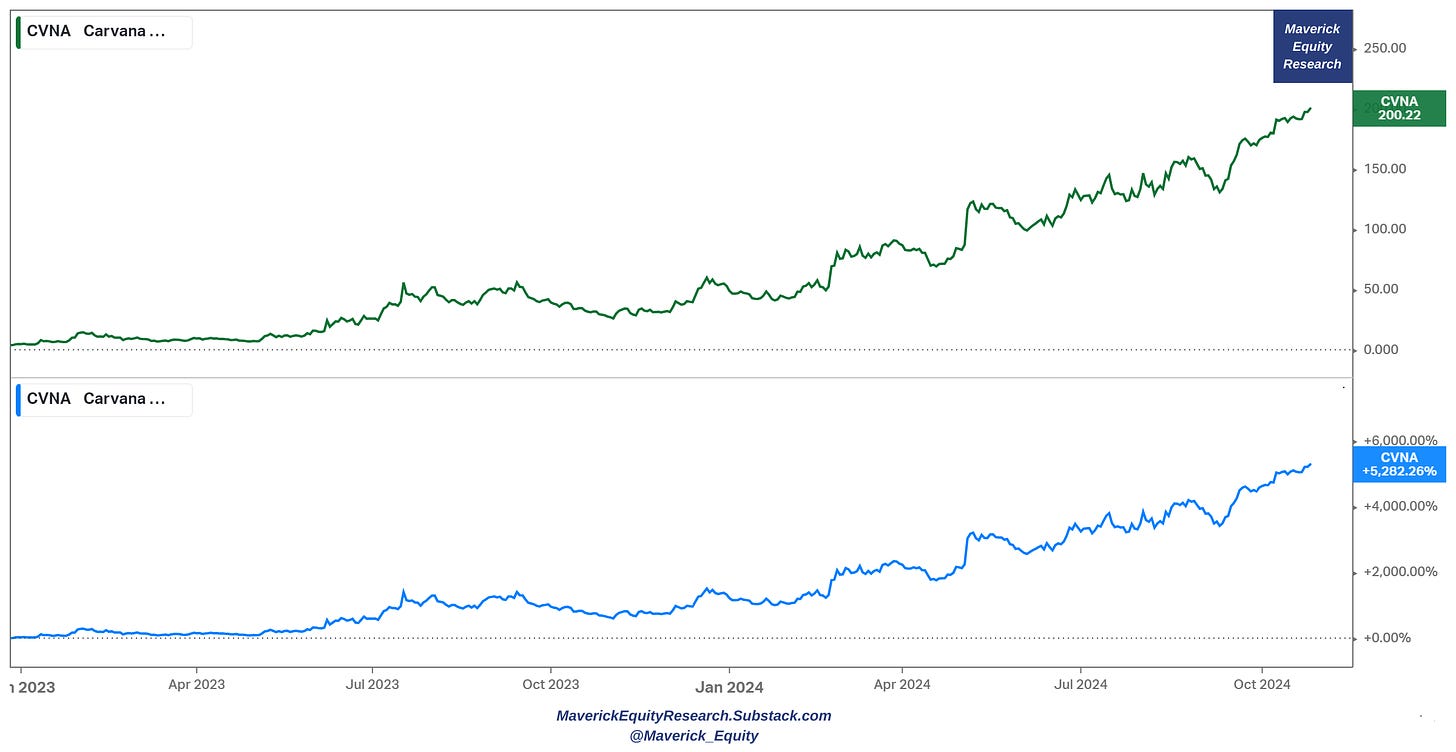

15 & 16. Carvana (CCNA), biggest stock turnaround or the biggest bubble? One of the most remarkable turnarounds in terms of stock price you’ll ever see:

👉 Carvana (CVNA) 52x or 5,200% in less than 2 years ... a $42 billion market cap

👉 just from a quick look at net income and FCF/share, such a turnaround in stock price does not sound fundamentally solid … I would lean it’s a take profit or short from here, but did not investigate all things properly for a solid call … food for thought …

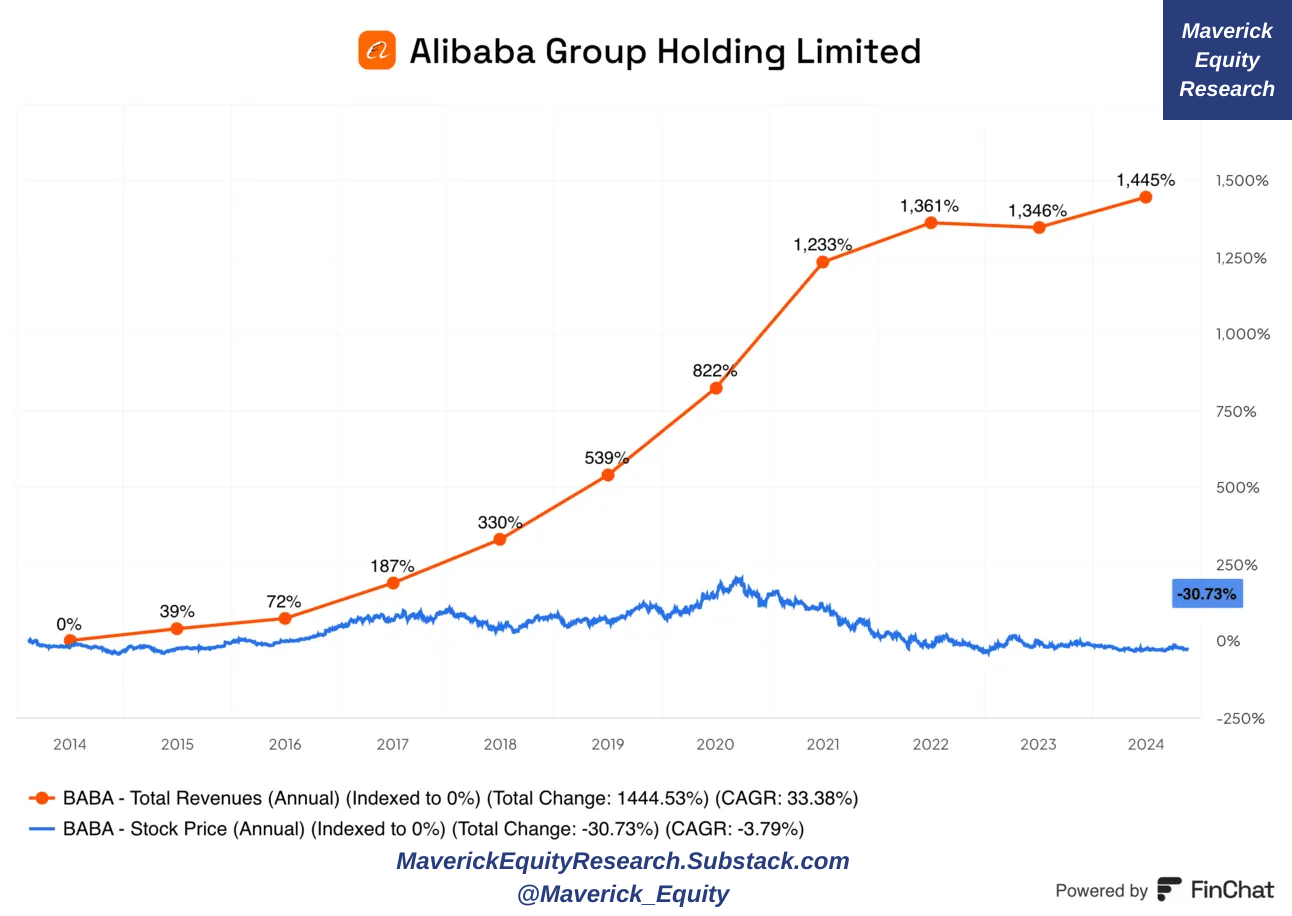

Alibaba (BABA) as one of the world’s largest online wholesale marketplaces, and what a story the stock has in the last 10 years:

👉 Revenue +1,445% while the stock Price -30.7% … food for thought …

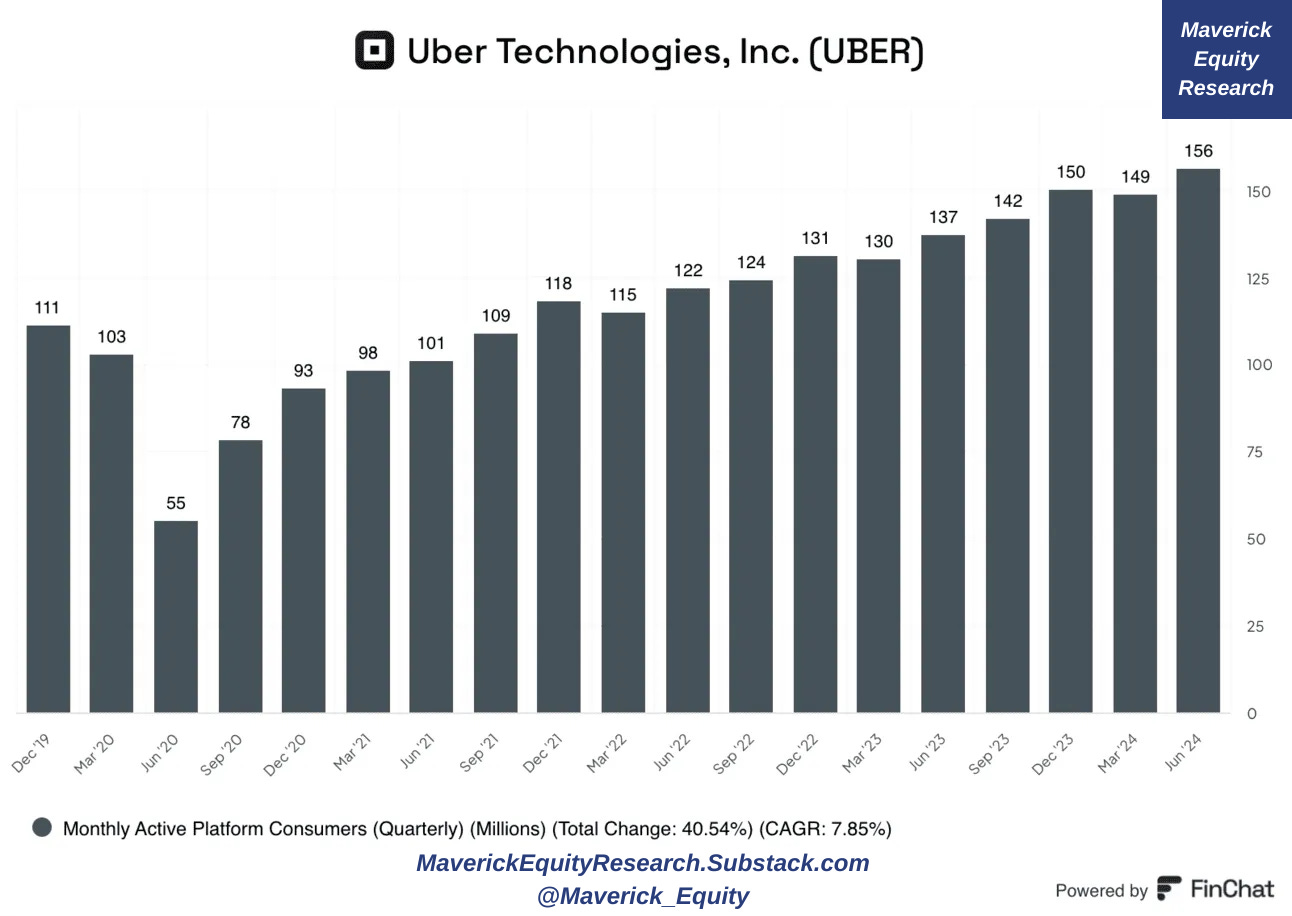

Uber Technologies (UBER) expands partnership with Alphabet’s autonomous driving division Waymo. Hence, the monthly active platform consumers likely going higher as more riders may be met with one of Waymo’s fully-autonomous, all-electric Jaguar I-PACE vehicles as opposed to a traditional Uber driver.

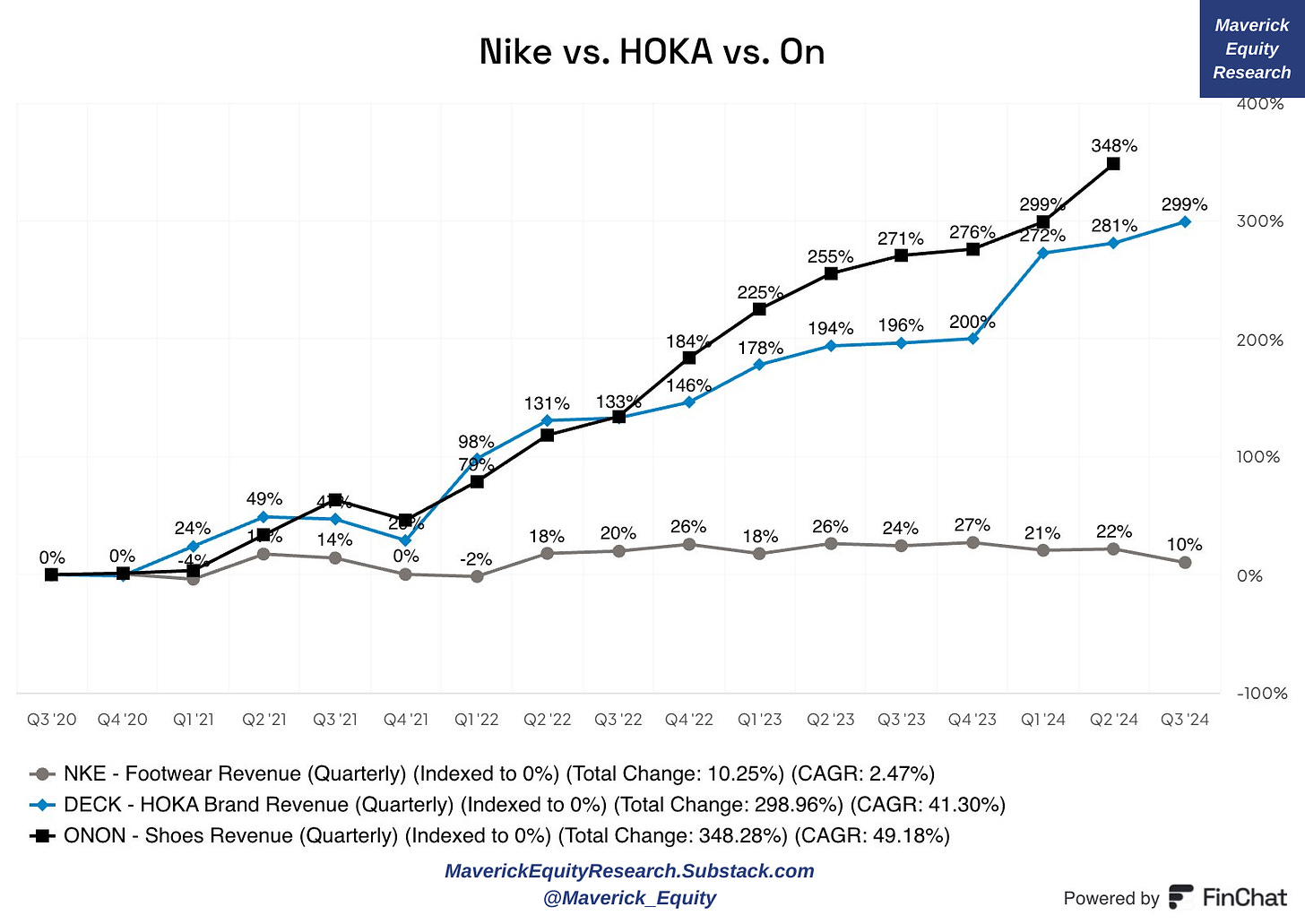

Sportswear battle, revenues trend in the last 4 years:

👉 On Holding (ONON) +348%, HOKA (DECK) +299% while Nike (NKE) +10%

The Trade Desk (TTD) keeps on delivering revenues

👉 +40% Revenue CAGR for 10 years = an incredible decade of growth

👍 Bonus charts: Gold, Taxes, Wealth/Person, Patents/Innovation edition 👍

China and Gold: the Chinese government buying more and more gold

👉 diversifying is not a bad idea in terms of the reliance to US bonds

Wonder which countries are the biggest buyers of gold overall? 2013-2023:

👉 Amid escalating geopolitical tensions, increased sanctions, and discussions around de-dollarization, interest in gold purchases is rising. But which countries are leading the charge in increasing their gold reserves? Russia and China ...

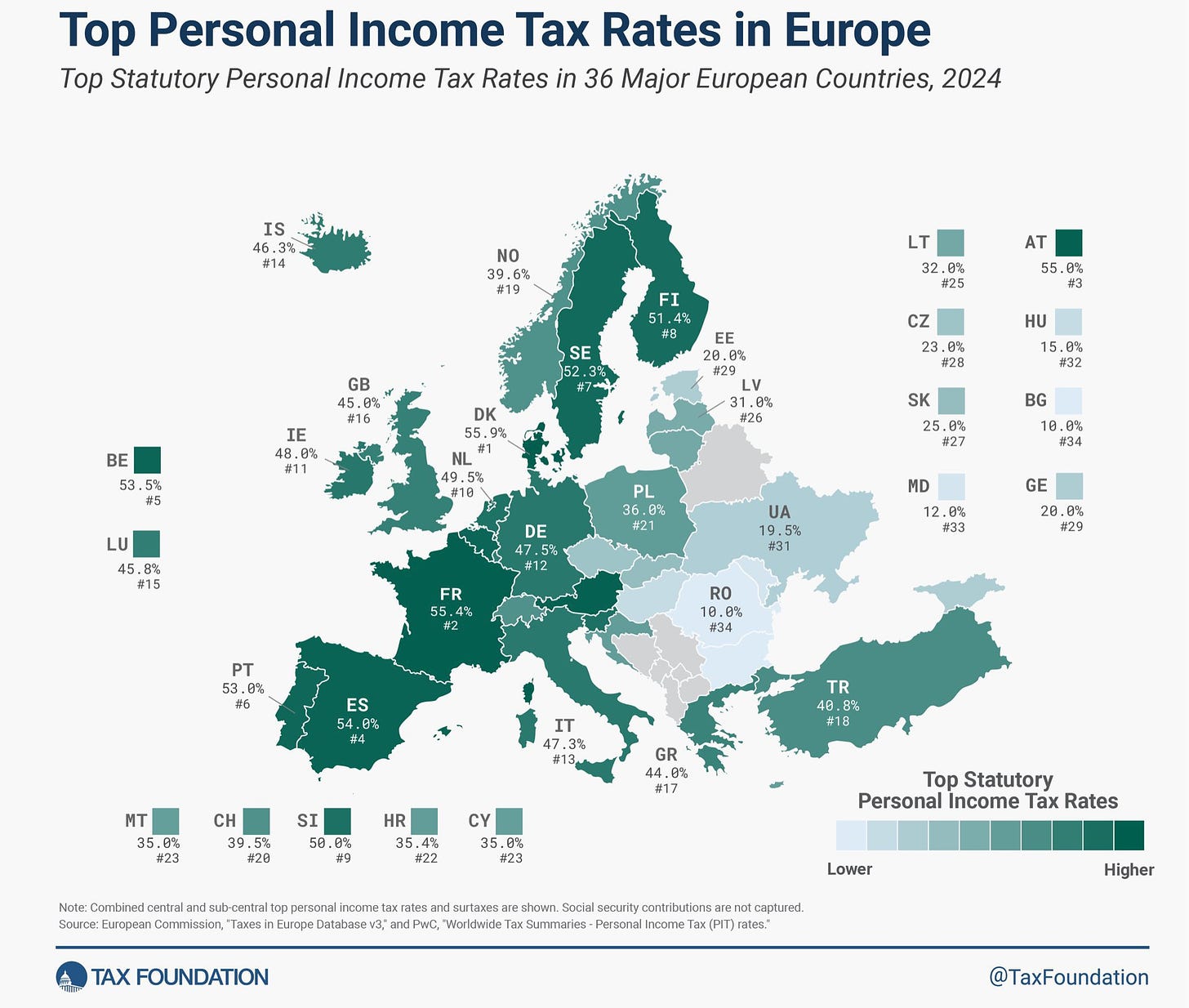

Top Personal Income Tax Rates in Europe

👉 once above 40-50%, how big can be the incentive to go the extra mile?

👉 I see a future where countries should fight for top citizens, for now the tax game is mostly for corporates …

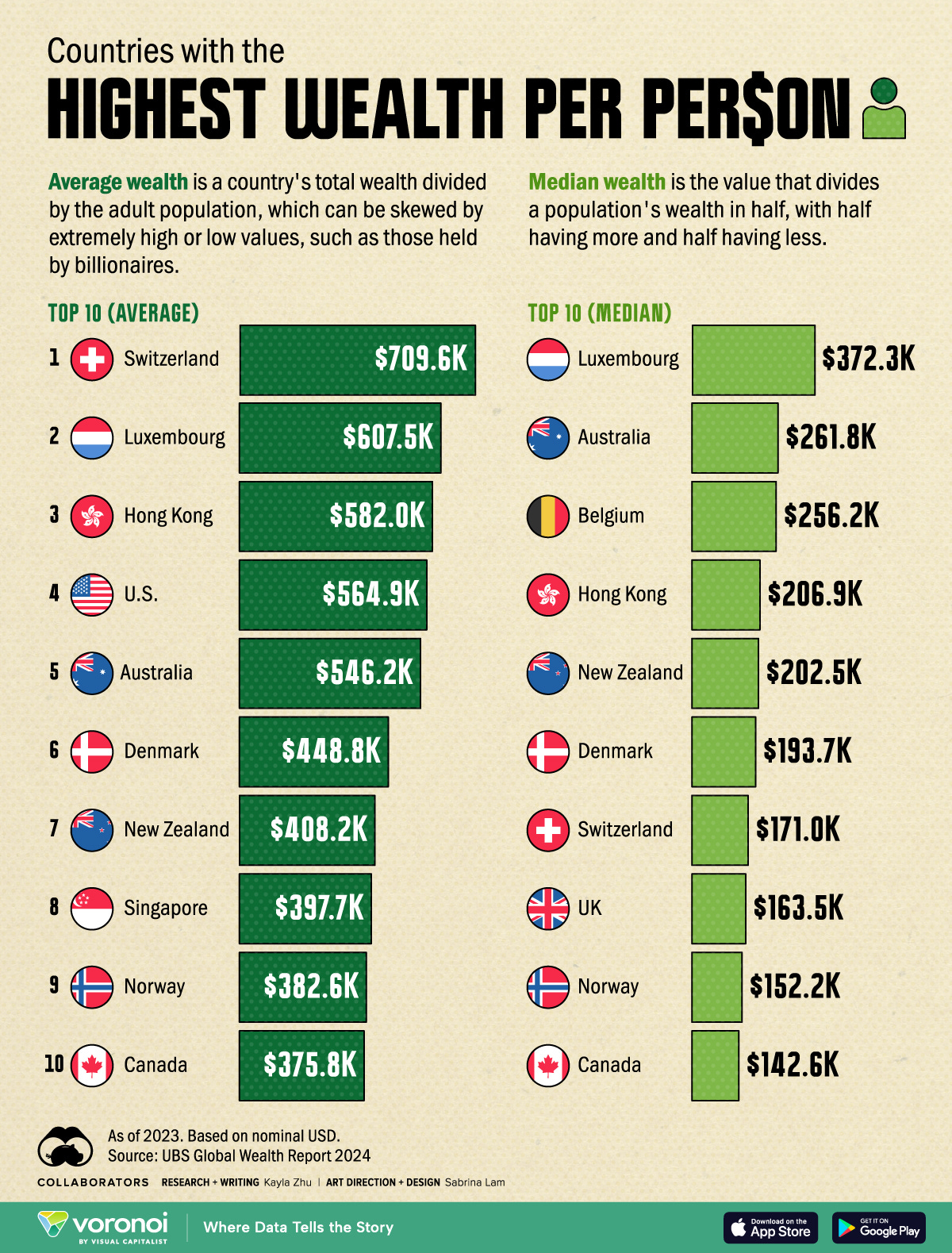

Countries With the Highest Wealth / Person, both average & the key MEDIAN!

👉 averages can be skewed by extremely high or low values, such as wealth held by billionaires (left rankings)

👉 the median, a more representative measure of wealth distribution = different story

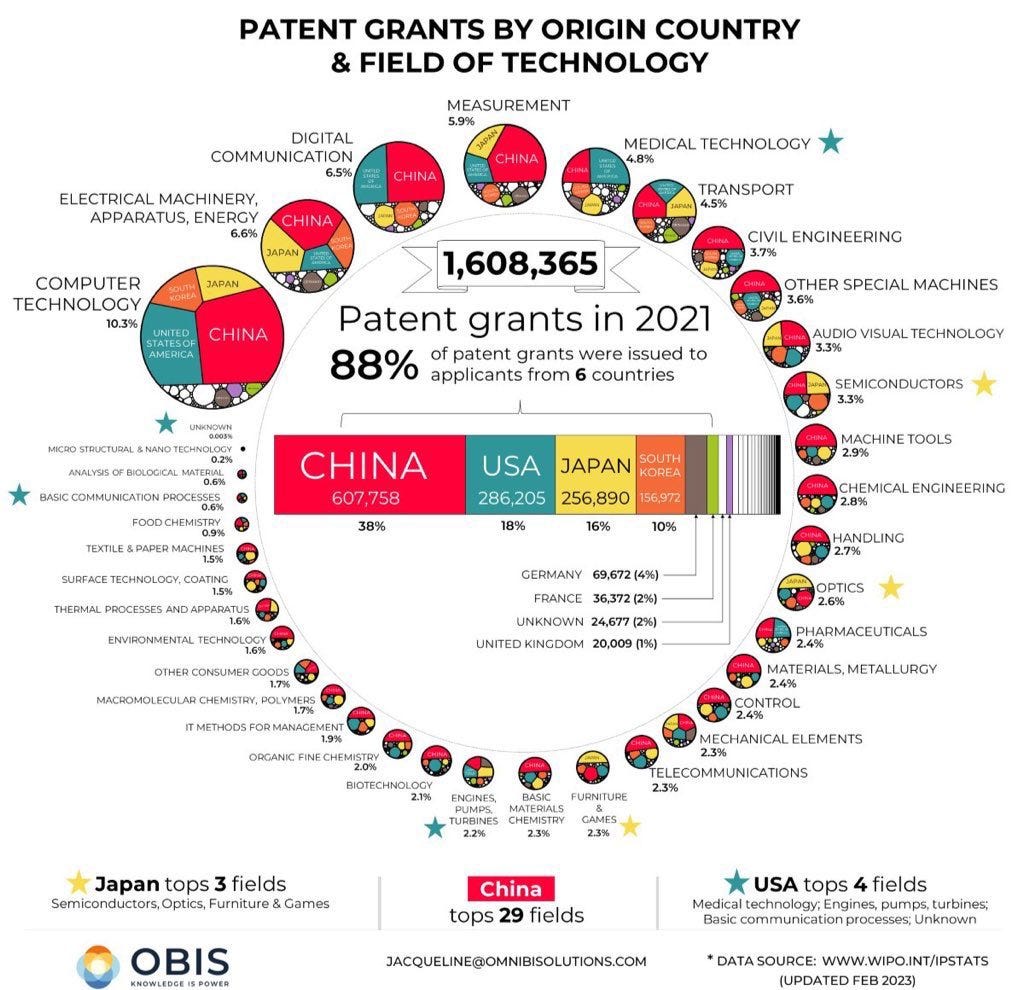

Patent grants by country:

👉 China, USA, Japan, South Korea, Germany & France = 88% of patent grants

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this extensive research by finding it interesting, saving you time & getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons! That’ll definitely support bringing in more & more independent investment research: from a single individual … not a bank, fund, click-baity media company or so … !

Have a great day!

Mav 👋 🤝

That Ackman story is wild, it happens to the best indeed! Thanks man for all your work!

Ackman ‘Netflix & Chill’, man that was hilarious! Thanks a lot, great all as always!