Why subscribe to Maverick Equity Research?

40% thinker, 40% doer and 20% talker, the world has too many talkers, doesn’t it? 😉

Lived and worked in 7 counties and 2 continents: Europe and US = global citizen

Education: double degree, Finance and International Relations, they connect well

Doing independent investment research with a focus on stocks, though also bonds, REITs, commodities, special situations, risk management & hedging. On top of all, a Macro big picture overlay to connect the numerous dots and generate further insights. Data-driven, namely evidence based research with a big focus on fundamentals: data, facts and visuals first, opinions after … via charts that say 10,000 words!

Independence = being free to say, write and both agree and disagree with whatever I think is the right approach in order to generate insights. Independence might sound basic and fundamental, but trust me, actually it’s a key feature given that a lot of talks & takes out there are not independent, though they might look professional & sound. Also free to say ‘I do not know’ which with the rise of the ‘IKA expert’ (I know it all) should be welcomed. The best people I know have no problem to say ‘I do not know’, and one of the best folks are the ones with the questions, and not with the answers.

Writing style: as simple as possible plain English, doing research and breaking down complex topics into insights via simple language and visuals is quite a skill. For me it’s way easier to write via jargon, technicalities in order to sound smart as too many do. Simply put: no fluff, no bluff, no hype, no fuzzy ideas, no boilerplate talk, no bullsh*t.

Frequency: expect to receive 2-4 research pieces a month. High quality research and analysis delivered via sleek visuals which say 10,000 words takes time to put together, hence I’ll be prioritizing value over frequency, that is the opposite of news & headlines.

Who: the entire independent investment research you read on this publication is done by a single individual, not a bank, fund, advisory, consultancy of any kind. The latter is just most of my finance professional work experience with its pros & cons.

Actually, from the rich feedback I received it was very interesting to acknowledge that the independence + the fact that the research is done by a single individual are the 2 key pillars why +7,500 people from 50 US states and 145 countries signed up! It is so great to see different opinions and views, constructively debating, hence agreeing to disagree. In this manner, we definitely build bridges not walls, hence we all benefit.

Why I am anonymous (at least for now):

content shall be the judge, and the audience should be like-minded for that also

it ensures maximum independence - once one puts his name out there, if employed & not independent, independence starts to be in question & it’s mostly not a bug but rather a feature: one has to play the employer’s play which is for sure not wrong per in most cases, but then one has to understand the whole story …

I like my privacy in general: I do not have Facebook, Instagram for years. We have enough distractions these days, hence the ability to focus on what matters is key!

after this 120,000 views tweet, I got plenty of direct messages with all kind of threats … being anonymous makes it easy not to be intimidated or bothered by it

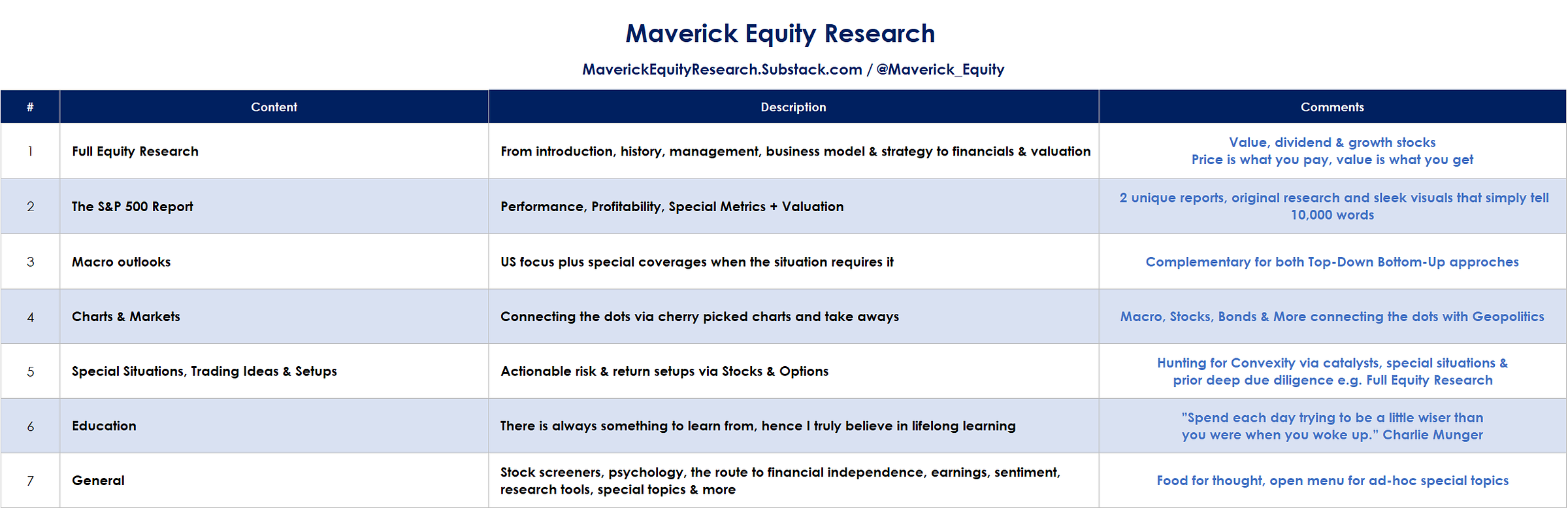

Receive straight into your inbox the following coverage:

Full Equity Research, single stocks deep dives from management & governance to industry, business model & strategy to financials and valuation: value, dividend & growth stocks from predominantly US, Canada, Switzerland & Europe.

In 2024, this section will start and where major time and focus will be dedicated.

The S&P 500 Report: Performance, Profitability, Special Metrics + Valuation = 2 unique reports, original research and sleek visuals that simply tell 10,000 words

Macro outlooks: US focus plus special coverages when the situation requires it

Charts & Markets: connecting the dots via cherry picked charts and take aways

Special Situations, Trading Ideas & Setups: actionable risk & return setups

Education: ”Spend each day trying to be a little wiser than you were when you woke up.” Charlie Munger

General: stock screeners, psychology, the route to financial independence, earnings, sentiment, research tools, special topics & more

Likely, big interesting & useful projects for 2024 and beyond that I might be working on, which is naturally a big function of time availability and costs with the data/tools:

MavGPT: working on an AI custom proprietary ‘MavGPT’, maybe a waste of 100-200 hours project & costs, but maybe something interesting comes … time will tell

MAV Index or Proprietary Metric: some ideas here, let’s see if & what comes out

Risk Management & Hedging for the Retail Investor scheduled for 2024 via maybe a dashboard, framework, a book(let), a course … time will tell

Leading Indicators & Models for the Economy & the Stock Market - The Ultimate Compilation: scheduled for 2024 via maybe a dashboard, a framework, a book(let), a course … time will tell

Nothing Changes Price More Than Sentiment - The Ultimate Compilation of Sentiment Metrics for the Economy & the Stock Market: scheduled for 2024 via maybe a dashboard, a framework, a book(let), a course … time will tell

Enjoy the independent investment research and if you find the coverage appealing, just share it with your friends that might also be interested. Thank you, appreciate it !

Feel free to reach out directly maverickequityresearch [at] gmail [dot] com, or via Twitter @Maverick_Equity.

Have a great day!

Maverick Equity Research

Disclaimer: information on this publication should not in any case or form be considered financial, business, tax or legal advice, but a publication for educational purposes and discussion only. Specifically, this publication is:

impersonal in nature

bona fide

general and regular in circulation