✍️ Apple (AAPL) - The Big Apple = The Most Valuable Company on Planet Earth

Size & Value, Financials & Valuation, Apple and the S&P500 & Buffett, Moat

Dear all,

first of all, welcome to the new subscribers as recently we crossed the 2,250 milestone!

Now let’s have a look at Apple via some sleek charts which tell a 1,000 words!

Report structure:

📊 Apple Size … Matters

📊 Apple & The Market aka S&P 500

📊 Apple Financials & Valuation

📊 Apple & Warren Buffet’s Berkshire

📊 Bonus & Fun Charts: Apple’s Moat

📊 Apple Size … Matters

First of all, Apple is the most valuable company on the planet and is the first one to cross the $3 trillion market capitalisation mark. With a +48% in 2023 alone, it equates to a $984 market cap gain which is equivalent to gaining the value of 12 Airbnbs, 6 Disneys, 2.3 Walmarts or 122 Ralph Laurens. Let that sink in & bring the sink!

Apple is also the 1st company to reach in value the following milestones:

$1 trillion in 2018

$2 trillion in 2020

$3 trillion in 2023 now

is $4 trillion possible? Your thoughts?

N.B. Microsoft, Google, Amazon & Nvidia the other trillion 5 club members ...

Apple 10 year total return of a whooping 1,266% for a 30% CAGR (Compounded Annual Growth Rate)! Note also it was not a smooth run with some big drawdowns which even they had:

2016: 32%

2019: 39%

Key take-away: business ownership vs stock ticker mentality is key ...

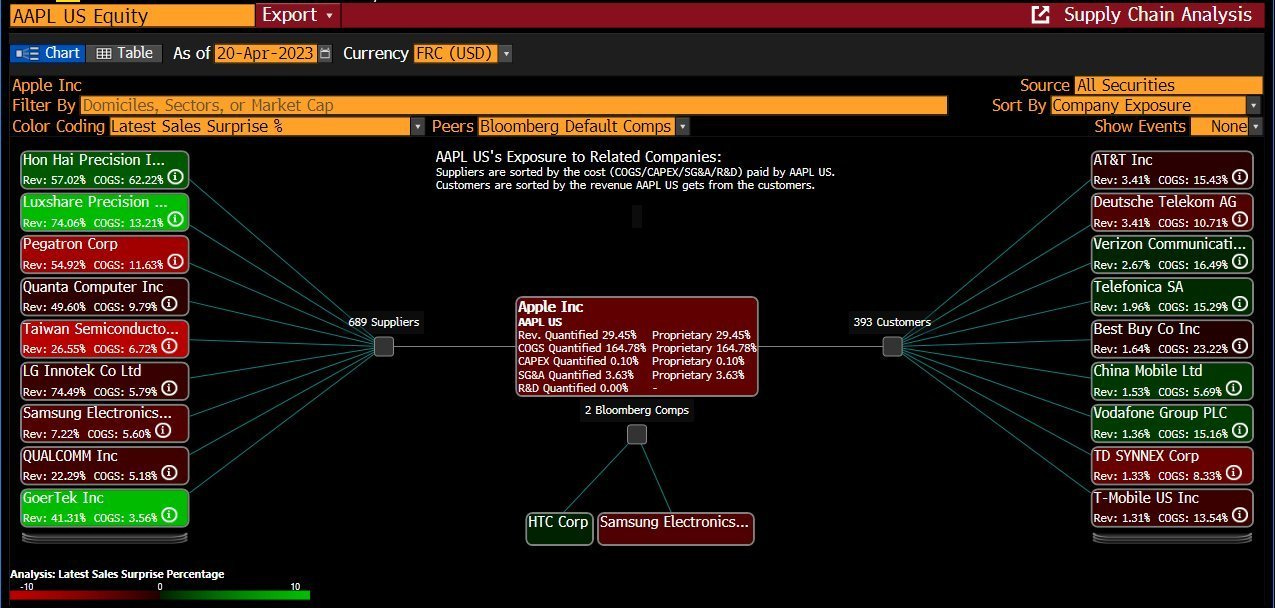

Apple supply chain analysis via this great overview which tells a 1,000 words in one go:

689 suppliers ... that barely have power ... can be replaced with ease ...

393 customers as big corporates, then a worldwide retail distribution and fan base

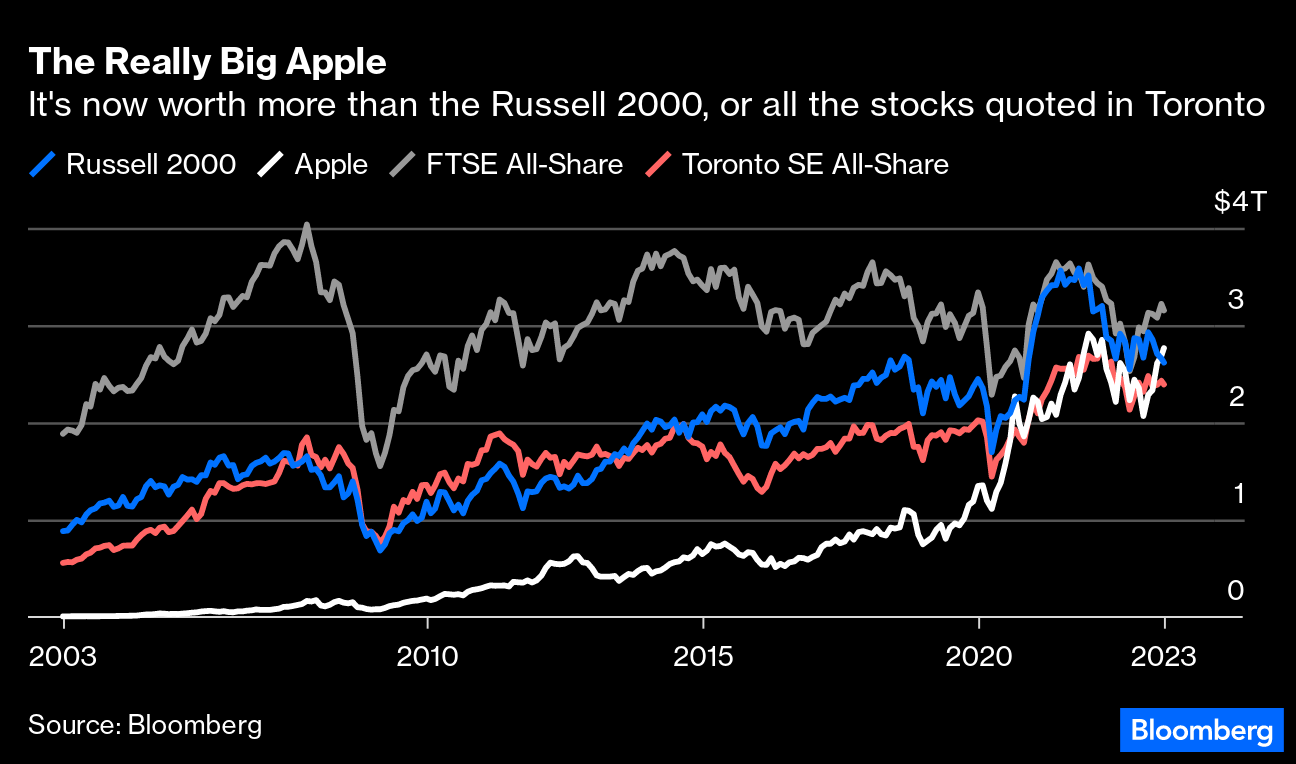

It’s a really Big Apple as it is now worth more than the entire Russell 2000 index or all the stocks listed on the Toronto Stock exchange! Let that sink in & bring the sink!

Apple is rounded in the top five by some of the world’s most recognizable brands: Microsoft, Saudi Aramco), Google’s/Alphabet & Amazon. The top 30 most valuable companies in the world are these as of May 5th 2023:

The 10 biggest stocks in the S&P 500 every 5 years going back to 1980: Apple was 2nd place in 2010, 1st in 2015 and again first in 2020 and as of today in 2023! Note also Microsoft’s (MSFT) great progression since 1995 once it entered top 10 in 1995.

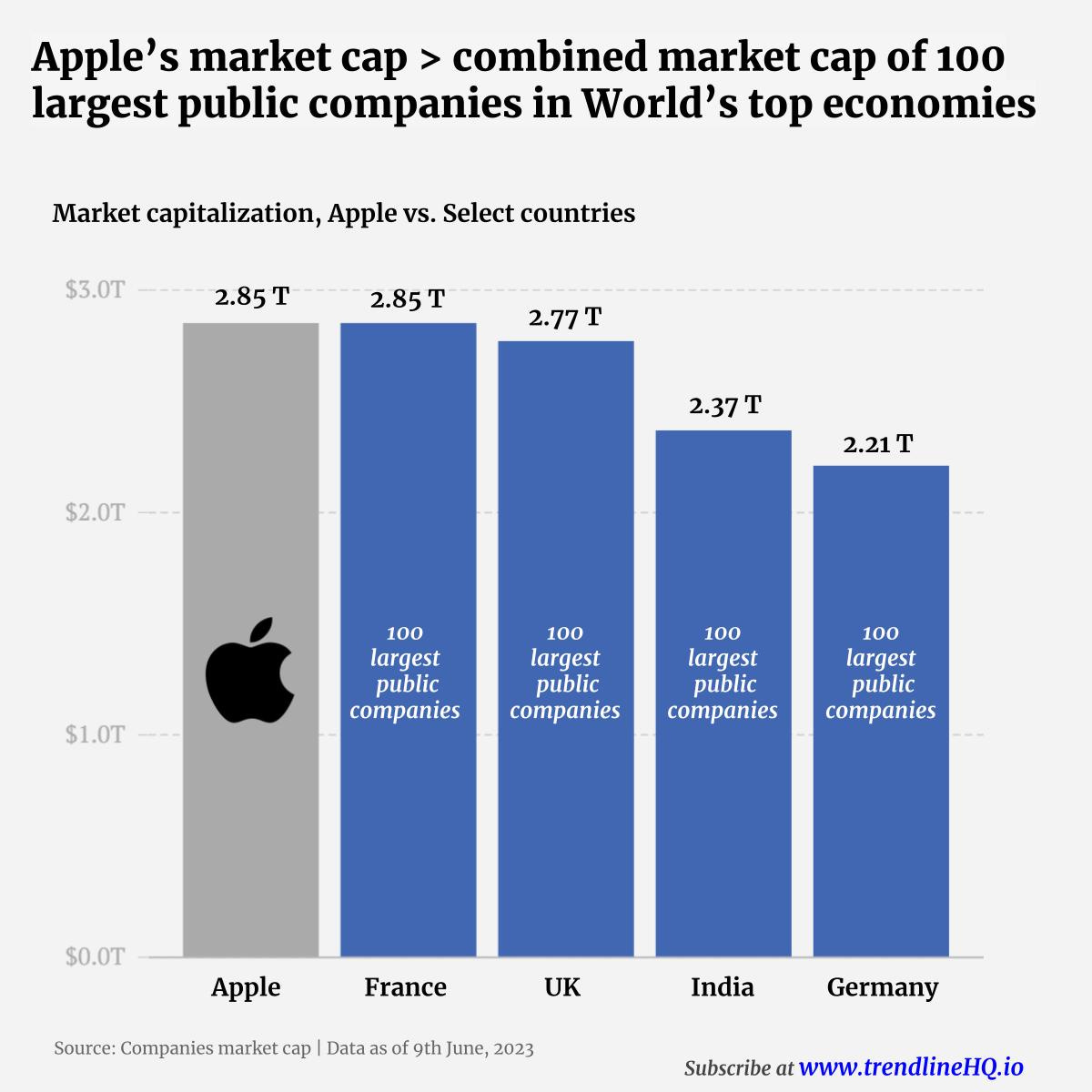

Not an apples to apples comparison, but how does Apple look versus the combined market cap of the 100 largest public companies from the world’s top economies?

Roughly equal to the market cap of 100 largest public companies in France

3% higher than the market cap of 100 largest public companies in UK

20% higher than the market cap of 100 largest public companies in India

29% higher than the market cap of 100 largest public companies in Germany

China and Japan have larger companies but Apple still beats many of them:

Apple’s market cap is larger than the 62 biggest public companies in Japan and 16 biggest public companies in China.

Apple VS The World, let that sink in too!

📊 Apple & The Market aka S&P 500

Apple is making new & new all-time highs relative to the S&P 500 (AAPL:SPY)

From a technical analysis point of view, Apple broke out convincingly of all time highs after basing for quite a while …

Apple has the biggest weight in the S&P 500 index, hence a big impact overall

How big is the effect in 2023? The S&P 500 is +14% in 2023 and 2.54% (254 b.p.) are driven by Apple alone which equates to 18% of the market was moved by Apple.

Complementary view, Apple & the S&P 500:

📊 Apple Financials & Valuation

Valuation wise:

Apple trades at a 7.2x forward P/S and a 29.1x forward P/E which looks expensive but note: even after the recent mega run, it’s below the 5 year median

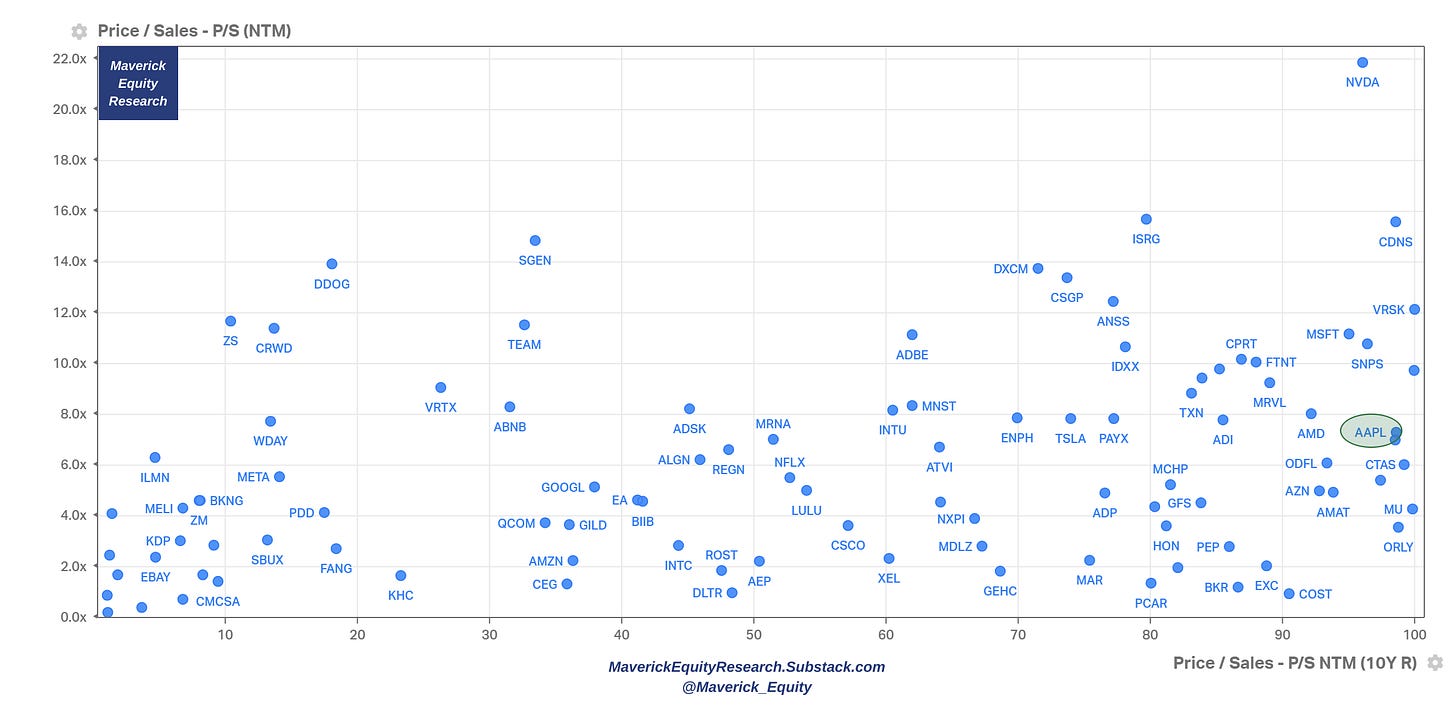

Next, some very ‘Maverick-esque’ visual analytics that you rarely see around: Apple and the Nasdaq-100 components with forward P/S multiples + the percentile of Apple’s stock & all Nasdaq-100 components key multiples vs their 10-year history (simply put, a good angle to see Apple’s historical valuation multiples with itself today and also the other tech businesses from the Nasdaq-100 for a relative comparison):

P/S: Apple trades at a 7.3x forward Sales while sitting at the 99th percentile with it’s 10-year historical P/S multiple. That does not look like ‘cheap’, but expected given their performance in the least years, hovering at all-time highs now and overall business model. Note also names that trade at an even higher multiple and still in the 90-100 percentile range

P/E: Apple trades at a 29.4x forward Sales while sitting at the 93rd percentile with it’s 10-year historical P/E multiple

P/FCF: Apple trades at a 29.8x forward Sales while sitting at the 98th percentile with it’s 10-year historical P/FCF multiple

Next, one of my favorite charts when a business can do at once ‘The Magic X Cross’ = sending dividends to shareholders & also the company buying back their own stock, hence rewarding shareholders also via these two corporate finance actions:

Apple shareholder yield at 3.81% = Dividend Yield 0.49% + Share buyback Yield 3.01% + Debt Paydown Yield 0.30%

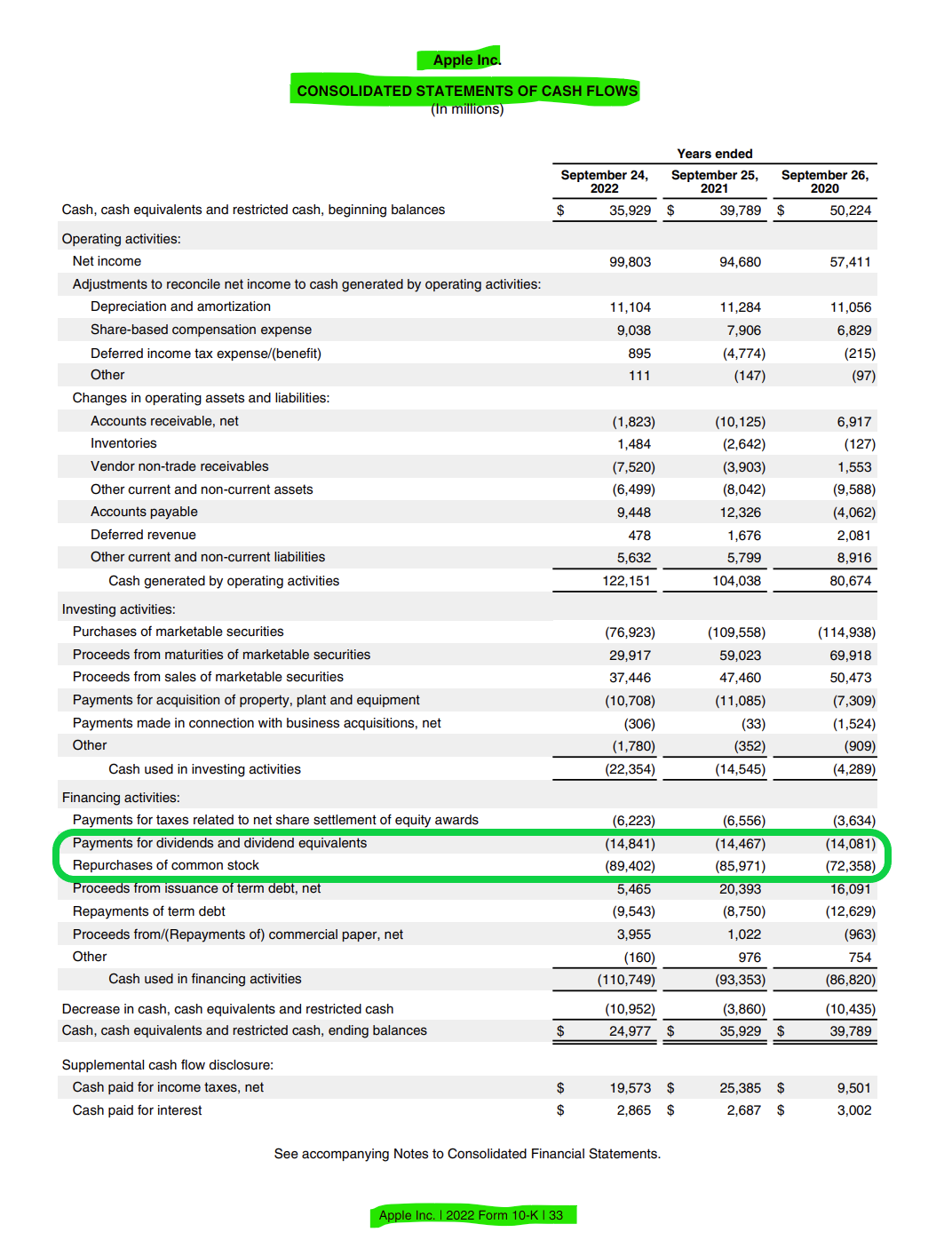

If you want the exact financials where you can find the buybacks & dividends, there you go with the Cash Flow Statement, Financing Activities section page 33 from their Annual Report / 10K. Note, numbers are in parenthesis as negative given they are cash outflows to shareholders:

Key question on the stock buybacks: how much of their own stock you think Apple bought back in the last 10 years? About $580 billions, yes, billions!

Let's put that into context now for magnitude: $580bn equates roughly to the market capitalisation of the cumulated 490 companies in the S&P 500. Let that sink in!

An Apple buy-back a day, keeps one's returns not away ... to make a fun word-play :)

How big is the current buyback program? $90bn magnitude:

that is LARGER THAN the *total market cap* of 420 constituents of the S&P 500

$90 billion is also about enough to buy every American an Apple Watch SE at full retail price ;)).

One luxurious worry in a way question here would be: all those dividends & buybacks now but is Apple also still investing to foster future growth? Let’s look at CAPEX = Capital Spending in absolute $ invested and % of Revenues:

since 2013 high & stable investments to fuel further growth

note how since 2018, CAPEX/Revenue has been trending lower which signals us that the investments do generate more & more revenues - the growth engine is on for CAPEX to further turn into + Net Present Value (NPV) projects

Having the trio of CAPEX deployed, dividends, buybacks is not something many companies can 'afford' to do all at ONCE from my experience at least … . Following up on that now, a key question: what’s needed to do that combo of dividends and share buybacks for shareholders, while also still investing for future growth via CAPEX? Cash flow baby! And for that I always like the following cash flow progression:

Operating Cash Flow (OCF) for 20 years:

Progressing further to Free Cash Flow (FCF) for 20 years:

Free Cash Flow done, how can we progress further? Free Cash Flow per Share! Why? Because plenty of businesses out there with good free cash cash flow but which dilute shareholders by issuing stock very often …

Wondering after all that, how much cash is still available on Apple’s balance sheet? Quite some: $48bn! Many companies do not have that total market capitalisation, even some popular and hot names that you see around quite often!

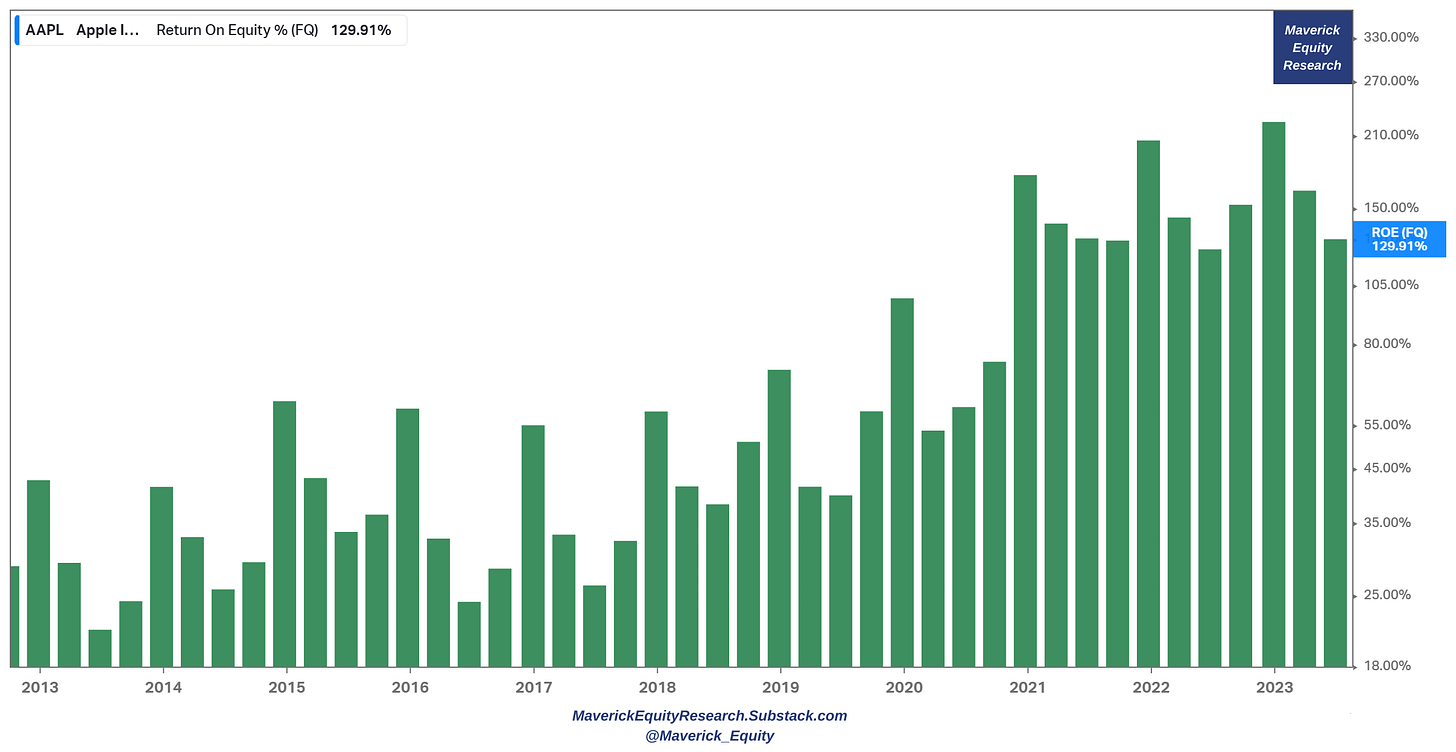

Apple ROE (quarterly) since 2013: impressive…

Apple Return on Capital (ROC, quarterly) since 2013: impressive again…

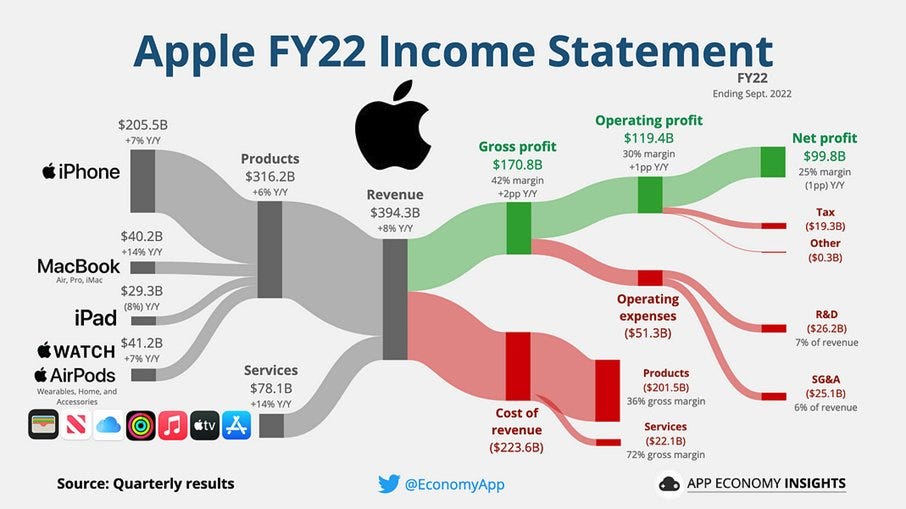

Now, how does Apple’s latest annual Income Statement look? Not bad, not bad at all …

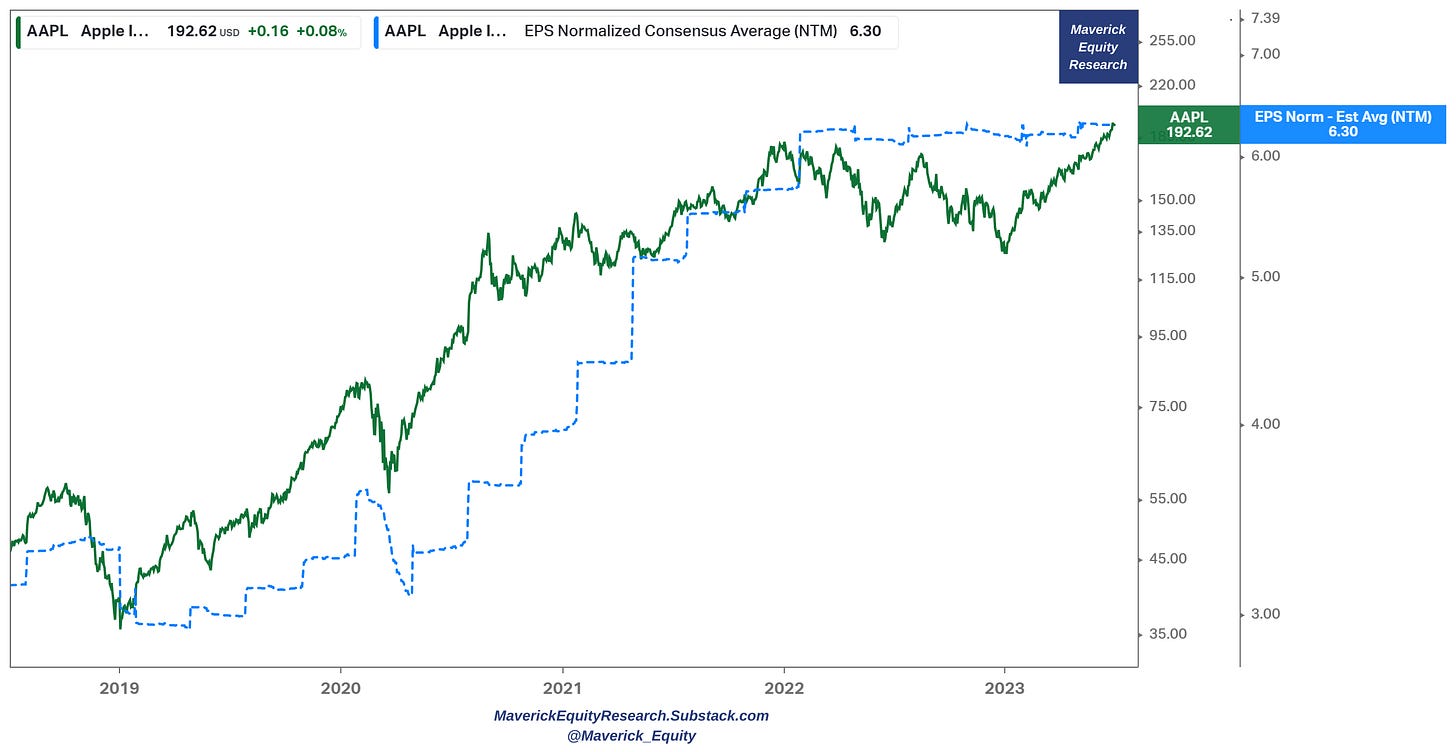

Apple price & EPS normalised consensus … price follows earnings, right?

The same just extended evolution over the past 5 years:

For a nice angle, what about Apple’s ecosystem & Google? Google annual payment to Apple to be the Default Search Engine on iOS … not bad, right?

What about Apple and gaming? Gaming? What’s Apple got to do with Gaming? A lot! They don't make games directly, but they have a very 'moaty' ecosystem aka marketplace generating a lot of fees:

👉 $9.5 billions of Revenue from gaming in 2018, $11 billions in 2019 and $13.5 in 2020

👉 in 2019 alone, Apple made $2 billion more profits from games than Microsoft, Nintendo, Sony and Activation Blizzard COMBINED! Let that sink in!

📊 Apple & Warren Buffet’s Berkshire

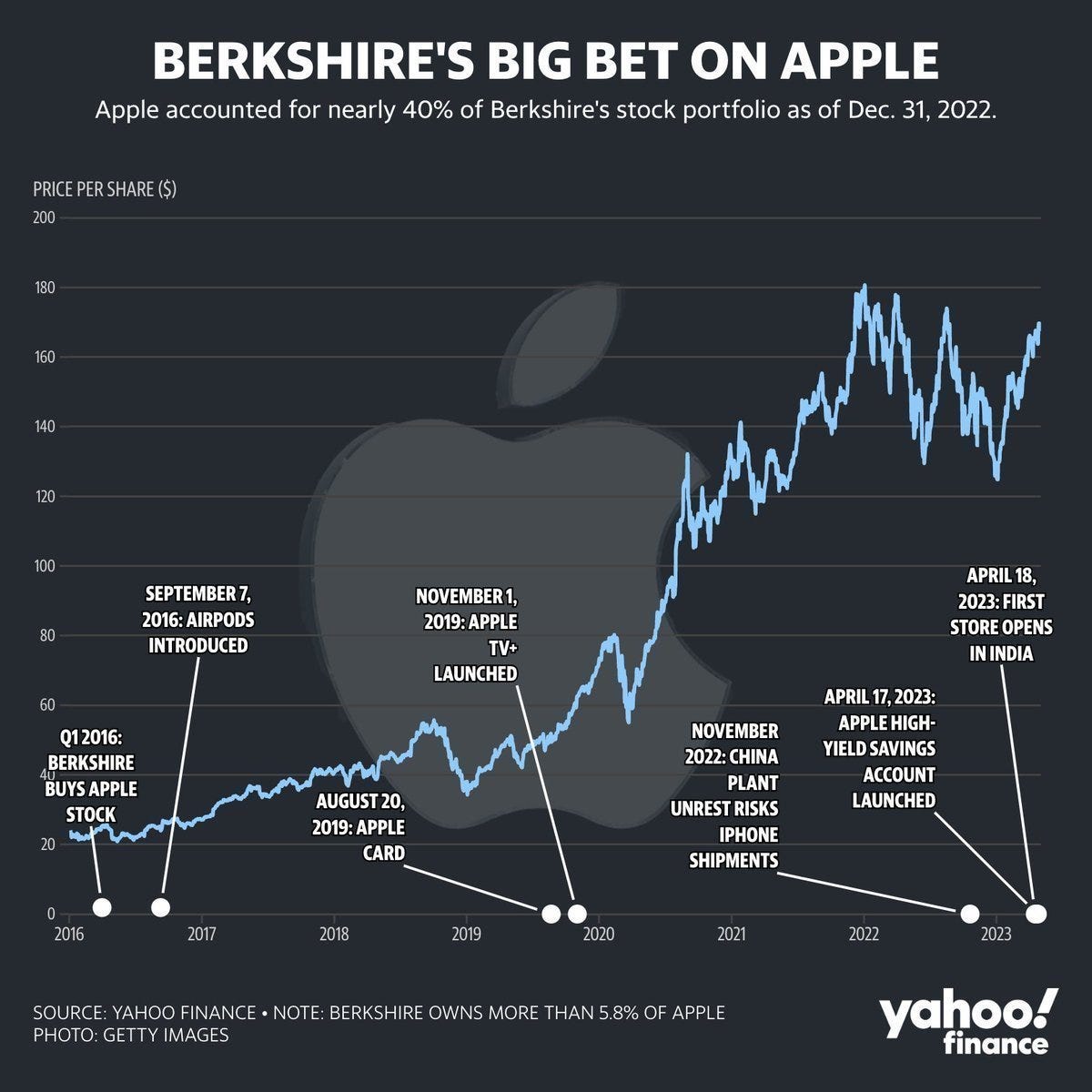

Buffett’s stake in Apple is now about 6% and is worth about $175 billions, which is about 5x his $31 billion cost basis. To clear out a common confusion out there: the $175 billion stake equates to about 24% Berkshire’s market capitalisation and 48.75% of Berkshire’s public stock portfolio (which is not at all Berkshire’s empire value). When Buffett bought Apple for the first time in Q1 2016, many said he was late to the tech party … but clearly that was not the case.

Complementary view of Buys & Sells - longer & shorter term 5-year timeframe:

Guess what was Apple's shareholder yield when Buffett started buying in Q1 2016? More than >7%! Note also that during 2019, it was even 13% while during the Covid crash, almost 10%.

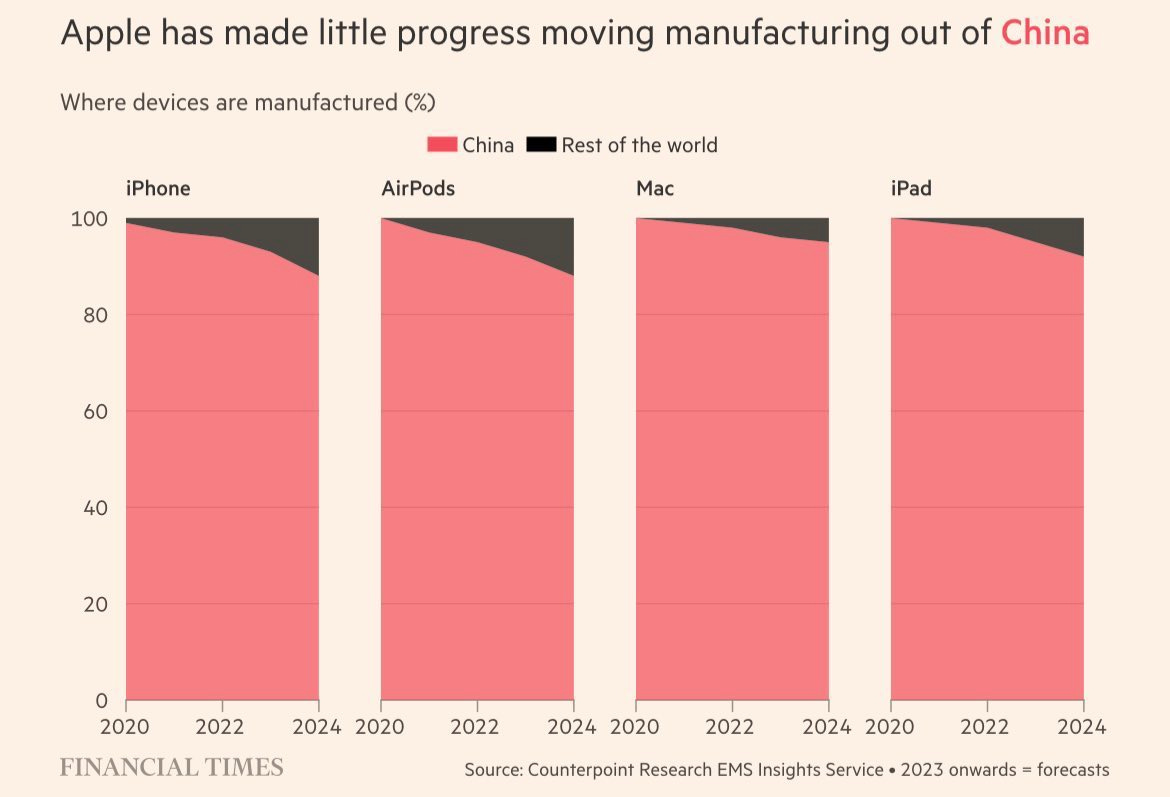

What’s the main risk Berkshire faces with this still concentrated position?

‘China risk’ as a major part of their manufacturing is in China still, though note the recent material progress. Note also that Buffett sold Taiwan Semiconductor TSMC on geo-political concerns in the region, yet did not sell Apple …

my best guess is maybe Buffett says, ok, if something happens will just buy more with the Berkshire big pile of cash + Apple itself would do more share buybacks ... hence can still sleep well via this 'natural hedge' ... !

recall Buffett in 2019: "I like our Apple holdings very much. We would like AAPL to go lower in price so we can buy more. But I won't say more than that since we do not give away advice about specific investments. We do like it when Apple buys back shares since we own more of the business."

What’s Buffett’s latest take on Apple and their stake?

'Apple is a better business than any other we own' ...

'I know where Apple is going to be in 5 or 10 years, but not car companies'

'I don't understand the phone at all, but I do understand consumer behavior'

‘Apple is NOT 35% of Berkshire portfolio overall’ (on portfolio concentration)

‘People would rather give up their 2nd car than their Iphone’

Apple buys back a lot of their own shares - regarding the shares outstanding situation ...

My Twitter post here & video via CNBC:

Buffett also said 4 years ago:

'Apple Makes Its Products Indispensable'

'if you look at that little piece of whatever it is, that is one of the most valuable real estate in the world’

Buffet & Apple clear now, what about Wall Street’s price targets via the consensus view on Apple? Stock is fairly priced. Note though the High & Low delta is quite big.

📊 Bonus & Fun Charts: Apple’s Moat

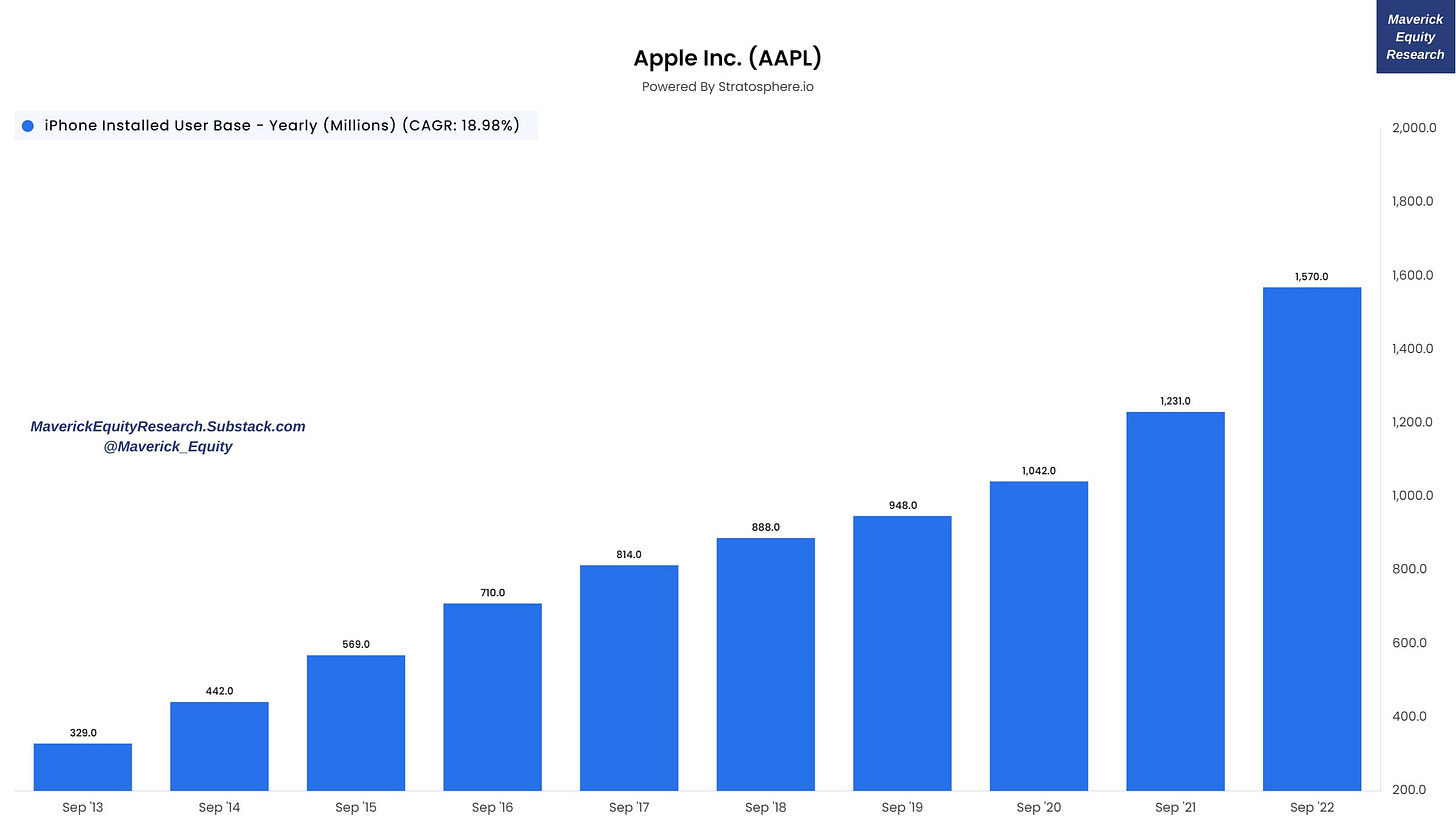

Apple KPI you do not see around too often: iPhone Installed User Base with a 19% CAGR since 2013

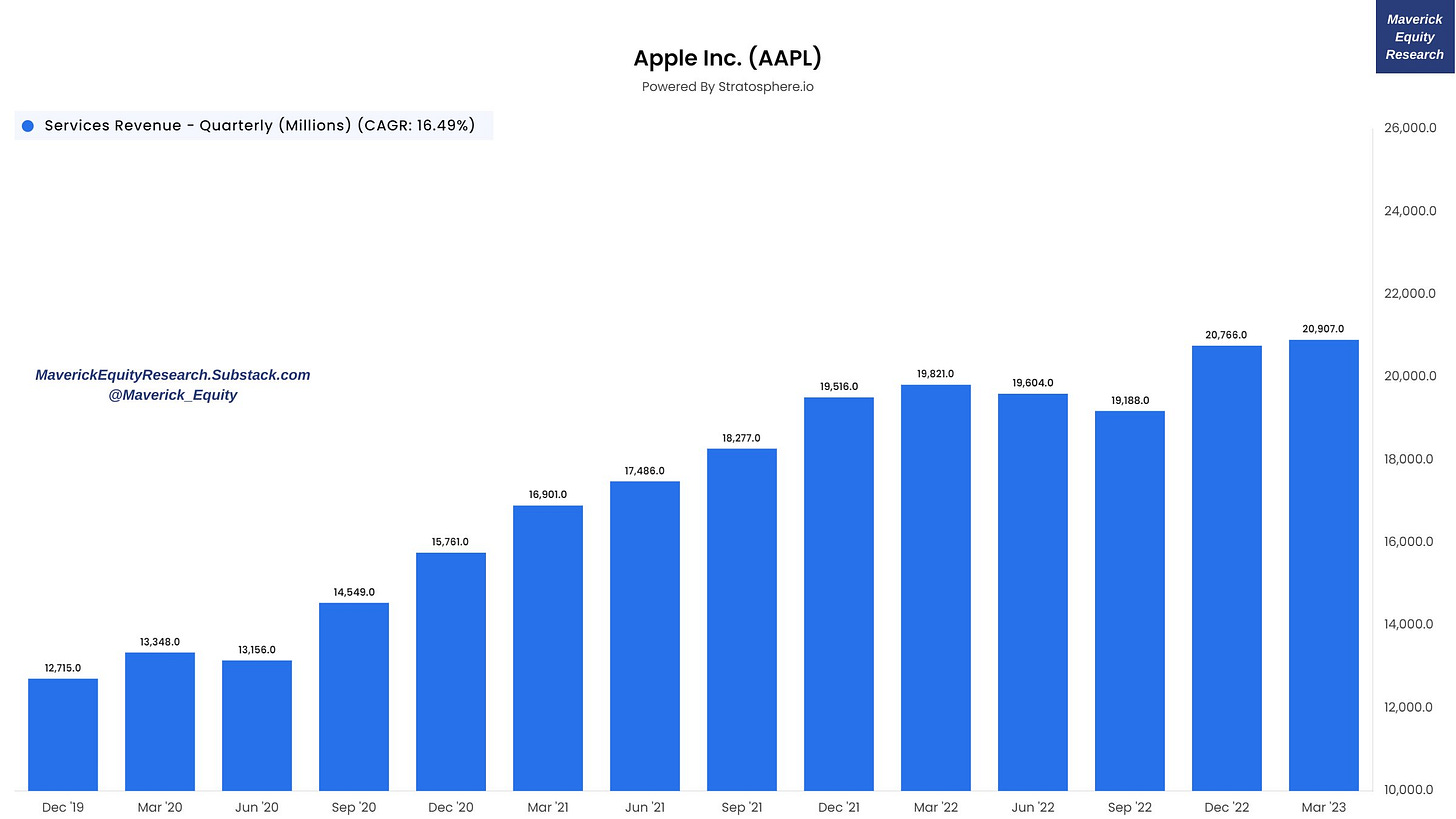

Apple Services revenue ... monster with a 16.49% CAGR!

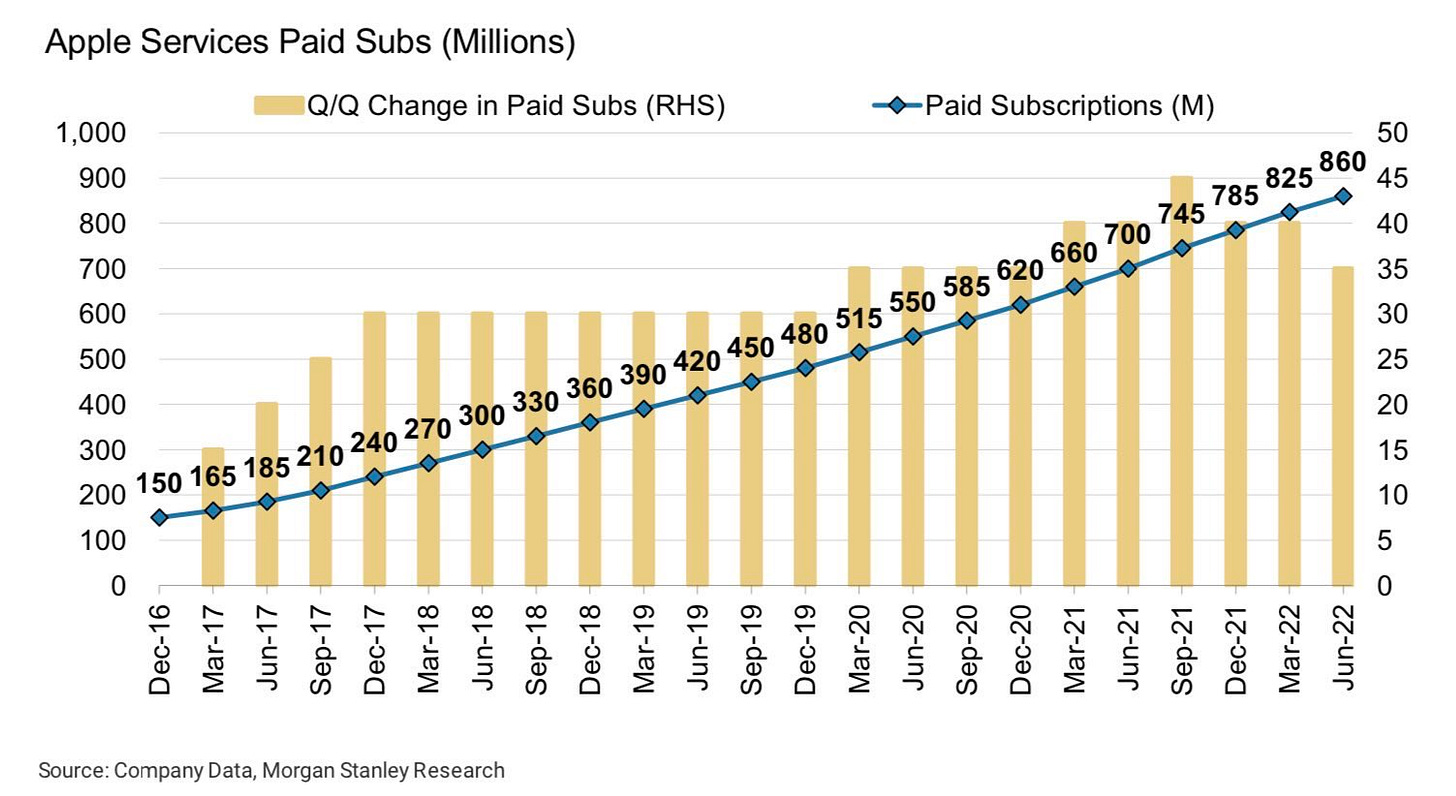

How many subscriptions do you think Apple has sold so far? 860 million!

How could this translate down the road? Well, if Apple would raise the monthly price by just 1$, could generate almost an extra $10 billions / year in revenue! How many would cancel Apple subscriptions with just a 1$ increase? Not many!

Hence, Apple has a big ecosystem with a lot of network effects and hence a ‘moat’ with an easy pricing lever they can tap into in order to generate incremental high margin returns for many years ahead. Let that one sink in!

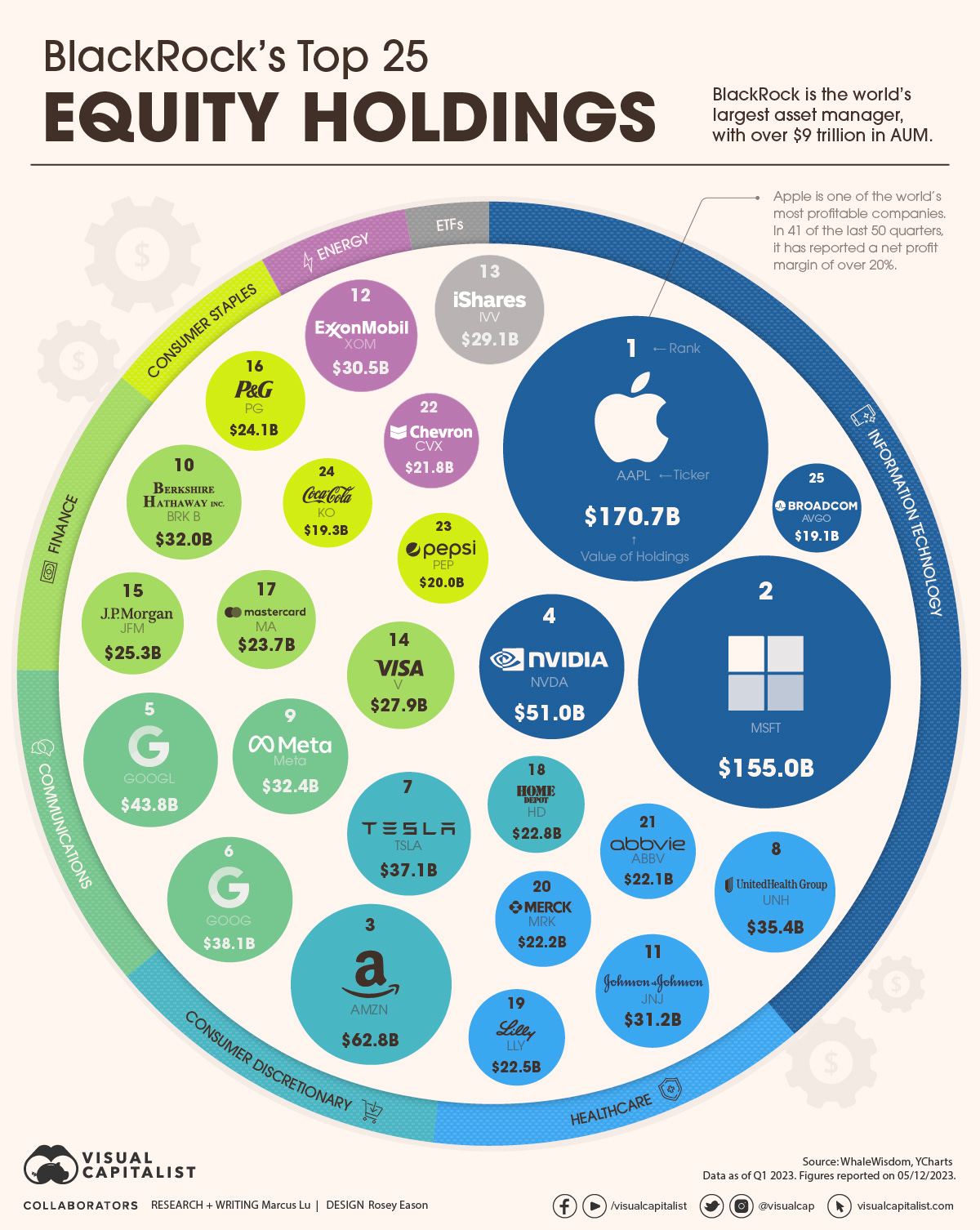

BlackRock = world’s largest asset manager with over $9 trillion in assets under management (AUM). Guess the number 1 holding? Apple! Top 25 equity holdings:

Which is The Most Innovative Company in 2023? Simple: Apple … and it’s not just in 2023 but it’s 4 years in a row now

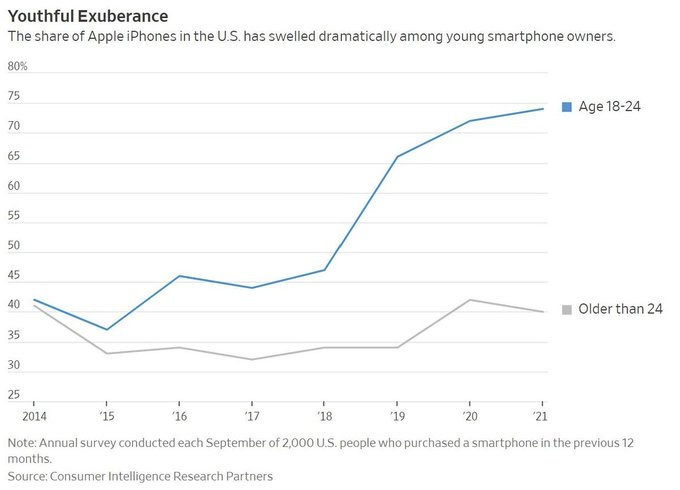

Apple’s growing moat via customer demographic profile:

👉 Share of young Americans (18-24 age group) that own Apple iPhones growing & growing ...

👉 Note: they are mostly not big money makers now naturally = more $ coming via future services ... future secured & ‘funding secured’

👉 once in, hard to switch = Buffett daddy & investors like that quite for sure

Can we translate the above via funny and cool MEMEs? Yes! Check the 2 below:

We can say that Apple has a ‘moat’ … no wonder Buffett said: 'I don't understand the phone at all, but I do understand consumer behavior'

Should you have found this cherry-picking endeavour interesting and valuable, subscribe and share it around with people that might also be interested! Thank you!

Have a great day!

Mav

This is an awesome chart compilation and they are each worth a thousand words or more. How many charts are there? I haven't counted but that's worth 10,000 words or more!

Shared! Thank you. It’s a little scary how much market power they have- their cash position is nuts.