✍️ ARK Invest Short & Squeeze - Edition #3

ARKW +35%, ARKF +27%, ARKK +25% & ARKQ +17% in 2023 - Performance, ARKK deep dive, Valuation, AI framework, Short Interest, Key Metrics, latest Ark trades & Direct Stock Commentary + Bonus

Dear all,

welcome to the 3rd edition of the ARK Invest Short & Squeeze report that covers state of the art analytics & visuals on Ark’s 6 main ETFs. A unique report after I studied what is out there & not even Ark Invest itself posts many of these key analytics.

Target audience: investors into the disruptive innovation thematic, traders from long, short & short squeezers of Ark. Useful also for investors in general, journalists and markets observers given how Ark is quite a distinct liquidity proxy, risk-on/risk-off, and sentiment gauge in the financial markets.

Report is NOT behind a paywall, there are no pesky ads here but pure data-driven research as always. It would be highly appreciated if you just spread the word around to people that might also be interested.

Report structure is the following:

📊 Ark Invest ETFs: Performance Overview

📊 ARKK flagship ETF: deep dive

📊 Ark Invest ETFs: Valuation

📊 Ark Invest ETFs: Artificial Intelligence framework

📊 Ark Invest ETFs: Short Interest - ETF level & single stocks

📊 Ark Invest ETFs: Key Metrics

📊 Ark latest trades in action

💬 Ark Invest Direct Stock Commentary

🏦 Bonus Takes & Charts

📊 Ark Invest ETFs: Performance Overview

All 6 ETFs positive in 2023 while ARKW ARKF ARKK ARKQ booming with 35%, 27%, 25% & 17% respectively. Risk appetite for the Innovation/Hyper Growth thematic is on!

Enhanced Price Action view: Ark 6 ETFs 2023 Returns & Rebounders from their 52-week low + I added S&P 500 (SPY) and the Nasdaq 100 (QQQ) for comparison:

ARKK/SPY and SPY/ARKK for the last 5 years in order to zoom out & more context: after massive ARKK outperformance, the mighty S&P 500 got back once inflation and subsequently interest rates came to town:

Before anything, may I clear a big misconception as I did on twitter that I saw lately very often on Ark & Nvidia. Ark Invest & Nvidia holding since 2014 inception:

WAS a top holding in 2014 when ARKK launched

IS the 4th biggest contributor to returns overall

SOLD before the recent crazy run, but overall did get quite some out of it

Side key note next: how are Nvidia insiders threating their own stock? Sell sell sell! No single buy since 2020. Selling this recent parabolic run would be fine for me, but no single buy in 3 years? I mean ... I thought this will change the entire S&P 500 and planet ... I wonder which names look like that, but with Buys! Food for thought …

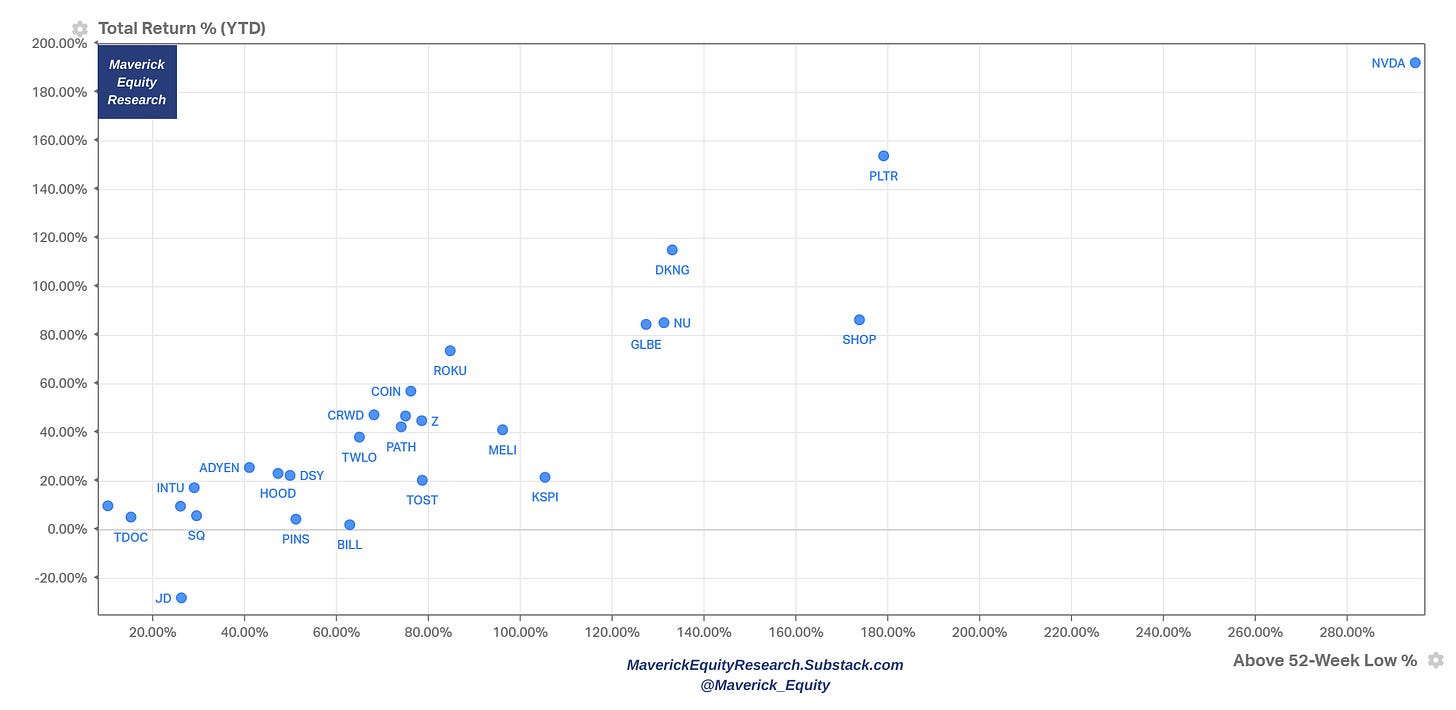

Further performance breakdown inside the ETFs via price scatterplots: 2023 Total Return % and Above 52-week Low % with the following likely use cases: check for market leaders & laggards, outliers, positive/negative momentum, short/squeeze candidates, relative strength, likely unwarranted cheap/expensive stocks, further deep dives on single stocks & connecting the dots for a general market assessment.

ARKK 2023 Total Return % and Above 52-week Low %: most names are up materially, check the outliers

ARKQ 2023 Total Return % and Above 52-week Low %: most names are up materially, check the outliers

ARKF 2023 Total Return % and Above 52-week Low %: most names are up materially, check the outliers

ARKG 2023 Total Return % and Above 52-week Low %: more names negative, check the outliers (ETF overall still positive in 2023 as per above)

ARKW 2023 Total Return % and Above 52-week Low %: best performer ETF in 2023 with almost all up materially, check the outliers

ARKX 2023 Total Return % and Above 52-week Low %: most names are up materially, check the outliers

Weekly price % change of the 6 ETFs for the past 12 months for zooming out a bit:

Zooming out further for the returns & CAGR since the inception of each ETF:

massive parabolic run up & then back to earth with a notable driver being cheap money driven by ultra low interest rates & central banks balance sheet expansion

ARKW leading with a 15.46% CAGR, followed up by ARKQ with 13.52% while the flagship ARKK ETF with 10.63%

📊 ARKK flagship ETF: deep dive

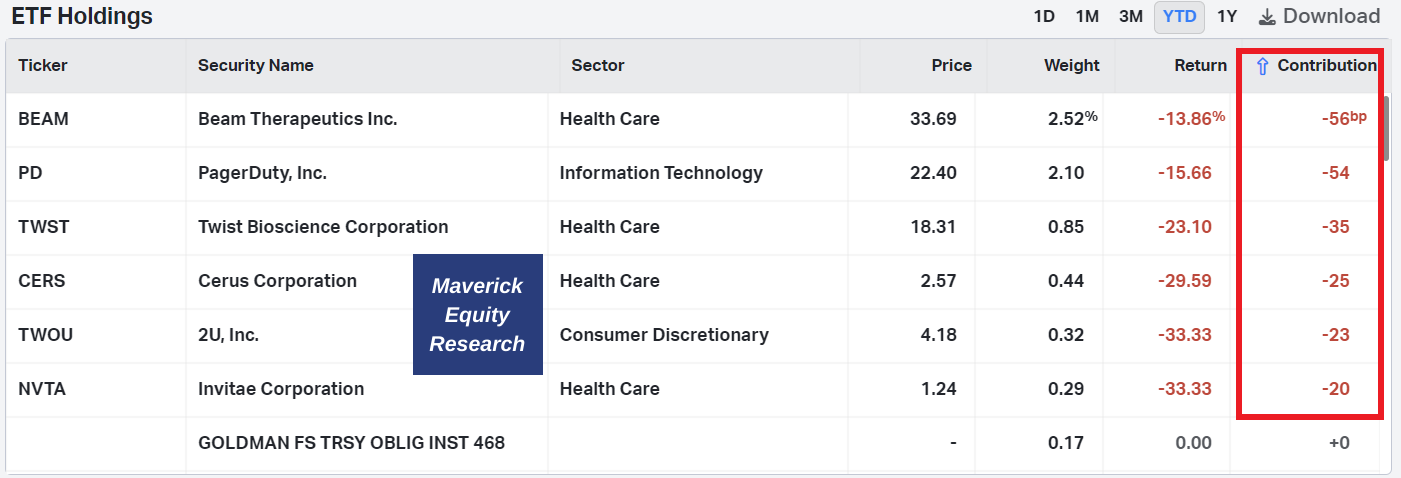

Digging inside the flagship ETF ARKK constituents via the angle of Performance & Weight in 2023: leaders and laggards

2023: TSLA ROKU EXAS SHOP DKNG PATH COIN doing the heavy work

2023: BEAM PD TWST CERS TWOU NVTA the laggards

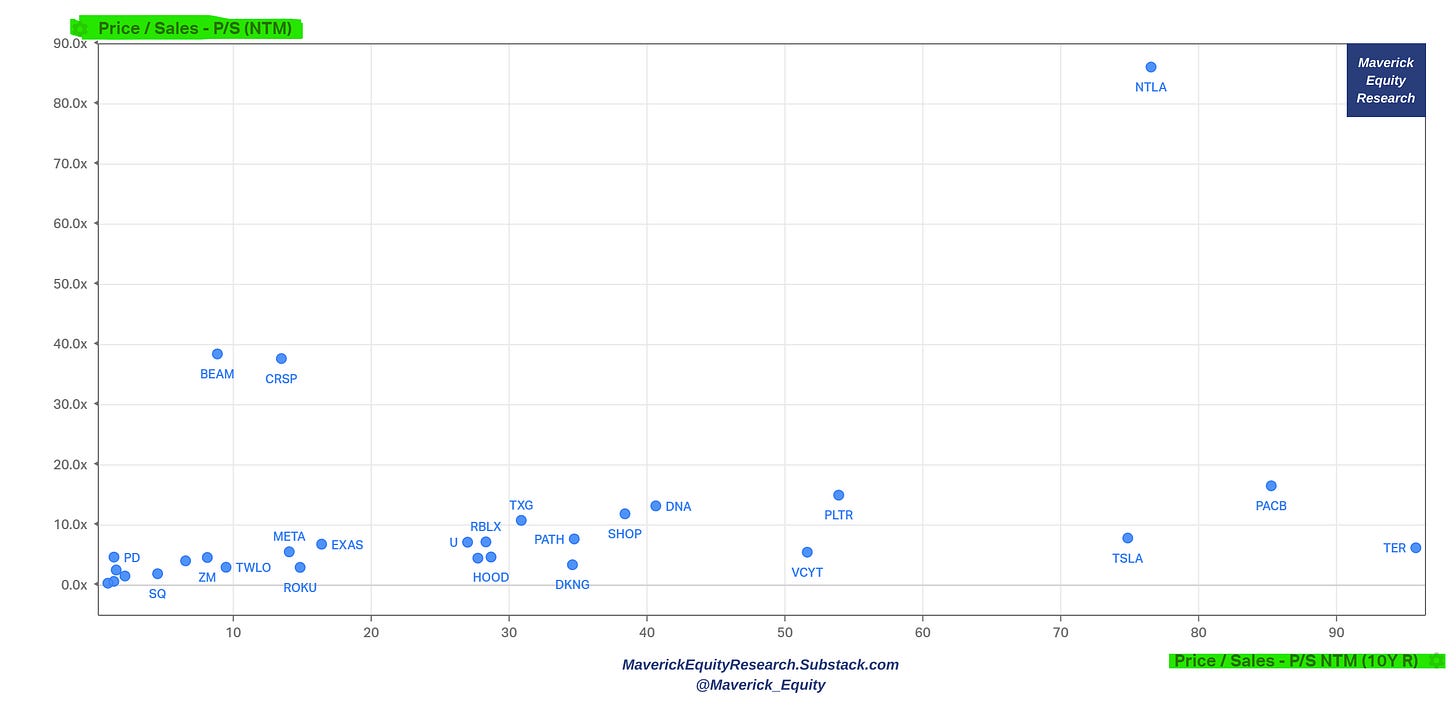

Valuation views:

Sales/Revenue aka ‘Top-line’: namely, looking at the P/S multiple & Revenue growth (next year estimates). Interpretation: Forward P/S multiple the stock is trading for the given level of estimated Sales growth

Next, a very ‘Maverick-esque’ visual analytic that you will very rarely see around: ARKK components with forward P/S multiples & the percentile forward P/S multiples vs their 10-year historical range (simply put, a good angle to see each stock’s historical valuation multiples with itself today and also the other tech businesses from the Nasdaq-100 for a relative comparison):

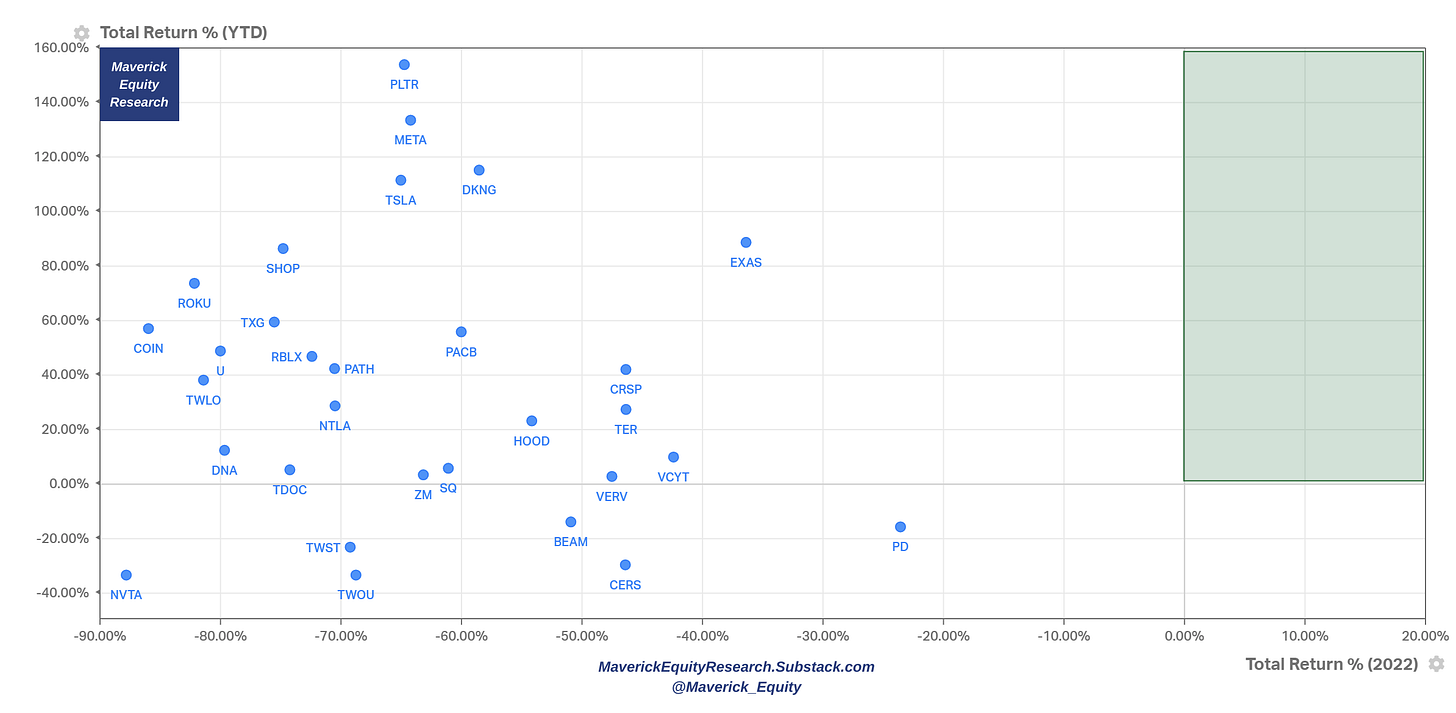

Research question next which some gets fun answers and sometimes interesting ones: which stocks were positive both in the 2022 bear market and up to today in 2023? Answer via 2023 YTD Winners & Total Return for 2022: None! Note thought in 2023 the rebound is big for many ARKK names!

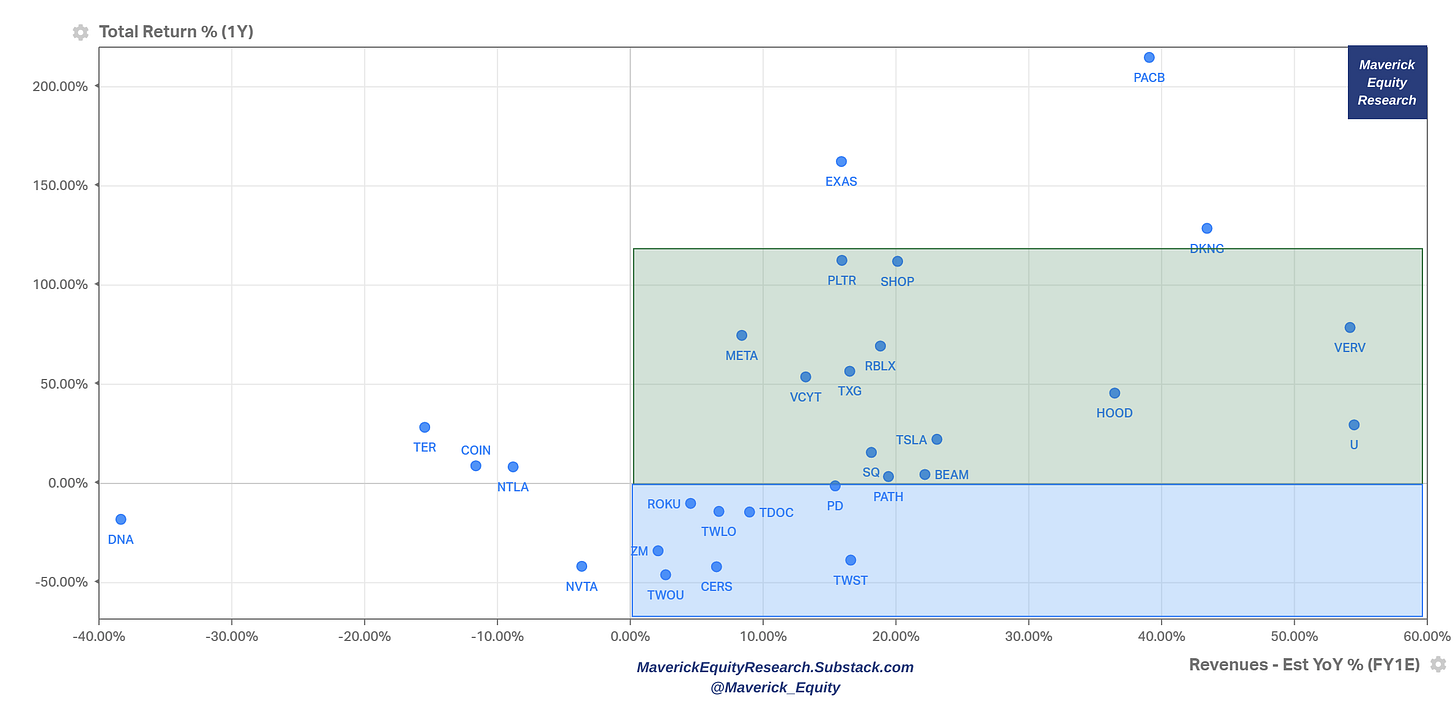

Complementary, it is quite interesting to plot also: 1 year past returns with consensus Revenue growth. Rationale? We want to spot companies with:

big but not too big recent returns & still strong expected growth (green quadrant)

declined stock price, but still strong expected growth (blue green quadrant)

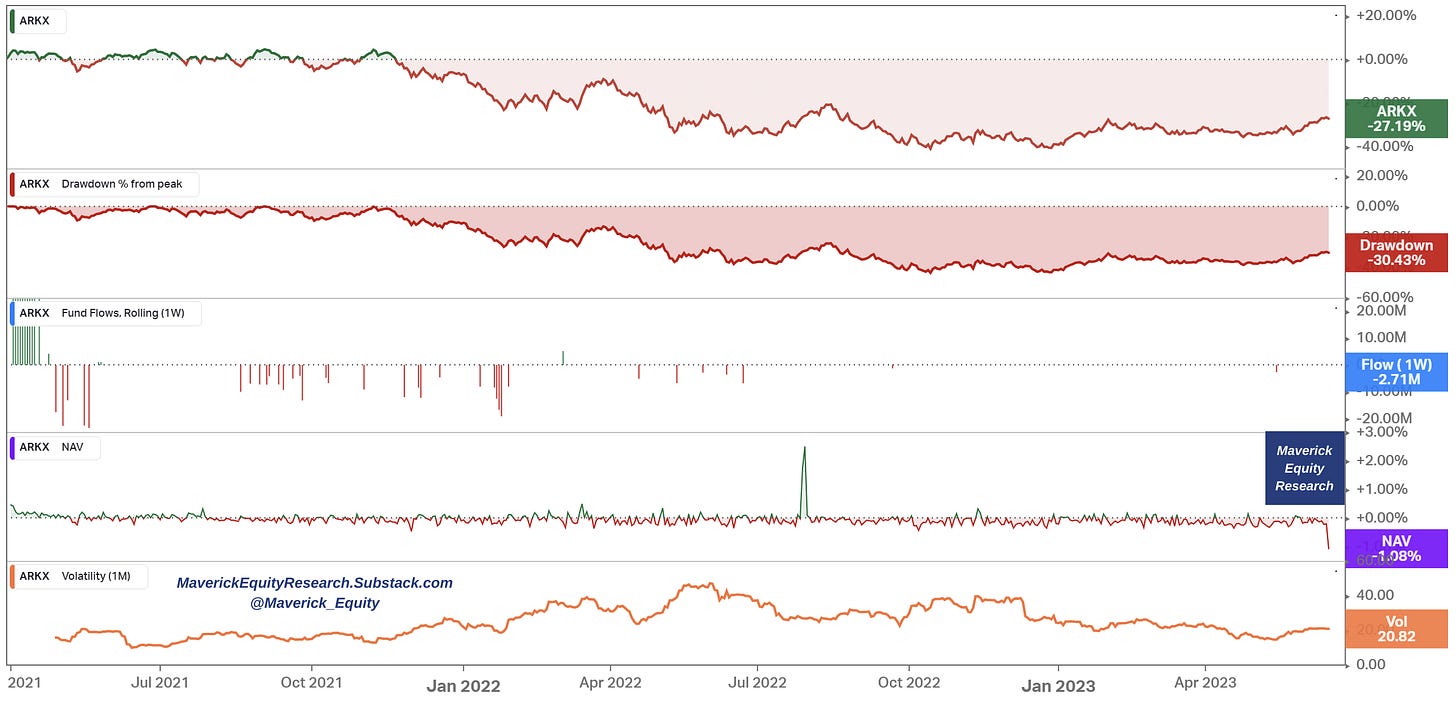

ARKK key metrics with the last 3 years for the 5 ETFs: Total Return, Drawdown from peak, Flows (weekly), NAV trading at Premium/Discount & Volatility:

A common statement I see online is that ARKK has been all about retail investors buying the innovation investing theme. Data clears the ski on that one also: Fidelity data shows us that current Institutional ownership is 52%, they bought more recently & in the Top 10 holdings by shares held, we find big household names as owners.

Via Fintel.io we see visually how institutional ownership increased in the last years, and that despite the price falling back to 2018-2019 levels. A big uptick recently!

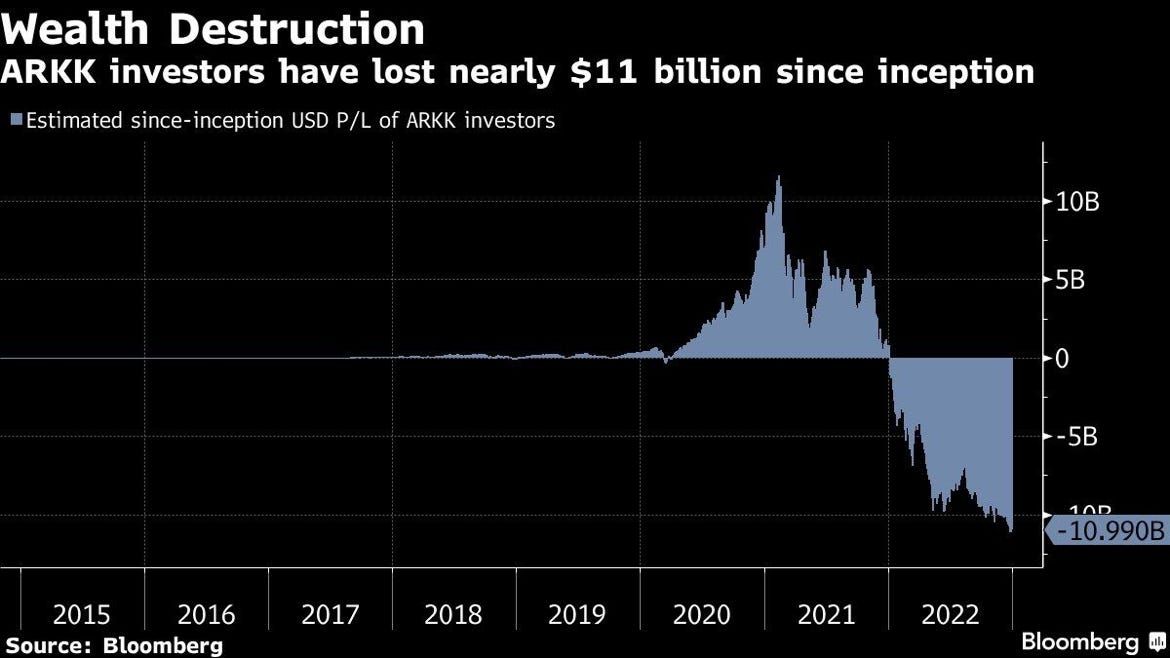

Since inception up to December 2022, Bloomberg estimates that ARKK investors lost almost $11bn, though let’s note that was also with a big positive sign back in Q4 2020. I personally always say: when anything works too well & too fast, time to ask questions, hedge, trim or mark a profit: nobody got hurt ever booking a profit, stepping a bit on the side for a new plan less influenced by recency bias. On hedging, a general message: it’s very likely to be cheap when the asset is going fast upwards (i.e. when nobody wants to hedge).

Is what happened lately a very unique Ark / Cathie Wood story? No: 5-year performance of ARKK vs a Goldman Sachs Basket of Unprofitable Tech Stocks. Spot the difference! Close to none! Ark / Cathie wood was not exactly an outlier!

ARKK Short interest with 2023 Total Return: check names with high short interest that performed well/bad in 2023 and conversely, and names that have low short interest that did well/bad in 2023 … outliers, special cases can get interesting

Execution wise for short sellers one way to short ARKK is via SARK ETF (‘the shark going for the Ark’) which is an ETF launched in 2021 and mechanics wise goes inverse via swaps on ARKK. A good 42% return since inception (was up 135% just recently in December 2022), though note lately the outflows (monthly) from the ETF and fading volume.

Looking into 2023 now, via SARK we see short sellers did not do well with a -34%. Note again the outflows (weekly series this time) from the ETF and fading volume.

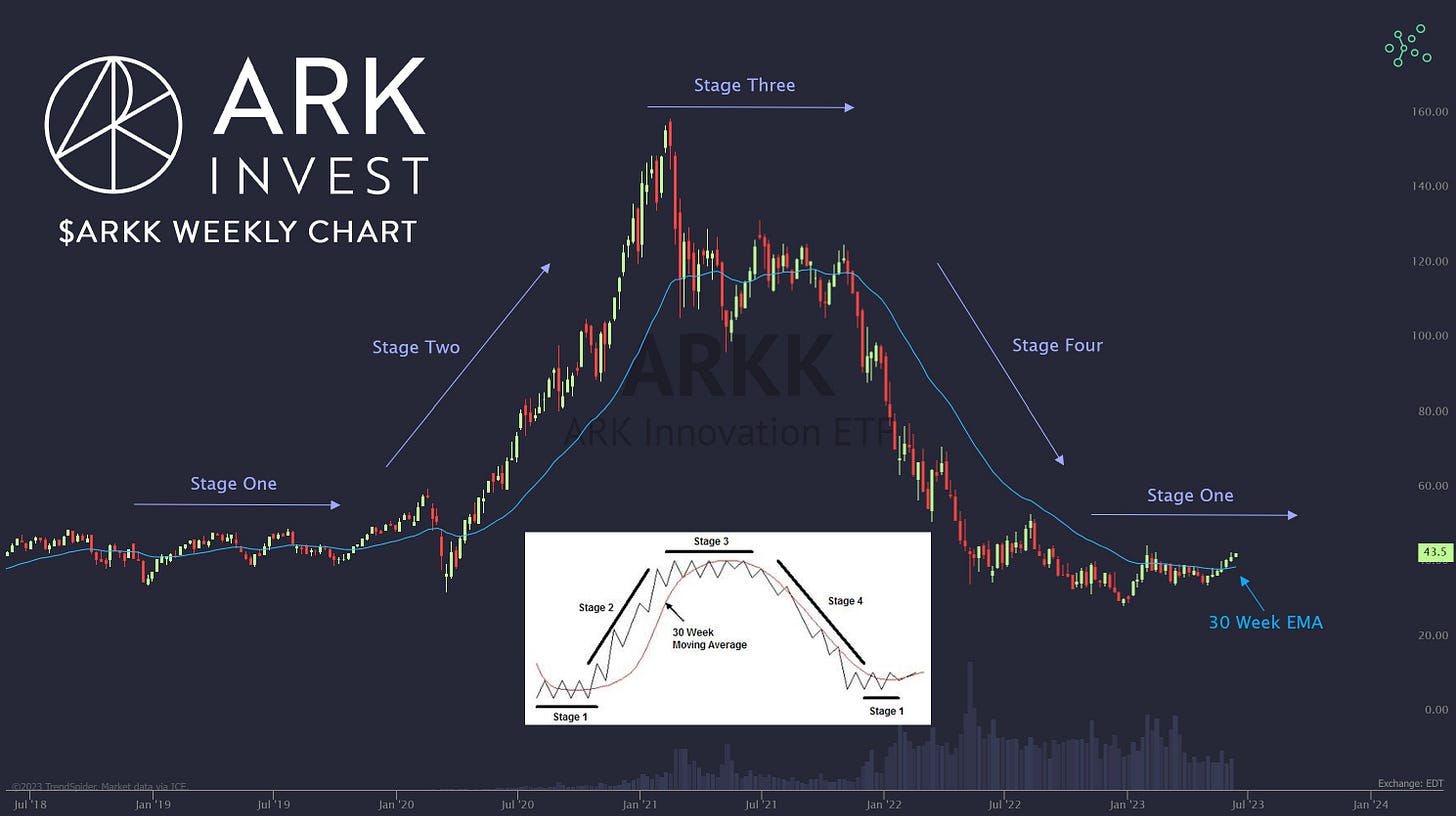

From a technical analysis view, ARKK formed a major Head & Shoulders pattern in the last 3 years. Going into 2022 year-end, it broke briefly below the right neckline, only to come back up in 2023 strongly. That’s a key resistance level to be watched.

Alternative view, when is Cathies comeback tour?

All in all, ARKK is very sensitive to inflation, hence the interest rates trajectory & liquidity profile that the FED embarks on. Chart below shows FED total assets yearly % change and ARKK price. As FED liquidity shot up, ARKK went parabolic and the other way around. ARKK for now is a bet on innovation and a liquidity proxy also. When and if the companies become profitable and deliver cash to investors, this sensitivity should drop materially.

We can see this sensitivity dynamic also with ARKK and the US 10-year gov yields:

All in all, when rates & inflation will fall fast enough, likely a sharp rebound for Ark ETFs, growth, hyper-growth & tech space in general. A wordplay & rhyme in the same time: at the end of the day it’s a big 'rates play' … for this space.

📊 Ark Invest ETFs: Valuation

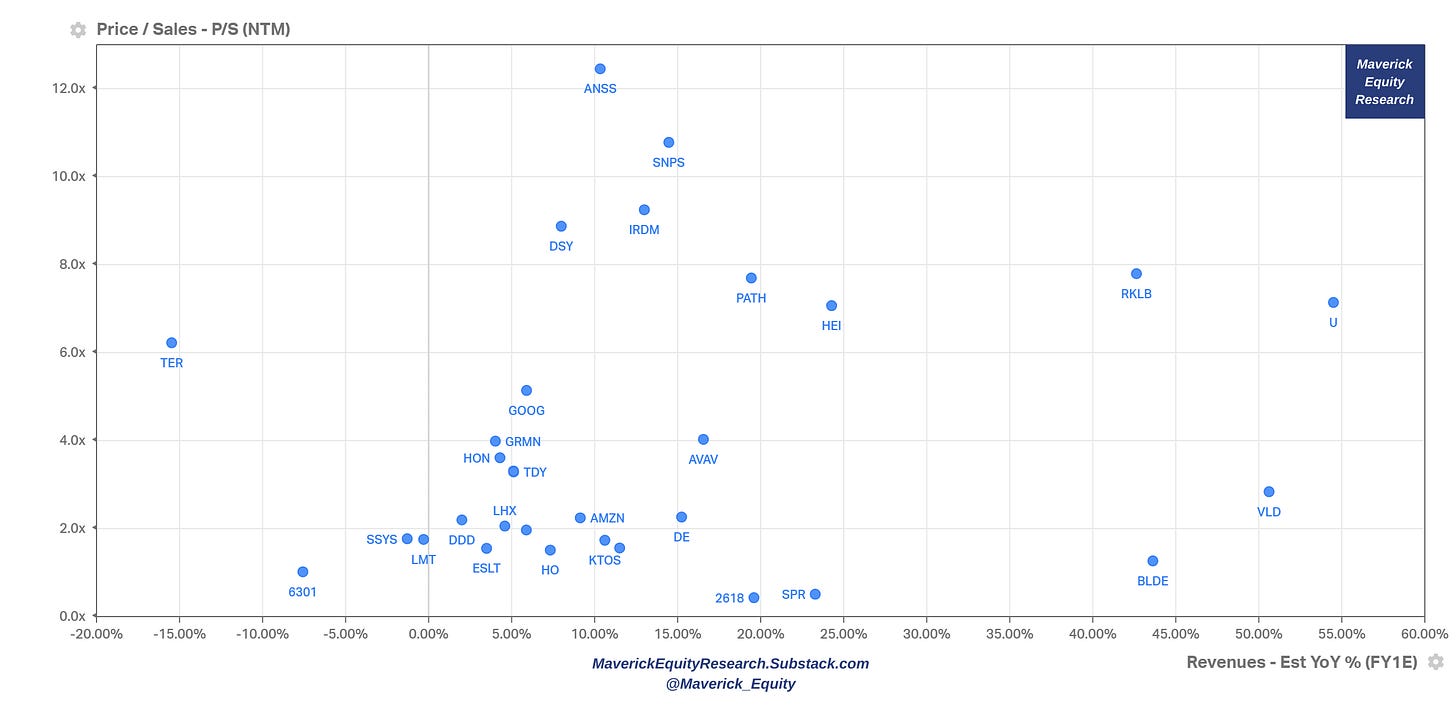

Sales/Revenue aka ‘Top-line’: namely, looking at the P/S multiple & Revenue growth (next year estimates). Interpretation: Forward P/S multiple the stock is trading for the given level of estimated Sales growth

ARKQ components:

ARKF components:

ARKG components:

ARKW components:

ARKX components:

📊 Ark Invest ETFs: Artificial Intelligence framework

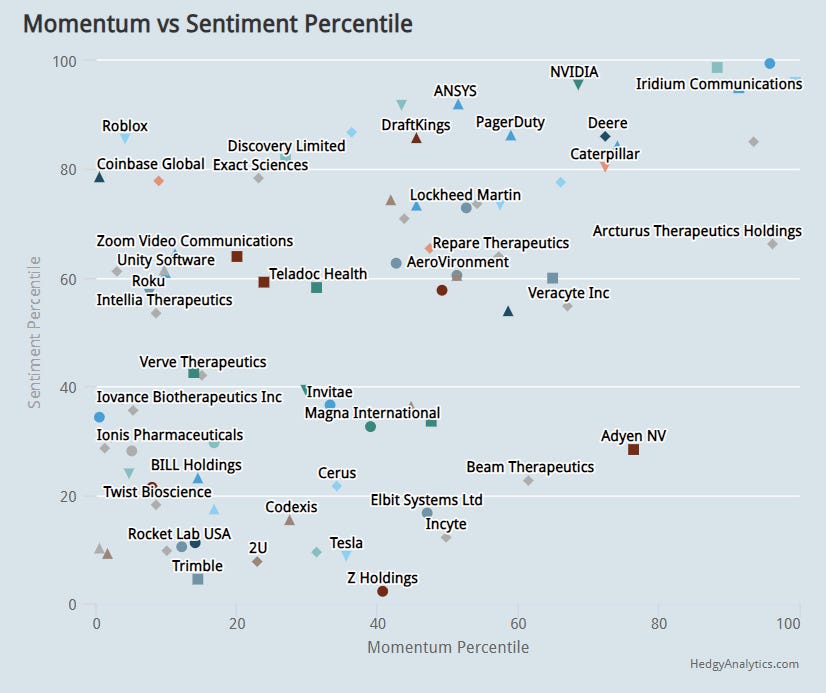

ARKK ARKQ ARKF ARKG ARKW valuation via an Artificial Intelligence (AI) framework provided by Hedgy Analytics via the Cheapness, Profitability, Sentiment & Momentum dimensions. Main takeaway: rock bottom Cheapness & Profitability while Momentum & Sentiment scores with a recent material jump

Profitability and Cheapness dimensions via a great scatterplot visual:

Momentum and Sentiment dimensions via a great scatterplot visual:

If you go on Hedgy's website, you can filter the Opportunity Triangle by Cheap, Value, Profitable, Growth, Loved, Trending and right in the middle, Ideal:

12 months forecast for ARKK ARKQ ARKF ARKG & ARKW components:

N.B. background on the Artificial Intelligence (AI) framework: model breaks down company historical and forecasted financial fundamentals to gain perspective on its Cheapness, Profitability, Sentiment, and Momentum. Then it further applies machine learning techniques to data to determine which measurements are most predictive in each distinct industry. It is improved and fine tuned week by week and more to come.

📊 Ark Invest ETFs: Key Metrics

Now let's plot 5 Key Metrics covering the last 3 years for all 6 ETFs: Total Return, Drawdown from peak, Flows (weekly), NAV trading at Premium/Discount & Volatility:

Complementary, Ark ETFs Assets Under Management (AUM) since inception:

AUM again, but linear scale - a good idea to watch for differences in linear/log scales:

📊 Ark Invest ETFs: Short Interest - ETF level & single stocks

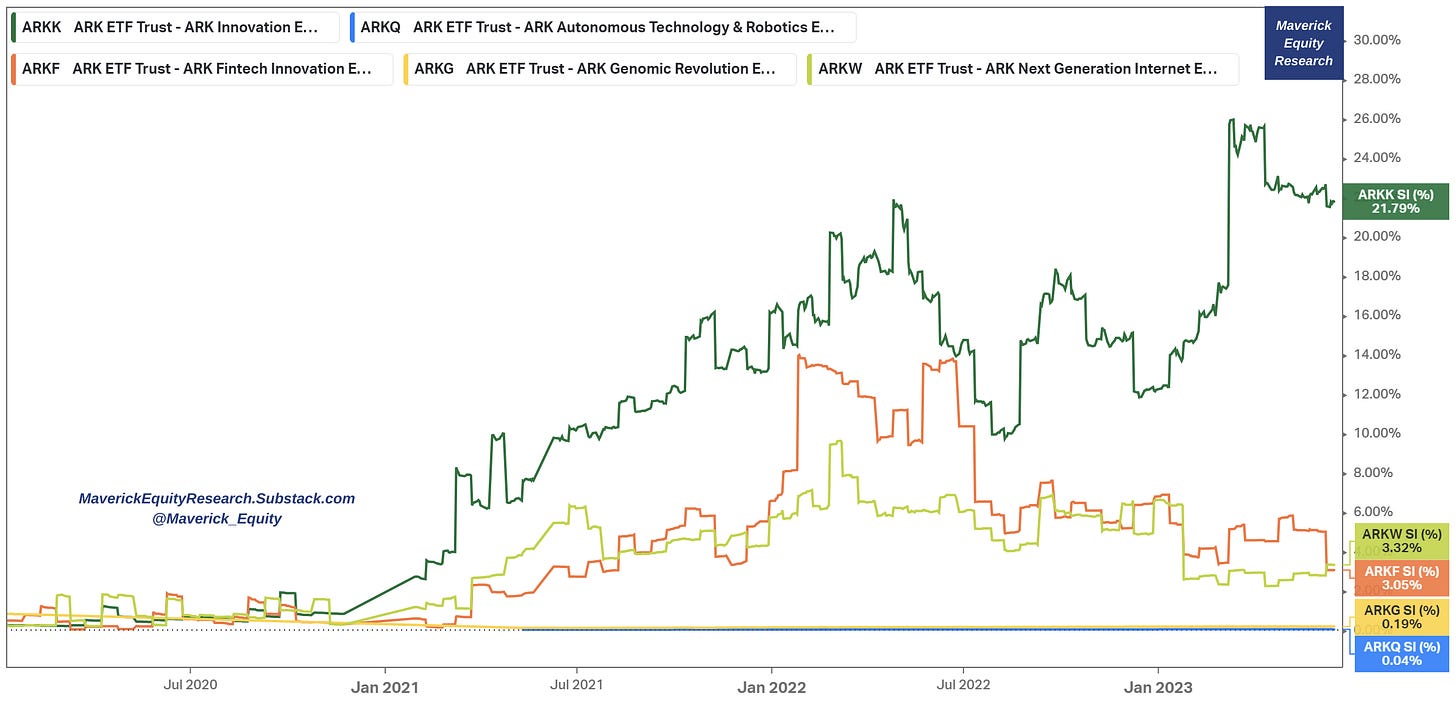

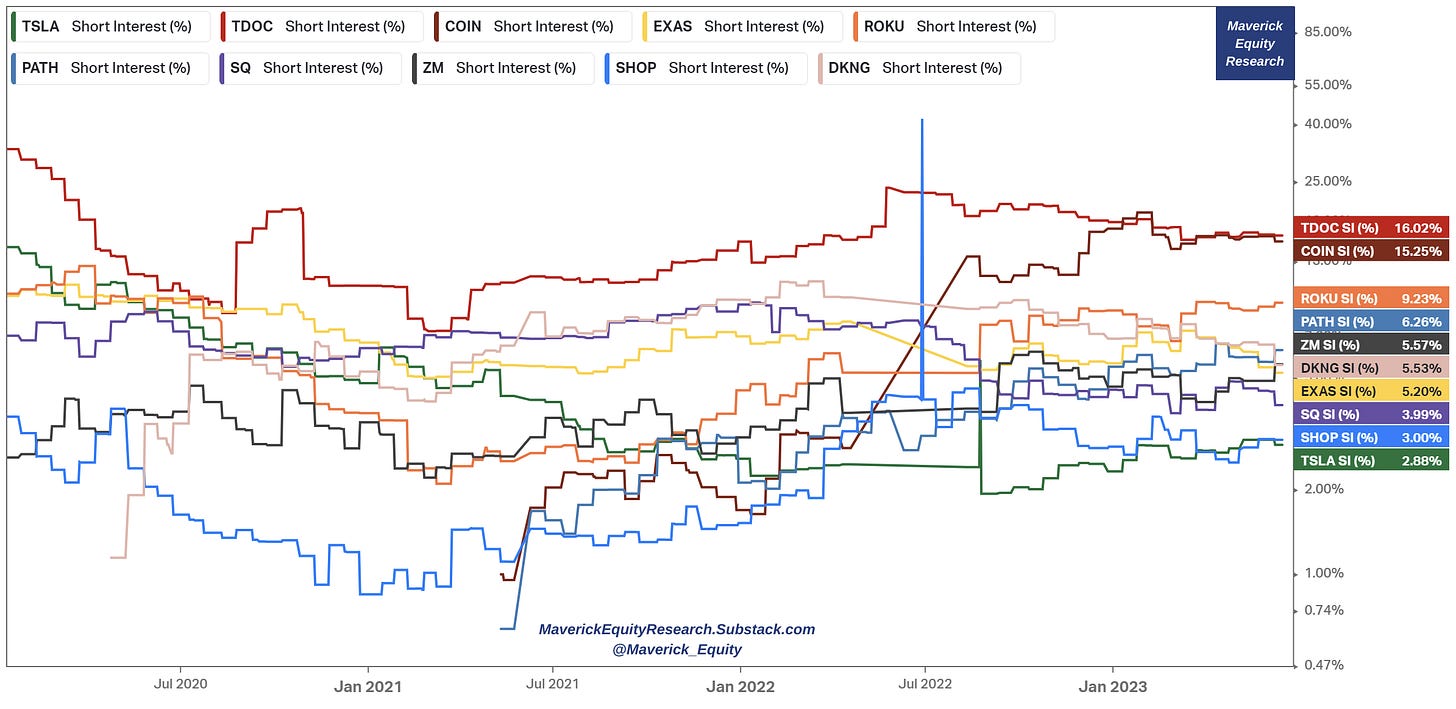

ETF level Short Interest: ARKK flagship ETF with a big 21.79% short interest, though note it cooled of a bit lately given the recent rally where shorts had to take losses and cover. Note also how ARKF used to be very high, though very low now.

Top 10 Ark holdings Short Interest across all ETFs:

TDOC & COIN & ROKU with the highest short interest while Tesla with the lowest.

Short interest of ETF components with 2023 Total Return: check names with high short interest that performed well/bad in 2023 and conversely, and names that have low short interest that did well/bad in 2023 … outliers, special cases can get interesting

ARKQ components:

ARKF components:

ARKG components:

ARKW components:

ARKX components:

📊 Ark latest trades in action

Profit taking in Tesla given the recent great run of the stock

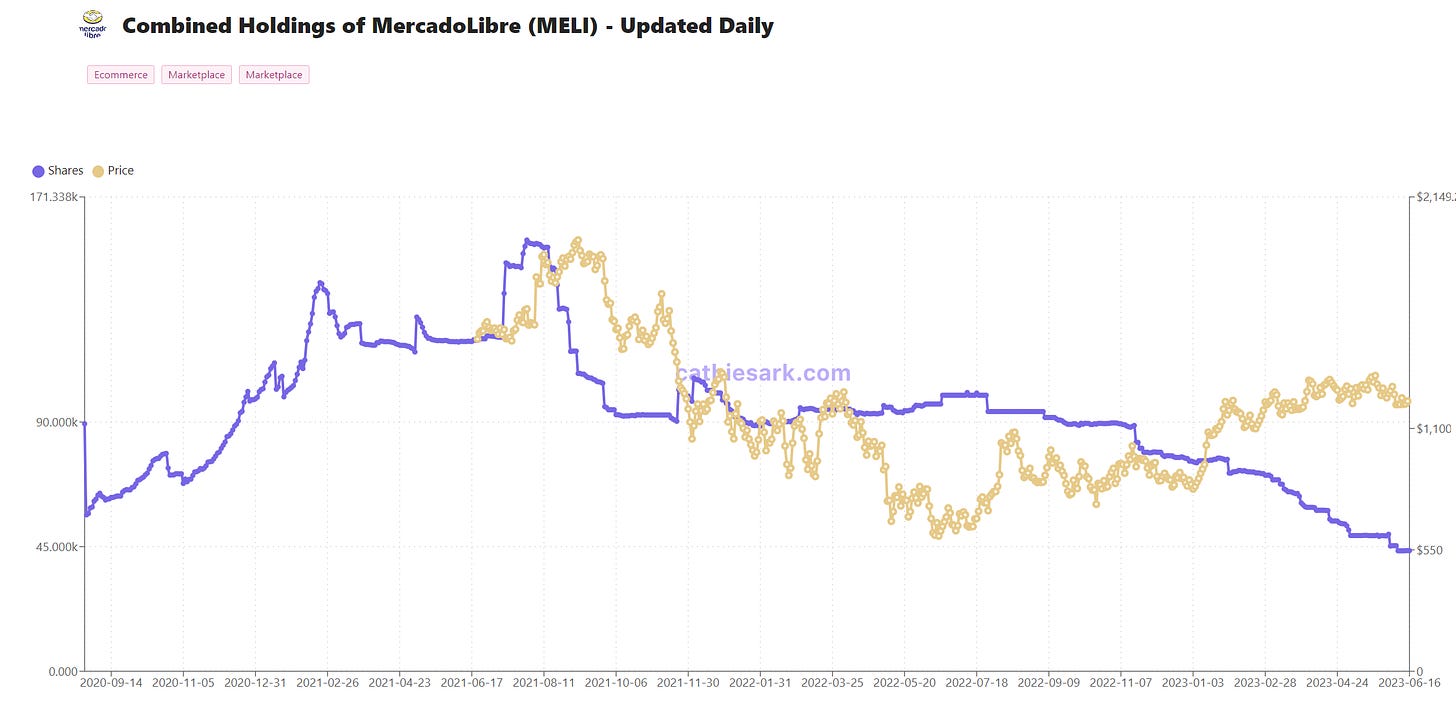

Newest biggest position? META/Facebook! Started in ARKK on June 12th 2023!

🐂 Bullish action🐂

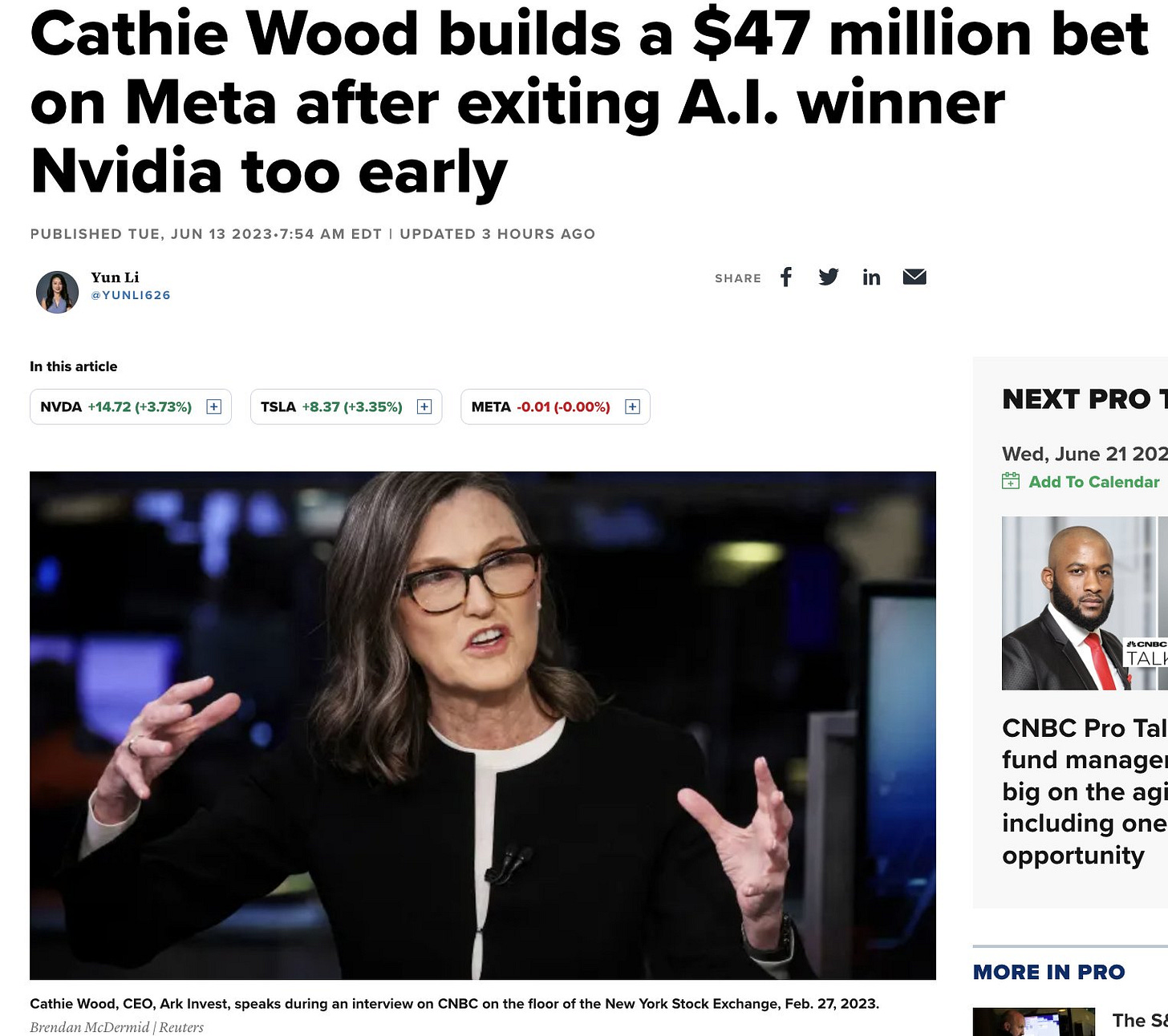

Ark with material buys lately: COIN, SQ, CRWD, ADPT & TER

🐻 Bearish action 🐻

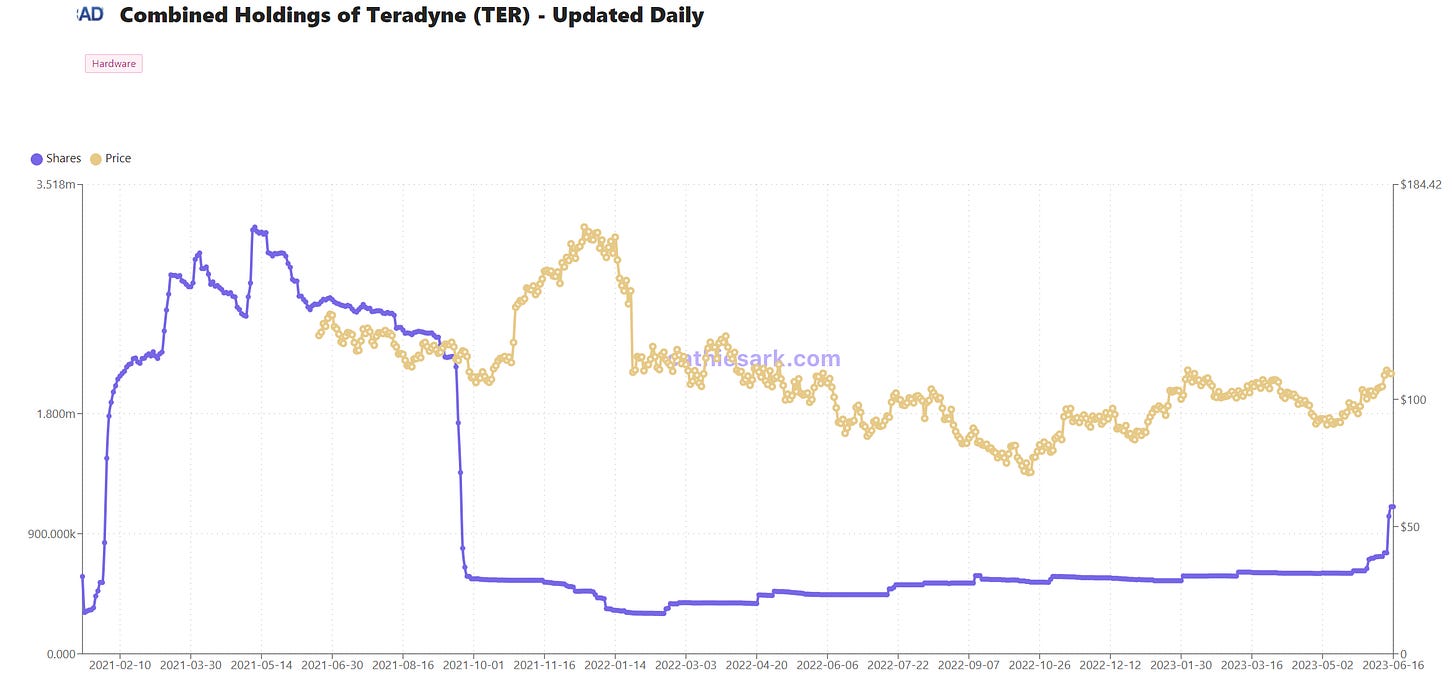

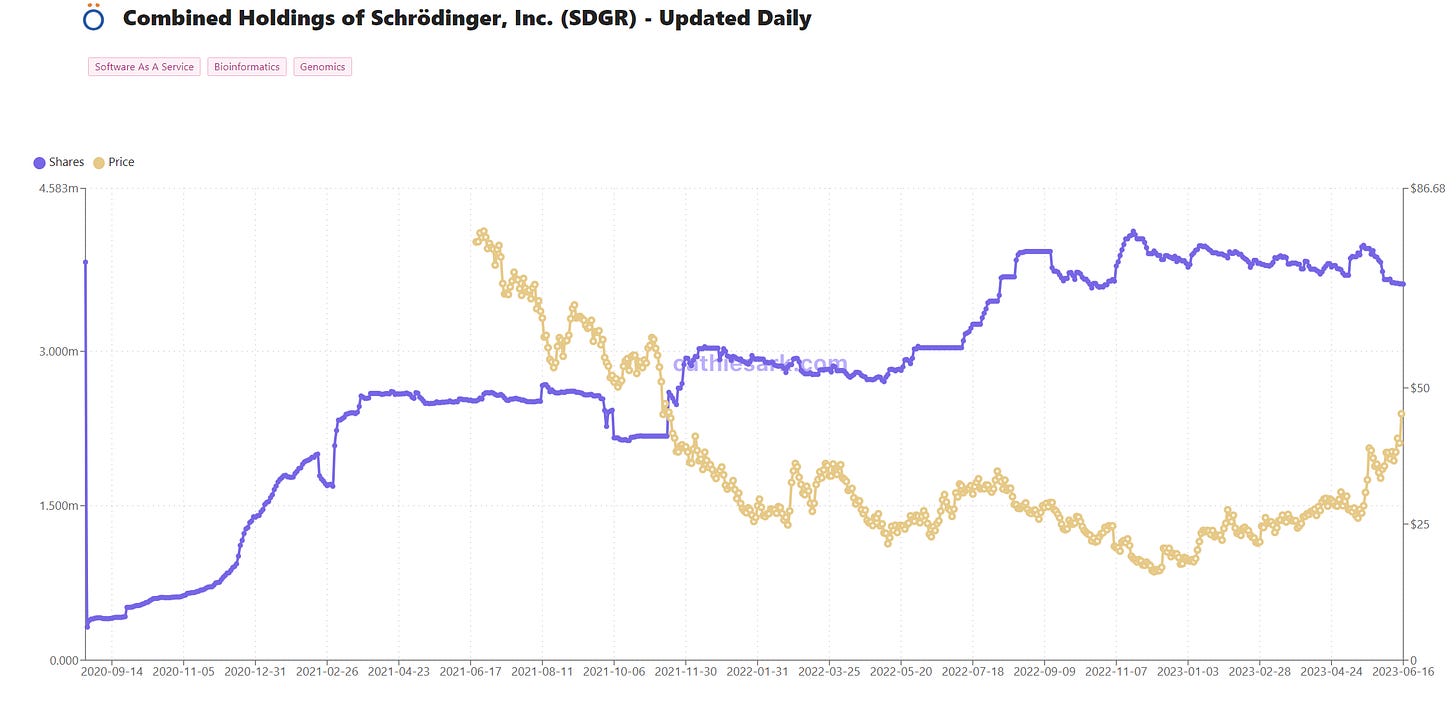

Ark with material sells lately: CRSP, SDGR, EXAS, DKNG & MELI

💬 Ark Invest Direct Stock Commentary

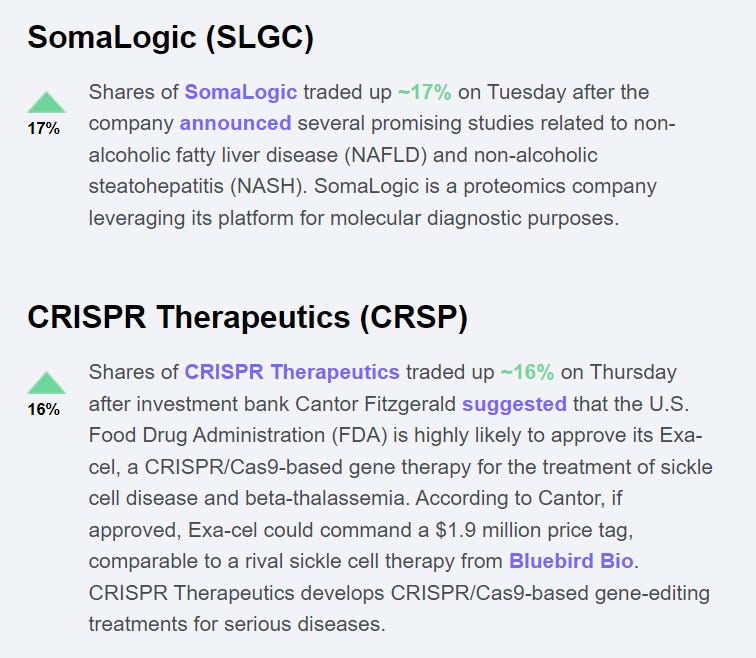

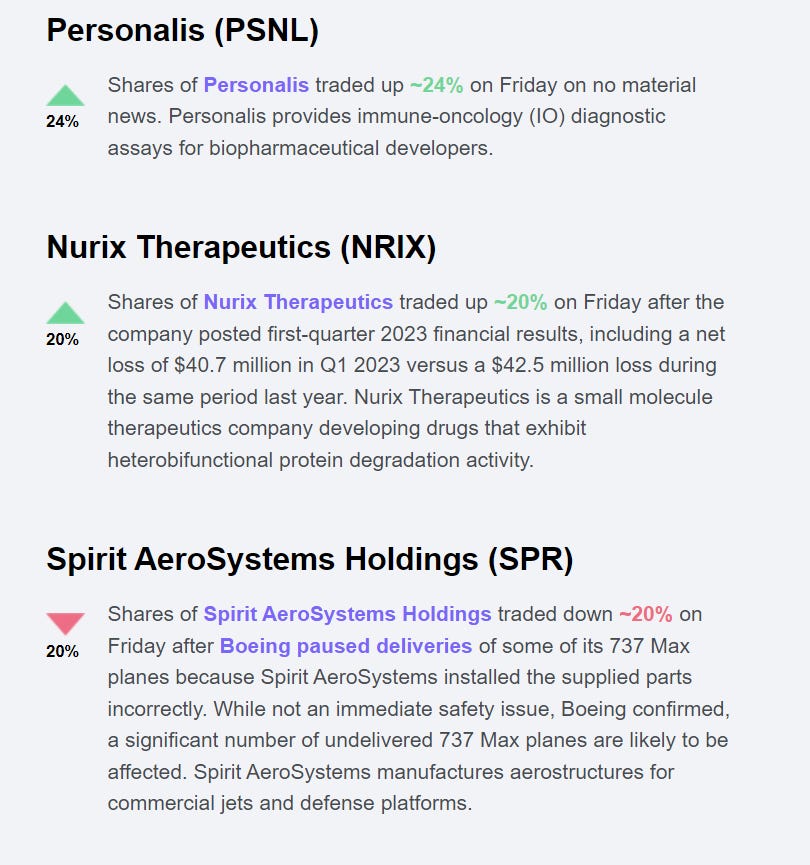

Ark shares weekly commentaries with investors on stocks part of their strategies that have appreciated or dropped more than 15% in a day during the course of the week.

🏦 Bonus Takes & Charts

Tesla approaching 200m full self driving miles driven. FSD run-rate now likely exceeds 1 million miles daily. Who owns the best & most data is likely a winner in the Artificial Intelligence race independent of industry.

Ark Research on Amazon’s Robotics: robot growth exceeded employee growth from 2021 to 2022 (Robots: 48.6%, Employees: 23.9%):

ARK Venture Fund holdings, the privates ones: note Twitter …

I hope you enjoyed this publication & it would be great to hear your feedback both in terms of what is currently inside & further coverage you would like to see further.

Have a great week!

Maverick Equity Research

you are mis-reading the institutional ownership. The overwhelming majority of shares held by institutions are market makers who hold positions to delta hedge their options book. Taking a quick look at the latest 13F's, I'd say this at applies to at least 90% of the shares. THey are certainly not "owners" of the stock in the way you think.

Thank you, great stuff!

Nice to see the Nvidia clarification!