Maverick Charts - December 2022 Edition #2

Cherry picked charts for interesting insights via short reads. This edition: stocks, interest rates, inflation, US Real Estate, FTX & Michael Burry

Dear all,

welcome to the 2nd edition of Maverick Charts, a dedicated section from Maverick Equity Research where I cherry pick 20 various charts from various contributors with the goal to provide interesting research insights via short reads. Enjoy it!

In case you did not subscribe yet for delivery straight to your inbox, it’s just 1-click:

From the world of Stocks:

Do small-cap stocks perform relative to large-cap stocks during periods of high inflation ? Chart via Longtermtrends.net and a great question from Silvan Frank for Aswath Damodaran (NYU Professor nicknamed the Dean of Valuation)

Damodaran’s confirmed the interpretation while adding: The data from the 1970s is right. Small cap stocks did better than large cap stocks during that inflationary decade. One swallow does not a summer make, though, and I am not sure that you can generalize this finding to today’s markets

From my side, I would just complementary add: having worked both in a start-up & a big listed corporate, definitely way easier & faster to adjust for a small company. Additionally, smaller companies tend to be more innovative & disrupt. Also, they are less sensitive to interest rates, and are less covered by Wall Street, hence higher potential for mispricing in the small cap space.

Longtermtrends.net is a great website for great long historical data series & sleek charts. Complementary, also a monthly report with delivery straight to your inbox.

2022 = Stock Picking Market via BofA: 2022 has been the best markets for stock pickers in more than 20 years! More than 60% of stocks outperformed the S&P500 this year which is the most since 2001

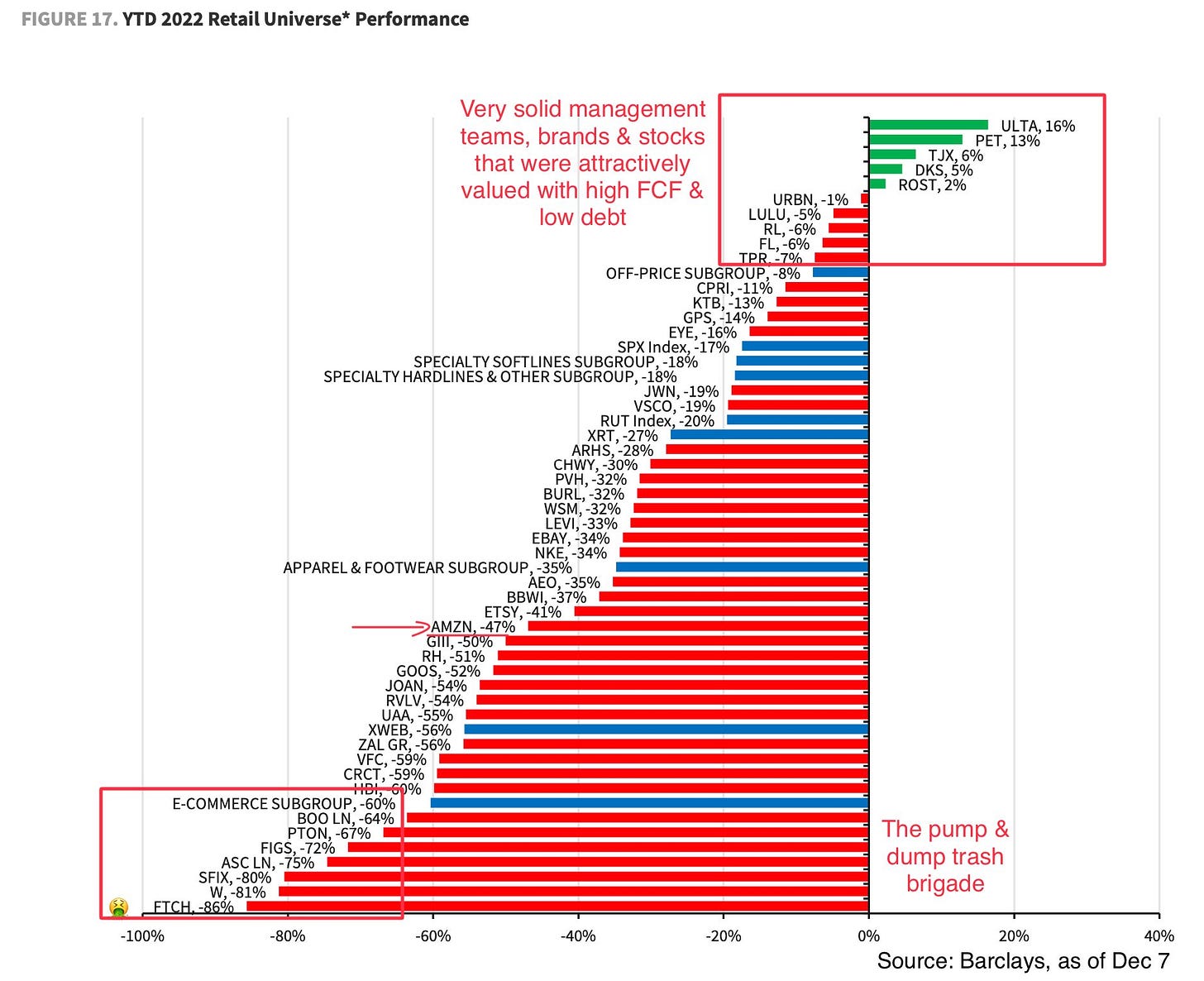

2022 Retail performance via @ecommerceshares: AMZN in the middle of the stack, down by half. FinTwit favourite FTCH at the absolute bottom at -86%, well-deserved for the most pumped piece-of-sh*t-co of all retail. Who told you?

Eurozone stocks valuations via TopDownCharts:

👉PE ratio dropped to very cheap levels: 2001 Dot-Com bubble & 2020 Covid crash

👉are we that bad currently? Imo quite likely not …

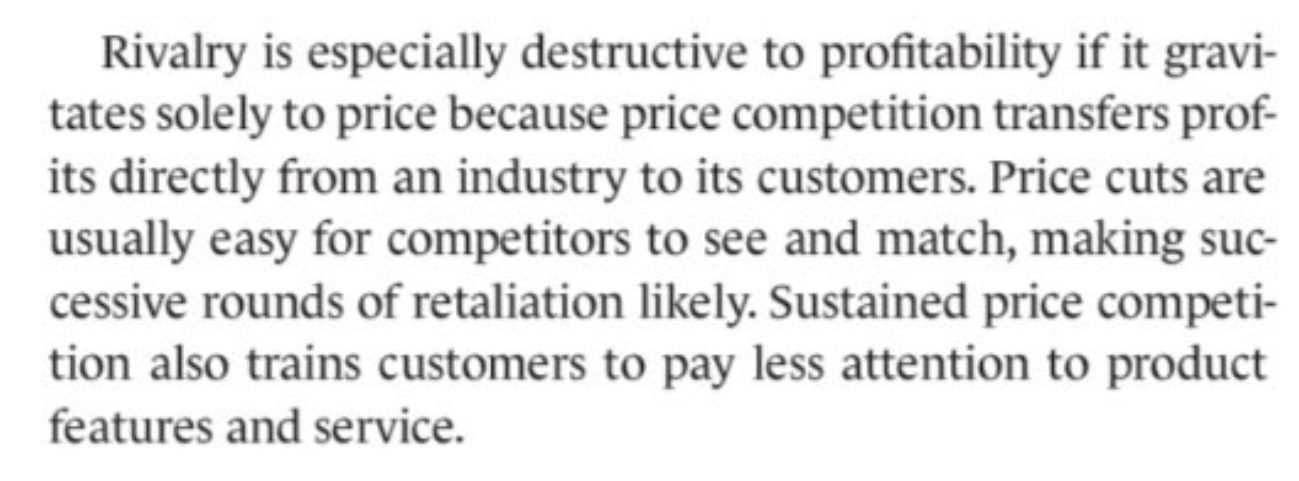

Via Finding Compounders: Michael Porter on price competition

Snowflake Inc (SNOW) via @HedgeVision: Altimeter's Brad Gerstner remains bullish "Not only is this one of the fastest growing software companies of all time, but its one of the most profitable fast growth software companies of all time."

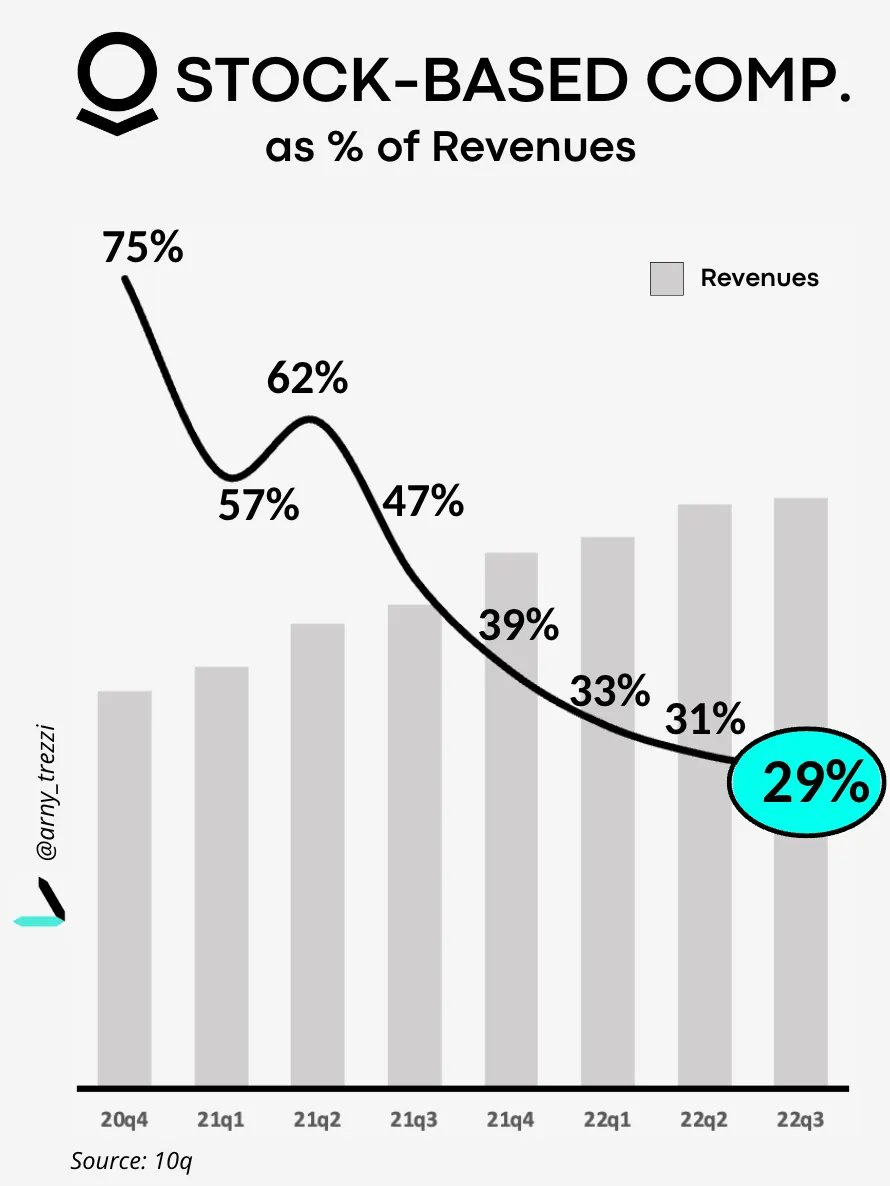

Palantir Technologies PLTR via @arny_trezzi: business is healthy. With the FCF they generate they can scale better than before and reduce the marginal impact of SBC. Slow, painful, but in the right direction

Via Art of Investment, a deep dive into Michael Burry’s top 5 positions: Michael Burry is one of the most famous investors of today. His fund made $700 million shorting the housing market in 2008 and is one of the main stories in the movie 'The Big Short.' Burry manages $41 million for Scion Asset Management

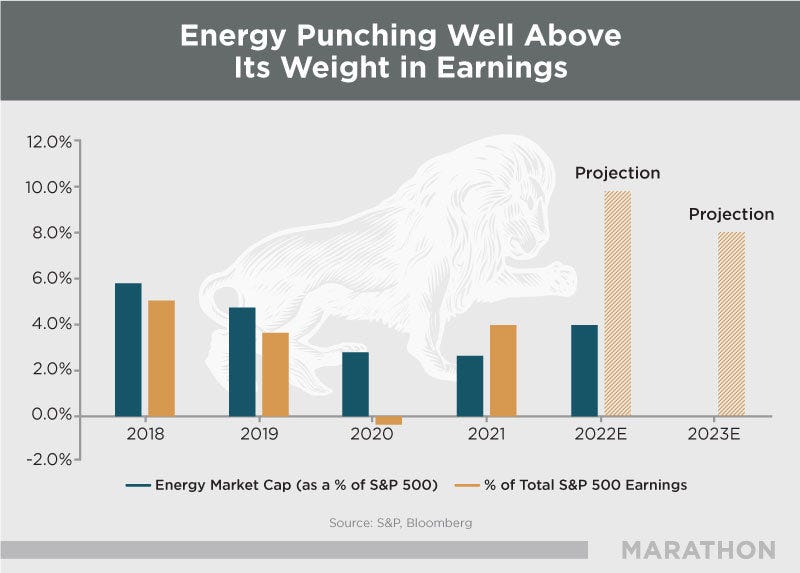

Energy stocks & oil via @AshendenFinance: JPMorgan Kolanovic says sell energy stocks with Oil gap wide. Bullish Wall Street voice on oil & gas tells investors to sell energy as share and oil price diverge He expects share prices to fall >20%, but over longer term still believes industry is experiencing a "super-cycle"

Complementary via @MichaelAArouet & @MRAfunds: Energy market cap and earnings as % of S&P 500. Draw your own conclusions.

How Seth Klarman Thinks About Risk via @JoinCommonstock:

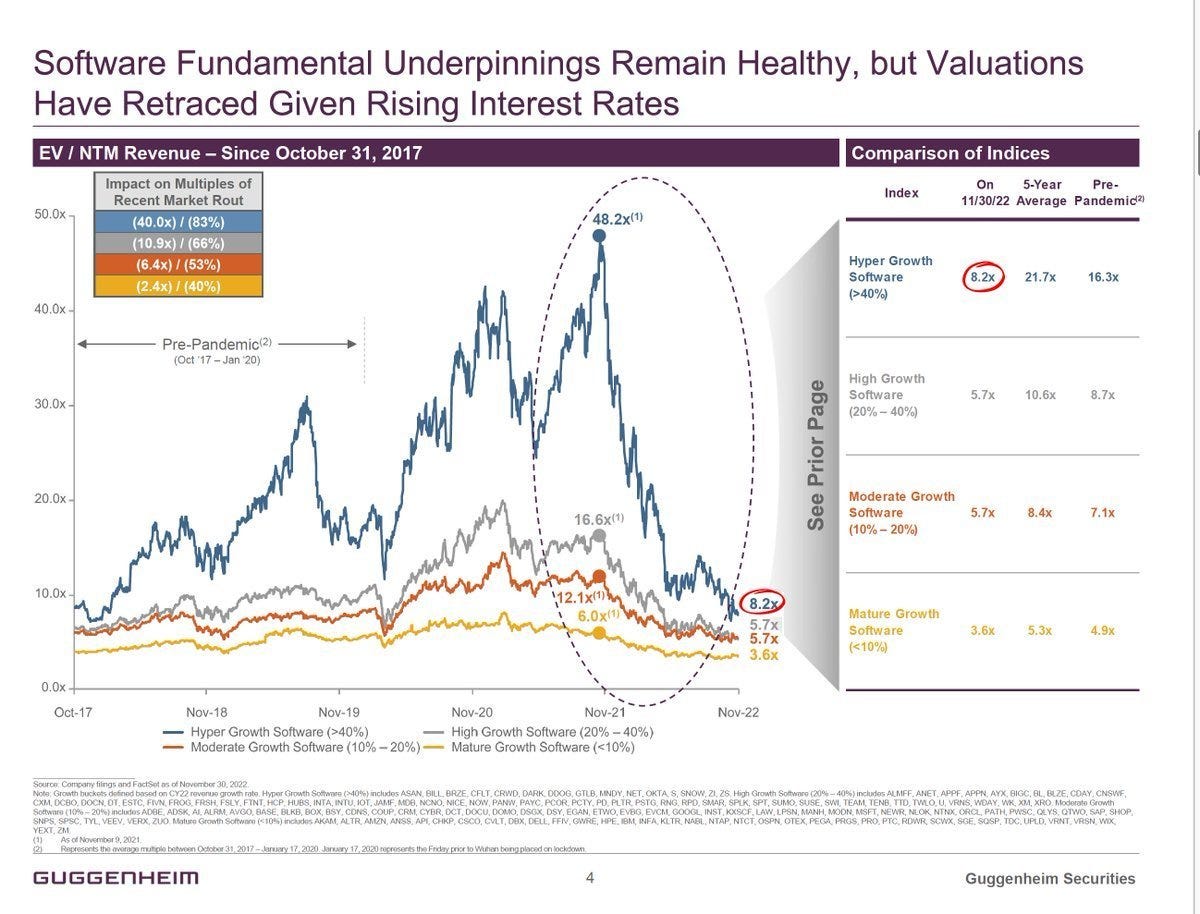

Software EV/NTM multiple since 2017 with hyper-growth, high growth, moderate & mature growth split via Guggenheim & Maverick Equity Research:

hyper-growth (blue) a big multiple expansion even BEFORE Covid crash & parabolic once FED/CB ample liquidity … while now tightening …

now at 2017 levels!!! Overcooked up & now on the way down? Opportunity?

The most recent on Macro & General:

On the much talked spooky Inflation via Longtermtrends: inflation dropped to 7.75% (after a peak of 9.06%) along with the Money Supply Growth Rate, which is close to turning negative for the first time since 1933 … let that sink in thinking about inflation in 2023+ …

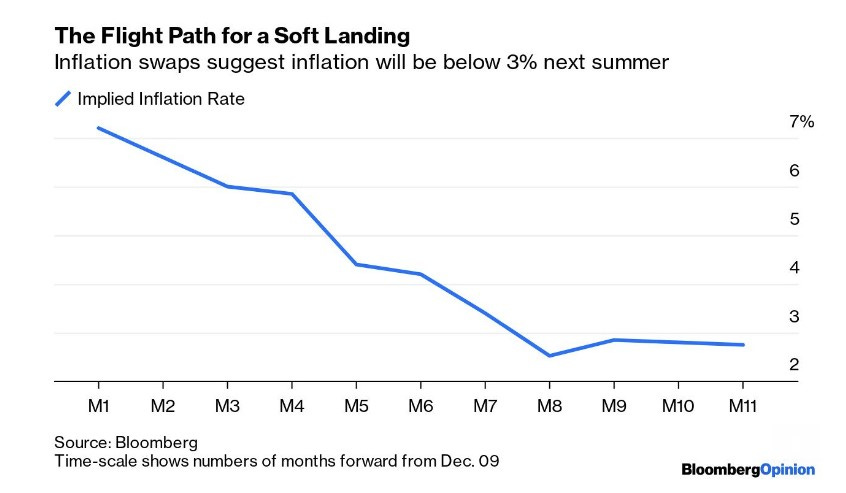

Inflation down also via swaps? Via Bloomberg & Maverick Equity Research: Implied inflation rates from the swaps market suggest that CPI will be back below 3% by summer 2023 Is the swaps market right?

US Real Estate, Homeowners’ Equity via @value_invest12: This ain’t 2008 with low underwriting standards

For a historical inflation throwback, a good question would be: what is the cumulative & average inflation by decade? This great research from @TorrasLuis puts inflation in perspective. Definitely inflation is not an isolated phenomenon and except the 1930s when we had deflation from the Great Depression, inflation shows its teeth with the note that the most recent decade marked quite a relatively low average & cumulative inflation. Average annual inflation by decade:

Cumulative inflation by decade:

Central Banks & Gold via @WinfieldSmart: record high purchases in Q3 2022

Silvergate Capital Corporation SI & FTX debacle via @NicoGladia short but epic take: No you did not conduct "extensive DD"

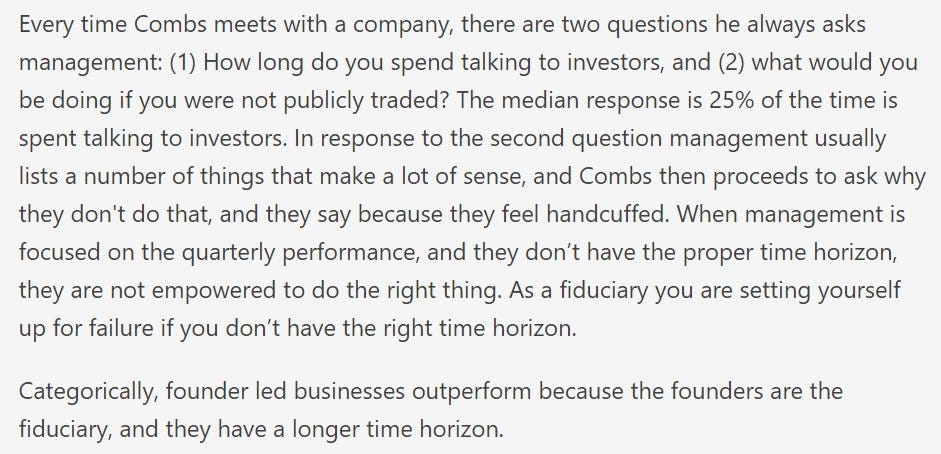

Via @breadcrumbsre: on being private vs being public (Marathon & Todd Combs)

US Bear markets & subsequent recoveries since the 1800s via Goldman Sachs

Should you have found this cherry picking endeavor interesting and valuable, subscribe and just share it around with people that might also be interested to read this kind of content in the future. Twitter post can be found here. Thank you!

Have a great day!

Maverick Equity Research

Damn, great harvesting!

https://www.longtermtrends.net/ is great as well, did not know about it!

Thanks & Thanks!

great chart pack ... super! You save me a lot of time + insight from a lot of cherry picked brains ... thanks!