Maverick Charts - November 2022 Edition #1

Cherry picked charts for interesting insights via short reads. This edition: stocks, FED, interest rates, inflation & general

Dear all,

welcome to the 1st edition of Maverick Charts, a dedicated section from Maverick Equity Research where I cherry pick 20 various charts from various contributors with the goal to provide interesting research insights via short reads. Enjoy it!

In case you did not subscribe yet for delivery straight to your inbox, it’s just 1-click:

From the world of stocks:

Peter Lynch's Magellan Fund had multiple drawdowns of >25%, but still outperformed the S&P 500 by more than 350% over a 30y period. I remember reading Lynch's book where he says the average investor in his fund had positive returns yet way lower single digit ones: buying tops, selling bottoms. Time in the market > timing the market, sticking to the plan ... Via @OKavrak

Key complementary note via @Maverick_Equity, despite in the last 3 years we had:

👉a pandemic

👉ramping inflation

👉higherrr rates &

👉a freakin' war in Europe

✅the S&P 500 still returned 35.86% = 10.71% CAGR to investors which is very good!✅Let That Sink In & Bring the Sink!

My S&P 500 deep dive: Performance, Profitability, Valuation & Key Metrics, look here.

Brilliant via @MichaelAArouet. Food for thought: where does the research you read or do stand? Definitely aim for Knowledge, Insight & Wisdom and from there develop a solid thesis which is naturally with assumptions about the future, but have them defensible and stress tested before actual investments

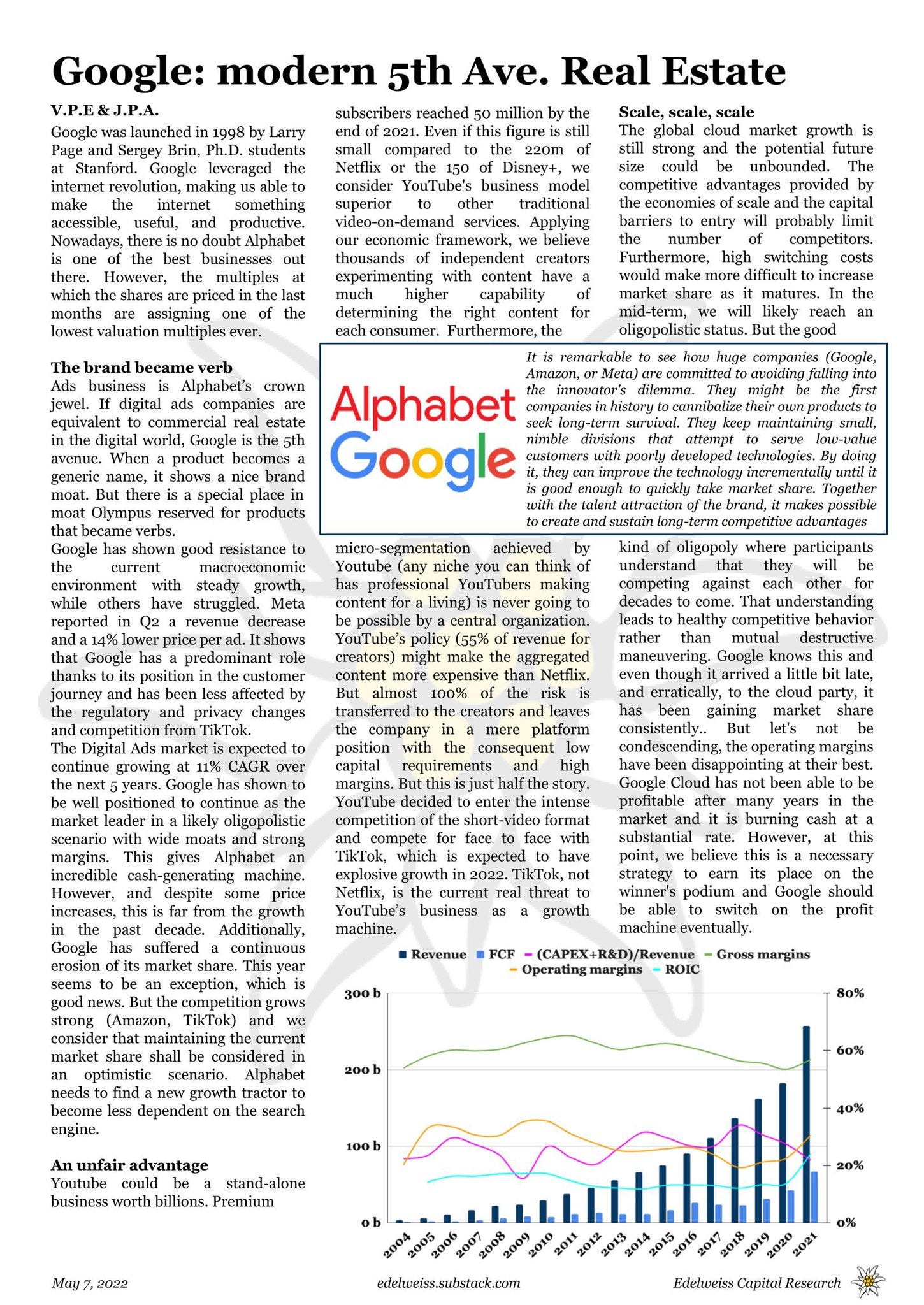

A great Google one-pager with the investment thesis from Edelweiss Capital: ‘Everyone realizes Alphabet is one of the best businesses out there. However, valuation is at the lowest multiples ever. We believe in the long-term competitive advantages and an incomparable future optionality.’

On Google also via @MrBlonde_macro: GOOGL trades at 20% discount to market, UNH trades at 20% premium. value, as usual, in the eyes of the beholder

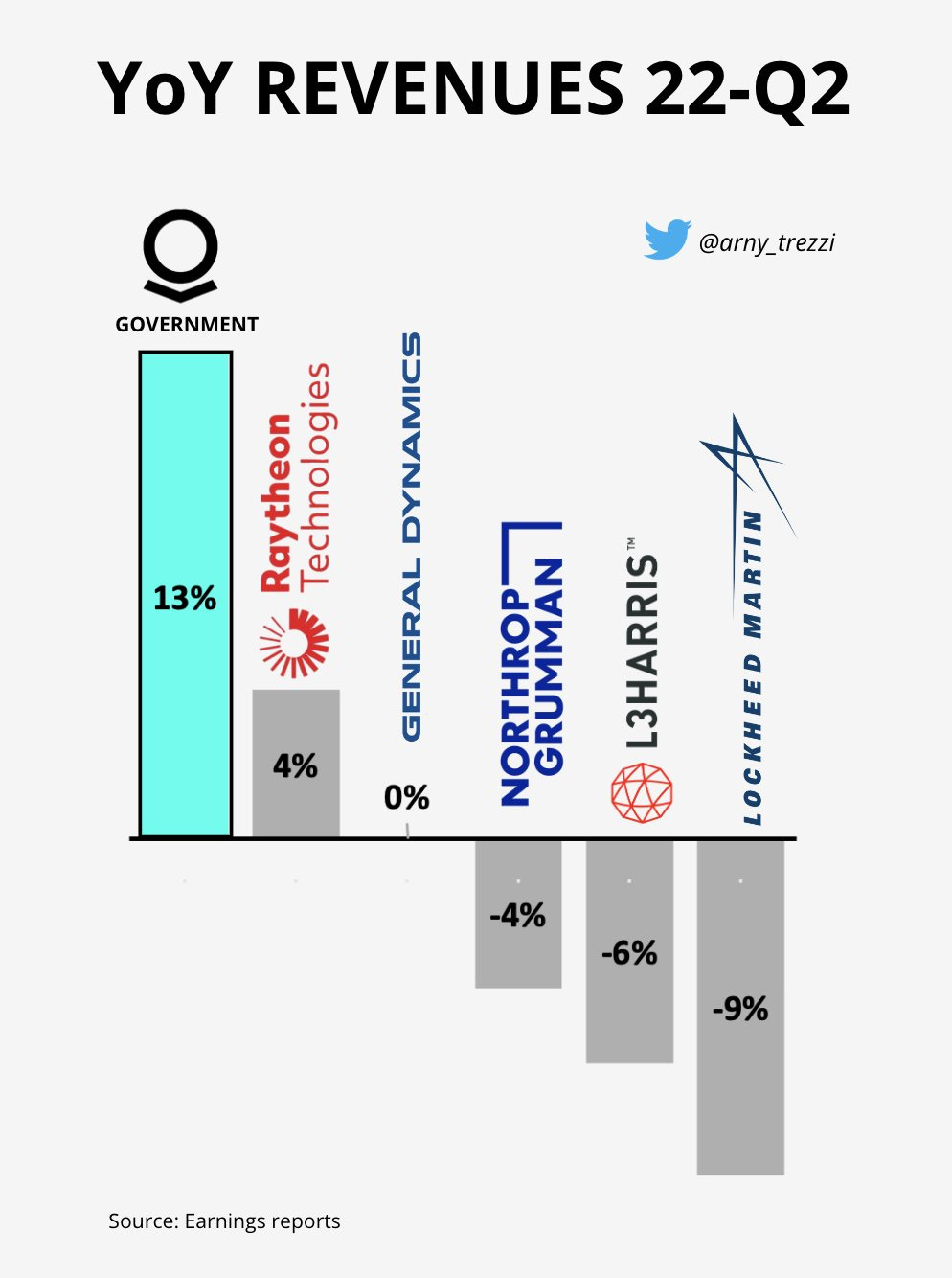

Independent analyst Arny Trezzi with a major focus on Palantir PLTR comes & clears out the sky via his research on general Defense Spending & related Prime Defense Contractors: ‘Palantir Government deceleration to 13% is not Palantir's fault only. The increase in Defense spending from NATO countries has not been recognized as Revenues yet by Prime Defense Contractors. Government accounts for ~40% of Palantir's Revenues, most of which are from DoD.’

From my own understanding, last year there seems to have been a change in US procurement process when it comes to Defense spending. This seems to create a bottleneck in new contracts despite the current situation in Europe. Once that is fixed, it will be interesting where and for how much do new contracts flow … a space to be watched especially now given the war & overall geopolitical situation

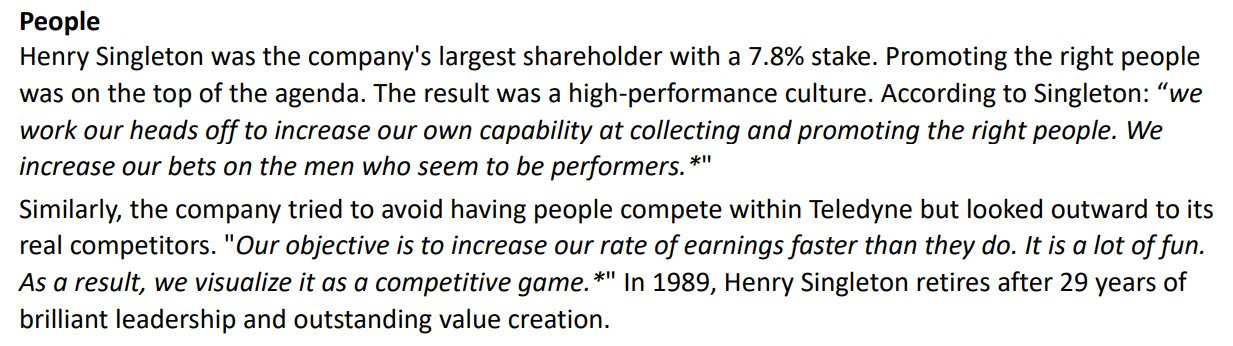

Via @breadcrumbsre, Singleton on people:

Via @F_Compounders, Li Lu on the points that changed his life after he attended a Warren Buffett lecture:

The rise of the iPhone via @InvestmentTalkk via a great visualisation:

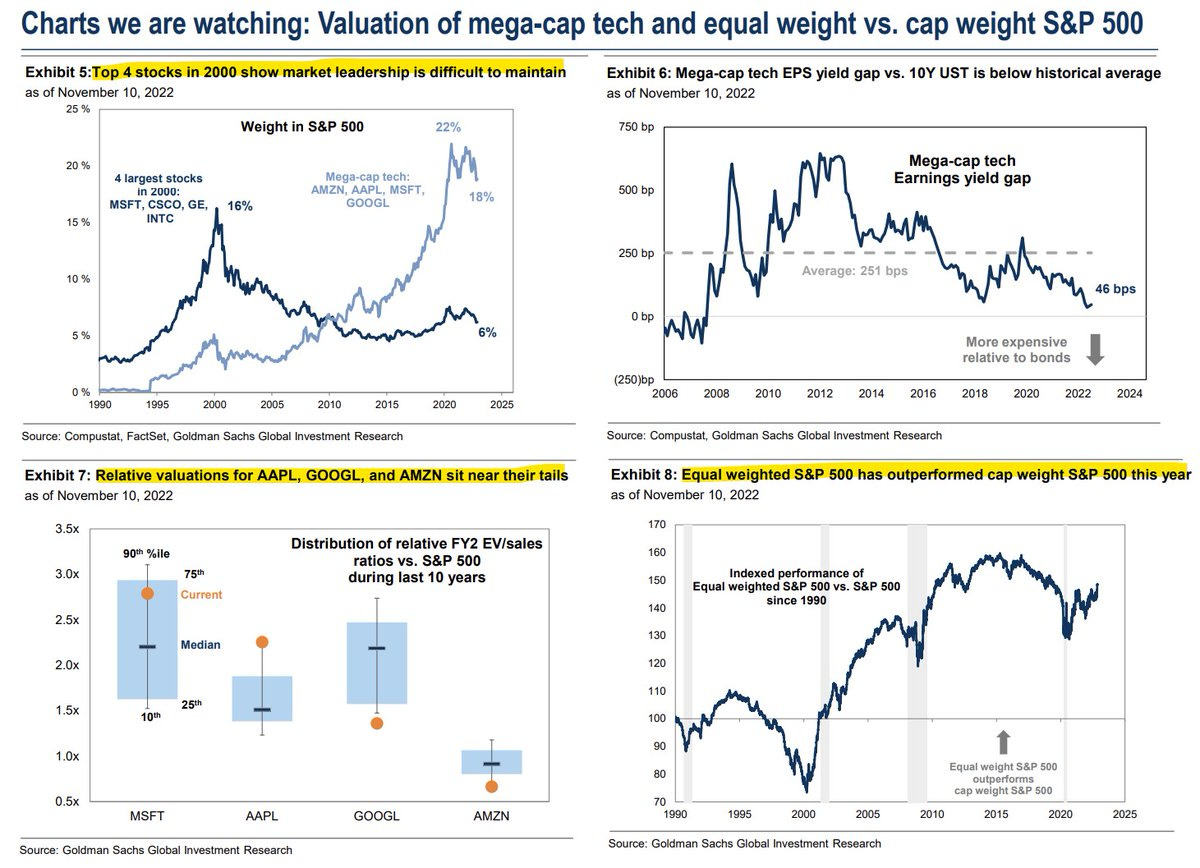

Big tech overview, very interesting via GS. My twitter post here:

The most recent & ‘all’ on Macro, Interest Rates & Inflation side - Inflation may have finally peaked?

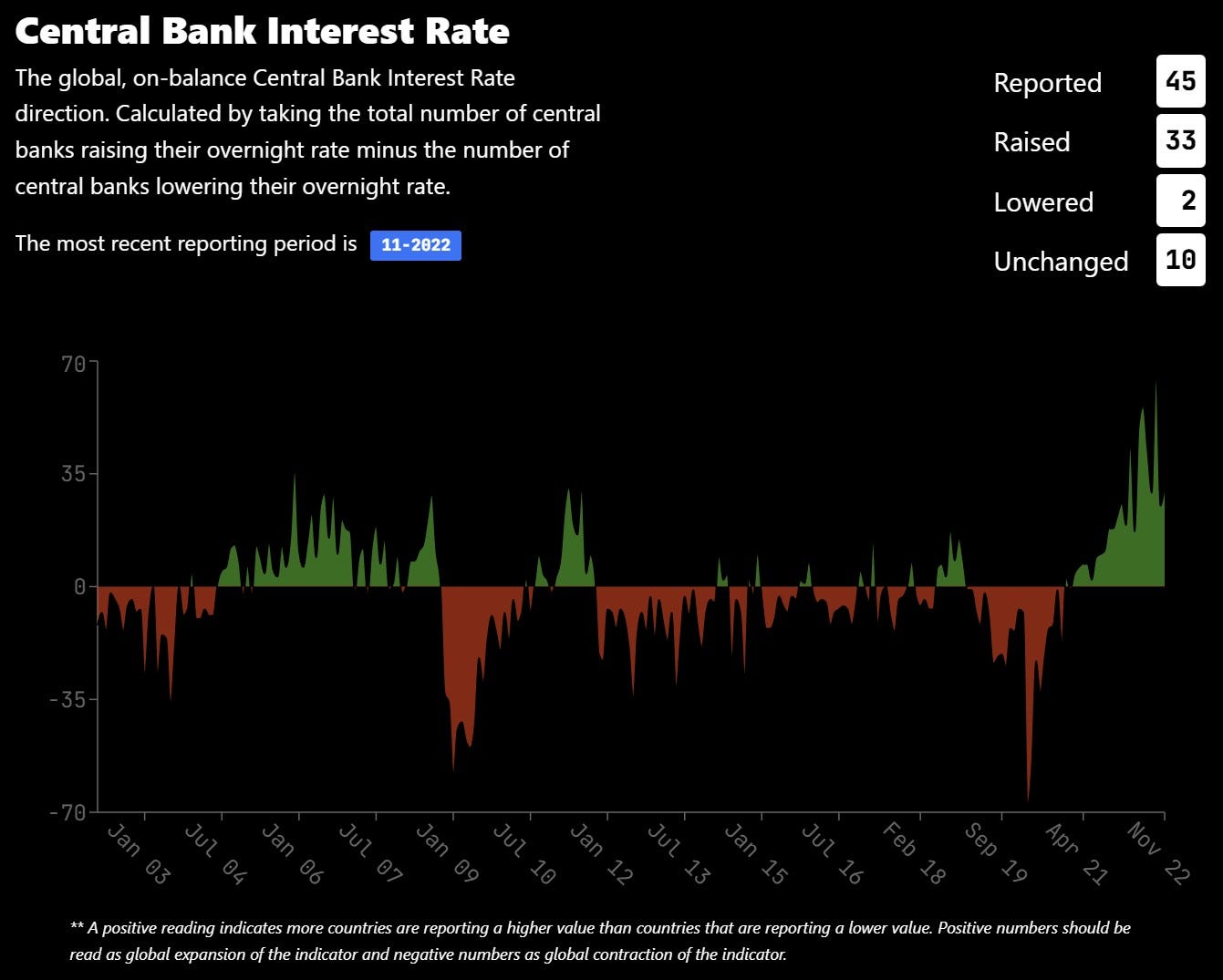

2022 central banks hiking pace: 243 so far = more than 1 hike per trading day.

1 hike per day, will keep the inflation away? Source: BofA

via Maxinomics, a complementary view on Central Banks interest rates action:

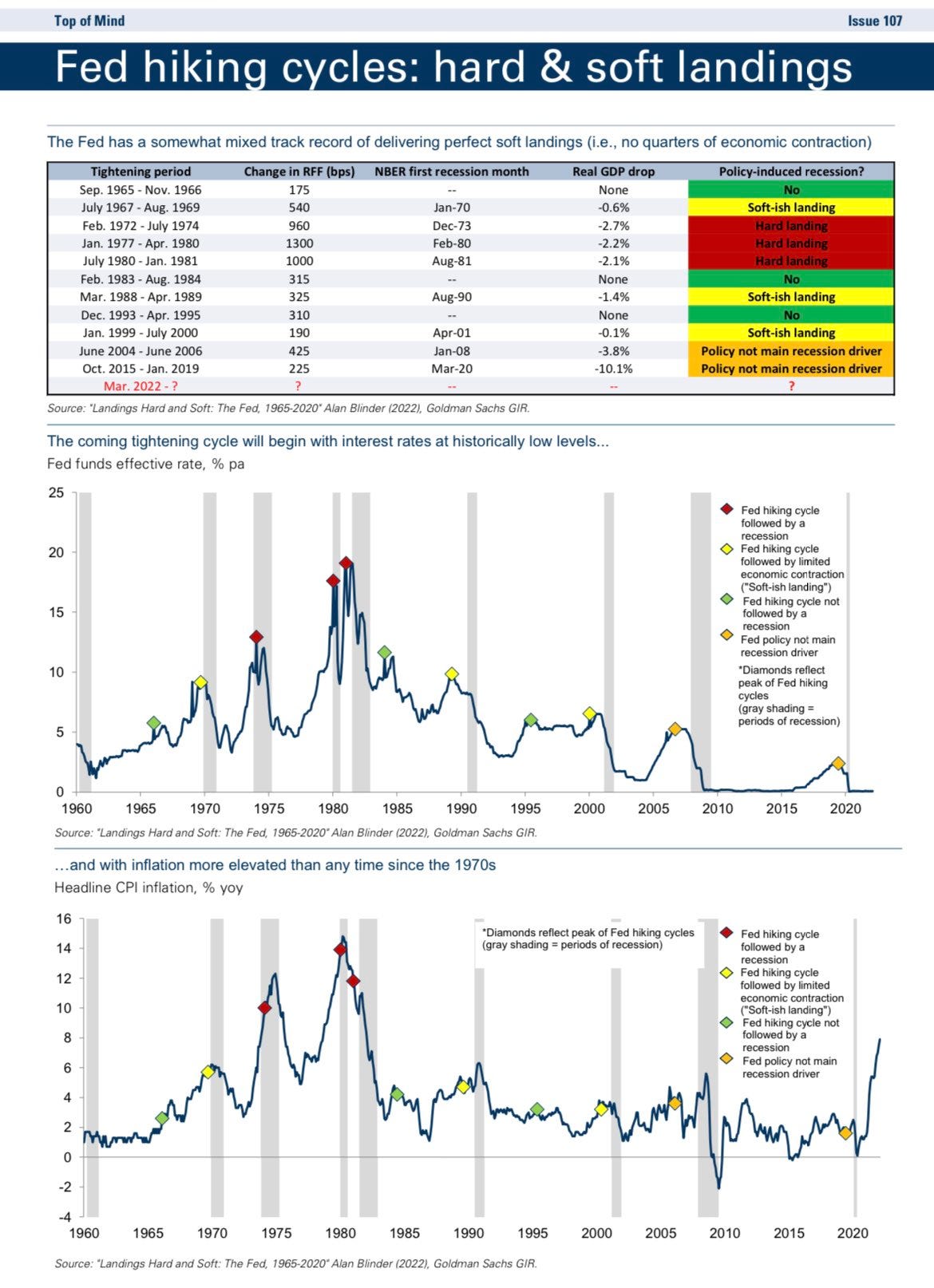

Via @TorrasLuis, GS overview on the FED’s mixed track record of delivering perfect soft landings (i.e. no quarters of economic contraction)

Via @CristianErimia1 almost $400bn in balance sheet reduction so far for the Fed

15. via @Credit_Junk, a more accurate & technical view on FED & a liquidity proxy:

Inflation may have finally peaked via Sandler: ISM Price index & Headline CPI

Complementary via @fxmacroguy, German PPI took a dive: expected was a print of +1.1%, we got -4.2%. Reaction from the EUR was pretty muted, though. (PPI decline is the first one since May 2020 before inflation came to town, heading home slowly now?)

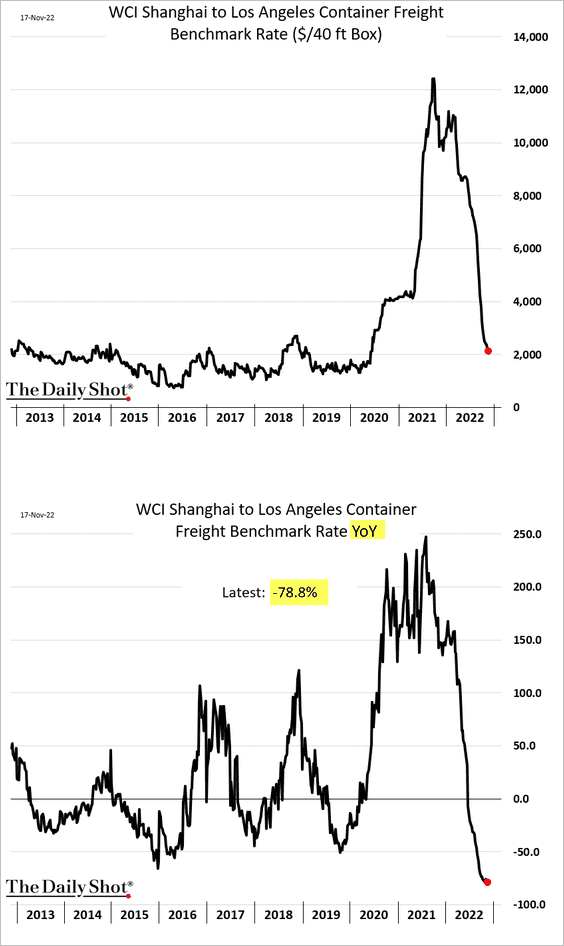

From supply scarcity & bottlenecks to supply abundance? via @AndreasSteno

Container 🚢 Shipping Costs via @WinfieldSmart. Supply bottlenecks easing are reflected also in the costs to move stuff around … which should also be supportive in lowering inflation

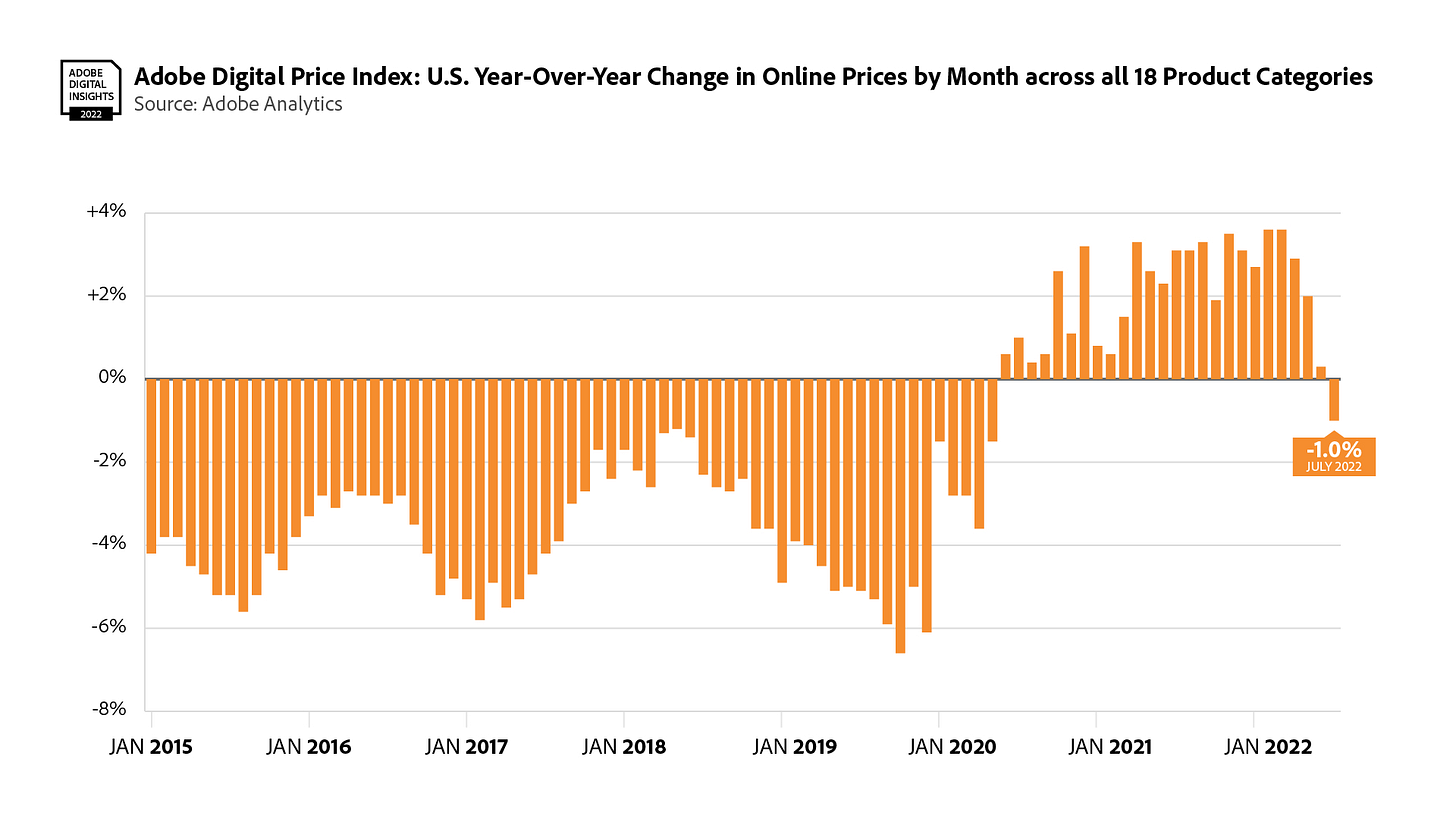

As well, E-commerce prices that are back into deflation after 25 consecutive months of inflation via @SnippetFinance

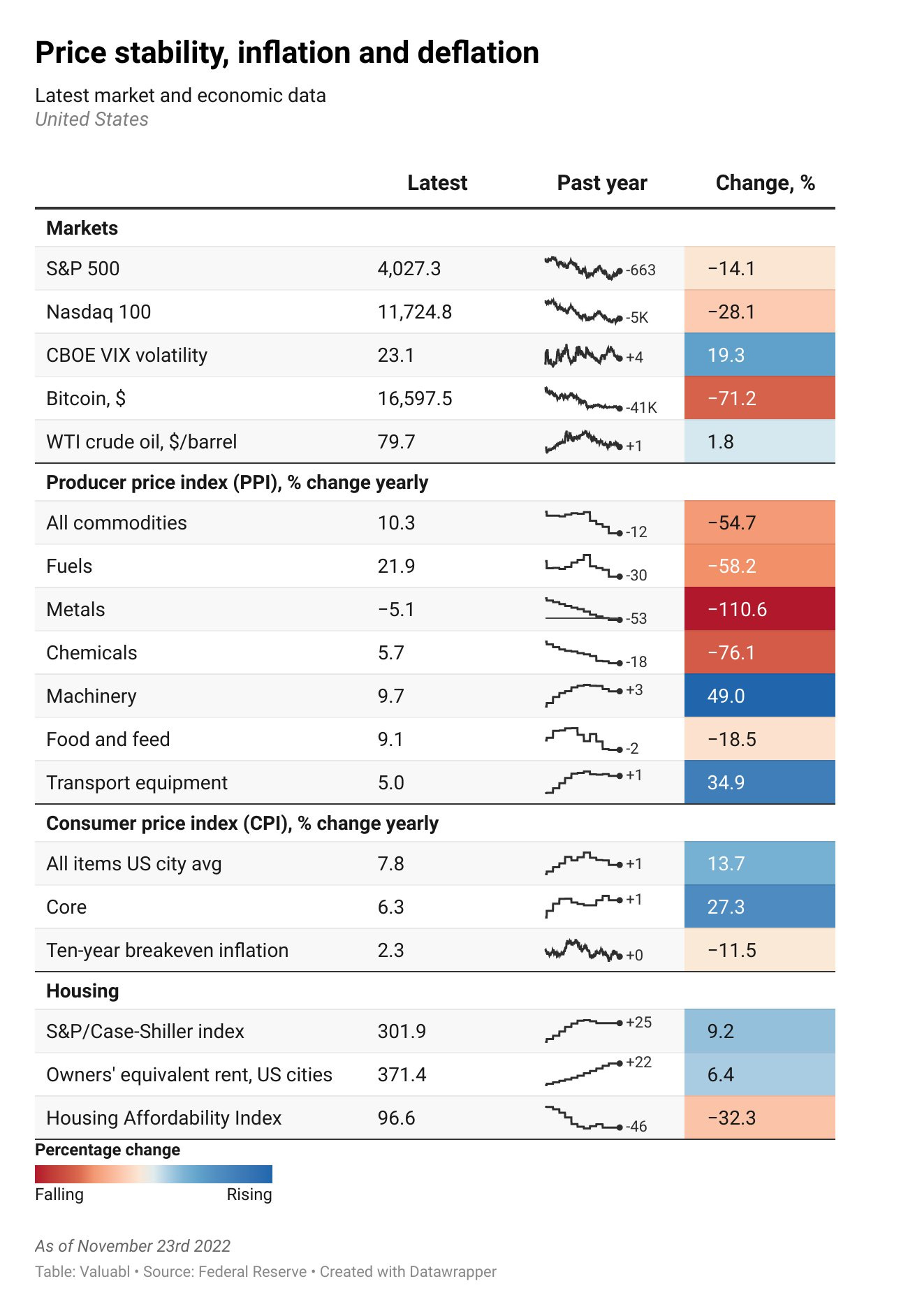

Overview via @ValuablOfficial, global inflation is on the way down:

Should you have found this cherry picking endeavor interesting and valuable, subscribe and just share it around with people that might also be interested to read this kind of content in the future. Twitter post can be found here. Thank you!

Have a great day!

Maverick Equity Research

I love no.11. Super interesting! Great job!

Great collection, and thanks for including mine 🙂