Maverick Charts - April 2023 Edition #6

Cherry picked charts for interesting insights via short reads. This edition: Peter Lynch interview, AI & FED, AI stocks baskets, ECB, Recession talk, Crypto, AT1

Dear all,

welcome to the 6th edition of Maverick Charts, a dedicated section from Maverick Equity Research where I cherry pick 20 various charts from various contributors with the goal to provide interesting research insights via short reads. Enjoy it!

In case you did not subscribe yet for delivery straight to your inbox, it’s just 1-click. And the same goes to share this around with whom might be interested as well.

The most recent on Macro & General:

The 'Non-Recession' Recession scenario: 'We're going to have a 'non-recession' recession' Apollo CEO. Video link short cut interview which had 55k views so far:

Via BofA: The most expected recession ever - given that some food for thought: is that priced in into stocks already?

Via CNBC legendary Peter Lynch interview - Video link:

Same 'rules' apply:

👉 'Buy what you know ... look at the balance sheet'

👉 'The sucker's going up is not a good reason'

👉 'People investing in individual stock, it's said, they are careful when they buy a refrigerator or an airplane flight ... but they'll hear about a stock on a bus & they'll put $5,000 or $10,000 on it, they have no idea what they do ...'

👉 'We have had 13 recessions since WW2 and we had 13 recoveries ... if this is a recession, is probably the most predicted one ever, maybe it's coming, idk'

Via @NicoGladia on big hedge funds facing new 72-hour deadline to report major losses:

👉 Wow.. how are they going to reconcile this 72h rule with monthly NAVs and MtM losses vs crystallized losses to begin with?

👉 Seems that regulators those days are just throwing random ideas up in the air for the sake of it!

Via Michael A. Arouet & Gavekal Research/Macrobond - US True Financial Conditions Index - I will just leave it here…

Via GWI Research / Reuters - rise in crypto ownership & countries ranked:

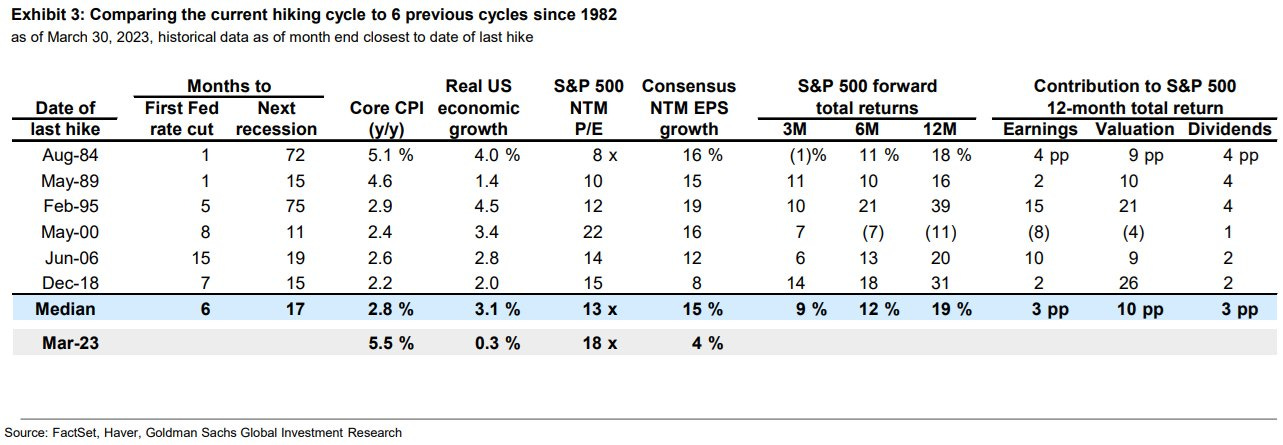

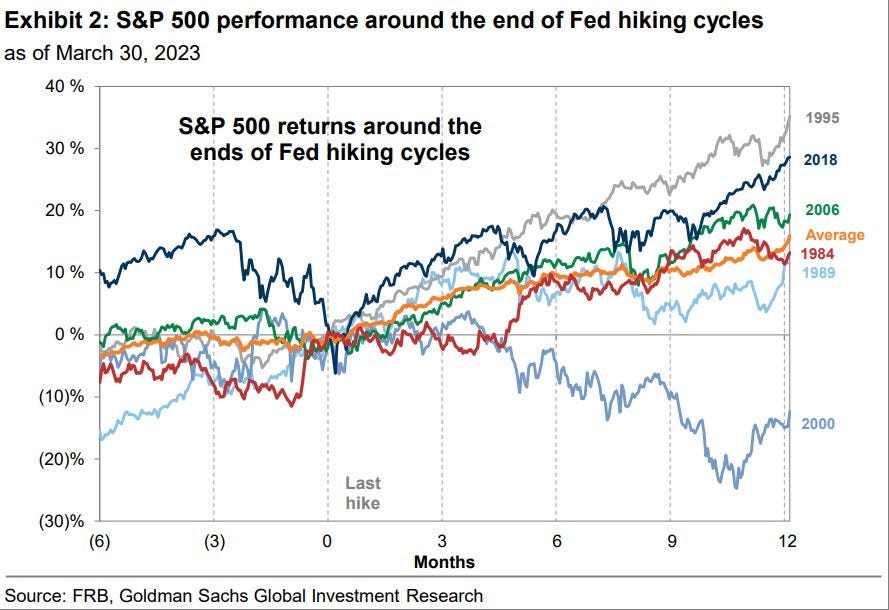

Via Kurang Patel & GS - Fed Hikes & Market Performance:

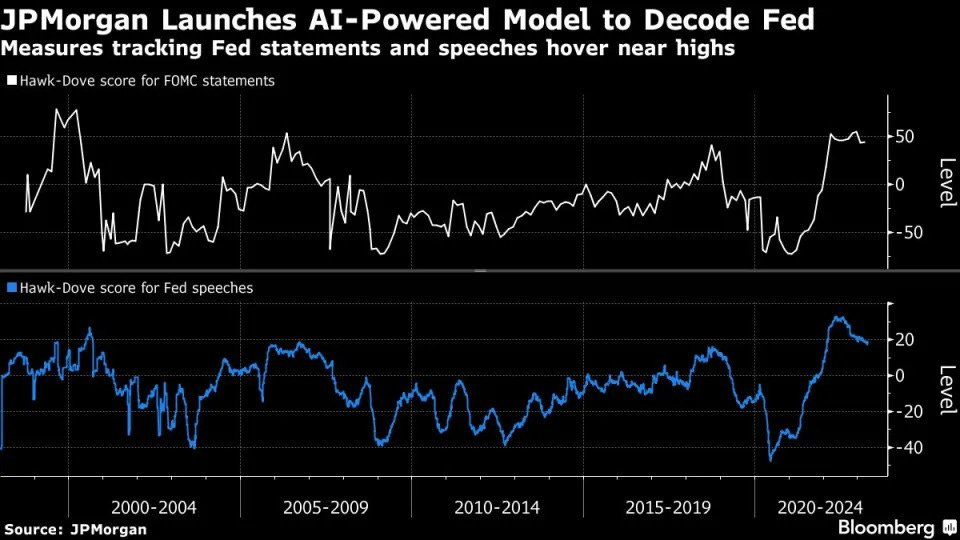

Via Maverick Equity Research & BBG - JPMorgan AI model to decode the FED:

👉 Blue line = score for trade/direction based on FED speeches analysis

👉 White line = score for the next Fed FOMC statement

Plain English: 10 points up in the score (blue) for a likely/forecasted 0.25% hike at the next FOMC decision (white)

Via Frederik Ducrozet: ECB hikes rates by 25bp, to the highest level since 2008. "The inflation outlook continues to be too high for too long", but "the past rate increases are being transmitted forcefully to financing and monetary conditions" albeit with uncertain lags and strength.

Via Bloomberg - ECB “We are not Fed-dependent”:

From the world of Stocks & Bonds:

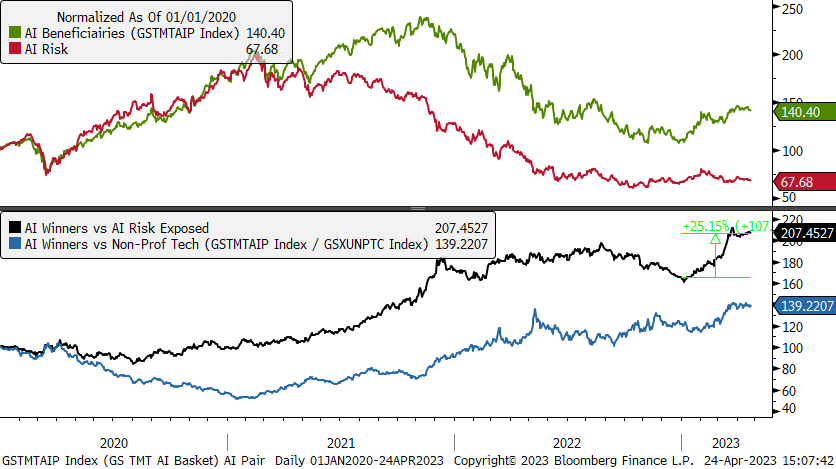

Via Maverick Equity Research & GS, cool AI baskets & performance since 2020:

AI Beneficiaries - VS - AI Disrupted (AI at Risk)

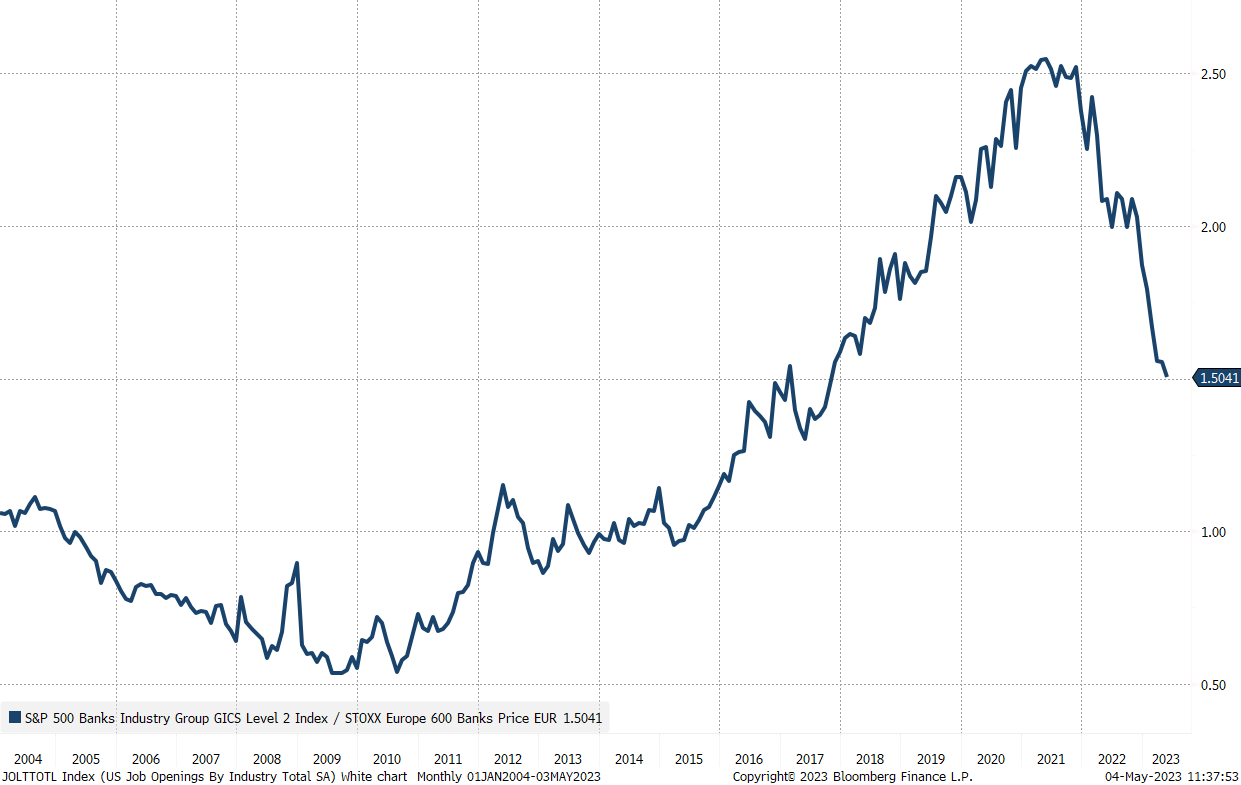

Via Peter Garnry: This must be one of the most fascinating charts this year. US banks massively outperformed European banks from 2010 to mid-2021. Since then US banks have underperformed by 41% in total return terms. European earnings have also been relative better overall

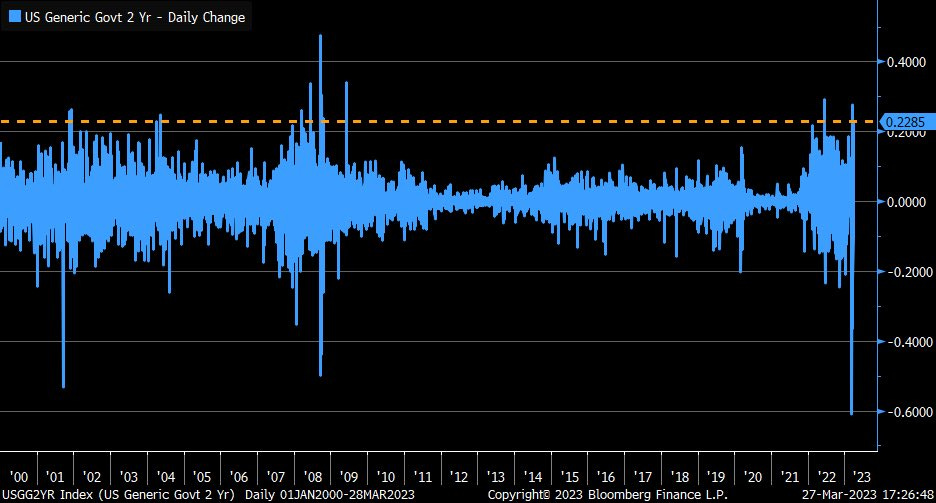

Via Liz Ann Sonders: Bond volatility not going away ... change in 2y Treasury yield yesterday was the kind of move we've only seen during GFC and tech bust

Via Maverick Equity Research: S&P 500: Equal Weight SPW / Market Cap Weight SPX at 52-week lows - Plain English: the gap between the mage caps and the rest of the market has never seemed so big

Via Maverick Equity Research & Oktay Kavrak, CFA: complementary: tech stocks via the Nasdaq are more expensive relative to the broader market than during the Dotcom bubble ... Sure, nowadays the Nasdaq has plenty of profitability and cash flow, though still a note to be taken: hard to say cheapness is around

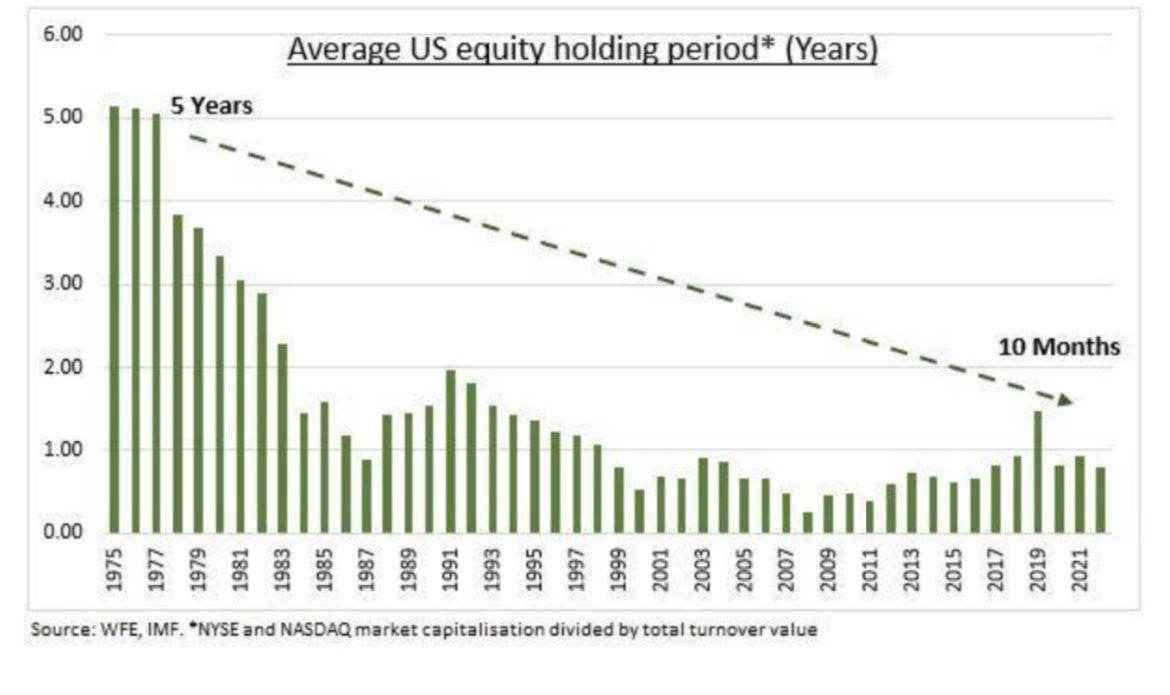

Via Luis Torras: average US equity holding period, from 5 years to 10 months:

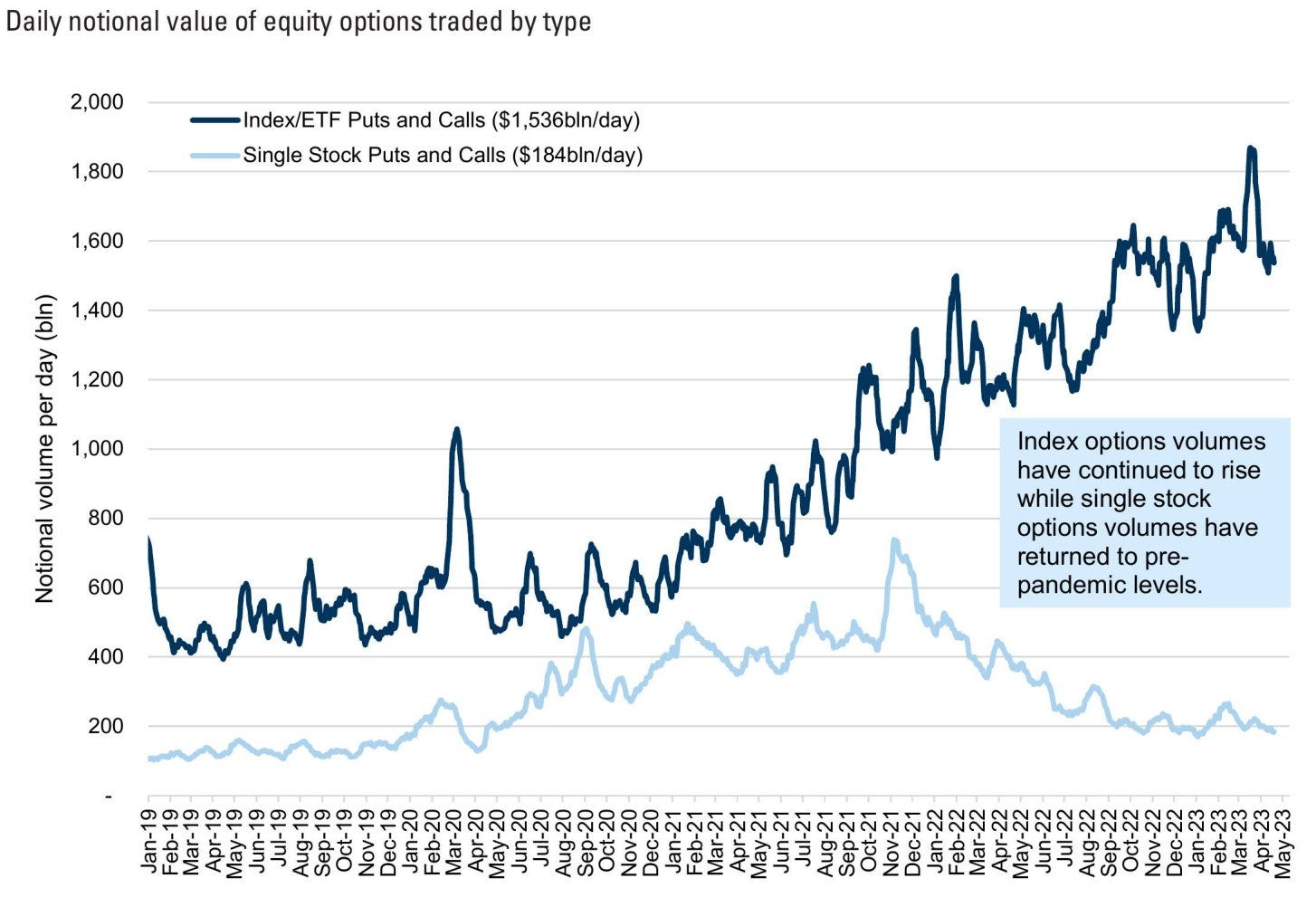

Via Ayesha Tariq CFA & GS: Index / ETF Options have far overtaken single stock options

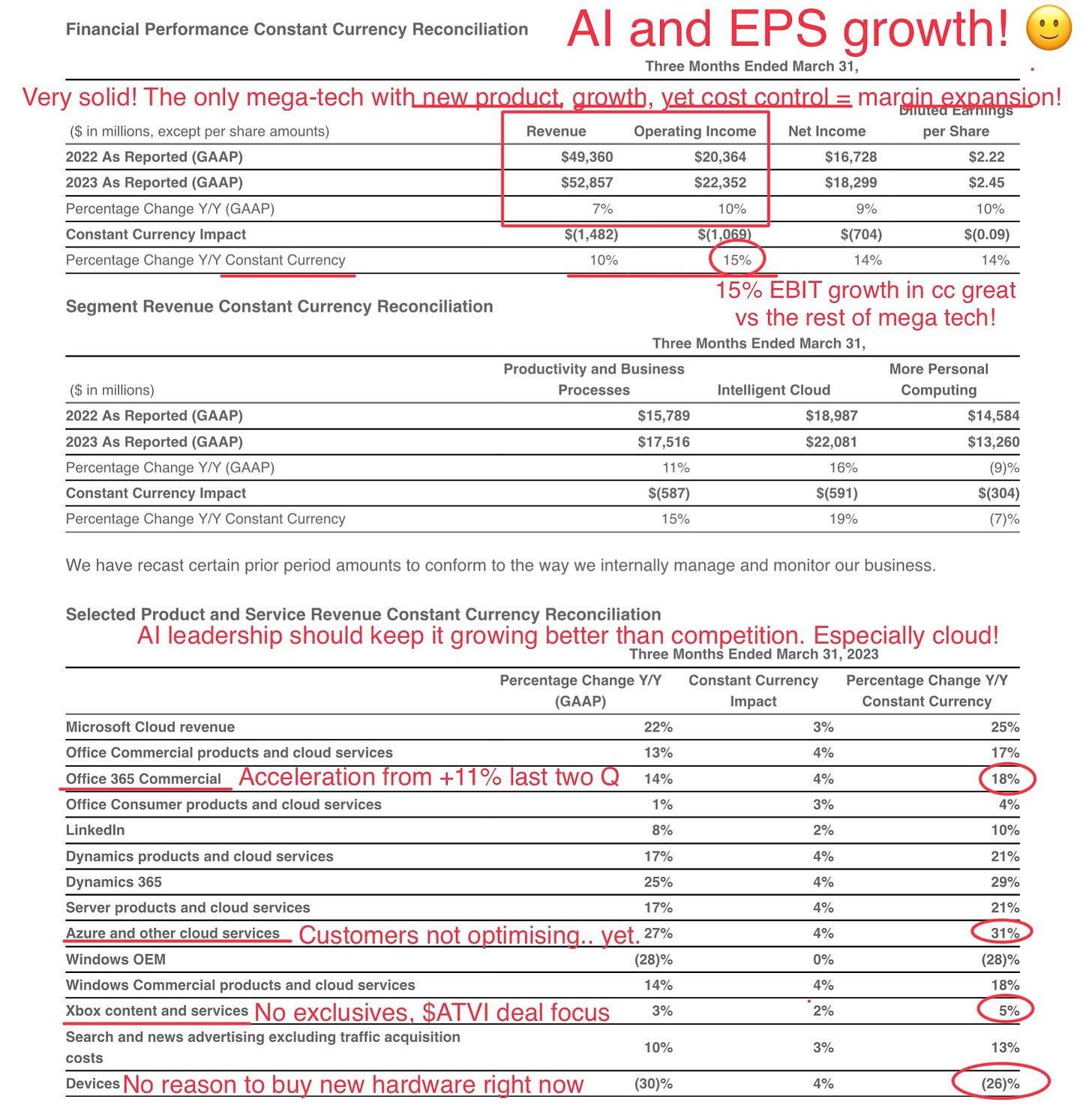

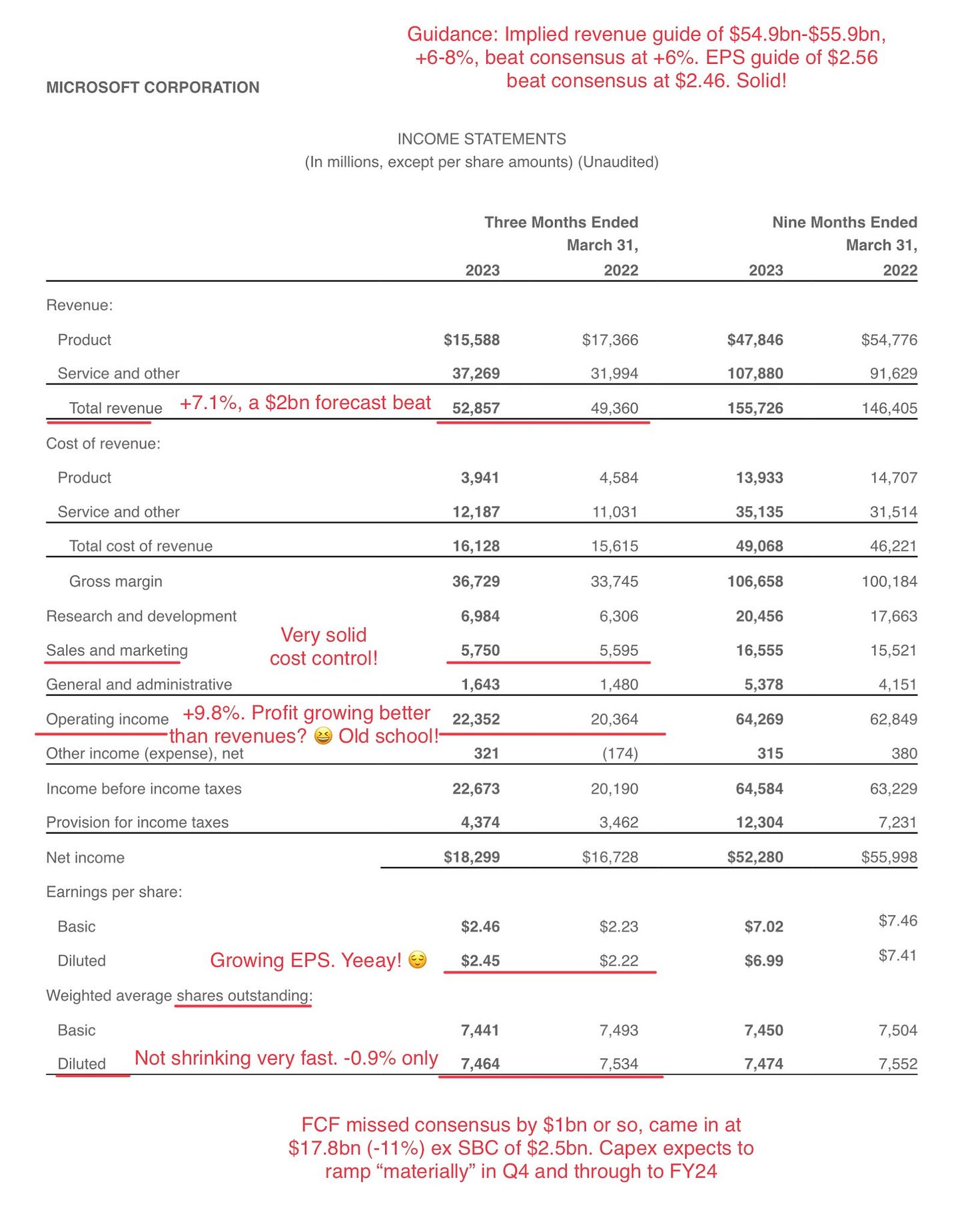

Via Wasteland Capital on Microsoft earnings: Clearly the best in mega-cap tech right now, Satya killing it. Rev +7.1% (+10% cc) beat by $2bn. Azure +31% cc (solid +27% guide), Commercial acceleration, with O365 +18%. EBIT +10% (15% cc) but FCF bit weak. Guide solid! 29x NTM P/E for 15-18% EPS growth next few yrs.

Via Abhinav Ramnarayan & Tasos Vossos from Bloomberg on the latest from the one and only AT1 bonds land: UniCredit is to redeem its AT1 bond in the first major call test since the Credit Suisse collapse, as @tasosvos reports here:

Via Topdown Charts - Global Profit Margins - Global Equities:

Should you have found this cherry-picking endeavour interesting and valuable, just subscribe and share it around with people that might also be interested to read this kind of content in the future. Twitter post can be found here. Thank you!

Have a great day!

Maverick Equity Research

Great writeup. I appreciate the format.

Thanks!