Maverick Charts - February 2023 Edition #4

Cherry picked charts for interesting insights via short reads. This edition: stock quiz, S&P 500 earnings, TINA & BOB & BAAAA, IPO, 60/40, Interest Rates, Europe, US Household Debt & Housing, USD/CHF

Dear all,

welcome to the 4th edition of Maverick Charts, a dedicated section from Maverick Equity Research where I cherry pick 20 various charts from various contributors with the goal to provide interesting research insights via short reads. Enjoy it!

In case you did not subscribe yet for delivery straight to your inbox, it’s just 1-click. And the same goes to share this around with whom might be interested as well.

From the world of Stocks & Bonds:

Via Maverick Equity Research, an interesting & fun stock quiz: guess this dividend growth stock (green) vs S&P 500 (blue)? Facts for the past 5 tough years:

👉 102% return for a 15% CAGR vs 61% return for a 10% CAGR for the S&P 500

👉 16 uninterrupted years of not ‘just’ paying, but INCREASING dividends & low 38.45% dividend payout ratio = dividend safety & room for further business growth

👉 Shareholder yield = a whooping 13.8% with the the breakdown:

it pays dividends at a current 3.3% dividend yield

it does also stock buybacks with a 3.45% yield

it pays down debt with a 6.96% yield, unlike some 'dividend stocks' that take debt to keep paying dividend which is not sustainable

Hence, a lot of free cash flow & forward confidence behind to do all that at once.

👉 Valuation, cheaper than the market AND own stock 5 year average multiples:

P/E of 11.6x while the S&P 500 18.05x, hence one pays way less for their earnings than vs the S&P 500, but also to the stock’s own 5-year average of 14.7x

P/S of 0.3x while the S&P 500 2.3x, which is like day & night in terms of price paid vs the S&P 500, and as well materially below the 5-year average of 0.4x

👉 March 2020 Covid indiscriminate selling crash & subsequent recovery because good investing is not just about upside and performance, but key to see how it holds during stock market crashes and overall harder times:

down only 21% vs S&P 33% while current drawdown -3.68% vs -17.02%

performance since 2020: 49.63% vs 29.19% for the S&P 500

performance in 2023: 11.57% vs 3.65% for the S&P 500

= resilience & performance of the business & stock

👉 Founded before 1890 = time tested business model that has seen a lot

👉 Based in Europe & operates in both Europe & US, not a ‘popular’ name at all, likely one never heard the name, barely seen coverage on it which is a big plus

👉 Bonus hint: Sector: Consumer Staples, Industry: Food & Staples Retailing which is defensive, low risk with inelastic demand. Part of my Recession Investing Research list: an investment strategy during turbulent times when the investor & researcher is looking for companies that are maintaining strong balance sheets with proven steady business models across time despite several economic headwinds ... .

All in all, this is a very typical ‘Maverick-esque’ business. I say first business and not stock because the business is what matters, not a moving ticker all day which many times on the short term is random & sentiment driven which = opportunity to me.

This business will be revealed & covered in detail the ‘Full Equity Research’ section:

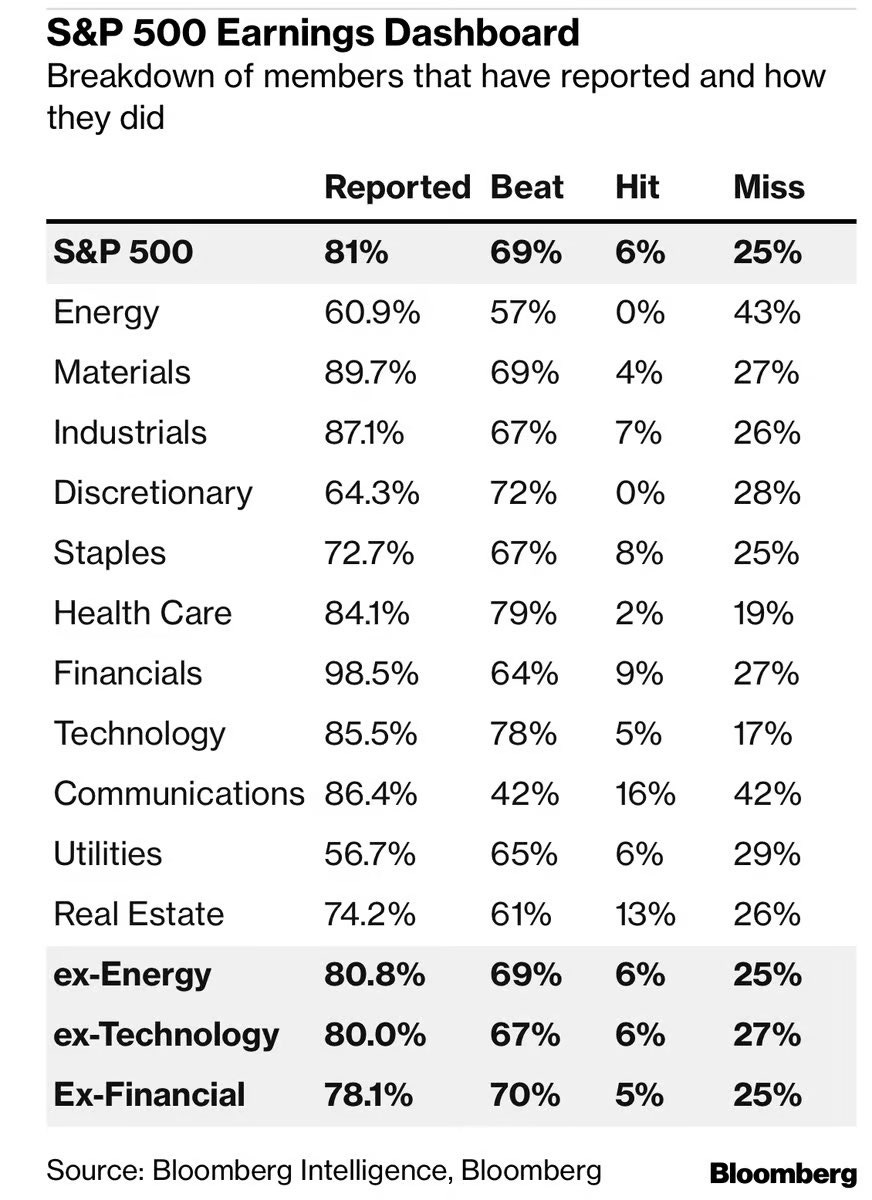

S&P 500 earnings dashboard via Bloomberg: with 81% of the companies having reported, we have 69% beats, 6% on target and 25% misses. Note: Energy had the most misses with 43%, though note that expectations were crazy high given the developments in 2021-2022. Conversely, tech had the least misses with 17% which had low expectations given the recent drawdown.

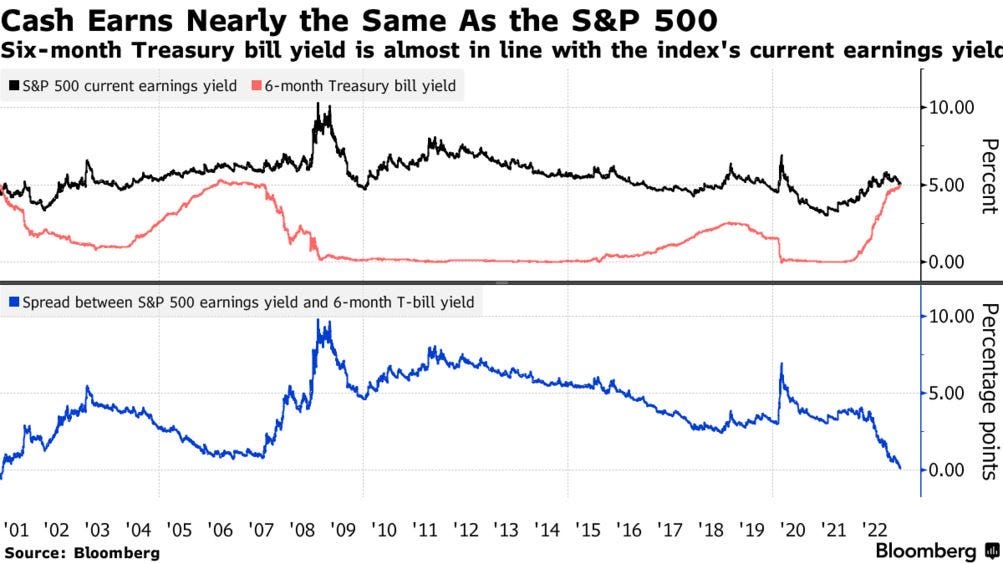

Via Michael A. Arouet: Say goodbye to TINA (me here continuing the word play: from TINA (There Is No Alternative) for Risk Assets to BOB (Bring On Bonds) or BAAAA (Bonds Are Again An Alternative).

Via Oktay Kavrak, CFA: IPO: It's Probably Overpriced. Companies like Coinbase, Rivian and Oatly have fallen over 80% (!) since going public. Ouch.

Via Arny Trezzi on Palantir Technologies (PLTR): mainly driven by 20 clients, which generate almost ~50% of Revenue.

Via @KillinGswitCH98: retail have massively switched to money market this year. Who would blame them when you air paid to wait?

Via Maverick Equity Research & BofA: and Yes, the rebound is there for the 60/40 portfolio ... after in 2022 all gloom & doomers, permabears at al. were saying all is destroyed and etc (for clicks/views and ad revenue) ... when that happens, the bottom is there quite likely

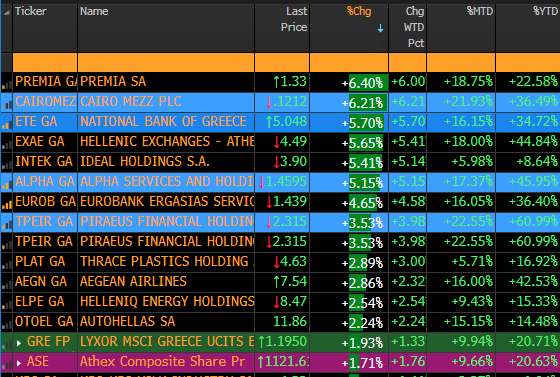

Via Nico: What a ride today in Greek names!

Via Athanasios Psarofagis: Greek stocks just won't stop going up. 4th best performing market in the world this year

Via ©️redit From Ⓜ️acro to Ⓜ️icro: Equity in Europe followed strong surprise index. On this, you can check my Stock Screening for Value in Europe Update.

The most recent on Macro & General:

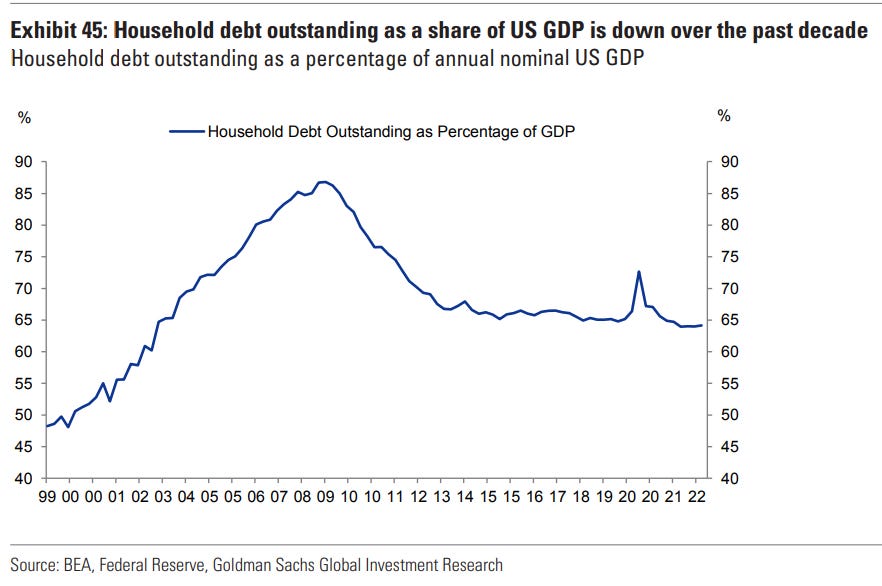

Via Gunjan Banerji: "Household debt outstanding as a share of US GDP is down over the past decade" -- GS

Via FX Macro Guy on FX intraday seasonal patterns: finally got around to making a spreadsheet that plots intraday seasonal patterns. Here are a few nice examples: $EURUSD starts selling off from the London open into the London fixing, then rebounds a bit. It's not a huge effect but around 10 pips from high to low.

Via Lawrence McDonald: Moving from a central bank controlled cost of capital to a market driven one

Via Steven Arons: German 2-year bond yield hits 3% for first time since 2008 😳

Via Maverick Equity Research & BofA:

"Bulls make money, bears make money, pigs get slaughtered!"

👉Bull & Bear index since 2002: that extreme bear in 2022 …

👉while the recent rally into the normal range, but note that is far to be in the Extreme Bull territory

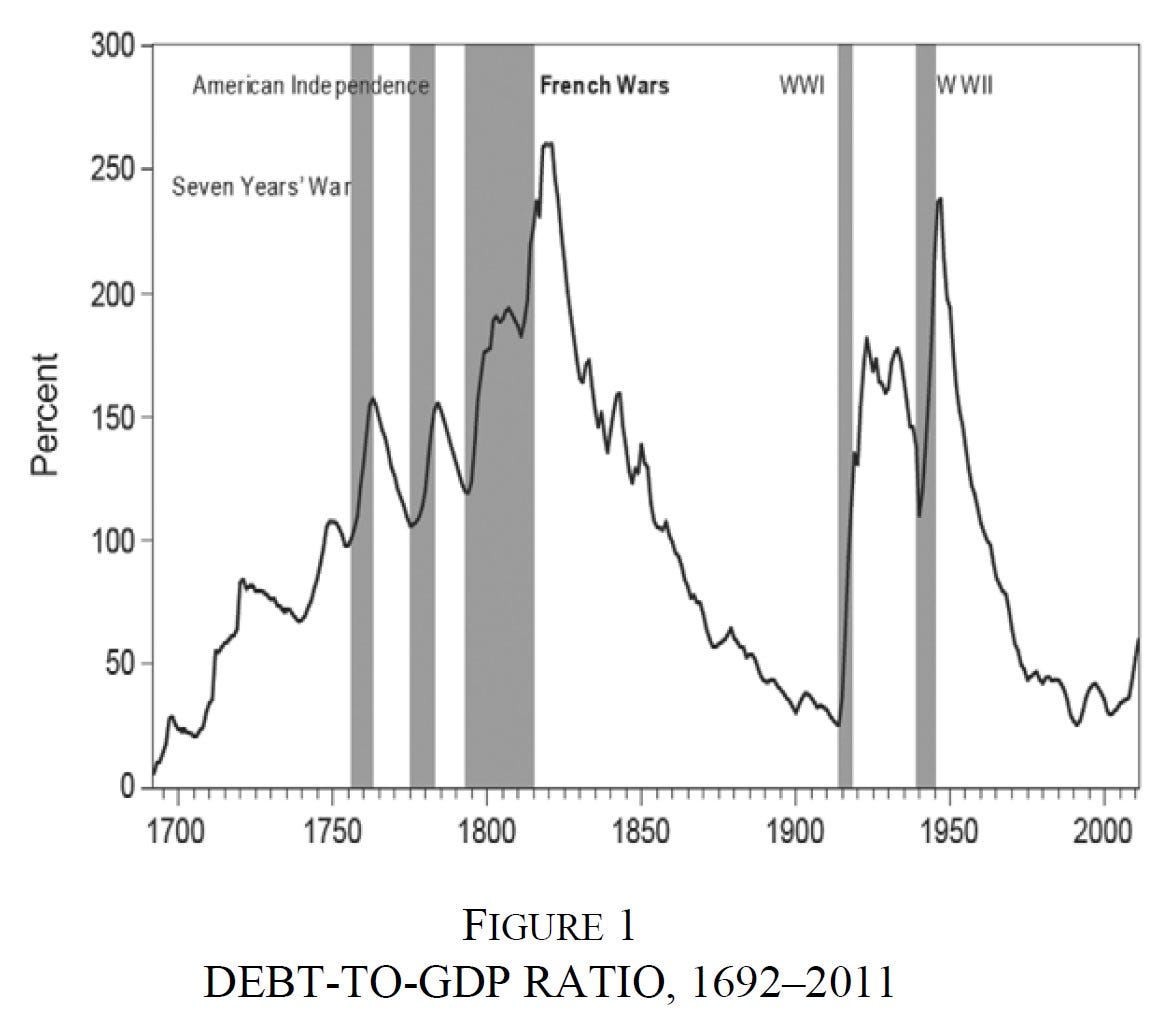

Via Luis Torras: Debt-to-GDP ratio in Great Britain

Via Heard on the Trading Floor: My beloved FFR futures are trading at a new terminal rate of 5.25% - 5.5% range. As a 'kind' reminder I want you to see the FFR expectations on the 1st of Feb'23 compared to today. Notice the 'minor' difference of roughly 75bps in the terminal expectations and 100bps in Jan'24?

Via Variant Perception: The US housing stock is very old....

Via Bob Gonzales: Reserve currency USD is everything but a HULK of vs little ol’ Swissy NB below: Why? - economic/political stability - backed by gold reserves - low interest/inflation rates - balanced budget amendment - surplus c/a - low overall debt - does not do wars - is very decentralized.

Via Bread Crumbs Research, Recommend reading this book, it's short and has some good ideas

Bonus & Fun take, AI Edition: the latest AI frenzy, ChatGPT & related:

I should launch my own index called 'Maverick AI', easy job, instant success ... sarcasm alert of course :)

Via ShrubGPT, KFC: the impact of just mentioning ‘AI’ in the presser …

Should you have found this cherry-picking endeavour interesting and valuable, just subscribe and share it around with people that might also be interested to read this kind of content in the future. Twitter post can be found here. Thank you!

Have a great day!

Maverick Equity Research

Love BofA's charts :D

Very cool idea to cherry pick tweets with useful info from accounts that are all worth a follow. Love the idea. Very well put!

Keep up the good work and appreciate the mention!