Maverick Charts - January 2023 Edition #3

Cherry picked charts for interesting insights via short reads. This edition: stocks, ETFs, BYND, FANG+, inflation, US & Canada Real Estate, AI, VIX & Orange Juice

Dear all,

welcome to the 3rd edition of Maverick Charts, a dedicated section from Maverick Equity Research where I cherry pick 20 various charts from various contributors with the goal to provide interesting research insights via short reads. Enjoy it!

In case you did not subscribe yet for delivery straight to your inbox, it’s just 1-click:

From the world of Stocks:

Via Shrub on Credit Suisse (CS) because as Elon Musk said ‘Trust the Shrub’: Do yourself a favor. Whoever compares Credit Suisse to Lehman, just block them. Means they know less about the markets than my pet rock.

Since I ever studied and worked in finance, I dealt too much with pessimists, fear mongering (especially in the age of social media chasing views & clicks), permabears, doom & gloom, conspiracy theorists et al., yet humanity & economies kept evolving, returns to investors kept coming. Despite in the last 3 years we had: a pandemic, very high inflation, one of the fastest interest rates hiking cycles, a war in Europe etc, the market aka S&P 500 still returned 33.84% to investors which is very good.

If you believe societies will evolve (as they did in the last millennia), not much to worry or waste time on as an investor, the business cycle is what it is. If one’s belief is different, that we might go back hunting, doing barter & living under rocks, then no matter how one takes care of their finances, it will not matter much.

If an investor, have the mindset of an owner in real businesses, not daily moving tickers moving often randomly. If a trader and very short-term focus, have a clear plan, be super diligent and naturally, each on his or her own via custom approaches.

I was always puzzled by how much people can be impacted by some 1-3% variability. I don’t know about you, but I rarely wake up each day with a lower variability than that. Fearmongering is common & even more pronounced with social media, yet the only people benefiting that are the ones doing it. The same, with ‘daily commentary’ out there, headlines, intra-day technical analysis, breaking news et al., only the ones doing that benefit, not any 3rd party. Hence, my coverage will never be about that because that is NOT research, nor insight, hence not adding any value to any investor.

Via Oktay Kavrak, CFA we have the earnings take of the month on Microsoft:

Via Kurang Patel Top 10 inflows into Short and Leveraged ETFs in 2023. 9 (!) in 10 are Inverse Funds. Return-chasing or foreshadowing?

Be sure what you are investing or trading and if not, just use a simulator before. On that, a great educational note via Oktay Kavrak, CFA on levered and inverse funds. Over the last 5 years, $QQQ has returned +65.4%. It's 3x leveraged version $TQQQ was up just +34.5%. Volatile markets are the enemy of levered and inverse funds - due to daily rebalancing.

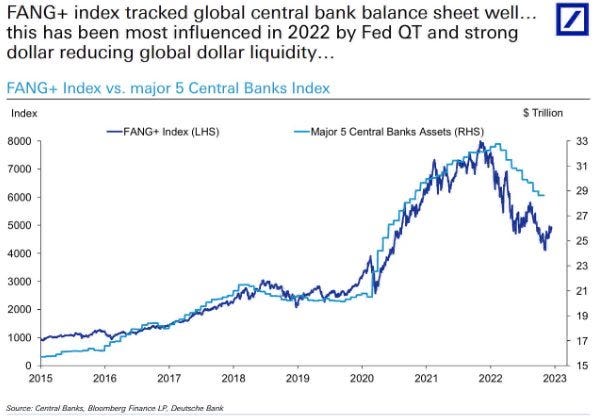

On a funny note via Michael A. Arouet, remember when we were told that the FANG rally was driven by fundamentals? 👇 (Deutsche Bank)

Via Tasos Vossos: BYND is the stock ticker of Beyond Meat BNYD is the ticker of BBG's negative-yielding debt index Don't worry if you ever confused the two. The amount of negative-yielding bonds globally has been moving in tandem with the share price of Beyond Meat (% change since 20/5/2019):

Via Athanasios Psarofagis from Bloomberg: worst performing equity ETFs of 2022 are leading in 2023

Via Eric Balchunas from Bloomberg: THINGS YOU NEVER SEE: A Europe ETF leading YTD flows w/ $3.6b. No doubt this is JPMorgan's own model, but that's a MASSIVE number, they must be ALL IN on this trade. Also, only one Vgrd ETF in Top 10. That won't last, neither will Europe, so good thing I captured the moment here.

S&P 500 performance: 2023 & last 12 months - quite a difference, isn't it?

Ark Invest innovation investing note: ARKK +37.5% in 2023 with the 2023 Winners & Rebounders from their 52-week low:

Via Avery: NDX/QQQ fair value - way overpriced.

The most recent on Macro & General:

Via LongTermTrends: after peaking in June 2022, inflation reversed and fell to 6.45% following the M2 money supply growth rate, which turned negative for the first time since 1933. Let that sink in! …

Via Maverick Equity Research, what is the market pricing for inflation? 2.36%? 1-year inflation swap prices currently at 2.36%, let that sink in! Inflation lags, hence so it should come down over the next couple of month ... thoughts?

Via Lawrence McDonald on the Orange juice price: ‘“It was the Dukes, it was the Dukes” - Mr. Powell…’

Via Nico Fitch has upgraded Greece to BB+ outlook stable (from positive).

Via JohannesBorgen, we have this popular chart and he clears the waters via a deep dive & the outcome is fascinating but NOT what you would expect! Link.

Via Michael A. Arouet on the US & Canada Real home prices & Disposable Income: Chart for future history books.

Via Sujata Rao from Bloomberg: No more negative-yield debt (from $18.5 trillion at end-2020)

Via Ashenden Finance & FT: Companies have rushed to borrow money in the US corporate bond market in the first week of the year, taking advantage of easier financial conditions as investors scale back their expectations for the path of future

Via Jamie McGeever from Reuters: The market volatility of 2022 triggered by Fed (and other central bank) rate hikes has evaporated. VIX 'fear index' lowest since Jan last year. US bond market vol lowest since March last year.

Via Liz Ann Sonders: Baltic Exchange Dry Index has come back down to where it was in June 2020

Bonus & Fun take, AI Edition: the latest AI frenzy, ChatGPT & related:

Nothing changed with these companies in 2023, yet … no comment:

Should you have found this cherry-picking endeavour interesting and valuable, just subscribe and share it around with people that might also be interested to read this kind of content in the future. Twitter post can be found here. Thank you!

Have a great day!

Maverick Equity Research

Great coverage as per usual, appreciate it! #3/#4 (short & leveraged ETFs), #8 (ETF inflows) & #9 (SP500) in particular startling snapshots to be mindful of.

Thanks a lot ... the Credit Suisse take was epic ... also liked a lot the Nasdaq with Yields and the S&P Scatterplot ... ahh and the note with the M2 going negative since almost a century ... not many noted that out there ... inflation should come down from here ... not worried it will not ... thank you and keep it coming, you save me a lot of time with this monthly report & insight from where I can dig deeper if and when I want to ... Tschus!