✍️ Maverick Charts - Macro & More - July 2023 Edition #9

Unemployment, mortgage & interest rates, FED cuts, US downgrade no problemo, consumer sentiment, gold & crypto

Dear all,

first of all, welcome to the new subscribers as recently we crossed the 2,400 milestone!

Maverick Equity Research is read across 48 US states & 112 countries worldwide!

Way more Independent Investment Research is coming out across all the sections!

Here we go with the Top 15 Macro & More charts from around the world + 5 Bonus!

US Unemployment Rate:

back down to the very low level of 3.5% (the 20-year median at 5.3%)

5.7% wage growth which translates also into solid real wage growth

= the consumer aka people are out & kicking: holidays spending, investing & consuming …

Side note, whenever the unemployment rate is very low you hear often the following:

‘it is a lagging indicator’: well, if it is lagging, why do markets react to it quite often quite some? Be it stocks, bonds, currencies?

‘it happens before a recession’: well, if it was high it would not be good either as the narrative would be ‘the economy / the consumer is not healthy’ or we would be in a recession already …

Turning positives into negatives is a way of life for some. I am an optimist-realist and no matter what, I am always for more jobs and decent wage growth as a net positive.

For insight, breaking down the unemployment rate & alternative measures:

who would have imagined that after the 2020 Covid panic (bigger even than the 2007-2009 GFC) that we will recover that fast? Amazing what the economy can do!

US 30-year mortgage rates back to 7% (4.46% median for the last 20 years):

hovering at the 2006-2008 peak levels - we are going down from here, right?

FED hiking on hold and priced to go lower in 2024, M2 very negative … inflation is cooling off (special Inflation report coming out soon from my side … stay tuned)

This metric also made a lot of headlines lately for clicks & views & ad revenue …

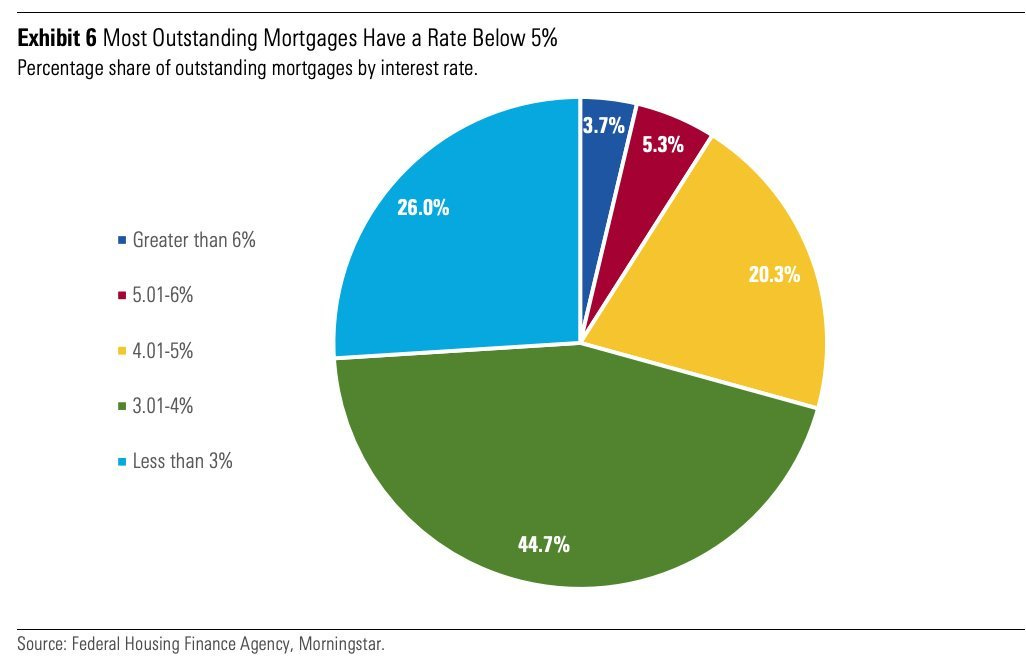

But you are not reading this for that, but for more insight, hence there you go with the mortgage borrowers by interest rates paid: 91% of people have a rate BELOW 5% which is close to the 20-year median of 4.46%. Detailed breakdown:

26% have a rate under 3.00%

70.7% have a rate under 4.00%

91% have a rate under 5.00%

96.3% have a rate under 6.00%

U.S. interest rates 1y 2y 3y 5y 10y 30y with a 20-year lookback period:

3 hiking cycles in 20 years: not the 1st one nor the last one I tell you that

currently above the 2015-2019 period, though below the 2004-2009 cycle with the exception of the very short end of the curve which is above

peak interest rates aka ‘peak FED’ should be here rather sooner sooner than later

A key note here for very short term rates movements:

in 40 years, the FED has never cut rates when CPI was above 3% and the unemployment rate below 4%

in other words, FED only cuts when above target CPI if unemployment is >4%

Why the FED will likely cut in Q1-Q2 2024?

The NY Fed’s US consumer inflation expectations survey tells a very similar story to last Friday’s University of Michigan price expectations data

Despite rising gasoline costs, consumers think inflation more broadly will continue to slow … US consumer inflation expectations also helping here

The Fed has got to be happy with that

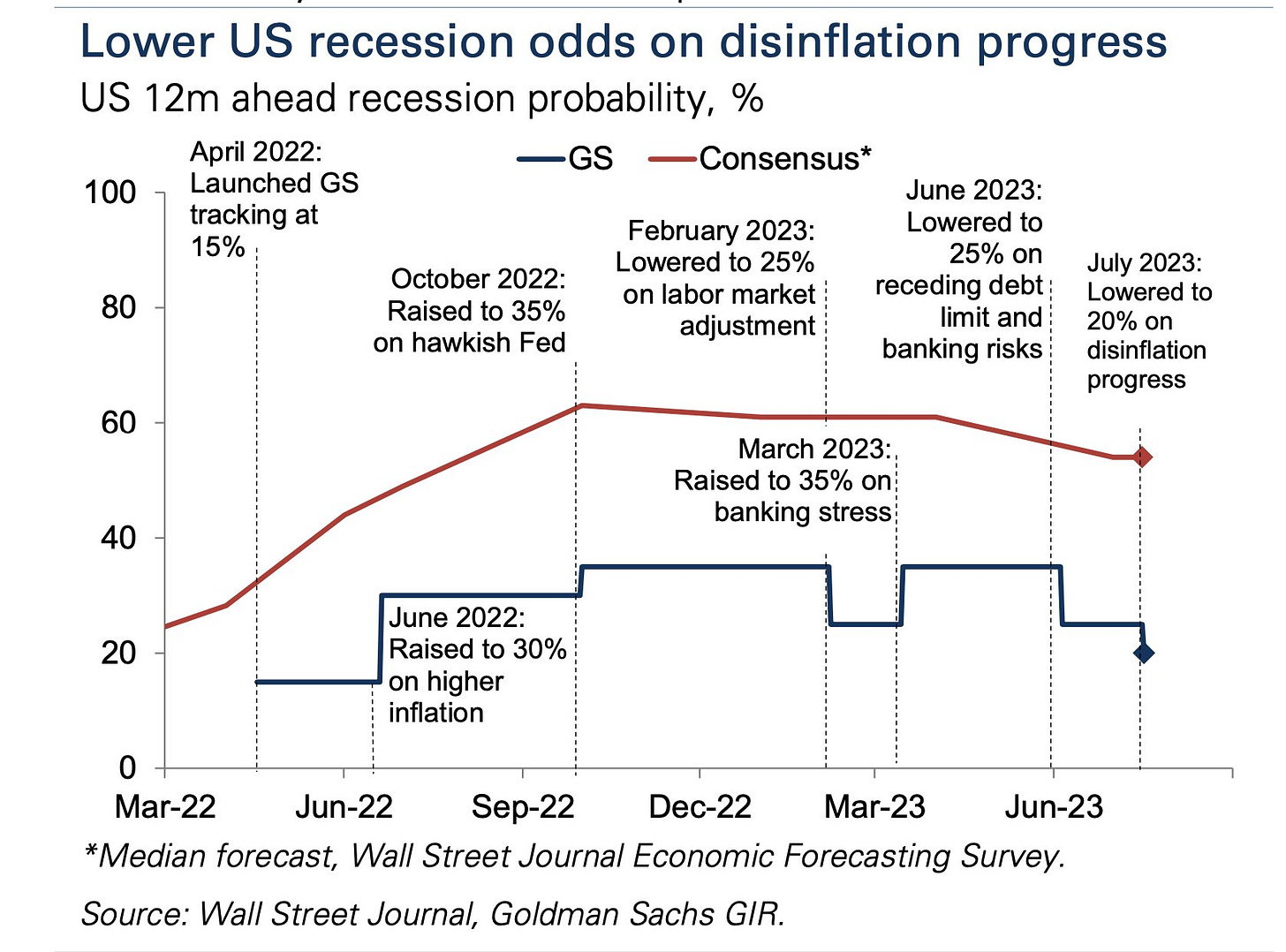

Goldman Sachs view is that the FED’s hiking cycle is now complete and will remain on hold at the current 5.25-2.5% levels until the 1st rate cut for Q2-2024.

They also assign lower US recession odds via the disinflation major progress.

Another one that made the headlines for not much was Fitch Ratings decision to downgrade the United States long term credit rating to AA+ from AAA. Note:

S&P had an AA+ rating on the US since 2011 when they downgraded it.

US historical credit ratings by rating agencies for a proper overview:

When looking at the CDS levels of other countries rated AA+, it should not have been surprising the decision from Fitch: US 5-year default protection has been costlier than peers this year

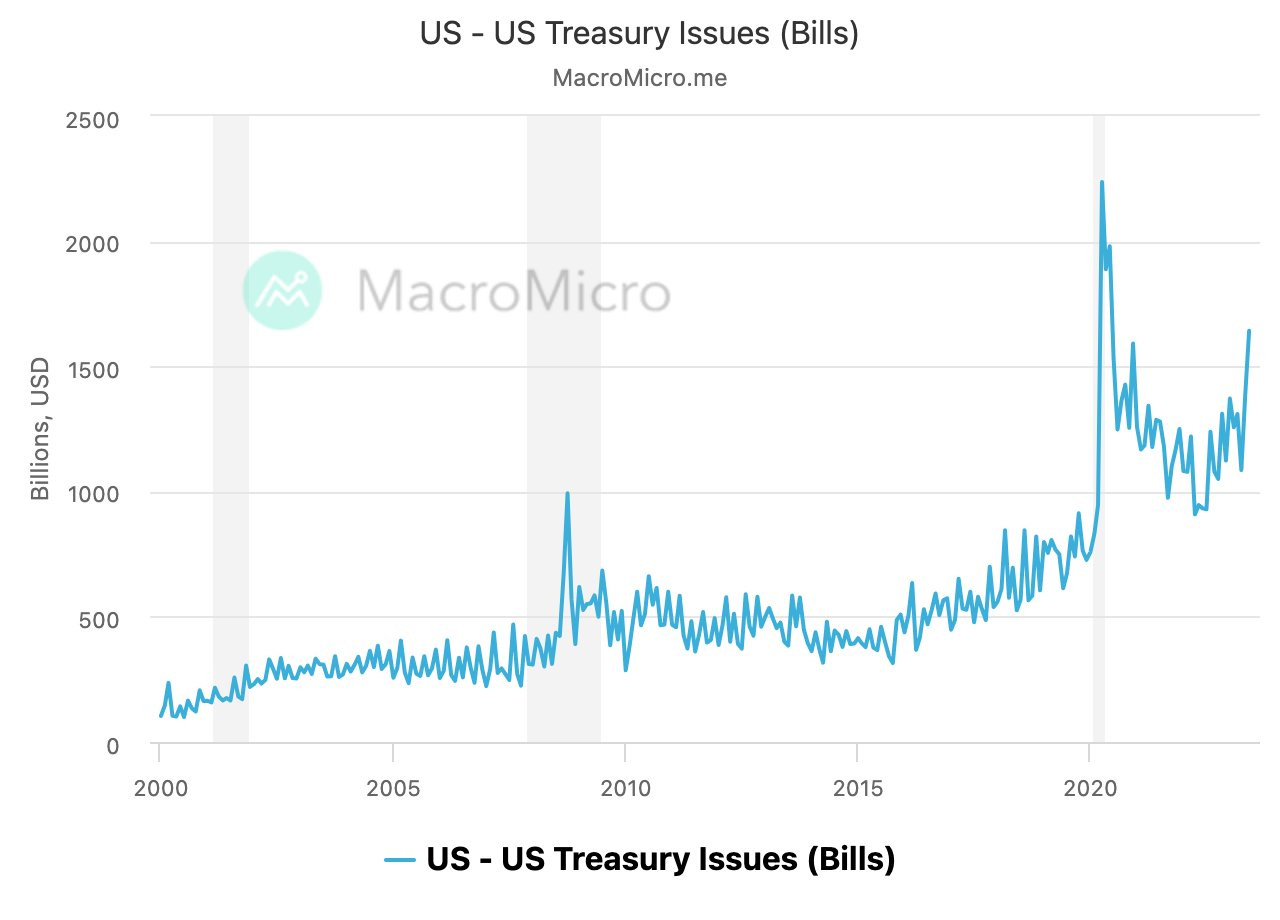

US downgraded, US issues debt for a new 3-year high, market buys it, chill pill.

For this kind of downgrades to be making a big impact, 2 conditions need to happen:

cause a major exodus from bonds - did not happen

ration action should be credible - it was, but market pricing said nehhhh, we have seen that movie before …

How is the consumer confidence feeling overall? Better!

Present Situation: +6.4% to 155.3

Expectations +7.8% to 79.3

Consumer Confidence Index rises 7.2% to 109.7 in June (highest since Jan 2022)

13 & 14. Gold price diverging from Gold ETF holdings: what’s the likely cause?

gold price diverging from real rates/yields

central banks physical purchases, both G7 & BRICS countries (2nd chart)

US GDP: a big +5.0% real growth via Atlanta FED GDPNow estimate (quarter/quarter annualized). Recession scenario dropping by a big margin.

Bonus Charts - Crypto focus:

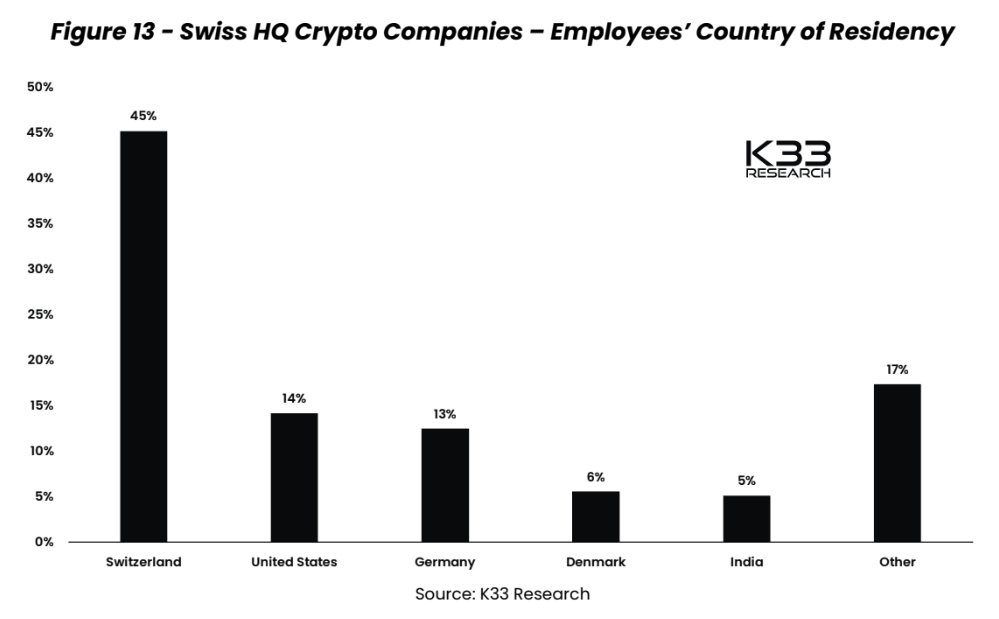

Where do you think most crypto companies headquarters are located?

Switzerland with 45% nearly half of the share - decentralised meets decentralized

The city of Zug aka ‘The Crypto Valley’ is the big center where guess what also? You can pay your taxes in Bitcoin, no joke ;)

Bitcoin miners having a banger of a year:

Both Bitcoin and Nvidia rose by less than public miners this year, let that sink in: 80% and 222% respectively

A good way to get leveraged/high-beta exposure to Bitcoin is Mining, right?

MicroStrategy (MSTR) is up with a whooping 170% in 2023! Guess what is the company doing next? Sell shares!

Shares issuance for $750,000,000. How could they lose if they keep printing shares & buy with the proceeds a finite amount of Bitcoin? Heads one wins, tails one wins … . Company owns 152,333 pieces of bitcoin worth about $4.6 billion.

Note though: crypto funding via VCs falls globally

Research is NOT behind a paywall & no pesky ads here. What would be appreciated?Just sharing it around with like-minded people. In case not already, subscribe to get all the future research straight to your inbox.

Thank you & have a great day!

Mav

Well done sir! Nice charts and insights. Even a chart from me! Keep it going ! 💪🏻

Great, congrats for the growth!

Thank you for giving us the essence from the myriad of information out there as we have too many nowadays. Also thank you for not hyping stuff as we have that too much as well.