✍️Maverick Charts - Macro & More - June 2023 Edition #8

US yields, FED interest rates pricing, Recession Probabilities, The World's Most Competitive Countries, AI Automation by Industries, Oil Market Size, Inequality

Dear all,

first of all, Happy 4th of July to all US folks, hope you had a good one! Cheers to that!

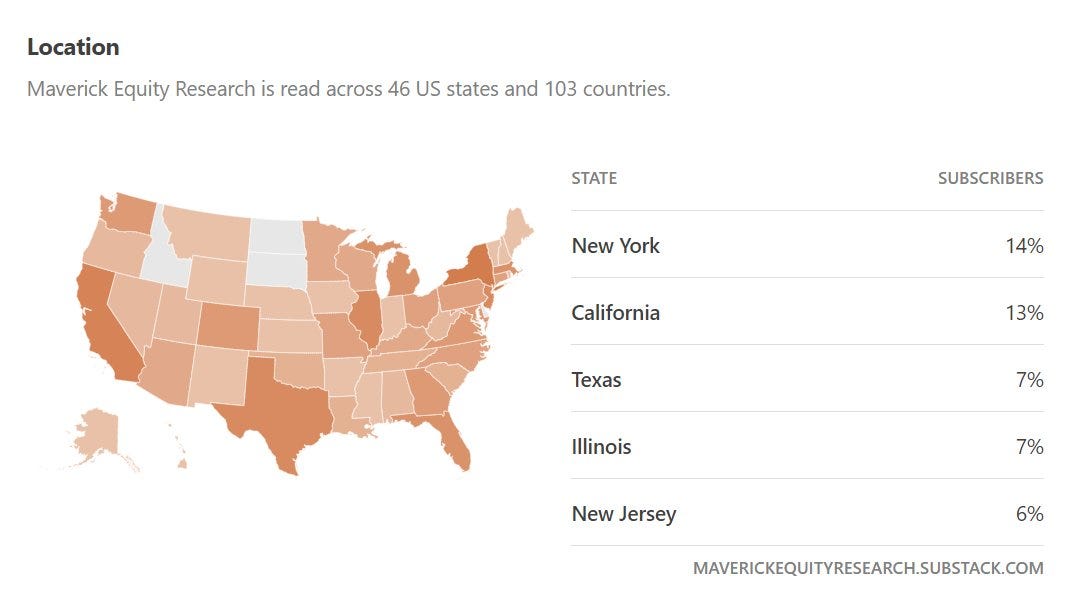

Maverick Equity Research is read across 46 US states & 103 countries worldwide! More independent research coming out ... just got started not a long time ago and almost 2,000 people enjoy & read the publication!

In case you did not subscribe yet for delivery straight to your inbox, it’s just 1-click. And the same goes to share this around with whom might be interested as well. Enjoy!

Here we go with the Top 15 Macro & More charts from around the world + 5 Bonus!

U.S. government bond yields 1y 2y 3y 5y 10y 30y with a 20-year lookback period:

3 hiking cycles in 20 years: not the 1st one nor the last one

currently above the 2015-2019 period and around the 2004-2009 cycle

FED interest rates latest pricing:

mr. market is pricing a high probability of ONE hike ... though FED's Powell said he expects TWO additional rate hikes down the road ...

Note how fast look the rate cuts in 2024 ...

And the famous FED 'dot plot' FOMC members projections:

longer term back to 2.5%

recall also that at the most recent FOMC meeting, the 'dot plot' was revised UP!:

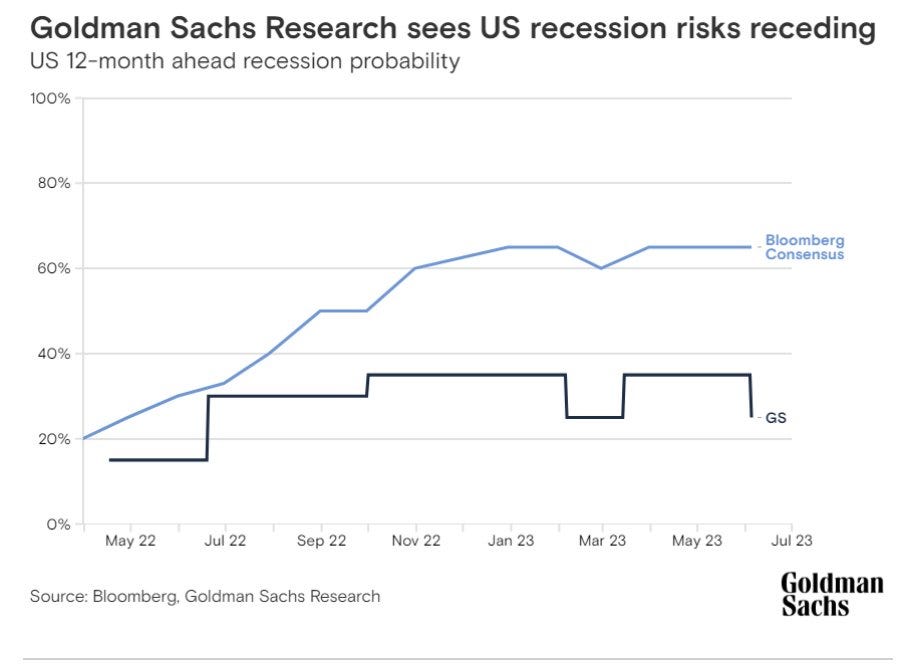

U.S. recession probability dropped to 25% ... down from earlier projection of 35% via Goldman Sachs ... while Bloomberg Consensus is way higher ... interesting ...

Similar good developments from the latest quarterly survey of asset managers by Absolute Strategy Research (covering 242 across the world, managing $6.6 trillion): global recession probability stands at 56% though note it has been falling steadily

How many recessions have you lived through? Via the Great Moderation period, downturns used to be frequent, these days investors are out of practice ...

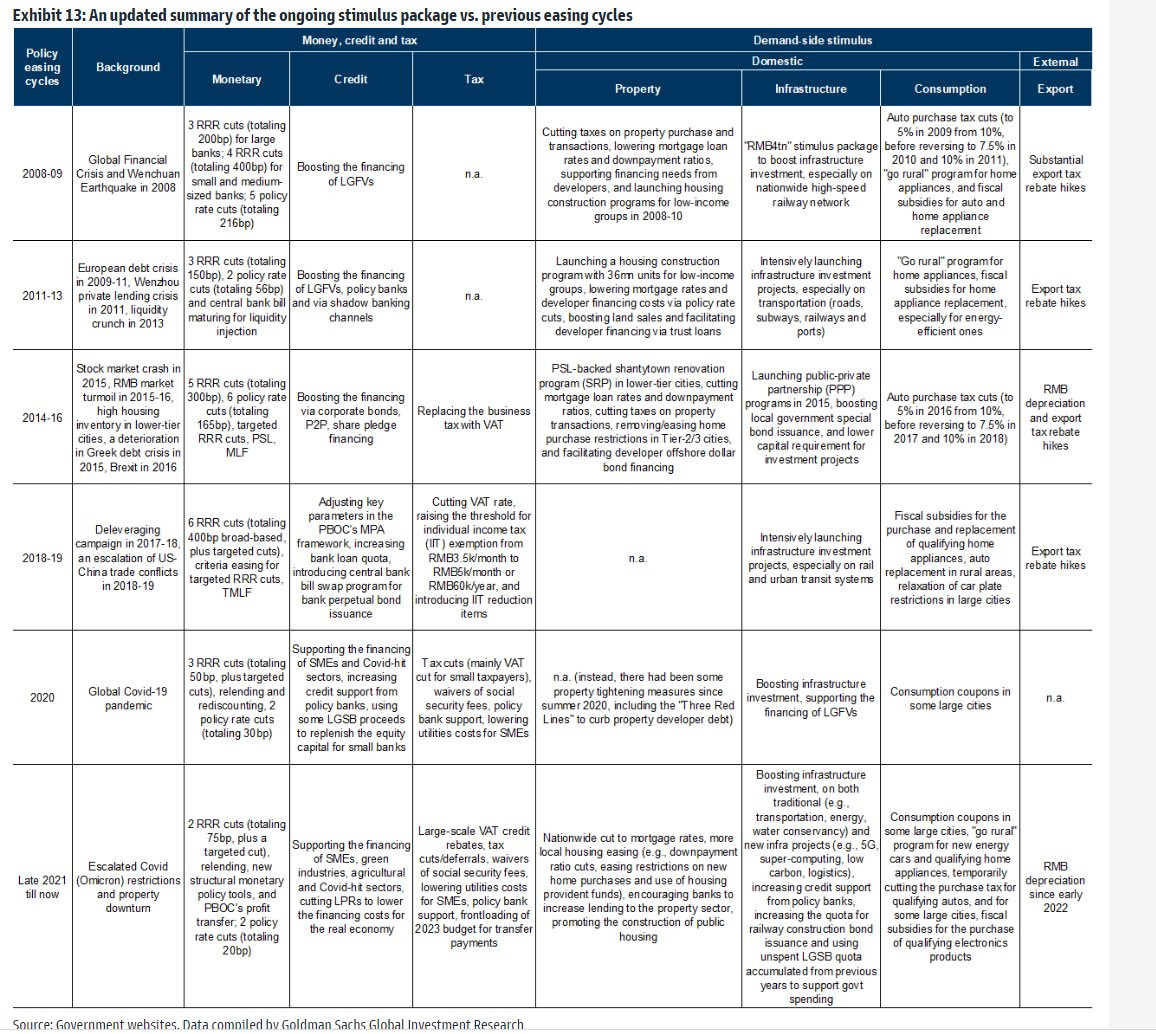

Current Stimulus Packages & former easing cycles - Goldman great overview:

Monetary, Credit and Tax side +

Demand-side stimulus: property, infrastructure consumption + external via exports side 1 pager which says 10,000 words and more ...

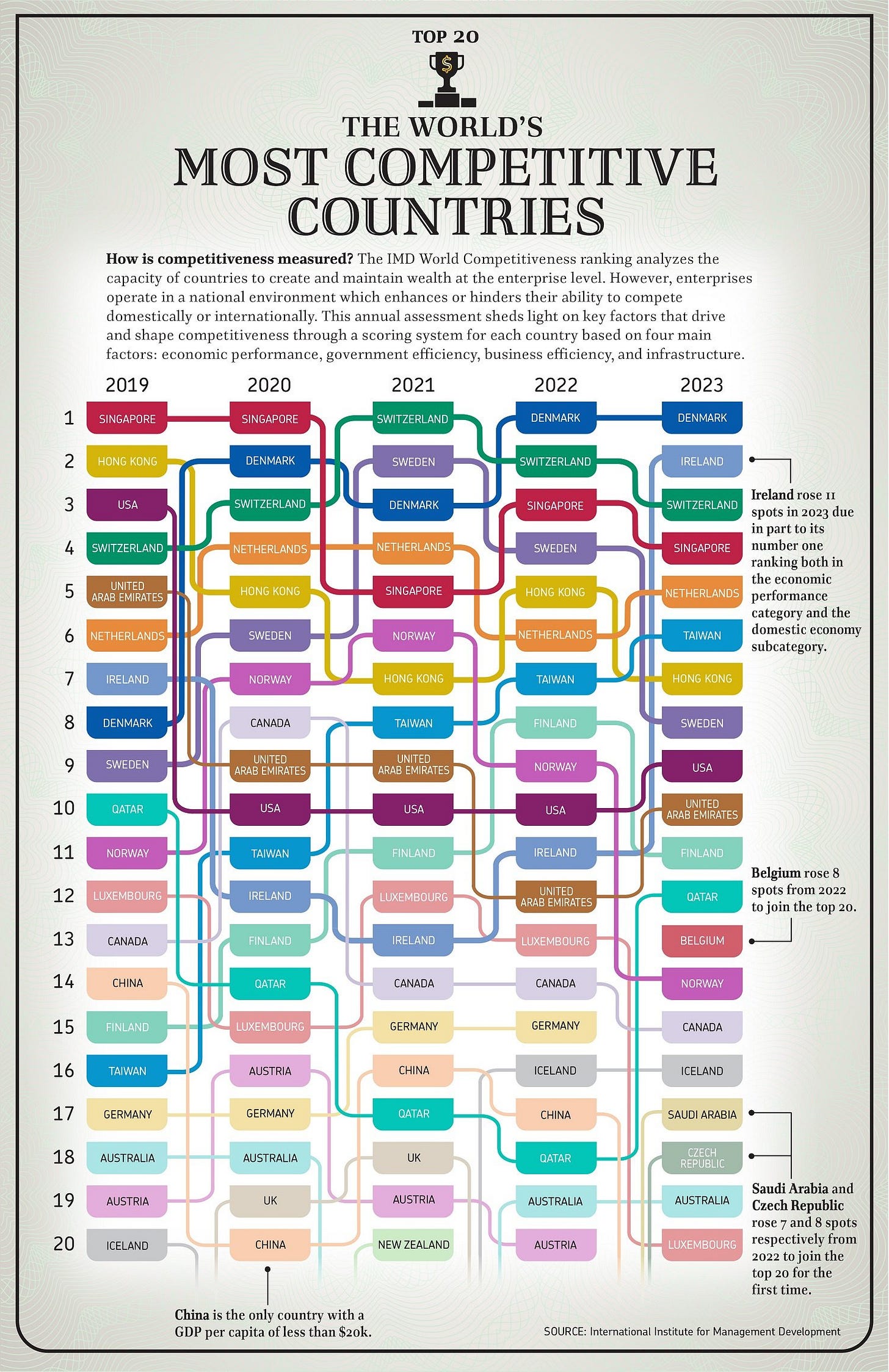

The World’s Most Competitive Countries (2019-2023):

How is Business Competitiveness Measured by IMD (International Institute for Management Development)? 4 major pillars: Economic Performance, Government Efficiency, Business Efficiency & Infrastructure

Top 10 Countries By GDP Per Capita & by Region:

U.S. Home Price Growth Over 50 Years: the business cycle is there too naturally…

Ranking Industries by Their Potential for AI Automation

The World’s Biggest Mutual Fund and ETF Providers:

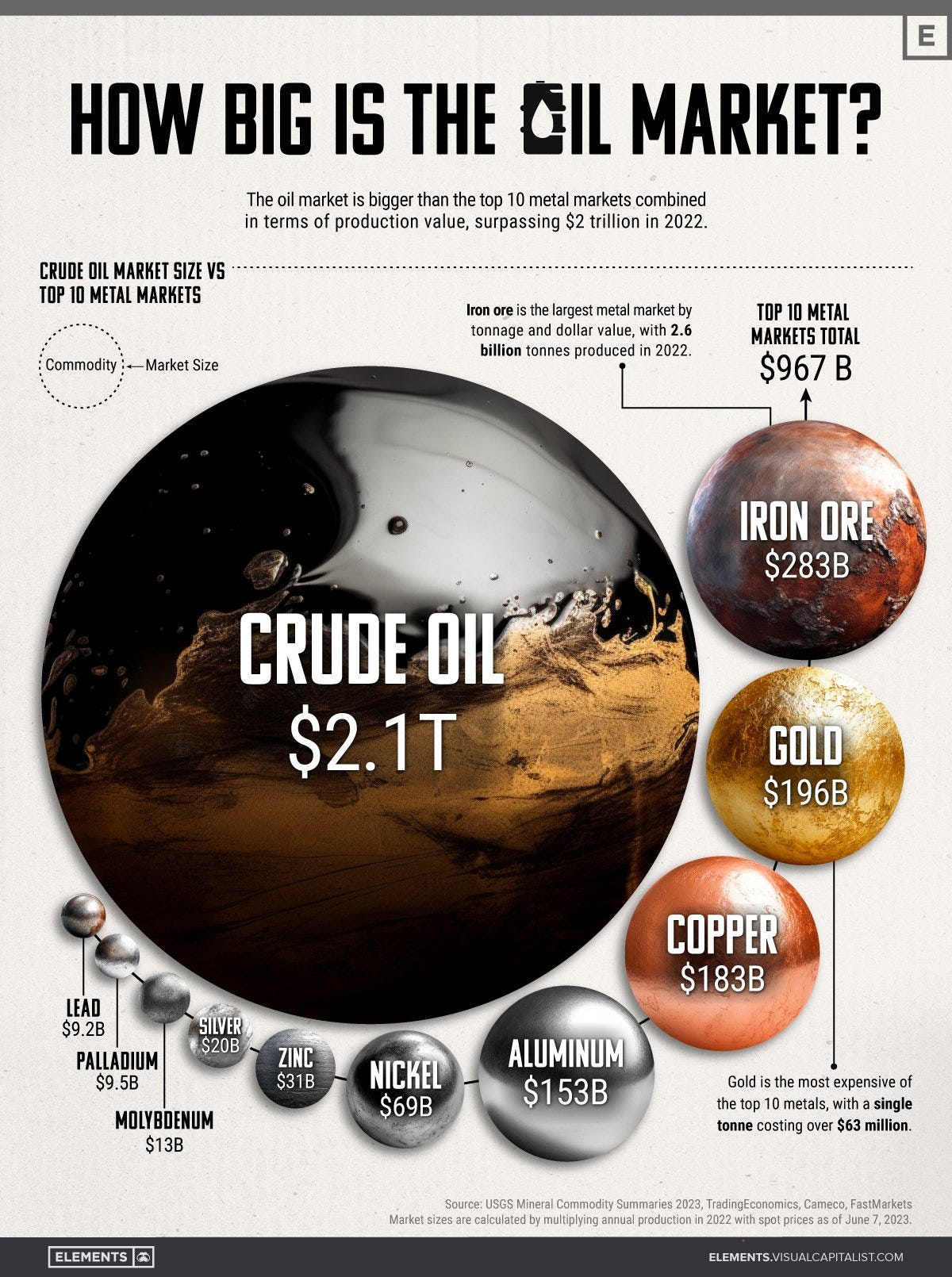

How Big Is the Oil Market? BIGGG! Sizing Up The Oil Market vs Top 10 Metal Markets Combined:

Oil market is bigger than the top 10 metal markets COMBINED surpassing $2 trillion in 2022 ...

The combined market size of the top 10 metal markets amounts to $967 billion, less than half that of the oil market. In fact, even if we added all the remaining smaller raw metal markets, the oil market would still be far bigger ...

The 100 Largest U.S. Banks by Consolidated Assets

European energy transition: 2/3 are expected to be SOLAR!

US labor productivity output per hour: 1 year average & 5 year … somehow the great innovation themes around are not showing up or measurement issues? …

Bonus charts

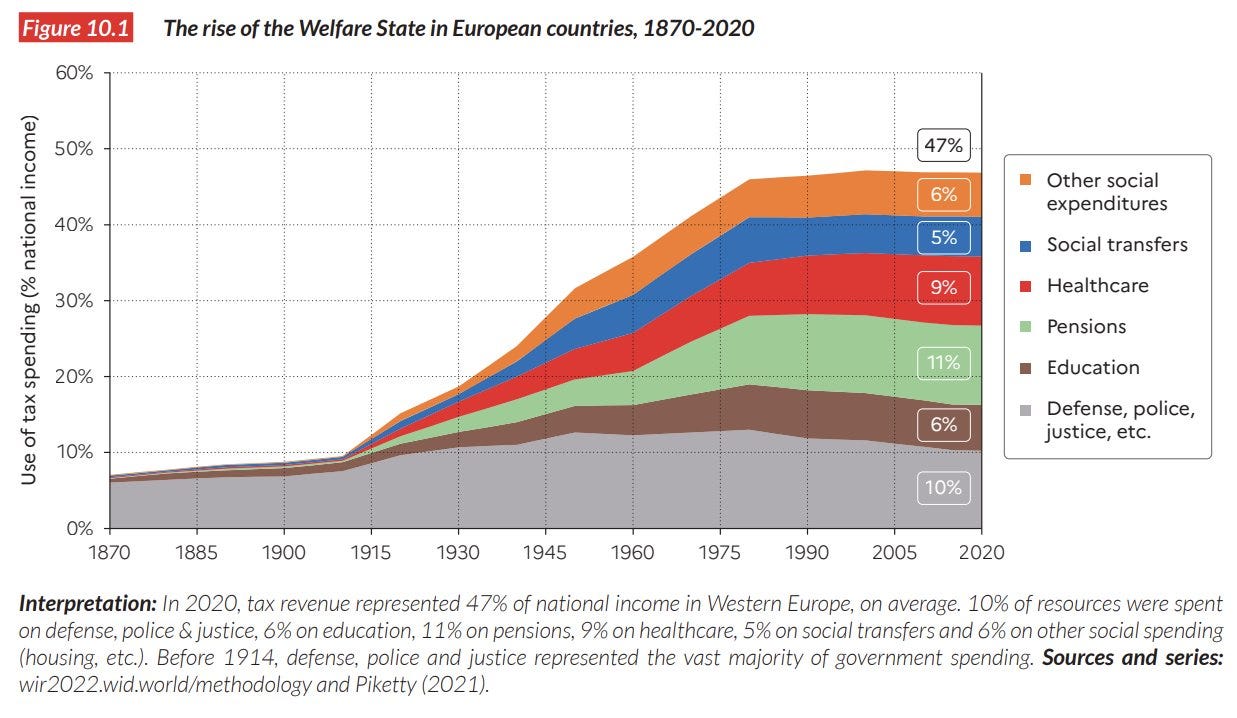

Wealth distribution/inequality: Top 1% vs Bottom 50% wealth shares in Western Europe and the US, 1910-2020

The rise of the Welfare State in European countries 1870-2020 as a major factor for less inequality? Fair assumption I would say …

Top 1%, Top 0.1% and Bottom 50% from 1820 to 2020 for a global view:

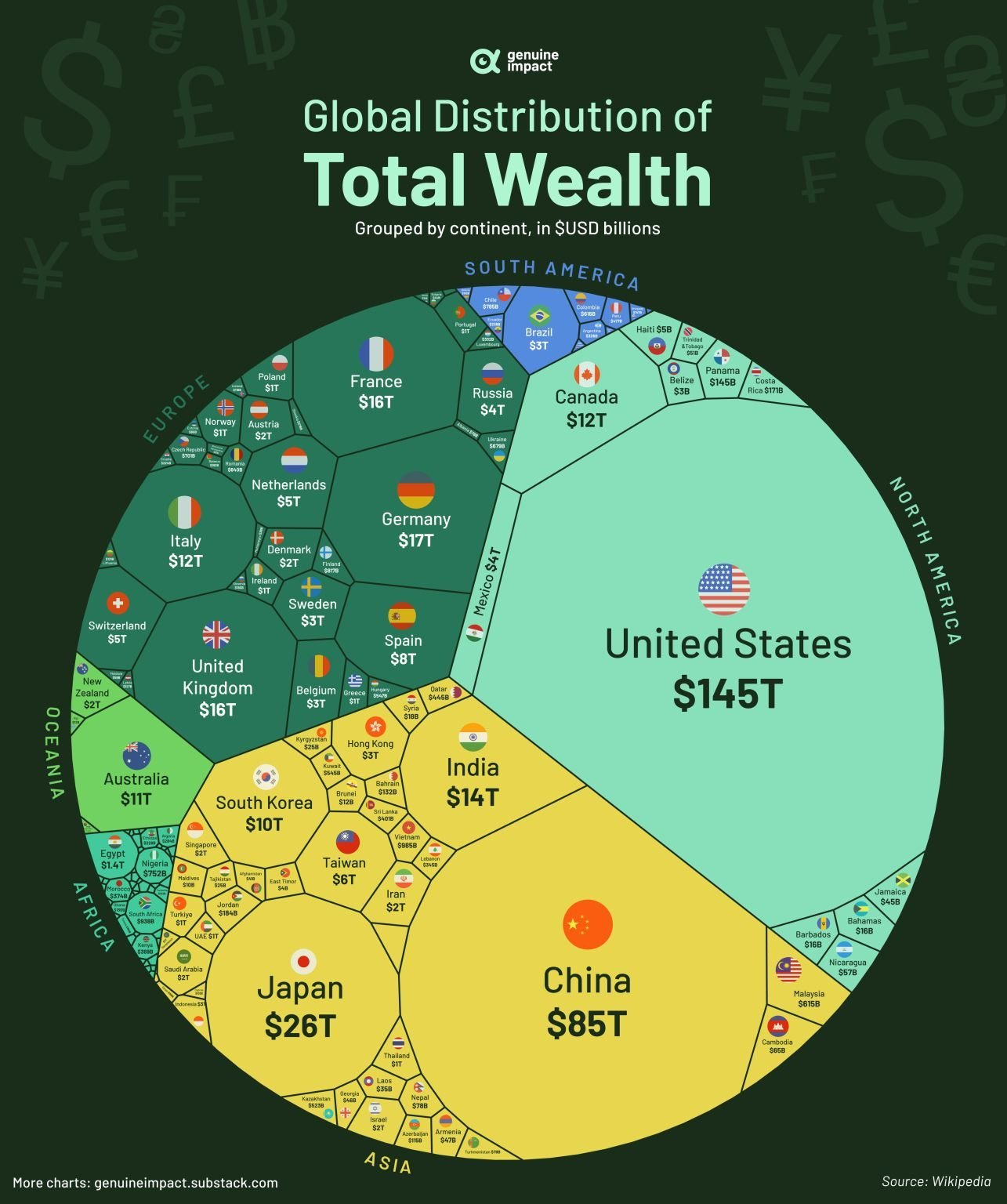

Global Wealth Distribution grouped by continent:

Visualizing Annual Working Hours in OECD Countries:

Should you have found this cherry-picking interesting & valuable, just subscribe & share this around with people that might also be interested! Thank you!

Have a great day!

Mav

Nice, danke!

Thx bud!