Maverick Charts - Macro & More - May 2023 Edition #7

AI, Interest Rates & the S&P 500, US Debt Ceiling, European Wages & Food, Supply Chain Pressures, Brexit a mistake? OECD GDP Projections, Global Tech & Security

Dear all,

here we go with Top 15 Macro & More charts from around the world + 5 Bonus!

In case you did not subscribe yet for delivery straight to your inbox, it’s just 1-click. And the same goes to share this around with whom might be interested as well. Enjoy!

1. November 1998 Forbes AI cover/headline - ‘Artificial Intelligence Gets Real’

is this time truly different? A big step though imo overhype train came to town

“History doesn't repeat itself, but it often rhymes?”

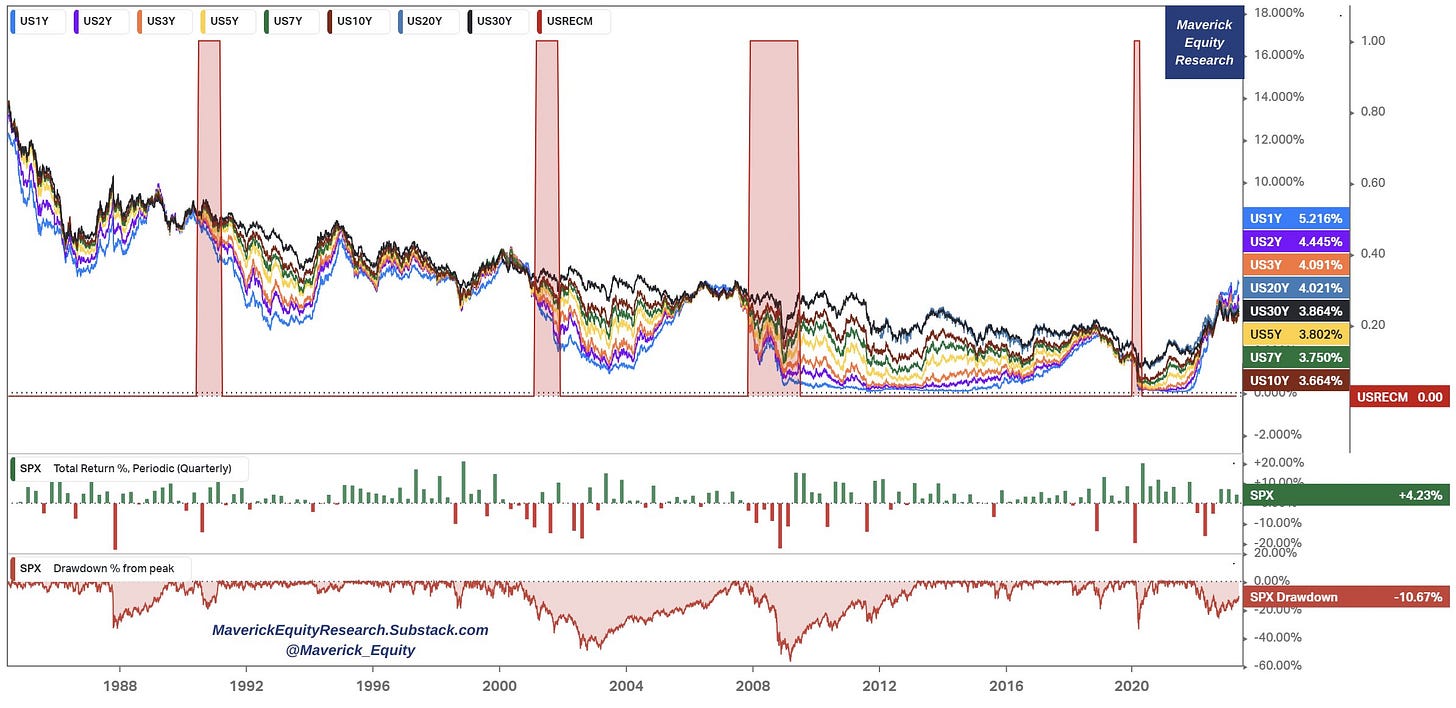

US Interest Rate cuts are pushed out of 2023 ... Fed Funds Futures tells us:

In 2022 we started the fastest interest rates hiking cycle in decades, yet the mighty S&P 500 aka 'The Market' is now +1.56% … we went from 0% to 5%+ rates and equities are all good, let that sink in!

Zooming out - Interest Rates & the S&P 500 via:

40 years of US interest rates with red bars recession periods

S&P 500 quarterly returns

S&P 500 drawdowns

N.B. with the fastest hiking cycle in the most recent decades, the drawdown was in 2022, yet 2023 no problemo my friend given that we are +12.5% in 2023

Visualising FED tightening cycles via interest rates rates increase by month

1994 cycle was very steep, but 2022-2023 even more

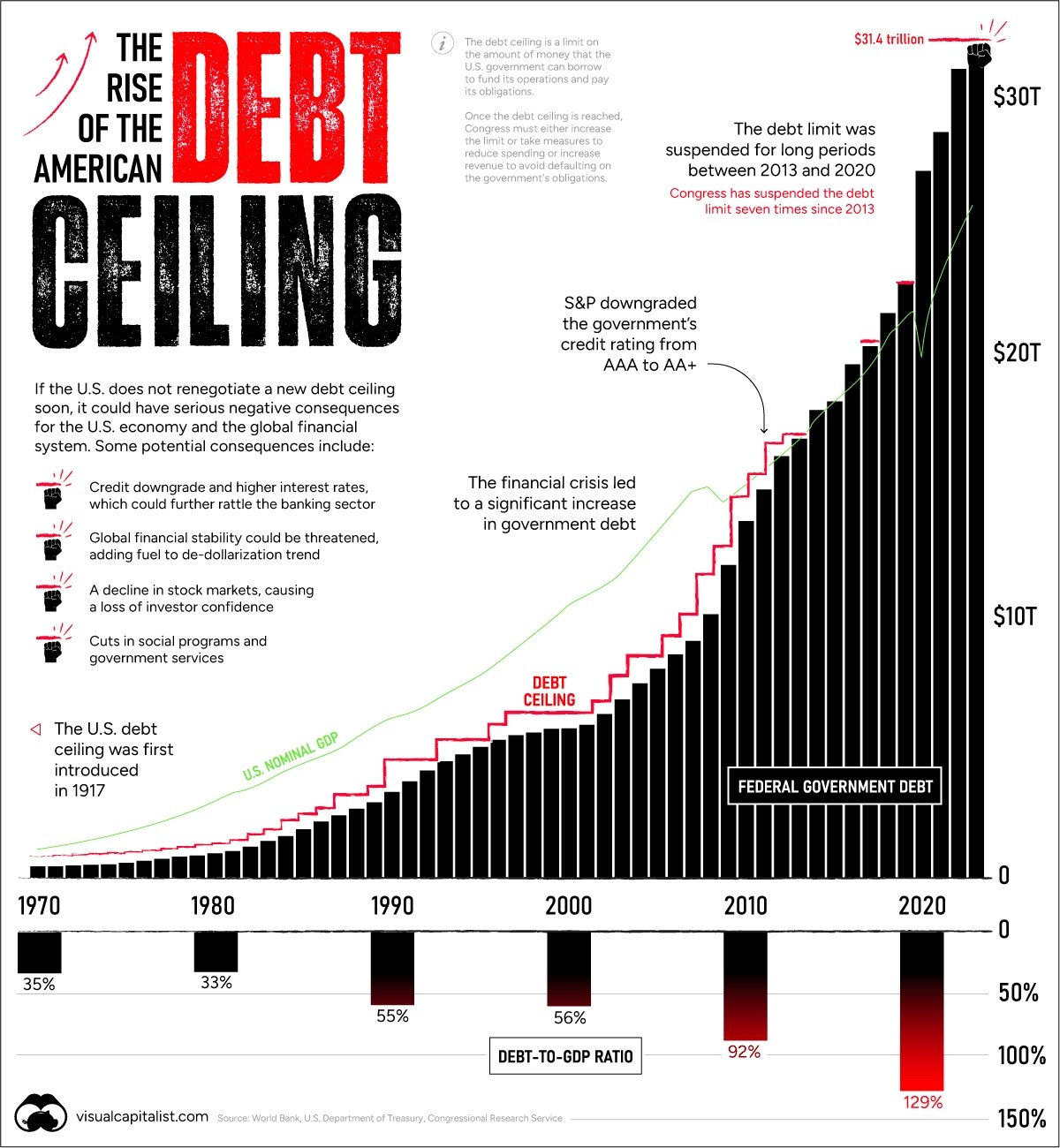

Charting the Rise of America’s Debt Ceiling:

Can now put a floor in place and problem solved ?

No circus theatre next time ... we can skip that part ... ;)

US debt ceiling & Market uncertainty: US overcooked it as always and this time like no other compared to previous episodes, UK did not care this time at all …

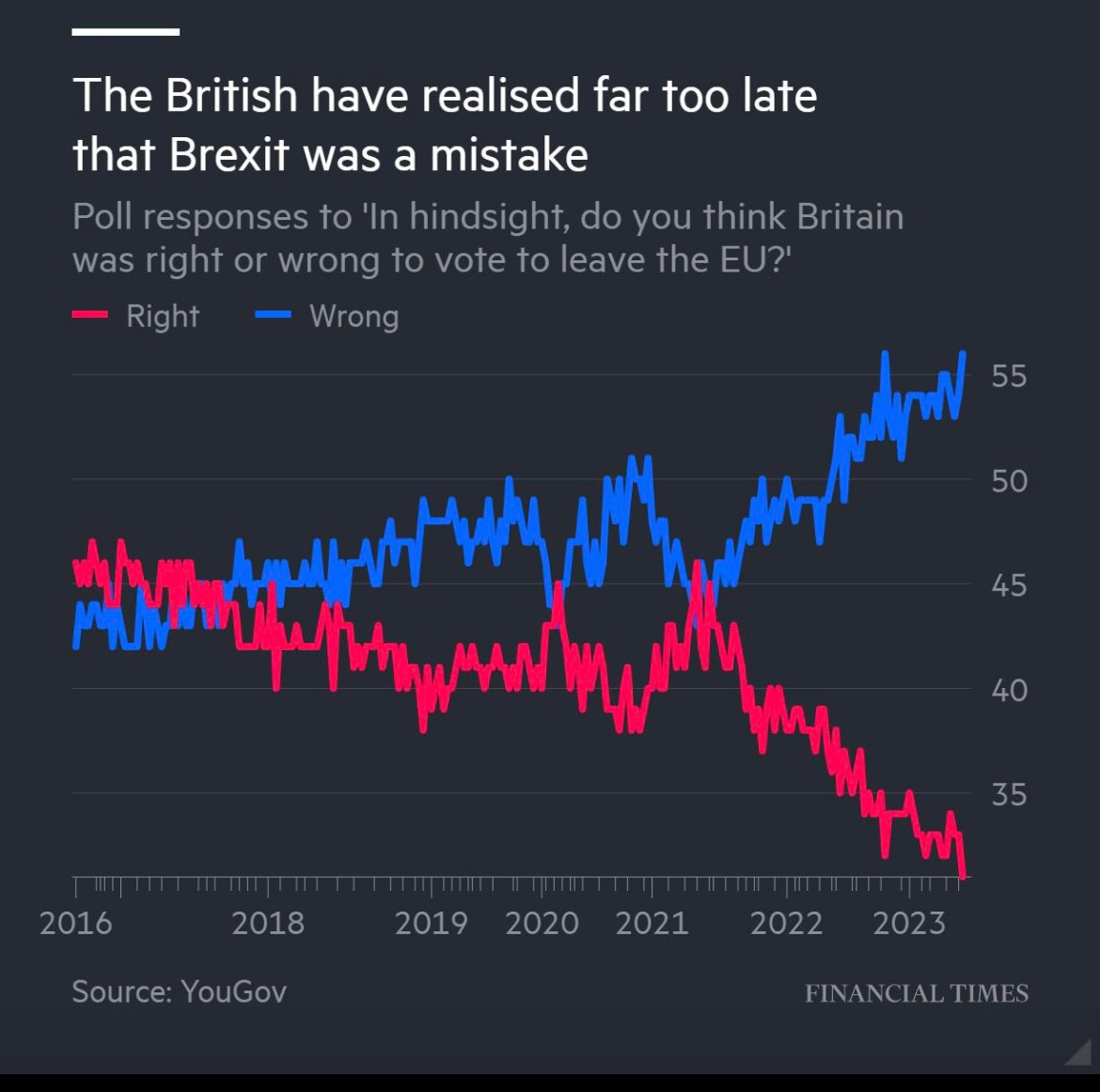

Was Brexit a mistake? It seems they realised that it was …

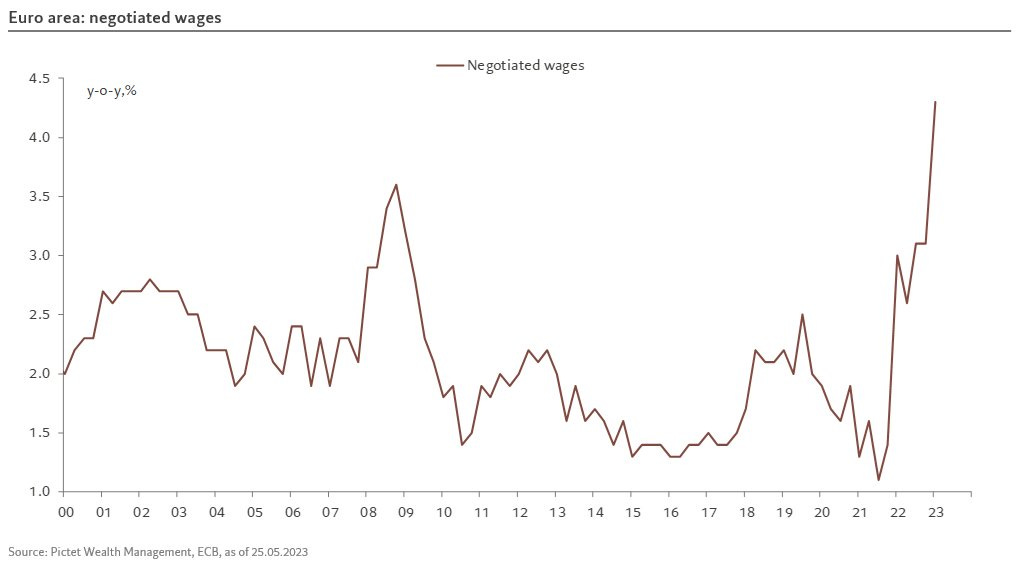

Power to the European employees: a sharp acceleration in negotiated wages … hedge inflation at least partly …

Europeans are buying less food but paying more for it …

Greece GDP growth vs Euro area: an interesting chart from Goldman Sachs ahead of the Greek election of May 21st:

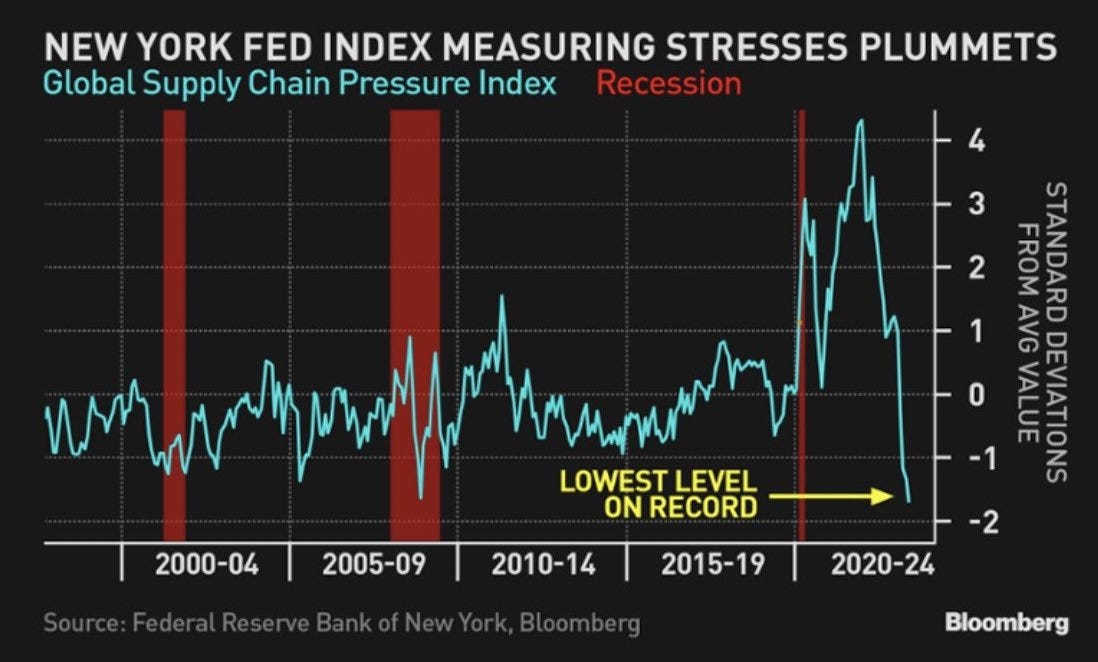

Global Supply Chain Pressure Index eases to lowest level on record! Let's Make Inflation Low Again, right?

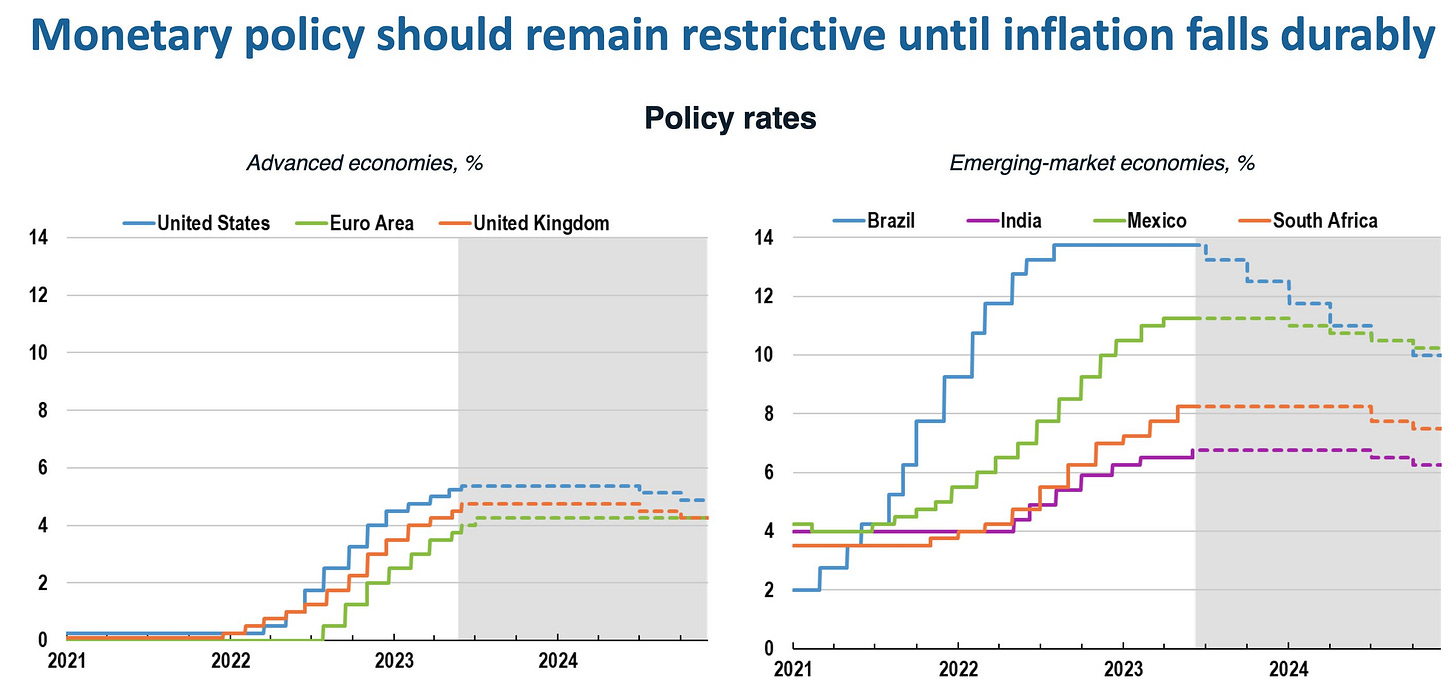

Monetary policy should remain restrictive until inflation falls durably (i.e. anchoring inflations properly)

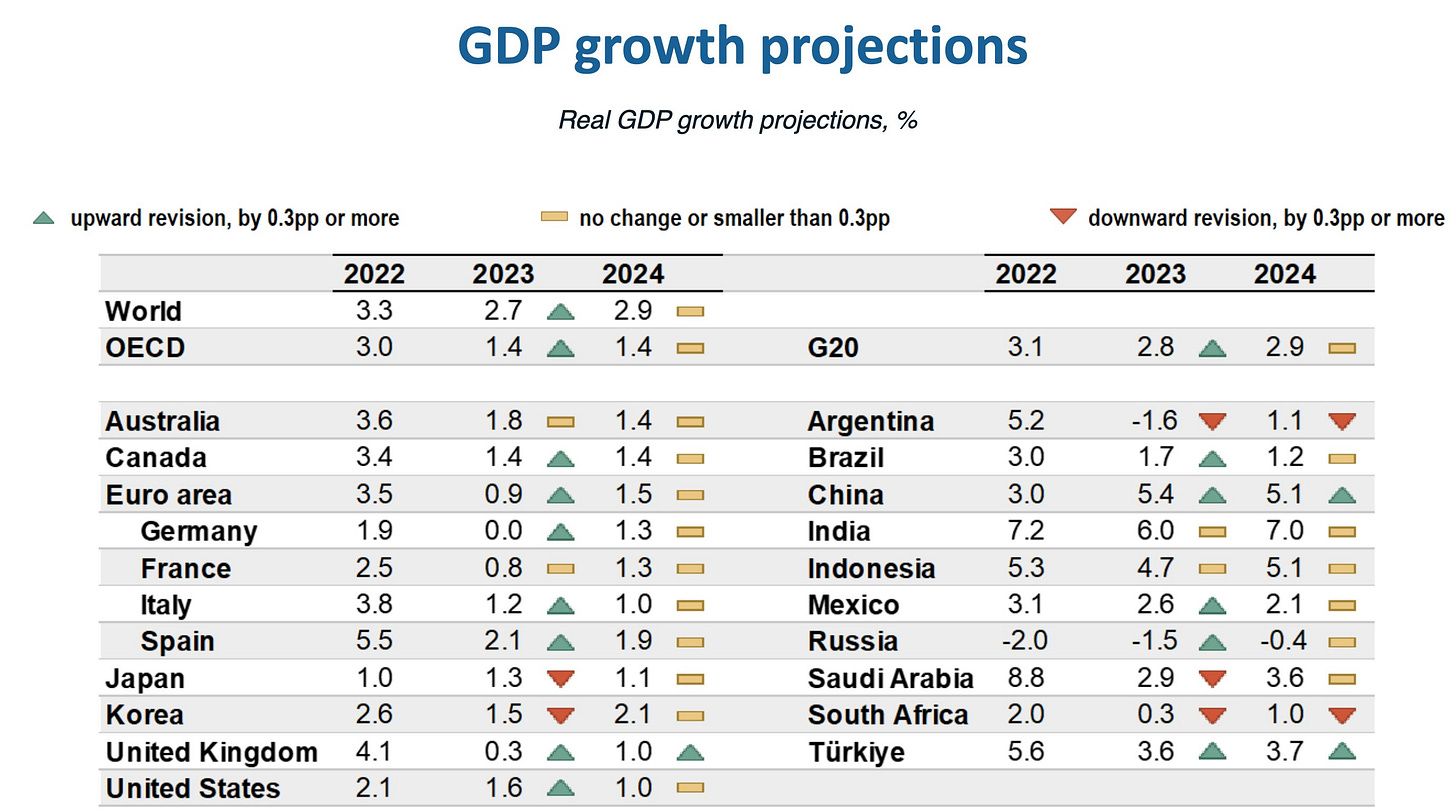

OECD raises GDP growth projections:

What is the most likely outcome for the global economy in the next 12 months?

Soft landing!

Source: May 2023 BofA Global Fund Manager Survey aka 'institutional investors'

Bonus charts

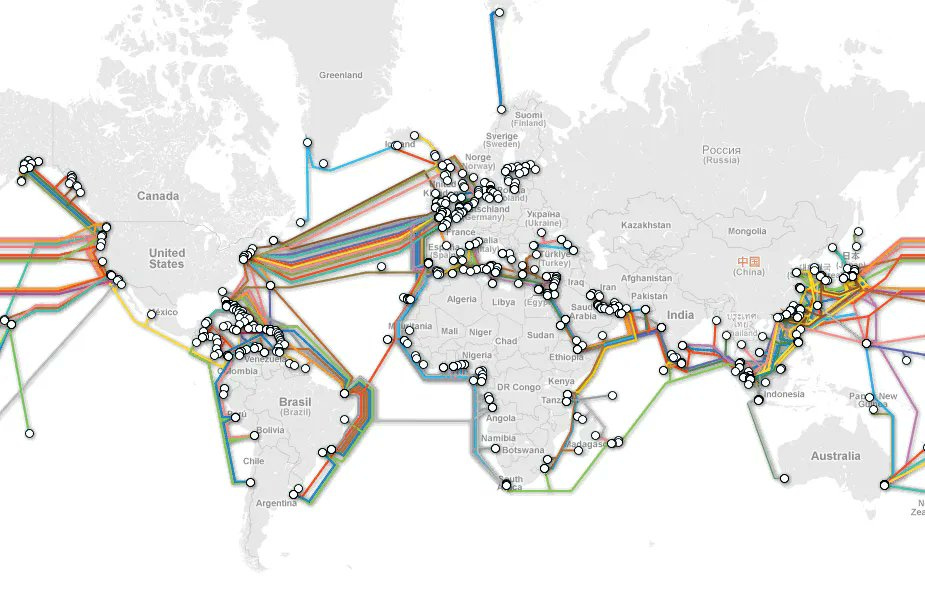

Global Tech & Security via The World & Undersea Cables

The ocean floor is crisscrossed by 1.5 million km of undersea cables = modern life isn’t possible without them …

552 cables carry 95% of global data and communications including everything from $10T in daily financial transactions to your crypto and local restaurant POS payment … 😉

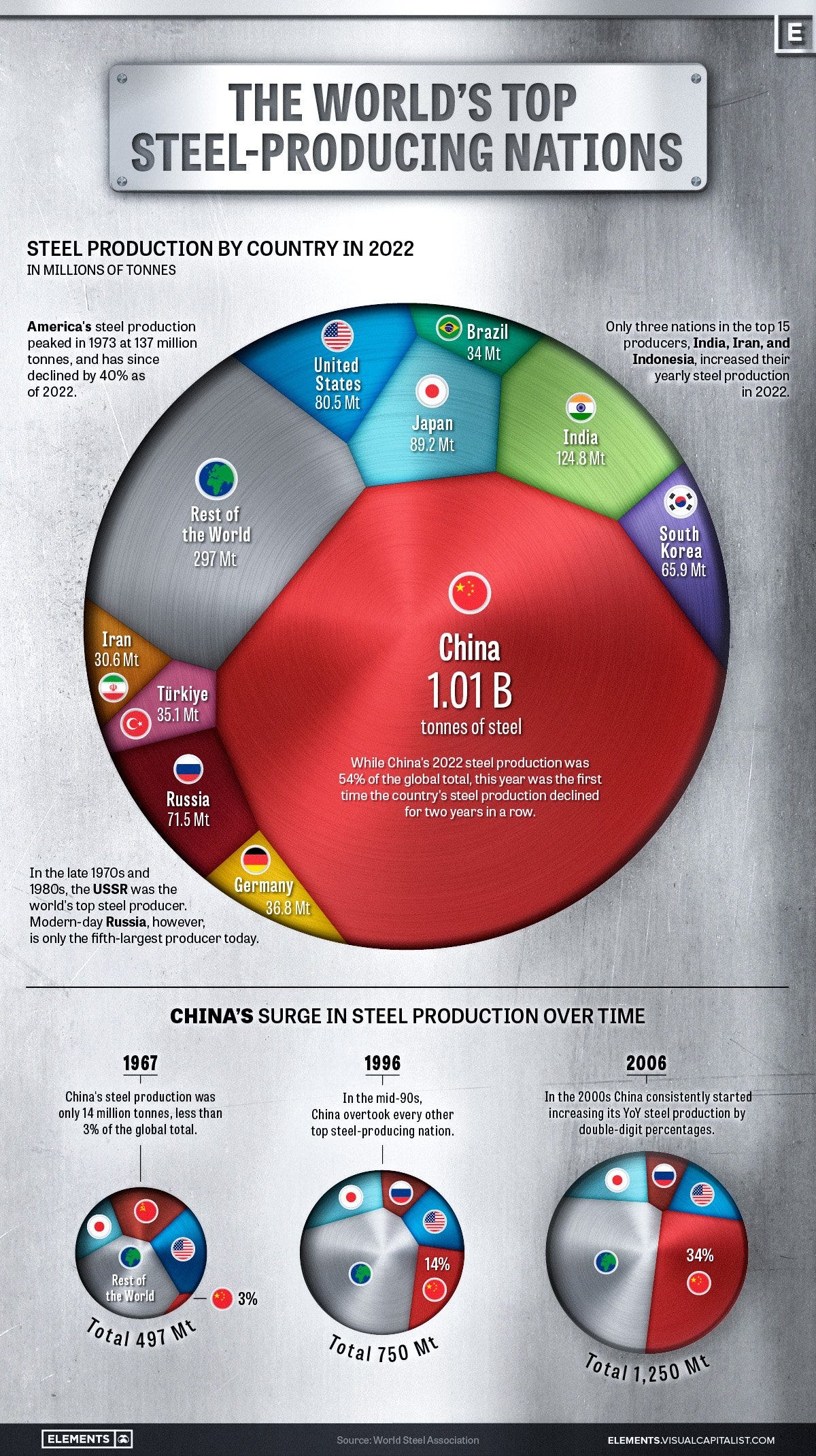

Visualizing the World’s Largest Steel-Producing Countries

Market needs Elon to go doge coin twitter mode it seems ;)): Dogecoin dropped -46.5% since November 1, 2022 while Bitcoin has gained 34% since then ...

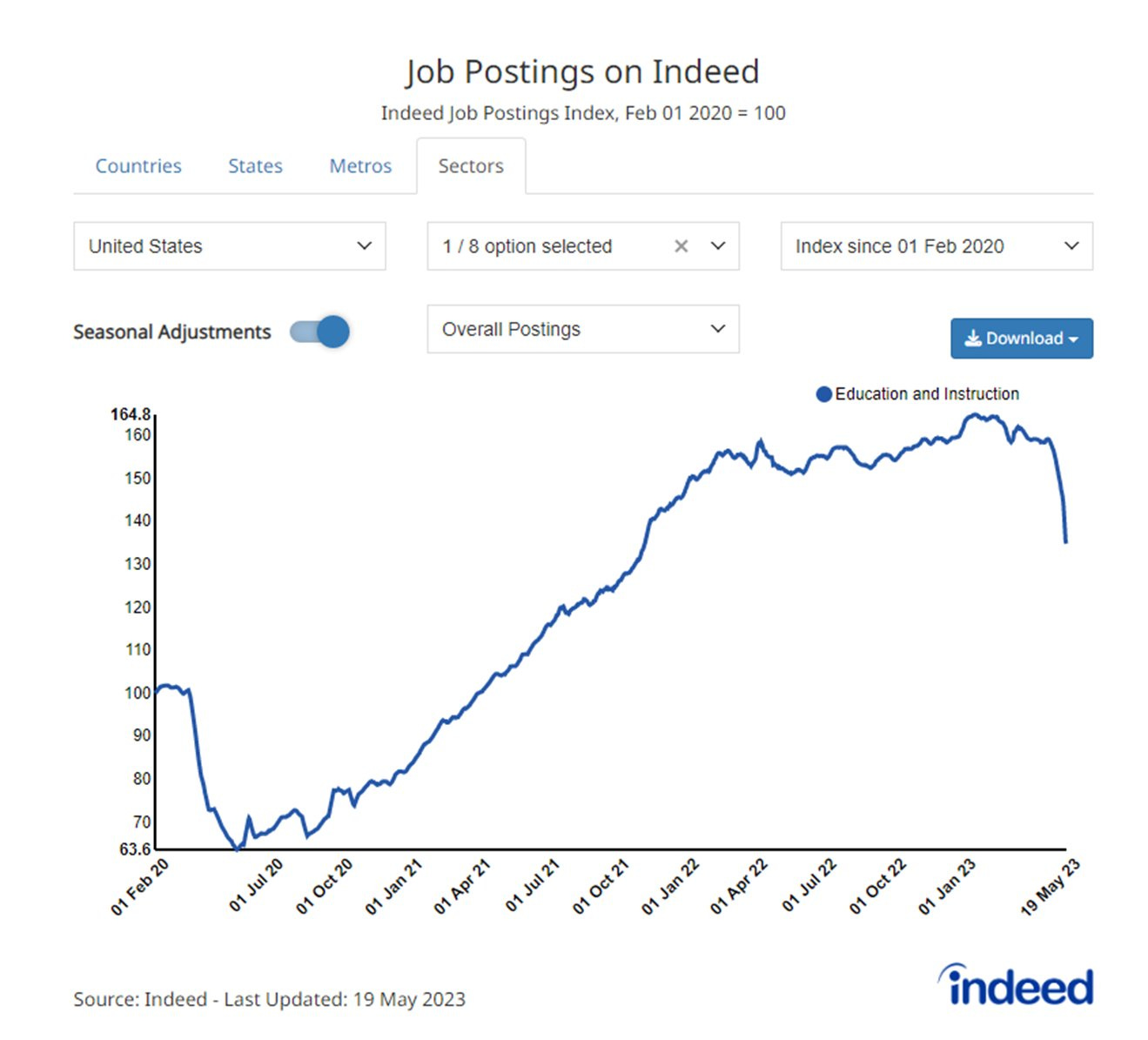

“Hey ChatGPT, are you going to disrupt the labor market for education?”

Survey on ChatGPT in the Workplace - Deutsche Bank asked 1,150 employees on ChatGPT usage:

Should you have found this cherry-picking interesting & valuable, just subscribe & share this around with people that might also be interested! Twitter post can be found here. Thank you!

Have a great day!

Mav

Thanks Mav!