✍️ Maverick Charts - Macro & More - November 2023 Edition #13

25 Sleek charts that say 10,000 words ... save precious time & provide insight!

Dear all,

to all US folks, I hope your Thanksgiving holiday was a good one while for the international folks, a good refreshing weekend! I am back as well with your monthly Top 20 Macro & More charts from around the world + 5 Bonus!

Before that, from the legend Warren Buffett: "The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd."

Goldman Sachs lowers the probability of a US recession while consensus around 50% chances, though dropped from 65%

"Despite the good news on growth and inflation in 2023, concerns about a recession among forecasters haven’t declined much. Even in the US, which has outperformed so clearly on growth in the past year, the chart shows that the median forecaster still estimates a probability of around 50% that a recession will start in the next 12 months. This is down only modestly from the 65% probability seen in late 2022 and far above our own probability of 15% (which in turn is down from 35% in late 2022).”

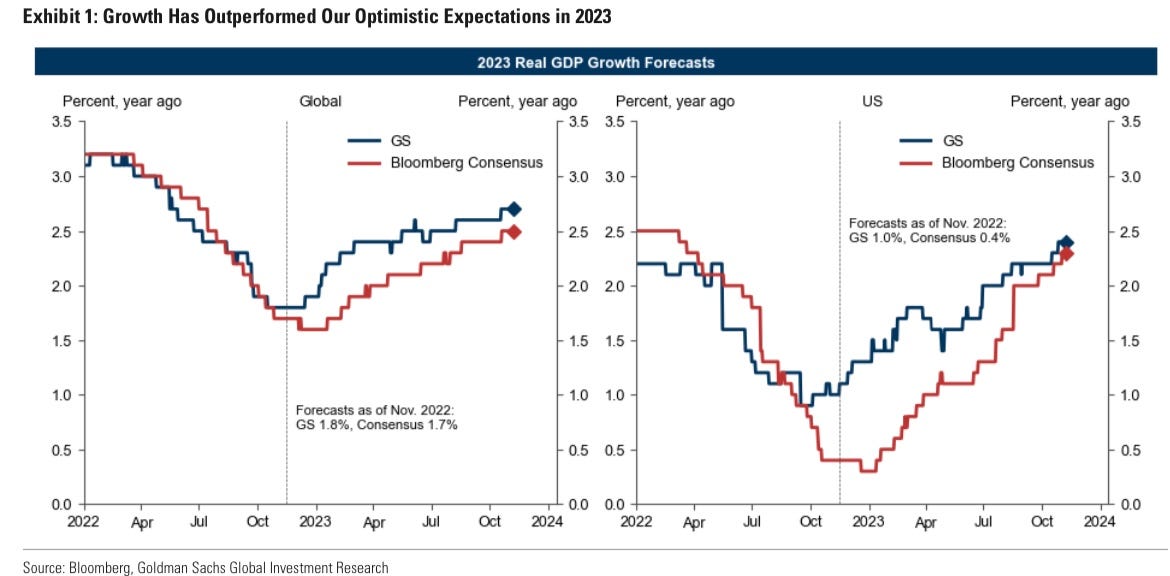

The US & global economy outperformed GS & consensus expectations in 2023

👉 US economy: GDP growth surpassing consensus forecasts by 2%

👉 global economy: GDP growth surpassing consensus forecasts by 1%

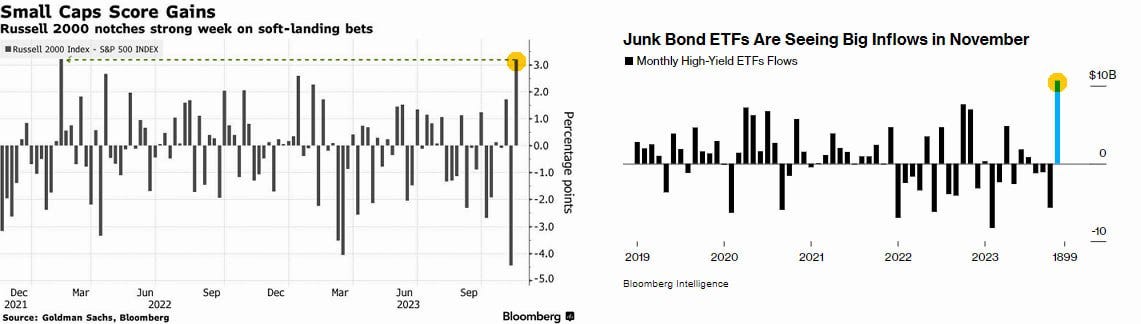

Small caps & Junk bonds getting good bids and inflows

👉 risky assets going up, traders see a soft landing for the US economy going forward

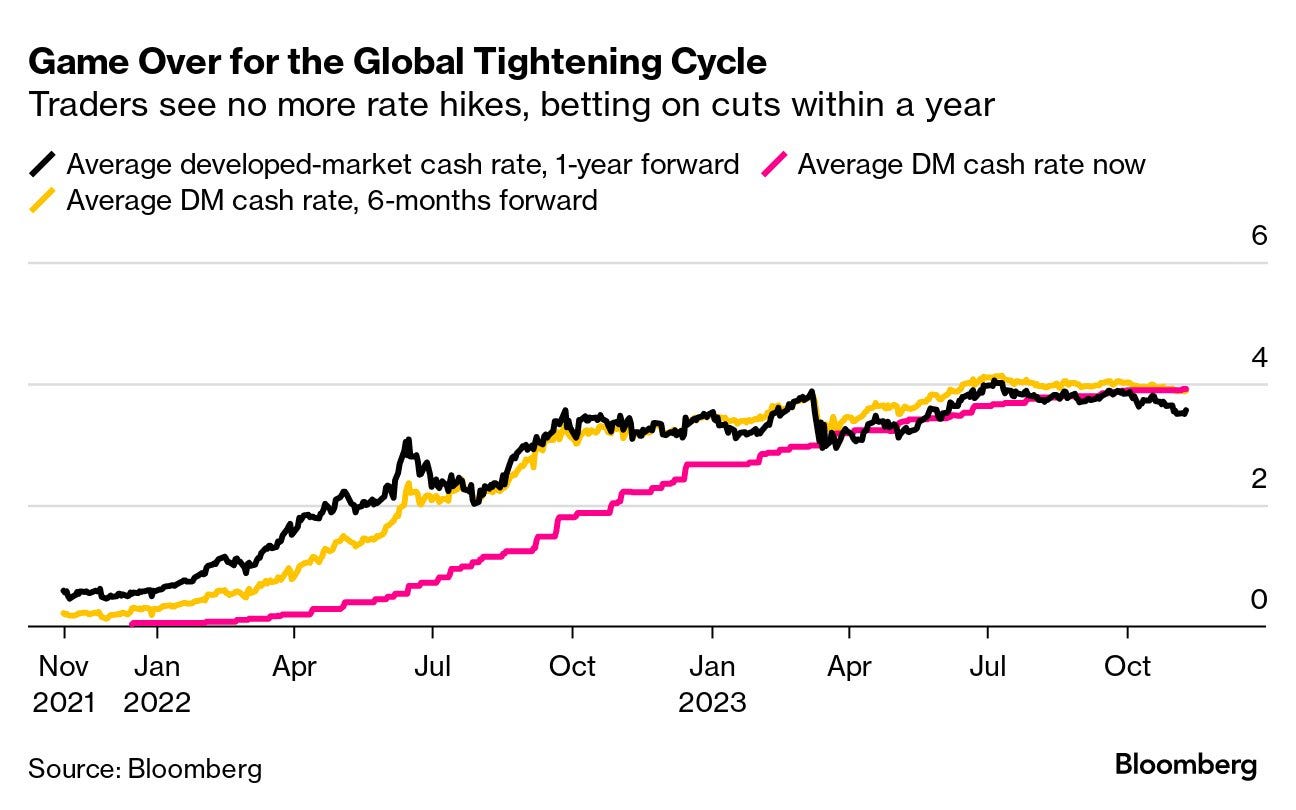

FED interest rates pricing:

👉 0% chance for more rate hikes, while 50 b.p. cuts by July are like a given ;)

Zooming out, let’s recall that we had 2 years & 7 FED anticipated ‘pivots’ ...

👉 so is this latest one 'the one' ? Nobody can say with certainty but I believe we are strongly having rather sooner than later

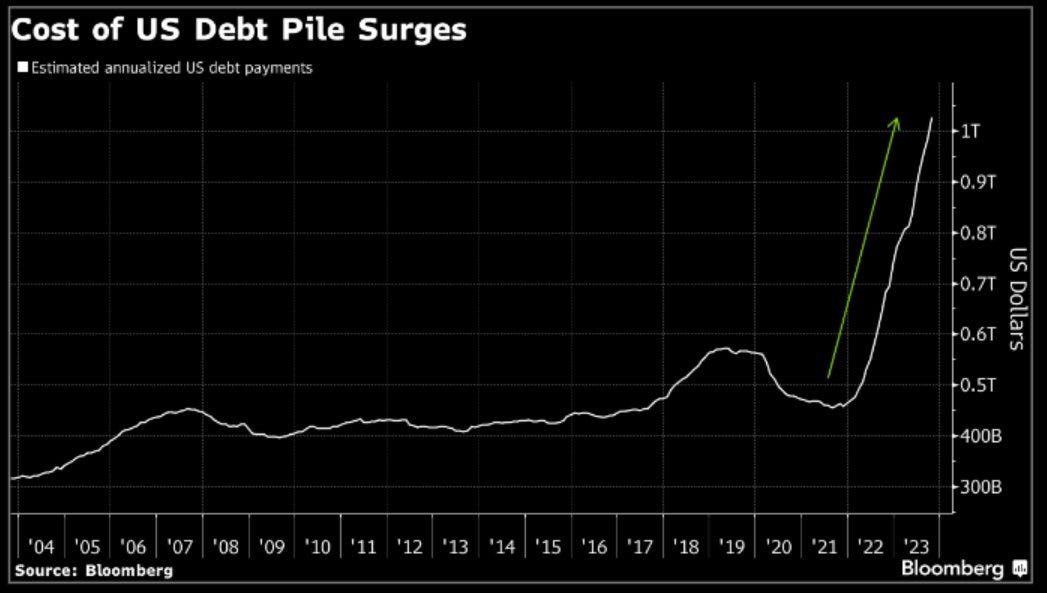

Moody’s changed US rating outlook to negative while affirmed the AAA rating.

Cited the massive fiscal deficit & political polarization which exacerbates fiscal risks. "These projections factor in Moody's expectation of higher-for-longer interest rates, with the average annual 10-year Treasury yield peaking at around 4.5% in 2024 and ultimately settling at around 4% over the medium term"

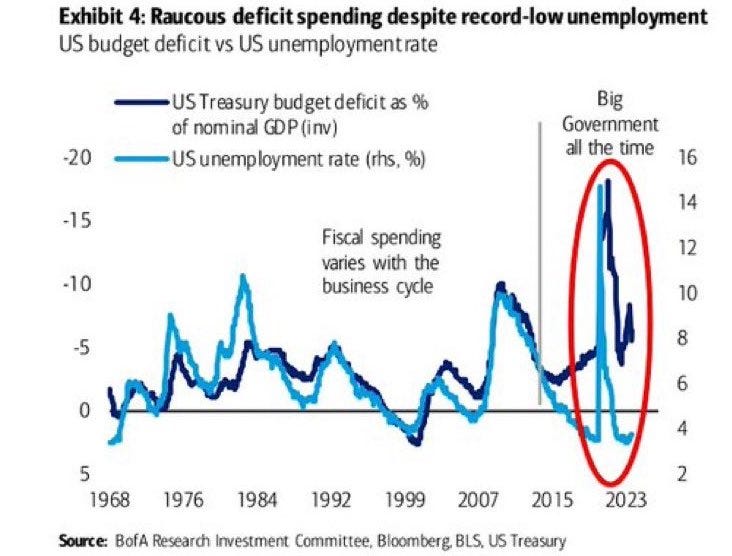

7 to 11. I don’t know why the surprise was so big for many out there, the data is clear:

👉 US public debt outstanding coupled with CBO projections

👉 and there you go also with the annualised debt payments per se

👉 If there was no big US fiscal spending, I believe many jobs would have been lost and we would not have record low unemployment levels currently

👉 Jep, not good for any debt rating in general, but in US case, not a biggie either:

USD world reserve currency status - if that’s not powerful, nothing is

Trusted by the world, can keep borrowing in its own currency

US economy the biggest one out there

'Could the US default on its bonds ?' Warren Buffett's 2020 answer

👉 ‘Are US treasury bonds safe to invest in ?' Greenspan's answer valid also today (0:46):

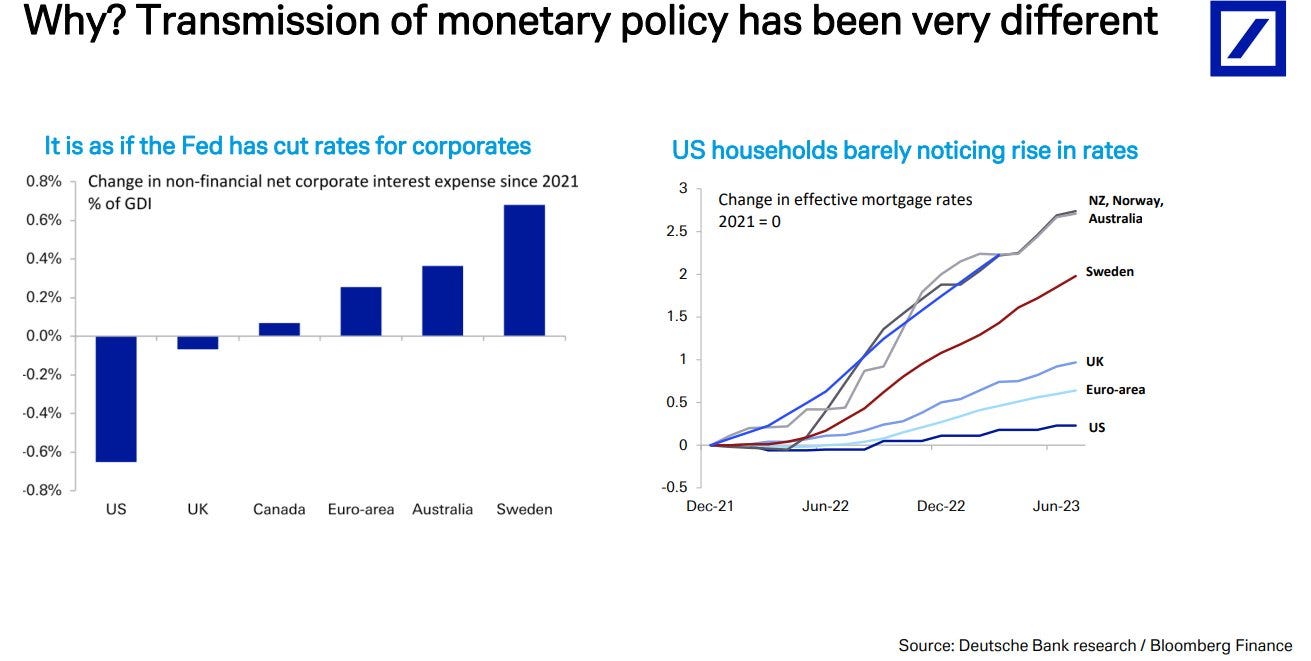

12 & 13. With rising interest rates, what about debt and related interest payments for Corporations & the Consumer? This might surprise many, so let these sink in:

corporations have the LOWEST net interest expense since the 1970s … ‘but, how comes bro? Higher interest rates should mean higher debt servicing costs!’. Well, there is a reason why corporations have treasury departments: many companies had enough time in 2020 & 2021 to negotiate very low fixed rates, and they did it!

consumer, similar story: financial obligations as share of income is quite low …

Key note: US is a special case given that other countries took rates differently

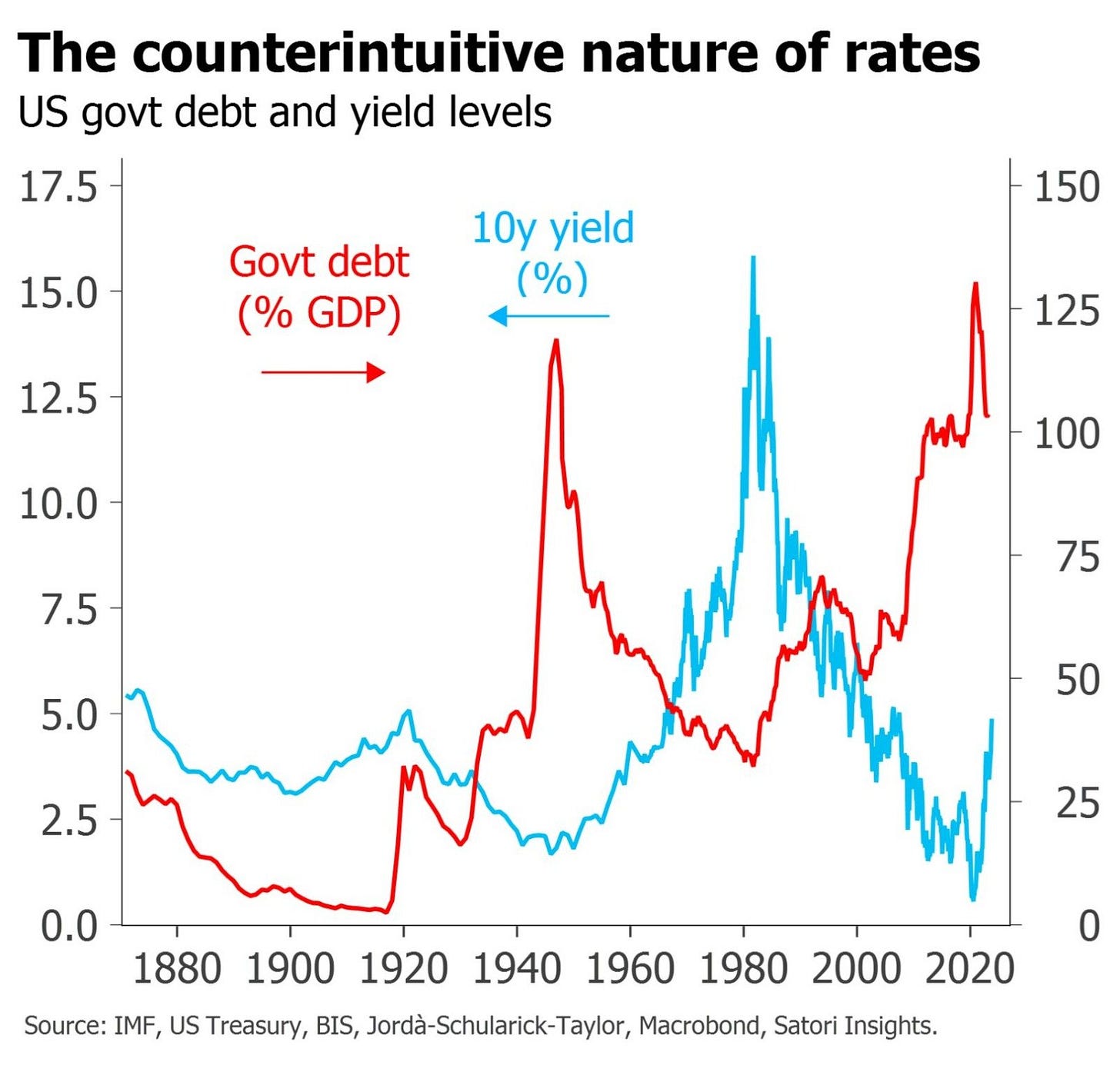

A very interesting chart, US Government debt and 10y yield levels since 1870:

we do not want both lines up together in the same time … but more like Maverick in Top Gun, meaning inverted & showing the bird aka the finger to the enemy 😉

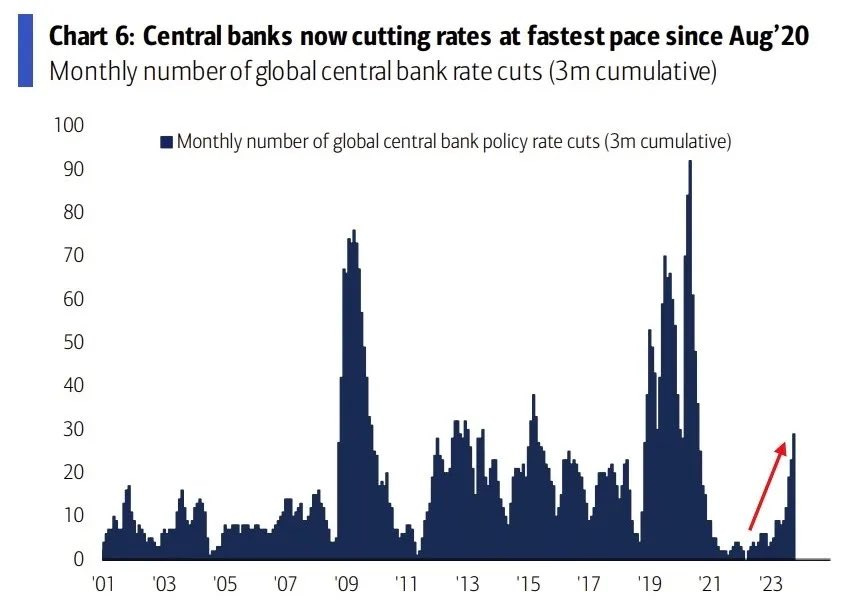

Are global central banks hiking or cutting rates? Let this one sink in:

👉 now cutting rates at the fastest pace since the 2020 pandemic

This is also seen via traders seeing no more rate hikes & betting on cuts in DMs

Hours Worked vs. Salaries in OECD Countries

your thoughts? your flag and that of neighboring countries very likely there

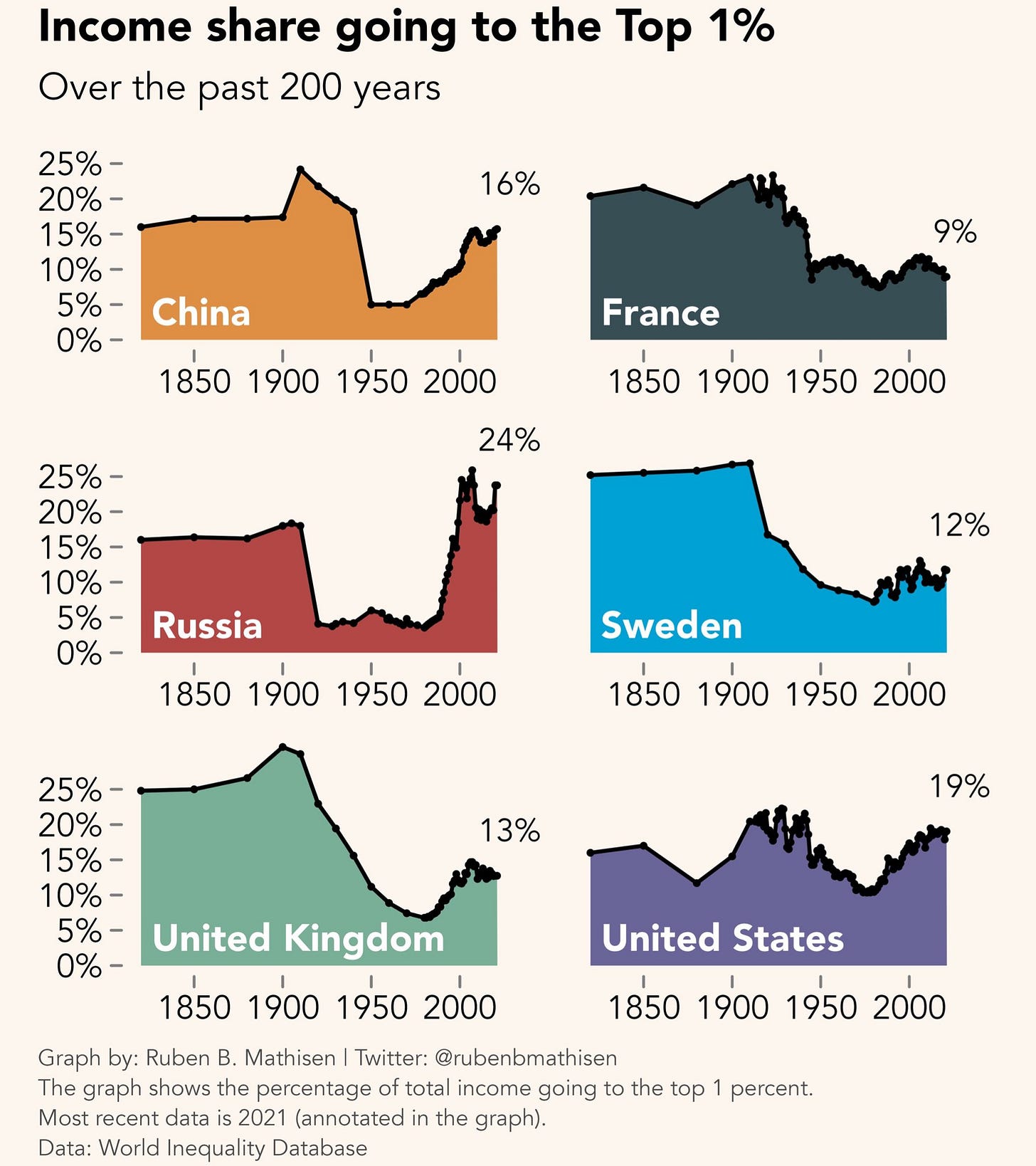

Income share to the top 1% over the past 200 years, a rare & great research:

since 1950s, mainly one direction: up and up, let that sink in!

Reasons? Many, I will just highlight 1 counterintuitive & 2 obvious ones:

👉 obvious one: tax on labor >>> tax on capital

👉 counterintuitive one: compound interest as many folks do now own assets

👉 the massive innovation after WW2, Industrial Revolution … winner takes it all …

Would be great to hear your thoughts as inequality is quite a topic no matter what …

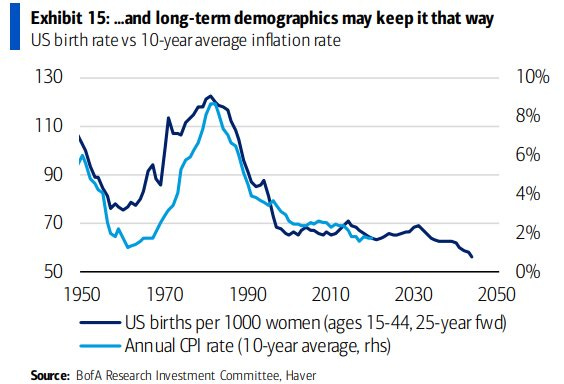

19. US 10-year average inflation rates and US birth rate:

long-term demographic trends may keep inflation low

more correlation more causation here? Inflation is like the world: complex, multi-faceted and nuanced … we can’t be put into 1 single chart, but interesting chart nonetheless … food for thought …

Europe’s natural gas prices chilling after 2 parabolic spikes since the invasion

5 Bonus charts:

The Most Innovative Countries in 2023 - Ranked!

👉 Top 10: Switzerland, Sweden, U.S., UK, Singapore, Finland, Netherlands, Germany, Denmark and South Korea.

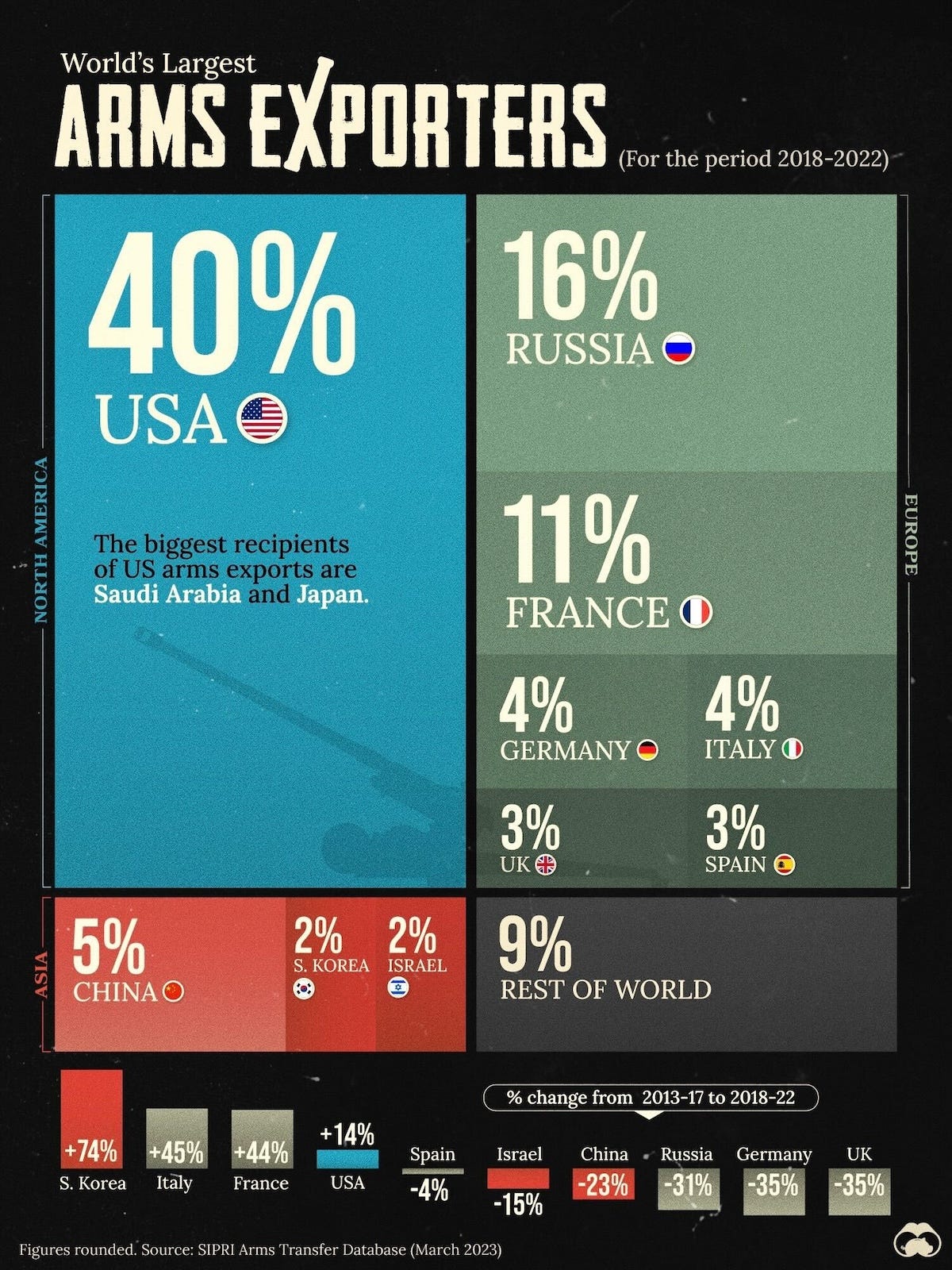

Ranked: Share of Global Arms Exports in 2022

👉 2022 global military budgets hit $2.2 trillion, an 8th consecutive year of increase

👉 US, Russia, France, China, Germany, Italy, UK, Spain, South Korea & Israel top 10

Best & Worst Companies for Employee Retention - some you’ll find surprising

energy with the longest tenures while tech giants with the shortest

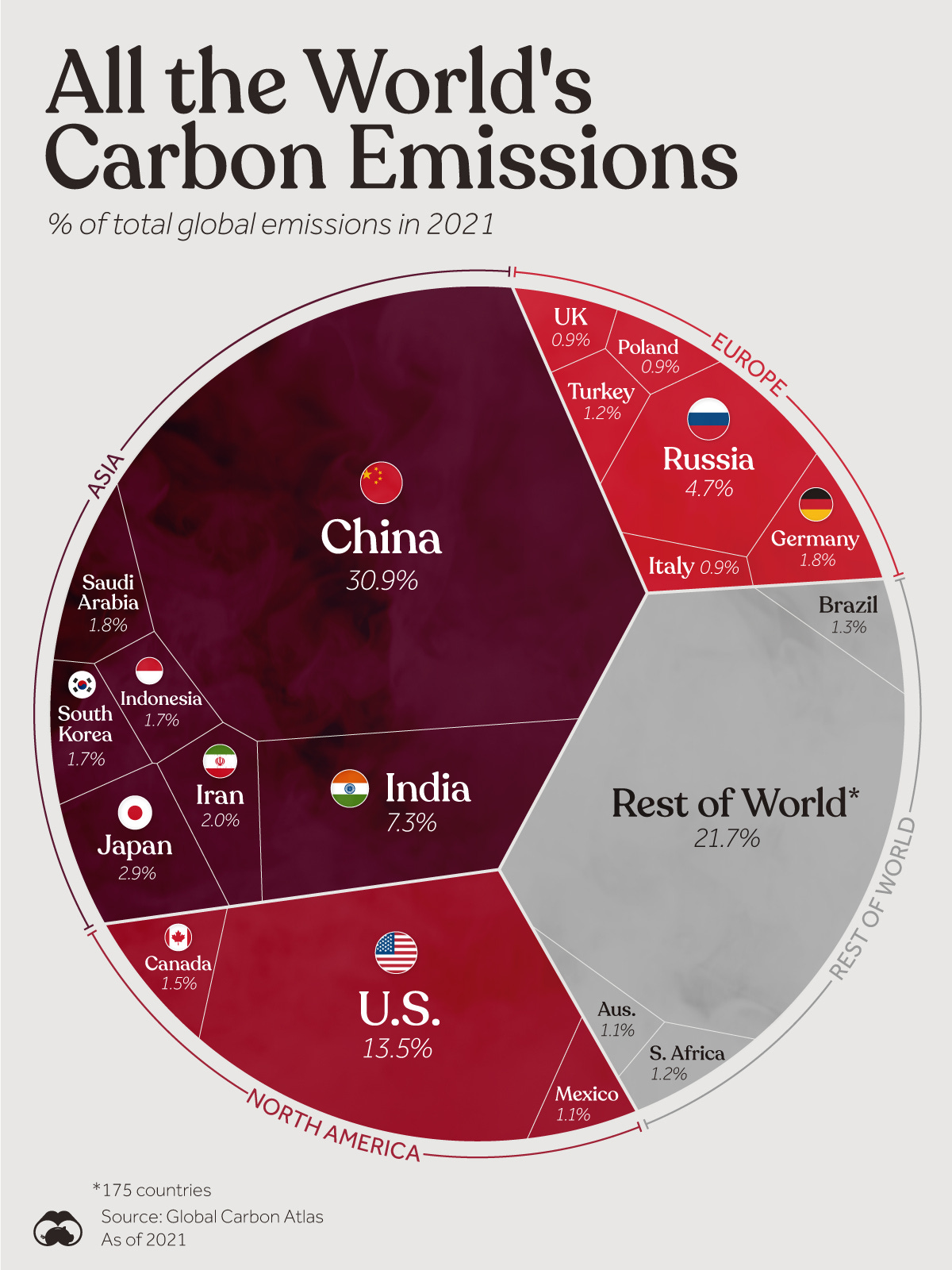

Visualizing All the World’s Carbon Emissions by Country

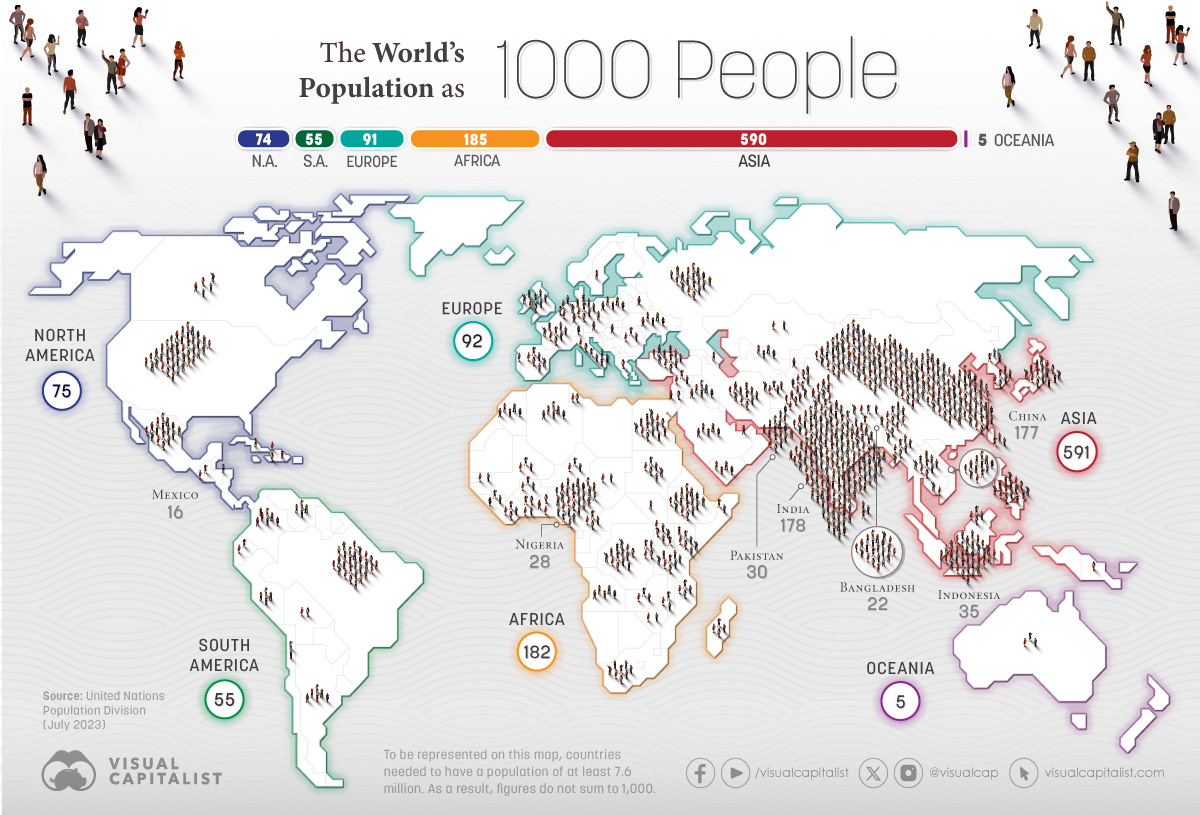

The World as 1,000 People

👉 The world’s population has doubled in size over the last 50 years

👉 In 2022, we reached the mark of 8 billion living on Earth. According to UN estimates, by July 2023, all the people in the world numbered 8,045,311,447

👉 Imagining Earth with only 1,000 people helps illustrate population concentration and dispersion: for example Asia is by far the world’s most populous region with over 4.7 billion people. Led by India and China, it represents 59% of the total population.

Research is NOT behind a paywall & NO pesky ads. What would be appreciated? Just sharing it around with like-minded people & hitting the ❤️ button. This will boost bringing in more and more independent investment research … . Thank you!

That’s all for ‘Maverick Charts - Macro & More -’ November 2023 edition.

Have a great week!

Mav 👋 🤝

Chart 12&13 are awesome, it indicates structural shift of the interest rate!

The 'Best & Worst Companies for Employee Retention' viz really surprised me. Employee retention is so crucial in terms of cost and organizational knowledge base, and it will become even more important in an environment characterized by labor shortages!

Thanks Maverick, great and engaging as always!