✍️ Maverick Charts of the Week #3: Tesla, Nvidia and Berkshire Valuation - Nature is Healing Sooner or Later

Wealth creation can develop exponentially, but it doesn’t work parabolic and fast! When that happens, take notice ... you might get a great deal, or avoid paying high!

Dear all,

first of all, you might be wondering what do Tesla, Nvidia and Berkshire Hathaway have in common as I have them all 3 here together? You are right, not that much!

Second of all, I believe all 3 are great businesses, yet investing is a lot about valuation. While there is a lot to be said about valuation, what you will see here is a simple, fast yet effective framework of wealth creation in time and related valuation implications.

From there making various comparisons helps to get the big picture. The best thing? You can do these easily and fast yourself in the future with various companies.

Table of contents:

📊 Tesla (TSLA) and Berkshire (BRKB): market capitalisation and wealth creation

📊 Nvidia (NVDA) and Berkshire (BRKB): market capitalisation and wealth creation

🤓 Quiz answered: what was Apple’s FCF yield when Buffett bought in Q1 2016?

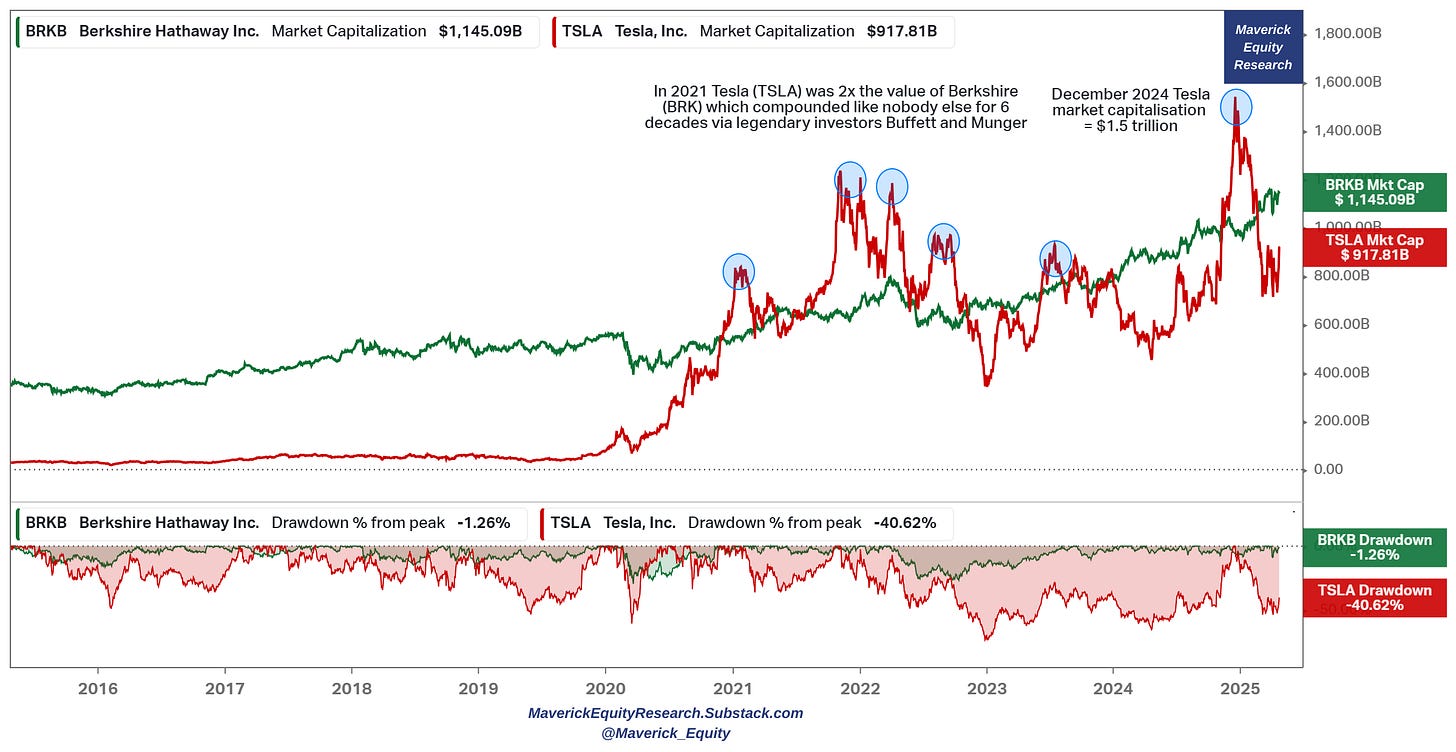

📊 Tesla (TSLA) and Berkshire (BRKB): market capitalisation and wealth creation

In this November 2022 post & 1st chart below on Twitter/X: I was saying it is crazy that at some point Tesla was twice the value of Berkshire (referring to the 4th quarter of 2021 when Tesla was valued at $1.2 trillion while Berkshire at just $600 billion).

👉 just in Q4 2020, their market cap was equal (already a big feat), and then in the span of less than a year in Q4 2021, Tesla was 2x the value of Berkshire … which compounded like nobody else for 6 decades via legendary investors Buffett & Munger!

👉 crazy wealth creation, but that was just way too much & way too fast - one cannot create a Berkshire or two so fast over night! Hence quite an easy Tesla sell or hedge signal to me - which shortly after went down to $600 billion matching again Berkshire.

Updating that chart with as of today below:

👉 similar episodes after with Tesla overshooting Berkshire, and then back to earth: just a few months ago in December 2024 Tesla was valued at $1.5 trillion while Berkshire $950 billion, hence a 50% premium. The recent -40% Tesla drawdown brought its market cap below $1 trillion at $917 billion, while Berkshire back above the $1 trillion mark at $1,145 billion.

👉 this is not about Tesla vs Berkshire, but about both of them being great businesses which did create a lot of wealth for investors - just a function of magnitude and time

👉 the main point is here to watch when wealth creation is just made too fast, and from there not necessarily to sell & time the stock to buy again (from the perspective of a medium-long term investor), but one can always check for:

when not to buy more if one plans to / wait a bit if a new investor in the stock

and especially hedge, lock in the gains - for example both recently in December when Tesla was 1.5x Berkshire and in 2021 when Tesla was 2x Berkshire, some Long Puts (options) would have worked beautifully …

📊 Nvidia (NVDA) and Berkshire (BRKB): market capitalisation and wealth creation

👉 in Q4 2021 Nvidia’s market cap surpassed that one of Berkshire, though 2022 brough the bear market and in Q4 2022, Nvidia’s market cap at $300 billion was half that one of Berkshire’s at $600 billion - big swings of value creation already though that was peanuts in comparison with what was coming

👉 from May 2023 when their market cap was equal at $700 billion, Nvidia’s market cap simply went parabolic and ultra fast reaching $3.6 trillion in November 2024 - while Berkshire was ‘only’ surpassing for the 1st in history the $1 trillion mark

👉 hence, in just about 1.5 years, Nvidia added an extra of $2.9 trillion in market cap which was the equivalent of almost 3x Berkshire = a compounding machine that created that wealth for 6 decades by legendary investors Buffett & Munger. Note also that Berkshire itself was reaching an all-time high - let that sink in and bring the sink!

👉 crazy wealth creation, but that was just way too much & way too fast - one cannot create a Berkshire or two so fast over night!

👉 since then Nvidia cooled-off some as expected, and at $2.7 trillion now almost dropped $1 trillion which came also very fast in just 6 months

All in all, all 3 businesses mentioned are great, though note their valuations swing big!

Over-optimism & naive extrapolations happen often in the financial markets, times when the collective view is that it will grow and last forever. It never does, but it is key to realise when that happens as one can take action and make that an edge!

To me it was quite clear both Tesla and Nvidia were overshooting big time, actually Nvidia is still doing it despite the recent drop - there is more to go down imho. Also it was clear back in 2022 and before that Berkshire will likely reach the $1 trillion mark!

Wealth creation can develop exponentially, but it doesn’t work parabolic & very fast! When that happens, take notice: pros and cons + risk and return, careful consideration what fits you best … key is: you might get a great deal, and/or avoid paying a lot!

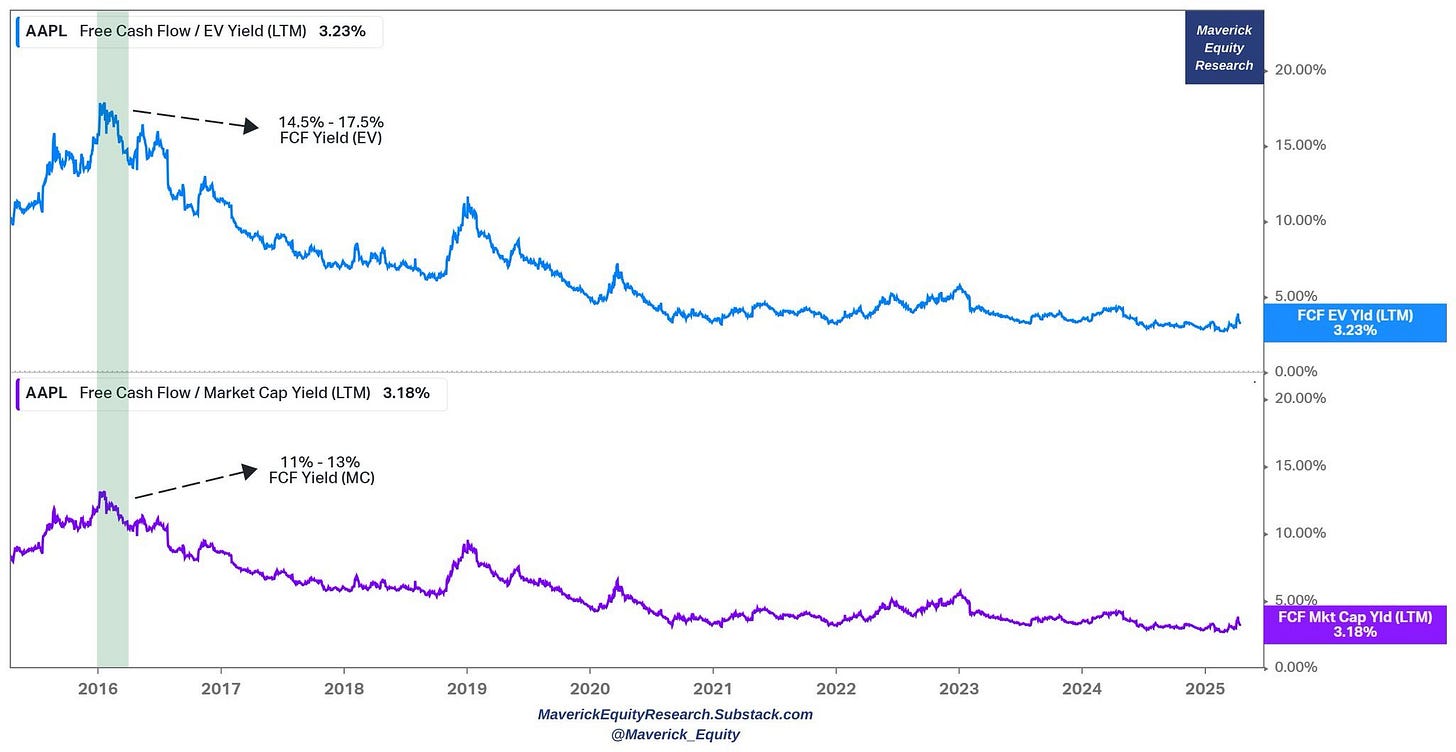

🤓 Quiz answered: what was Apple’s FCF yield when Buffett bought in Q1 2016?

Recently I made a quiz on both Twitter/X and Substack asking what was the FCF Yield when Buffett started to buy the stock in 2016?

👉 Twitter/X distribution of answers were very good:

👉 same good answers when it comes to Substack folks

Answer & chart as promised:

👉 Buffett got a 14.5% - 17.5% FCF yield (FCF/EV) when he started to buy Apple back in 2016 and 11%-13% on a FCF/market cap basis

👉 chart 2 goes back more in time with Apple's FCF yield as further reference

P.S. next incoming research which is work in progress right now:

✍️ Why Independent Investment and Economic Research = Paramount Nowadays!

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this quick update by finding it interesting, saving you time & getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons! That’ll definitely support bringing in more & more independent investment research: from a single individual … not a corporate, bank, fund, click-baity media or so … !

Like this, the big positive externalities become the name of the game! Thank you!

Have a great day! And never forget, keep compounding: family, friends, hobbies, community, work, independence, capital, knowledge, research and mindset!

Mav 👋 🤝

“Compound interest is both the ultimate and biggest natural hedge!” Maverick Equity Research

Great point. Nvda and tsla likely have amazing futures but people can get too excited about them.

People usually overestimate short term technical development but underestimate long term trend.😏😏😏