Maverick Charts - Stocks & Bonds - May 2023 Edition #7

Nvidia > Tesla & Berkshire, AI, ChatGPT, Brainteaser, Bonds, Oil, Financial Flows, China Exports = Economic Integration & Dependency, Sovereign Wealth Funds

Dear all,

here we go with Top 20 Stocks & Bonds charts from around the world + 5 Bonus!

In case you did not subscribe yet for delivery straight to your inbox, it’s just 1-click. And the same goes to share this around with whom might be interested as well. Enjoy!

Nvidia (NVDA) value crossed Buffett’s Berkshire’s (BRK) financial empire:

$961bn vs $701bn market capitalisation, while the truly bonkers stats is this one:

$681bn value gain since just October 2022 equates to 97% of the entire Berkshire value that has been ever created for 6 decades by legendary investors

All one needs are 7-8 months & can equate Berkshire empire? Not an apples-apples comparison, but a question of market pricing & value creation …

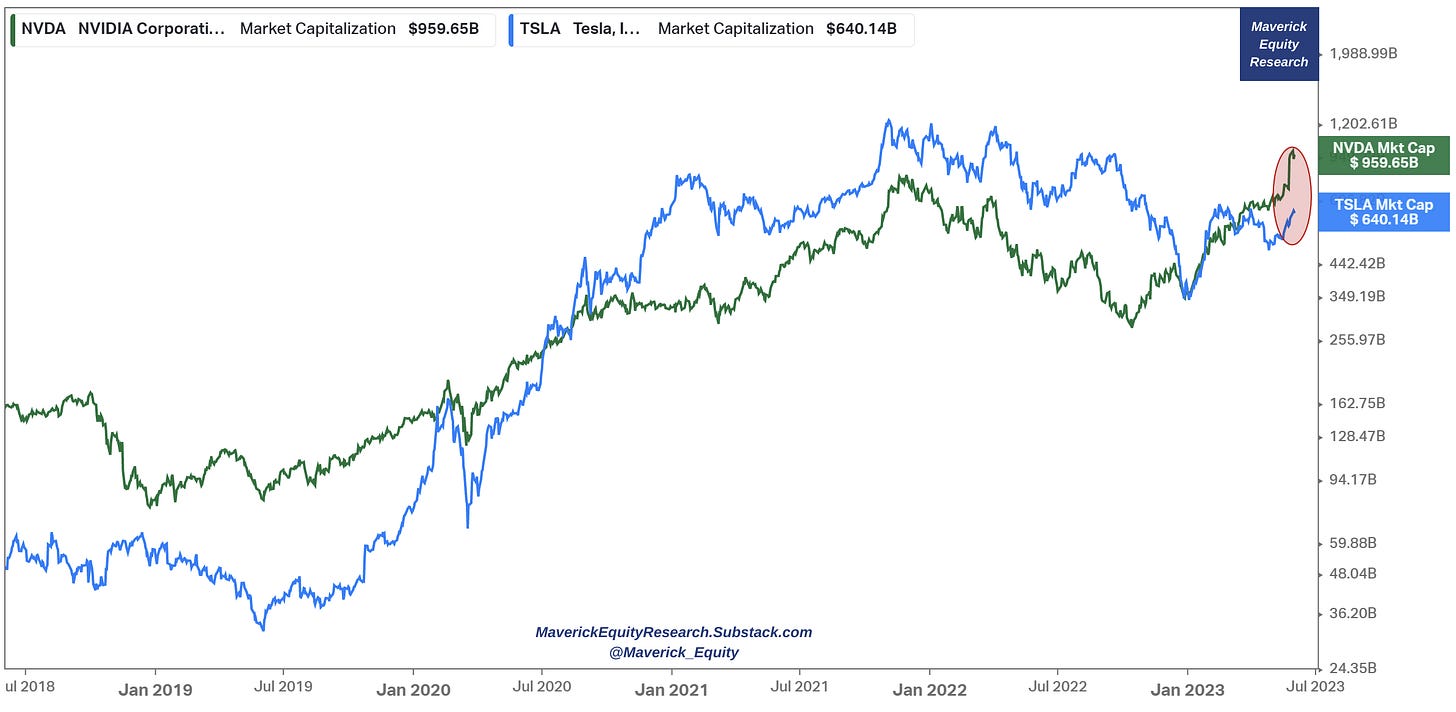

Nvidia’s value crossed also Tesla’s by a wide margin recently:

$961bn vs 640bn market capitalisation, while the truly bonkers stats is this one:

$681bn value gain since just October 2022 equates to 106% of the entire Tesla value that has been ever created

All one needs are 7-8 months & can make a new entire Tesla & surpass it? Not an apples-apples comparison, but a question of market pricing & value creation …

Let that sink in & bring the sink!

This also reminds me when Tesla was double the market capitalisation of BRK: about 1.2 trillion vs 600 billion hence quite an easy Tesla sell signal to me despite a great business. Nov 2022 post & chart:

Firms that have AI exposure are easily beating the S&P 500 in 2023 ...

S&P 500 Information Technology going BoomGPT

biggest tech rally in 2 decades & there’ve been plenty of innovations in those 20 years: in May, tech beat the rest by >10% for the first time in two decades

chart shows the spread between the return on the S&P 500 IT sectors & the broader S&P 500 for each month going back to 1990

If we compare the tech sector to the S&P 500 excluding technology index, initiated in 2000, the boom created by AI looks even bigger:

ChatGPT Usage in the Workplace survey: Deutsche Bank asked 1,150 employees

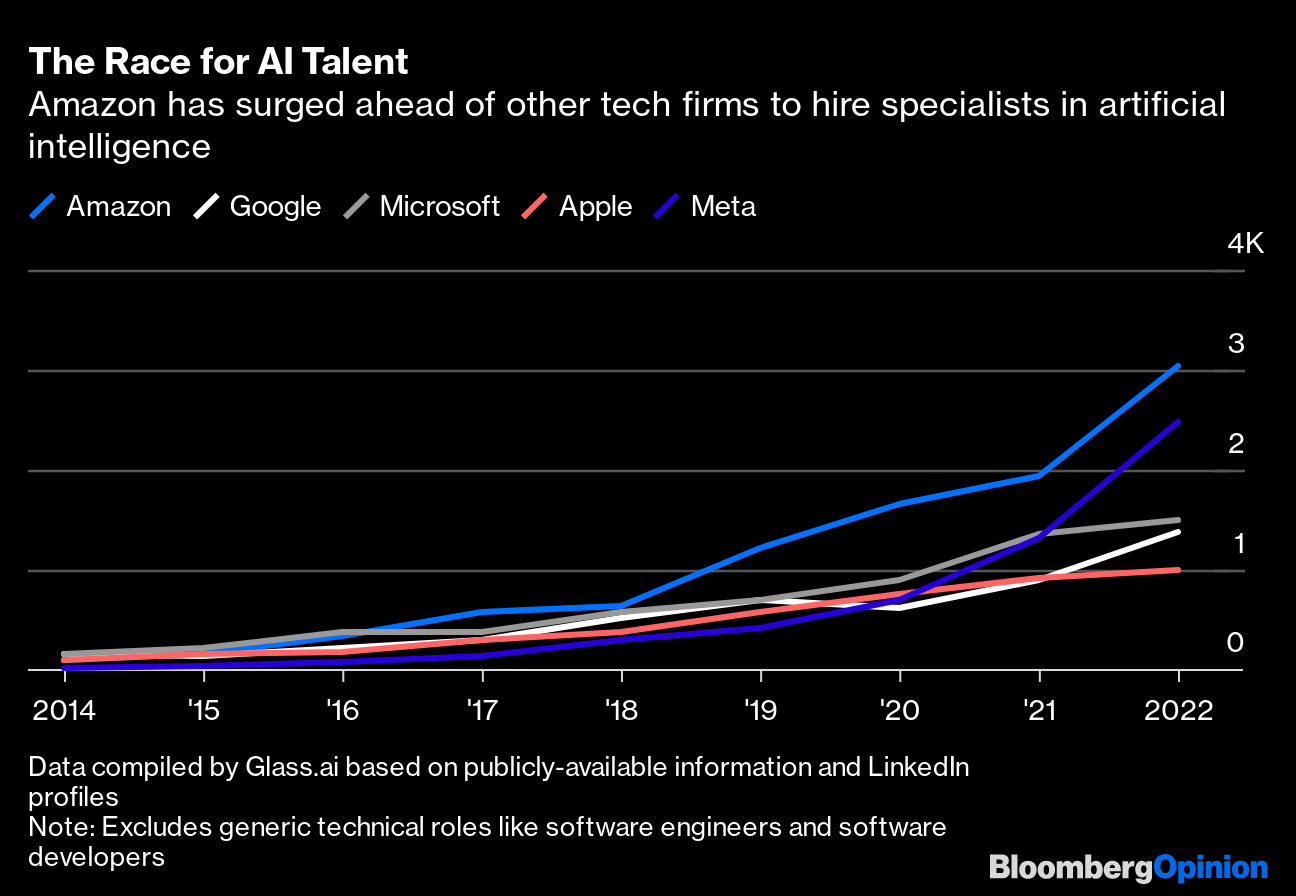

The Race for AI talent ... Amazon ahead ? hmmm

Retail investors big appetite for big tech/mega caps in 2023 or just call them: America's Magnificent Seven stocks: +70% in 2023 S&P 500 equal weighted, other 493 stocks only +0.1%.): AAPL MSFT GOOG AMZN NVDA META TSLA

S&P 500 financial flows in May:

$14 billion into SPY ETF = big, even vs outlier months (usually tax loss harvesting)

Hence I guess we did NOT sell in May and went away ;)) …

Stocks & Football/Soccer: in anticipation that Borussia Dortmund will win the German championship, stock straight up, only to go straight down as they lost it in the last minutes … 1 goal or not about €180 millions up & down along the ride

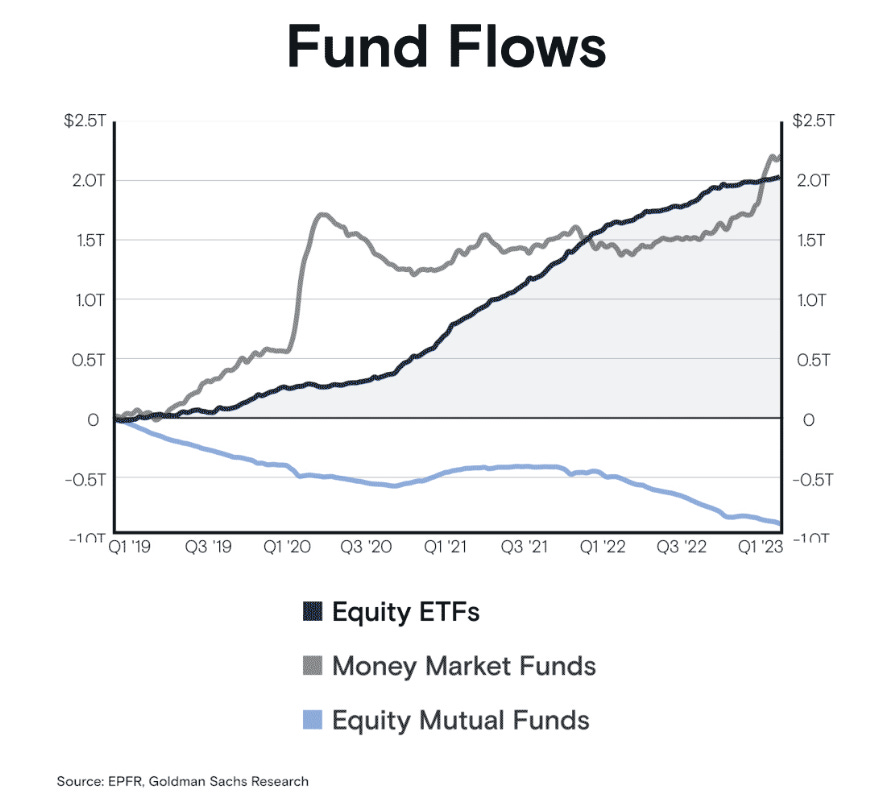

Financial flows, ‘flow baby flow’:

Money entering money market funds mostly coming from bank accounts

And since the start of 2019, equity ETFs have taken in more than double what equity mutual funds have given up ...

Key note: nearly half of those inflows are coming from individual investors ...

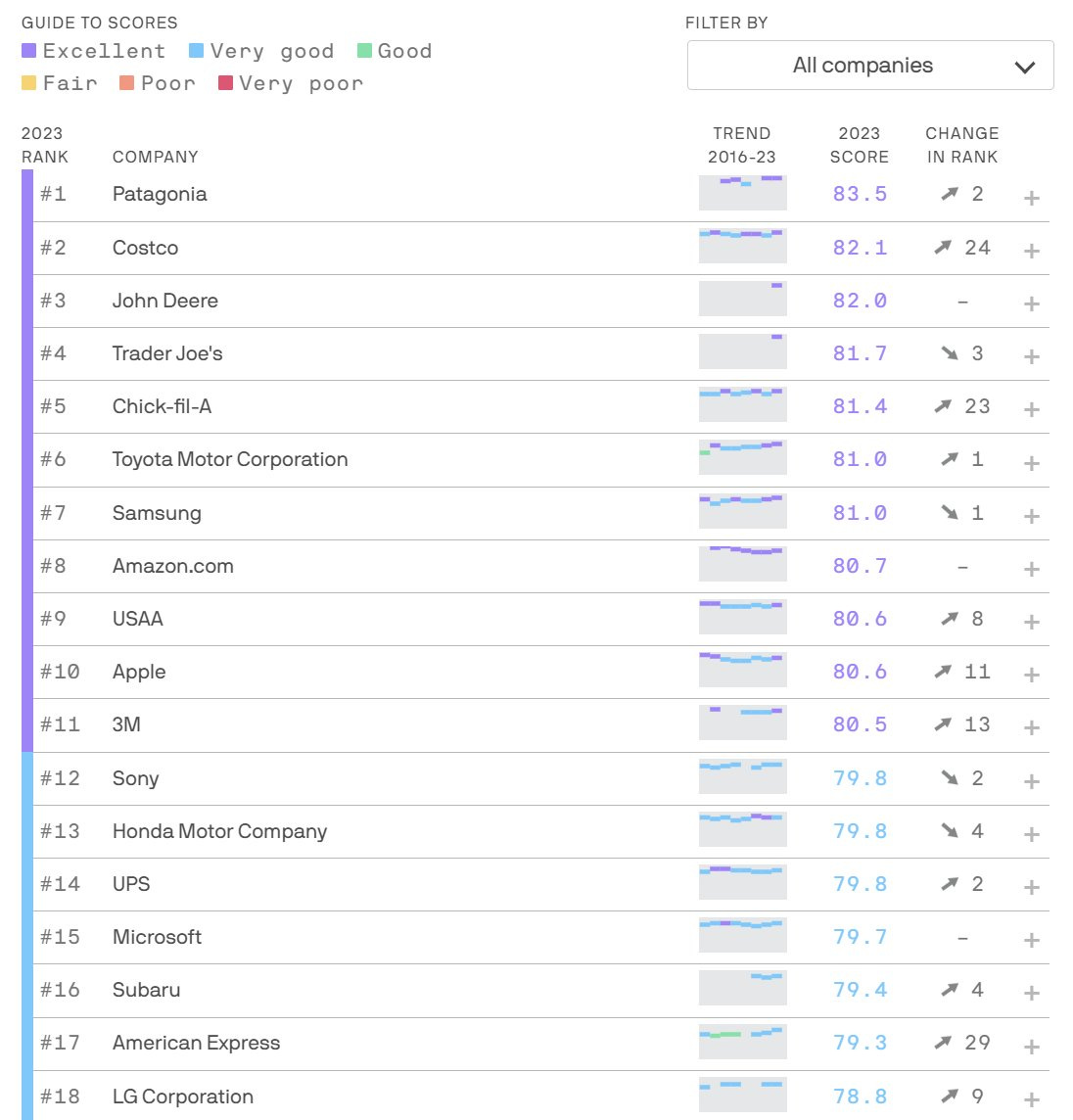

Top 100 US companies by reputation:

With rising interest rates, government bonds pay more and more: surveyed fund managers are overweight Bonds & soon will approach GFC levels

On this, I also made a bonds survey which still has 3 days to go, you can vote here:

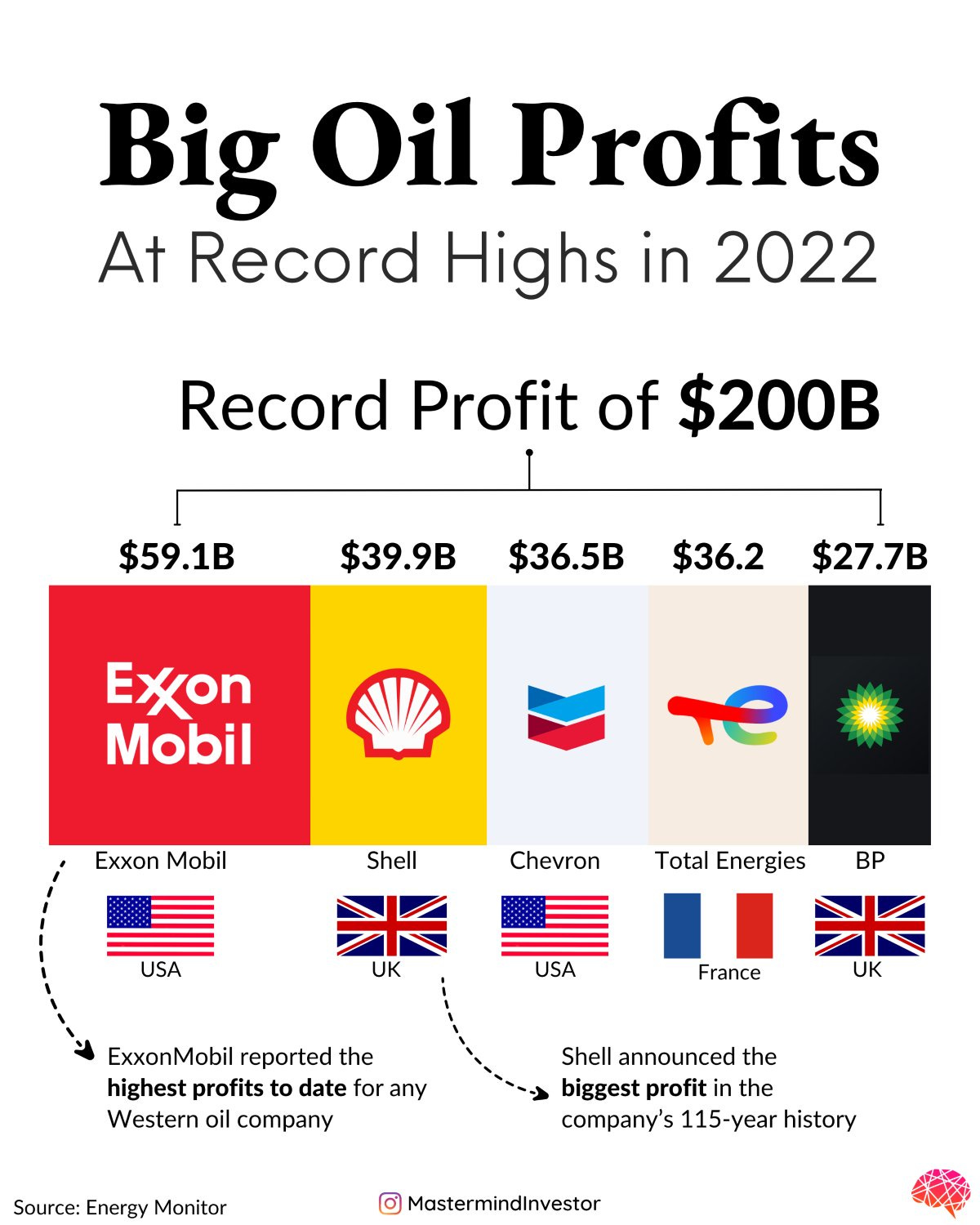

Visualizing Big Oil's Profits in 2022 🫰

Remember when oil was negative in 2020? Recall that all we touch, see and eat daily is directly or indirectly made out of OIL! Common sense investing ...

Big 5: ExxonMobil, Shell, Chevron BP, Total. But any $ thrown in oil stock producers or distributors, ETF, futures you name it ... would have made big bucks! No need to be a pro, have any macro/guru/mega think thank oil forecasting ... clear head, cash & common sense investing …

Charting & Mapping China’s Exports (imho = key geopolitically given big economic integration & dependency) Since 2001

How many 'trade wars' exaggerated & gloomy worded headlines we had since years? Yet:

China is with US & EU more integrated economically than ever ... integration creates dependencies which lowers the probability of harsh decisions ... like outright real wars ...

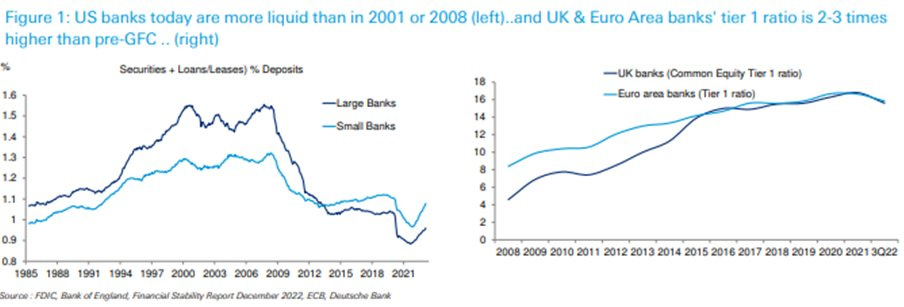

Health of US, Euro Zone & UK banking systems in one single chart: way better than Lehman Brothers times

Retail & Professional investors on 2023 return expectations for the S&P500

+5-10% from current levels

Bonus charts

Visualizing the Global Share of U.S. Stock Markets

US makes 4% of world population, 24% of global GDP and 42% of global equities

NYSE & NASDAQ have ~ 6,100 listed companies

The Global Bond Market visualised & ranked: In 2022, the global bond market totaled a whooping $133 trillion

US = largest bond market > $51 trillion, 38% of total ...

China = 2nd at 16% … US + China = 54% of total

ECB in Europe = $5.4 trillion via QE 1,2,3 etc

Nvidia short sellers with huge 8.1 billion in losses in 2023: short selling in general is a very very hard business + asymmetric: limited upside, unlimited downside. If by chance short selling anything, rule of thumb: only frauds, big failures ... and hype if either one of the previous two and/or unprofitable … otherwise, chances to lose = very high

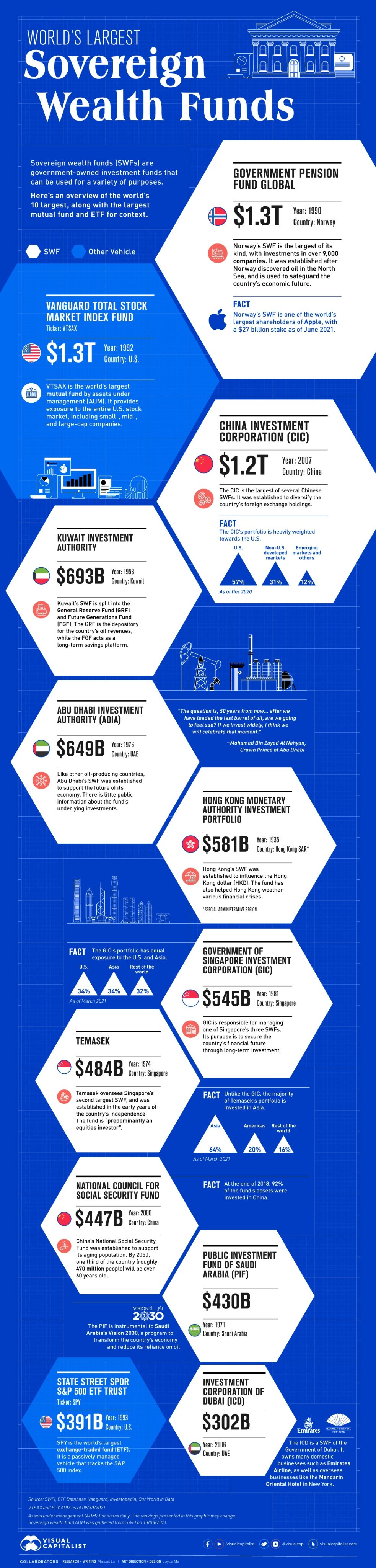

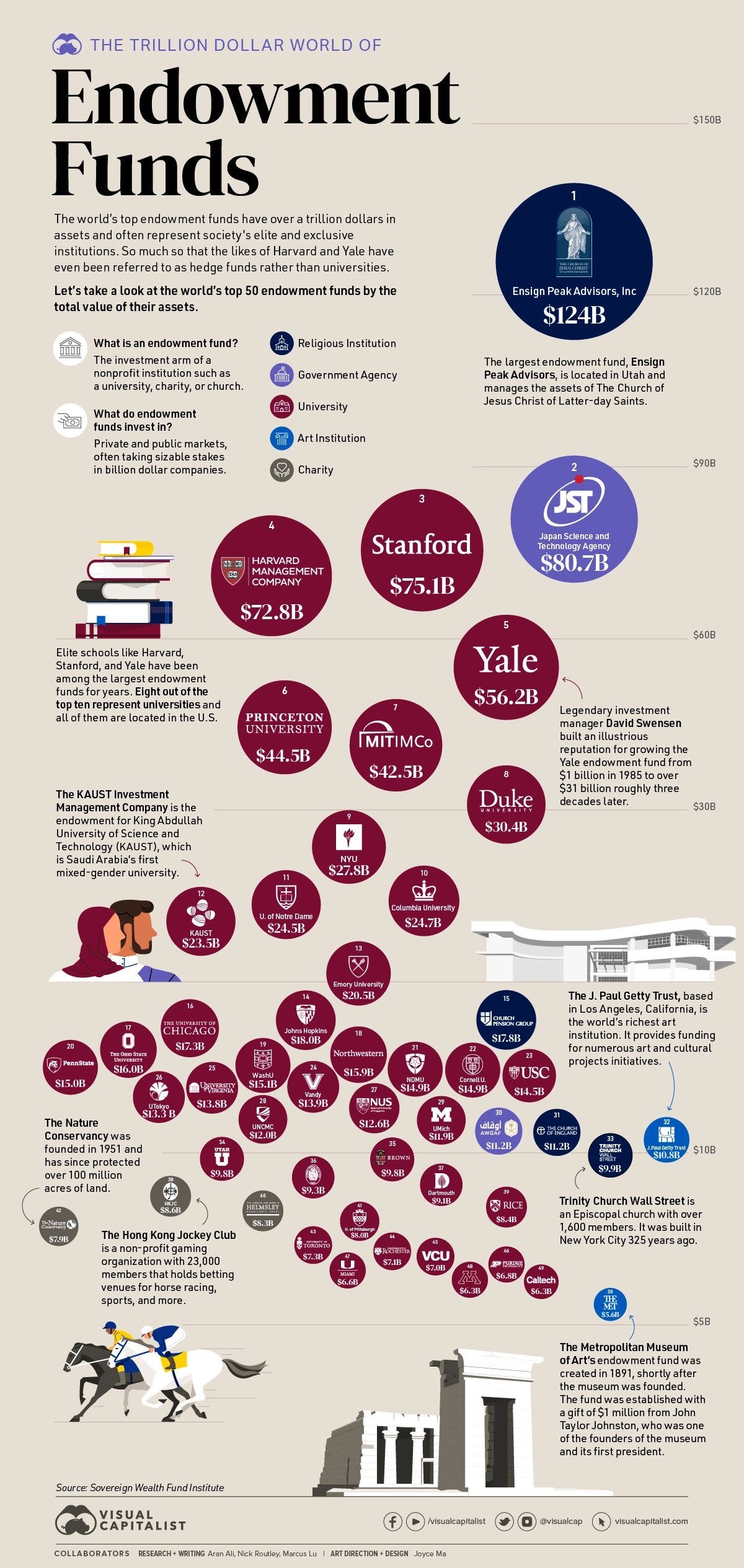

The World’s Largest Sovereign Wealth Funds visualised ... quite some stats ...

The World’s Top 50 Endowment Funds: Ensign Peak Advisors with $124bn

Should you have found this cherry-picking endeavour interesting and valuable, subscribe and share it around with people that might also be interested! The Twitter thread can be found here. Thank you!

Have a great day!

Maverick Equity Research

This is great, thanks!

great inputs, thanks a lot