✍️ Maverick Charts - Stocks & Bonds - November 2023 Edition #13

25 Sleek charts that say 10,000 words ... save precious time & provide insight!

Dear all,

first of all, welcome to the 643 new subscribers that came in the last month! A record!

From a linear progression to lately an exponential one for a total of 4400+ subscribers.

Maverick Equity Research is also read across 130 countries and 50 US states!

Structured in 3 parts + designed to have a natural flow:

📊 ‘Which tool do you use for fundamental investment research?’ - FAQ answered

📊 Top 20 Stocks & Bonds charts from around the world

👍 Bonus: 5 charts special edition on ‘2023 the year of the US tech Magnificent 7’

📊 ‘Which tool do you use for fundamental investment research?’ - FAQ answered

The vast majority of people like a good research service nicely done and served by email. On the other side, some want to check different data at will, do their own charts & research, and some even start doing research publicly for all out there.

Hence, a common question I got from some of you here, then Twitter/X and also by banking current or former colleagues and peers is some variation like the following: ‘which tool do you use for the cool research you do when you also put your brand/logo inside’?

The most funny (in a good sense) ones come from people that also want to start a newsletter like I did, as they ask in ‘whisper mode’ because they think I might find it inappropriate as I would basically help competition to come ‘into the arena’.

👉 as a former athlete, I find the word ‘collaboration’ rather soft while the word ‘competition’ not inspiring enough and definitely not scary - what I like the most is ‘co-opetition’, that is competition that clearly made me better and better and better

👉 ‘If you are the smartest / strongest person in the room, you are in the wrong room!’

I believe in that so much that once I went ‘Maverick’ (some called me crazy) and because I was the smartest guy in the room (not a good environment and culture also), I did leave the room and quit. From daily nice walks to the office in a suit, status some say, salary to one day showing up to the unemployment office in jeans & t-shirt with a cap worn backwards to get my benefits (just my previous cumulative high taxes paid).

Some time passed by, found a new better job and from the smartest guy in the room, I ended up where I wanted: the least smart guy / most dumb one in the room, a great decision. There is always something to learn from somebody, hence I truly believe in lifelong learning and development. And we have no shortage of that nowadays, the internet = ‘the great equaliser’ where one can dive into any topic, meet great people and even create joint-ventures or own businesses.

And now question answered: I use the great investment analytics platform Koyfin!

I have been using the product since many many years, the development path from 0 has been phenomenal and also their pipeline development is looking very good

I did burn a lot of time to compare many tools out there, pros & cons, different costs, hence I believe one gets a lot of value! Not only anyone interested saved a lot of time, but via my partnership with Koyfin, you would get a 7 day gift of Koyfin Pro + a considerable 20% off on any of their premium plans.

👉 I am 80% doer, 20% talker (the world has enough talkers, doesn’t it?), not a sales man here, hence I will juslt et my work and in this case the product I use and partnered with to do the talking

Hence, now with the November ‘books closed’, your monthly Top 20 Stocks & Bonds charts from around the world + 5 Bonus! All powered by myself via Koyfin!

📊 Top 20 Stocks & Bonds charts from around the world

Stocks & Bonds in 2023: stocks very good, long and medium term bonds down a bit while short term & IG nicely up

👉 Nasdaq 100 (QQQ) with a big new bull market: +45.8% in 2023 alone

👉 S&P 500 (SPY) printing great at 2x the long-term average: 20.1%

👉 SHV (short-term government bonds 1-year or less, cash proxy): +4.5%

👉 AGG (investment grade: treasuries, corporate, MBS, ABS, munis): +1.9%

👉 IEF (intermediate-term government bonds 7-10 year maturities): -0.16%

👉 TLT (long-term government bonds 20-year+ maturities): -5.4%

S&P 500 (SPY) index valuation analysis - P/E (forward estimates), 20-year period

👉 trades at a 19.7x P/E materially above the 20-year 16.4x average

👉 sits also slightly above the +1 standard deviation, a 19.2x correspondent

👉 note also the 9.4x Low and 25.3x High

The big takeaway? Raise an eyebrow whenever we break Standard Deviations and also when reaching previous Lows and Highs:

👉 Covid crash to -1SD was a good indication of a bottom, and a good top indication with the 2021 parabolic rise

👉 same for 2007-2009 GFC when we went materially even below the -1SD, normally good times not to throw in the towel, but accumulate

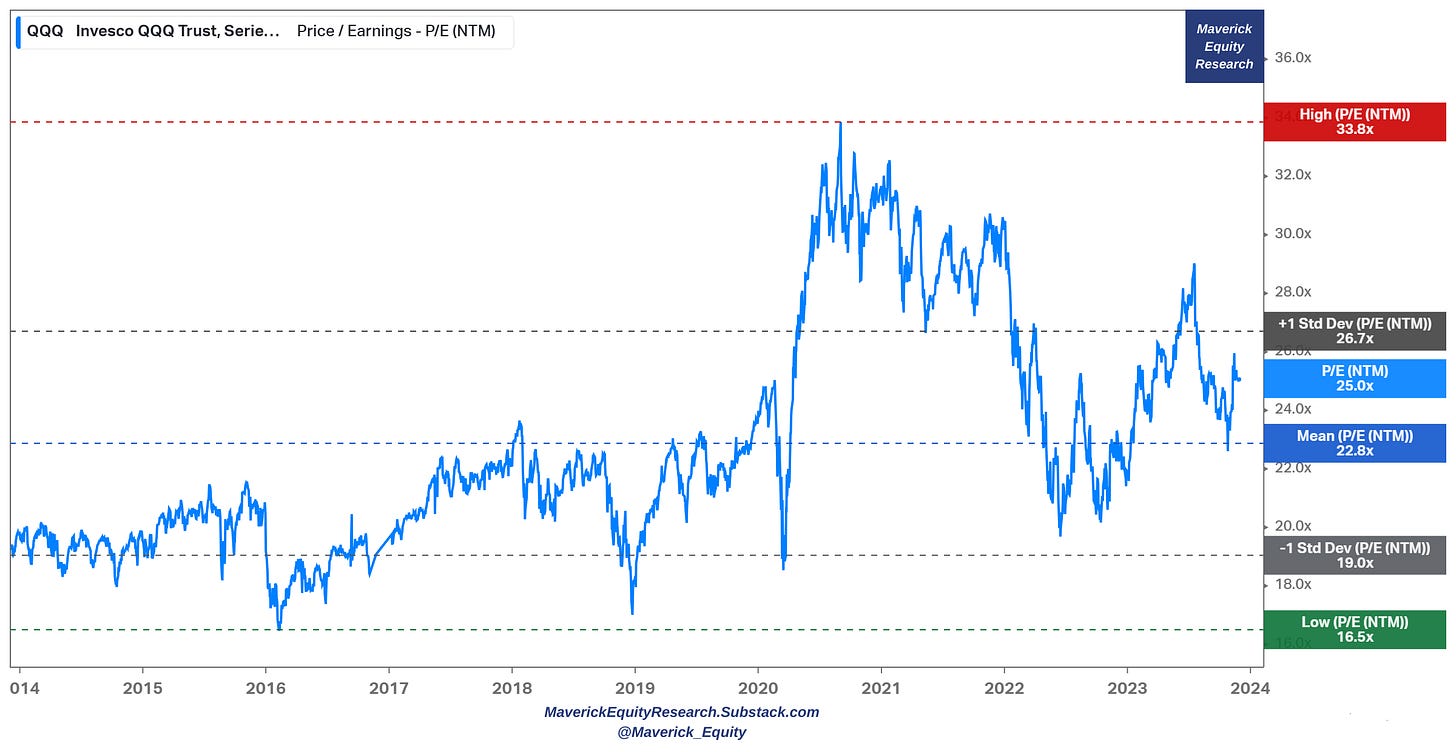

Nasdaq-100 (QQQ) index/ETF valuation analysis

👉 trades at a 25x P/E materially above the 20-year 22.8x average

👉 sits below the +1 standard deviation, a 26.7x correspondent

👉 note also the 16.5x Low and 33.8x High

The big takeaway? Raise an eyebrow whenever we break Standard Deviations and also when reaching previous Lows and Highs:

👉 Covid crash to -1SD was a good indication of a bottom, and a good top indication with the 2021 parabolic rise

👉 same for 2007-2009 GFC when we went materially even below the -1SD, normally good times not to throw in the towel, but accumulate

QQQ (Nasdaq-100): note the record Assets Under Management (AUM) and also the weekly flows pattern: lately solid flows keep coming in

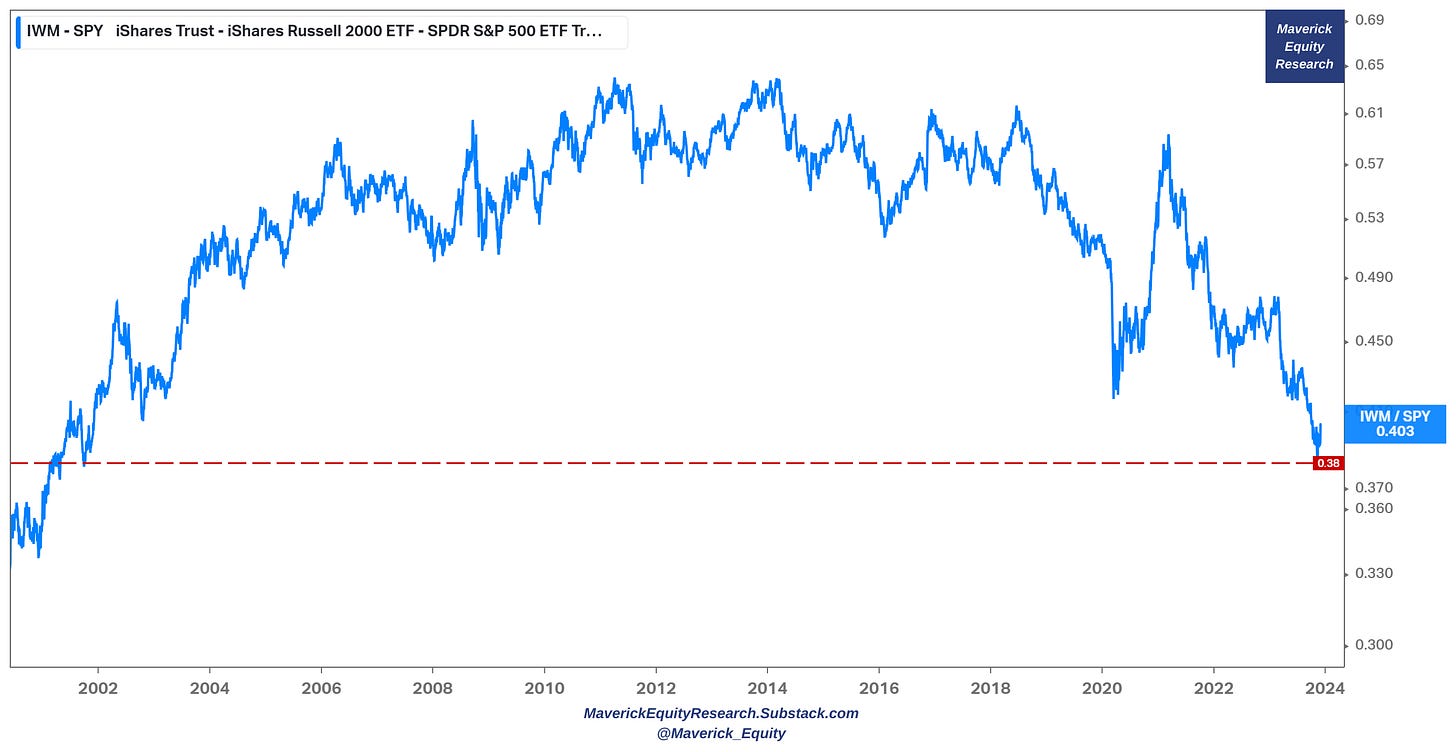

Mighty tech QQQ is quite a case, especially relative to small caps (IWM)

👉 in 2023 it crossed materially the 2001 dot-com levels (horizontal dashed blue line)

👉 it has been trending upwards after the dot-com bust in that nice blue channel, while note the most recent 2 key moments: Covid 2020 1st big breakout, and now again with the AI huge breakout

No surprise also then that Tech (XLK) is at an all-time high versus the S&P 500

Who is on the other side? Banks (XLF) with an 80-year lows versus the S&P 500

Small caps (IWM) also trading at their lowest level VS the S&P 500 in 23 years

👉 I see a lot of opportunity in the under-covered small caps for the next years

👉 Hence, I will cover in details very interesting businesses in my dedicated section Full Equity Research … planned to start in Q1 2024

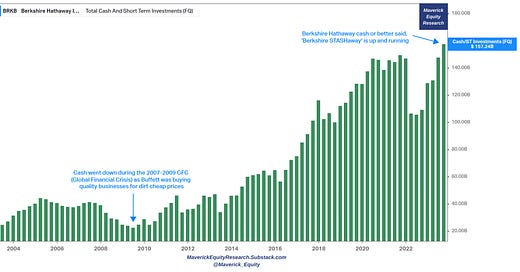

Berkshire Hathaway cash position or better said Berkshire cash STASHaway

cash at an all time record of $157 billions, doing the ‘T-bill & Chill’ strategy

note also how it went down during the 2007-2009 GFC (Global Financial Crisis) as Buffett was buying quality businesses for dirt cheap prices

if by chance we get a recession (well, reminder: sooner or later it will happen, it is called the business cycle), what do you think Buffett will do? Same thing again 😉

So, I would call this the ‘T-bill & Chill’ or ‘T-bill & Wait’ strategy hunting for opportunities that always come along sooner or later

Berkshire 10Q from Q3 2023 also for for clarity

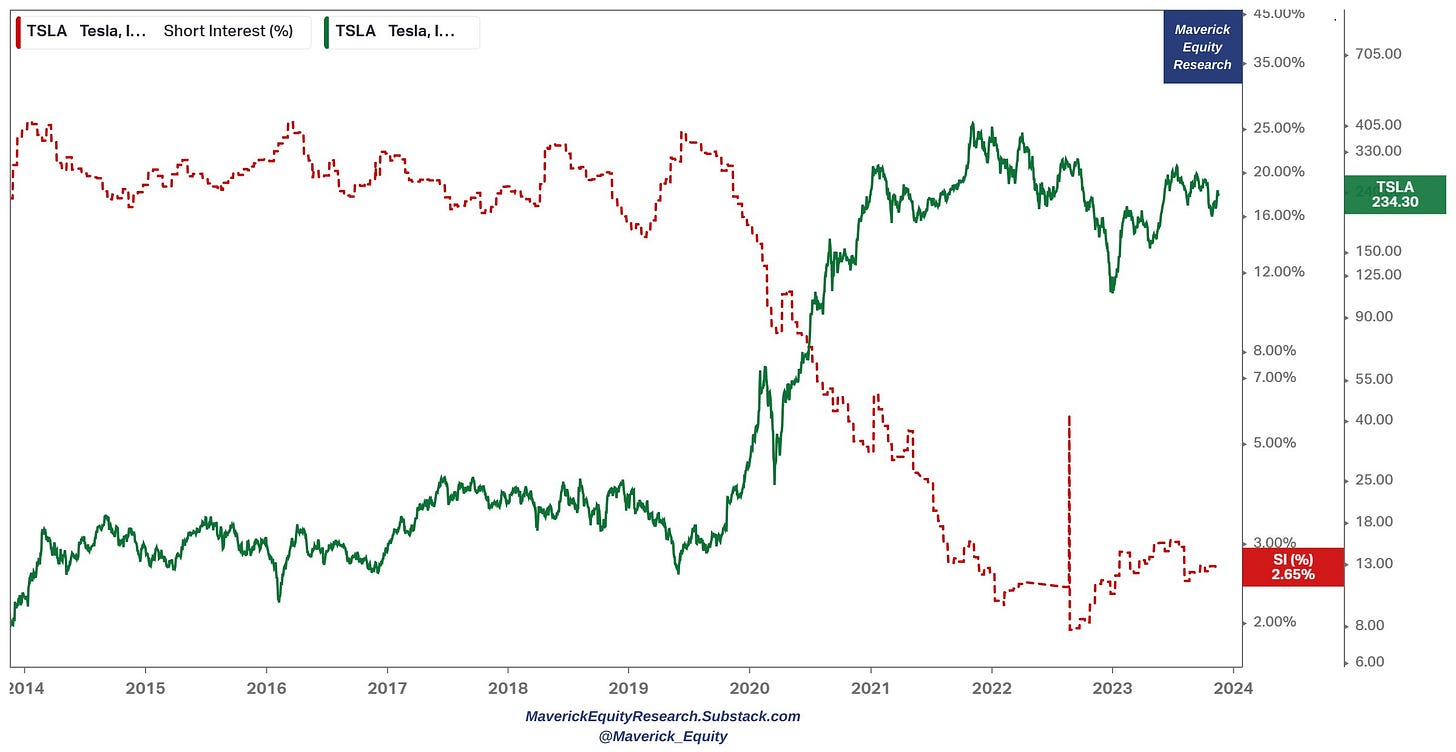

Tesla & Short Sellers, a ‘Love Story’ 😉

👉 Tesla price & short interest for the past 10 years: total short sellers destruction …

👉 Cybertruck just launched … thoughts on it?

Elon Musk at the 'New York Times' DealBook Summit' from the 30th of November

‘The Tesla Model Y will be the best selling car of any kind on earth this year, of any kind: gasoline or otherwise’ … ‘The unusual thing about SpaceX & Tesla is that we’ve done things that have helped our competition!’

‘At Tesla we have open sourced our patents, anyone can use our patents for free, how many companies you know who have done that’? You name one!’ At SpaceX we do not use patents!

Let those sink in … and bring the sink!

Elon Musk at the 'New York Times' DealBook Summit'

Elon & Disney CEO / advertisers trying to blackmail him with advertising/money:

👉 Disney & others: We are going to boycott advertising on X

👉 Musk: 'Don't advertise, go f**k yourself, f**k you!'

👉 Meanwhile, Disney stock with a bigger drawdown than even the 2009 GFC period

Maverick take: some like Musk some not, nobody is perfect, I for sure do like more than not, I strongly believe he certainty does not receive enough credit for all what he has done, though one thing is for sure:

he is a fully free human … an unfiltered person who answers to absolutely no one

a freedom which at times works against himself and his many moving parts he handles … but his freedom is priceless and worth it … how many people have that?

biggest figures in many fields, CEOs, Boards you name it … they do not have that

Let’s skip the ‘corporate’ parts and financing and financial markets aka Tesla market capitalisation, SpaceX, Optimus etc … let’s look at the human market:

Ask the brightest & most motivated engineers, AI, rocket scientists where do they wanna work? Tesla, SpaceX, Neuralink, Optimus projects, they want to work for Musk! Not for some seasoned CEO in a suit (that only he knows how he got there) living in the PowerPoint ‘cloud’ totally disconnected from its own employees, products, real life problems, projects, processes and work! Let that sink in …!

US tech (QQQ) vs China tech (CQQQ) since 2019

👉 China tech was running together with US tech until Q1 2021 when controversial unfriendly shareholder policies

👉 US tech dominance was anyway clear since more than a decade & no reason to stop here, unless China reverses policies and then big institutional money will flow back again to China (as they will not face anymore a big career risk)

👉 on the other side, no matter which valuation metrics we look at, China tech looks cheap … I am very tempted with some 2025-2026-2027 long calls …

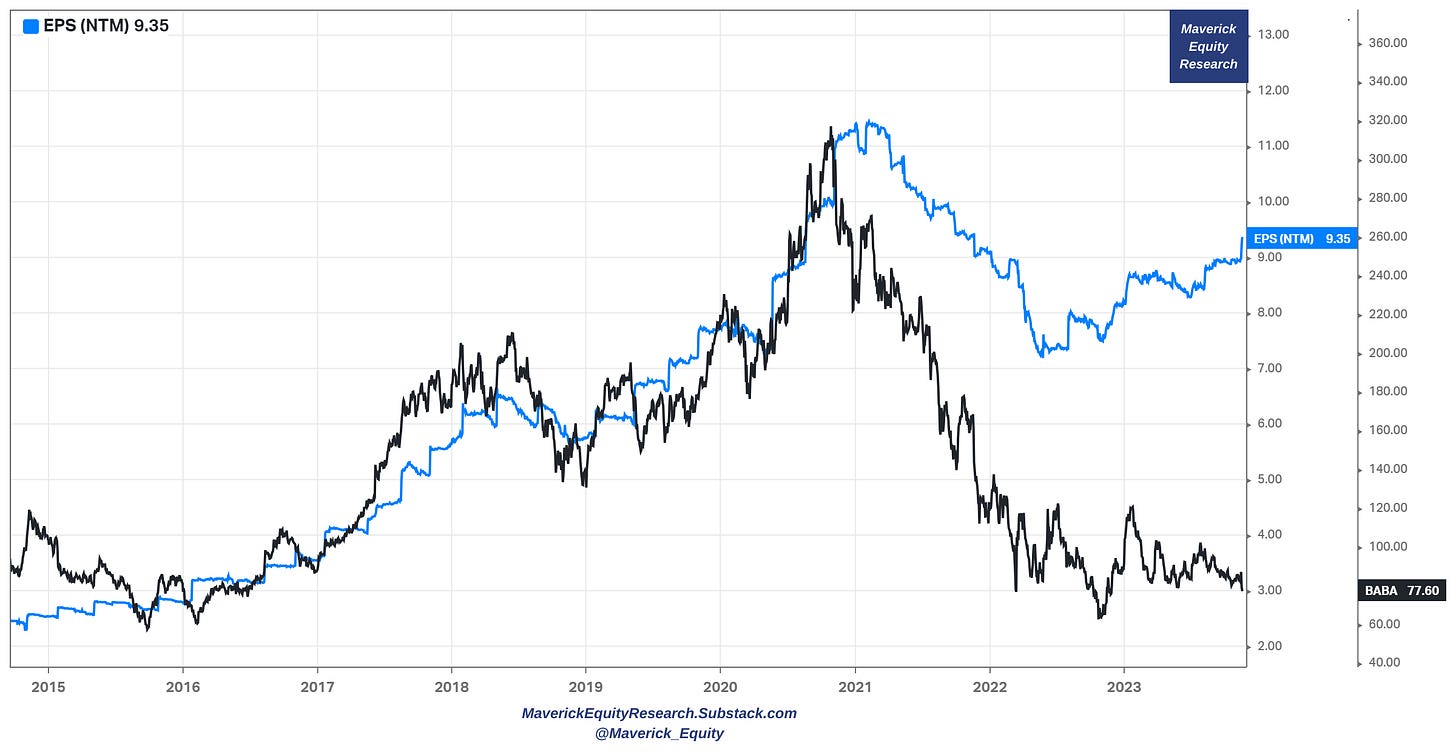

13 & 14 & 15. Stock example via Alibaba (BABA) in terms of valuation fundamentals

👉 stock with a major disconnection from the fundamentals since CCP & Jack Ma: EPS is up 3.7x since 2015 … while price is flat ... let that sink in!

👉 it trades at a very low 8.5x PE, 31% of the market cap is net cash

👉 Cash + investments amounts to 63% of the market cap

That looks like deep value no matter how I look at it, but needs confidence & flows

👉 looks very cheap by pretty much all metrics - percentile rank vs own 10-years history, vs US consumer discretionary and US overall

👉 also they buyback stock quite heavily: buyback yield at 5.25% is at all-time highs, share count dropping quite fast and at 2017 levels

TLT wise (long-term government bonds 20-year+ maturities):

👉 record financial inflows: more price drops, the more the inflows keep coming …

👉 $22 billion in 2023 alone, which ranks in the 2nd place ETF inflows, only VOO (S&P 500) attracting more flows

N.B. currently writing on a research series on Investing in Bonds/Cash/Credit in the current high interest rates environment … stay tuned …

US equities volatility via ‘vola VIX’ at 12.99 = as low as January 2020 with the average (purple) since 2020 at 23.02

👉 Black Friday, Thanksgiving turkey, u name it ... stomach full, new gizmos in the house, Netflix & chill, all good 😉

👉 VIX = CBOE’s index of equity volatility, often called the “fear gauge” and probably the best-known measure of market sentiment

👉 Ukraine invasion and Hamas attacks with brief spikes, but shrugged off as usual

Carvana (CVNA) is up 561% in 2023 while European based Auto1 (AG1) with no net debt trades at an all-time low and is down 26% … quite a funny case …

Mighty Swiss franc keeps marching on and on VS both the USD and EUR

Ark Invest ETFs (Innovation/Hyper-Growth thematic) with big rebounds in 2023

👉 ARKW +80%, ARKF +73%, ARKK +56%, ARKG +34%, ARKX +19%, ARKG +3%

👍 Bonus: 5 charts special edition on ‘2023 the year of the US tech Magnificent 7’

2023 is the year of the mega tech Magnificent 7 ‘M7’ group of US stocks, namely: Apple, Microsoft, Google, Amazon, Nvidia, Meta and Tesla

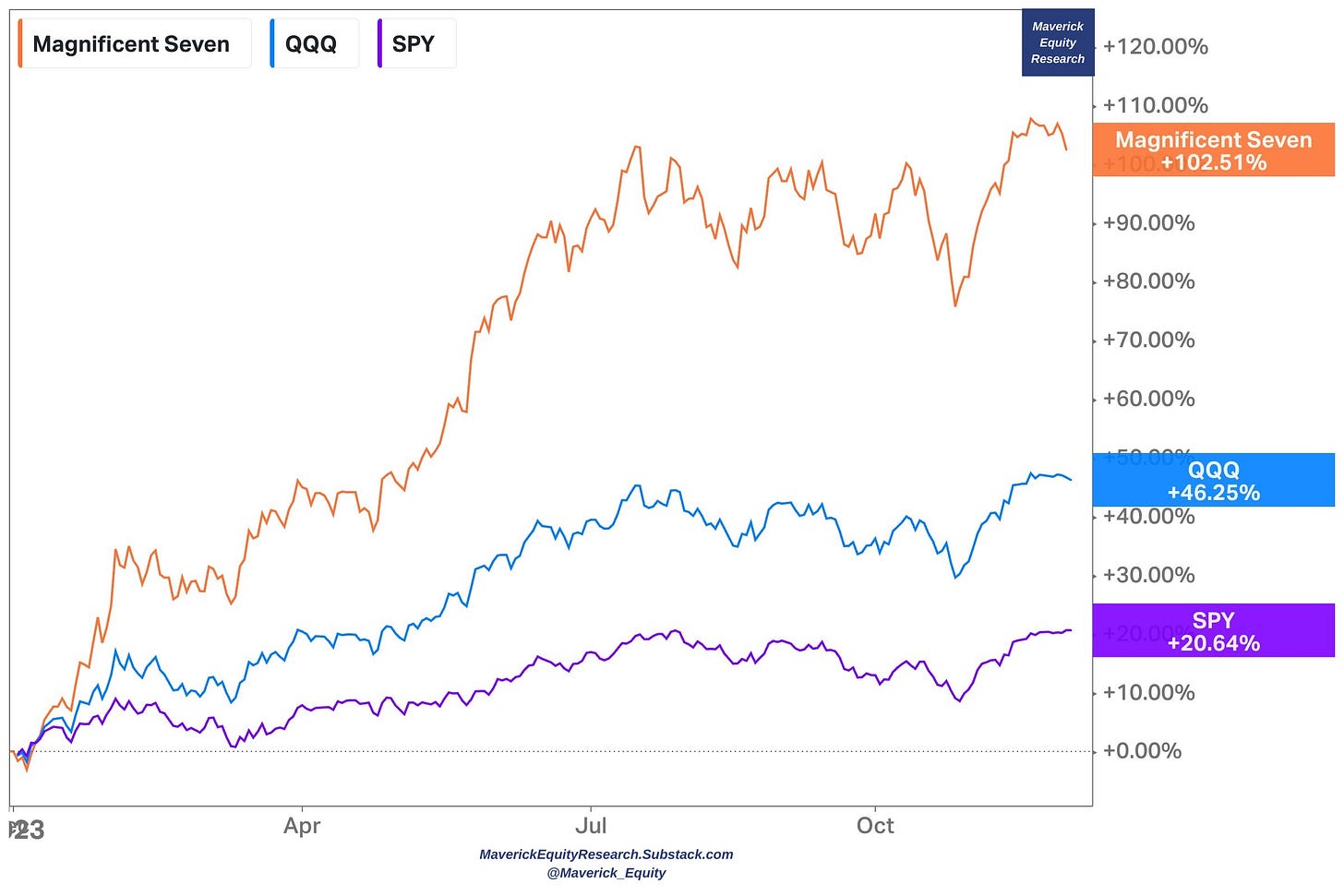

👉 102% is very impressive for sure while the S&P 500 +20% and Nasdaq-100 +46%

Key note: Mag 7 group is overlapping with S&P 500 and Nasdaq-100, hence let’s do a return attribution analysis to see the M7 effect on the 2 indices

S&P 500 (SPY) wise:

13.75% (1375 b.p basis points) are due to just 7 stocks

which is a whooping 68.72% of the 2023 total performance (13.75/20.01)

Nasdaq-100 (QQQ) wise (top 6 stocks this time):

23.41% (2341 b.p basis points) are due to just 6 stocks

which is a big 51.77% of the 2023 total performance (23.41/45.79)

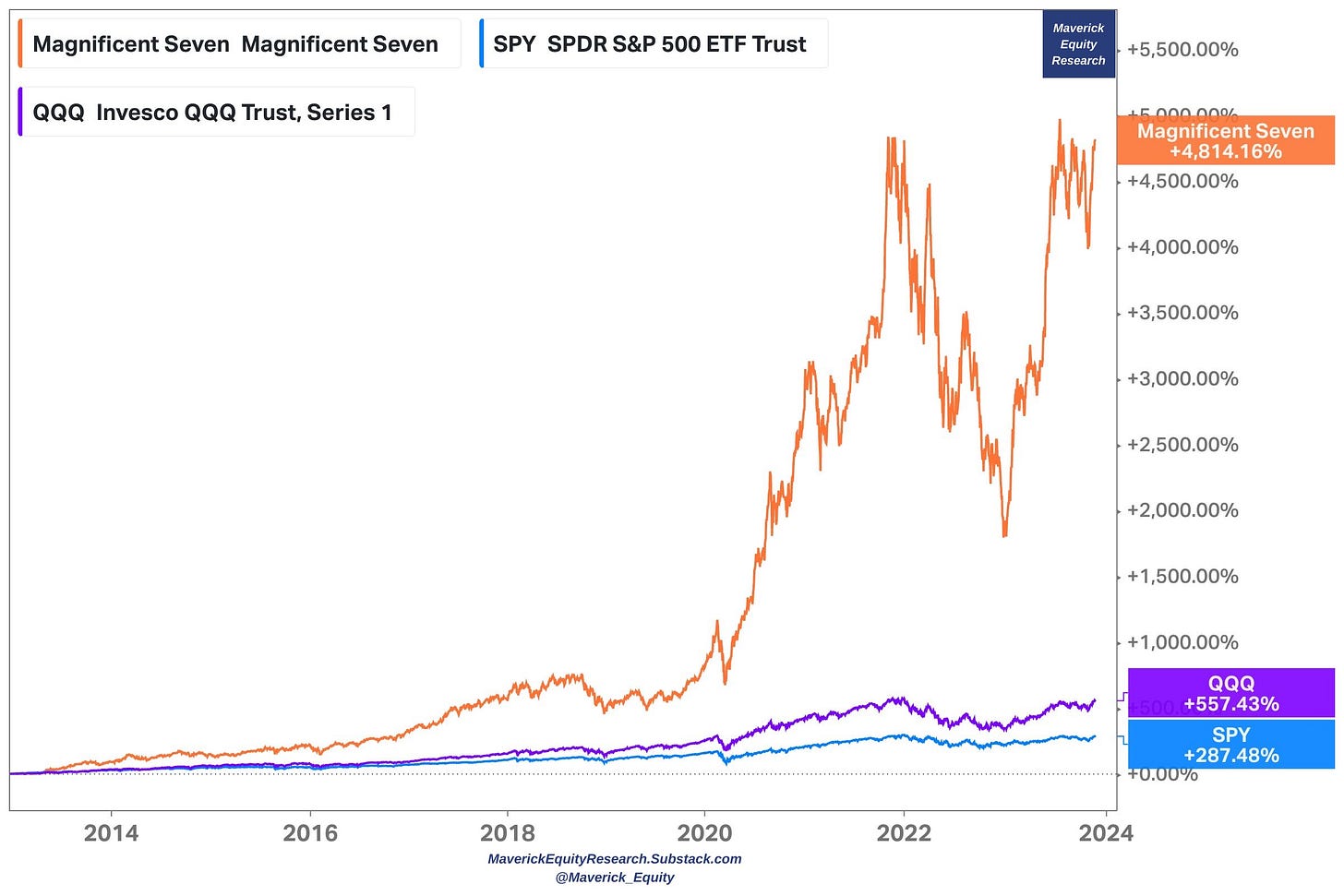

Magnificent 7 is not really a new phenomenon, a big reason for the club name

👉 just check the 4,814% return in the last 10 years … let that sink in! Note also that

👉 from +5,000% to below 2,000% in less than a year in 2022 … let that sink in too!

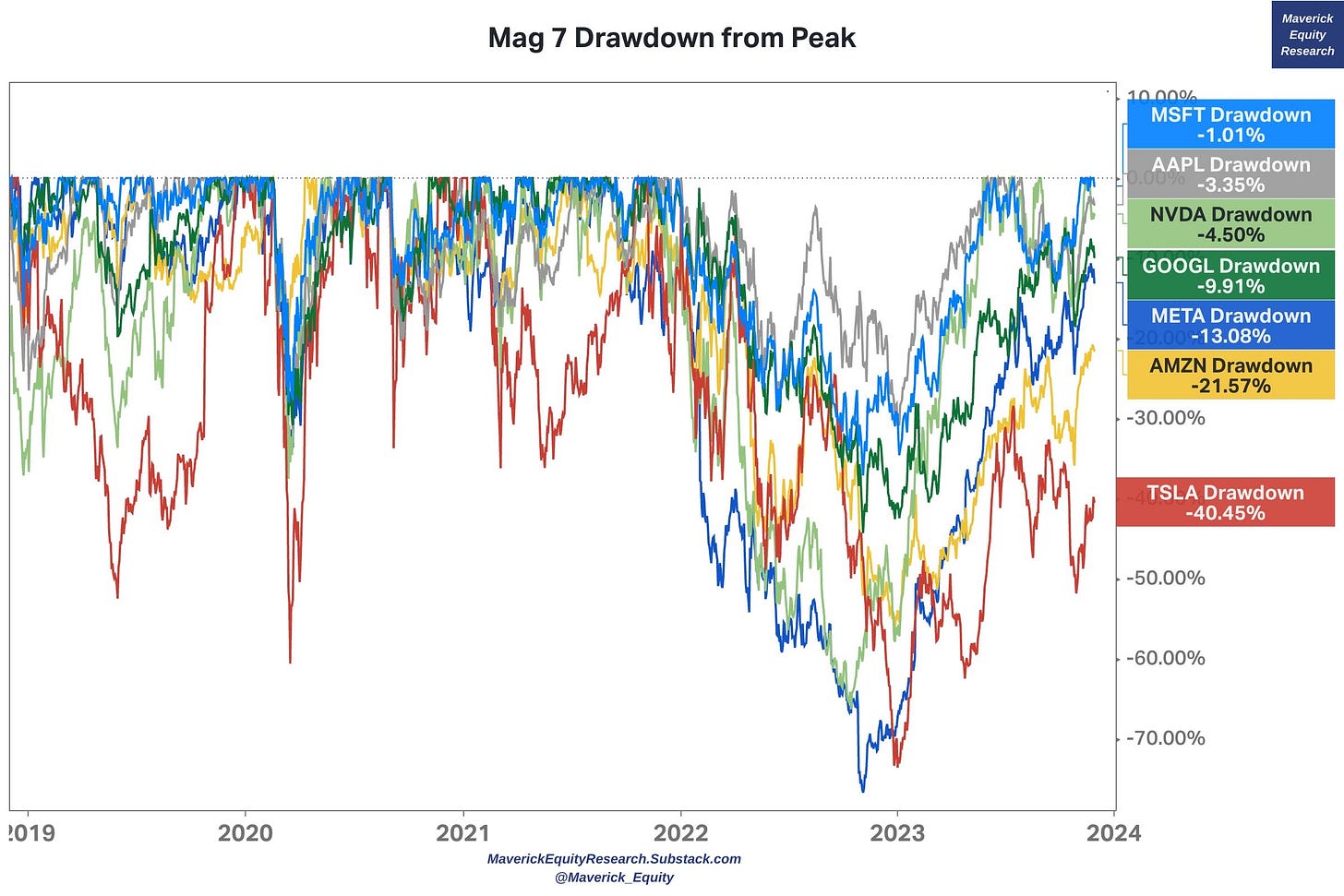

Complementary angle: M7 big drawdowns are not uncommon - a huge 60% one in 2022 and note also the 35% one from 2018 and the 40% in 2020

And here the Mag 7 drawdowns on the individual stock level

Microsoft -1.0%, Apple -3.4%, Nvidia -4.5%, Google -9.9%

META -13.1%, Amazon -21.6%, Tesla -40.5%

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

What would be appreciated? JUST sharing it around with like-minded people and hitting the ❤️ button. This will boost bringing in more and more independent investment research … from an independent guy with a laptop & sometimes 2 screens, usually writing from a library, home or while commuting via a train in Europe.

Looking forward for your feedback, questions & thoughts … Thank you!

That’s all for November. Have a great day!

Mav 👋 🤝

Much appreciated charts and insights between the lines!

Indeed, charts that say 10,000 words! Most need 5 pages to send some key and insightful messages, thanks, much appreciate your work & time to do all this! All the best!