✍️ Maverick Charts - Stocks & Bonds - August 2023 Edition #10

20 Sleek charts that say 10,000 words ... save precious time & provide insight!

Dear all,

your monthly Top 15 Stocks & Bonds charts from around the world + 5 Bonus!

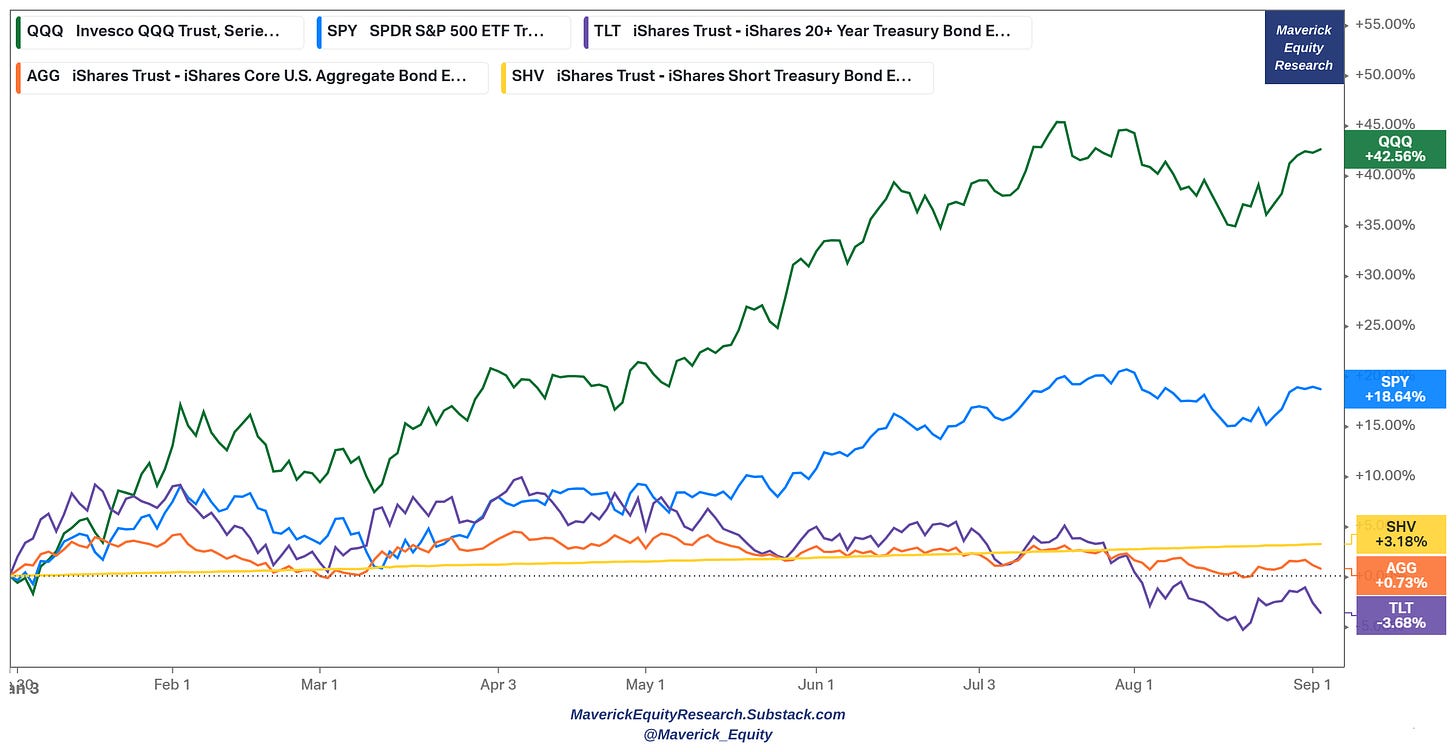

US Stocks & Bonds 2023 performance:

👉 Nasdaq 100 (QQQ) with a new bull market, +42.5% in 2023 alone

👉 S&P 500 (SPY) with a new bull market, +18.6% in 2023 alone

👉 TLT (long term government bonds 20-year+ maturities) -3.6%

👉 SHV (short-term government bonds 1-year or less, cash proxy) +3.1%

👉 AGG (investment grade: treasuries, corporate, MBS, ABS, munis) +0.7%

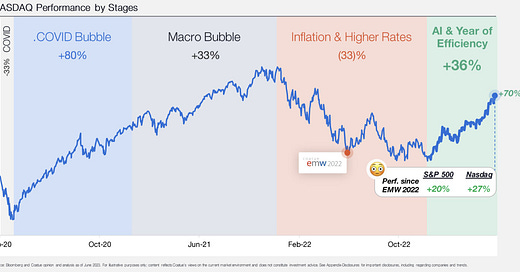

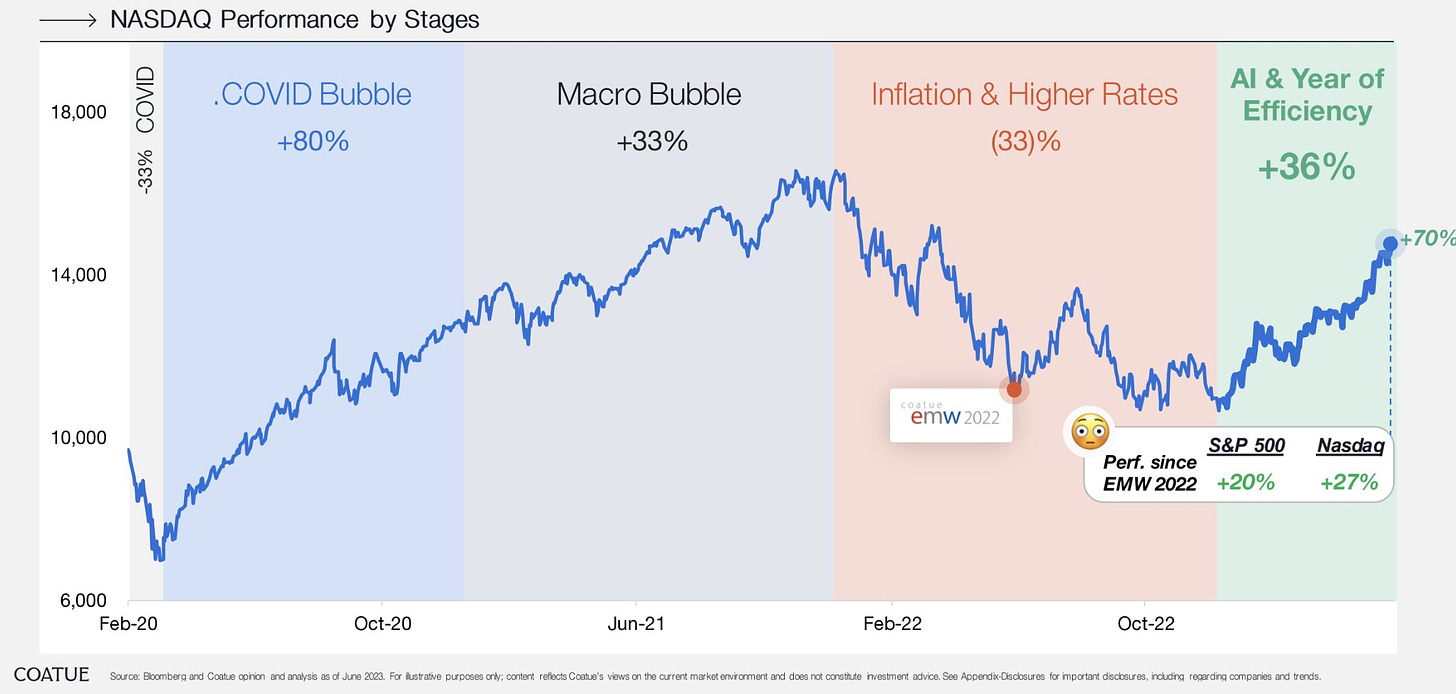

NASDAQ timeline story via returns by stages since 2020

👉 Covid Bubble +80%

👉 Macro Bubble +33%

👉 Inflation & Higher Rates -33%

👉 AI & 2023 Year of Efficiency: +36% as of June, +42 as of September, 2023 run is the best YTD run rate in its history

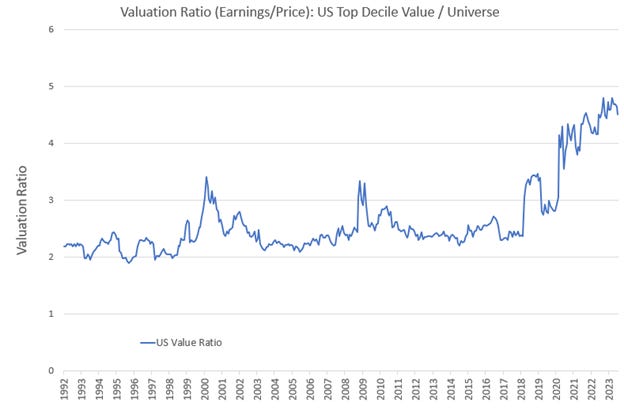

Where are good U.S. investing opportunities to be found in the next years be it we have an overvalued overall stock market or not?

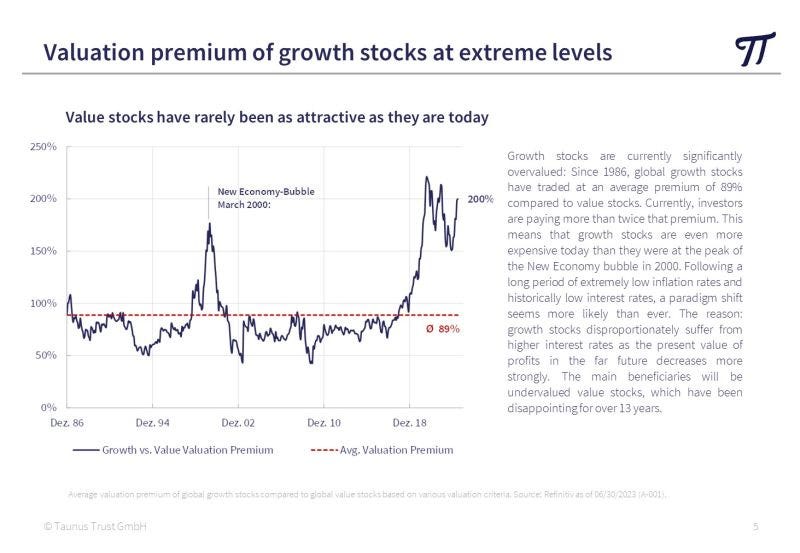

👉 Meet the value trade: the spread between value stocks and the rest of the stock market universe is at historically wide levels

👉 The Full Equity Research section from Maverick Equity Research is where I will cover bargain hunting and margin of safety in the Value investing space. How? Via fundamental analysis, namely comprehensive data driven research …

Value for/vs Growth, complementary view:

👉 average premium of growth stocks to value is 89% since 1986

👉 nowadays, investors keep paying a premium that is more than 2x the already average premium & more than 3x on a growth/value 1:1 basis ... let that sink in!

👉 growth stocks are even more expensive today than they were at the peak of the New Economy bubble in 2000

Value the place for opportunities, anything even more to add? Yes, small caps!

👉 the last time small-cap stocks were this cheap on a relative basis was coming out of the 2000s tech bubble

👉 that led to a years-long run of outperformance

As this newsletter sub-section covers ‘Stocks & Bonds’, one very frequent question I get is: ‘how do stocks and bonds perform throughout the business cycle?’ There you go:

👉 early & mid expansions is where stocks shine

👉 late expansions is where both do still pretty good and pretty close

👉 treasuries do their best during recessions while stocks the least

Nvidia (NVDA) and Berkshire (BRK) market capitalisation

👉 NVDA $1,200 billion vs $BRK $790 billion and the truly bonkers stats is this one:

👉 $920 billion market gain since just October 2022 equates to 116% of the entire Berkshire value that has been ever created for 6 decades by legendary investors

Only 10-11 months for a new & surpassed Berkshire empire? Not an apples-apples comparison, but a question of market pricing & value creation … food for thought ...

Nvidia (NVDA) and Tesla (TSLA) market capitalisation

👉 $NVDA $1,200 billion vs $TSLA $775 billion and the truly bonkers stats is this:

👉 $920 billion market gain since just October 2022 equates to 119% of the entire Tesla value that has been ever created...

Only 10-11 months & can make a new entire Tesla & surpass it? Not an apples-apples comparison, but a question of market pricing & value creation … food for thought ...

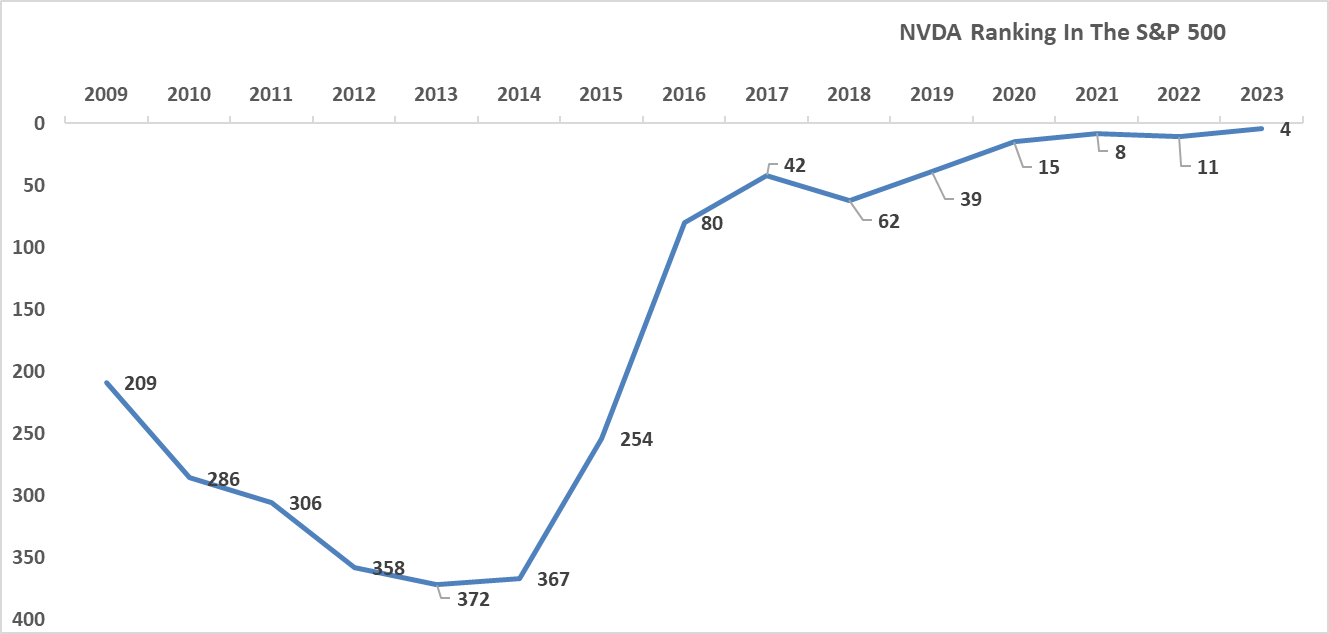

Nvidia (NVDA) weight in the S&P 500: in 2023 #4, in 2009? Give it a guess: 209th!

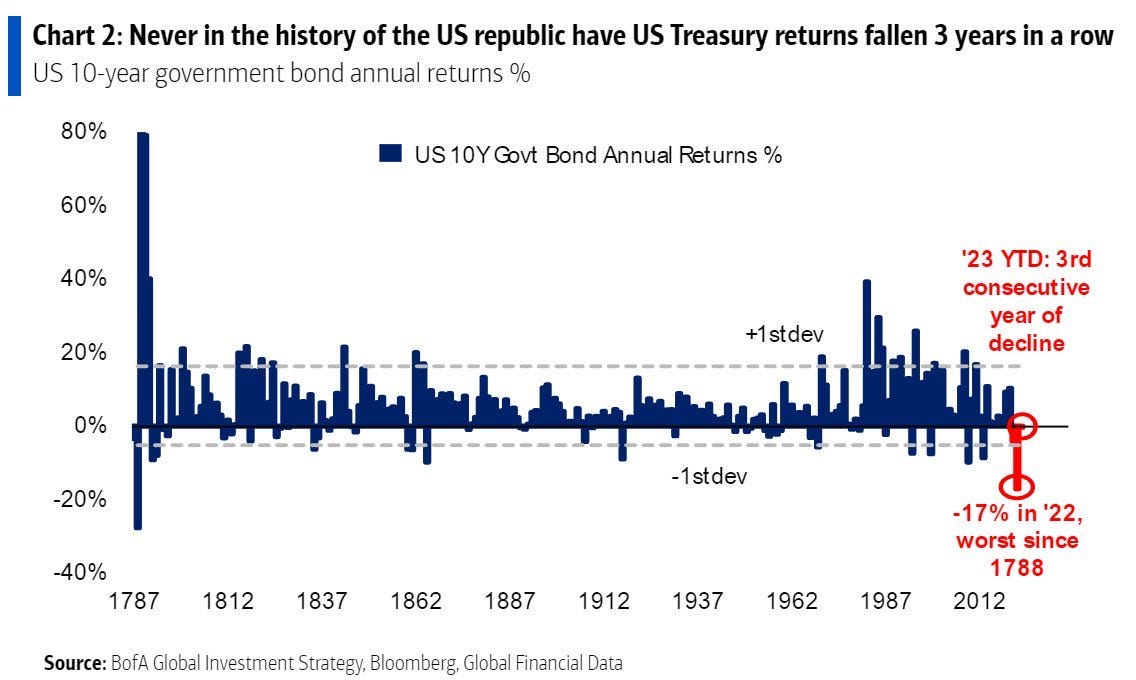

US 10-year government bonds: never in the history of the US republic have US treasury returns fallen 3 years in a row!

👉 2023 is the third consecutive negative year - my view is that it will end positive

👉 if 2023 by chance is negative also, likelihood of 4 years in a row? very close to 0!

BofA institutional investors survey on bonds

👉 they are overweight in bonds for the first time since the Global Financial Crisis which climaxed in 2009, at which point fixed income was outperforming ...

👉 now, they are following the logic of mean reversion and loading up with bonds after 18 months of historically terrible performance

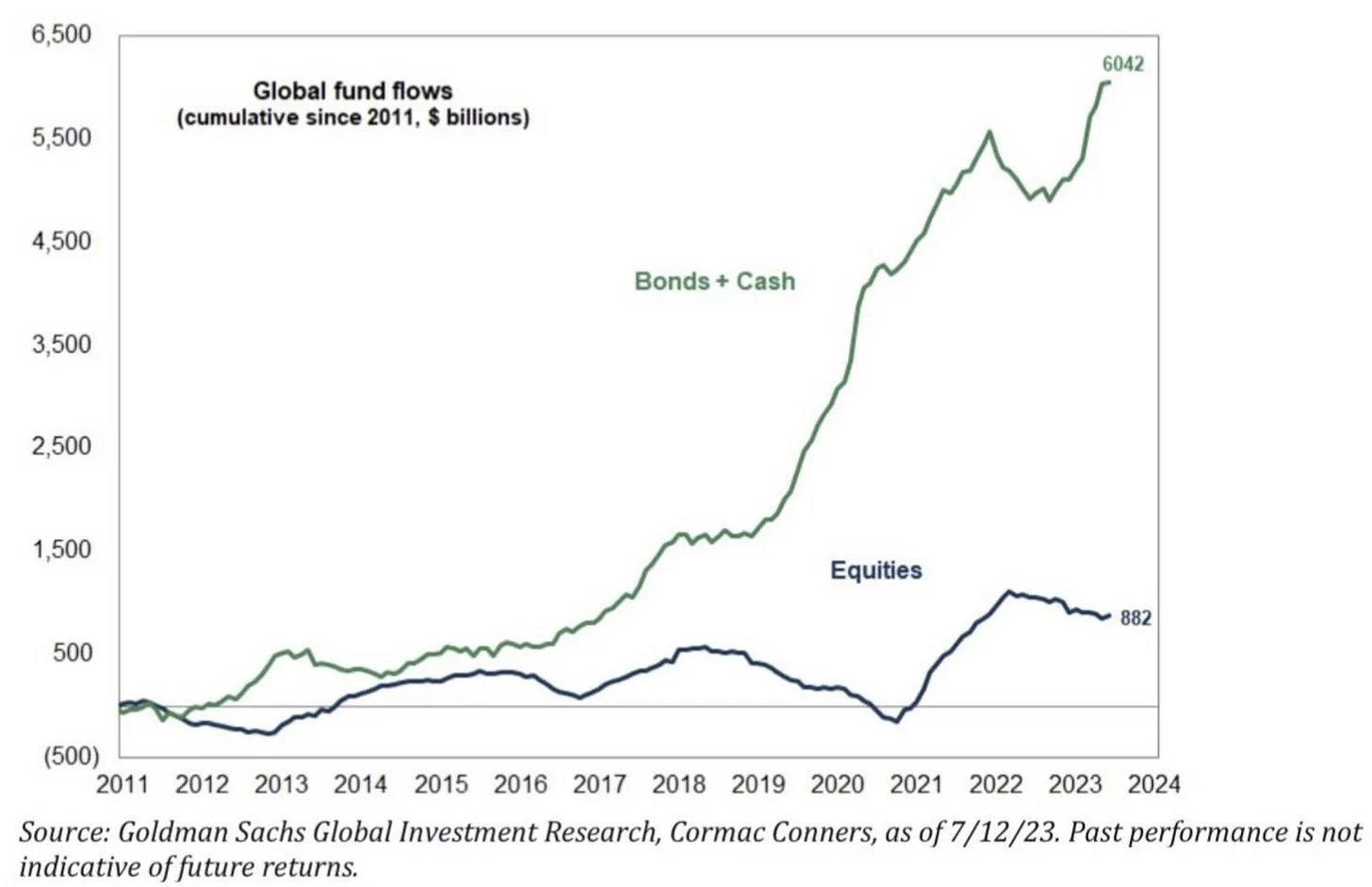

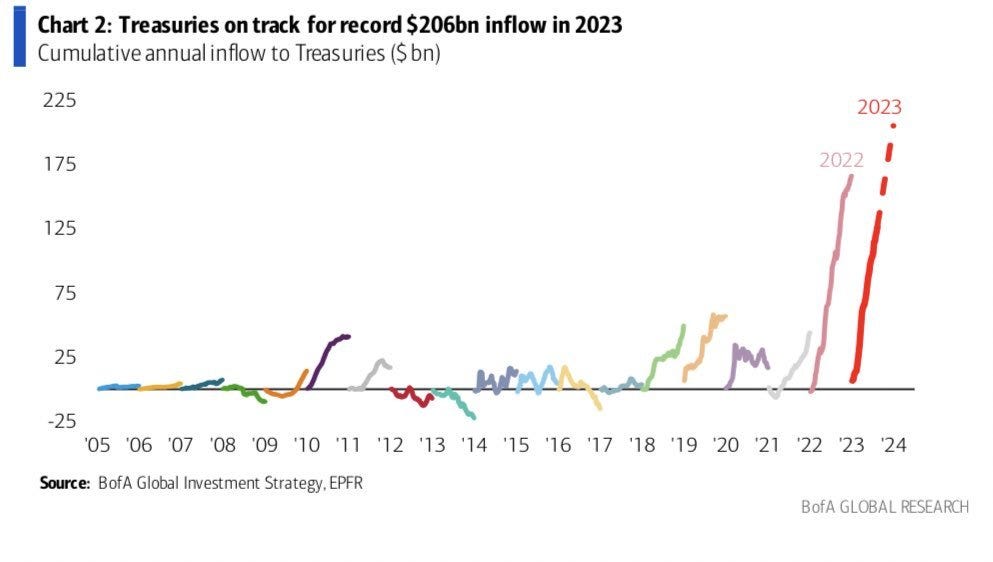

Flows Baby Flows: bonds & cash keep attracting loads of capital given high rates

👉 once the FED eases, that = dry powder for equities given that bonds/MM funds will pay less and less ...

👉 while for now bonds good risk/return? right? ...

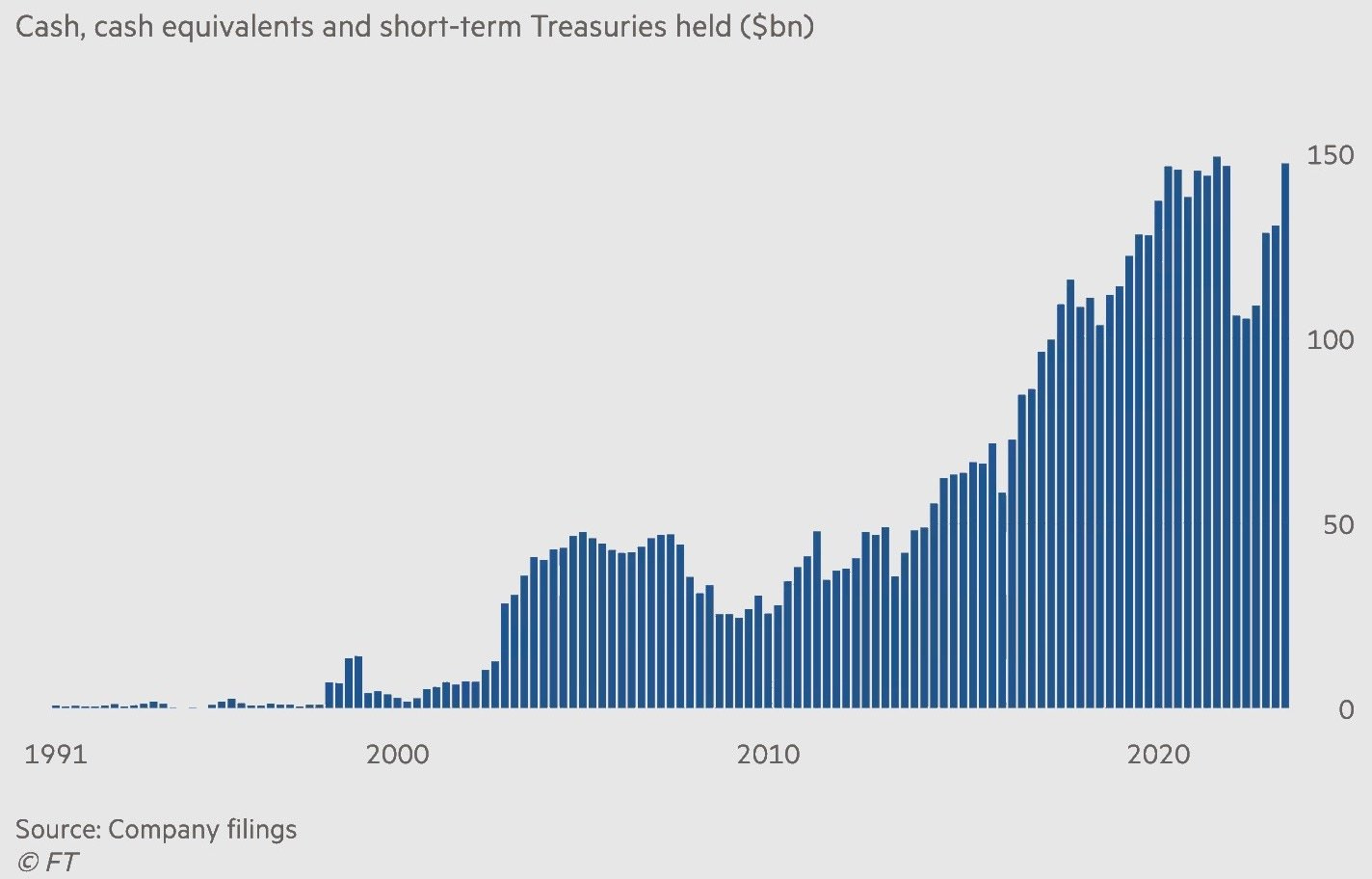

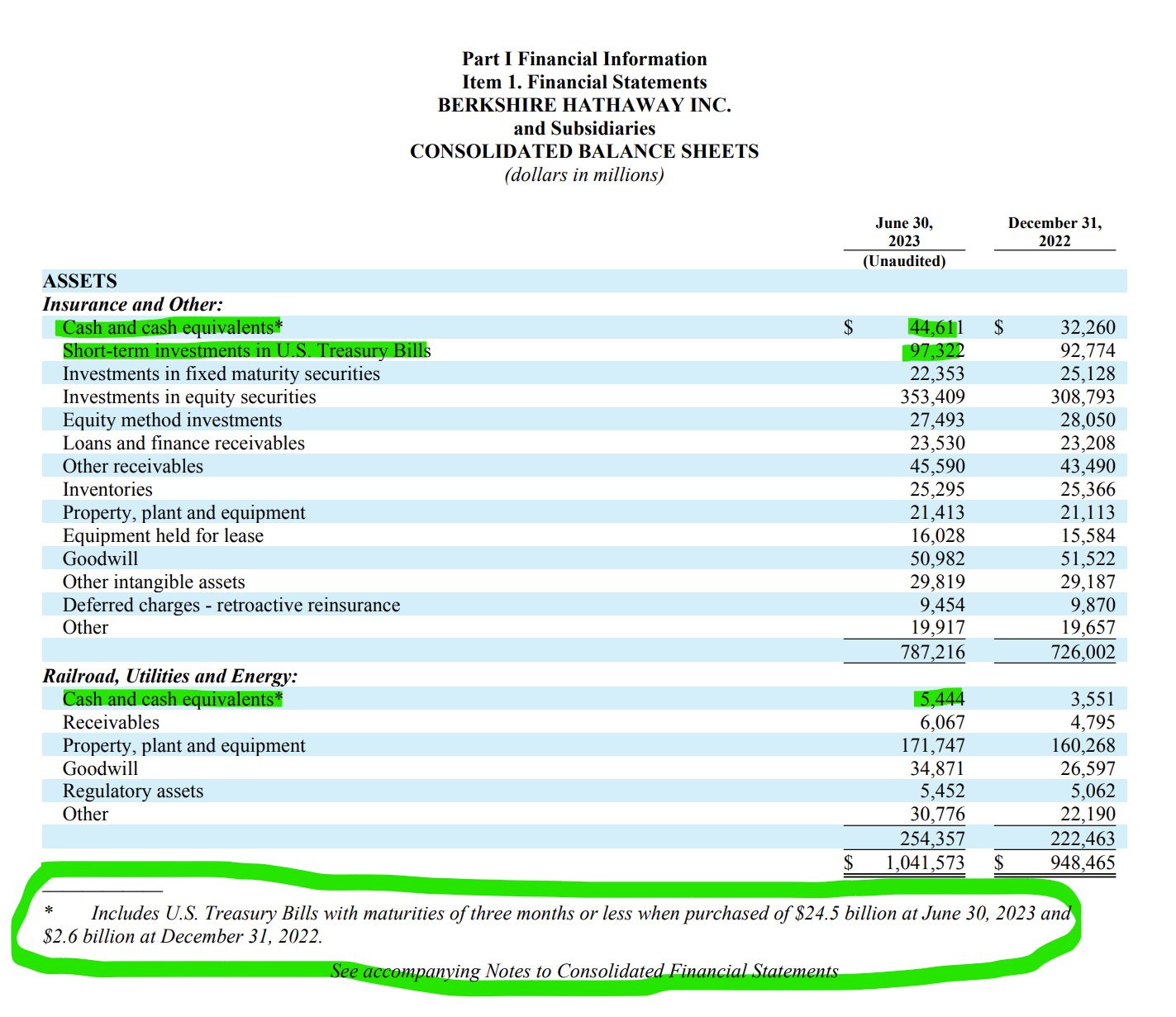

Buffett / Berkshire also cash piling - not really new, but note as close to ATH

👉 recently said they are buying as many short term 3/6-month Treasuries as possible each Monday ...

👉 also said some quarters ago that he would have bought more Apple, but price went too high too fast ... he does not mind the price recent price drop I am quite sure ...

Q2 2023 cash pile:

👉 Q2 cash pile increased to $147.38 billion close to the record and

👉 materially higher than the $130.62 billion from Q1

87% (127/147 billion) of the total $147 billion cash pile = TREASURIES

Flows into Treasuries

reached $127 billion this year and are

set for an annualized record of $206 billion

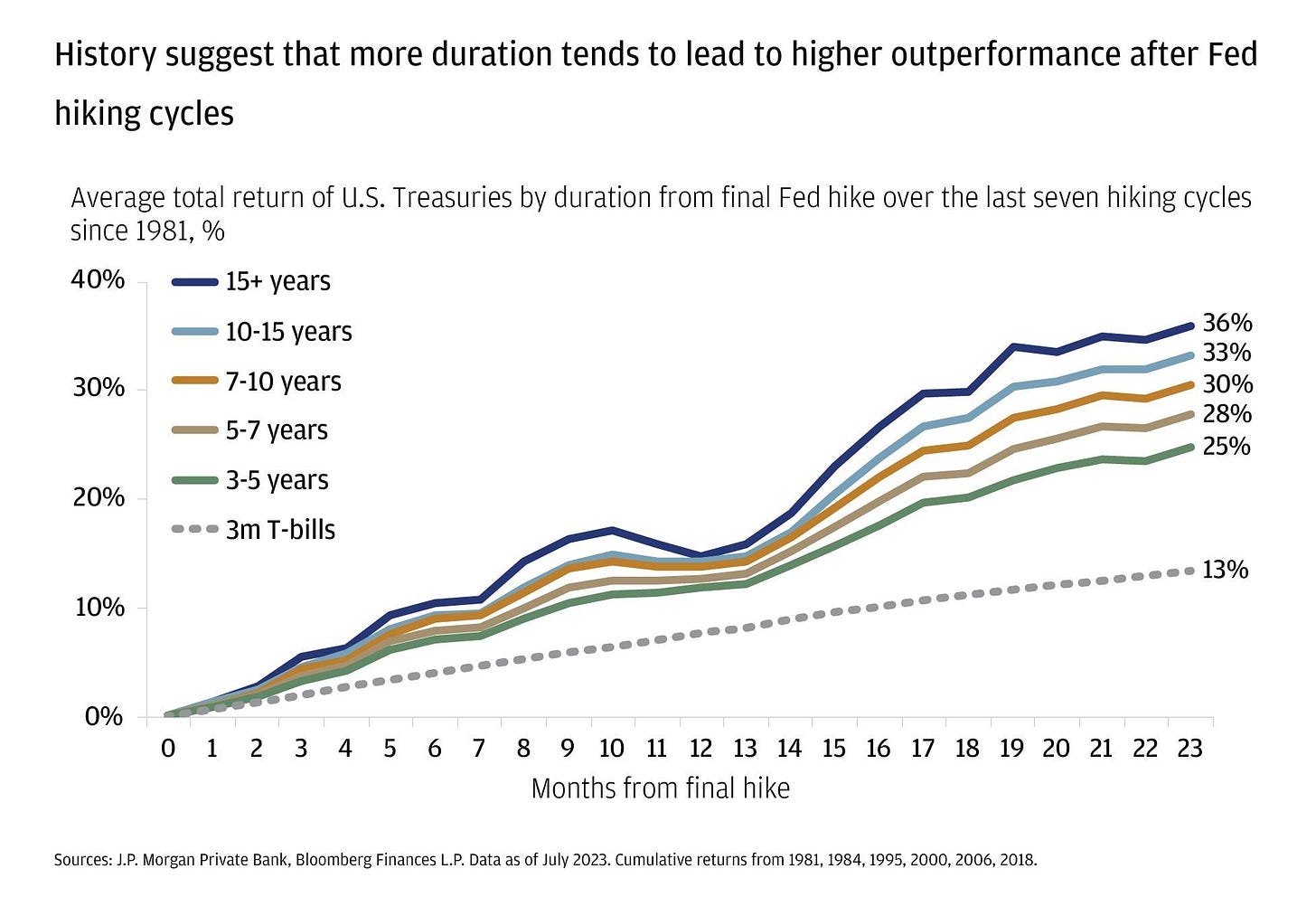

And now a key question: ‘how do treasuries perform after he final FED hike?’

👉 longer term treasuries (aka long duration) leads to higher outperformance after the FED’s final interest rate hike … not bad, not bad at all, right?

5 Bonus charts:

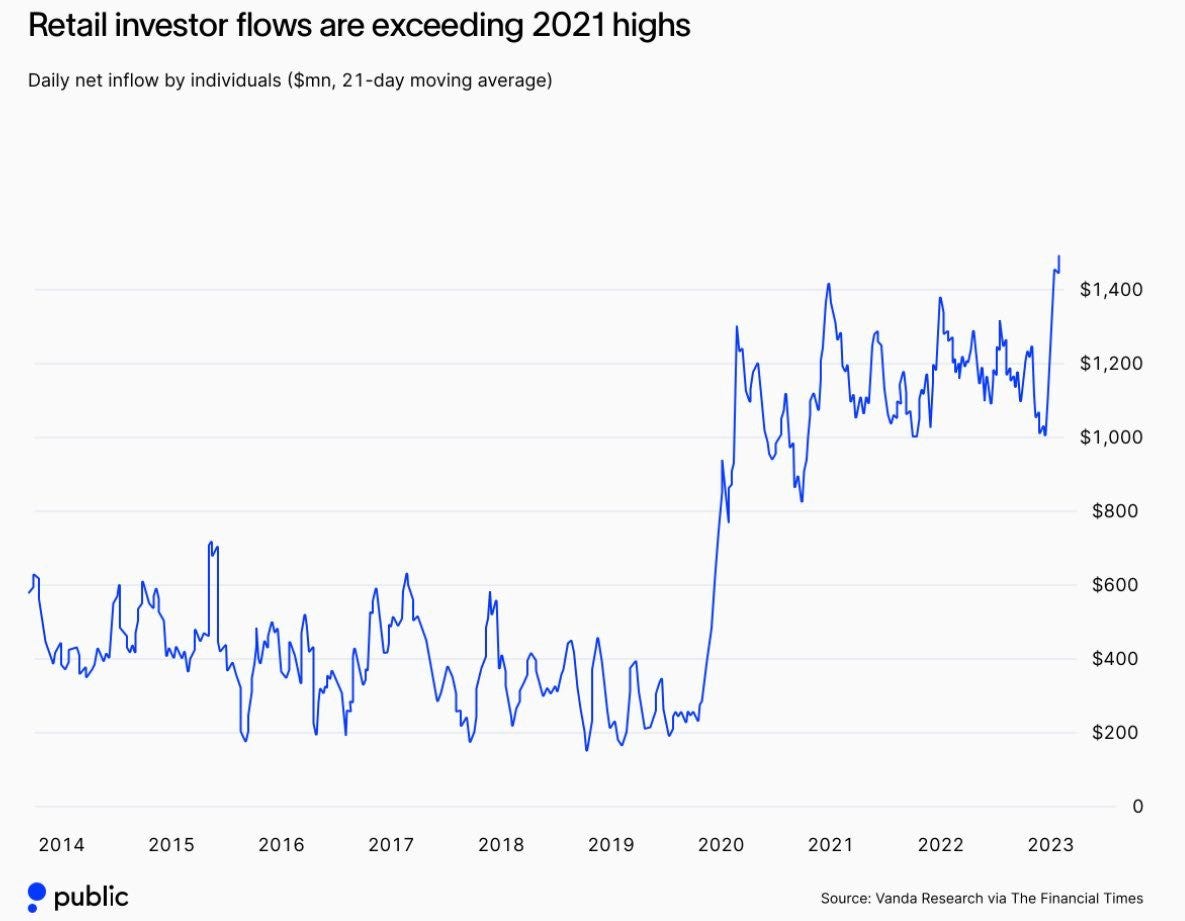

Retail investors with an even bigger buying appetite than the 2021 highs

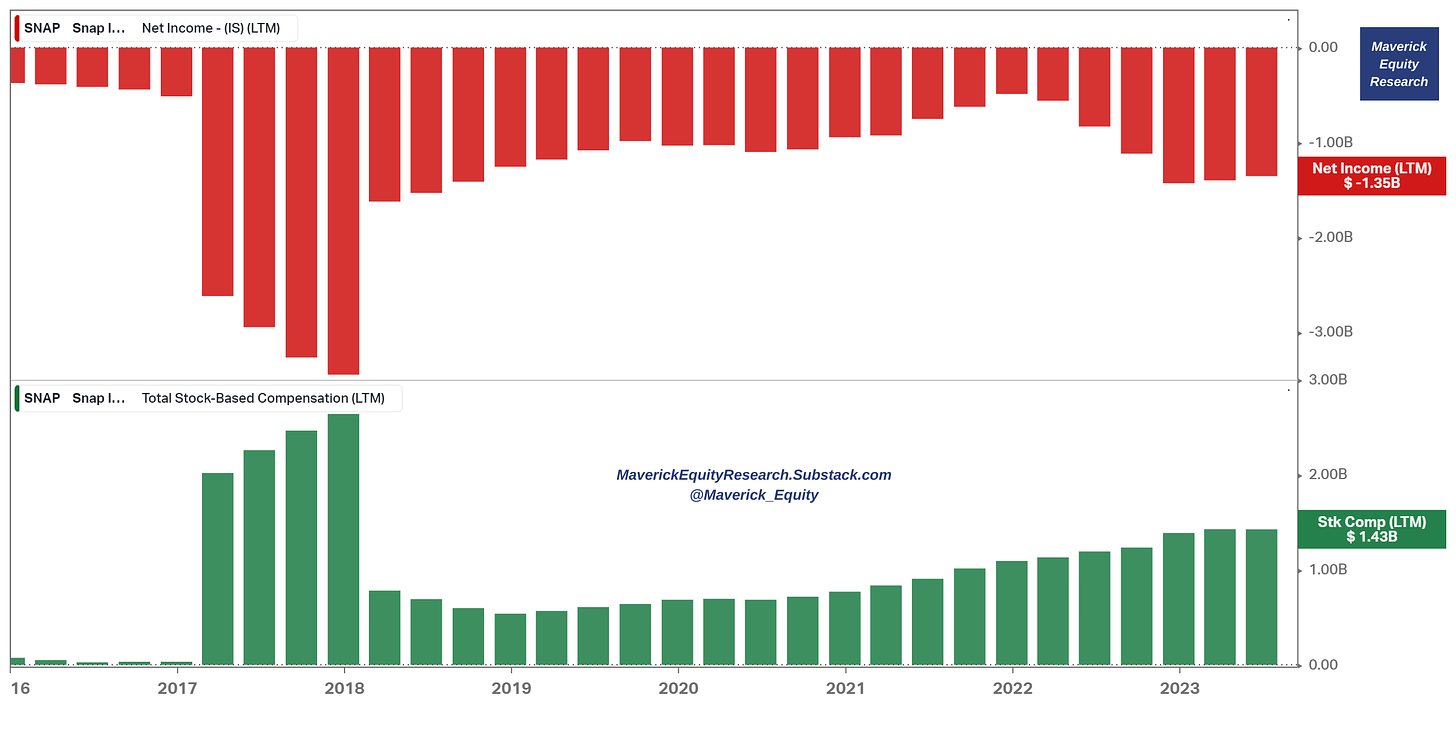

Social media company SNAP managed 2 incredible things since going public

skyrocketed the amount of ‘sexting’ and genitals sharing that people do🙃

stock -57%, never a profit with a cumulative $9.2bn loss, but insiders got a money printing machine for themselves via issuing stock (SBC) for a cumulative $7.8bn

Net Income (red) and Stock Based Compensation (green) mirroring each other…

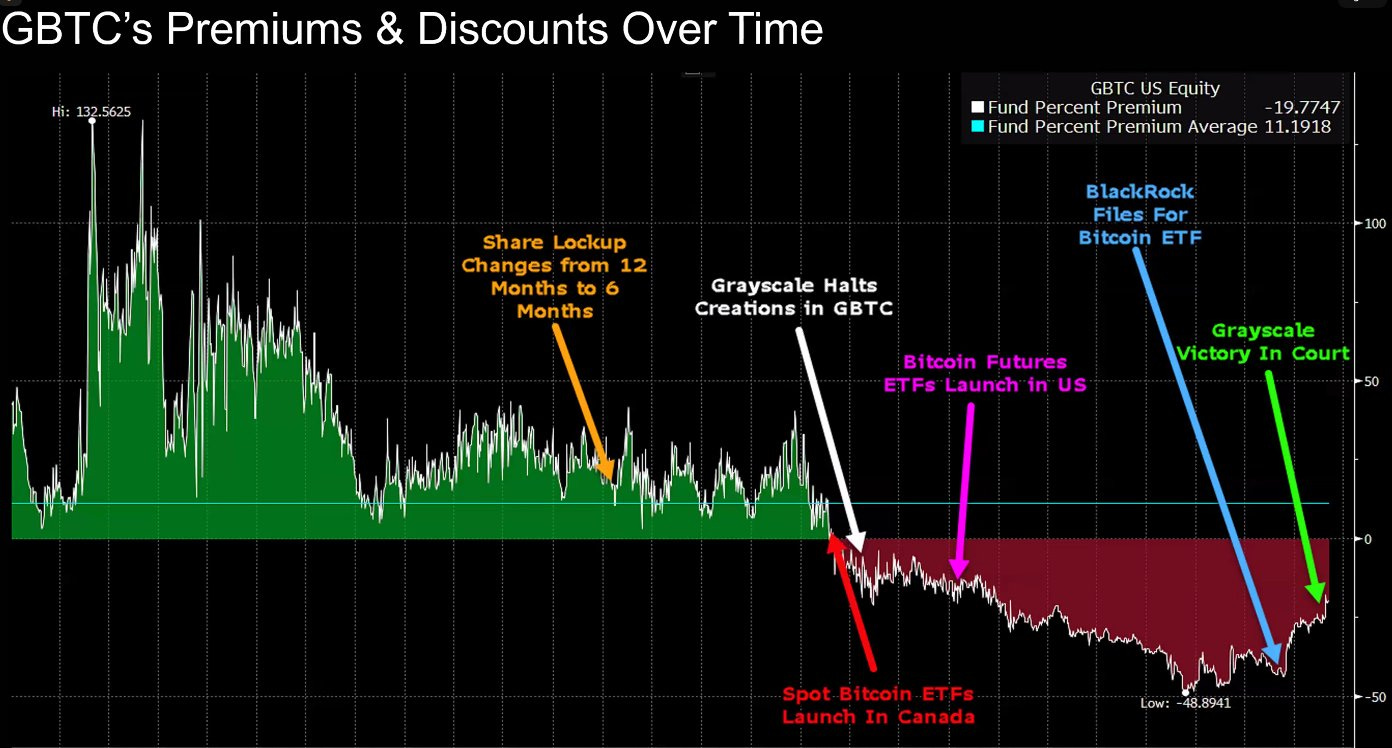

Grayscale Bitcoin Trust (GBTC) timeline

catalysts driving up & down its premium/discount trading, currently -19% discount

quite a story with another chart that say 10,000 words

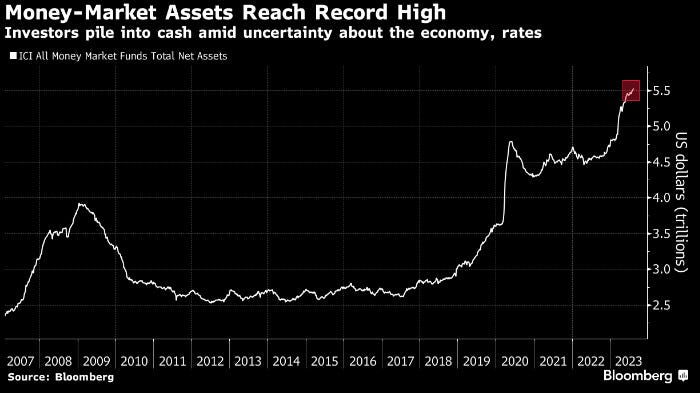

Money Market assets since 2007

👉 record high $5.5 trilliones

👉 with high interest rates, they pay …

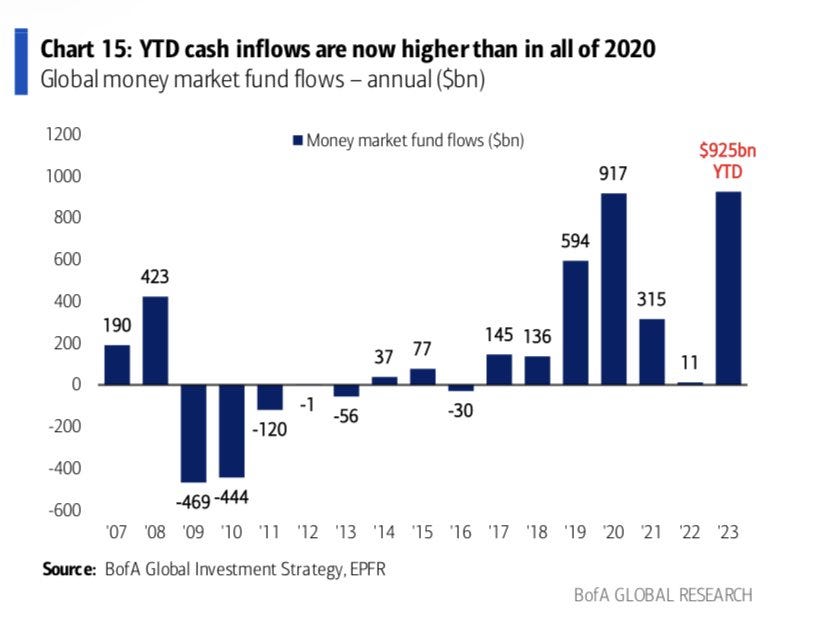

Global Money Market annual inflows

2023 inflows already higher than all 2020 covid panic

“About $40 billion poured into US money-market funds in the week through Aug. 16.…Total assets reached $5.57 trillion, versus $5.53 trillion the previous week.”

Research is NOT behind a paywall & no pesky ads here. What would be appreciated?Just sharing it around with like-minded people. In case not already, subscribe to get all the future research straight to your inbox. Twitter thread can be read here.

Thank you & have a great day!

Mav

great post! i always enjoy seeing Maverick charts in my inbox.

Great charts!