Dear all,

starting a new series here with the 1st edition of the ‘Maverick Food for Thought’.

Big ideas & trends will be the focus, key questions & thematics for further reflection. The thought-provoking subjects will be the economy and investing, or Macro Finance. Naturally, it is where I will be less opinionated given the many nuances that these subjects carry, yet there will be my own thoughts and insights.

Frequency: ad-hoc, whenever things come along and deserve attention. As you got used to it, this is about research, not news, headlines or the latest hot takes.

Delivery: via the typical Maverick fashion, via charts that say 10,000 words!

Report structure:

📊 Value VS Growth: Maverick Insights 📊

👍 Maverick Food for Thought & Takeaways 👍

📊 Value VS Growth: Maverick Insights 📊

This very first edition will be about Value VS Growth as investing styles and factors.

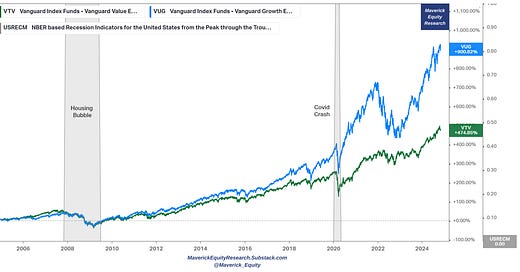

First of all, how did they perform in the last 20 years? Taking Vanguard index funds as proxies, specifically, Growth (blue, VUG) outperformed massively Value (green, VTV). Growth domination started around 2009 as we were getting out of the 2007-2009 Global Financial Crisis (GFC).

👉 very low interest rates helped Growth a lot as low discount rates boost the valuation of growth companies (‘duration’) way more than value (it all comes down to the magic of discounting cash flows)

👉 tech companies also making their full effect into the economy via the many efficiencies they bring across the sectors

An interesting way to see when Growth took over big time is by plotting Vanguard Growth (VUG, blue) & Value (VTV, green) relative to the market via the S&P 500 (SPY).

👉 Growth outperformance started in 2009, yet the exceptionalism in 2017, and then went parabolic as the US government and the FED deployed the bazooka stimulus during the 2020 Covid times

👉 2022 was the most anticipated recession that never came, a time when Value was catching up strongly as inflation and high interest rates showed their teeth also

👉 most recently, AI makes for another big Growth run relative to Value

A more pronounced ‘gap’, but a similar message when we also look at the Russell 1000 proxies for Growth (IWF, blue) & Value (IWD, green):

Another way to look at Value & Growth is also via Schwab’s SCHG/SCHV proxies, Large-Cap Growth / U.S. Large-Cap Value, last 10 years: recall 2017 when growth started the 1st major run while in 2023 ramping up via the new kid in town, AI boom!

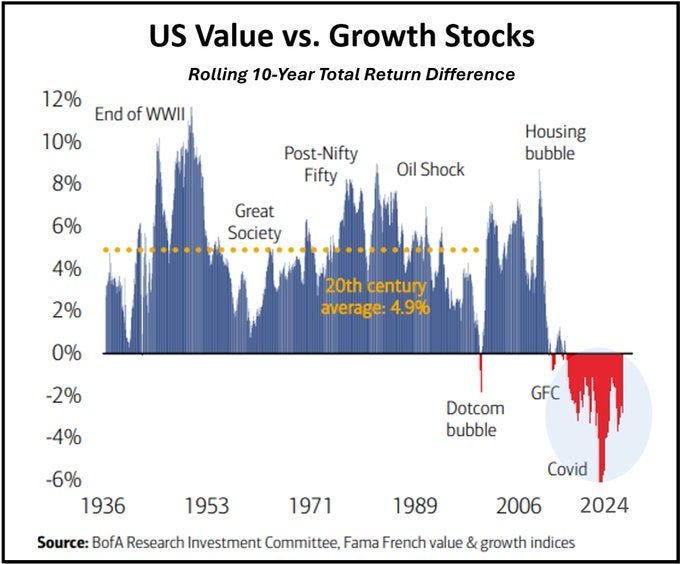

You saw the last 20 years, what about zooming out further for the very big picture? Sure, almost 90 years of U.S. Value vs Growth return differences in one single visual:

👉 Value did dominate BIG time the 20th century with a 4.9% average, a period marked by many historical economic and geopolitical events

👉 about 15 years of a difficult period for value investors as growth took over ...

On this, curious for an outlook for financial market going forward? Via Vanguard:

👉 US Value, Small Caps, REITs, Global Equities (excluding US), Global equities developed markets (excluding US) in the green

👉 in the red? US growth: a lot is baked in already into the valuation, great execution and a blue sky scenario.

Do not forget, starting valuations always do matter! Price is what you pay, value is what you get! Like with everything … .

P.S. I will also cover interesting US REIT’s and small caps via the Full Equity Research section, valuations look pretty good!

👍 Maverick Food for Thought & Takeaways 👍

So, are tables turning anytime soon between Growth and Value?

👉 how about Growth keeps going as expected via the AI and lower interest rates combo, while the AI tech boom is also adopted by the more traditional value companies, hence also value to perform well. That is all the major 11 sectors that shape the S&P 500 benefit also … Heads we win, tails we win …

👉 how about going GARP (Growth at a reasonable price) style a’ la Peter Lynch? That is combining Value & Growth investing by hunting companies that exhibit strong revenue and earnings growth potential while at the same time not trading at very high valuations, case where where a lot is baked into the price already.

👉 Maverick’s way will be a mix of Value, Growth and GARP for the diversified win! Also diversifying geographically from US with a focus on Switzerland. More on that in the next ‘Maverick Food for Thought’ edition: ‘US vs International Valuation’. Independently, it all comes down to the underlying business and valuation (see below).

It is key to hunt for changes that may cause longer term shifts, but a big reliance on any single thing is not my way - the big saying in finance is that there is no free lunch, well no, diversification is a free lunch, and it is the only one I believe!

N.B. US, Swiss (and more) stocks will be covered in the Full Equity Research section.

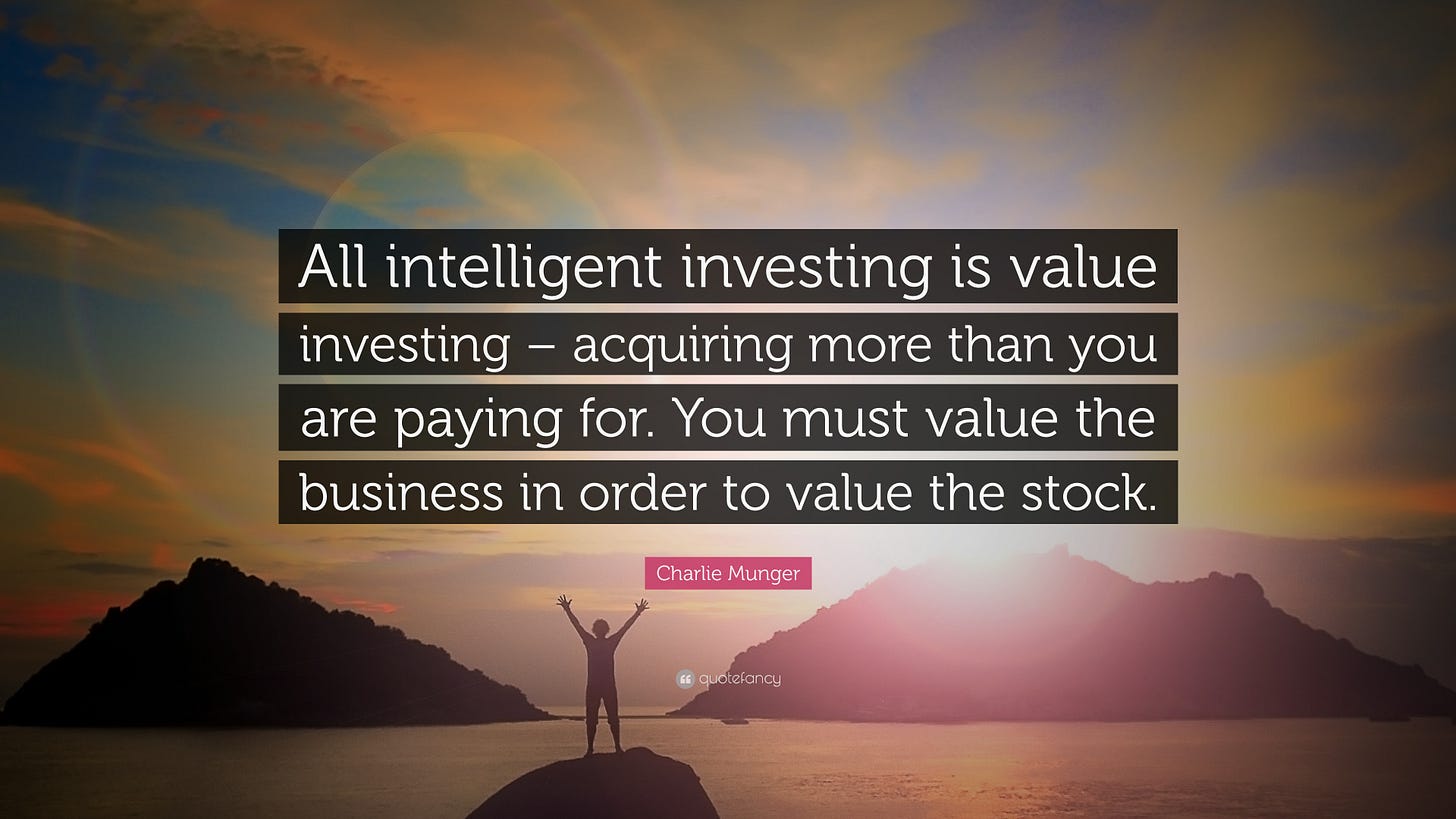

👉 is all this Value, Growth, GARP confusing or not worth thinking about? Then simply take Charlie Munger’s mighty & simple approach which I definitely like a lot:

“All intelligent investing is value investing - acquiring more than you are paying for. You must value the business in order to value the stock.”

That is like the common denominator of all investing ways and approaches! It will never get old, it will never get out of fashion or trend … it will simply be there forever!

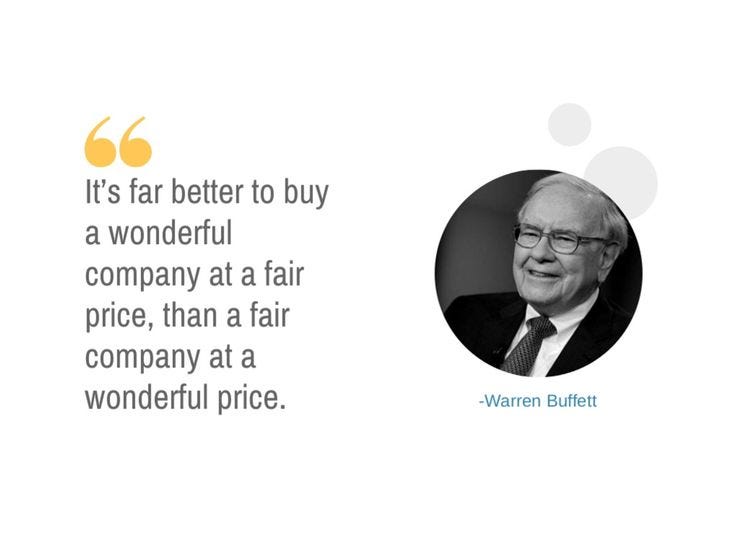

Buffett complementary on that one: "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

What are your thoughts? What is your approach? Just comment …

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this special report? Found it interesting, saving you time and getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons! That’ll definitely support bringing in more & more independent investment research: from a single individual … not a bank, fund, click-baity media company or so … !

Have a great weekend!

Mav 👋 🤝

great new series, cheers!

Danke Mav!