✍️ Maverick Macro Charts of the Week #15: U.S. Neutral Interest Rate, Switzerland Economic & Consumer Sentiment, France VS Greece aka 'Long FETA Short BaguETTA' 😉

Maverick Charts that say 10,000 words

Dear all,

7 cherry picked Maverick Charts of the week say 10,000 words or more = the ‘How’!

Table of contents = the ‘What’:

📊 Maverick Charts: U.S. Neutral Interest Rate (R-Star), Fed Funds Rate (FFR), Fed Funds Futures, Switzerland Economic & Consumer Sentiment, France VS Greece aka 'Long FETA Short BaguETTA'

📊 Bonus: G10 & Global Central Banks in Action

✍️ Incoming Maverick-esque research: +195,000 views for a key Maverick tweet

Objective: both data-driven insights + valuable food for thought = the ‘Why’!

📊 Maverick Charts 📊

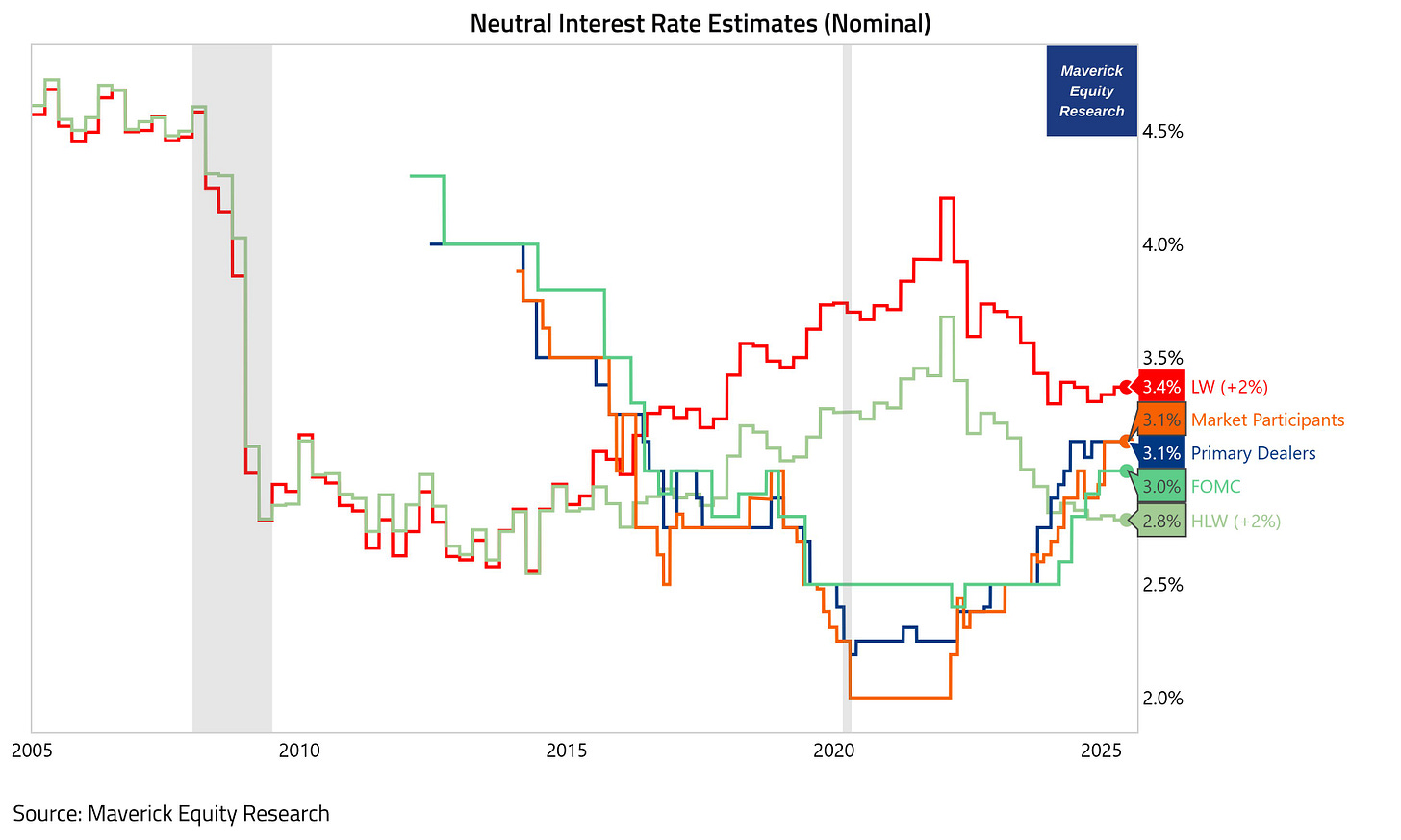

One key question in Macro is ‘What is the Neutral Interest Rate’ for the U.S. economy?

Before you get the answer as a best estimate via a typical Maverick Chart that says 10,000 words, a refresher/intro:

👉 also called the long-run equilibrium interest rate, the natural rate & to insiders, r-star or r* = in plain English, it is the interest rate that neither stimulates nor restricts economic growth, maintaining stable inflation (at target) and full employment

👉 this rate is not directly observable, it changes over time due to structural factors (demographics, productivity, global savings/investment trends, risk preferences), and is best estimated using various models, economic indicators & surveys

And now a very rare Maverick chart you see elsewhere with the answer/estimates:

👉 3% FOMC (green) - Longer Run Summary of Economic Projections for the Fed Funds Rate, Median

👉 3.1% Primary Dealers (blue) - Survey of Primary Dealers: Longer Run Target Federal Funds Rate

👉 3.1% Market Participants (orange) - Survey of Market Participants: Longer Run Target Federal Funds Rate

👉 3.4% LW +2 (red) - Laubach-Williams U.S. Natural Rate (R-Star) plus 2

👉 2.8% HLW +2 (light green) - Holston-Laubach-William Natural Rate (R-Star) plus 2

‘What about the practical takeaways for us investors Mav? Will you update this in the future?’

There you go with Maverick’s net takeaway & guidance:

👉 3% is the Neutral Interest Rate 'mas o menos' - see this rate as a gravitational force, a benchmark or a reference point for the FED doing & guiding monetary policy

👉 note the 2015-2018 high convergence, after Covid a high dispersion, lately converging again - when/if they diverge again, I would use the median of the five as a quick rule of thumb - further inspection of the macro & measures could tilt the view

👉 connecting Macro to Equities which is the main purpose of this: very important not just for policy makers, but also for equity & bond investors - recall Buffett’s take: ‘everything in valuation gets back to interest rates, interest rates are 'gravity' on stock prices’, basically the discount rate, hurdle rate, the cost of capital in pricing and valuation

👉 aggregating these key 5 estimates is a gauge for interest rates, understand why & how they went higher/lower across time, and couple current and future inferences for cost of capital and valuation purposes ... and intellectual food for thought … enjoy!

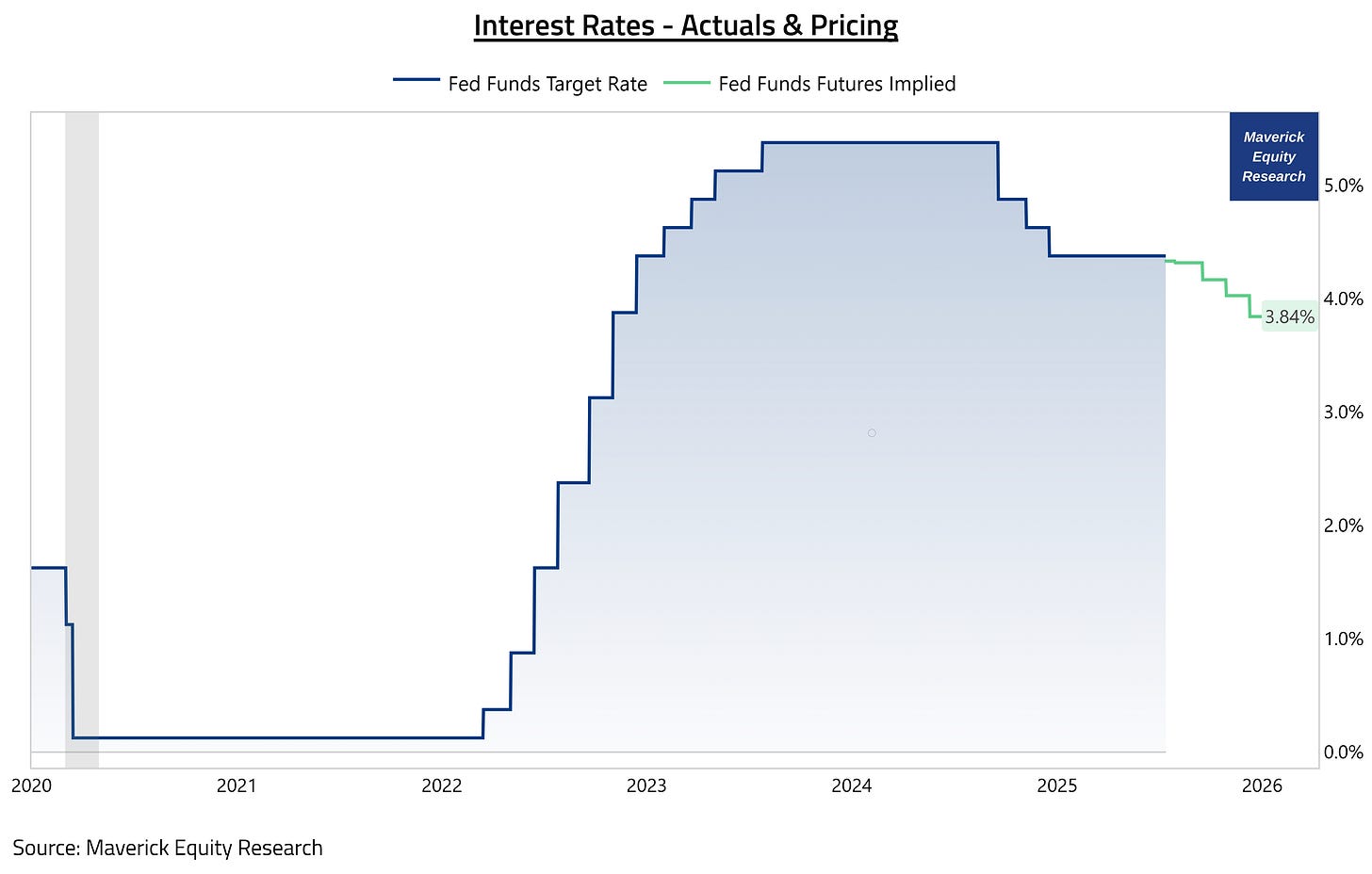

2. The Neutral Interest Rate (R-Star) & the Federal Funds Rate (FFR) + Rates Pricing:

👉 the FED’s current target range for the Federal Funds Rate (FFR) is 4.25% to 4.50% - the Effective Federal Funds Rate (EFFR) which is the actual rate at which banks lend to each other overnight) is around 4.33%

👉 given that all the 5 estimates around 3% for the Neutral Interest Rate (R-Star) are BELOW the 4.33% Effective Federal Funds Rate (EFFR), we can say that the current monetary policy is in restrictive territory - a big reason is to really anchor inflation expectations for the future so that is goes back to target, 2% on average over time

👉 going forward, Fed Funds Futures (green) implies a 3.84% rate for the end of 2025 (2 rates cuts), hence direction is lower - towards the 3% Neutral Interest Rate (R-Star)

All in all, from the past & actual estimates of the Neutral Interest Rate (R-Star) to the past, actual & future implied values of the Federal Funds Rate (FFR), we connected the dots via a round trip in a short amount of space/text and just Maverick 2 visuals!

Going forward, I will update these 2 key charts in the future Macro-Equities reports, especially in the reports covering the State of the U.S. Economy and the S&P 500.

✍️ The State of the U.S. Economy in 75 Charts

✍️ S&P 500 Report: Valuation, Fundamentals & Special Metrics

From U.S. interest rates, to Switzerland Economic & Consumer Sentiment given that U.S. + Switzerland are my main Macro focus! Growth & Safety/Safe Haven for the long term balanced and diversified win (equities I’ll cover also outside these two countries)!

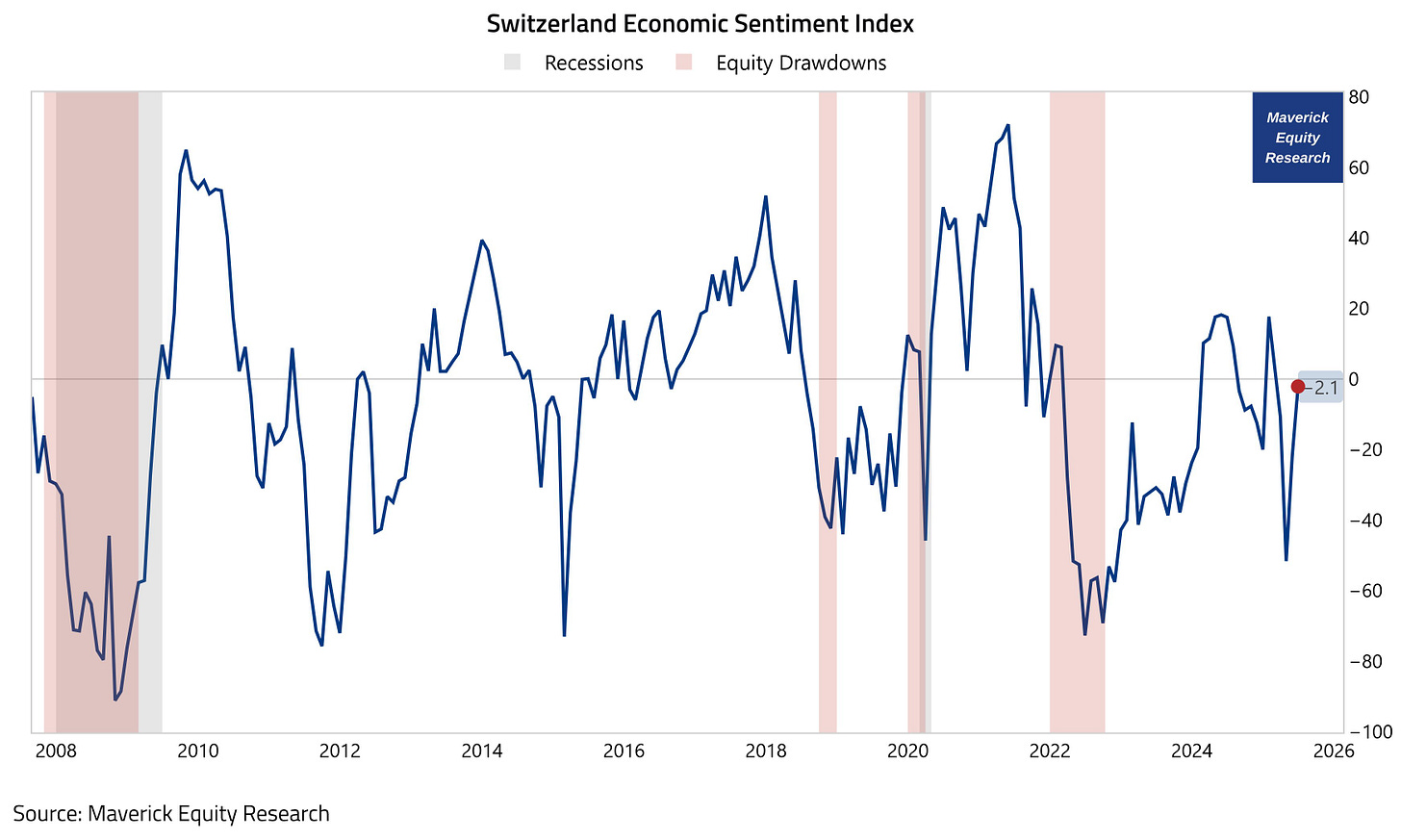

Switzerland Economic Sentiment with recessions and equity drawdowns shaded:

👉 a major rebound from -51 to -2.1, almost back into positive territory

Maverick’s takeaway:

👉 2022 bear market (red shaded) made it for a crazy -72.7 reading, worse than 2020 Covid times and not far from 2008 GFC times - hence, overcooked it badly this time around - staying calm and seeing it as a buying opportunity was again the key

👉 rather a contrarian indicator - the more negative it gets, the more likely the local bottom is around the corner, hence cheaper times to buy the same quality companies or the juicy & long-awaited from the buy & wish list

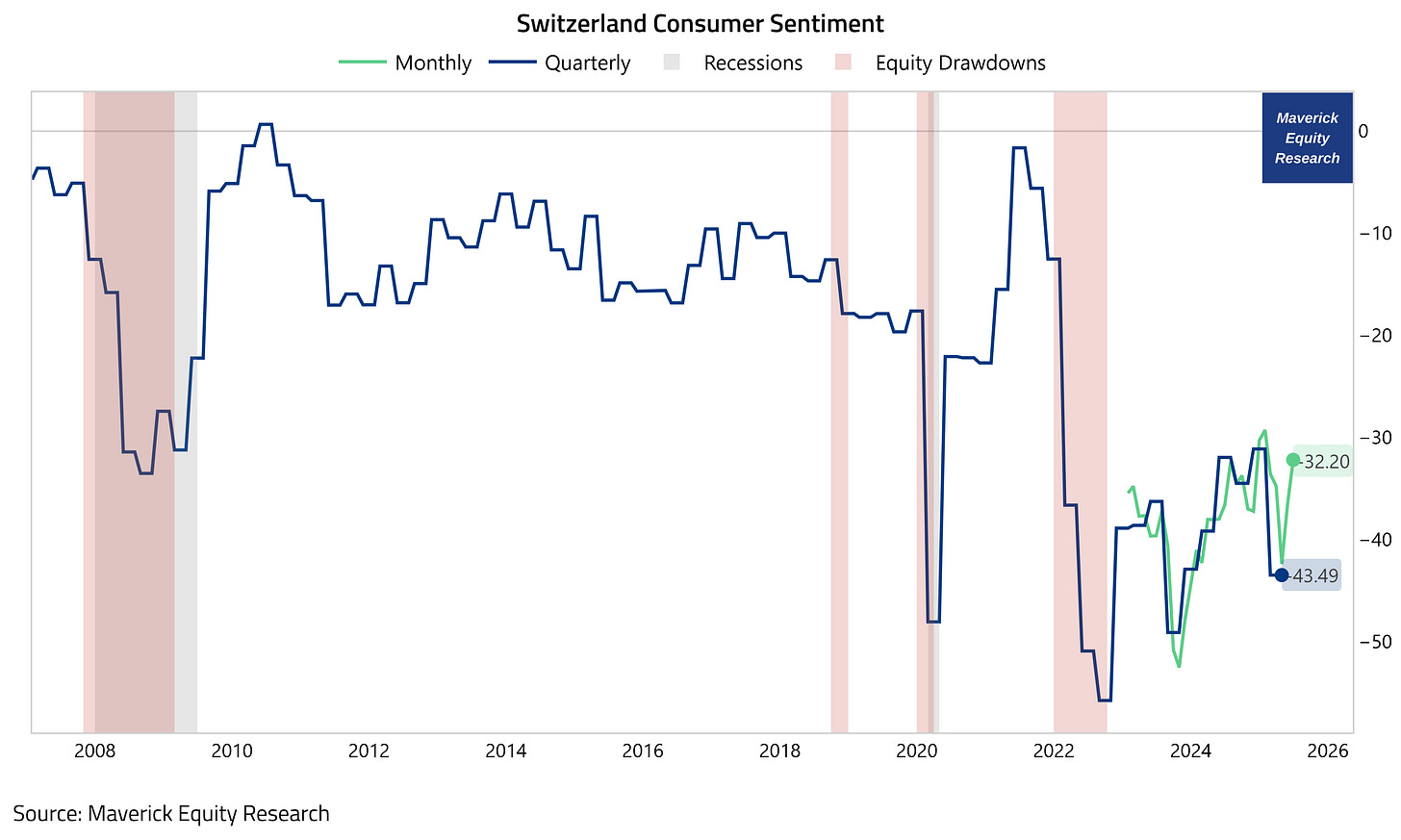

Switzerland Consumer Sentiment, quarterly and monthly values:

👉 monthly values (green) also rebounding from -42 to -32

👉 quarterly values (blue) shall follow also in terms of an improving trend

Maverick’s takeaway:

👉 2022 bear market (red shaded) made it for a crazy -57.7 reading, worse than 2020 Covid times and even more worse than 2008 GFC times - hence, overcooked it badly this time around - staying calm & seeing it as a buying opportunity was again the key

👉 rather a contrarian indicator - the more negative it gets, the more likely the local bottom is around the corner, hence cheaper times to buy the same quality companies or the juicy & long-awaited from the buy & wish list

P.S. I will cover the Swiss economy also in the future, Swiss single stocks included!

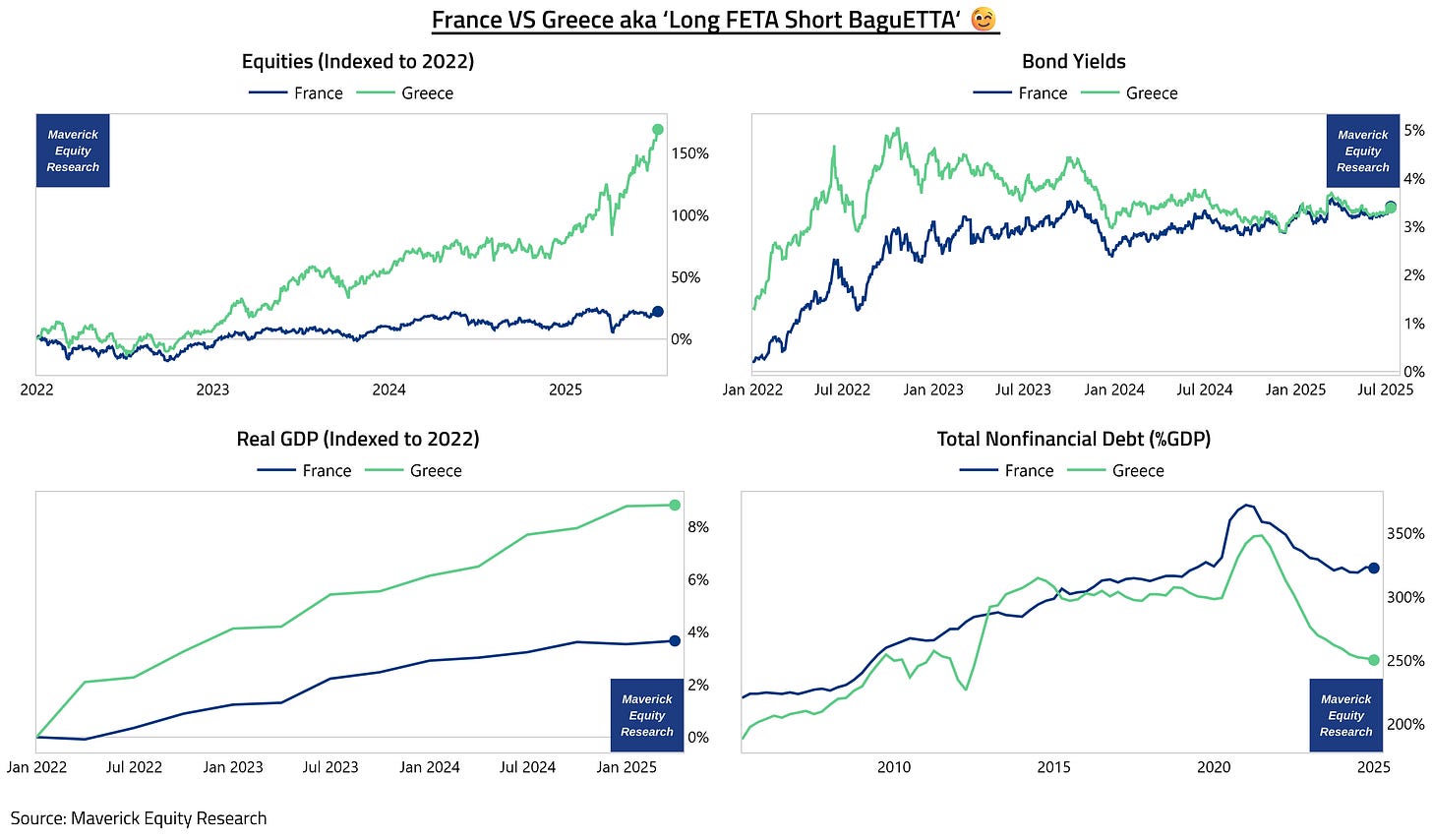

France VS Greece aka 'Long FETA Short BaguETTA' 😉 via 4 Maverick Charts in one single panel! Greece with a phenomenal rebound since 2022:

👉 Stocks: Greece outperforming France big time: 147% spread!

👉 Real GDP: Greece outperforming France big time: expanded by 8.8% vs. 3.7%

👉 Total Non-Financial Debt (%GDP): in Greece is now 72% lower than France, sleek!

👉 Bond yields (borrowing costs): Greece not just converged, but the 10-year Greek bond yield traded tighter & tighter & is now LOWER than the French: 3.39% vs 3.42% - recall the Eurozone Sovereign Debt crisis aka ‘PIIGS’ times - impressive turnaround!

📊 Bonus: G10 & Global Central Banks in Action 📊

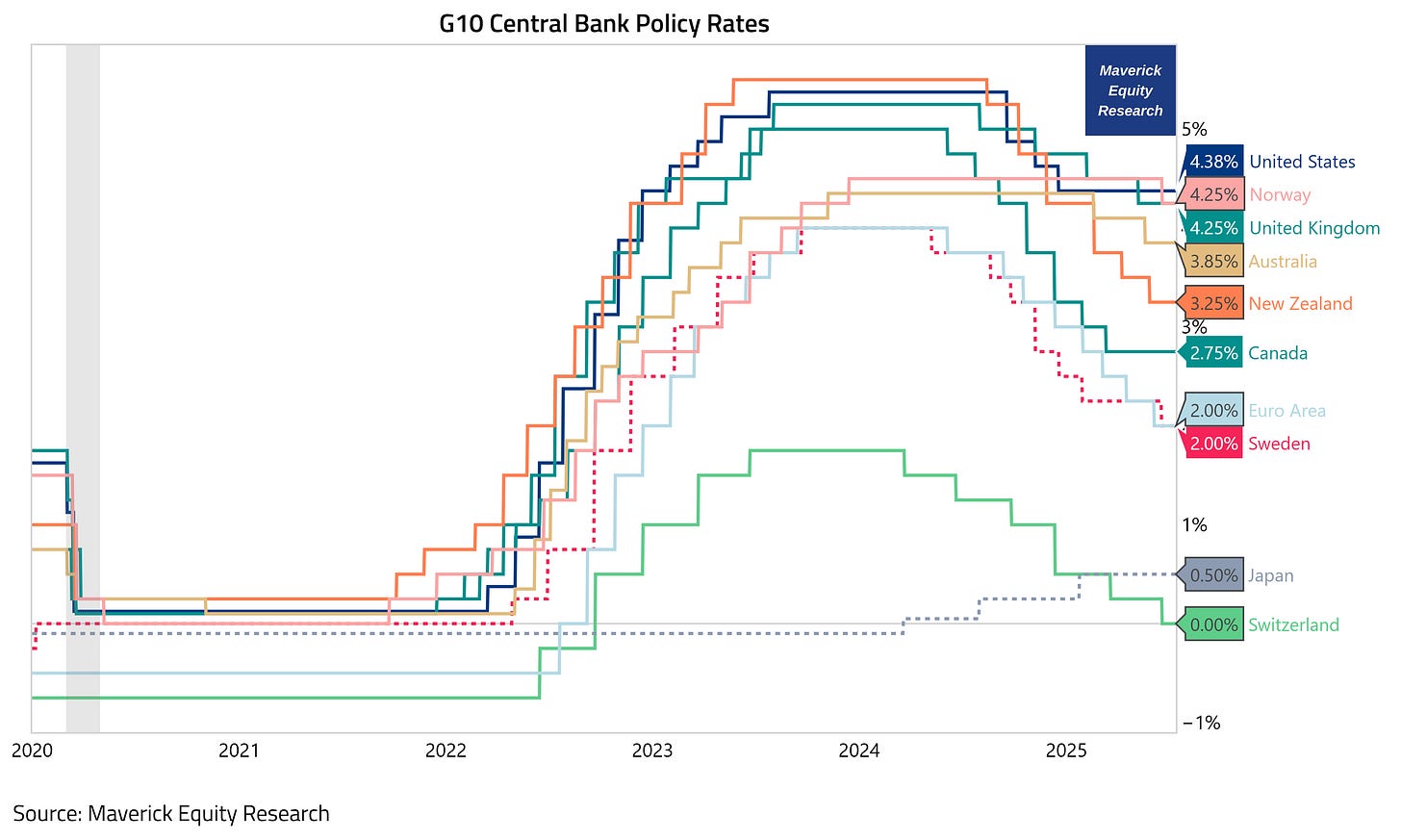

G10 Central Banks, latest action:

👉 FED remained on hold at 4.25%–4.5%

👉 ECB also on hold at 2%

👉 SNB (Swiss National Bank) cut rate by 25 bps to 0% as expected

👉 Norges Bank cut rate by 25 bps to 4.25%, defying expectations for a hold

👉 BOE (Bank of England) kept rates unchanged at 4.25%

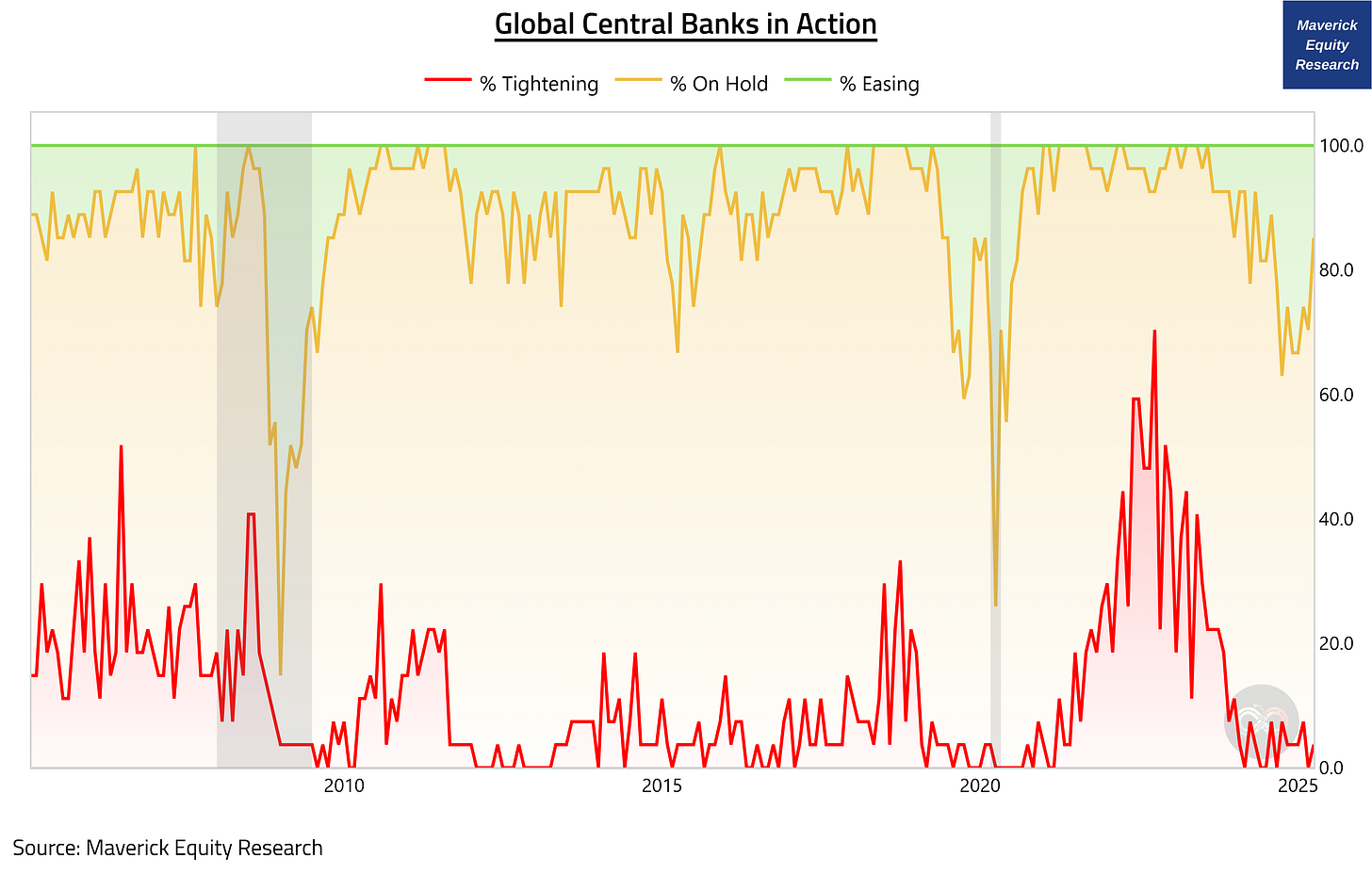

Global Central Banks:

👉 during 2020 Covid 74% of central banks were easing ultra fast as the global economy was more or less on a halt - during 2008 Lehman/GFC, 85% were easing

👉 after peaking in 2022 with an unprecedented 70% of central banks tightening to curb inflation (basically, a global phenomenon this time around), nowadays most central banks are on hold (81.5%) & some are easing (14.8%) as inflation is cooling off

N.B. when I say inflation is cooling off I refer to the growth rate, not the price level: way more on that in my future dedicated Inflation reports as it drives interest rates

✍️ Incoming Maverick-esque research: +195,000 views for a key Maverick tweet ✍️

What is coming next through the independent investment & economic research here? What’s next for you? Many drafts are work in progress - the next one is a key one!

✍️ Why Independent Investment and Economic Research = Paramount Nowadays!

common sense is mostly common, sometimes not so common - what I am confident to say is that conflicts of interest are too common, hence independent investment and economic research for the win!

+195,000 views for this Maverick tweet which was quoted/commented also by the legendary Nassim Taleb … so great from his side and I thank him a lot!

'If something is nonsense, you say it and say it loud. You will be harmed a little but will be antifragile — in the long run people who need to trust you will trust you.'

Nassim Nicholas Taleb: Commencement Address, American University in Beirut

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this by finding it interesting, saving you time and getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons! That’ll definitely support bringing in more & more independent investment research: from a single individual … not a corporate, bank, fund, click-baity media or so … !

Like this, the big positive externalities become the name of the game!

Have a great day! And never forget, keep compounding: family, friends, hobbies, community, work, independence, capital, knowledge, research and mindset!

With respect,

Mav 👋 🤝

Thank you again and again..

Thank you !