✍️ Maverick Special Report #5: Disconnected - Economic Policy Uncertainty & Corporate Bonds Spread (IG & HY)

What to watch during this volatile period? A key metric & Maverick chart = 10,000 words!

Dear all,

first of all, 15,000 subscribers milestone reached after 2.5 years of ad-free & paywall free independent investment research delivered to 164 countries and 50 U.S. states!

Way more incoming from my side, though one thing at a time, research and quality are very time and data intensive. Quite some drafts are currently work in progress …!

Table of contents:

📊 Economic Policy Uncertainty & Corporate Bonds Spread: not kissing anymore!

📊 Why is Trump so fast pausing and entering into negotiations? ‘Bond Vigilantes’!

📊 Maverick takeaways: trade war affairs + zooming out & mindset overall

👍 Bonus charts: Bloomberg Trade Uncertainty + Google ‘Recession’ trends

🤓 Quiz: what was Apple’s FCF yield when Buffett started to buy in Q1 2016?

📊 Economic Policy Uncertainty & Corporate Bonds Spread: not kissing anymore!

5th edition of from the Maverick Special Report series aims to disconnect, zoom out and get a birds eye view on the current ‘trade war’ circus and fiasco (or however we can call it) mixed with social media on steroids full of clickbait for advertising money.

With a cool head as always, one key question is: what is a very relevant, fast and easy framework to look at the current debacle without having to go down the rabbit hole?

Not easy at all to cover those 3 key features in the same time without a very long essay. Nonetheless and as pretty much always, the solution is through a few or some more Maverick-esque sleek charts that simply say 10,000 words!

Inverted spoiler alert 1st: nope, I’m not looking at the latest tariff headlines, nor the S&P 500, Nasdaq-100, Dow Jones, nor the VIX, China, EU, gold, inflation, or bitcoin!

It is the bond market, the ‘bond vigilantes’ baby! And now, let’s get visual for that!

Disconnected: U.S. Economic Policy Uncertainty (EPU): Daily News Index (blue) & U.S. Investment Grade (IG) Corporate Bonds Spread (green), Recessions (grey): this 1st chart highlights a historical correlation between economic policy uncertainty and bond spreads, with synchronized peaks during financial crises and volatile periods

‘But Mav, the current period shows a huge disconnect between the 2, what the heck bro’? Yes:

👉 Policy Uncertainty ≠ Policy Outcome (more likely = quite a circus or silly show)

after Trump won the 2nd presidential term on November 5th 2024, the EPU index started to rise given the new proposals, anticipated changes and headlines about fiscal shifts and tariffs (a hot topic also during Trump’s 2016-2020 1st term), and climaxed recently with the April 2nd Tariff/Liberation debacle

the EPU went from a 82 low to a bonkers 558 and now at 543, lately going down: a big part of the spike upwards was also done given the way news ‘work’ in a social media on steroids kind of way: chasing controversy, making controversy also where there is not much the case, over-exaggerating almost everything

policy real outcomes are not clear at all as Trump backpedalled lately, paused, entered negotiations, then again with the typical verbal rhetoric, back & forth …

👉 IG spreads did react from the 77 (basis points) low to 121 and currently at 114 = a jump, but by far major, and lately went actually down (note also: it went up from the lowest level in more than 20 years, arguably it was ‘too’ low anyway)

👉 Corporate Fundamentals: corporate balance sheets are still strong and a lot of the refinancing activity happened especially in 2024, hence low current credit risk overall

👉 Liquidity and Central Bank policies: 100 bps of Fed rate cuts happened in 2024 and overall ample liquidity which suppress risk premiums even as uncertainty rises

Disconnected: U.S. Economic Policy Uncertainty (EPU): Daily News Index (blue) & U.S. High Yield (HY) Corporate Bonds Spread (green), Recessions (grey): this 2nd chart has the same logic with the 1st one, just looking here at the naturally more sensible & responsive high-yield (HY) corporate bonds spread

👉 HY spreads did react from the 259 (basis points) low to 461 and currently at 409 = a jump, but by far major, and lately went actually down (note also: it went up from the lowest level in more than 20 years, arguably it was ‘too’ low anyway)

👉 Corporate Fundamentals: same message as before, with the key note that the refinancing in 2024 were done in particular from the high-yield (HY) corporate issuers, which makes for a lower current credit risk overall

Overall, the historical pattern VS the current environment:

Normal cycle: rising EPU → higher risk premiums → wider spreads

2025 outlier: EPU spike did not cause similar spreads widening due to solid fundamentals, liquidity and huge ambiguity - how much is it real and how much in some ways a show given that we are just 7% down (S&P 500) from the 2nd of April Trump Liberation/Tariff day

📊 Why is Trump so fast pausing and entering into negotiations? ‘Bond Vigilantes’!

I mentioned above that Trump backpedalled lately, paused, entered negotiations, and now even blaming the FED for not cutting rates … why did he backpedal so quickly after the mighty 2nd of April ‘Liberation/Tariff day’ which was just 2 weeks ago?

Before the rationale, recall my April 5th tweet which was exactly the playbook that happened right after: negotiations, kick the can down the road, blame the FED …

Yes, the stock market, other nations response & other variables, but mainly again the bond market, the ‘bond vigilantes’ baby! Let’s get visual also for that!

👉 especially the longer 10-year and 30-year U.S. government bond yields reacted higher, and they do carry a big stick - the ‘bond vigilantes’ were on and they showed the stick clearly to the U.S. government and their tariff war implementation

Stock market in action - let’s get visual also for that!

👉 S&P 500 (blue), Nasdaq-100 (orange) and the Dow Jones all went down materially after the 2nd of April ‘Liberation/Tariff day’ … and volatility got very high and still is!

Fun and key fact from my side: on balance, the bond market is smarter than the stock market - yes, I admit that easily despite as the name says my focus is on equities, hence I’m looking many times at the bond market!

Overall, Trump going deeper now into the negotiations route is a positive aspect! Were all these threats & decisions on trade policy needed just to be able to negotiate? I highly doubt so, U.S. is the U.S. and they could have entered negotiations (even with the upper hand) without creating a mess (a big one, but not a very big one for now) in both the financial markets & the real economy.

📊 Maverick takeaways: trade war affairs + zooming out & mindset overall

Maverick current state of the trade war affairs takeaway in simple words:

👉 the name of the game & bonds pricing is heavily denoted by a "wait-and-see" approach to real trade policy outcomes, and the real effects down the road

👉 does it mean everything is fine and we are coasting smoothly forward? No! Is volatility here to stay? Very likely yes, and for the next months or even entire year

👉 though despite the news headlines, both current stability and expected stability (via bonds spreads, chart 1 & 2) is present and the base case scenario

👉 I give credit and put trust into the bond market than any media coverage out there

👉 in other words, until bond spreads (green line, chart 1 & 2) goes parabolic, there is no big drama or worry (except in the media space to chase views for ad money)!

Maverick takeaway via zooming out and mindset overall:

Issues were, are and will always be present! Being skeptical is great and needed, but one cannot invest, have a growth mindset, do serious research if always negative. So no bear-porn 24/7 here, no doom & gloom, no fear-mongering, no everything given a negative or controversial spin … stir the pot … .

And yes, overall, I am a realist-optimist! The way humanity and economies evolved exponentially especially in the last 100 years with the Industrial Revolution in the West, and as well the momentum behind the re-emergence of Asia is off the charts! (one day, I’ll do an extensive research piece exactly on this topic via Maverick charts!)

I don’t see us stopping here at all! Setbacks yes, but upwards & onwards for the win!

In case you missed the 2nd ‘Charts of the Week’ edition:

✍️ Maverick Charts of the Week #2: Charts Off the Charts ... Though Back to Breakeven!

👍 Bonus charts: Bloomberg Trade Uncertainty + Google ‘Recession’ trends

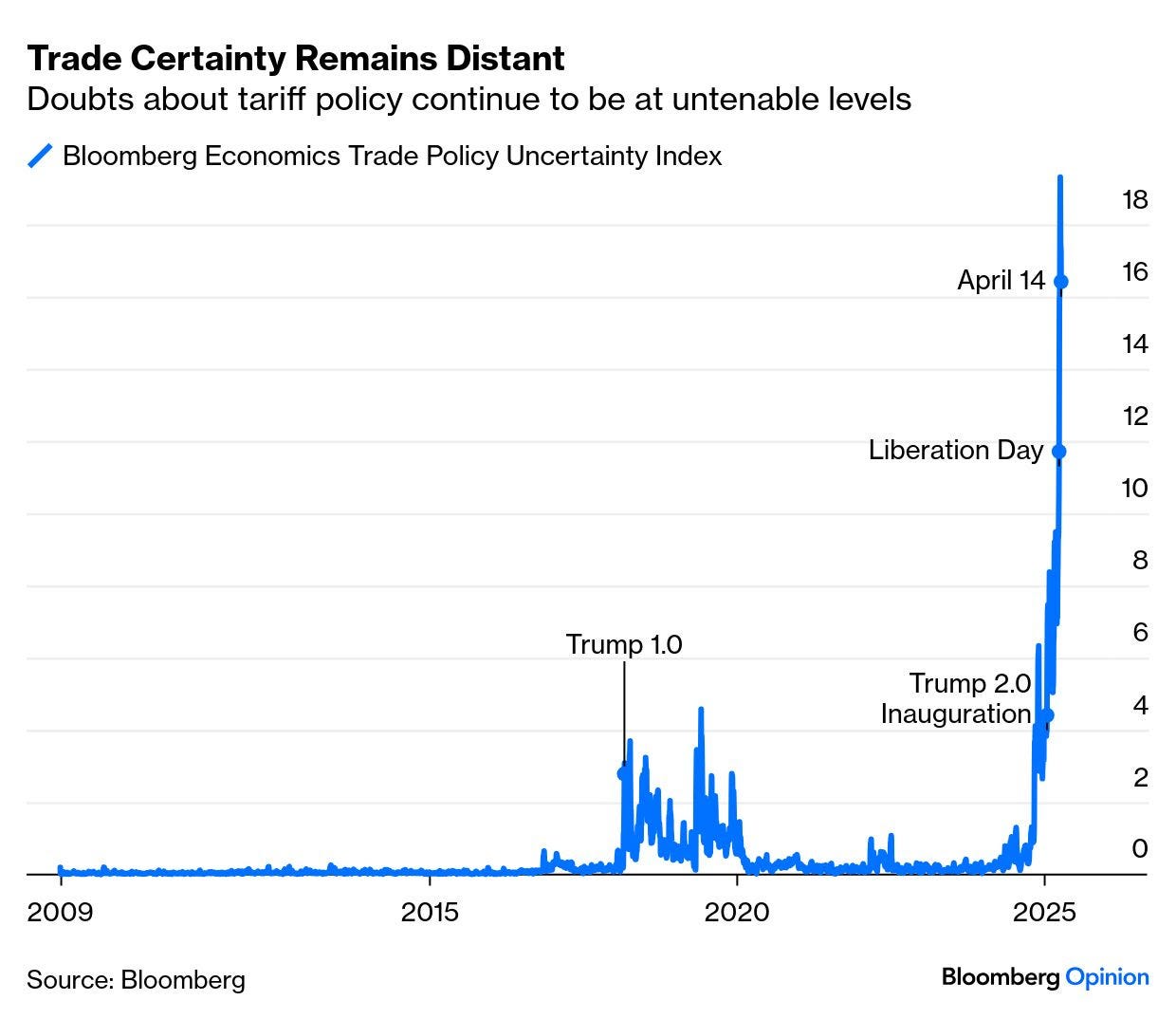

Bloomberg also has a great Trade Policy Uncertainty index

👉 while it dropped a bit recently like the EPU from above, trade certainty remains a very distant wish now, and like the EPU I see it not cooling off on the short-term

👉 I am subjective here, but I like my EPU and Bond spreads visual way more: it is more insightful as I can connect the dots from the trade uncertainty to the finance world via the bond market, and from there generate real insights and takeaways

U.S. 'Recession' via Google trends

👉 not far from 2020 Covid levels

👉 way lower than in 2022 - the most anticipated recession ever that never came ...

👉 higher than 2008 Lehman bankruptcy, but note the impact of the online space: social media algos, news and headlines way more nowadays than back then ...

Way more on the U.S. economy with a view on both the short and long-term via my dedicated report which is work in progress and coming with further improvements!

4th edition quick preview: current tariffs game is not fun, high stakes and they point to a combo of higher inflation + lower growth, hence a stagflation scenario.

you can read as reference the previous edition from June 2024:

✍️ The State of the US Economy in 75 Charts, Edition #3

👍 Quiz: what was Apple’s Free Cash Flow (FCF) yield when Buffett started to buy the stock in Q1 2016? (Free Cash Flow yield defined as FCF/Enterprise Value)

First of all, give it a mental guess! Secondly, give your best shot via my dedicated poll!

Third of all, vote & check the distribution of answers from my Sunday Twitter/X poll: you get a decent guess before I provide the answer & chart via my next research piece:

✍️ Maverick Special Report #6: Big Volatility & Drawdowns = Juicy Returns which will cover the practical aspects on how can uncertainty, volatility and drawdowns be seen not as a threat, but as an opportunity! Counterintuitive for some, but it works!

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this special report? Found it interesting, saving you time and getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons! That’ll definitely support bringing in more & more independent investment research: from a single individual … not a bank, fund, click-baity media or so … !

Like this, the big positive externalities become the name of the game! Thank you!

Have a great day! And never forget, keep compounding: family, friends, hobbies, community, work, capital, knowledge, research and mindset!

Mav 👋 🤝

“Compound interest is both the ultimate and biggest natural hedge!” Maverick Equity Research

Hello Maverick,

I hope this communique finds you in a moment of stillness. Have huge respect for your work.

We’ve just opened the first door of something we’ve been quietly crafting for years—

A work not meant for markets, but for reflection and memory.

Not designed to perform, but to endure.

It’s called The Silent Treasury.

A place where judgment is kept like firewood: dry, sacred, and meant for long winters.

Where trust, patience, and self-stewardship are treated as capital—more rare, perhaps, than liquidity itself.

This first piece speaks to a quiet truth we’ve long sat with:

Why many modern PE, VC, Hedge, Alt funds, SPAC, and rollups fracture before they truly root.

And what it means to build something meant to be left, not merely exited.

It’s not short. Or viral. But it’s built to last.

And if it speaks to something you’ve always known but rarely seen expressed,

then perhaps this work belongs in your world.

The publication link is enclosed, should you wish to open it.

https://helloin.substack.com/p/built-to-be-left?r=5i8pez

Warmly,

The Silent Treasury

A vault where wisdom echoes in stillness, and eternity breathes.

Policy Uncertainty brings more volatile to the treasury market(government confusion) instead of corporate fundamental. I think that is the reason IG bond spread and HY bond spread did not shot up.