✍️ Maverick Special Situation #6: 🪙 Gold Special Seasonality Pattern

100% win rate for the past 10 years, 2.79% average return for 2 weeks

Dear all,

the independent economic & investment research here is focused on the medium-long term as compound interest naturally works, and a clear focus that’ll never change!

Nonetheless, there is also a dedicated section for ‘Special Situations’ where actionable short-term, tactical, trading setups or cheap hedges (risk management) will be outlined occasionally when the ebbs and flows of the financial markets offer it to us, and my research finds them. Naturally, these are tailored for the more active investor and/or speculator/trader.

Special situations can arise from any corner of the financial markets: any asset class, sub-asset class and any geography, simply put, the world is our oyster!

Report structure:

📊 Identifying the asset and mechanism

📊 Show me the evidence, research and rationale Mav

📊 Summary and final thoughts

👍 Bonus: year-end price target

Delivery is in typical Maverick fashion, via data and charts that say 10,000 words!

📊 Identifying the asset and mechanism 📊

On this occasion, it is time for that shiny Gold from the commodities world that has been making many headlines in the last 2-3 years. Among other factors, due to the:

👉 unexpected and very high inflation

👉 very solid central banks demand

👉 Russia-Ukraine war in Europe which nobody foresaw, and also one that it could still last until today + Israel-Gaza conflict & other geopolitical risks / uncertainty

We identified the asset, what about the mechanism through which we have a special situation on it these days? That is via its seasonality pattern!

Specifically:

a long seasonal pattern in Gold (XAU/USD) starting tomorrow: from March 31st to April 13th (indirect alternatives: long calls options or long gold miners)

what is the win rate over a full decade? 100% win rate as it worked beautifully every single year. Goes without saying, this is very rare, especially for a decade

What about the generated returns? Average return 2.79% which is great given it is just 2 weeks

📊 Show me the evidence, research and rationale Mav 📊

As always, in an evidence-based Maverick-esque fashion, this is what the data says:

More rationale on top: seasonal patterns are primarily based on historical data, though it is important to research and understand why Gold has been consistently moving higher during this exact time window every single year for the last decade. We have a few key recurring fundamental factors that very likely contribute to this move around early April:

👉 Tax-related portfolio adjustments in the U.S.

👉 Gold buying ahead of Akshaya Tritiya in India

👉 Institutional repositioning after the end of Q1

What is one can say not favorable is that the starting point now is when Gold is at all-time highs, though on the other side:

high starting point like now happened before also, and an extra +2.79% would not be considered a big move which needs a big catalyst for the next 2 weeks

the media are running headlines with the all-time highs, especially as Gold crossed for the 1st time the magic round number of +$3,000

From a technical analysis (TA) point of view:

Gold keeps doing what it does best via the black boxes in the chart denoting: consolidate, break up, consolidate, break up … lately broke up nicely again …

also the 21-day moving average (blue dotted) continues to support

📊 Summary and final thoughts 📊

A seasonal setup with a 100% win rate over a full decade is very rare, hence it certainly is worth a closer look. Of course, no strategy is without risk, and past performance is never a guarantee of future results. However, for traders who systematically follow seasonal opportunities, this one deserves the spotlight.

To summarise it all, there you the bullet points:

💰 Gold (XAU/USD) = long decade seasonal pattern (indirect alternatives: long calls options or long gold miners)

📅 Period = March 31st - April 13th

📈 Win Rate (last 10 years) = 100%

💰 Average Return = +2.79%

Will we have it 11/11 this year as well, or this very interesting pattern will break? This will definitely be one to watch for the next 2 weeks! As always, special situations are all about improving the probability to be right, and how that fits ones style, risk tolerance, risk capacity and overall portfolio.

👍 Bonus: year-end price target 👍

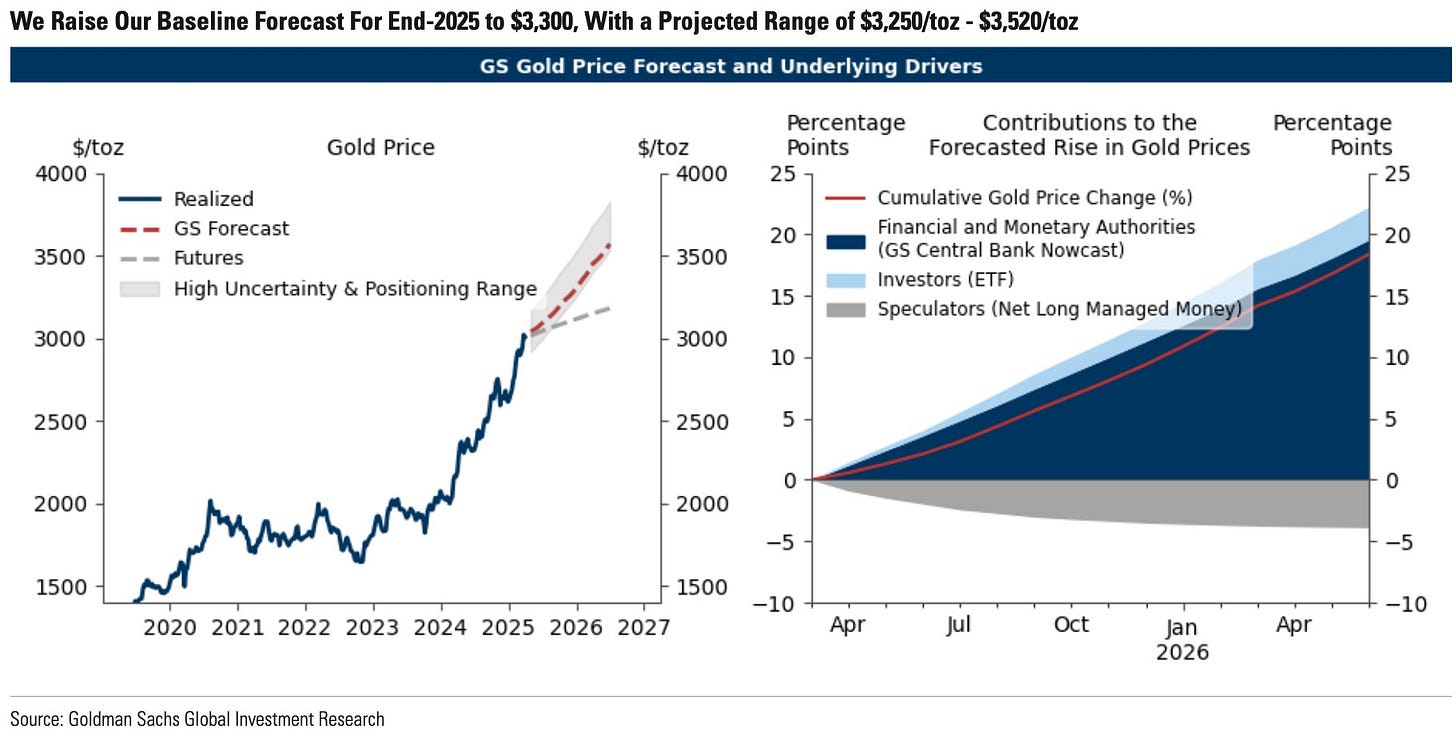

Breaking away from the very short-term seasonality pattern, what about the overall outlook for 2025? Via Goldman Sachs: "We raise our end-2025 forecast to $3,300/toz (vs. $3,100) and our forecast range to $3,250-3,520, reflecting upside surprises in ETF inflows and in continued strong central bank gold demand."

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this new format for one key insight? If yes, what would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons! That will boost bringing in way more independent economic & investment research!

Like this, the big positive externalities become the name of the game! Thank you!

Have a great weekend and next week! And never forget, keep compounding: family, friends, community, capital, knowledge, research and mindset!

Mav 👋 🤝

“Compound interest is both the ultimate and biggest natural hedge!” Maverick Equity Research

Super interesting, hmmm, will be a nice one to follow!

THX Mav!

Brilliant Mav, brilliant