✍️ Maverick Valuations #1 - Switzerland

Sleek visuals & analytics via Price & Valuation scatterplots … because they say 1,000 words ... and ... further food for thought ...

Dear all,

welcome to the 1st edition of the ‘Maverick Valuations’ report covering Switzerland.

This report is unique, hence quite ‘Maverick-esque’ as I tried to find it served by banks, overall media, or independent investment researchers like myself, but none. Therefore, I decided to create it myself and also plan to improve it going forward.

Report is NOT behind a paywall & there are no pesky ads here. It would only be highly appreciated you just spreading the word around to likely interested people.

Report structure:

📊 Swiss stocks = ‘Swissness’ 📊

🏦 Bonus Charts 🏦

What are the various likely use cases provided by this report & visual analytics? Research for market leaders & laggards, likely un/warranted cheap or expensive stocks, peers analysis, stock screener, outliers, positive or negative momentum, relative strength, full equity research on single stocks & general market assessment.

My favorite use cases:

finding future winners via further research

finding stocks that did well across past tough times, hence resilient winners … which are likely also going forward to be future winners

N.B. the Full Equity Research section will cover those in the future

Great to have at hand at least 8 times per year: before & after each of the 4 quarterly earnings. An overall yearly recap is also very interesting. Let’s see before Q1 2023 earnings are out & usefully compare going forward with the future editions. Check your stocks & also outliers in the scatterplots, it can get interesting & food for thought.

📊 Swiss stocks = ‘Swissness’ 📊

What’s inside? Let’s dive into the MSCI Switzerland ETF (EWL) which was created in 1996 & consists of 42 stocks. It invests in stocks operating across diversified sectors, market capitalizations (size) & both growth & value (style).

How? Via sleek visuals & analytics, namely price & valuation scatterplots because they say 1,000 words. Full names, tickers with sectors & industries to begin with:

Performance via the overall 5 year Total Return of EWL vs ACWI: EWL not only outperformed ACWI, but note as well how during the Covid crash it dropped less: EWL is 56.7% in Health Care & Consumer Staples which are defensive sectors.

Note: EWL has a 0.5% fee / year, hence on the medium-long term it can be a material dragger on the compound interest for investors vs buying the individual names.

Very interesting via a 20-year dividend overview, namely yield and payments:

current dividend yield is 1.82%, though note it went above even 5% during the 2007-2009 Global Financial Crisis & the 2012 EuroZone Sovereign debt crisis. Now given that defensive sectors dominate and also AAA rated Switzerland, during bad times locking in a 5% dividend yield is quite tempting to me

dividend payments not interrupted & increasing over time - during 2007-2009 more often payments to likely signal the market that this is a relative safe place

6 Maverick visuals in total now, 3 on price & 3 on valuation:

Price action views:

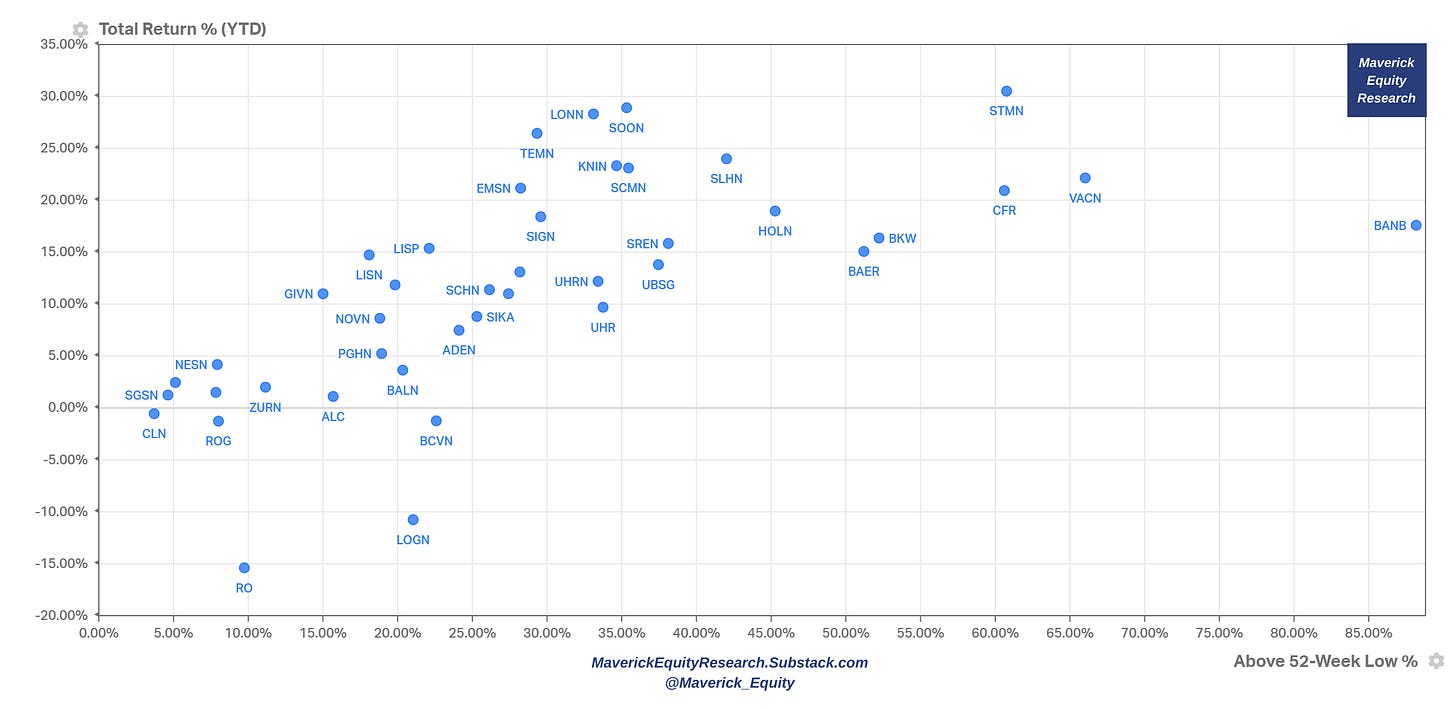

2023 YTD Winners & Rebounders from their 52-week low

2023 Total Returns & 2022 Total Returns to answer an interesting research question: which stocks were positive both in the 2022 bear market & up to today in 2023?

Here on recent performance returns, it is quite interesting at times to plot it like this: 1 year past returns with Earnings/EPS growth. Rationale? We want to spot companies with declined stock price, but still strong expected earnings growth

Valuation views via:

Sales/Revenue aka ‘Top-line’ view: P/S multiple & Revenue growth (next year estimates). Interpretation: Forward P/S multiple the stock is trading at for the given level of estimated Sales growth

Profitability aka ‘Bottom-line’ view: P/E multiple & Earnings/EPS growth (next year estimates). Interpretation: Forward P/E multiple the stock is trading at for the given level of estimated Earnings/EPS growth

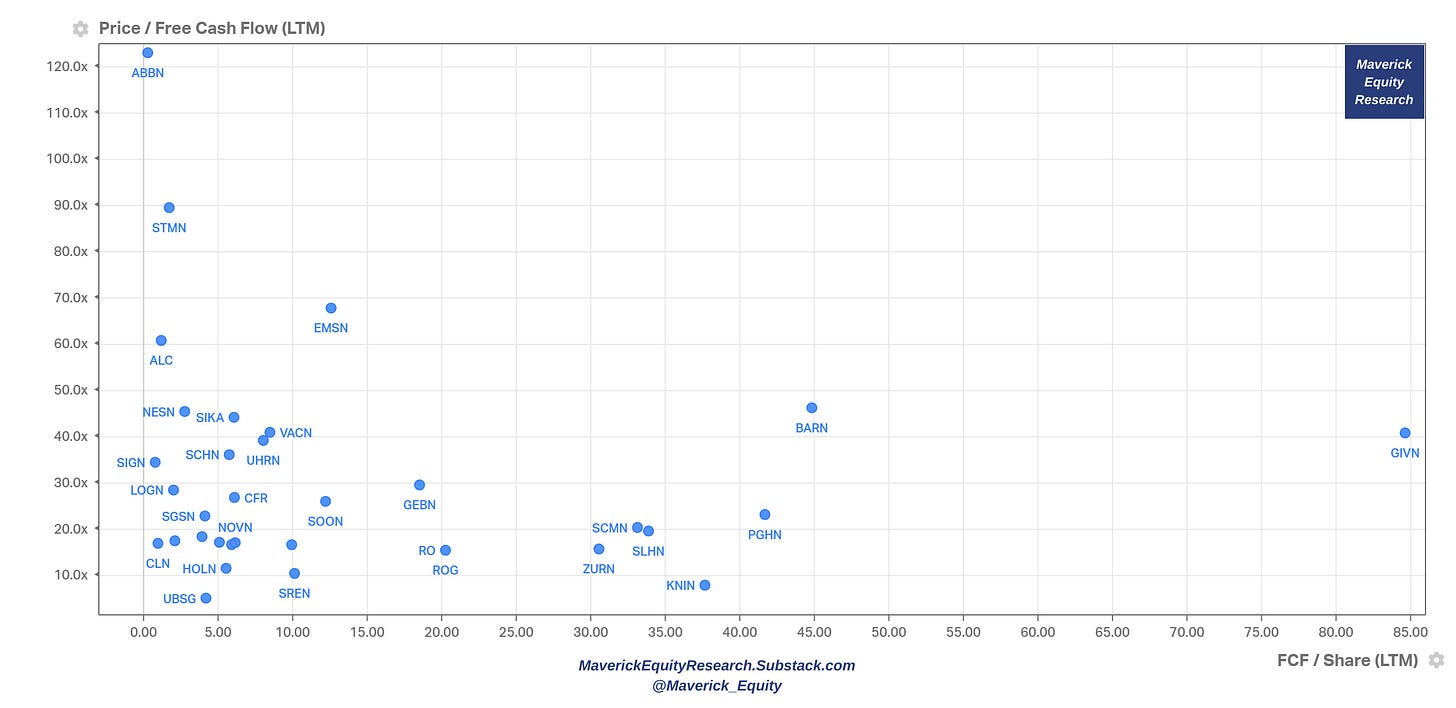

Free Cash flow aka ‘cash’ view: P/FCF multiple & FCF/Share (last twelve months). Interpretation: P/FCF multiple the stock is trading at for the given level of FCF/Share

🏦 Bonus Charts 🏦

Fun fact: Swiss National Bank stocks holdings overview as of YE 2022 = $139 billions market value & 2677 positions!

Some call it a mutual fund, some jokingly a hedge fund ... quite sure a big tech investor with a 26.9% weight: Apple, Microsoft, Amazon, Google, Nvidia … then Tesla, United Health, J&J, Exxon, P&G, Visa, Chevron, Tesla, HD

SNB does not ‘trade’ to be sure here about the jokes, it tracks +/- the MSCI USA index with a 80/20 allocation between bonds & stocks (algorithmically rebalanced)

Check how it changed since the middle of 2020, very interesting ... $118 billion market value back then while now $139 billion market value

I hope you enjoyed this research & it would be great to hear your feedback! Should you have found this interesting and valuable, just subscribe & share it around with likely interested people as well. Thank you!

Have a great day!

Maverick Equity Research

Thanks, great coverage! Every time something interesting & new! Cheers!

Nice, barely coverage on Swiss stuff … can you do more in the future ? Or at least continue this … thanks!