✍️ Maverick Valuations #1 - Themes & Trends: AI, EV, Battery, SaaS & Cloud, Cybersecurity, E-Commerce, Innovation, Infrastructure, Green Energy & Big Tech

Sleek visuals & analytics via Price & Valuation scatterplots … because they say 1,000 words ... and ... further food for thought ...

Dear all,

welcome to the 1st edition of the ‘Maverick Valuations’ report covering powerful Themes & Trends, namely: AI, EV, Battery, SaaS & Cloud, Cybersecurity, E-Commerce, Innovation, Infrastructure, Green Energy & Big Tech.

Why? Powerful forces set to shape our economies both vertically & horizontally. Additionally, thematic investing has 2 big potential advantages: industry expertise can make a big difference & portfolio diversifier via recurrent low correlations. What’s inside? Selected leading & emerging businesses. How? Via sleek visuals & analytics, namely price & valuation scatterplots … because they say 1,000 words.

This report is unique, hence quite ‘Maverick-esque’ as I tried to find it done & served somewhere else (comfy, no?), be it by banks, overall media, or independent investment researchers like myself. Therefore, I decided to create it and plan to improve it as we move forward. Was willing to pay for a good regular service straight to my inbox, yet none, but if you find similar somewhere, please let me know.

Report is NOT behind a paywall & there are no pesky ads here. It would only be highly appreciated if you just spread the word around to likely interested people.

Report structure = 10 major themes & trends:

📊 Artificial Intelligence ‘AI’: AI & Robotics + Semiconductors as AI Hardware 📊

📊 Electric Vehicles (EV) & Autonomous Driving 📊

📊 Lithium & Battery Technology 📊

📊 Software as a Service & Cloud Computing = ‘SaaS’ & ‘Cloud’ 📊

📊 Cybersecurity = ‘Cyber’ 📊

📊 E-Commerce = ‘online shopping’ 📊

📊 Disruptive Innovation = ‘Hyper Growth’ 📊

📊 Infrastructure = ‘CAPEX’ 📊

📊 Clean Energy = ‘Green’ 📊

📊 Big Tech = ‘FANGMAN’ 📊

What are the various likely use cases provided by this report & visual analytics? Research for market leaders & laggards, likely un/warranted cheap or expensive stocks, peers analysis, stock screener, outliers, positive or negative momentum, relative strength, full equity research on single stocks & general market assessment.

My favorite use cases:

finding future winners via further deep dives / full equity research

finding stocks that did well across past tough times, hence resilient winners … which are likely also going forward to be future winners

finding ‘Pick & Shovel’ businesses that span across industries with many use cases which can make tick 2 boxes in the same time: limited downside risk though still keeping good potential upside. Hint: check NVDA & others😉

Great to have at hand at least 8 times per year: before & after each of the 4 quarterly earnings. An overall yearly recap is also very interesting. Let’s see now after Q4 2022 earnings & usefully compare going forward with the future editions. Check your stocks & the outliers in the scatterplots, it can get interesting & food for thought.

Here we go with the 10 thematic trends that shall shape economies going forward.

📊 Artificial Intelligence ‘AI’: AI & Robotics + Semiconductors as AI Hardware 📊

Artificial Intelligence & Robotics = ‘AI’ & ‘ROBOS’

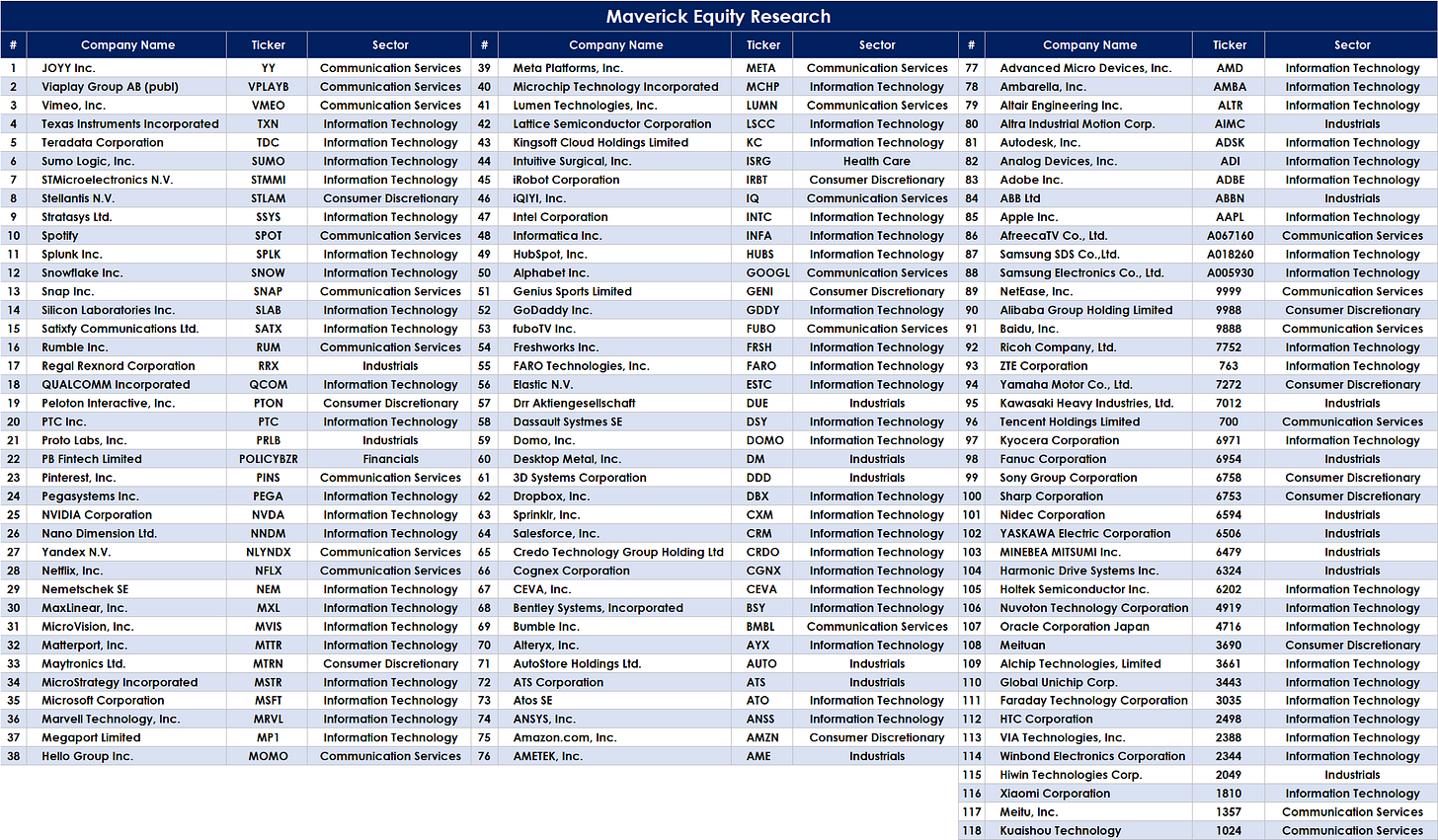

What’s inside? Global coverage via 118 businesses operating across AI software, robotics technologies, industrials, health care, consumer discretionary, software research & systems. Full names, tickers and sectors to begin with:

Price action view: 2023 YTD Winners & Rebounders from their 52-week low

Sales/Revenue aka ‘Top-line’ view: P/S multiple & Revenue growth (next year estimates). Interpretation: Forward P/S multiple the stock is trading at for the given level of estimated Sales growth

Profitability aka ‘Bottom-line’ view: P/E multiple & Earnings/EPS growth (next year estimates). Interpretation: Forward P/E multiple the stock is trading at for the given level of estimated Earnings/EPS growth

AI Hardware = Semiconductors

What’s inside? 30 businesses operating across semiconductors producers, equipment & information technology. Full names, tickers & sectors:

Price action view: 2023 YTD Winners & Rebounders from their 52-week low

Sales/Revenue aka ‘Top-line’ view: P/S multiple & Revenue growth (next year estimates). Interpretation: Forward P/S multiple the stock is trading at for the given level of estimated Sales growth

Profitability aka ‘Bottom-line’ view: P/E multiple & Earnings/EPS growth (next year estimates). Interpretation: Forward P/E multiple the stock is trading at for the given level of estimated Earnings/EPS growth

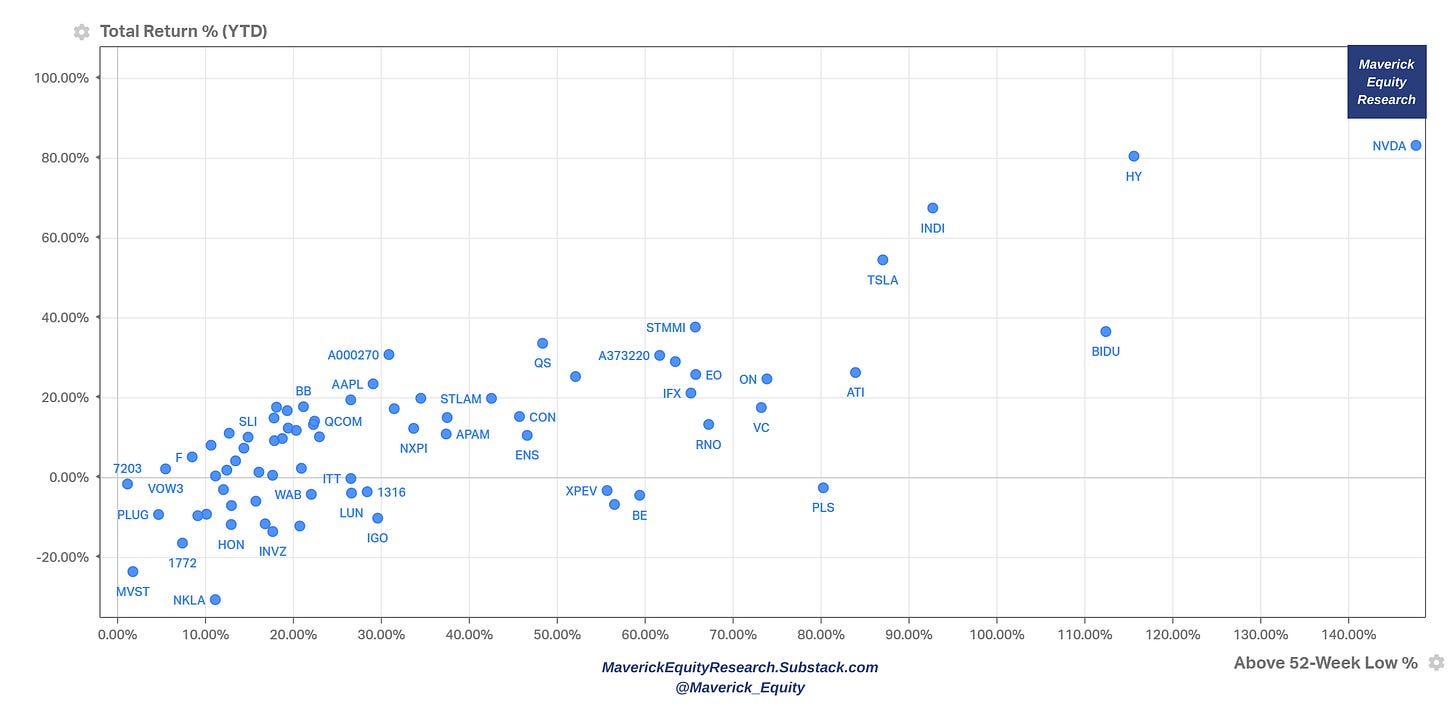

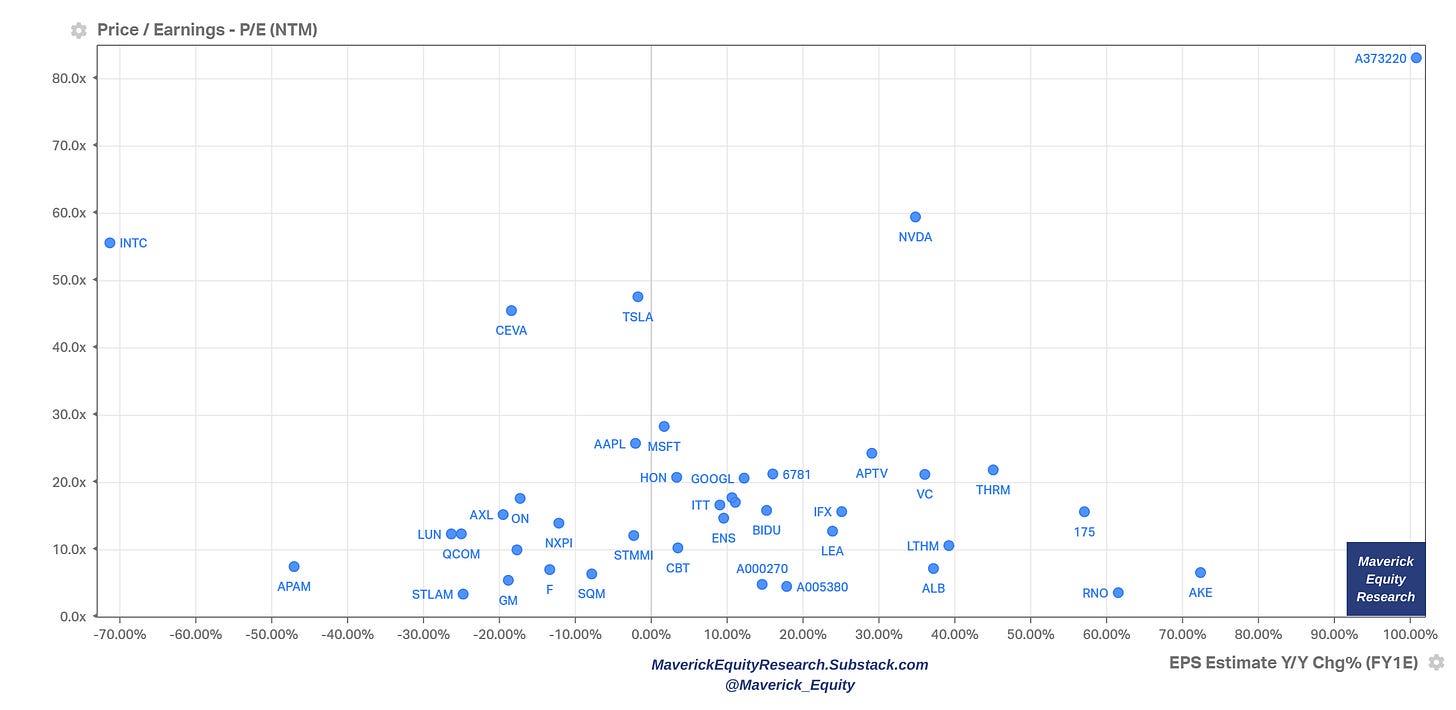

📊 Electric Vehicles (EV) & Autonomous Driving 📊

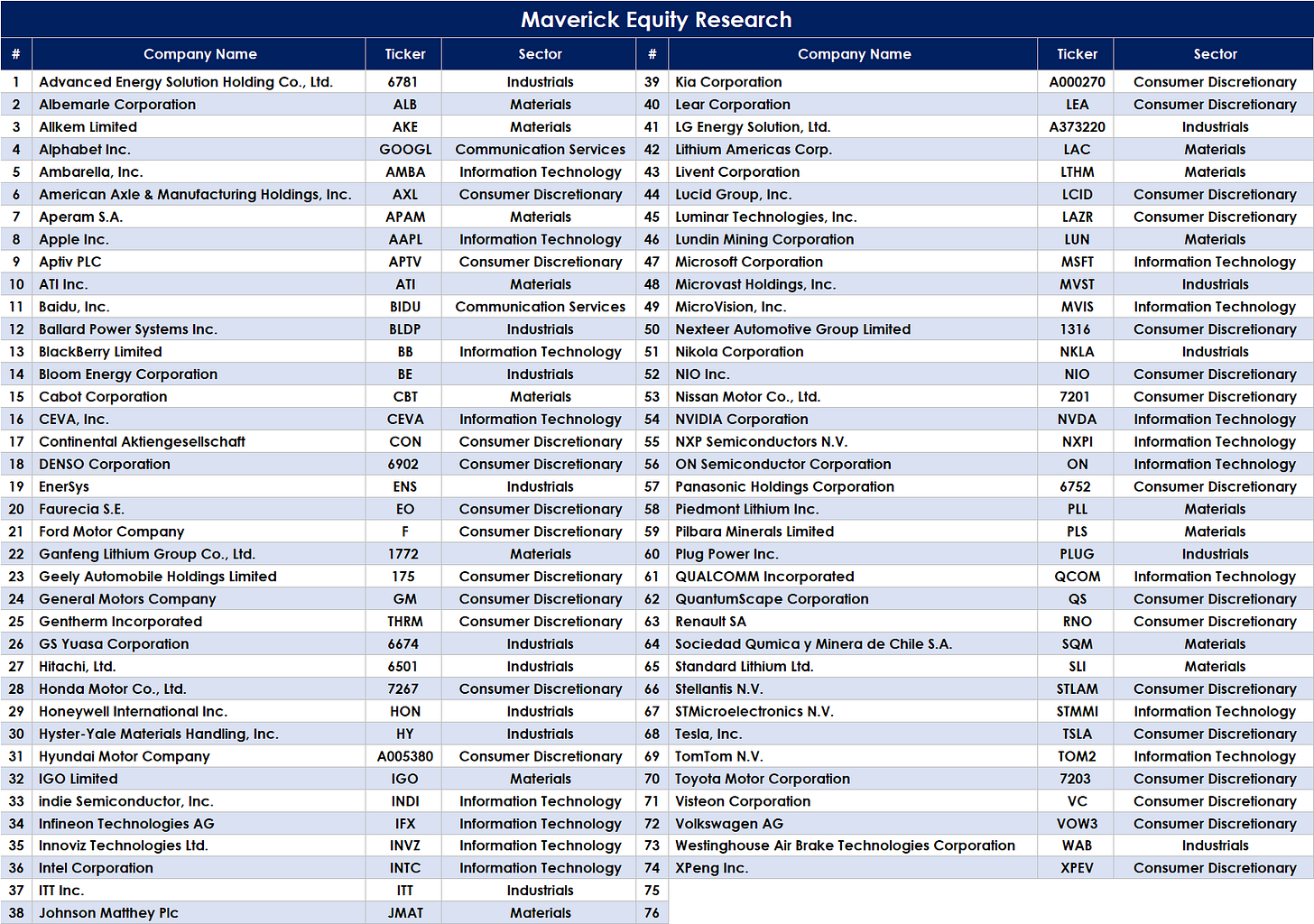

What’s inside? 74 companies operating across the development of electric vehicles and/or autonomous vehicles, including companies that produce electric/hybrid vehicles, components and materials, autonomous driving technology, and network connected services for transportation. Full names, tickers and sectors:

Price action view: 2023 YTD Winners & Rebounders from their 52-week low

Sales/Revenue aka ‘Top-line’ view: P/S multiple & Revenue growth (next year estimates). Interpretation: Forward P/S multiple the stock is trading at for the given level of estimated Sales growth

Profitability aka ‘Bottom-line’ view: P/E multiple & Earnings/EPS growth (next year estimates). Interpretation: Forward P/E multiple the stock is trading at for the given level of estimated Earnings/EPS growth

📊 Lithium & Battery Technology 📊

What’s inside? Global coverage via 99 businesses operating across development and production of lithium battery technologies and/or battery storage solutions, exploration, production, development, processing, and/or recycling of the materials and metals used in lithium-ion batteries such as Lithium, Cobalt, Nickel, Manganese, Vanadium and/or Graphite. Full names, tickers and sectors:

Price action view: 2023 YTD Winners & Rebounders from their 52-week low

Sales/Revenue aka ‘Top-line’ view: P/S multiple & Revenue growth (next year estimates). Interpretation: Forward P/S multiple the stock is trading at for the given level of estimated Sales growth

Profitability aka ‘Bottom-line’ view: P/E multiple & Earnings/EPS growth (next year estimates). Interpretation: Forward P/E multiple the stock is trading at for the given level of estimated Earnings/EPS growth

📊 Software as a Service & Cloud Computing = ‘SaaS’ & ‘Cloud’ 📊

What’s inside? Global coverage via 64 companies operating across software & services, IT services, internet services & infrastructure, data management & storage services, technology hardware and equipment, data storage & peripherals, companies that deliver a platform for the creation of software in the form of virtualization, middleware, and/or operating systems. Full names, tickers and sectors:

Price action view: 2023 YTD Winners & Rebounders from their 52-week low

Sales/Revenue aka ‘Top-line’ view: P/S multiple & Revenue growth (next year estimates). Interpretation: Forward P/S multiple the stock is trading at for the given level of estimated Sales growth

Profitability aka ‘Bottom-line’ view: P/E multiple & Earnings/EPS growth (next year estimates). Interpretation: Forward P/E multiple the stock is trading at for the given level of estimated Earnings/EPS growth

📊 Cybersecurity = ‘Cyber’ 📊

What’s inside? Global coverage via 51 companies operating across cyber security sectors and industries. Full names, tickers and sectors:

Price action view: 2023 YTD Winners & Rebounders from their 52-week low

Sales/Revenue aka ‘Top-line’ view: P/S multiple & Revenue growth (next year estimates). Interpretation: Forward P/S multiple the stock is trading at for the given level of estimated Sales growth

Profitability aka ‘Bottom-line’ view: P/E multiple & Earnings/EPS growth (next year estimates). Interpretation: Forward P/E multiple the stock is trading at for the given level of estimated Earnings/EPS growth

📊 E-Commerce = ‘online shopping’ 📊

What’s inside? Global coverage via 55 businesses operating across online retail sectors & industries. Full names, tickers and sectors:

Price action view: 2023 YTD Winners & Rebounders from their 52-week low

Sales/Revenue aka ‘Top-line’ view: P/S multiple & Revenue growth (next year estimates). Interpretation: Forward P/S multiple the stock is trading at for the given level of estimated Sales growth

Profitability aka ‘Bottom-line’ view: P/E multiple & Earnings/EPS growth (next year estimates). Interpretation: Forward P/E multiple the stock is trading at for the given level of estimated Earnings/EPS growth

📊 Disruptive Innovation = ‘Hyper Growth’ 📊

What’s inside? Global coverage via 27 companies operating in the disruptive innovation sectors, namely development of new products or services, technological improvements & advancements in scientific research relating to the areas of genomics, innovation in automation & manufacturing , transportation, energy, artificial intelligence & materials - the increased use cases of shared technology, infrastructure & services and technologies that make financial services more efficient. Full names, tickers and sectors:

Price action view: 2023 YTD Winners & Rebounders from their 52-week low

Sales/Revenue aka ‘Top-line’ view: P/S multiple & Revenue growth (next year estimates). Interpretation: Forward P/S multiple the stock is trading at for the given level of estimated Sales growth

Profitability aka ‘Bottom-line’ view: P/E multiple & Earnings/EPS growth (next year estimates). Interpretation: Forward P/E multiple the stock is trading at for the given level of estimated Earnings/EPS growth. Note: most are not profitable yet.

📊 Infrastructure = ‘CAPEX’ 📊

What’s inside? USA coverage via 154 businesses operating across materials, industrials, capital goods, construction and engineering, machinery, transportation, road & rail, railroads & utilities sectors. Full names, tickers and sectors:

Price action view: 2023 YTD Winners & Rebounders from their 52-week low

Sales/Revenue aka ‘Top-line’ view: P/S multiple & Revenue growth (next year estimates). Interpretation: Forward P/S multiple the stock is trading at for the given level of estimated Sales growth

Profitability aka ‘Bottom-line’ view: P/E multiple & Earnings/EPS growth (next year estimates). Interpretation: Forward P/E multiple the stock is trading at for the given level of estimated Earnings/EPS growth

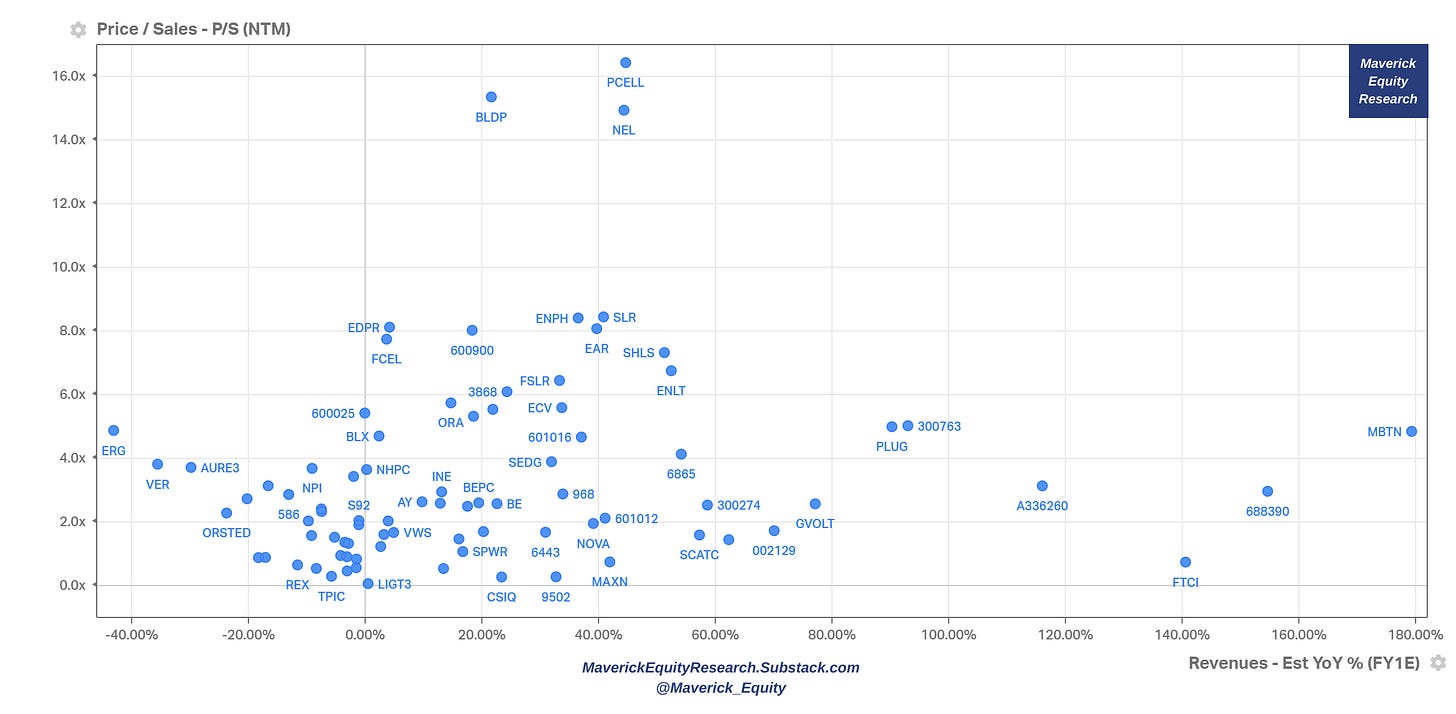

📊 Clean Energy = ‘Green’ 📊

What’s inside? Global coverage via 95 businesses operating across utilities, independent power & renewable electricity producers, renewable electricity, alternative energy resources, biofuels, electric power by solar energy, by wind energy, & hydroelectric power generation. Full names, tickers and sectors:

Price action view: 2023 YTD Winners & Rebounders from their 52-week low

Sales/Revenue aka ‘Top-line’ view: P/S multiple & Revenue growth (next year estimates). Interpretation: Forward P/S multiple the stock is trading at for the given level of estimated Sales growth

Profitability aka ‘Bottom-line’ view: P/E multiple & Earnings/EPS growth (next year estimates). Interpretation: Forward P/E multiple the stock is trading at for the given level of estimated Earnings/EPS growth

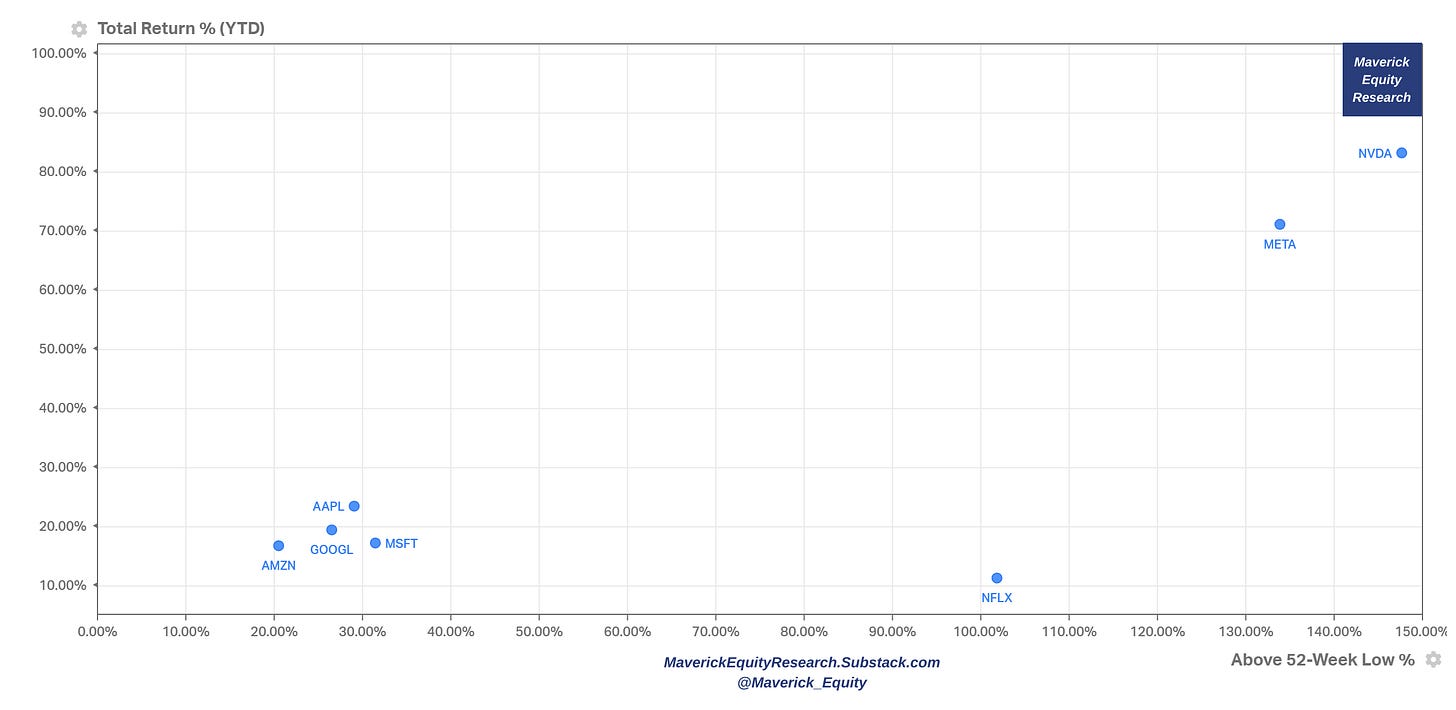

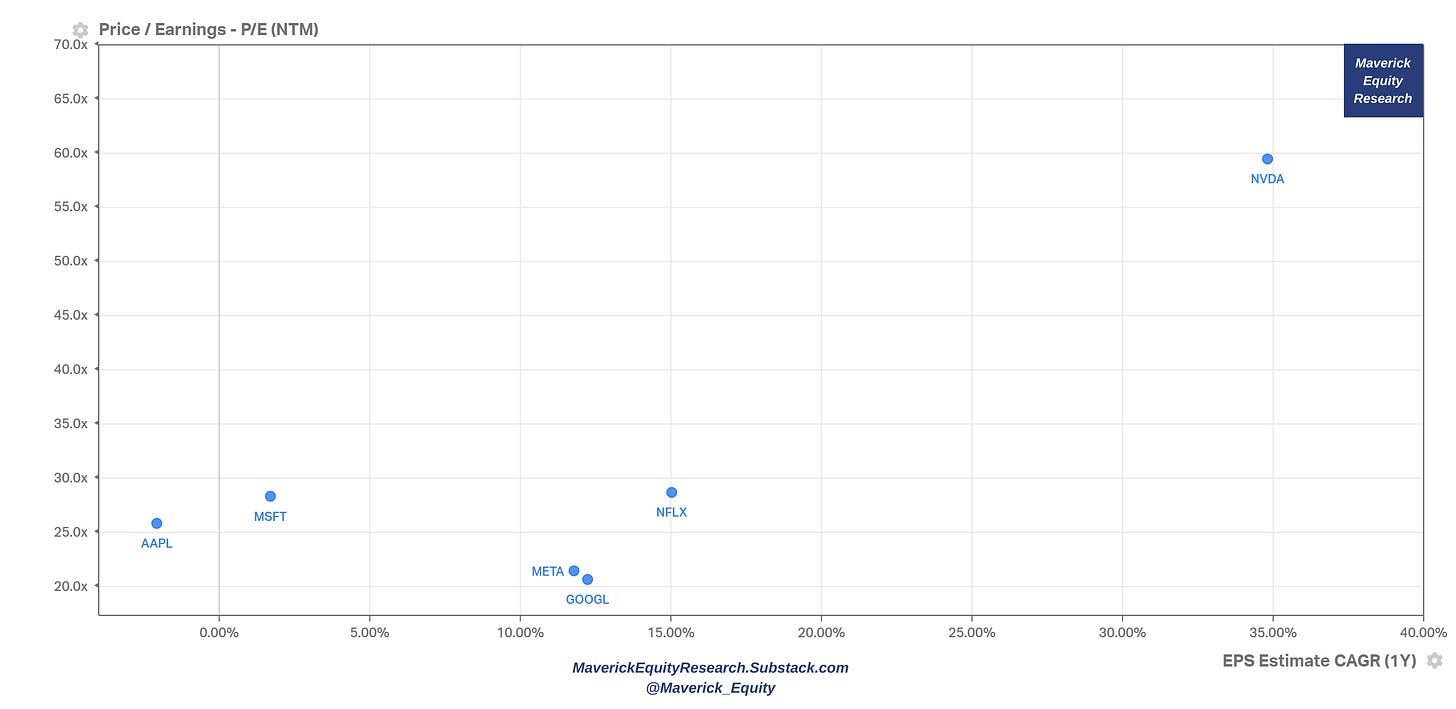

📊 Big Tech = ‘FANGMAN’ 📊

What’s inside? The 7 tech industry juggernauts: Facebook (META), Apple (AAPL), NVIDIA (NVDA), Google (GOOGL), Microsoft (MSFT), Amazon (AMZN) & Netflix (NFLX) & chill … 😉

Price action view: 2023 YTD Winners & Rebounders from their 52-week low

Sales/Revenue aka ‘Top-line’ view: P/S multiple & Revenue CAGR 1Y (next year estimates). Interpretation: Forward P/S multiple the stock is trading at for the given level of estimated Sales CAGR

Profitability aka ‘Bottom-line’ view: P/E multiple & Earnings/EPS growth (next year estimates). Interpretation: Forward P/E multiple the stock is trading at for the given level of estimated Earnings/EPS growth

Free Cash flow aka ‘cash’ view: P/FCF multiple & FCF/Share (last twelve months). Interpretation: P/FCF multiple the stock is trading at for the given level of FCF/Share

I hope you enjoyed this extensive research & it would be great to hear your feedback! Should you have found this endeavour interesting and valuable, just subscribe & share it around with likely interested people. Twitter thread can be found here. Thank you!

Have a great day!

Maverick Equity Research

great take, nice themes ... that must have been quite some work to do ... great you added Infrastructure ... not much talked ... can I propose to add another thematic / set of baskets?

Thanks a lot, I really got a lot of food for thought indeed out of this … have a great week Mav!