✍️ Maverick Special Situation #4: My name is Bond, Yield Bond! The Return of Yield! Getting Paid to Chill ... (Part I)

Goodbye Negative-Yielding Bonds & Hello Decade-High Bond Yields. From TINA (There Is No Alternative) to TARA (There is A Reasonable Alternative) or BAAAA (Bonds Are Again An Alternative)

Dear all,

guess this time from where I wrote this 1st part research piece on Investing in Bonds?

Drum rolls … from a place where I did not find Inflation but Deflation:

from the Prague to Budapest RegioJet comfy train for 22.9 EUR

from Vienna to Budapest it costs around 16-18 EUR depending when booked

3 great cakes, 2 coffees and tea = all for 2 EUR (bottled water and coffee is free & unlimited, one can also serve a good salad or hot meal for a great 2-4 eur price)

What does this have to do with investing besides inflation? It is about finding value when seen not available or very hard to find, specifically value investing. “All intelligent investing is value investing, acquiring more than you are paying for.” Charlie Munger

Funny enough, I did not know myself about this specific train until 2 years ago. Told this to friends & the common feedback ‘can’t be’ or ‘thanks man, that’s deep value’ or ‘thank you for bringing the real world ‘Alpha’ factor’ 🤝! Now you know also! 😉

Travelling by train in Europe is something I like to do a lot and also recommend. The route across the Alps from Vienna to Zurich is one of the best ones I ever took, and while that it’s not gonna be 20-30 EUR, it is fully worth it especially in the winter time.

Back now to research, investing, economics, finance and … business!

Maverick Equity Research is focused naturally on equities, however these days we have a ‘Special Situations’ case because since a while and unlike before, Bonds pay!

Now whenever there is a new trend or innovative development in investing, plenty of ‘hot takes’ like ‘THIS is the best investment out there’ start coming to town like a big cult.

In my research, I strive for 3 key pillars: independence, integrity and objectivity. Hence, I can already say: there is no ‘best investment’ out there that fits all investors and traders. That’s because we all have different needs, time horizons, risk capacity & tolerance, income vs total return, follow-up strategy (DCA/lump sump, hedging etc), tax, liquidity needs on a timeline, retail, professional or institutional investor etc.

Therefore, a 2-part series via a balanced take on Investing in Bonds/Credit/Cash in the current environment. There are good and many opportunities for the investors looking at ‘Fixed Income’ for the years ahead, especially via the risk/return lens.

I have been tweeting quite some about bonds since Q3-Q4 2023 as bonds were paying more and more, below for warmup, a few selected tweets:

Today’s research structure below & designed to have a natural flow:

📊 Setting Up The Stage - How Did We Get Here? - this edition -

📊 Why Investing in Bonds Nowadays - ‘Why Now?’ - next edition -

📊 Setting Up The Stage - How Did We Get Here?

There used to be a time when interest rates were very low? How low? Well, like rock bottom for more than a decade after the 2007-2009 Global Financial Crisis (GFC). Before anything, notice how the trend of lower rates has been going on for decades.

US yields - 1y 2y 3y 5y 10y 30y since 1985:

As investors have a short memory, let’s recall the prevailing consensus we had once rates hit rock bottom: we will have rates very low for a very long time and likely replicating the ‘Japanification’ with low/negatives rates for more than 2 decades.

The world of finance got so disrupted that after the 2007-2009 GFC we did reach the peak of $18 trillion worth of negative-yielding debt in 2020.

In terms of number of bonds, we reached a whooping number of 4,500 bonds trading with negative yields. While now in 2023, negative-yielding bonds are not to be found.

The 2020 pandemic came where huge monetary & fiscal stimulus along with supply chain constraints (among others) brought inflation, and created a recipe for the latest fastest interest rates hiking cycles in 4 decades.

These are the FED (green) and the ECB (blue) policy rates since 2004 - the FED funds rate is higher even than in the 2007-2009 period while the ECB a bit lower:

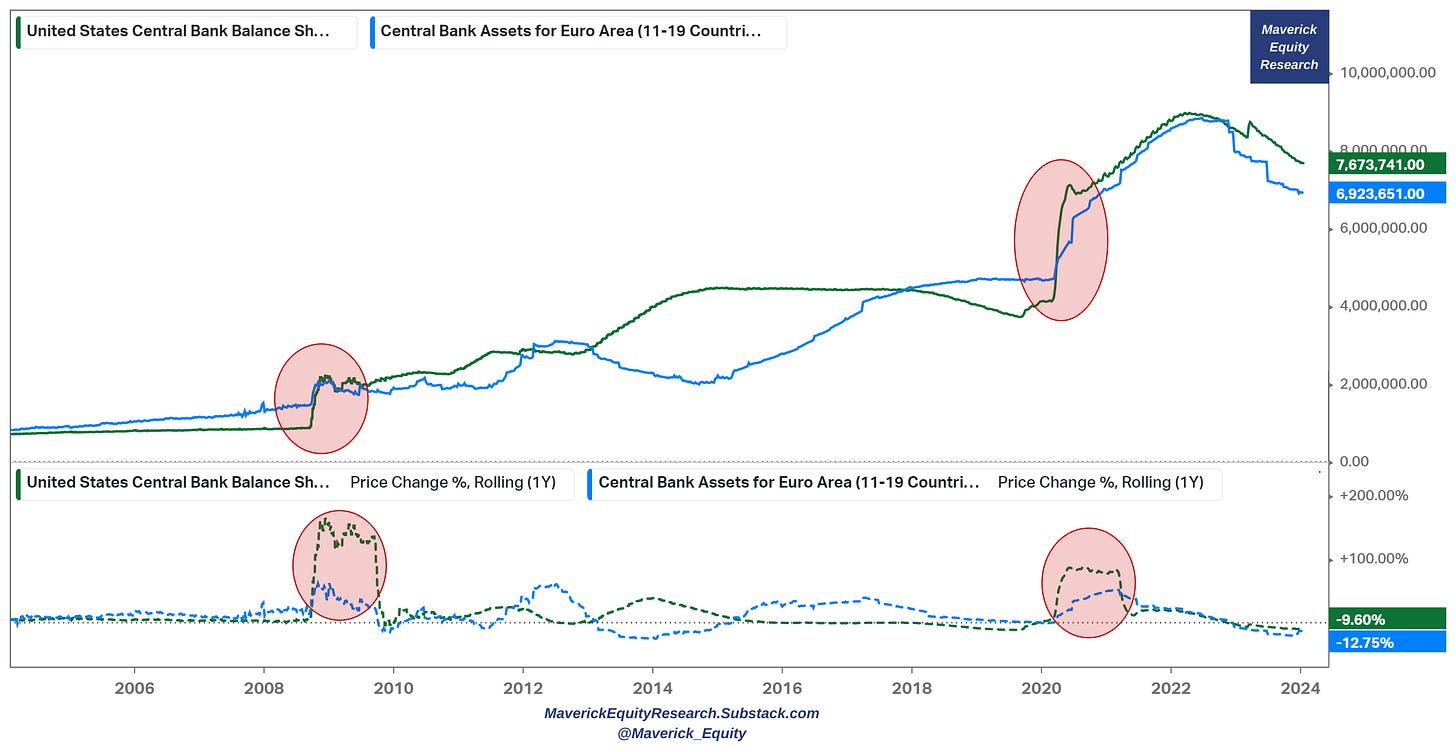

Below how the FED (green) and the ECB (blue) balance sheets expanded big time (absolute values above and the 1y rolling % change since 2004):

👉 once a first big unprecedented spike once Lehman brothers imploded in 2008

👉 twice once the 2020 pandemic came to town

👉 currently both balance sheets shrinking towards normalisation

So, after more than a decade where (too) many mocked central banks for not being able to ‘get it up’ i.e. inflation, from deflation worries we switched fast to ketchup inflation since 2021, and we have been all witnessing it since then. Hence, central banks had to act strong & fast in order to cool it off which is happening as we speak.

Before moving on, how high are US yields relative to the 2007-2009 GFC (last cycle)? With longer maturities about the same, and with shorter maturities even higher!

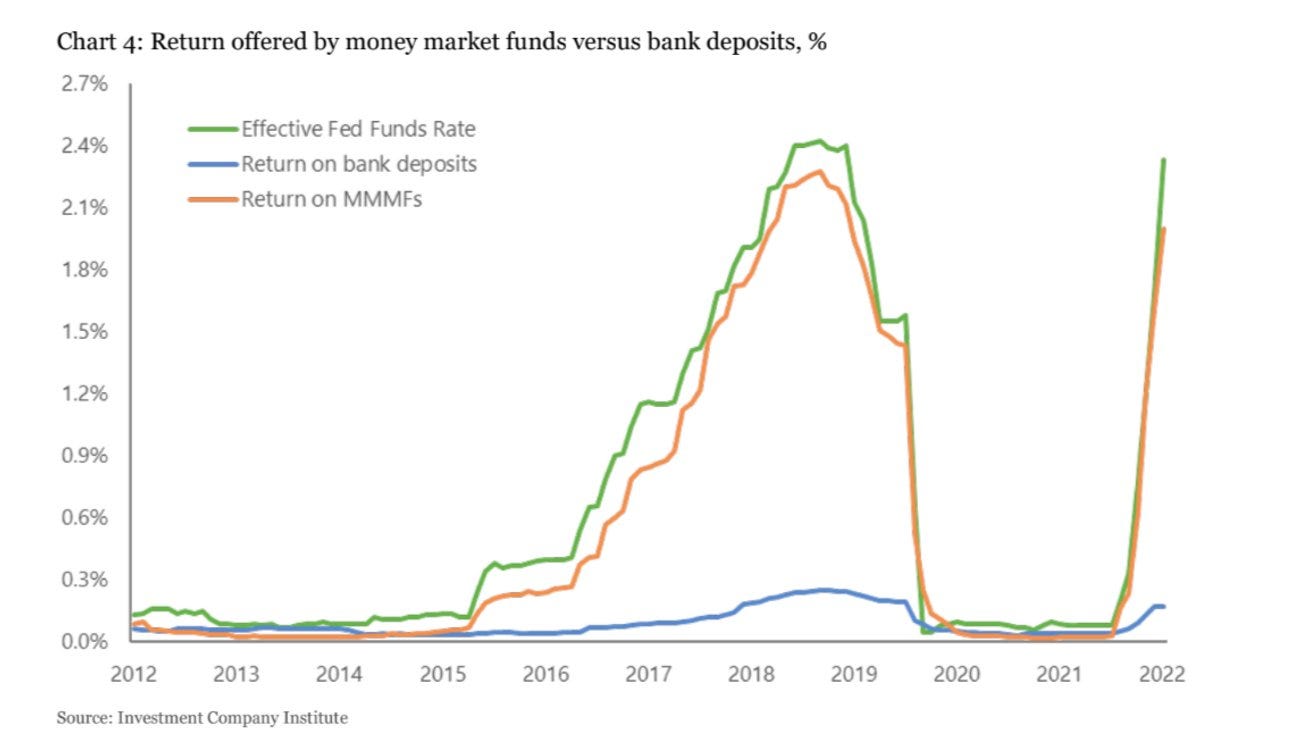

So now we can ask ourselves, how did banks react in terms of paying depositors? What about Money Market Funds (MMFs) returns offered? 2022 below shows:

👉 how banks (blue) ‘naturally’ are quite ‘lazy’ paying depositors more and more

👉 while Money Market Funds MMFs (orange) paying decently, not much below the FED Funds Rate (green)

Banks are eager for cheap funding via retail deposits that are seen as ‘sticky’, and from there keeping the spread by investing themselves in riskless treasuries or giving loans. Nonetheless, MMFs are efficient & also an incentive to pay customers as they can optimize for fees on their Assets Under Management (AUM), high AUM = high fees.

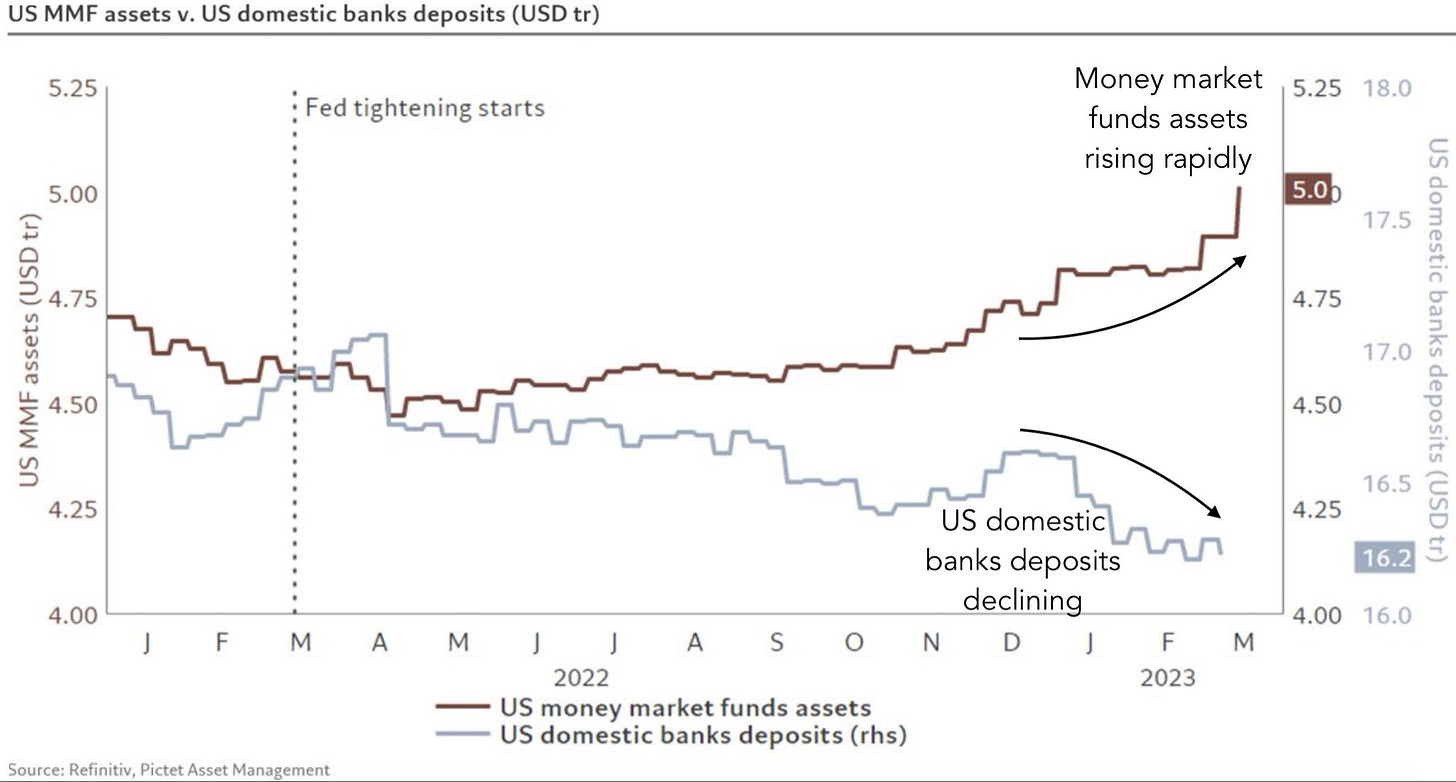

Complementary MMFs assets and Banks Deposits with the 1st FED hike: divergence! For a while it worked for banks, but then investors & households said nahhh, yield me!

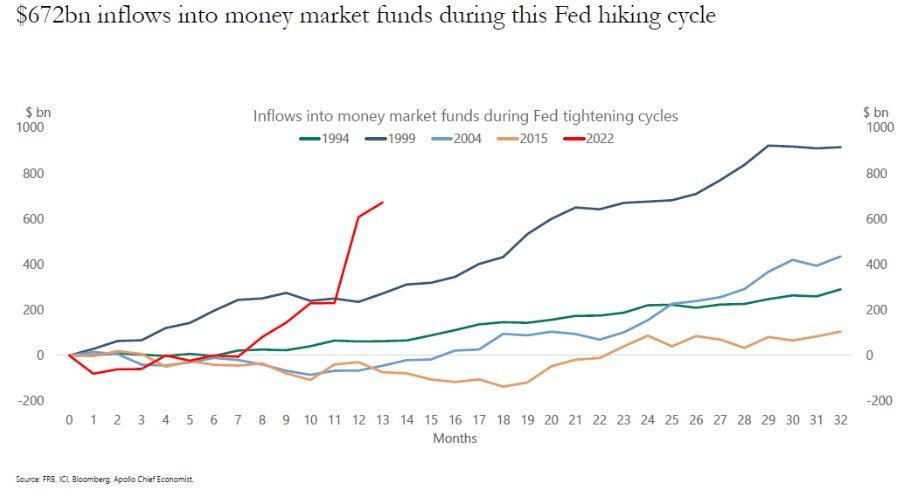

Therefore, $672 billion parabolic flows during this FED hiking cycle as of Q1 2023. Fastest hiking rates cycle in 4 decades, also makes for the fastest inflows into MMFs:

Mid 2023, further confirmation - huge inflows for MMFs, huge banks deposit outflows:

👉 MMFs: +750 billion on course for record year while

👉 US bank deposits: -578 billion deposit outflows

Just like a salary, returns offered to investors matter and they react via allocations. As of the latest data available (Q3 2023), some key notes:

👉 MMFs total financial assets with record highs above $6.1 trillions

👉 the higher the rates driven by FED hiking rates (green), the higher MMFs assets

From MMF total financial assets, let’s isolate if retail MMFs also reacted:

👉 yes, big time … also at record highs above $1.7 trillion

👉 note also below the price change % rolling 1-year: record high growth

Hence the answer to ‘How do Money Market Funds pay investors in relation to FED and interest rates?’ is quite easy and this time via an even longer time series:

👉 the higher the interest rates, the more Money Market Funds pay and both corporate and retail MMFs react … as banks pay less and experience outflows

👉 once the FED starts cutting, Money Market Funds experience outflows as they pay less & less … but until then, as of today they pay decent … especially via a risk-return basis and if one already compounds nicely …

Now that we covered both Bank Deposits and Money Market Funds, a very common question I get and hear often is, ‘what’s really the difference between them?’ And that in terms of not just how much they pay, but like structurally as a product offering. I also realised in time even experienced professionals are not very clear on the differences.

Table below offers a great overview, while for an investor one to take-away would be: investing in a MMF with US treasuries inside, one would get both a higher rate of return and also a safer form of investing relative to deposits above the FDIC limit. In essence, that is risk free US treasuries vs deposits of a single bank’s creditworthiness.

Hence, should not be a surprise MMFs collect financial assets at record levels!

After progressing from the simple bank deposits everybody knows to Money Market Funds, next to be tackled will be bonds which come in 4 main flavours:

👉 Treasury bills aka ‘T-bills’, notes ‘T-notes’ and treasury bonds aka ‘T-bonds’

👉 Agency bonds issued by U.S. government agencies or Government-Sponsored Entities (GSEs)

👉 Municipal bonds aka ‘munis’

👉 Corporate bonds: investment grade (IG) and high-yield non-investment grade (HY)

The good thing with bonds is that nowadays are accessible way easier by investors, unlike before when it was very expensive, very high minimum investment value (ranging from 100,000 to 200,000 USD/EUR), and mostly a market that could be accessed only via banks, mutual funds, wealth management & private banking (especially from Europe). Now with a good broker, it can be easily done and with lower transaction fees also by retail/private investor also. One can also just buy them via ETFs or directly from the government auctions. Plenty of choices!

All in all, ‘Cash Is Not Trash’ anymore, cash pays so Bob is saying ‘Bring On Bonds’!

Goodbye Negative-Yielding Bonds & Hello Decade-High Bond Yields!

From TINA (There Is No Alternative) to TARA (There is A Reasonable Alternative) or BAAAA (Bonds Are Again An Alternative)!

Part 1 done as preamble for Investing in Bonds/Credit/Cash:

📊 Setting Up The Stage - How Did We Get Here?

Part 2 coming next will cover the nuts & bolts:

📊 Why Investing in Bonds Nowadays - ‘Why Now?’

Stay tuned … loads of practical investment insights delivered via sleek charts as always!

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this extensive research by finding it interesting, saving you time & getting valuable insights? What would be appreciated?

Sharing, restacking it around with like-minded people and hitting the ❤️ button. This will help me bringing in more & more independent investment research!

Thank you and have a great day!

Mav 👋 🤝

A timely piece on bonds and a good discussions the difference between money market funds, bonds, and bank deposits!

Also importantly, tell us more about your best train trips in Europe - I am envious and hope to visit again soon!!

Im pretty sure Warren Buffet would also agree to your breakfast anecdote. (still uses McD coupons)