✍️ Stock-Based Compensation (SBC) 101: Study case: Snap Inc. SNAP + SBC = Love

Skin In The Game: when there is no game (profits), nor skin in the game

Dear all,

3rd post in the ‘Education’ series is special & hot: Stock-based Compensation (SBC)!

Depending on your age and propensity to consume tech, specifically social media, you might be more or less aware of Snap Inc. (SNAP) which for me is a very peculiar case, and with quite some rare symmetrical charts, though not the good types this time … .

To do well in investing, one should rather stay on the bright realistic-positive side, yet some rather not so positive cases occasionally deserve attention in order to make comparisons, get insight, for educational purposes and to avoid various pitfalls. One of my favorite mottos is actually: ‘watch the downside, the upside will take care of itself!’.

Table of contents:

📊 Stock-Based Compensation (SBC) 101

📊 Snap since IPO: Profits = SBC

📊 Skin In The Game: when there is no game (profits), nor skin in the game

📊 Stock-Based Compensation (SBC) 101 📊

The main points about Stock-Based Compensation (SBC):

👉 it pays executives & employees with stock instead of cash, hence it can be a valuable tool in attracting, motivating, retaining and incentivising employees/insiders

👉 accounting wise: it is recognized as a non-cash expense on the income statement, from there related tax benefits, hence the company gets a higher cash position and better free cash flow measures

👉 cash not leaving the company gives the company a higher solvency ratio and overall optionality with it when it comes to both strategic & operational decisions

Nonetheless, there are 2 sides to the coin just like debits and credits go:

👉 the attribute that it is a non-cash expense can be twisted that it is not a ‘real’ expense, hence not a big deal or that it does not matter much

👉 even worse, heard folks saying SBC is free cash flow because it’s not a cash expense

Maverick opinion now: CAPEX (capital spending) of software companies = SBC

recall that many tech companies are 'capital light', no need for factories, buildings & concrete ... which is true, but context matters …

they just replaced that with Stock Based Compensation (SBC): 'capital light' it depends for whom, and the definition: physical or non-physical … one can be ‘capital light’, yet not bringing profits for ages …

if a manufacturing/industrial company does not deploy new CAPEX, or at a minimum allocate the maintenance CAPEX, the business model starts to suffer: just like that if tech companies stop SBC, the business model will suffer soon

the greatest trick Silicon Valley ever pulled was convincing everyone that Stock Based Compensation (SBC) didn’t exist ... or it did not matter … but it does!

SBC is an expense, a real one and somebody must pay for it … shareholders …

Overall, SBC is not bad per se, but forgetting or ignoring is! Especially when high, and even more so when on a recurring basis, otherwise SBC can bring many benefits.

The MEME below summarises it all: management/insiders can be very happy with SBC, it even boosts free cash flow, yet investors can be left holding the bag … .

👉 On how to treat SBC in valuation/DCF models & more, 2022 key twitter thread where I had also Aswath Damodaran from NYU answering 😉, enjoy!

📊 Snap since IPO: Profits = SBC 📊

Social media company SNAP managed 2 incredible things since going public:

👉 skyrocketed the amount of ‘sexting’ and genitals sharing that people do, a different kind of a SaaS business model, namely ‘Sexting As A Service’ (lol🙃)

👉 stock -65% since the 2017 IPO, for a -12.8% annual decline … still called compounding I guess … just that is has a negative sing in front … I guess …

👉 stock with a 89.7% current drawdown

👉 never ever made a profit in any given year with a cumulative $10.6bn loss

👉 but here is the Maverick kicker: insiders got a money printing machine for themselves via issuing stock (Stock-Based Compensation) for a cumulative $9.49bn

👉 did you notice the ‘symmetry’? $10.6bn loss with $9.49bn …

👉 Net Income (red) and Stock Based Compensation (green) mirroring each other not just in total, but basically across time also (last twelve months basis) - rarely you see such a perfect Net Income 'hedge' with SBC (lol) ... Swiss clockwork bro' … lol …

👉 a serious question: is this company run by Executives for the benefit of shareholder or the Executives themselves?

👉 I get that big 2017 net income loss via loads of stock-based compensation for executives after the IPO … years of work and all that before … but what about after?

And in case you want to see the chart also on a full quarter basis, mirror like also.

👉 Voice of the narrator (aka me):

‘what is our net profit projection?’

strategic decision: ‘let’s just 'hedge' it with Stock Based Compensation (SBC) for delta neutral for the shareholders, and delta positive for us’ as a Maverick wordplay 😉

Would you like the Q1 2025 exact 10-Q disclosure? There you go:

👉 SBC $247 million, Net loss $139 million

👉 shouldn’t it be Net Income of $247$ million … with $139 million SBC?

👉 at least no ‘restructuring charges’ in 2025, unlike the $70 million in 2024

👉 despite growing revenues very very well … losses keep coming, but no problem to issue SBC for the insiders … what about profits? I don’t know, haven’t seen them …

Some extra nuances:

👉 giving credit where credit is due: Snap did increase their revenues quite nicely

👉 I do understand that SBC programs are designed ahead of time, and also that a lot of SBC was issued in 2017 at the IPO as it is quite the case in tech

👉 Nonetheless, it has been 8 years since the IPO and no profits at all … it’s not okay

A MEME from 2024 which says it all basically - consistency is key it seems lol

📊 Skin In The Game: when there is no game (profits), nor skin in the game 📊

Skin in the game is seen as a solution to the Principal–Agent problem in which shareholders (principals) hire managers (agents) to run a company … but managers may prioritize personal benefits (like bonuses or perks) over shareholder value.

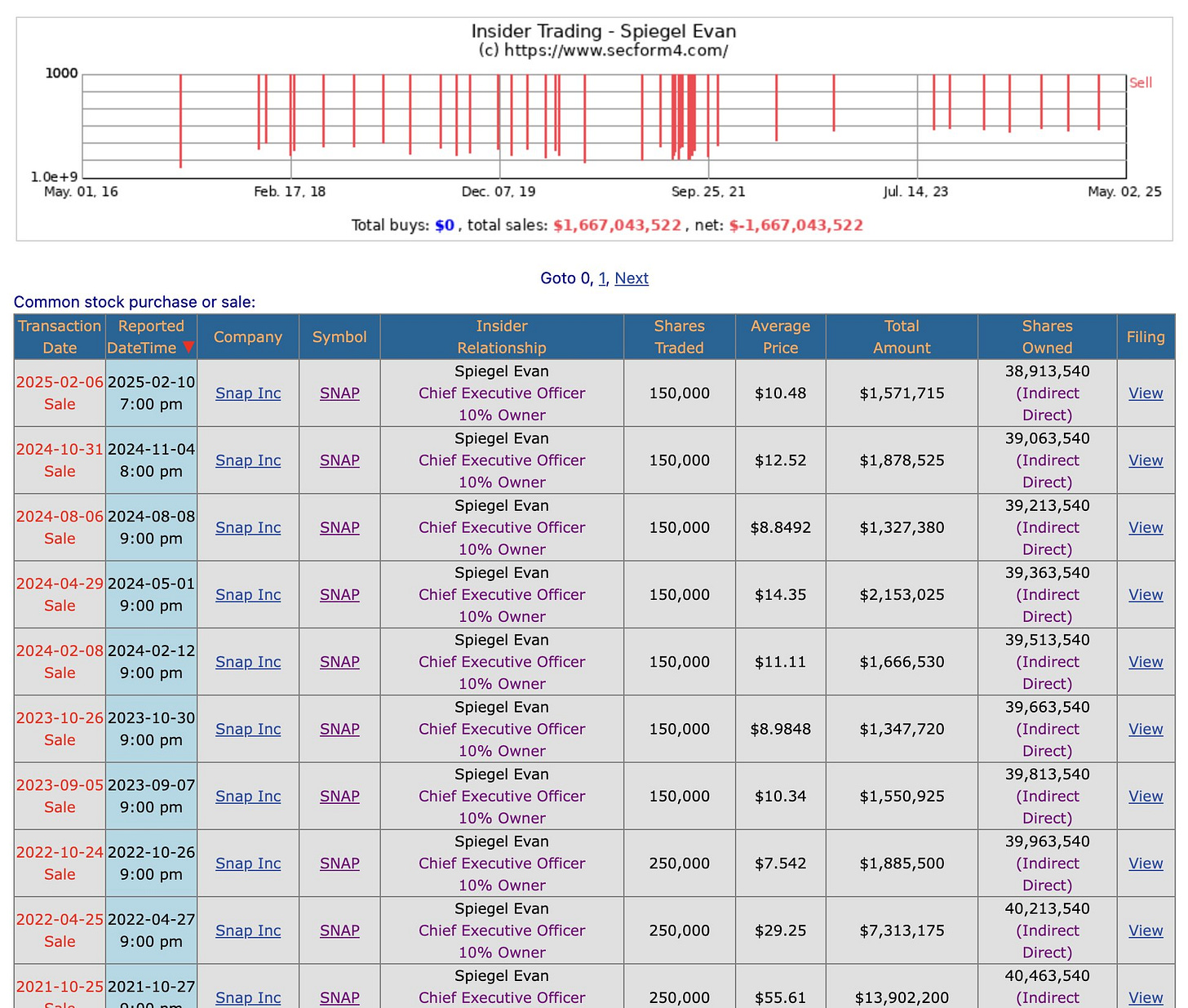

So, wow is the CEO doing in terms of Snap stock? Selling, buying?

👉 $1.7 billion in selling … milking the cow like a pro’ …

👉 investing or reinvesting the milk or so? No, not a single BUY … not even for cosmetic/looks reasons … I mean why would one buy into a business that is not making any profits, nor even the outlook says so? …

Therefore, where is the skin in the game for the outlook and future of the company?

All in all, to summarise:

👉 hope you enjoyed this SBC 101, especially the study case for an overall framework on how to analyse this topic going forward

👉 the technology sector can have many high flyers, very scalable, capital light, but it can also have a bunch of stuff which do not deserve their price tag, not bringing profits ... I mean for shareholders, for insiders it can be very lucrative as we saw …

👉 I am pretty sure nobody from Snap Inc. (SNAP) will send me a gift after this post, but hey, that is what independent investment and economic research is all about: not massaging each other other sentence like it is done in most banks and funds etc

all I did was present data/facts via charts, and then an opinion based on that

I did not have an opinion presented as a fact, but based on nothing

very happy to make an update on SNAP when/if they change course and start making a single yearly profit - more than happy to give credit where credit is due: additionally, when facts change, I change!

👉 quoting Nassim Taleb, Commencement Address, American University in Beirut:

'If something is nonsense, you say it and say it loud. You will be harmed a little but will be antifragile — in the long run people who need to trust you will trust you!' (Twitter post)

P.S. on the independence in investment and economic research, a central theme especially nowadays, I am working currently on a dedicated piece … stay tuned!

✍️ Why Independent Investment and Economic Research = Paramount Nowadays!

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this quick update by finding it interesting, saving you time & getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons! That’ll definitely support bringing in more & more independent investment research: from a single individual … not a corporate, bank, fund, click-baity media or so … !

Like this, the big positive externalities become the name of the game! Thank you!

Have a great day! And never forget, keep compounding: family, friends, hobbies, community, work, independence, capital, knowledge, research and mindset!

Mav 👋 🤝

P.S. in case you missed my previous 2 Educational pieces, there you go:

📖 Fiat Currency - VS - Cryptocurrency, Centralised - VS - Decentralised

📖 Yale courses I did and highly recommend - Education, a new section inside Maverick Equity Research

SBC is the most abused aspect of corporate finance in the US. The regulators are also asleep at the wheel. Shareholders ought to hold management to account, but most of the market is now passive, so there is no challenge. That's why they get away with it. Worse, SBC artificially inflates share prices and dislocates them from economic reality. Markets have been broken by the combination of these things. Regulators - wake up!

Man... but we need a high SBC... otherwise, how will management pay for their second vacation home? Or rent private planes? Or send money to their secret children?