✍️ Stock Screening for Value in Europe - Edition #1 - Update

Stock Screenings are interesting - insight & always some further food for thought

Dear all,

below an update on the ‘Stock Screening for Value in Europe - Edition #1’ from last year that was done in the middle of a historical European energy crisis & a war.

In case you did not subscribe yet for delivery straight to your inbox, it’s just 1-click:

Report is not behind a paywall & there are no pesky ads here. It would be highly appreciated if you just spread the word around to people that might also be interested.

Report structure is the following:

📊 Stock Screening Results & Valuation 📊

📊 Europe overall Performance, Earnings & Valuation 📊

📊 Tailwind: Stock Buybacks & Dividends 📊

📊 Fund Managers Positioning & Financial Flows 📊

📊 Economic Sentiment, Monetary Policy & Energy 📊

📊 Bonus: European Energy sector 📊

📊 Stock Screening Results & Valuation 📊

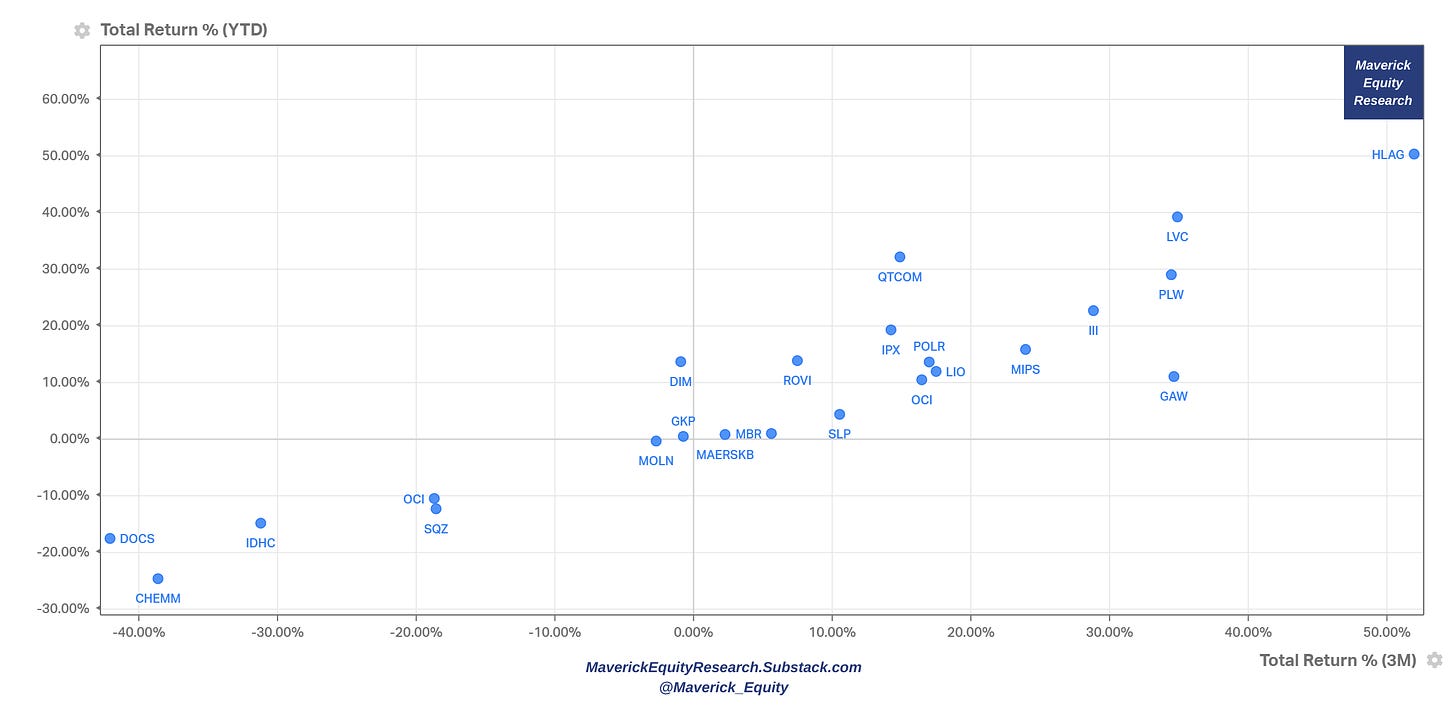

First of all, the results visualised via the combined view of Total Return in the last 3 months & Total Return in 2023:

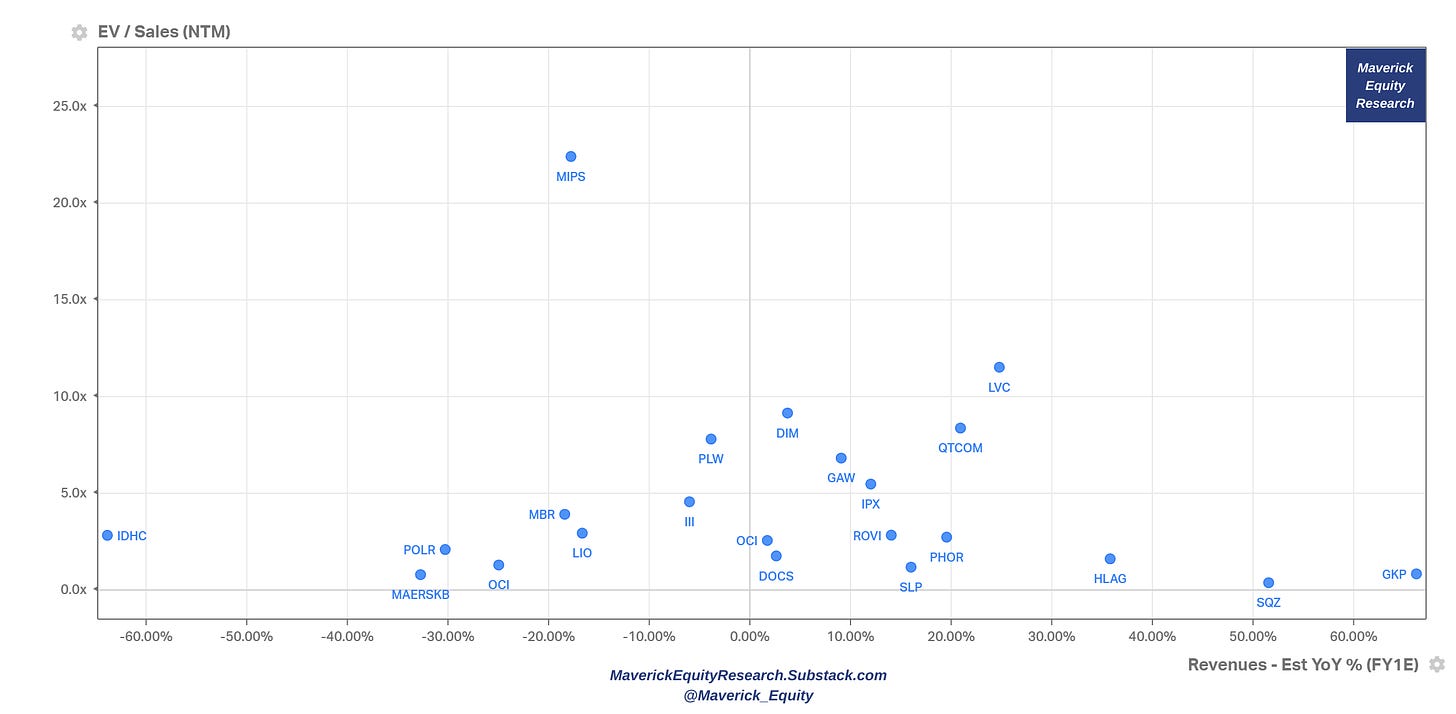

And now going into valuation territory. For that, the following scatterplot shows the EV/Sales multiple (next twelve months) ‘VS’ the 1 year ahead Revenue estimates for YoY% growth:

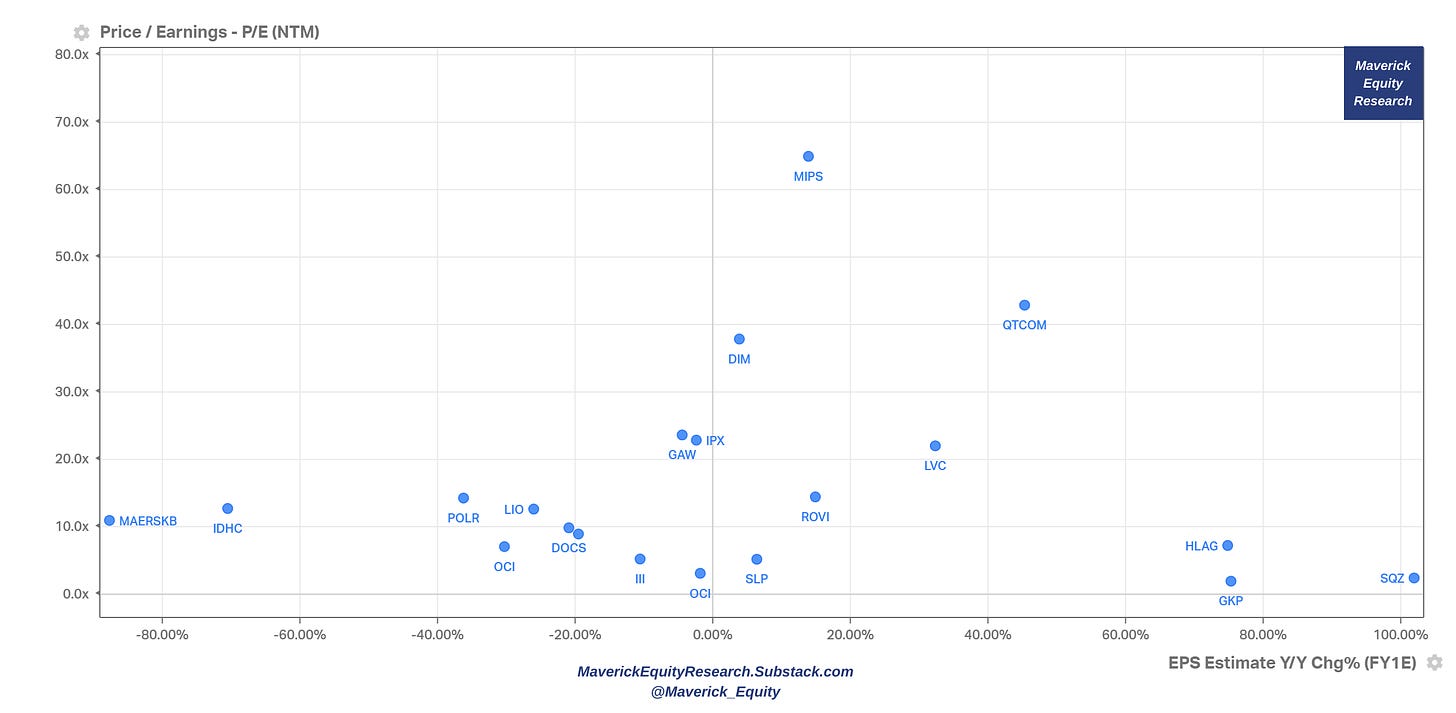

From Sales to Earnings, let’s see also the output via the lens of P/E (next twelve months) ‘VS’ 1 year ahead EPS estimates for YoY% growth:

📊 Europe overall Performance, Earnings & Valuation 📊

Secondly, let’s see what’s going on currently in Europe via complementary research & key questions answered.

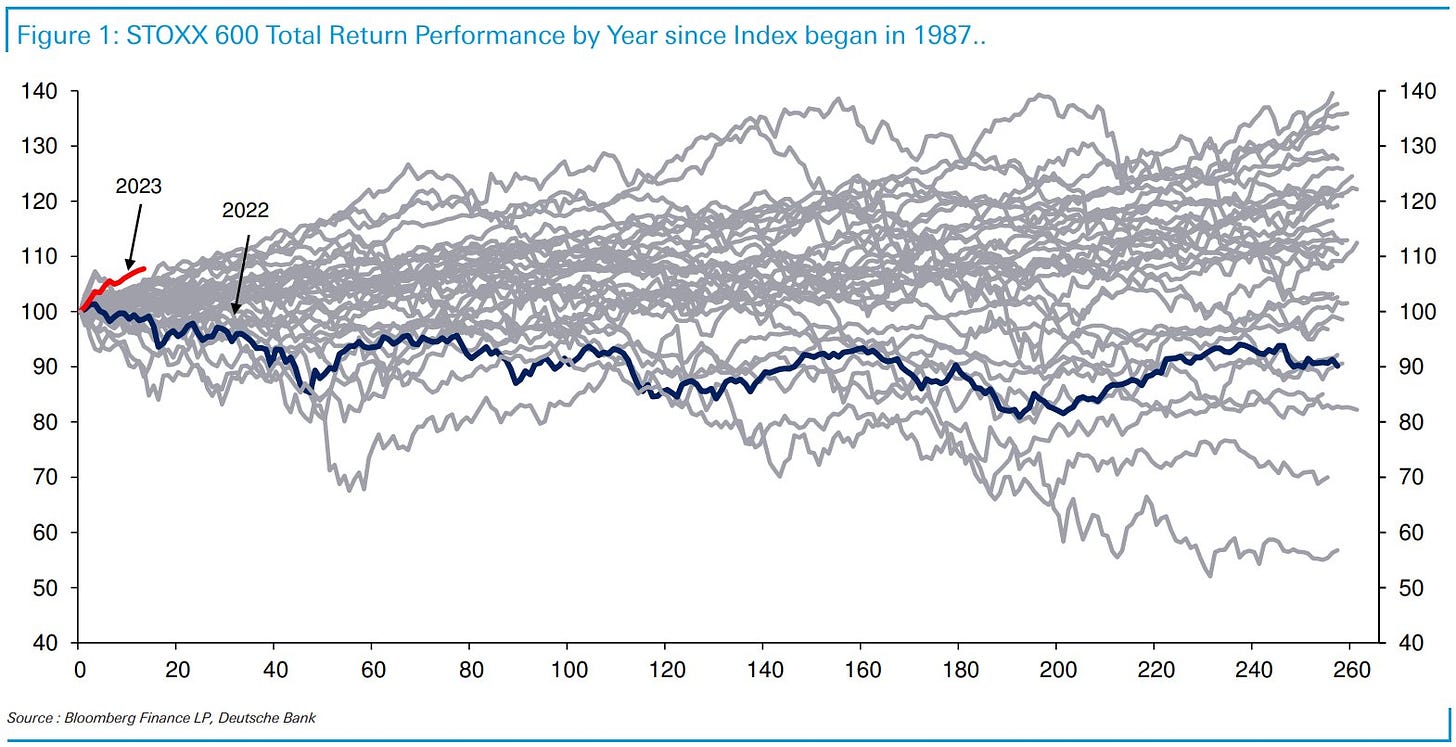

How did Europe overall via STOXX 600 start? Best start since at least 1987:

How does this start look relative to the US S&P 500 counterpart? According to Bernstein, European earnings estimates of 0.6% growth for 2023 are the lowest ever at the start of a year & the market expects fourth-quarter profits to show the weakest growth in two years, Barclays strategists say. There's "room for more short covering if earnings meet expectations" said Emmanuel Cau at Barclays.

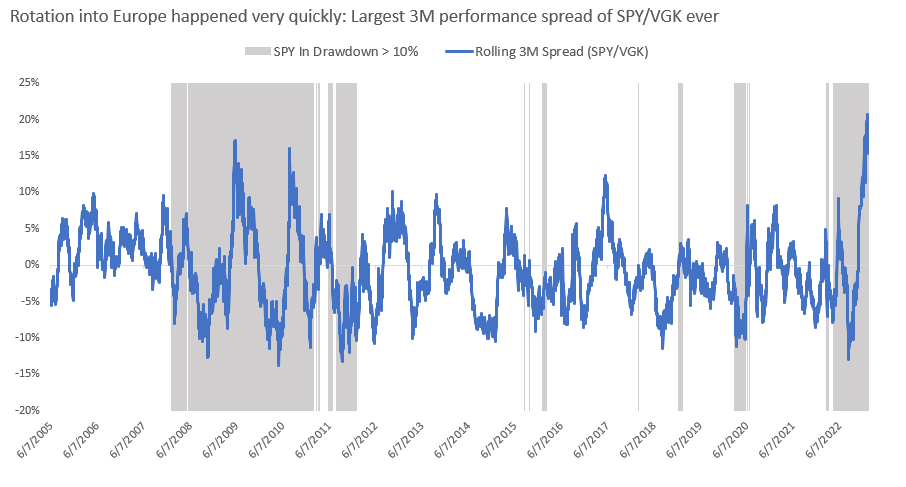

Complementary via Athanasios Psarofagis from Bloomberg: the rotation into Europe happened very quickly while the performance spread over SPY is the largest ever:

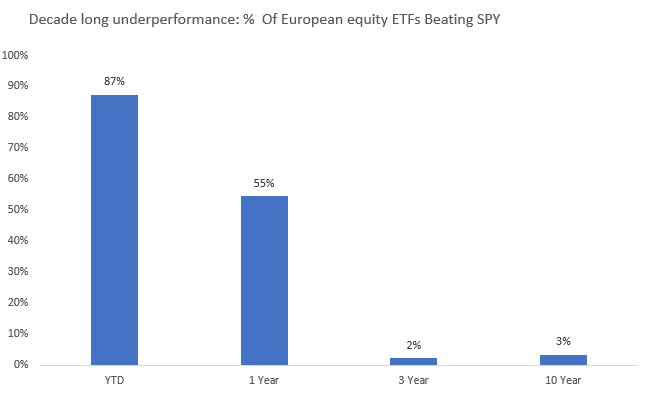

ETFs level wise, after a decade long underperformance, the % of European equity ETFs beating the SPY is at a whooping 87% level:

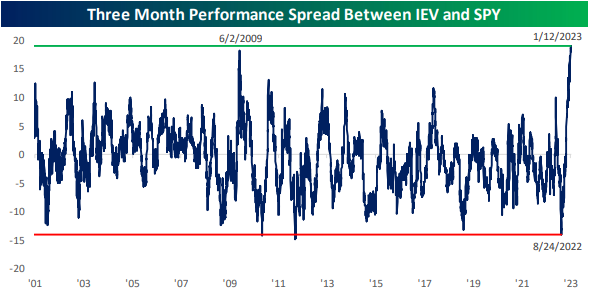

Complementary via Bespoke, after underperforming by one of the widest margins in over 20 years from late May through late August, in the last 3 months European stocks (IEV) have outperformed the S&P 500 ETF (SPY) by a record margin:

What caused this performance? A lot have to do with guess what, earnings! Estimates were revised DOWN materially in 2022 (left), while in 2023, Q4 2022 earnings have surprised by 4% to the UPSIDE (right):

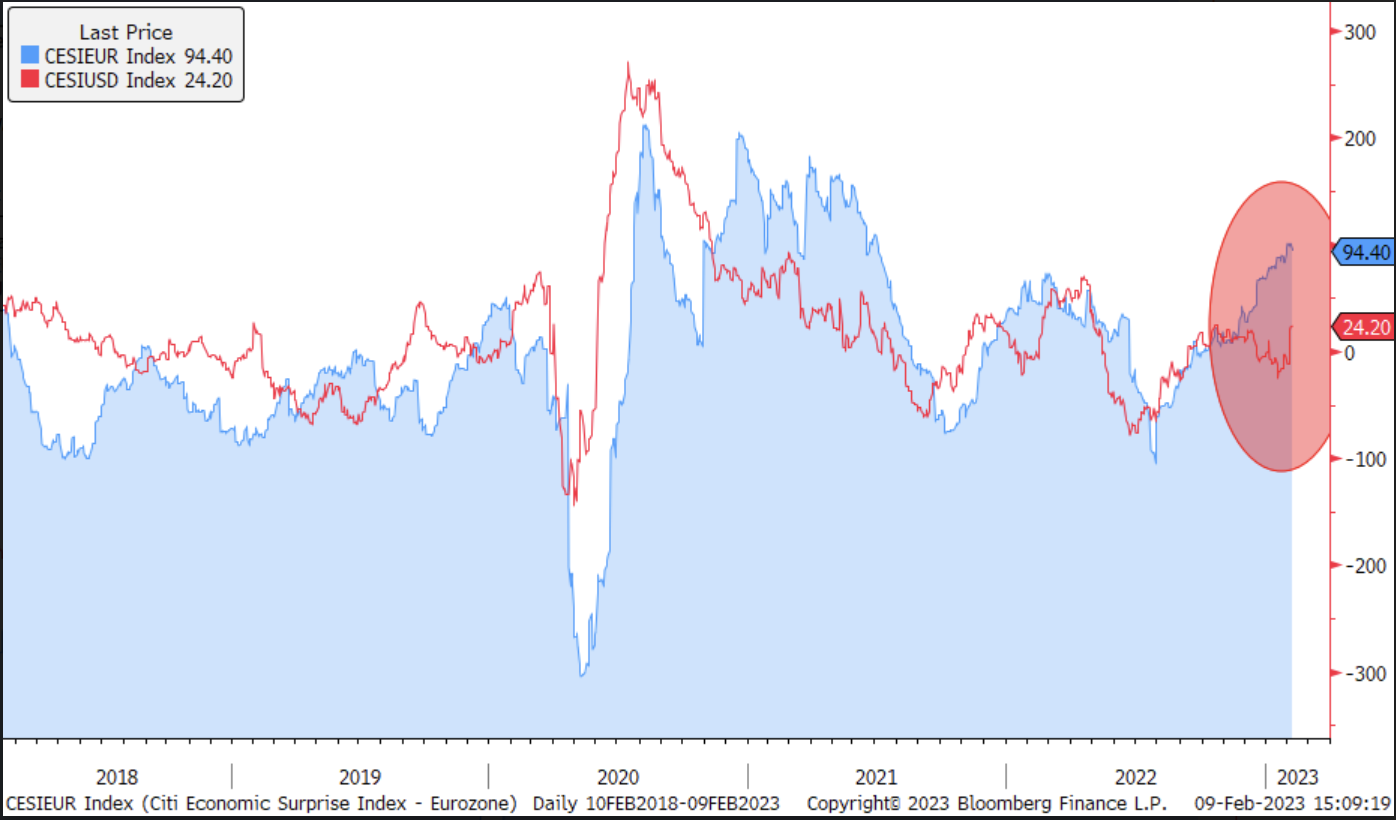

And it’s not just earnings, but also incoming economic data which via Citigroup’s Economic Surprise Index (CESI), kept coming out lately above expectations. Below both indices for the EuroZone (blue) & US (red) with Eurozone strong lately:

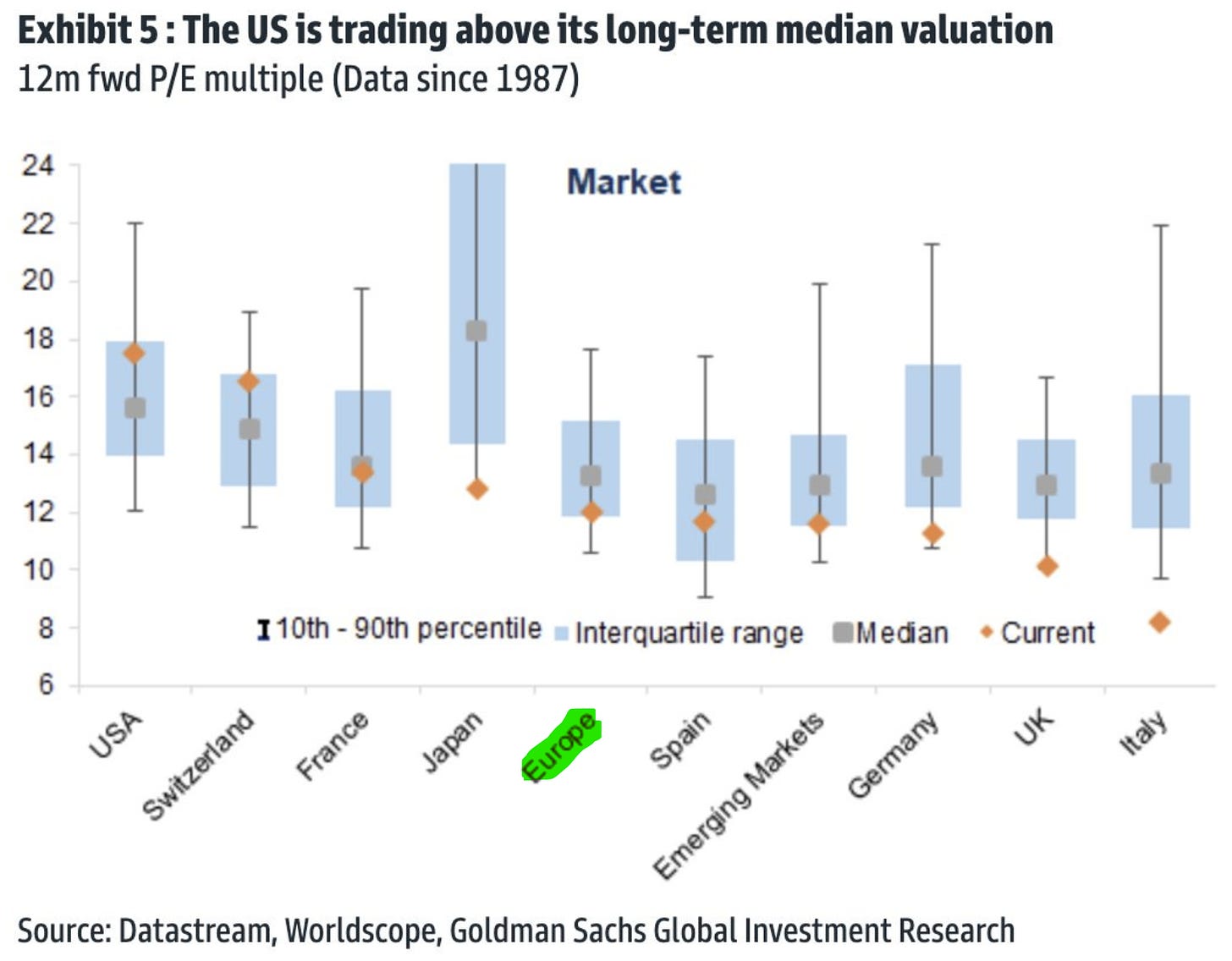

Valuation wise via Goldman Sachs, a great chart with geographical ranges of historical forward P/E valuation multiple: currently relatively low for Europe & Emerging Markets while high for the US & Switzerland. Europe wise, Germany, UK & Italy are far below from their long-term median P/E.

📊 Tailwind: Stock Buybacks & Dividends 📊

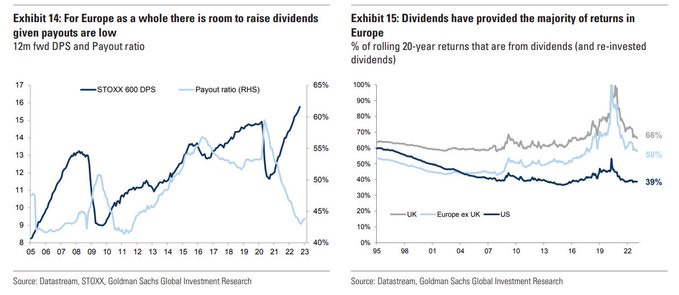

Europe as a whole has room to raise dividends given payouts are low & dividends have provided historically the majority of returns in Europe:

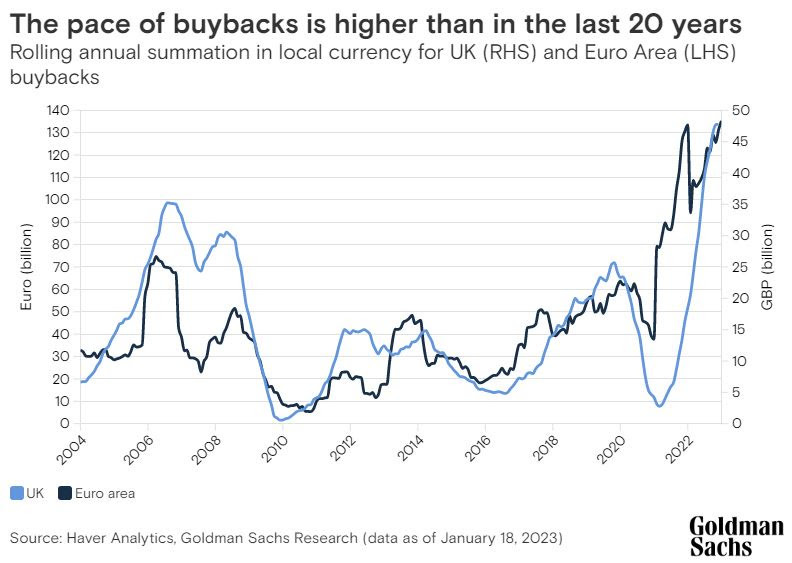

Stock buybacks wise, the pace is higher than in the last 20 years:

📊 Fund Managers Positioning & Financial Flows 📊

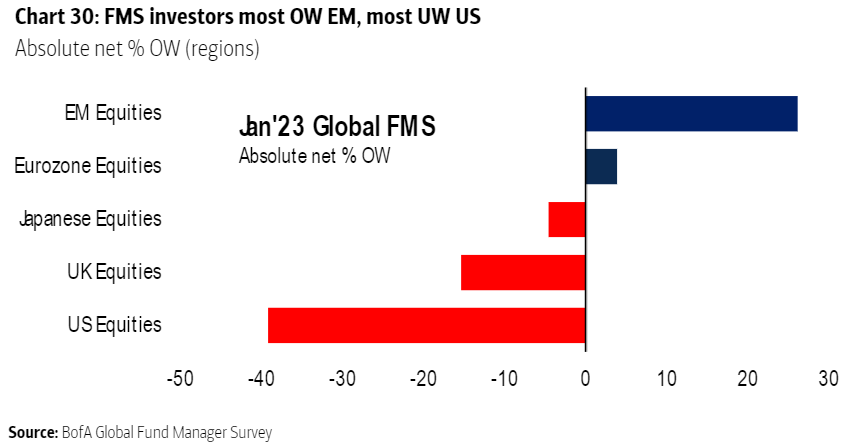

How are fund managers positioned via BofA’s FMS investors popular survey? EuroZone & EM overweight, US, UK & Japanese equities underweight:

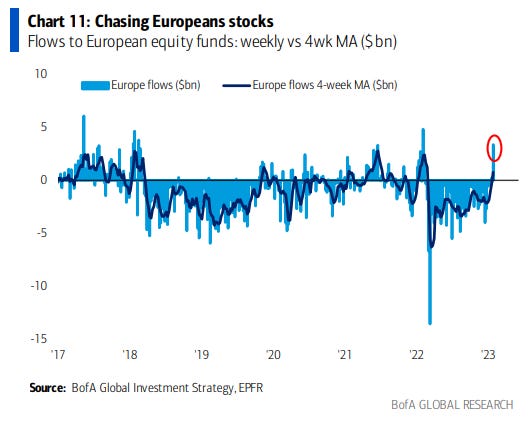

How about we quantify financial flows into Europe? Equity funds Capture investors’ $ chasing following strong Q4 Performance. $3.4bn weekly inflows in the week through January 25th which is the largest since February 2022. Note: before these funds had 48 straight weeks of outflows:

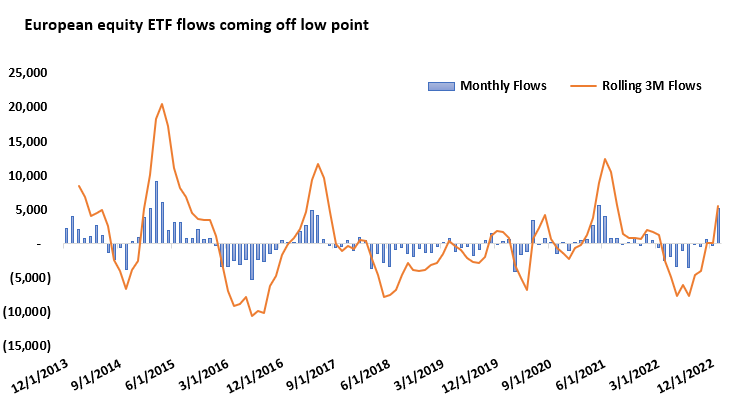

ETFs wise via Athanasios Psarofagis from Bloomberg: European equity ETF flows coming off low point:

And it’s not just flows into equities, but strong inflows to Euro credit ETFs as well:

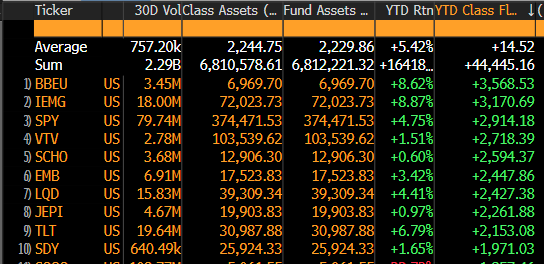

Single ETFs flows wise via Eric Balchunas from Bloomberg: THINGS YOU NEVER SEE: A Europe ETF leading YTD flows with $3.6 billion:

📊 Economic Sentiment, Monetary Policy & Energy 📊

How are economic sentiment indicators lately? Picking up in both Europe & US while Europe relatively better since a while:

What are the latest probabilities of default in Europe? Currently nowhere near the higher levels of risk in 2012 and 2015 based on CDS market pricing. Given the great reforms & progress Greece has made lately, values looks way too high though they are low on an absolute level and past comparison.

Side note: since the 2012 European Debt Crisis we kept hearing from the permabears and gloom & doomers that Europe is about to break up ‘imminently’. One way to get attention is to constantly be a pessimistic and ‘forecasting’ the worst because at some point the business cycle tells us since ages that it turns & then suddenly somehow somebody ‘is right’ (sarcasm alert) ;).

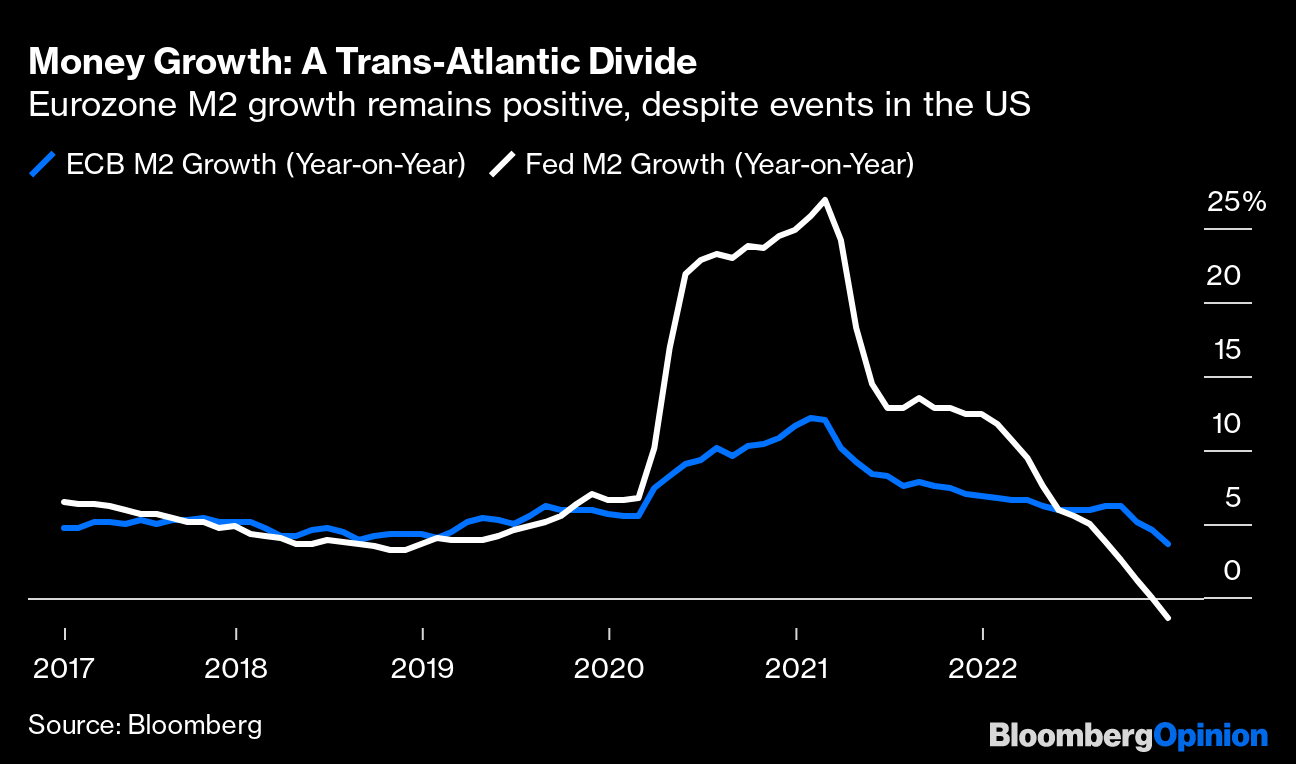

Monetary Policy & Inflation in Europe? ECB will combat inflation bye tightening and then tightening some more while the Fed is nearly done:

Liquidity wise, M2 (money supply) growth in the EuroZone growth (Y-o-Y) is trending lower and it’s not very unlikely to go negative.

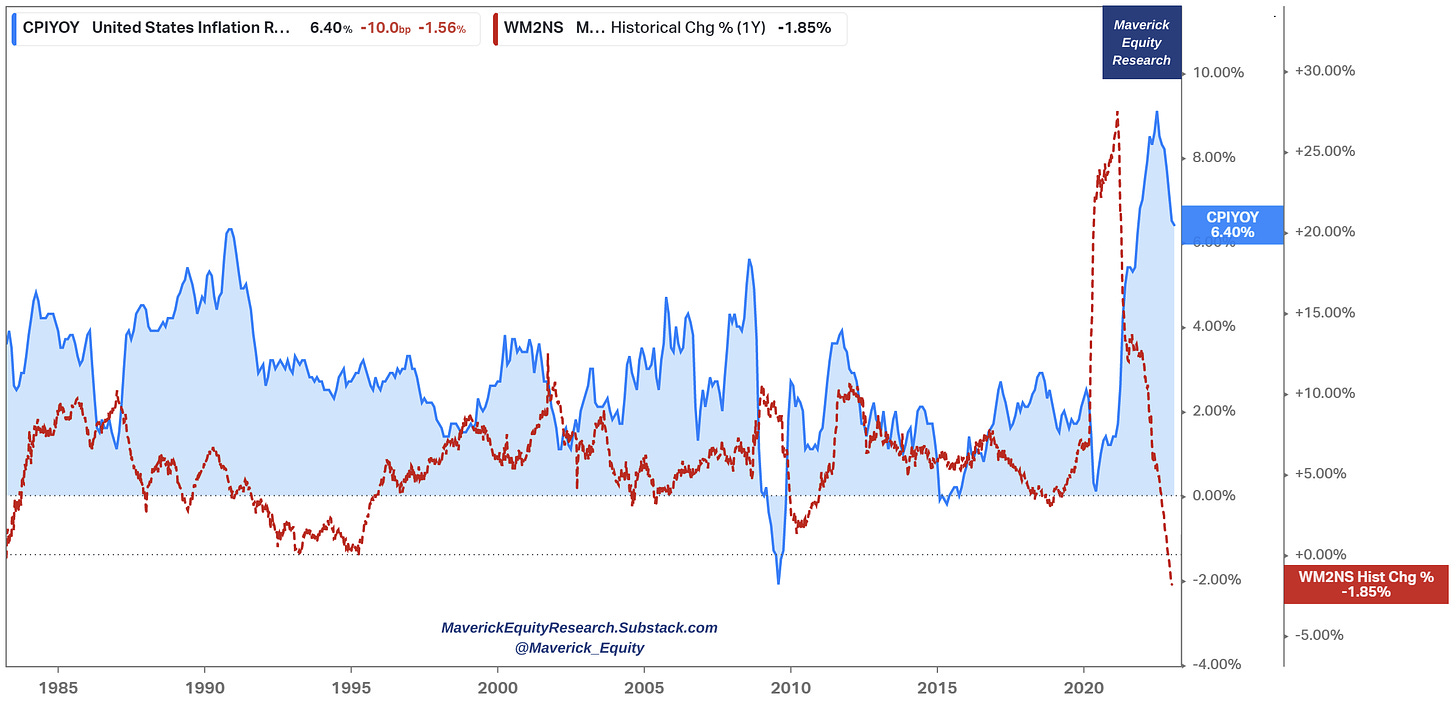

Why? Well, what was seen until recently as something very remote and extreme, in US it already happened & it is the first time since 1933 when M2 growth goes negative. Let that sink in! US CPI (Y-o-Y) & M2 growth (Y-o-Y):

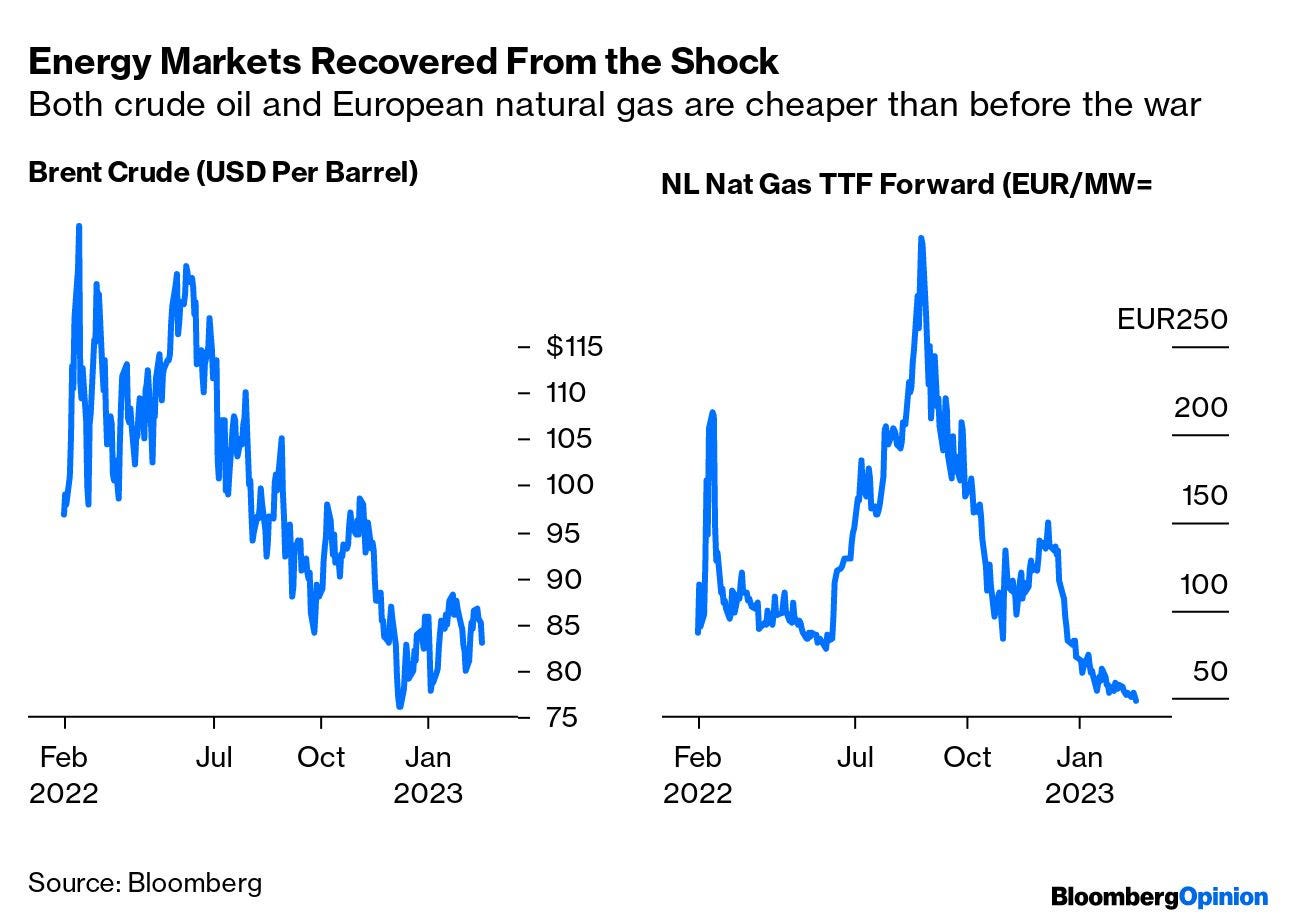

What about Energy markets? Both crude oil & natural gas are materially cheaper than before the invasion:

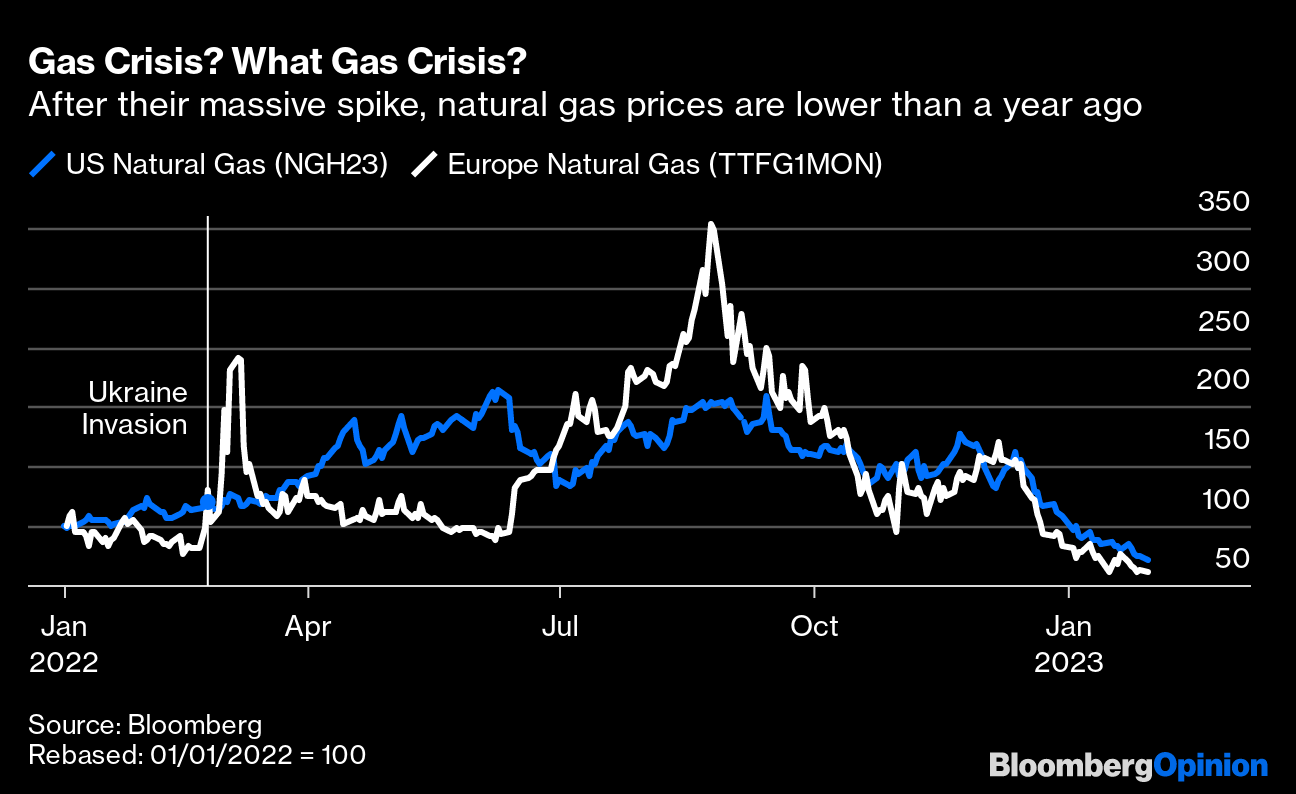

Complementary, combined view of US & Europe natural gas with both cooling off and now lower than a year ago:

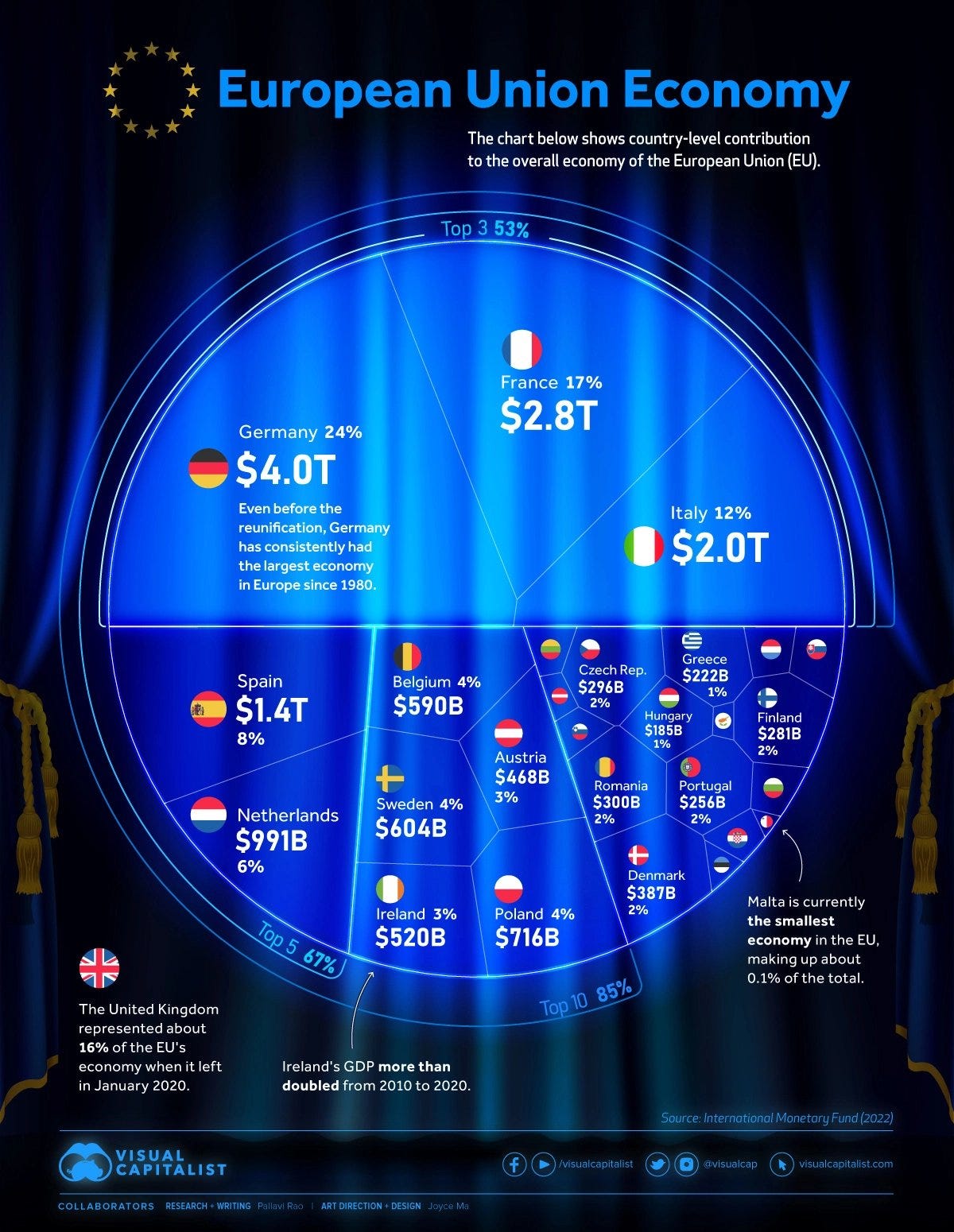

Last but not least, for a big overview how big is the European economy? $16 Trillion!

📊 Bonus: European Energy sector 📊

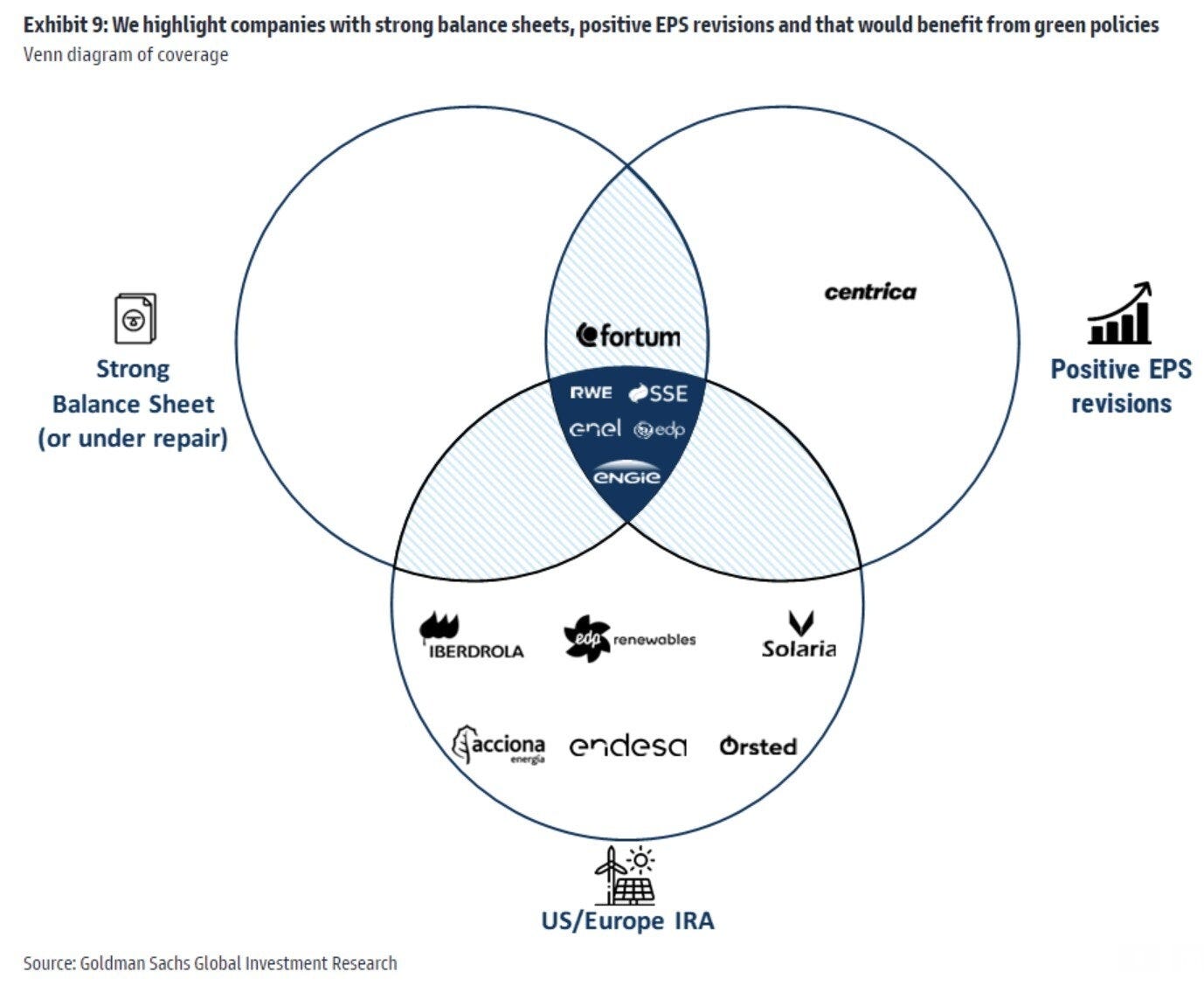

A great Venn diagram from GS with companies featuring strong balance sheets, positive EPS revisions that would benefit from green policies going forward in Europe (estimate that a Europe IRA could mobilise €4tn of capital over the coming ten years): RWE, SSE, ENEL, EDP & ENGIE.

And that was it! Should you have found this cherry-picking endeavour interesting and valuable, just subscribe and share it around with people that might also be interested to read this kind of content in the future. Twitter post can be found here. Thank you!

Have a great day!

Maverick Equity Research

Thanks! Are you zh based?

Great report, interesting and complete!