✍️ Maverick Special Situation #1: Take Profit or Hedge Semiconductors $SOXX: market took the winter SOCKS on too early & got a little bit too hot?

Semiconductors running ahead: time to Sell, Trim or Hedge

Dear all,

welcome to the 1st post in the Trading Ideas & Special Situations section. Maverick Equity Research is about medium-long term investing, though occasionally interesting situations arise in the market which you might find interesting: be it for tactical short-term trading, hedging to protect gains, complementary confirmation to your views, or simply an interesting insight & research to have a look into.

Report is not behind a paywall & there are no pesky ads here. It would be highly appreciated if you just spread the word around to people that might also be interested.

So here we go, the Trading idea / Special Situation in short: semiconductors $SOXX getting too hot & too ahead - time to Sell, Trim or Hedge

For this, the assessment was done via:

Financial Conditions

FED’s less aggressive rate hiking path

Relative strength & performance VS the S&P 500 and Nasdaq

S&P 500 bouncing at the ceiling level

Short Sellers & Bears coming

Technical Analysis resistance

Rationale for the thesis:

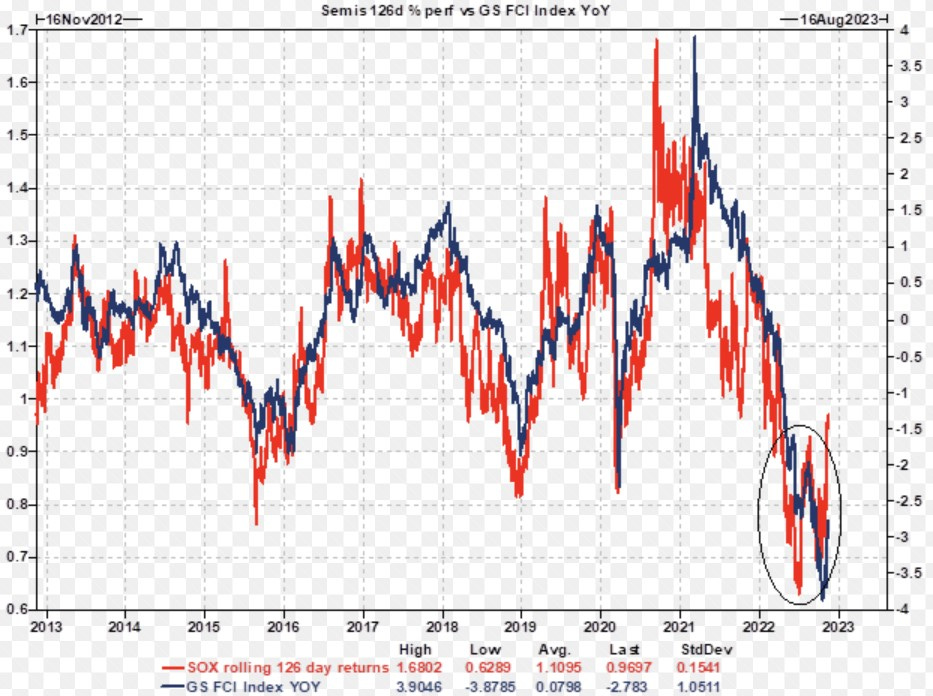

Goldman Sachs US Financial Conditions Index: to start, the 15-day change in the (GS US FCI) we just had equates to one of the bigger ones in 2022

Now it’s a good time to catch for parts of the stock market that ran ahead not just with it but way more & above - for that when the GS US FCI Year-over-Year is plotted with the SOXX ETF 126-days rolling % daily returns, this is what we get: SOXX getting hot & running ahead above this latest optimism & easing in the US financial conditions. Source GS GMD.

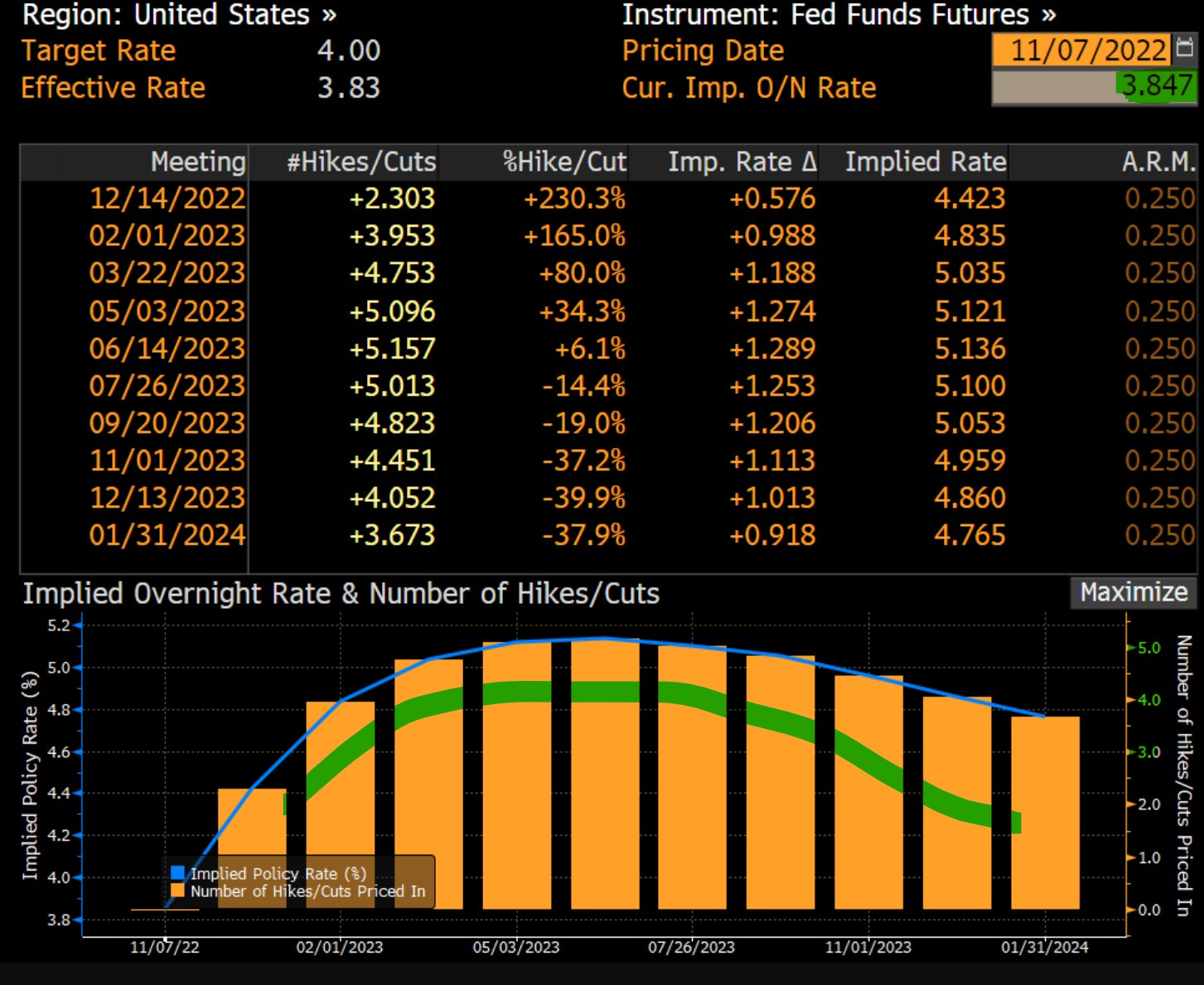

FED’s less aggressive rate hiking path: the easing above in the GS FSI has in the background the latest encouraging inflation data. In this respect, below we can see the ‘Before’ & ‘After’ FED hike path. 'Before' & 'After' the CPI data: until recently market was all about 'higher for longer', while now way less ... rather getting closer to the 'neutral rate'. Funny how fast things can move, isn't it?

Relative strength & performance VS the S&P 500 and Nasdaq: now let’s also see SOXX with the SPY (S&P 500) & QQQ (Nasdaq): SPY & QQQ with the relief rally, but SOXX getting hot in November recording more than double & triple the returns in the SPY & QQQ respectively

The same trio SOXX SPY & QQQ with a relative % performance:

Now if one does not own SOXX, but individual semiconductors, things get even more interesting via the SOXX scatterplot: 1 month % price change & % holdings weight. In the green circle I did highlight here the semis which had returns between 15% to 35% in just one single month: overcooked? returns front-loaded?

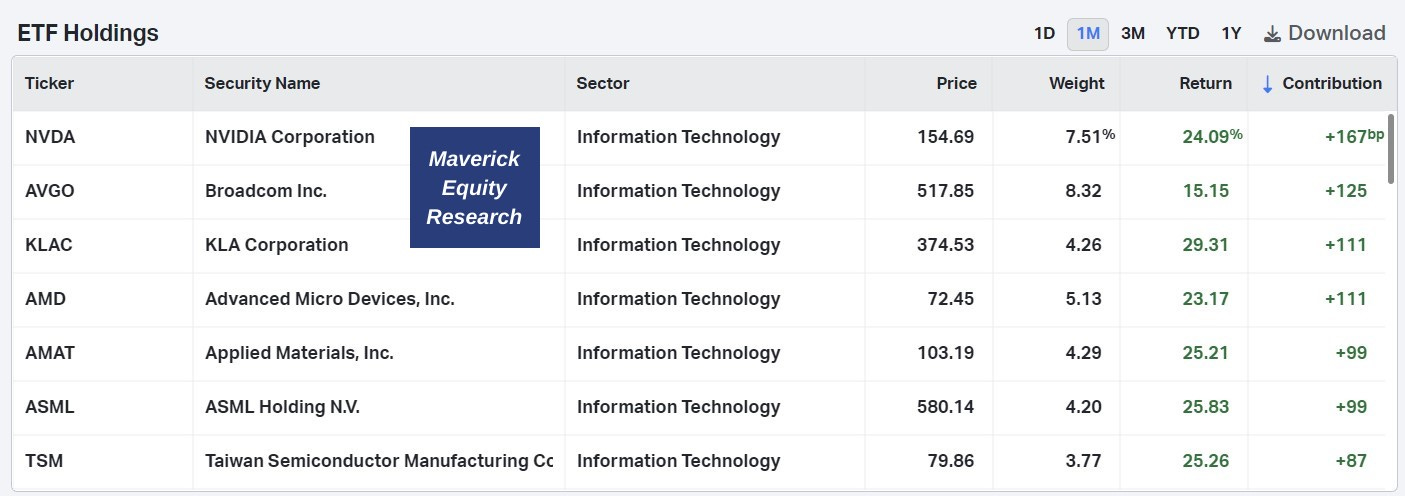

Complementary, SOXX ETF holdings and contribution to the 1-month returns: NVDA, AVGO, KLAC, AMD, AMAT, ASML & TSM are rocking the boat heavily:

S&P 500 level, a ceiling as well? Let’s also note that the current 3,942 level is very close to the 4,000 level that was twice surpassed briefly last week, but could not hold above, hence seen as a ‘ceiling’. Round numbers & psychology, we like it or not, matter in markets and are a battleground threshold for the bulls & bears, especially on the short term. Hence, this also is a pressure point for SOXX / Semiconductors to keep rallying from here after such a nice run

Bears & Short Sellers coming in strong? SOXS ETF (3X short Semiconductors) recorded +$500M inflows on high volume last week. Pocket of the market looking aiming to gain by shorting after this very good recent rally (via @cfromhertz):

Last but not least, let’s also have a look at SOXX via the Technical Analysis lens:

price (blue) should it meet & kiss the 200-day moving average (red), it would mean that is a ceiling/stop level short term wise given a resistance level

the downward dotted trend line (black & 4 red circles) as a closer resistance level

RSI also hovering lately around the upper oversold level, which supports the overall view that we had a very good rally lately, though it might have been too fast & strong:

Trade Execution:

Sell or trim SOXX ETF

Sell or trim top holdings from the SOXX ETF that ran ahead too fast & strong

Hedge to protect gains via options Long Puts or other instruments

To wrap it up, 3 final notes on trade execution:

should one sell too early now & semis would keep running, it would be a good signal for the market & economic recovery overall & one can always jump in back into the semis train … market will always open

hedging cheap is my preferred way when it can be done relatively cheap

my thesis here is downside risk after a great recent run - Medium-Long term Semiconductors should do well along economic recoveries

Did you find this Trading Idea / Special Situation interesting? Questions, feedback? Would be great to hear, hence just comment or reply to this email. What would help a lot from your side? Very easy, just spread the word around & share this with people that might also be interested into this coverage.

Feel free to reach out to me personally here or via Twitter @Maverick_Equity

Have a great day!

Maverick Equity Research

P.S. in case you missed my S&P 500 deep dive which includes my Ceiling & Floor levels going into year end and related rationale, you can read it via this link:

P.S. in case you missed my Value Stock Screener in Europe has some interesting findings in the context of the energy crisis and the war, you can read it via this link:

Disclaimer: information on this site should not in any case be considered financial, business, tax or legal advice, but instead independent research

Interesting presentation. Also, the movement of US rates from today, with China story in the background, supports your thesis.

Thank you, semis look indeed overcooked ... nice run ... in some ways like Energy ... we had it very good lately, time to think about risk/downside ... investing and especially trading is about risk management, not chasing dreams & fantasy ... like way too many other propose out there