✍️ Top 10 Charts Goldman Sachs is Watching

Stocks, bonds, commodities, real estate - inflation & asset classes, recession odds, risk appetite, investor sentiment & positioning, volatility and financial flows

Dear all,

here we go with Goldman’s Top 10 Charts to Watch & Bonus ones. Enjoy!

Coverage is NOT behind a paywall & there are no pesky ads here. It would only be highly appreciated you just spreading the word around to likely interested people.

Report structure:

📊 Goldman Sachs Top 10 charts to Watch

📊 Bonus Charts: 10 more to Check

📊 Goldman Sachs Top 10 charts to Watch

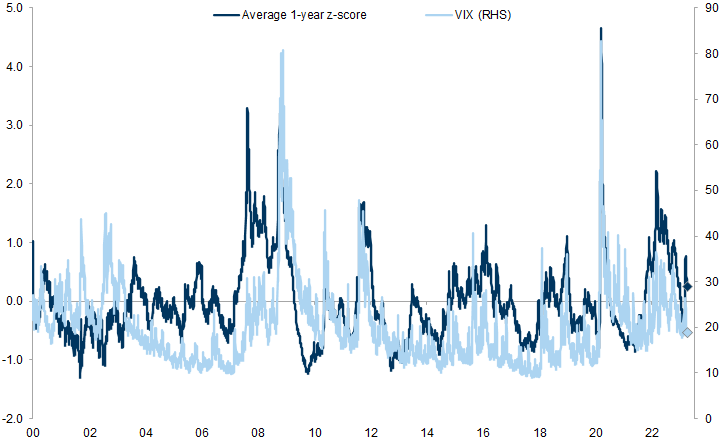

Market stress has picked up around the US banks stress but did not spill over to equities or more broadly

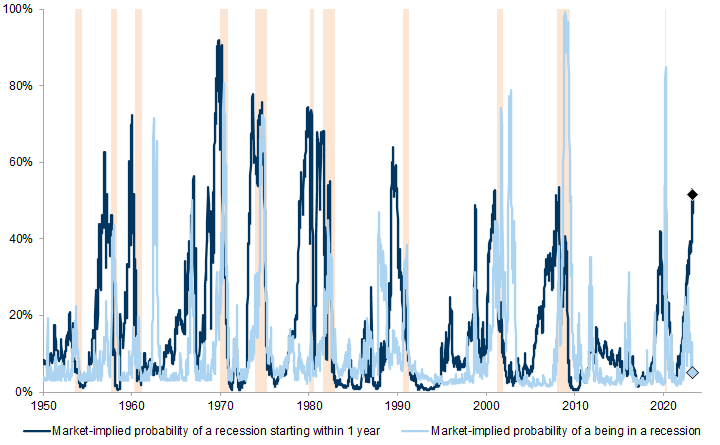

Recession: imminent recession risk has been priced out while latent risk remains

Market-implied US recession risk (average of univariate logit models). Orange shade: NBER recession.

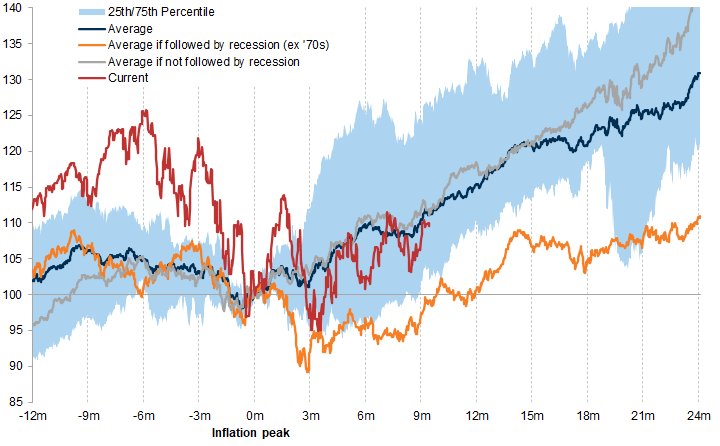

S&P 500 & Inflation: a peak in inflation is not sufficient – monetary policy and recession risk matter too

S&P 500 total return. Data since 1950s. Indexed at 100 at historical inflation peaks

Some real assets including real estate, infrastructure and precious metals can do well as inflation normalizes. Data since 1970s when available. Performance as of March-23

Commodities have been the worst performing asset class as inflation normalizes; cyclicals have outperformed recently. Data since 1950:

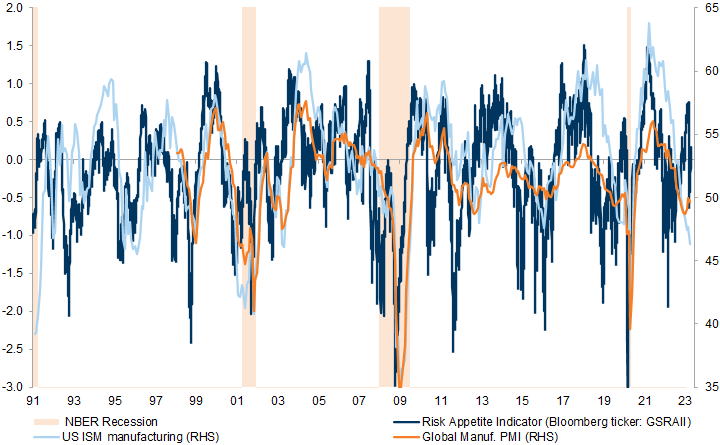

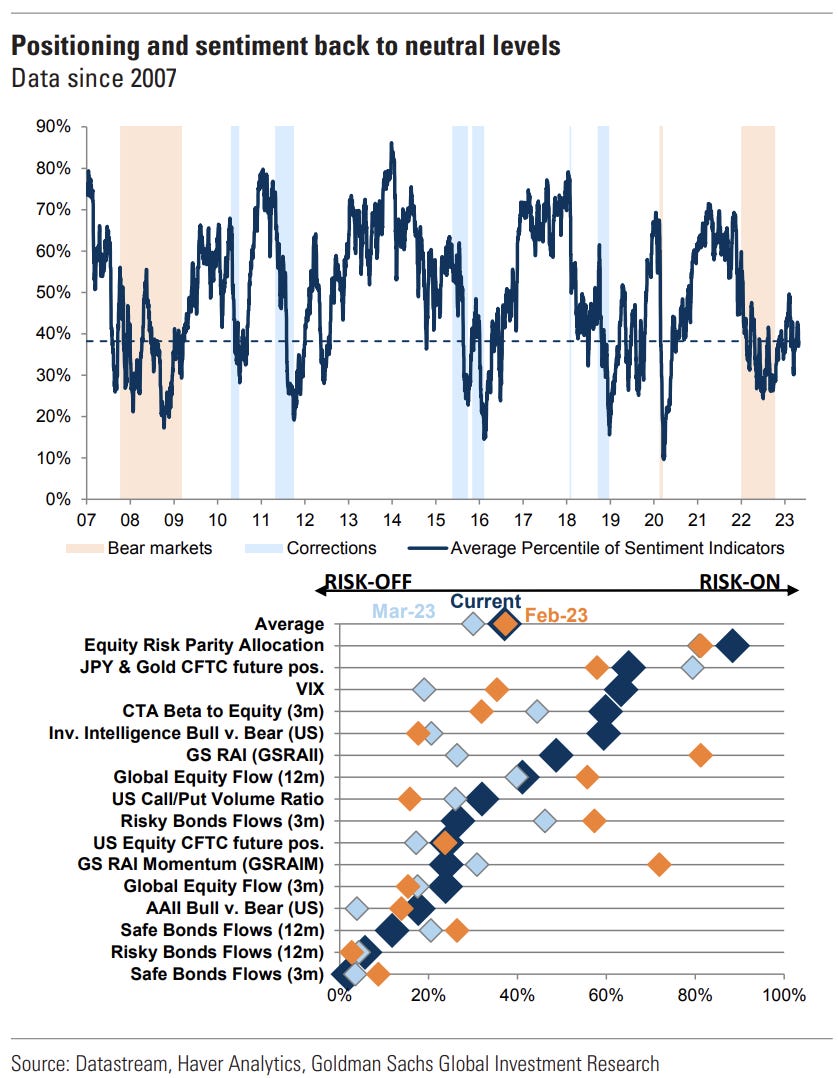

Risk appetite picked up materially earlier in the year but is now more neutral

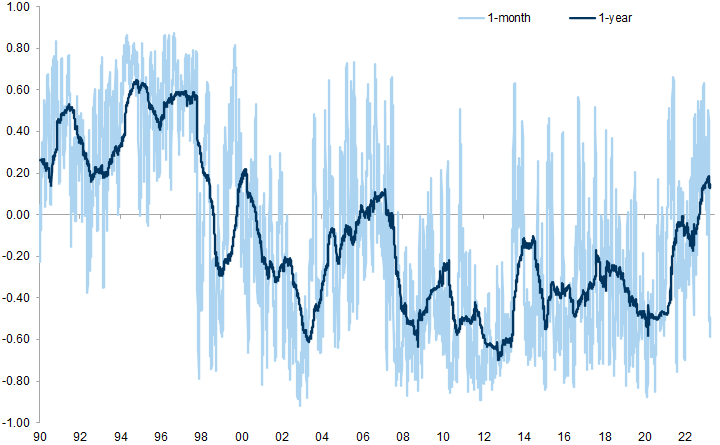

US equity/bond correlations declined sharply last month after being positive last year. S&P 500 vs. US 10-year bond correlations (daily returns)

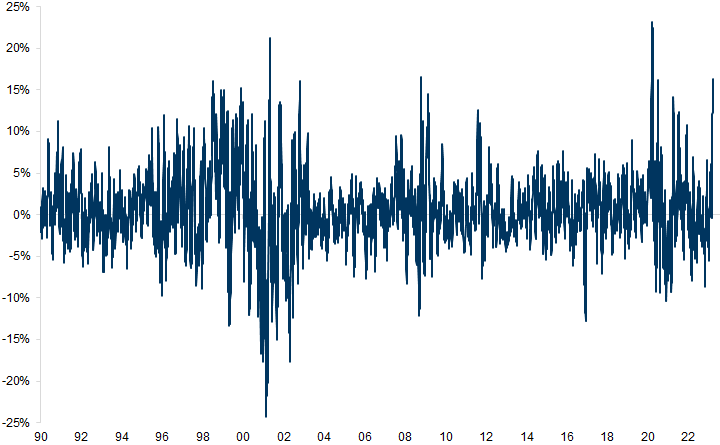

Sharp outperformance of long duration Tech vs. US domestic cyclicals kept equity volatility lower. Nasdaq vs. Russell 2000 relative return (monthly)

US 10-year interest rate volatility implied by macro variables peaked & is falling

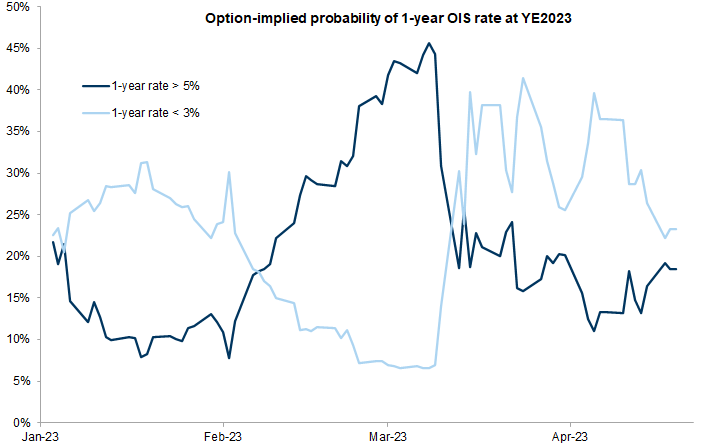

Right tail risk for rates has been priced out while left tail risk has picked up

📊 Bonus Charts: 10 more to Check

As bonus, another 10 cherry picked charts via Goldman Sachs:

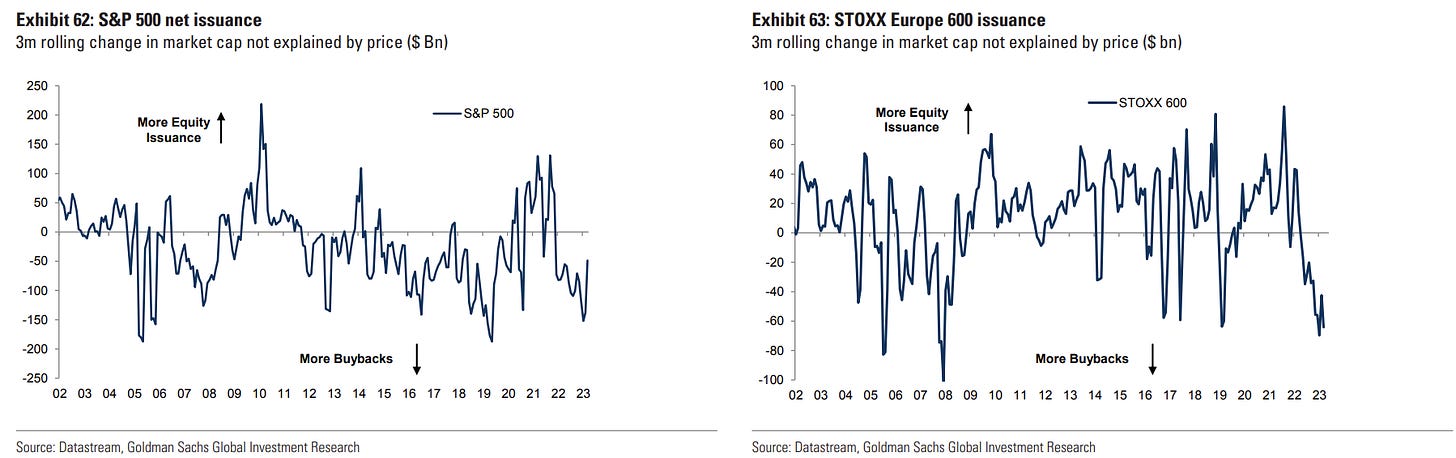

Stock buybacks are on in both US & Europe (S&P500 & STOXX Europe 600)

Flight to quality:

👉 Signs of rotation into defensive equity (Exhibit 1)

👉 Signs of reversal of the significant large cap outflows (Exhibit 2)

👉 Large inflows into global quality ETFs since the banking crisis (Exhibit 3)

Investor sentiment surveys much more bullish in April compared with March

Cross-Asset Global Fund Flows in 2023: Money Market a winner by distance …

Cross-Asset Global Fund Flows: Cumulative & 1-month rolling by asset class & region

Equity Global Fund Flows: Foreign/Domestic Investor Flows

Retail investors single stock net buying/selling:

"Retail investors sold twice what they accumulated during the pandemic over the last 15 months." Not really buy & hold investors imo it seems … buying ticker symbols not pieces of real & solid businesses … rarely is a good strategy …

Complementary view - Retail Selling has reached a new Milestone: In April, we reached a milestone in retail trading trends in NASDAQ single stocks. After a buying frenzy during the pandemic, we estimate retail investors started to sell stocks in February 2022. Selling continued until they sold all of their pandemic-acquired NASDAQ single stocks as of November 2022. The selling intensified in early 2023, and we estimate retail investors have now sold more than twice what they acquired during the pandemic

Gold ETFs flows picked up materially since the banking stress …

Positioning & Sentiment indicator has made a round-trip over the past couple of months, turning bearish around the March banking stress and recovering to neutral levels now. Risk-off skew has increased across risky assets.

U.S. Investment Grade (IG) and High Yield (HY) debt interest coverage ratios (ICRs): they look pretty solid (median values):

Should you have found this cherry-picking endeavour interesting and valuable, just subscribe and share it around with people that might also be interested to read this kind of content in the future. Twitter post can be found here. Thank you!

Have a great day!

Maverick Equity Research

Disclaimer: information on this site should not in any case or form be considered financial, business, tax or legal advice

That retail selling is impressive. “Recession fear” worked lol.

Great overview, thanks for sharing!

Thanks man!