✍️ Which Research Tools Do I Use? FAQ answered: AI powered investment research tool!

Institutional level research tool with many features, in short: value!

Dear all,

frequently asked questions I get: ‘which tools do you use for your independent research? Do you know a solid tool out there for stocks which can do a lot but without a big price tag? How do you cross-check other research for accuracy? How can I research best various stocks?’

Likely you know Bloomberg, FactSet etc which are top tools but the problem is price: $30,000/year & respectively $18,000/year. The good thing is that competition is on and there are many tools out there, each with their pros & cons and various price tags. The bad part is comparing them & seeing which one offers great value for many uses cases.

I did the work and one tool that I use regularly which offers great value is FinChat!

they are the first product I partner & affiliate with given the value they offer: institutional data quality, unique features, speed, automation, charting & more

you will see more & more of it via my future research, especially in the Full Equity Research (Stock Deep Dives) section where it shines. Below you will see an overview of the tool with clear examples & use cases

Should you see the value via my use cases but also you testing it, as an ambassador/affiliate you can get the current price before future increases and on top a further -15% off from any plan applied at checkout.

Grant Williams asked in June if there is a ChatGPT like product for finance?

Yes, there is: FinChat.

And now my overview via sleek use cases & examples and I also encourage you strongly to personally check and test the research platform:

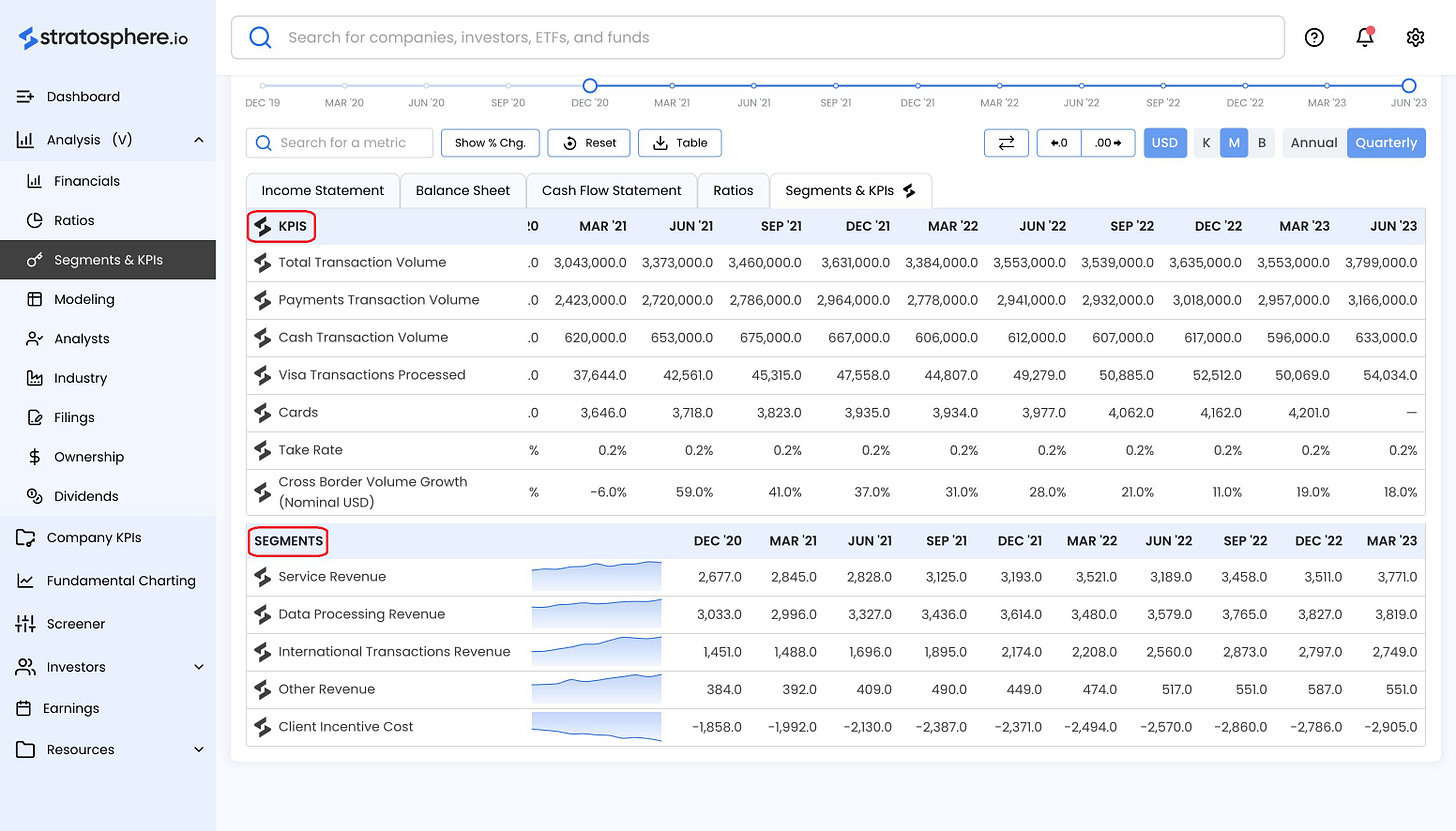

Business Segments & KPIs on specific stocks, Visa (V) example & two key notes:

KPIs are proprietary and a key differentiator and guess what, not even Bloomberg ($30,000/year) or FactSet ($18,000/year) have them inside…

Business Segment data to collect it all & chart them manually is very time intensive & humanly error prone which happens independent of research providers: did mistakes there myself, saw mistakes at very big houses and sometimes even after approved deals worth tens of millions…

Just 1-click & the Payments Transaction Volume KPI 2020-June 2023 is charted:

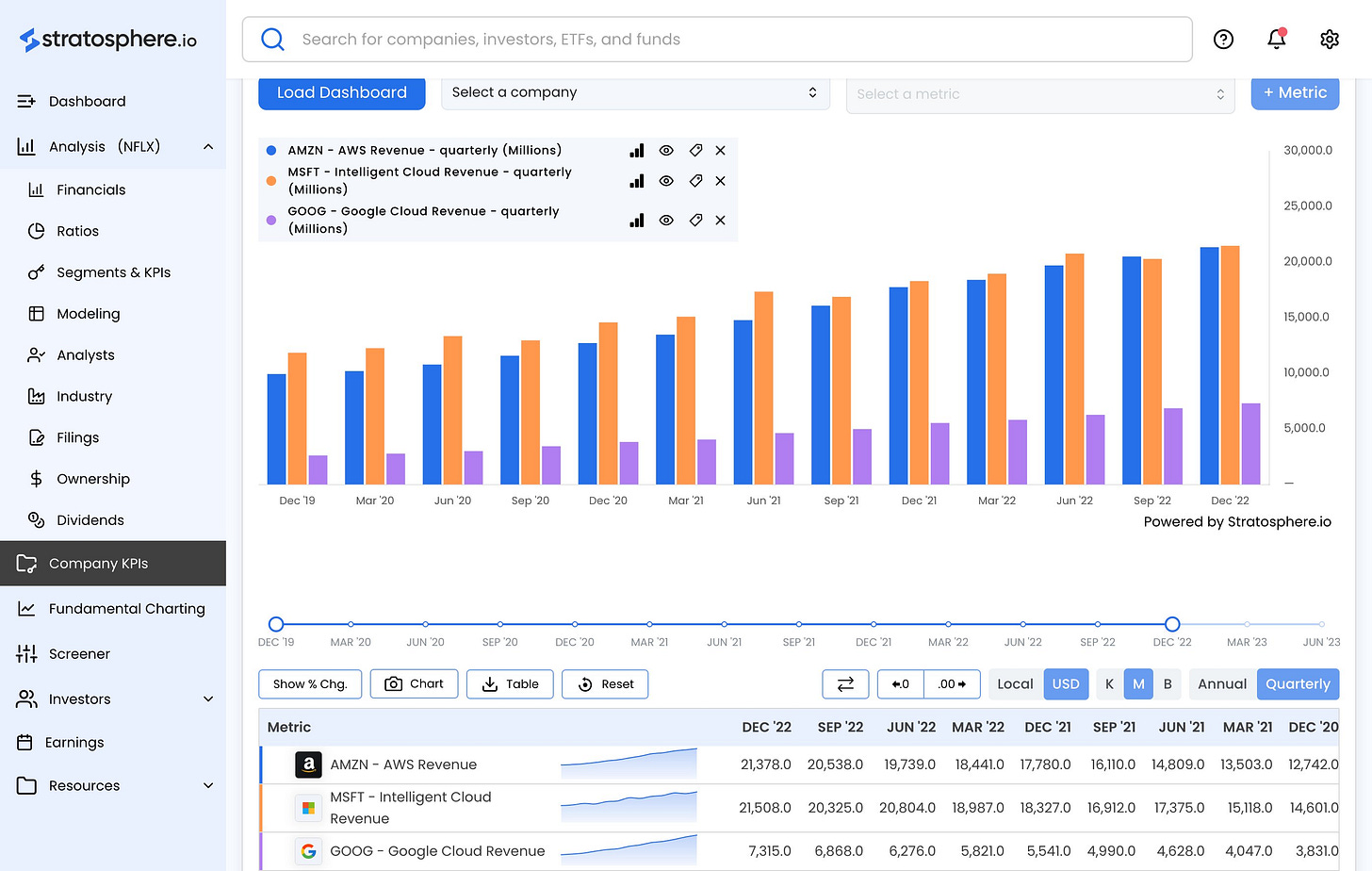

Cloud segments of the mighty techs Amazon, Microsoft & Google:

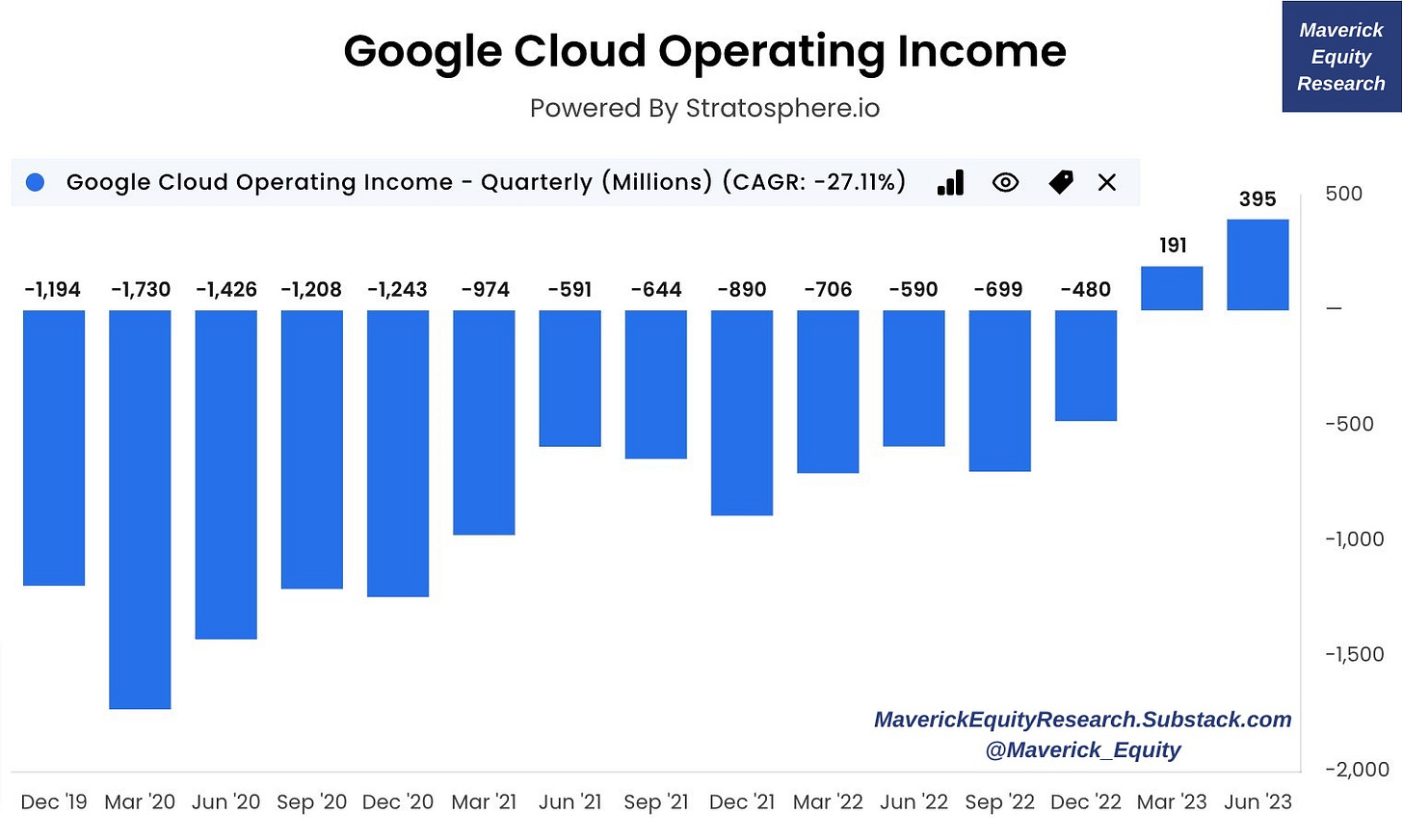

Google Cloud segment: 2nd profitable EBIT (Operating Income) quarter:

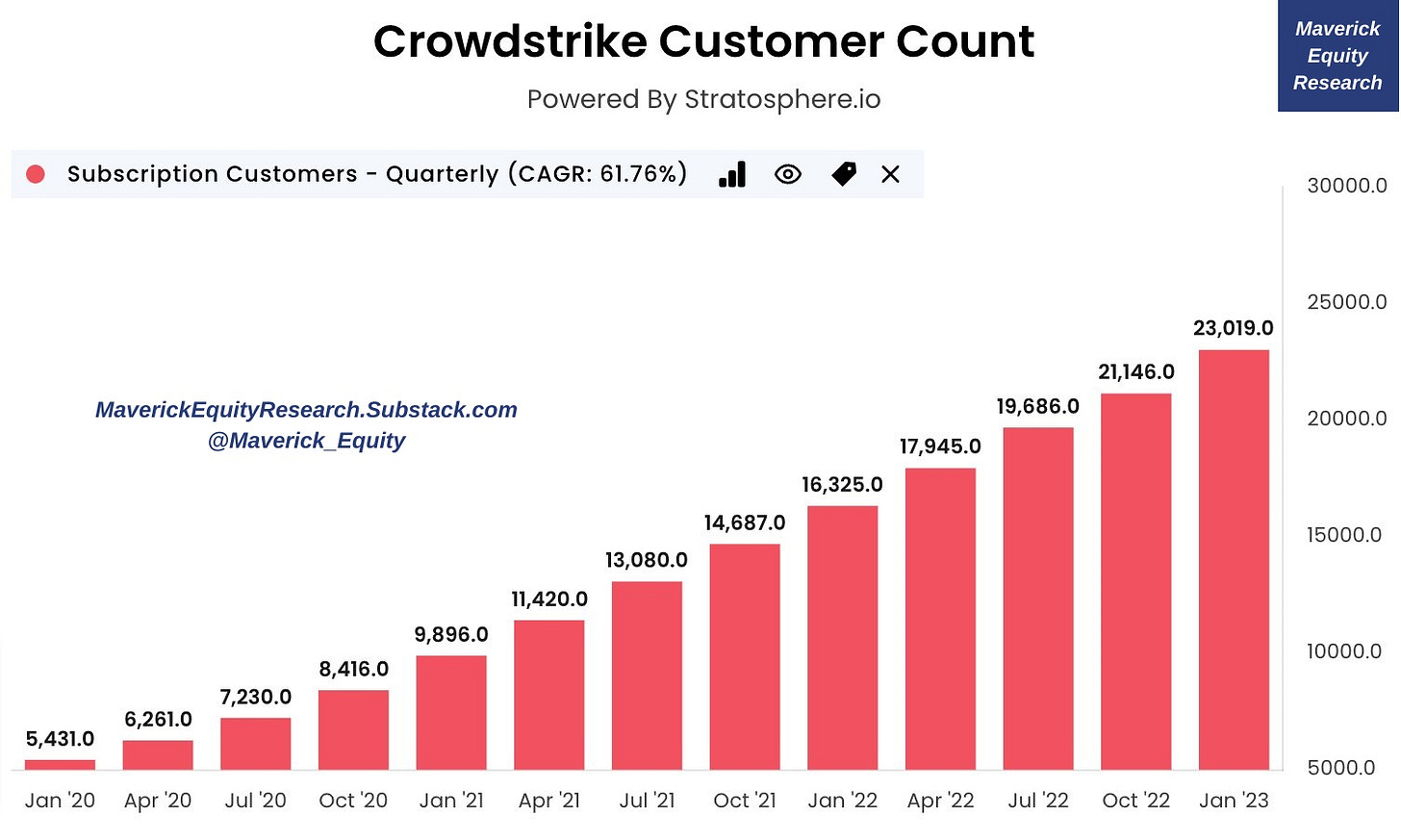

CrowdStrike (CRWD) Subscriber growth: quarterly since 2020 for a 61.6% CAGR

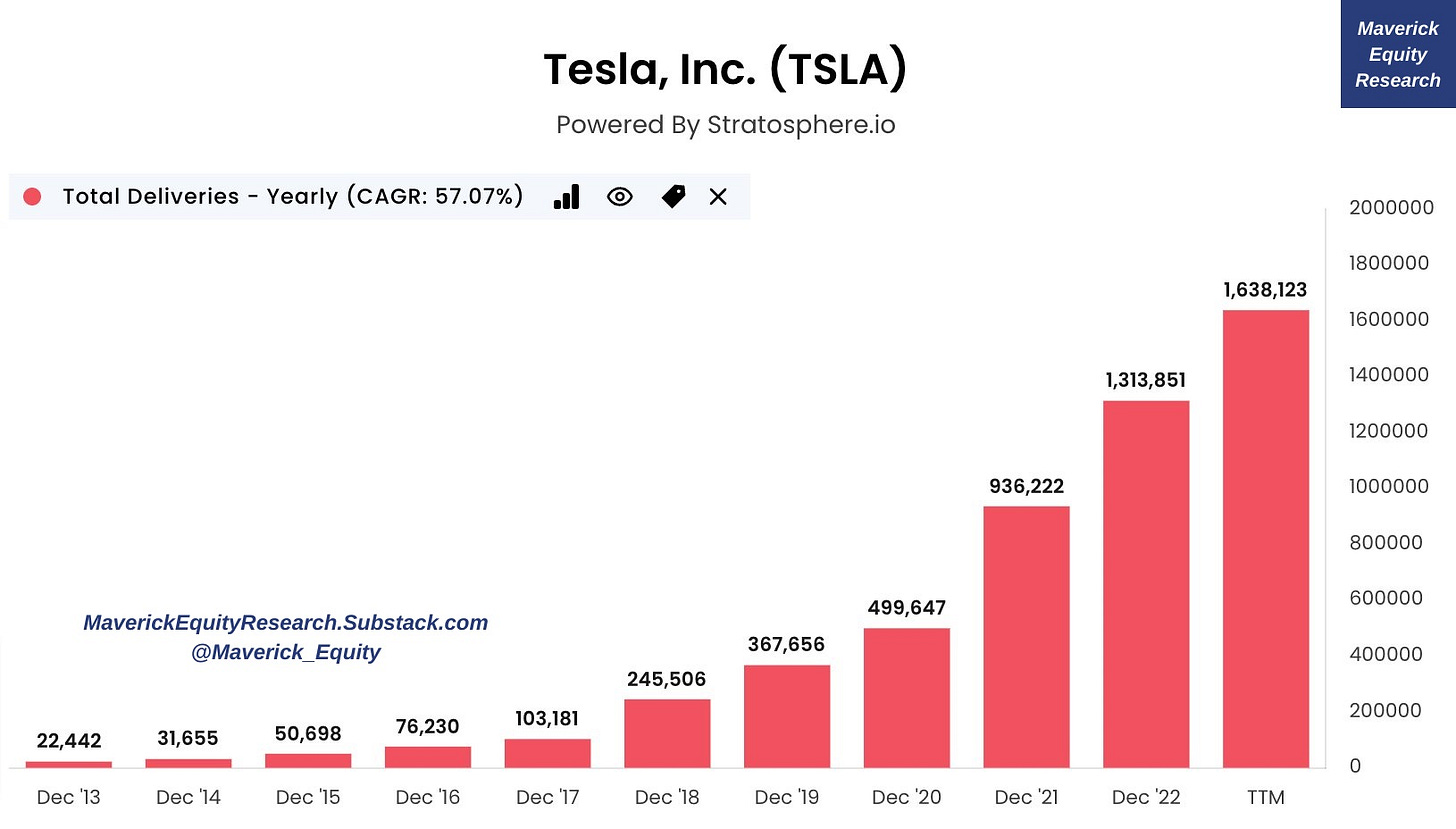

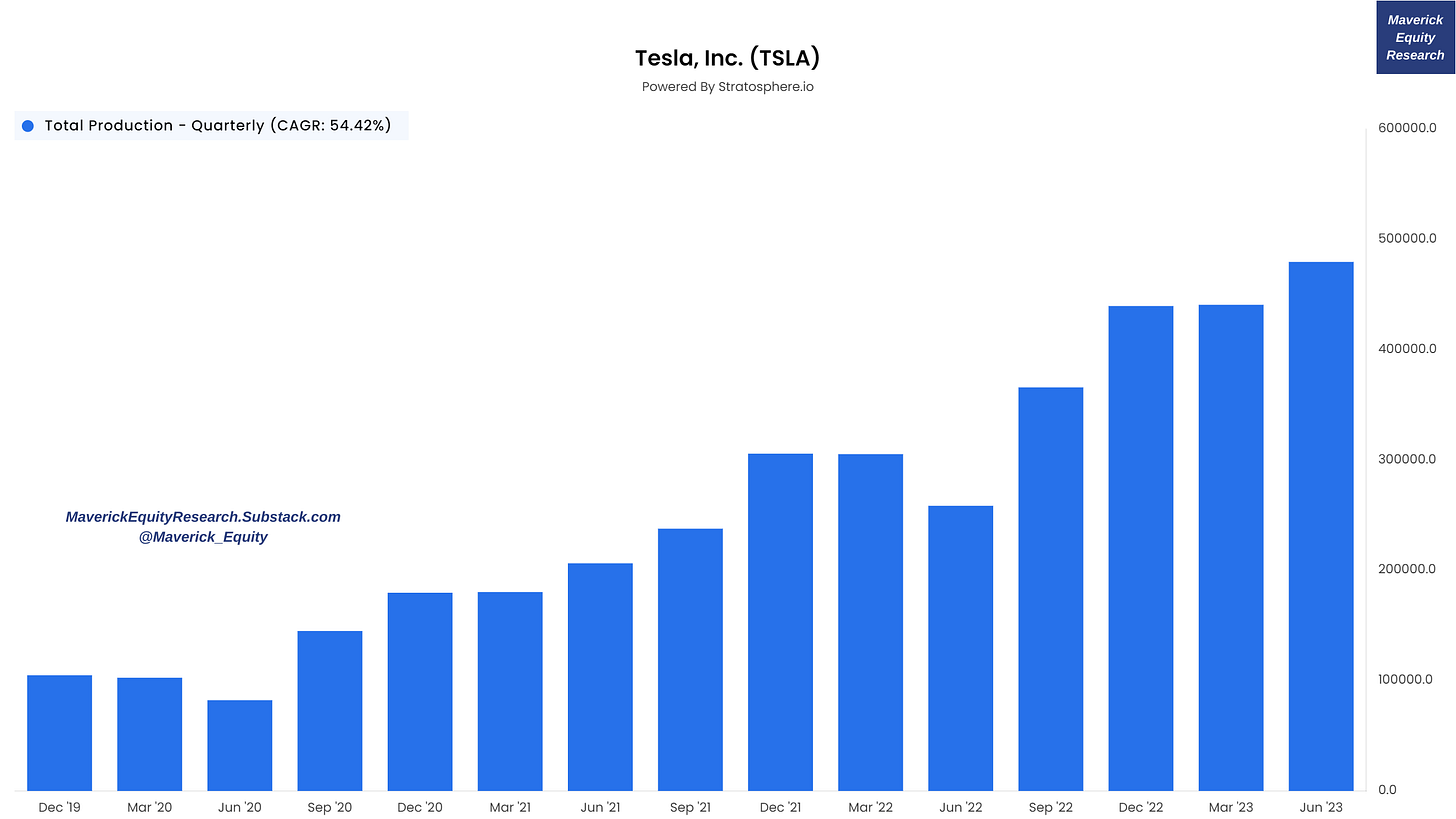

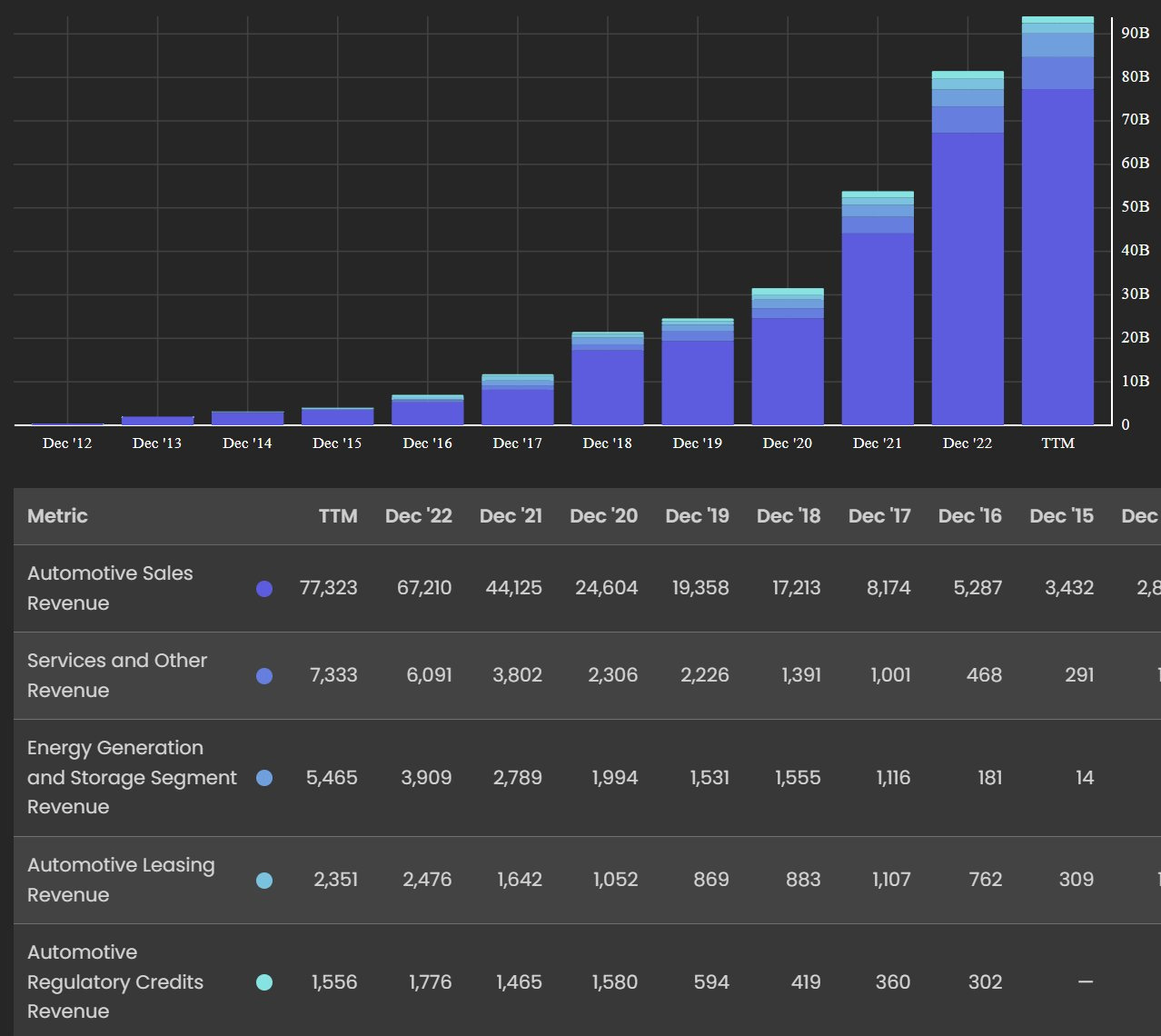

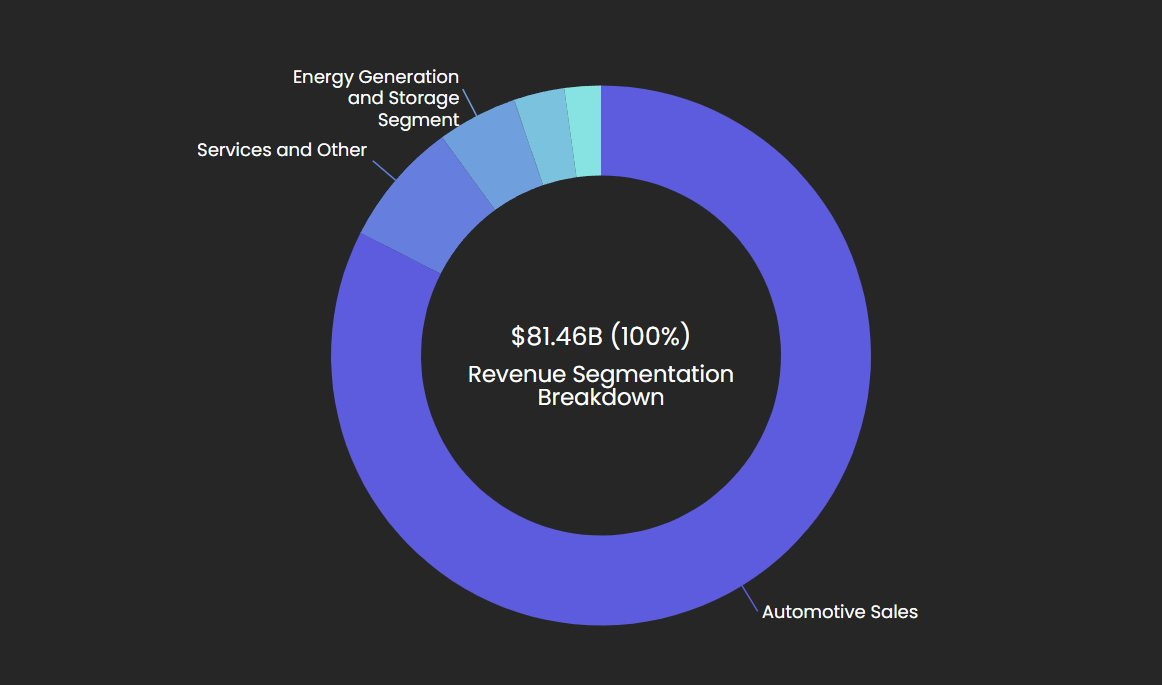

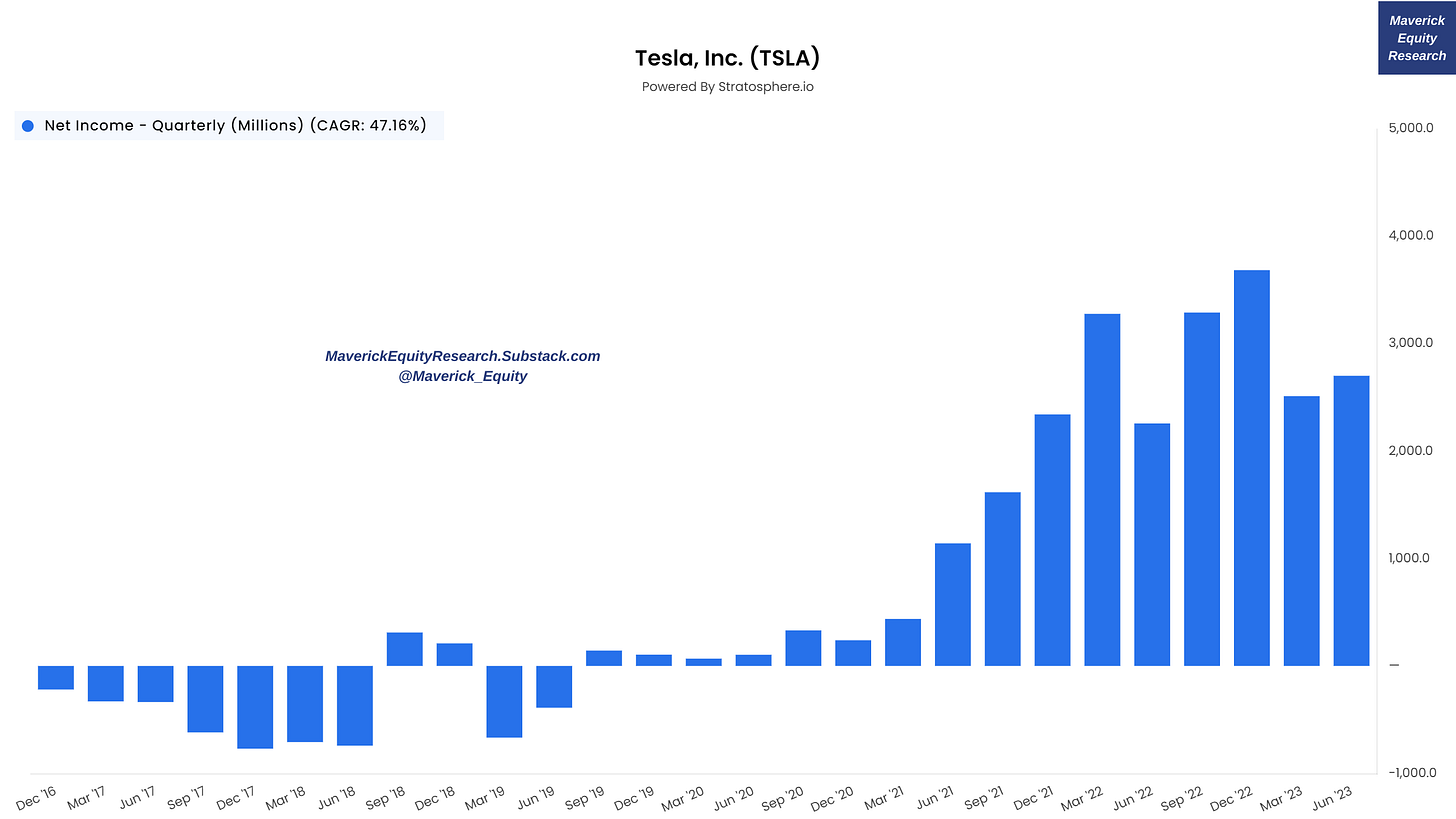

Tesla (TSLA) Segments, KPI and Financials breakdown:

Total Deliveries since 2012:

Tesla Model 3/Y Production with Quarterly data since 2020 for a CAGR of 61.00%:

Tesla Model S/X Production with Quarterly data since 2020 for a CAGR of 2.41%:

Tesla Total Production with Quarterly data since 2020 for a CAGR of 54.42%:

Tesla Total Revenues Breakdown since 2012:

Automotive Sales with the big 82.5% share

Services & Other Revenue growing very very well ... that will be quite big down the road imo ... ecosystem power ...

the same for Energy Generation and Storage ... and the latter with big margins imo ... It is all about the ecosystem ... hence, creating a big moat ...

Follow up complementary questions are offered automatically:

Tesla Income Statement (P&L):

Just 1-click and you get the Net Income charted, quarterly since 2016:

Financial Modelling via FinChat AI made fast & easy, DCF (Discounted Cash Flow) use case. Example: you just ask the built-in FinChat AI Assistant: ‘Build me a discounted cash flow (DCF) model for Tesla’

You will get first a nice walkthrough of the DCF with the taken assumptions & values. Following that, you get the output where the DCF uses consensus estimates, but every single assumption is editable according to your views & research after it is generated:

Additionally, you will get complementary questions that you might want to ask:

No question how much time this saves to anybody doing DCFs, and that’s besides the consensus estimates guidance which is very valuable as well be it one agrees or not with it. Simply impressive!

FinChat AI assistant can do way more, just ask it and answers will come back. For example: "Why was Roper's (ROP) free cash flow down in 2022?".

FinChat AI will directly index and show transcripts from management talking about the drop in FCF and provide you the why!

Additionally, it will tell you the key aspect: when normalized, it actually grew 8% adjusting for Vertafore. Just for this 2 questions, quite some time would have to be spent … but not anymore. FinChat AI is like having a research super assistant.

Examples of questions for the 50,000+ companies you can currently ask FinChat about:

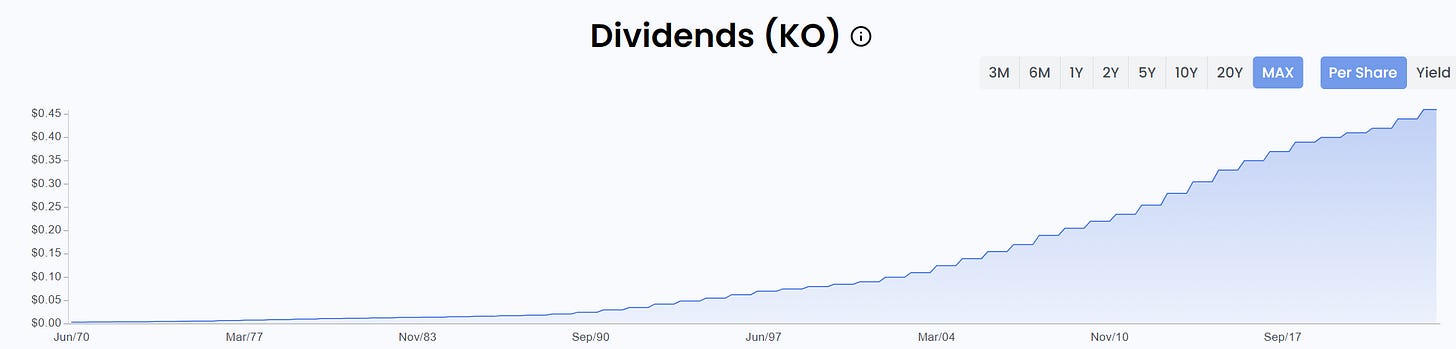

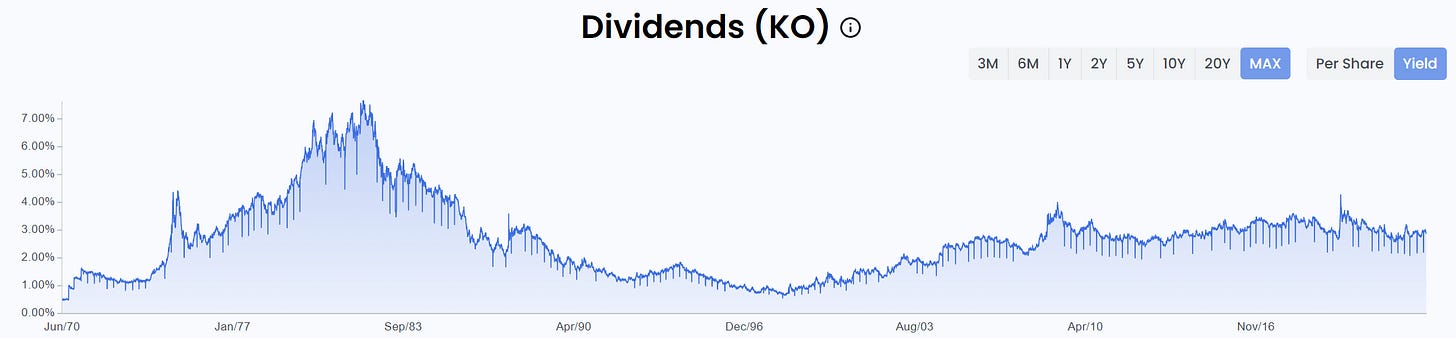

Are you a dividend investor? There you go taking Coca Cola (KO) as an example: dividends per share & dividend yield since 1970 … done with 2 clicks!

Stock Screeners: very robust with many filters, both quantitative & qualitative:

General Stratosphere Tools overview, feel free to explore: Wall Street analysts view, industry peers, ownership, fillings, ratios, charting, super investors holdings, hedge fund letters, Excel add-in, dashboards & more:

Note: FinChat V2 was released in July … check what was brought & also the pipeline:

All in all, the main take-ways are:

Further major developments are incoming for an industry defining research tool

You can lock in the current price, and on top a -15% off via my ambassador link

I hope you found this timely information & offer useful! Feel free to ask any questions.

Have a great day!

Mav

Was not aware of Stratosphere at all, will have to check it out!

Now that’s something! Being able to ask ‘why did this company experience this or that in the last quarter or going back in time’ is quite a crazy good feature.

I am playing now with the tool, looking great!

Thanks for the announcement!