✍️ Maverick Charts & Markets - January 2024 Edition #14

25 Sleek charts that say 10,000 words ... save precious time & provide insight!

Dear all,

greetings from Vienna and just like last time from the Austrian National Library. This time around with the day time view, while in case you missed the night time view that came with the research piece from last week, you can easily give it a read:

✍️ The State of the US Economy in 45 Charts, Edition #2

One would meet here people from all walks of life, interests, subject of study, leisure reading, university studying, work etc. One can meet a 20-year youngster that dropped from university and works 10-12h/a day on his app which already works very very well, to a 45-year chap that has been devoting his last 5 years to give Shakespeare a new novel interpretation … which makes me tell myself and my friends many times that our single focused interests, opinions, biases and views about the world might be quite narrow and 100,000 miles apart from somebodies else’s. It’s not about being ‘right’ or ‘wrong’, but about the fundamental aspect to remain open minded … .

+ the view from the entrance shows in the background the city hall and the parliament:

There you go with January’s 25 charts storm covering Macro, Stocks, Bonds & More which also naturally connects the dots with many aspects of Geopolitics.

Before that, from Buffett the legend: “Price is what you pay. Value is what you get. It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

What would be appreciated? Sharing, restacking it around with like-minded people and hitting the ❤️ button. This will help bringing in more & more independent investment research!

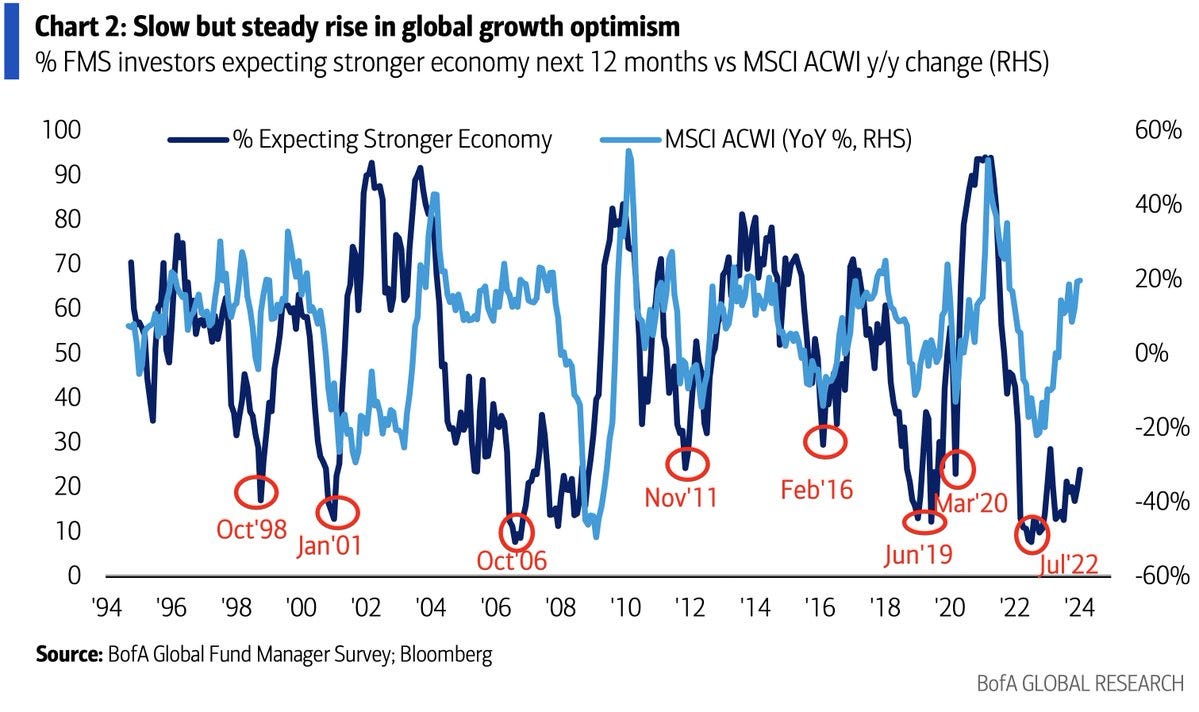

The number of global fund managers expecting a stronger global economy in the next 12 months is rising slow but steady: at a 12-month high now

Getting granular, what is the most likely outcome for the global economy?

79% expect a ‘soft’ or ‘no’ landing for a 9-month high

Conversely, only 17% expect a "hard" landing which equates to a 9-month low

What about timing the next recession?

41% see no recession in the next 12 months, followed by 21% for Q2 2024

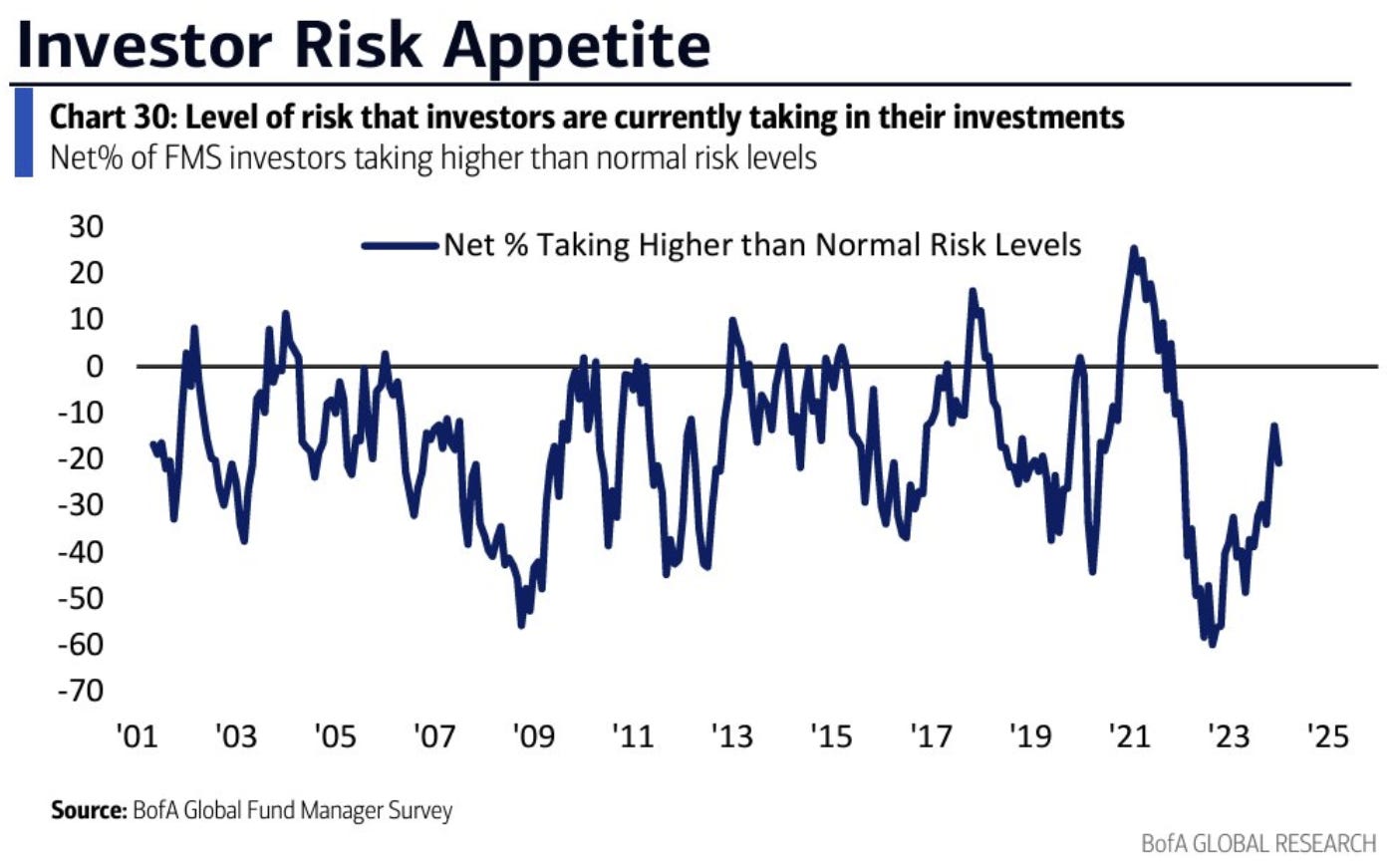

In terms of risk appetite, 21% are currently taking lower-than-normal risk levels. How to use this in practice?

whenever it goes too much and too fast above the 0 line, euphoria kicks in in and might be time to sell or de-risk (see 2021 mania) … until then, normally the bull market has legs

Large caps vs small caps

investors expect small caps to outperform large caps (first time since June 2021)

N.B. my Full Equity Research section will cover interesting small caps in 2024 as I believe also many uncovered great companies in the space with solid business models

US capital markets wise and economy: for a healthy economic growth and a leading indicator (partly) I always like when Semiconductors (Blue) and Homebuilders (XHB) lead and outperform the S&P 500 index (black).

US economic activity is give it a guess … concentrated:

50% stuffed in the orange spots

US is not an outlier: I lived in US and 6 other countries in Europe … and looked at economic activity stats at many countries: many countries exhibit concentration, what differs is the degree …

Eyes on Washington Baby! NY Times articles count Mentioning Trump & Biden - Trump with the most counts since 2021 …

it’s not just NY Times, most media outlets will do anything for clicks & views and what brings most of that? Controversy, polarisation, extremism, hot takes etc … hence expect of Trump, Biden et. al headlines in the 2024 election year

elections are always important, but my simple and some say controversial take is: if people would spend just 1/5 of the time they spend on politics (reading, debating etc) and with the rest 4/5 they would learn a language, read a book, a new skill, eat better, exercise … or simply sleep more … the world would be a more peaceful place with 4/5 less heated & mostly useless debates, way more

US job market update:

Initial jobless claims (people filing for unemployment benefits) fell big to 187k

the estimate was 205k and 203k in prior weeks

FED funds target rate naturally very correlated with the 2-year yield, key notes:

👉 FED Funds rate is now with more than a full point above the 2-year yield

👉 tight monetary policy from the FED is on as more work/time on the inflation side is needed, but as the 2-year yield started going south … expect FED funds rate to follow

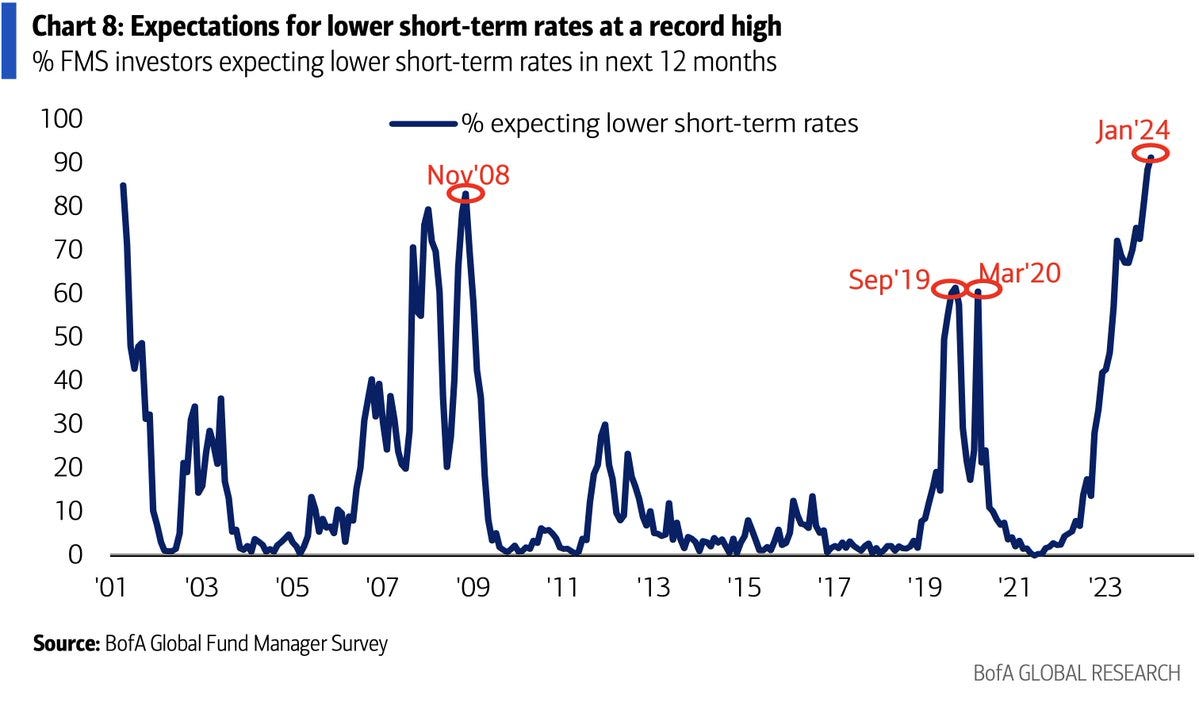

What do fund managers expect in terms of interest rates for the next 12 months?

they started 2024 more confident than at any previous point in this century that rate cuts were on the way

What about long term rates and an inflection point towards down?

expectations got tempered a little lately, yet the investment idea that it’s time to buy long bonds is popular

How does the current FED pricing of cutting interest rates (green) look like compared to previous actual cuts? Not that aggressive as many headlines say. Hence, +room for upside for investors in bonds should the FED cut even harder.

Price changes on selected US consumer goods and services Jan 2000 Dec 2024

overall inflation is 82.4% but note how wide the differences are among this basket

hence, inflation impacts everybody differently …

What’s the connection between US recession periods and budget deficits?

with the current so large deficit, the US has never entered into a recession

Investing in stocks for capital gains - a hot topic:

besides compounding, a great feature about investing in stocks is that gains are never taxed unless realised which boosts the compounding effect via taxes not being a drag … there is reason why the super-rich are into stocks big time …

Americans For Tax Fairness says ‘Unrealized gains are the largest source of income for the ultra-rich—but they're completely UNTAXED under our tax code.’ which is not correct: unrealized gains are NOT the largest source of income for the billionaires etc ... because by definition they are not 'INCOME' ...

I get the message that rich get richer etc, they can get loans with the stocks as collateral and the interest paid as tax write-offs = huge advantage … but let’s not confuse key terms big time … the real message is that we should all benefit from untaxed capital gains

plus how would it work in practice if one gets taxed on unrealised gains? Would you get the money back if the stock goes DOWN AFTER you paid the tax? Or how would equity that is not listed be taxed then? Small businesses and entrepreneurs would suffer a lot if taxed on their ‘unrealised’ equity in the firm

tax code reform is needed and should start before we reach taxing unrealised gains

Global Cannabis stock index

got ‘smoked’ in the last 10 years … probably the more returns got smoked, more cannabis smoking had to happen ;)) …

a few winners might come out of this space, but until then occasional hypes make for some momentum runs on the upside, while other than that, not my cup of ‘tea’, pot or pipe ;)) … not investing, nor personal …

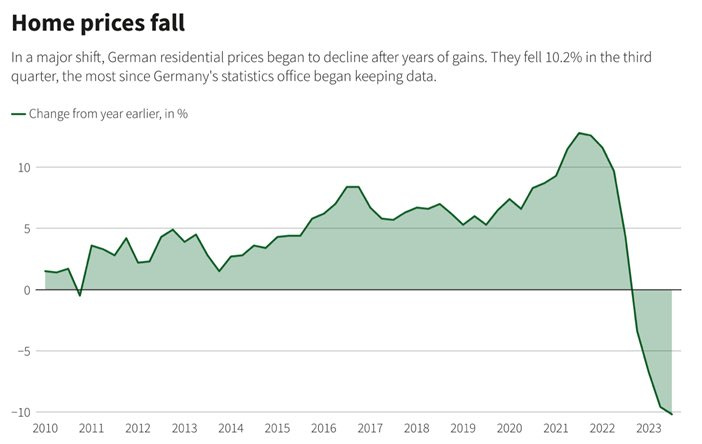

Real Estate does *NOT* always go up, Germany edition:

-10.2% for residential properties in Germany which is the most since Germany’s statistics office began collecting data

somebody buying before the 10% fall + adding the 11.5% initial purchasing costs, amounts to 21.5% down! If the down-payment was 20%, equity in the home = -1.5%

e.g. for a 500,000 home, the 100,000 down payment is gone and negative 1,500

but even in this unlucky case, assuming it is the home where one lives and it’s for the long run, it’s not bad and pretty much always an investment … but the 2nd 3rd home I am very skeptical how good of an ‘investment’ it is …

My opinion in general on buying residential real estate, more like a reminder for most:

real estate prices do NOT always go up

bought with a mortgage, it’s not owned outright … the only thing owned is an ‘option’ to own it after all payments are done (10-20-30 years)

owning outright or via a mortgage: repairs, maintenance, insurance, issues with neighbors, damages etc all to be paid (when renting, none to be paid)

One thing I am sure of as I worked in Real Estate landing more than a decade ago (banking side) and also I heard it from many private individuals: it’s faulty when people say ‘I am making 4-10%/year with real estate renting’ and how easy it is (modelling the rate of return is very complex anyway … better not to know in a way ;)) )

they often do not mention taxes, insurance, their own precious time to find and manage the property … and that it is not liquid (in a crisis very hard to sell), or possible but with a big heavy ‘discount’ … which is a forced sale …

they do not ‘count’ the initial purchasing costs which if 10% = 50k at 500k = big opportunity cost: if one invests those 50,000, in 20-30 years time it can get a very good amount and it can be done passively & without paying any tax or insurance

they compare it with stocks or let’s say the S&P 500 which is very wrong: real estate is a highly leveraged investment (let’s say 80% with a 20% down-payment) while S&P 500 not really (debt on the balance sheets is leverage, but not an issue and not comparable to an investment in property via a mortgage/huge leverage)

rental income is taken out, it’s not reinvested hence it does not compound like the returns in stocks (5% earned via renting is not the same with 5% via stocks: be it dividends stocks or growth etc)

rental income is not a bad idea at all, while if one wants that REITs might be a good alternative idea than owning physical real estate

with stocks one buys cash flow, with real estate one buys the utility that somebody will want to rent the place or that will pay a higher price in the future

higher prices in the future should not be much more than the evolution of the costs to build and the overall CPI - for the return to be way above that, there must be very strong wages and corporate cash flows, hence reflected in higher equity prices first … real estate to follow … and/or some big supply/demand imbalance

RE bubbles are usually a result of some very strong mania as RE is ‘the best’ or ‘never goes down’, cheap financing costs which both make for a strong narrative

All in all, as always, pros and cons, pros and cons … my 2 main points are:

to generate some food for thought for real estate this time around (I’ll do on stocks and bonds also)

if one is an expert and really dedicates time & the effort, any asset class can be ‘the best’ including real estate … hence, that there is no ‘best investment out there’ for everybody: there are both good & bad general approaches out there, the rest is customisation for each individual case

1st Bitcoin ETF launched and 1st Gold ETF launched

Once the first ETF on gold was launched, this is the evolution of gold after. First Bitcoin ETF was approved the other day, but I highly doubt it will follow the same pattern as many are inferring given the bitcoin ‘digital gold’ mantra

one can torture the data quite some to ‘prove a point’ in general independent of asset class, thesis - watch out always for the incentive of the opinion & research …

Recall Charlie Munger: “Show me the incentive and I will show you the outcome.”

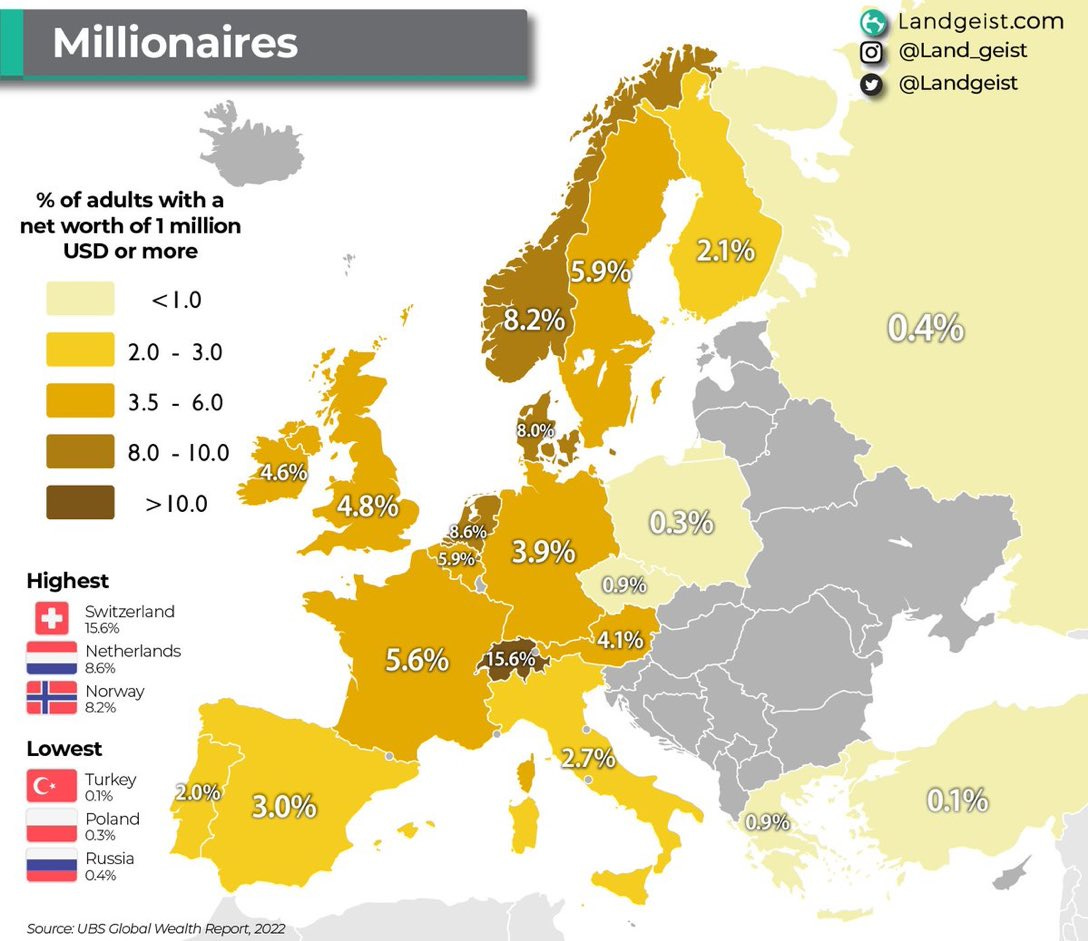

Wondering in Europe on the % of adults with a net worth of $1 million or more?

Switzerland leads as expected but recall the joke of the German guy crossing the border to Switzerland to open a bank account to park his cash: quietly waits in line, then his turn comes at the counter and starts whispering to the bank teller:

‘I have 1 million EUR with me in cash, could you please open an account and make a deposit with this huge sum?’

Bank teller replies: ‘sure Sir, but you know, in Switzerland you don’t need to whisper this because you don’t need to be ashamed to be poor’ 😂 …

👍 Bonus charts: China edition

A great long time series chart depicting the share of global GDP since 1500:

China (red) with more and more of the pie and aiming to equal or pass the US = quite a development and story since about 150 years

have a look on India … might be the surprise of this century …

China GDP growth and China’s Benchmark Index CSI 300 - economic growth via GDP normally makes for higher equities value, but not in China’s case

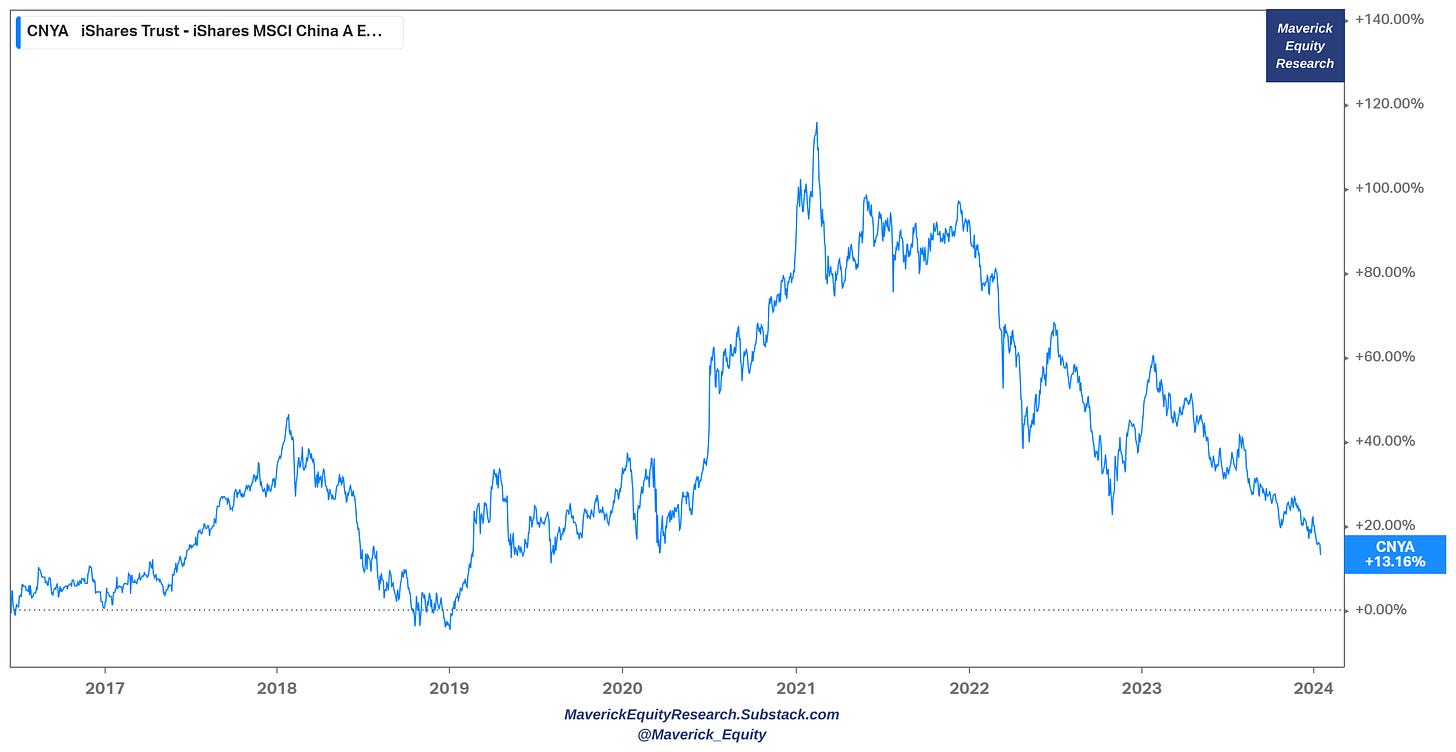

MSCI China A shares tanking as well … used to be a very popular ETF

Interestingly, Japanese stocks emerging higher in comparison with China

Valuation dislocation between US & China: Hang Seng Index’s P/E drops below Nasdaq’s P/B … quite a chart from no matter what angle I look at it …

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this extensive research by finding it interesting, saving you time & getting valuable insights? What would be appreciated? Sharing it around with like-minded people and hitting the ❤️ button. This will help me bringing in more & more independent investment research: from a single individual, not a company of any kind!

Have a great day!

Mav 👋 🤝

Great thoughts about properties! Here, in Bulgaria, lives the same mass mantra "They always go up". Maybe people really want to touch the asset class

I really love the idea about Real Estate. Particularly, the illustration of rental yield reminds me China property crisis at present, the intrinsic value of real estate really depends on location or macro envrionment. Housing Price always go up seems already embedded in lot of Chinese peoples' heart, but it doesn't make sense at all. Also, the joke of German goes to save money in Switzerland really make me Laugh Out Loud