✍️ Maverick Charts & Markets - November 2024 Edition #23

Magnificent 7, US & Switzerland valuation, Fair Isaac, Apple, AutoDesk, Palo Alto, Tesla, S&P 500, Mercado Libre, Nvidia, Google, Domino's, META, USD, Bitcoin, Musk, D.O.G.E, Musk-Trump, MicroStrategy

Dear all,

first of all, a Happy Thanksgiving to all the U.S. folks, and a great Sunday to all! Enjoy!

Now there you go with November’s 20 charts + 5 bonus that I carefully cherry picked.

Report structure is as always:

📊 Maverick Charts & Insights

👍 Bonus charts: D.O.G.E, DOGE, Trump-Musk, MicroStrategy & Bitcoin edition

Delivery is in typical Maverick fashion, via charts that say 10,000 words!

📊 Maverick Charts & Insights 📊

Have you ever wondered what is the combined revenue and evolution of the U.S. Mega Tech companies ‘Magnificent 7’ aka ‘Mag 7’?

👉 more than HALF A TRILLION DOLLARS in Q3 2024, the second time ever …

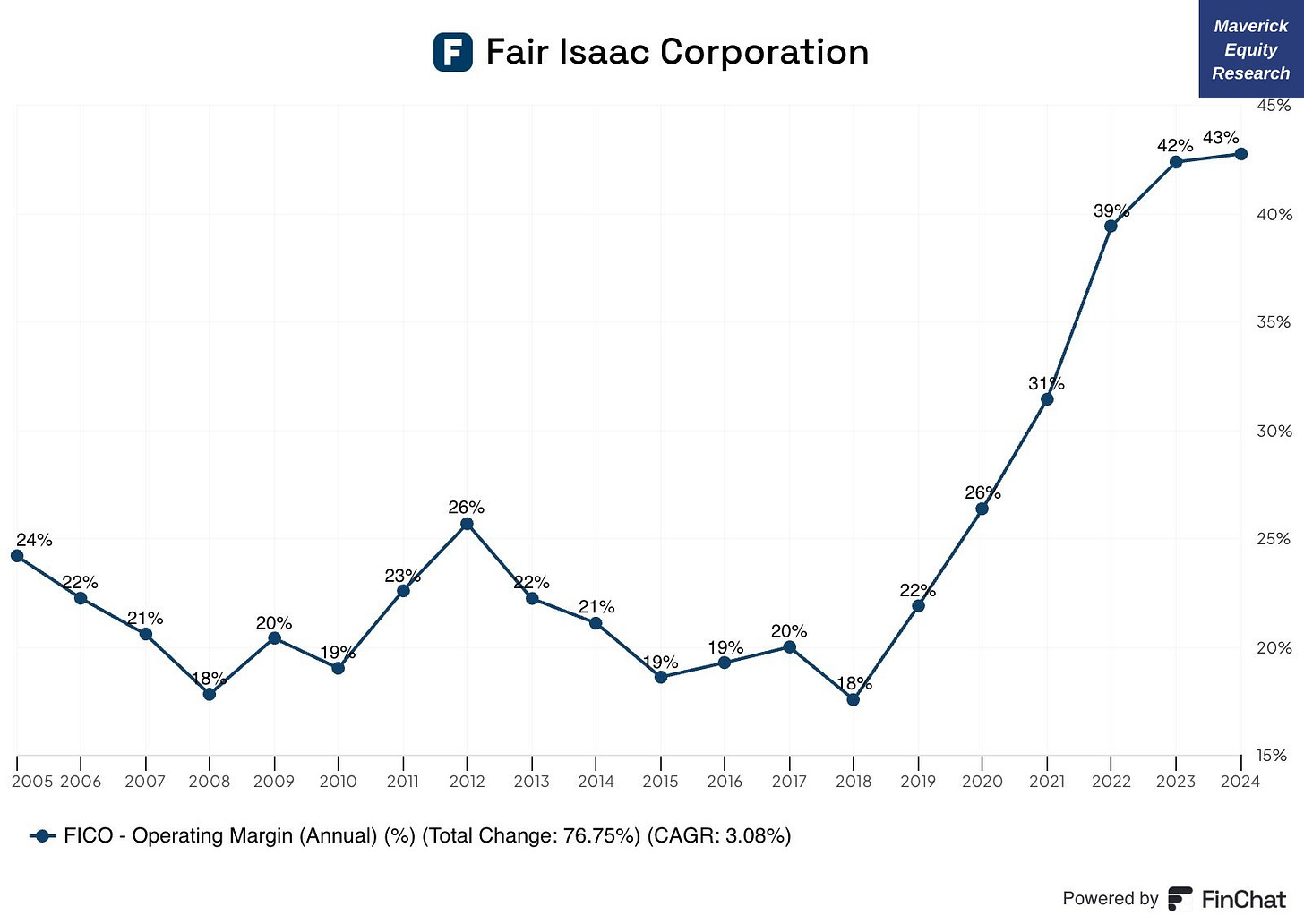

Fair Isaac Corporation (FICO) - what is your FICO score? Just joking :)

👉 in 2012, for the first time in 3 decades, FICO began renegotiating its contracts with the credit reporting agencies, while in 2018 they started raising prices beyond their previously allotted amount

👉 what did operating margins feel about that? Very good …

Overall a very interesting and can say rather unique (MOAT) business model, a company I might cover in the future in detail via the Full Equity Research section

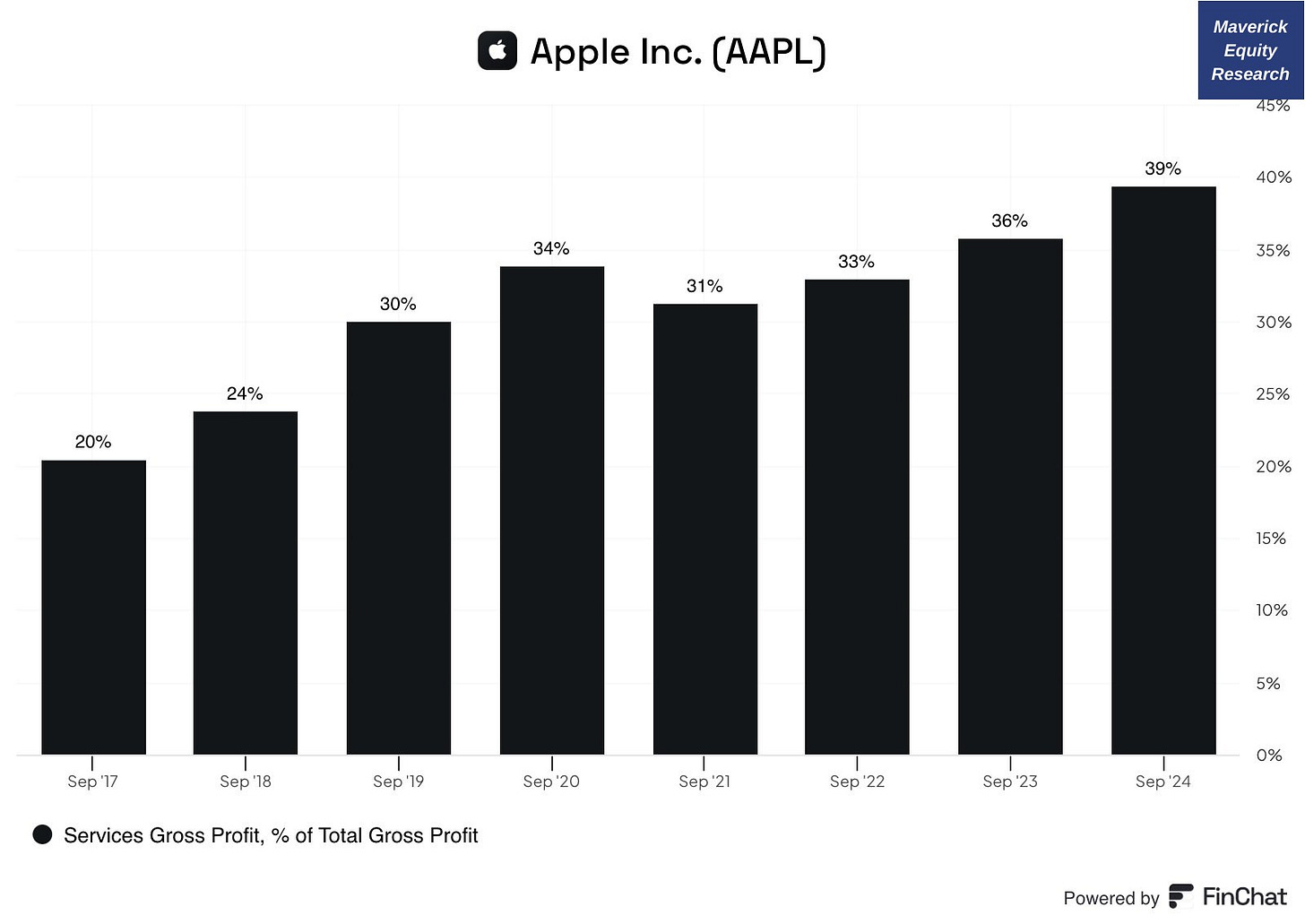

Apple (AAPL) Services segment is very important for the future of the business model (as mentioned in the past quite a few times). As expected:

👉 it keeps on growing: from 20% as total gross profit in 2017 to 39% in 7 years … how lung until it makes up the majority? Just a question of time not if …

N.B. you can read my Apple overview from 2013 where I cover quite some angles

✍️ Apple (AAPL) - The Big Apple = The Most Valuable Company on Planet Earth

Autodesk (ADSK) providing an array of specialized software tools for various industries keeps delivering revenue growth across all their product categories

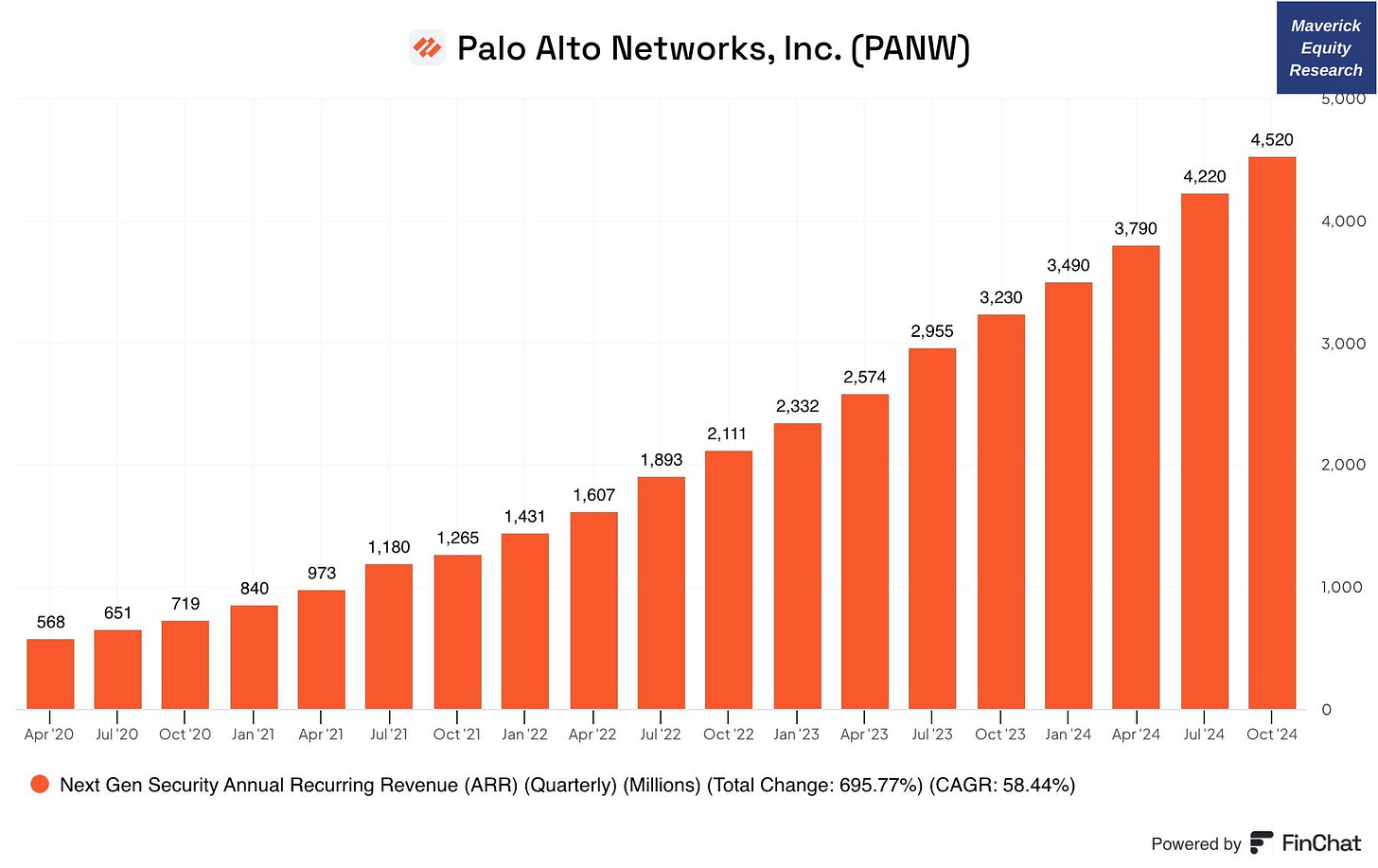

Palo Alto Networks (PANW), a growing cybersecurity multinational:

👉 has grown its Next-Gen Security annual recurring revenue (ARR) at a 58% CAGR over the last ~5 years

Going to South America for Ecommerce & Fintech via MercadoLibre (MELI): keeps bringing the revenues with a staggering 43% CAGR in the last 10 years - from $600m to 18.5bn

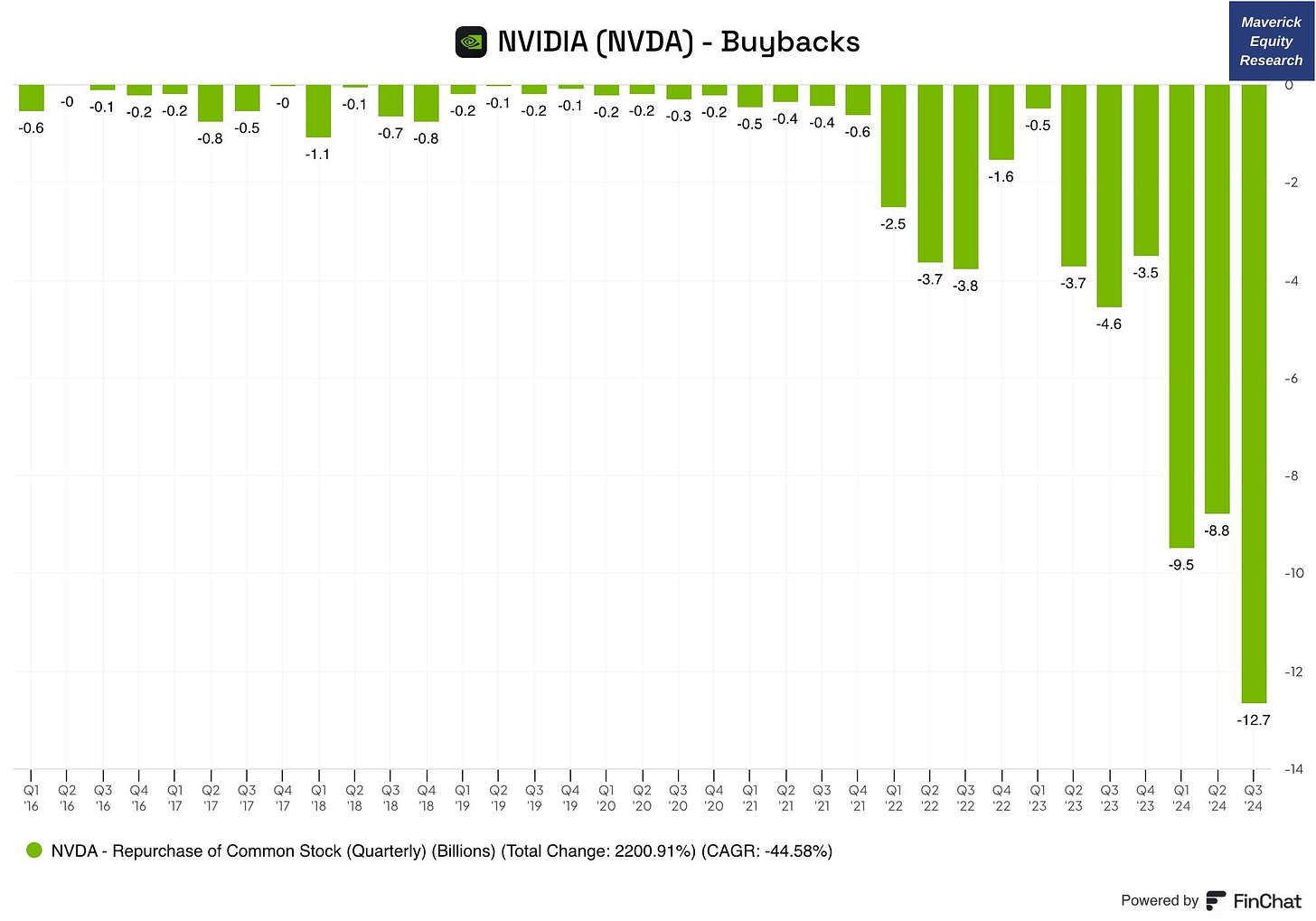

Nvidia (NVDA) doing record stock buybacks despite the meteoric rise in the stock

👉 they repurchased $55 billion in stock since 2022

👉 for perspective: from 2005 to 2022 Nvidia repurchased just $11.7 billion in stock

Nvidia (NVDA) again - what about their latest Bottom line and margins?

👉 it just keeps on delivering: quarterly net income keeps coming on and on, and not only that, but with very high Net Income margins, above 55% … let that sink in!

9-11. S&P 500 and Google valuation

👉 does any of the Mag 7 trade at a lower P/E (forward) than the S&P 500? Yes, Google!

👉 Not just relative to the S&P 500, but also to itself, Google trades below its 10-year average in terms of both forward P/E and forward EV/EBIT multiple

Google and Domino’s Pizza? Are they connected? 20 years ago they went public:

👉 Alphabet's Google became a Search monopoly: +6,650 returns 23% CAGR while

👉 Domino's cornered the globe with a pizza empire: +7,760 returns 24% CAGR

US & Switzerland, stocks valuations edition:

👉 a lot of talk on U.S. markets getting overvalued as the S&P 500 reached a trailing P/E of 30 which is the 4th highest in the past 124 years

👉 check the Swiss Market Index (SMI) with a half P/E ratio of 14.9x (lower than its 3-year average PE of 17.2x, its 5-year average PE of 17.4x, its 10-year average PE of 17.6x)

👉 plenty of very interesting Swiss businesses with even lower P/E like 12 or 10 or even below 10, which I plan to cover in 2025 in detail via the dedicated section

✍️ Full Equity Research - U.S., Swiss, Canadian and European coverage

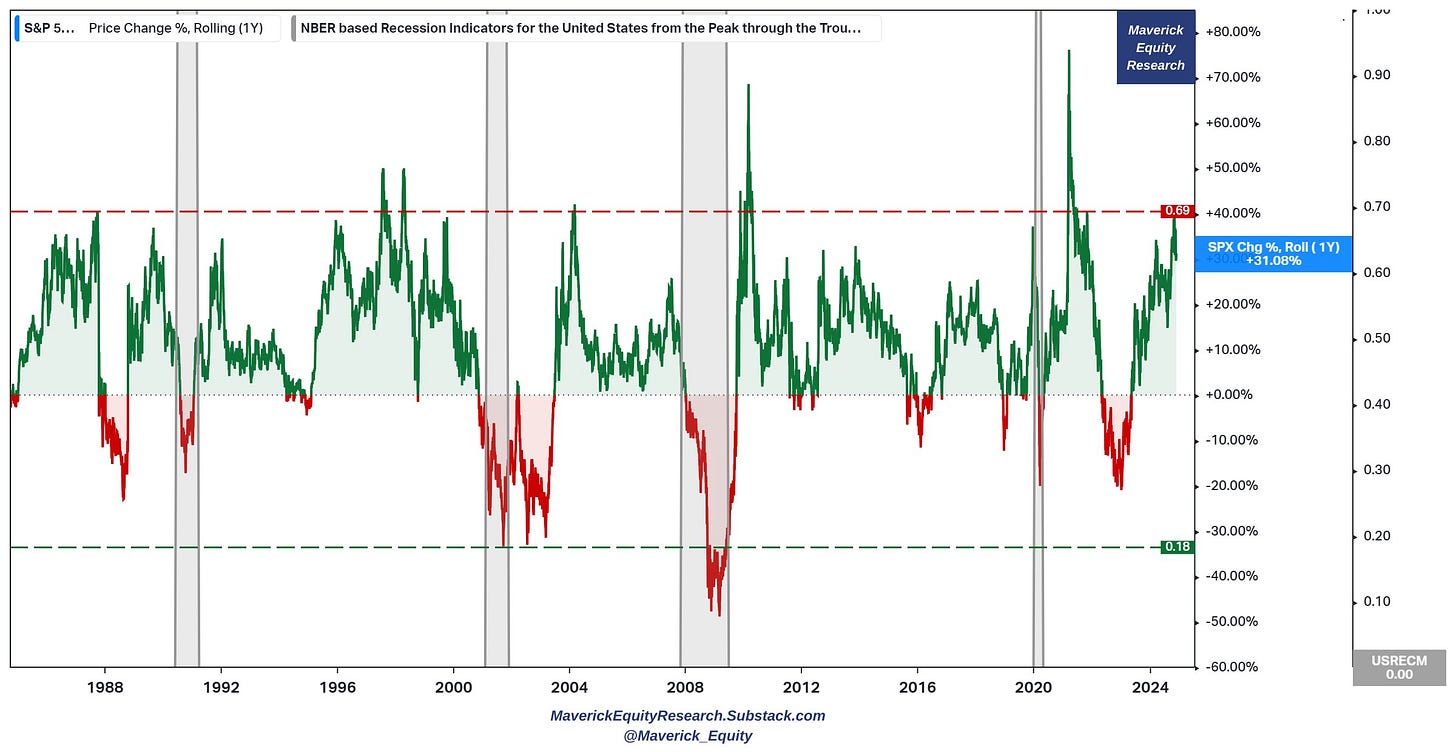

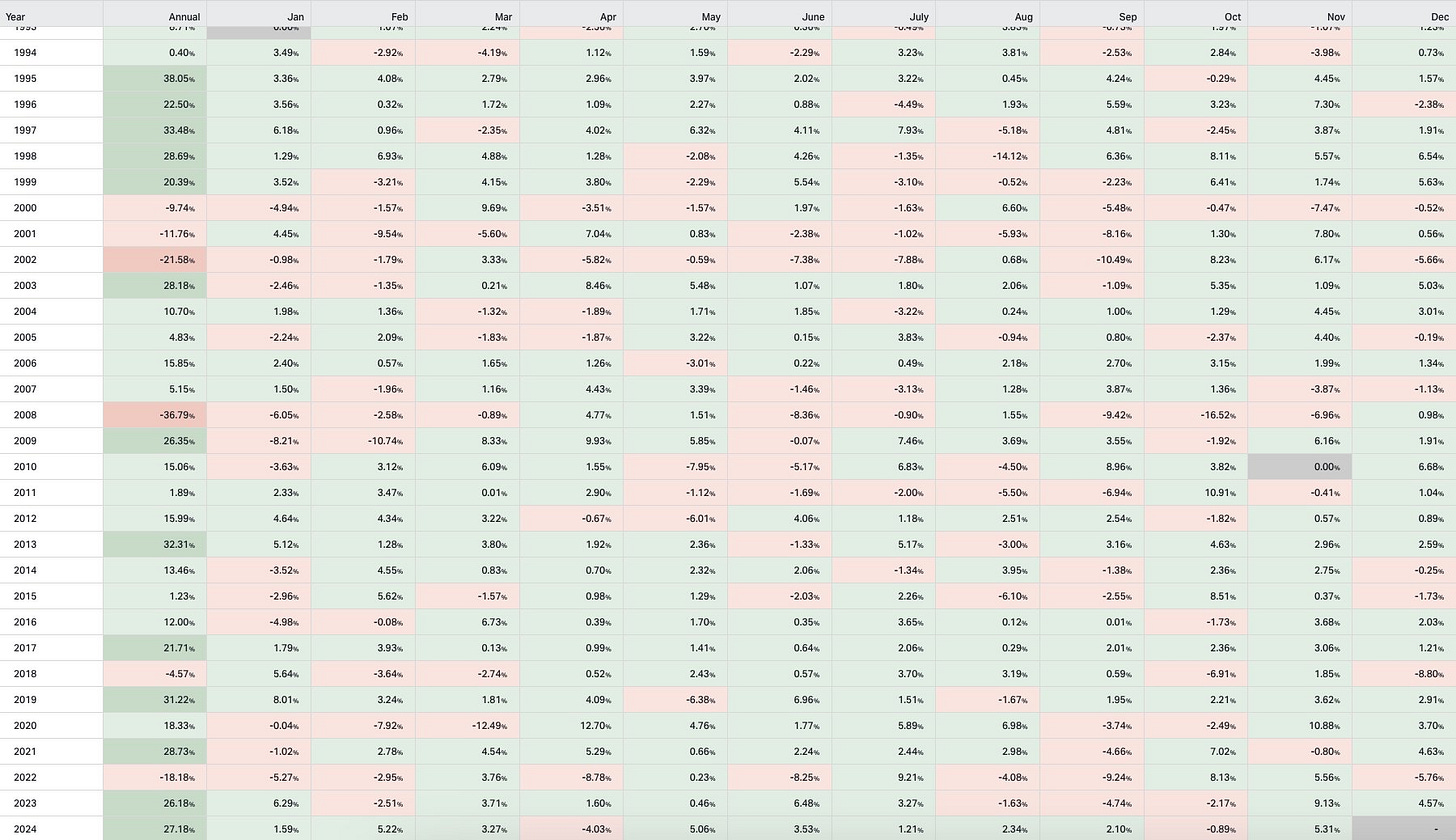

13-15. S&P 500 via a rare Maverick visual: 40 years of 1-year rolling returns, recession periods, with upper & lower dotted discretionary lines as a rough thing ...

👉 food for thought for you for now, way more on that in my next further improved and streamlined S&P 500 reports - you can read the previous reports until then:

✍️ S&P 500 Report: Valuation, Earnings & Fundamentals + Special Metrics #Ed 5

✍️ S&P 500 Report: Performance, Profitability, Sentiment & More - #Ed 5

👉 complementary: 52 times, the times the S&P 500 reached all-time highs in 2024

👉 further complementary: the S&P 500 is currently on pace for 2 consecutive years with a total return greater than 20% - the last time this happened was 1995-1999

It is Facebook/Meta time

👉 all-time high quarterly free cash flow of $16.5 billion with a FCF margin back to above 40% and materially above the 10-year average

Meta and Tesla? Not an apples to apples comparison, but numbers could provide you a peculiar perspective & food for thought regarding valuation / what’s baked in

👉 Tesla is currently worth $1.1 trillion compared to Meta's $1.4 trillion

Now check this one out:

👉 over the last 12 months, Tesla has generated $3.6 billion in free cash flow while Meta's $52.1 billion

Let that one sink in … and bring it either to the META’s HQ or Tesla’s HQ 😉

Can one beat the U.S. mighty tech without tech? Possible even with a Retailer selling teddy bears, stuffed animals, and characters?

👉 Apple, Meta, Microsoft, Google, Amazon, Tesla - but what about Build-A-Bear Workshop (BBW)? +1,300 since 2020 with just Tela closer, rest way behind! Cute right?

Going to South Asia with a 2021 internet darling, namely Sea Limited (SE) which focuses on mobile gaming and e-commerce platforms - to be watched:

👉 I doubt it can reach the 2021 bubble levels anytime soon, though note it is +222% since January this year

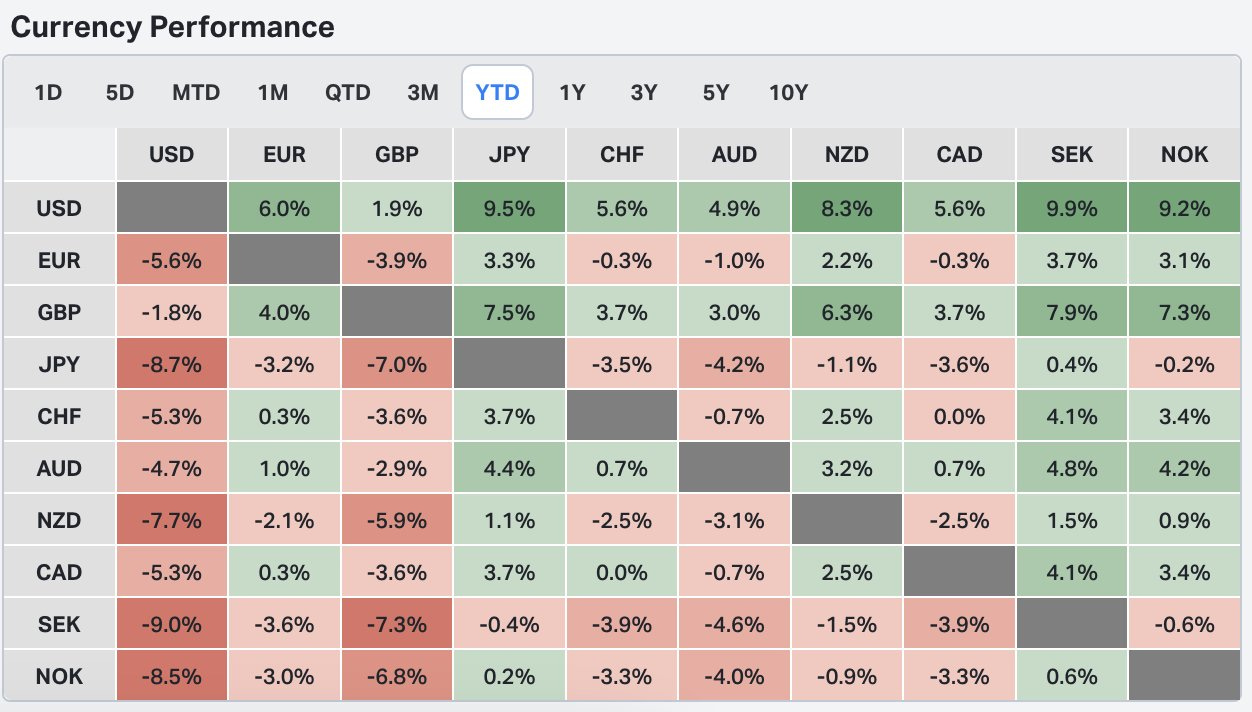

2024 Currency of the year? You might guess this one, yes, it is the U.S. Dollar …

👍 Bonus charts: D.O.G.E, DOGE, Trump-Musk, MicroStrategy & Bitcoin edition 👍

Trump decided to create the Department of Government Efficiency (DOGE) shortly after his election which will be lead by Musk and Ramaswamy

👉 DOGE is a backronym referencing Doge, an Internet meme, and Dogecoin, a cryptocurrency supported by Musk and derived from the meme

👉 is DOGE the cryptocurrency over night a better payment system? Does it create better products and services for the consumer? Nope

👉 yet the price is up: is it fun trading it? Maybe. Is it based on the Greater Fool Theory that more will buy after one buys? Likely. Is it for you? I don’t know. Is it for me? For sure not, but fun and interesting to watch the psychology behind this …

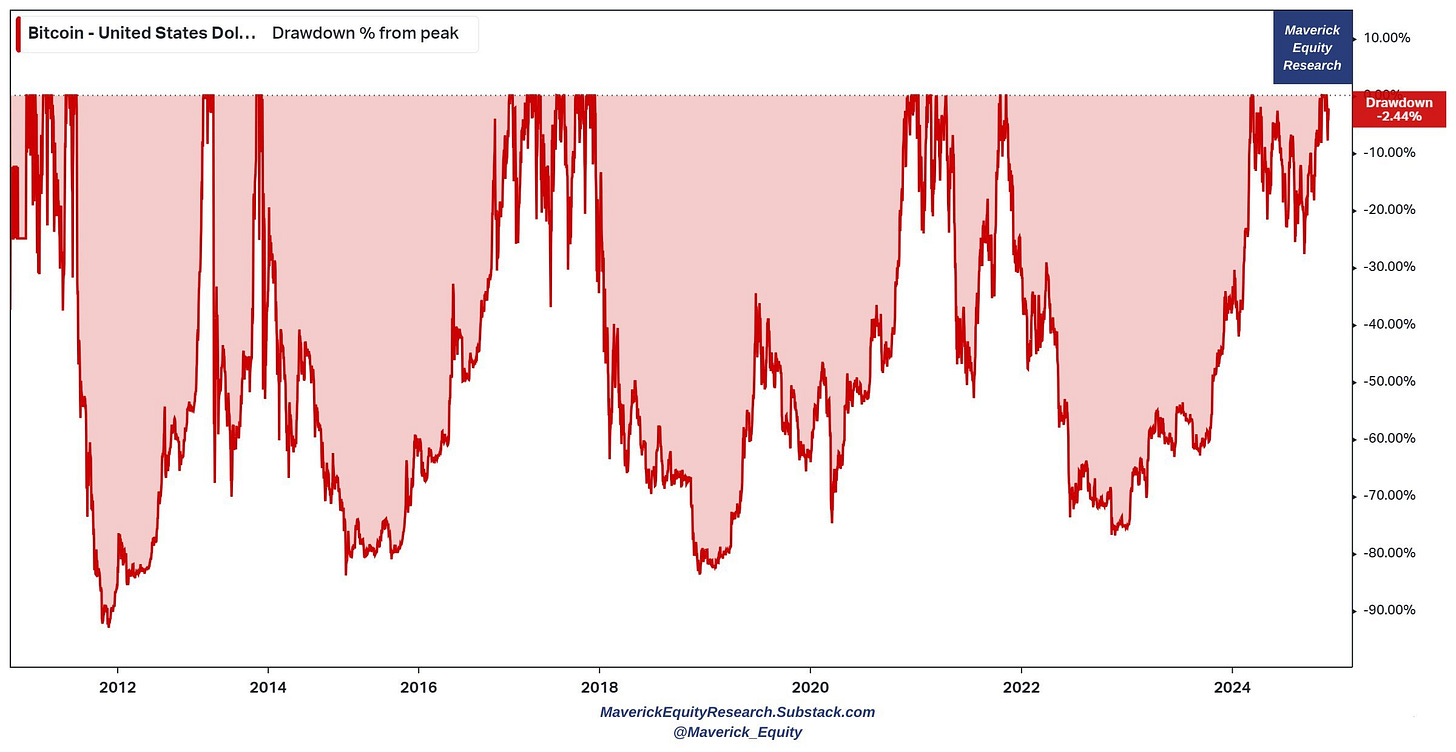

Loads of talks lately about Bitcoin reaching the $100,000 milestone, probably a topic also for many at the U.S. Thanksgiving: some hyped, some with big regrets for not buying, some indifferent. From my side just a few casual reminders:

👉 drawdowns of 70-80% are not uncommon at all - if down 70%, one needs 233% to breakeven, while if 80% down, a whooping 400%

👉 no matter what bitcoin truly is in the end of the day, it is not a store of value - also you do not see this chart around too often online, I wonder why … thoughts?

👉 strange for me to see experienced mature people online giving advice to the younger generation to put all their savings into Bitcoin (would not name call them)

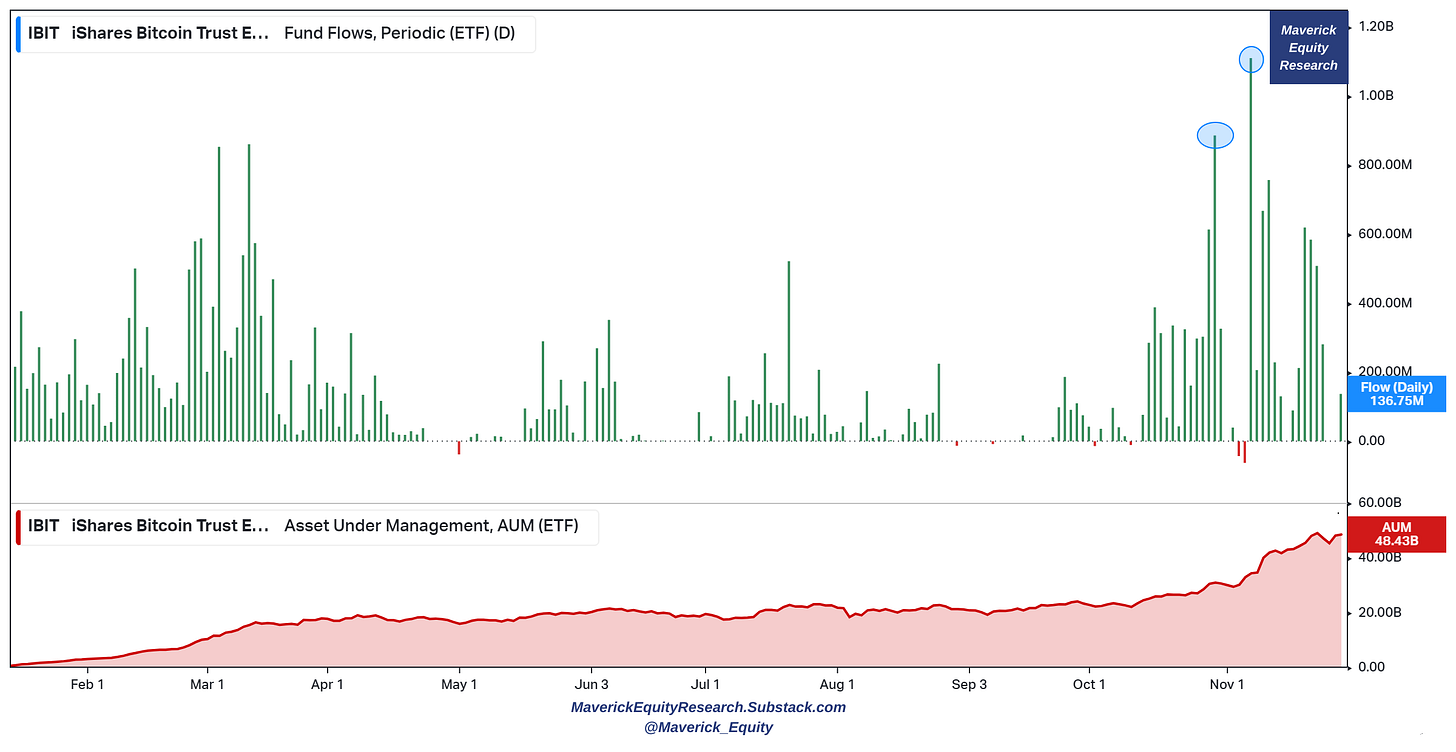

Yet, Blackrock's spot bitcoin fund (IBIT) saw in November:

👉 its largest 1D inflows: first a $885 million, then another even above $1.1 billion

👉 the fund’s Assets Under Management (AUM) is now above $48 billion - and note that the ETF was launched this year in 2024 in January … let that sink in!

MicroStrategy (MSTR) went parabolic in 2024:

👉 it makes even Nvidia (NVDA) shareholders look poor in 2024 … (temporary thing)

👉 MicroStrategy is such a case, I could write an entire thesis - maybe I will have a dedicated article on it if time allows (quite a Maverick-esque perspective I have on it)

For now, a teaser with no comment with its Free Cash Flow per Share, just have a look … trading at 3x Net Asset Value (NAV), but free cash flow negative, I don’t know, what do I know? 😉

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this extensive research by finding it interesting, saving you time & getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons! That’ll definitely support bringing in more & more independent investment research: from a single individual … not a bank, fund, click-baity media company or so … !

Like this, the big positive externalities become the name of the game! Thank you!

Have a great day!

Mav 👋 🤝

P.S. if you are into piano music, there you go with my recommendation for a calm and relaxing Sunday … and if you ever see Ludovico Einaudi touring around your town, you won’t regret it … you will forget everything and enter into another dimension …

Thank You!

Thank you Maverick for your time and the value provided, it is always a pleasure to read you and stay up to date in this exciting world.