✍️ Maverick Charts & Markets - September 2024 Edition #21

BlackRock, Apollo, Lockheed Martin, Mag 7, Walmart, Uber, Snap, Monster, FED, Yield Curve, Switzerland, Money Market Funds, S&P 500, Wealth, U.S. Elections, Geopolitical Events and Investing

Dear all,

starting this monthly edition with a quote which I haven’t heard elsewhere, hence I will simply self attribute it. Just let it sink in:

“Compound interest is both the ultimate and biggest natural hedge!” Maverick Equity Research

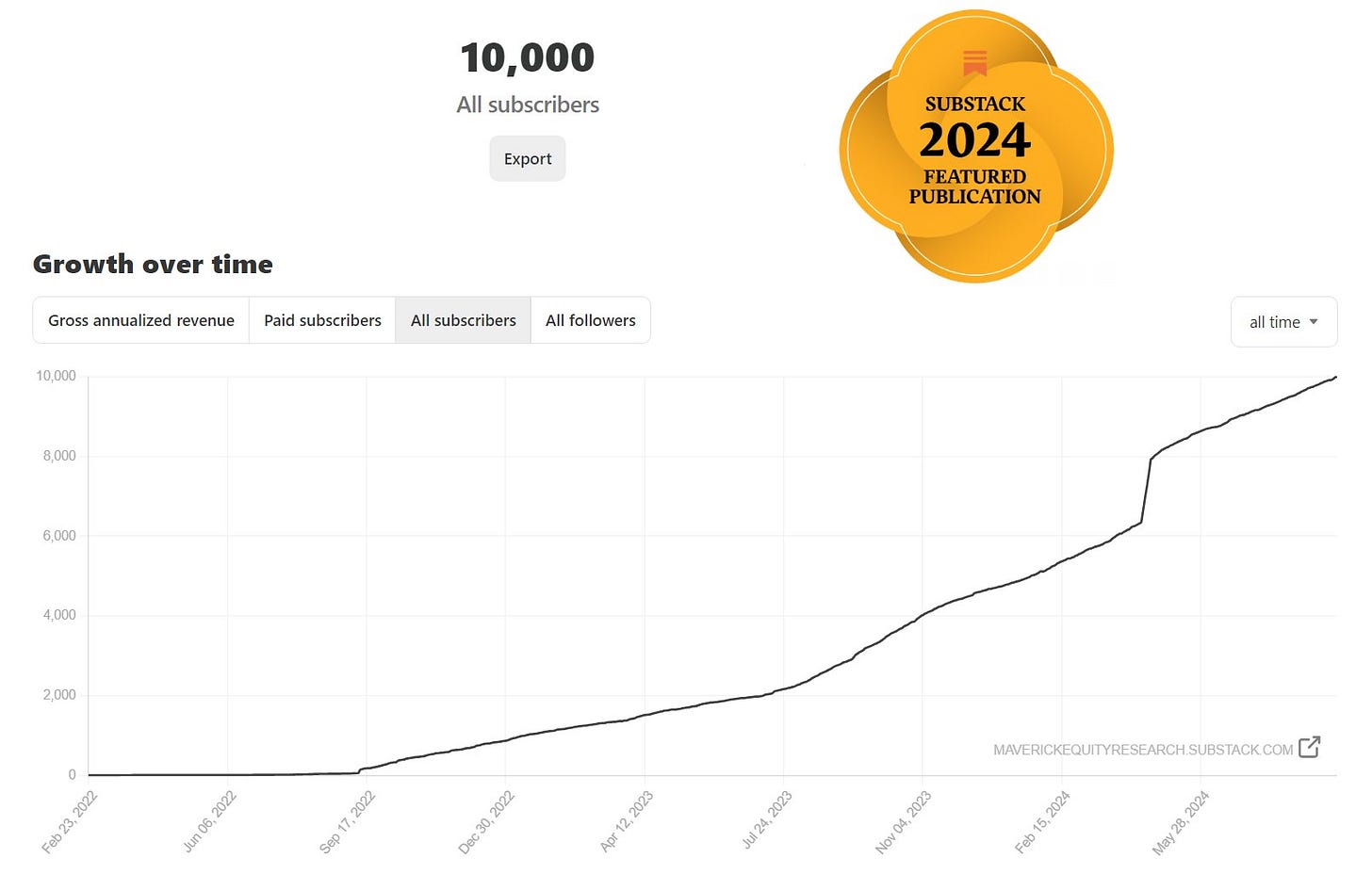

Secondly, 10,000 subscribers milestone reached after 2 years of ad-free & paywall free independent investment research delivered to 155 countries and 49 U.S. states! Also posted on Substack & Twitter/X (how is your Ex?, not nosy here just a fun rhyme 😉).

Way more incoming from my side, but one thing at a time, research and quality are very time and data intensive. As most of you got used to it by now, this is not about news, headlines, clickbait, BS, get rich over night schemes/frauds and all that … .

Third of all, watch out there for the many pesky impersonators. I will never ask for your WhatsApp number, any kind of personal data, there is no other separate website. This Substack is the one & only home. The following is the verified Twitter/X profile for more shorter & frequent content. Recently, I also started a LinkedIn, let’s connect!

Maverick Charts report structure is as always:

📊 Maverick Charts & Insights

👍 Bonus charts: Investing, U.S. Elections & Global Geopolitical Events edition

Delivery is in typical Maverick fashion, via charts that say 10,000 words covering Macro, Stocks, Bonds & more which also naturally connects the Geopolitics dots.

Now there you go with September’s 20 charts + 5 bonus that I carefully cherry picked.

📊 Maverick Charts & Insights 📊

Do you think the S&P 500 (blue) & the Nasdaq-100 (red) did very well since 1999, hence including the Dot-com bubble, 2007-2009 GFC, 2018 taper tantrum, 2020 Covid and all the geopolitical events since then? Yes, very well!

👉 now check that green line which is kind of ‘off the charts’ ? Guess who that is? Since IPO, Blackrock (BLK) with a 20.7% per year and even drawdowns were not that big. Even outperformed mighty Amazon and Microsoft!

👉 Blackrock deep dive and more planned via via my Full Equity Research section

How about the Apollo Global Management (APO) side?

👉 since the 2011 IPO, blasting through with a 1,772% return (green) … let that sink in!

👉 why bother distinctively with Apollo PE funds when you can very likely outperform them all with the Apollo stock?

👉 but also in general, why bother with alternative investments like Private Equity, Credit via an expensive ETF? When one can just buy the Apollo stock for example?

Maverick food for thought …

Is it a bird, is it a plane? No, well, kind of a plane, it is Lockheed Martin (LMT):

👉 S&P 500 did very well in the last 3 years with a 37.9% return, but Lockheed Martin’s 88.5% is a big outperformance, just in 2024 with a 36% return

P/E: the Magnificent 7 US mega tech VS the mighty Nasdaq-100 and S&P 500:

👉 only META and Google have a forward P/E lower than the Nasdaq-100 (QQQ)

👉 only Google has a forward P/E lower than both the Nasdaq and the S&P 500 (SPY)

👉 Tesla is quite off the charts with a 91.5x forward P/E

Talking about tech, Mag 7 and the S&P 500 P/E values, bring some P/E groceries:

👉 the consumer staple Walmart (WMT) with a 42.2x P/E (LTM), let that one sink in!

Uber with a big turnaround in terms of that hunted free cash flow:

👉 From -$5 billion in outflows to almost +$5 billion (TTM) is a difference

👉 more importantly: free cash flow / share also there and the stock price noticed

The underlying in terms of the business model, the how for all that, for another time.

For the ones that Snapchat while riding their Uber, quite a different story. The company managed 2 incredible things since going public in 2017:

👉 skyrocketed the amount of ‘sexting’ & genitals (just 1 sec) sharing that people do

👉 stock -56%, never a profit, but insiders got a money printing machine for themselves via their Stock-based compensation (SBC)

👉 recall many tech companies are 'capital light' indeed, no need for factories, buildings and concrete ... they just replaced that with Stock Based Compensation ... 'capital light' it depends for whom, and the definition: physical or non-physical

👉 Voice of the narrator: ‘what is our net profit projection?’ Strategic decision: let’s just 'hedge' it with Stock Based Compensation for delta neutral for the shareholders, and delta positive for us ;))

Chart: Net Income (red) & Stock Based Compensation (green) mirroring each other … in other words, ‘snap your genitals online = snap some more SBC/bonuses for insiders’

The US FED slashed interest rates by 0.5% (50 b.p.) in September, at 5% now, an aggressive move to its first easing campaign in 4 years. As mentioned before:

👉 note the 2-year U.S. bond yield (green) plunged way earlier, sitting way below

👉 ‘Who is following who in the Zoo?’ The FED funds target rate naturally highly correlated with the 2-year yield, yet time has come to cut interest rates as the FED welcomes further cooling in the labor market

What about FED’s cut by 0.5% and the mighty Yield Curve? Quite curvy moves:

👉 today's curve VS the day before the FED lowered rates (for the first time in more than two years): quite a difference … quite a difference …

What about the yield curve inverting, un-inverting/dis-inverting? I know you are quite wondering about that one … there you go:

👉 we officially marked just recently the end of the longest 2y10y curve inversion in 50+ years ... 545 consecutive sessions, let that one sink in!

👉 last 4 recessions ONLY STARTED once the curve was positive again which is back right now, namely it did un-invers/dis-invert. A smooth 'Soft Landing' would bring a steeper curve as the FED cuts rates & we get lower yields at the front-end of the curve

Is this time different? Dangerous words in finance ... Can we avoid a recession with the un-inversion? I am confident yes, at least for 2024. Way more on that in my incoming 4th edition covering the US economy. Check my 3rd edition from June:

✍️ The State of the US Economy in 75 Charts

In a nut shell, after inverting both big & for a long time without preceding a recession, even Maverick in Top Gun with his negative 4G inverted dive would be impressed. Current un-inversion is simply a reflection of the path towards ‘normalising’ interest rates as inflation is cooling off. In Maverick terms, no more showing us the birdie 😉.

What about Money Market Funds (MMFs) at record highs but lowering rates?

👉 MMFs total financial assets with record highs above $6.5 trillions (blue) … if we count time deposits, we are around $9 trillions ...

👉 the higher the rates driven by FED hiking rates (red), the higher MMFs assets

Q: and now the key question now: as the FED just made that decent rate cut recently, how long after the 1st cut from the FED do MMFs assets peak?

A: about 9 months looking at the past 5 cycles, in other words, inflows to MMFs continue for 9 months after that 1st FED interest rate cut

Maverick take-away: if one wants to maximise returns via Money Market Funds, especially for the low risk profile they carry (or if one wants to maximise the high interest rates that looks like they topped), one can still benefit nicely for 9 months.

How are Retail Investors doing regarding Money Market Funds (MMFs)? Did they react from deposits paying peanuts? Isolating retail MMFs:

👉 yes, they did … also at record highs above $1.9 trillion, might even reach $2 trillion before topping (note also below the % record high growth)

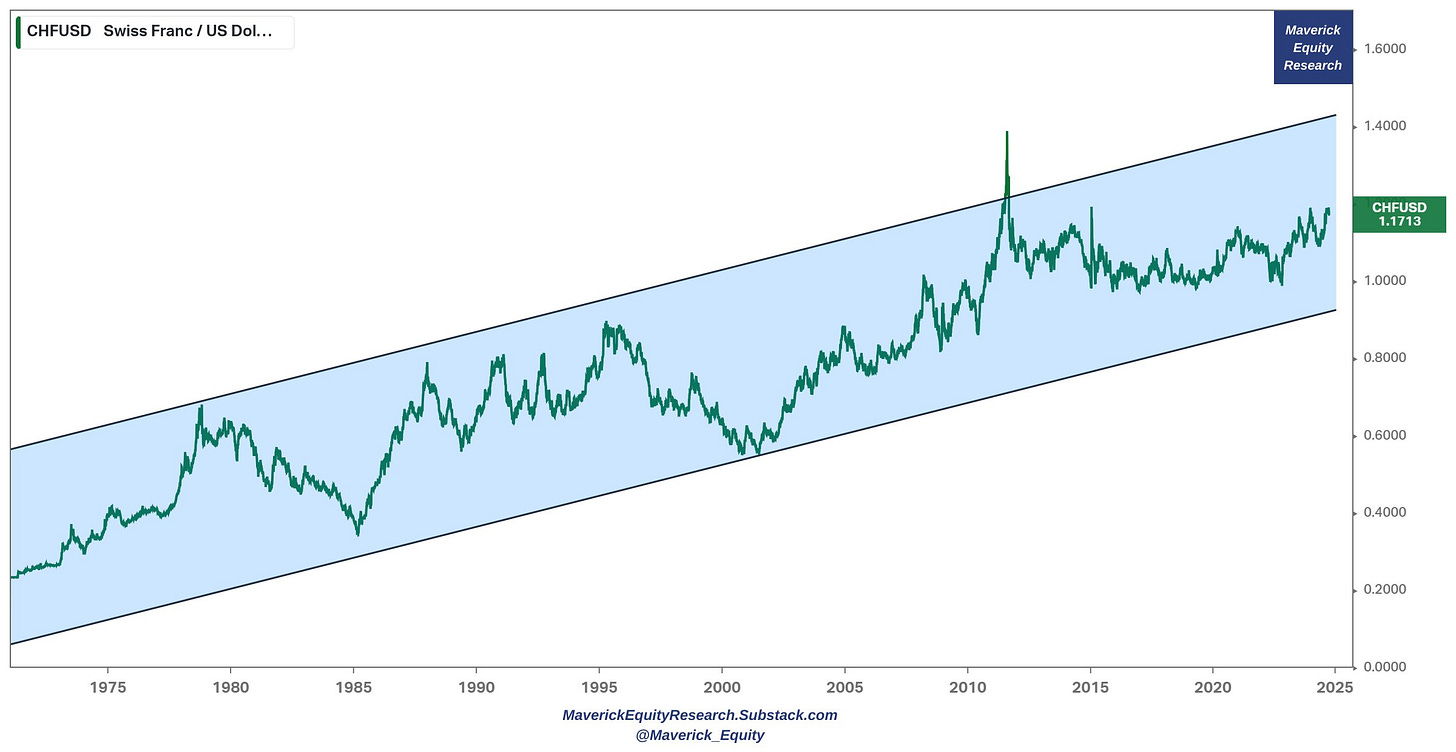

CHF/USD since 1970: Mighty Swiss Franc for the win ...

P.S I will also covers stocks from Switzerland via the my Full Equity Research section

What is the big idea to invest in Switzerland (not just home biased countries)?

👉 Investing channel:

Cash flow diversification

Currency diversification which can also act in the same time as natural hedges via the Swiss franc (CHF) for outside international investors

Save haven / flight to safety in times of geopolitical tensions and business cycle turns for an overall more balanced, less volatile & with lower drawdowns portfolio

👉 Economic, political and until lately, under considered Geopolitical reasons. And now for quite a ‘Maverick-esque’ opinion that very often raises eyebrows when I say it: “In the end of the day, there is only one true AAA rating country out there: SwitzerlAAAnd!”

Neutrality, no wars, trusted by the rest of the world which was a key factor for a lot of generations after generations to accumulate and compound wealth

Direct democracy & federalism works given the decentralized driven efficiencies

Balanced fiscal budget, conservatively managing current account C/A surplus

Low debt & low rates of inflation

Swiss National Bank (SNB) reserves: 100% forex reserves relative to GNP, big 'mutual fund' inside tracking MSCI USA index with a 80/20 allocation between bonds & stocks (algorithmically rebalanced)

Low taxes with loads of 🧀+⛰️+🍫

Monster Beverage (MNST) going monster mode with the stock buybacks: they repurchased $3.1 billion of shares in the 2nd quarter = 6.7% of their market cap

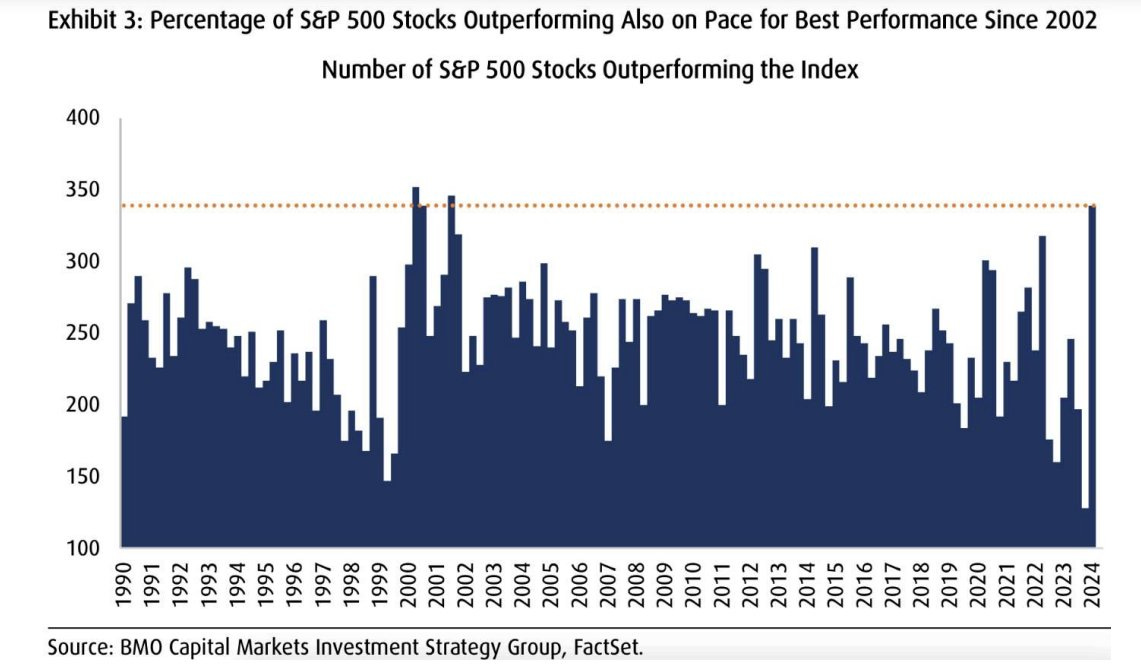

S&P 500 Chart of The Month = number of S&P 500 stocks outperforming the index set to reach the highest since 2002

P.S my two S&P 500 reports (6th edition) are work in progress, previous editions:

✍️ S&P 500 Report: Performance, Profitability, Sentiment & More - #Ed 5

✍️ S&P 500 Report: Valuation, Earnings & Fundamentals + Special Metrics #Ed 5

US Businesses Profit Boom! Not just the financial but also the Real economy:

👉 US business earnings soared since 2020

👉 the expansion that started in the second quarter of 2020 is so far among the best since the aftermath of World War II ... let that one sink in & bring the sink!

P.S. my US economy coverage (4th edition) is work in progress, previous edition:

✍️ The State of the US Economy in 75 Charts

Time for some key US and Global wealth check insights:

Where are the highest number of millionaires in the world? Via UBS:

👉 U.S. baby! Almost 22 million Americans are millionaires, roughly one in 15 people

👉 Worldwide, millionaires accounted for 1.5% of the adult population analyzed, and the U.S. had 38% of all millionaires

👉 Wealth mobility has been more likely to be upward than downward - roughly 1:3 individuals moves into a higher wealth band within a decade

👉 A great horizontal wealth transfer is under way - $83.5 trillion of wealth will be transferred within the next 20–25 years

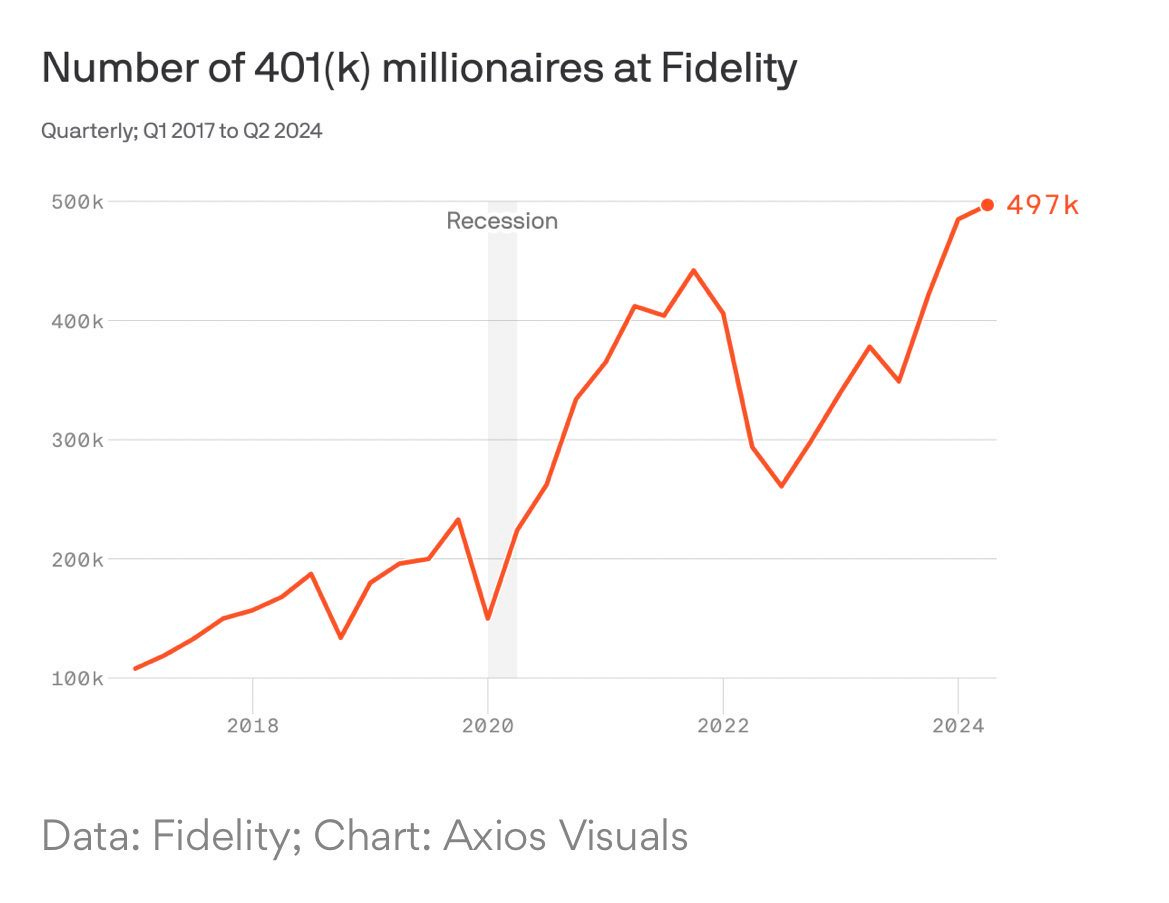

18 & 19. Key question, what is the #1 way Americans get to be millionaires?

👉 Investing: specifically and simply part of their usual paycheck parked into their 401(k). Numbers baby, we have nowadays more 401(k) millionaires than ever.

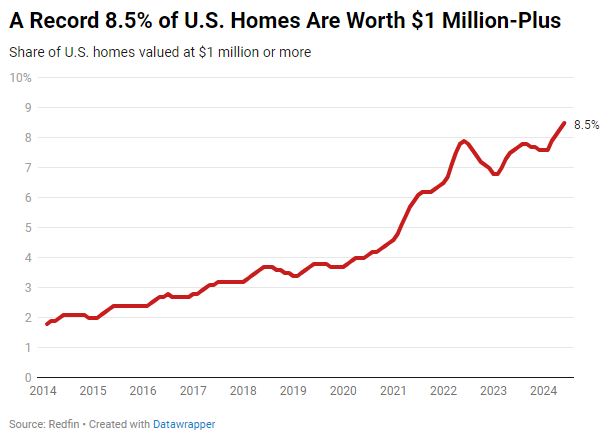

👉 US Housing time baby! Housing affordability for new home buyers is very low, but let this one sink in for the other side of the coin: 8.5% of U.S. homes are worth $1 million or more = the highest share of all time which is up from 7.6% a year ago and more than double the 4% share before the pandemic!

Good time to bring in: Return and Tax on Capital, Return and Tax on Labor ... for my topic on the 'The Dangers of Not Investing' via Bloomberg's, Beth Kowitt:

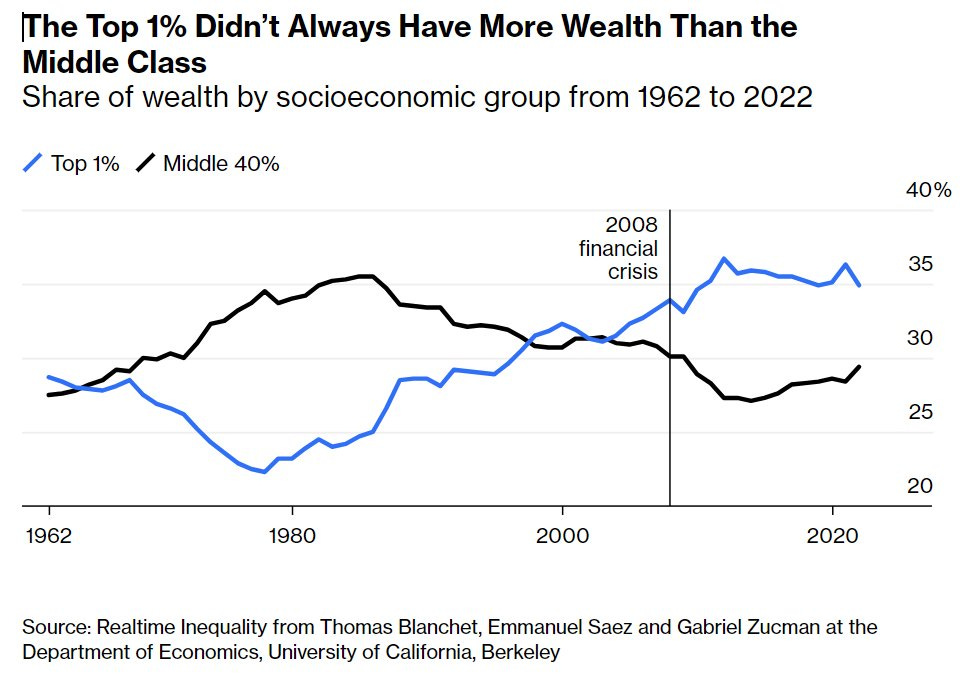

👉 The top 0.01% grew their wealth almost 6x as fast as the bottom 50% since 1976

👉 The top 1% now hold a greater share of wealth than the entire middle 40% (chart 2); three decades ago, the reverse was true. For that to happen, the wealth of the very richest Americans had to grow exponentially faster than that of the poorest

👉 350 years for a typical employee to match what their CEO made in just a single year: ”2 years ago, CEOs at the 350 largest publicly-owned US companies took home a projected $25.2 million. Meanwhile, the CEO-to-worker pay ratio was approximately 344-to-1, meaning it would take nearly 350 years for a typical employee to match what their CEO made in just 1 year. Compare that with 1965 when the ratio was 21-to-1”.

👍 Bonus charts: Investing, U.S. Elections & Global Geopolitical Events 👍

Investing wise, never mind the bollocks politics. Afraid of the ‘KK’ or ‘TTT’?

👉 ‘Komrad’ Kamala? (KK)

or

👉 Trump The ‘Terrible’? (TTT)

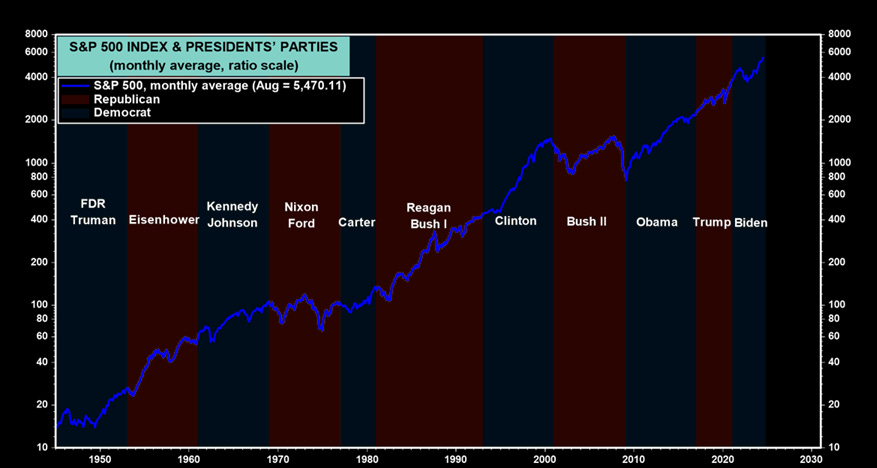

No need to! The stock market tends to rise no matter who sleeps at the White House.

Short term / current cycle : S&P 500 and Donald Trump as a winner?

👉 a common belief = Trump to be good for the stock market. Yet note how recently the S&P 500 performance has decoupled from Trump's odds of winning

👉 the disconnect is good, because than we can get into the scenario: if Trump wins, good, if Harris, good as well for the stock market: Heads one wins, Tail one wins!

Investing just like in life, if one manages to get into these kind of situations where the downside is rather limited, one can’t say no! Nonetheless, all is possible as you know!

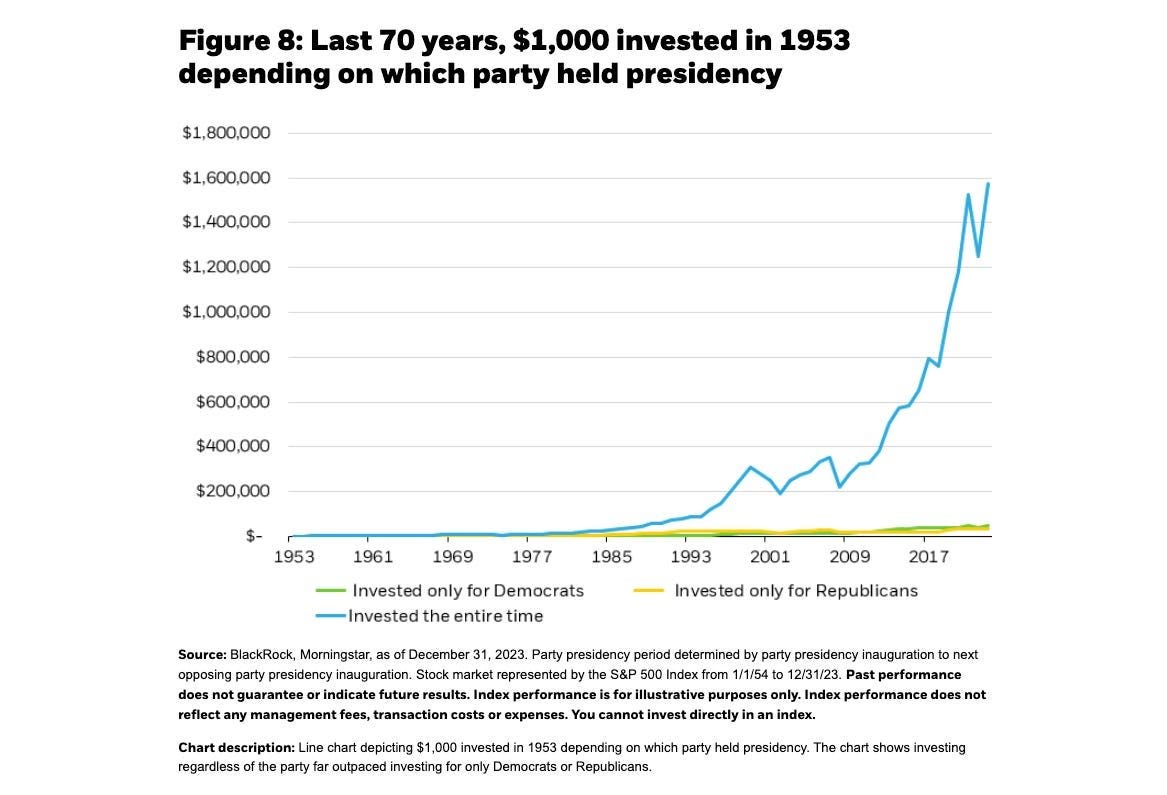

In general, invested when a Democrat is running the show is a bit better, but overall irrelevant. Investing mainly on the US presidency party = a fool's game (unless a very good short term/tactical trader), as an investor just having a solid portfolio & staying invested should do well independent of the U.S. (plug another country) political circus!

Want numbers? $1,000 invested 70 years ago, boom! ∼$1.6 million, ain’t peanuts 😉!

Recall my mantra, “Compound interest is both the ultimate and biggest natural hedge!”.

Recall Charlie Munger: “The first rule of compounding: never interrupt it unnecessarily”.

👉 overall, investors should avoid as much as possible letting personal political views influence their investment decisions. Detachment is key! Particularly for me doing independent investment research, going down the political rabbit hole and ‘endorsing’ one or the other is a big No Go. Zooming out is key, emotions not really!

👉 to be sure here, politics are important and not to be ignored, but any research should be as unbiased as much as it possible. ‘Just’ taking things and data as they are, infer from there for the best forward looking outcome given the situation. That detachment is easier to be said than done by anybody, but it is very important: ‘Detach, detach, detach … !‘ and then ‘Act, make the best out of it … !‘

Election is less than 30 days away, latest odds from 8th of Oct via Polymarket:

👉 recall, many betting odds, surveys on this matter … Polymarket is just one … the latest Trump’s surge was quite anomalous, but let’s see … more in the next newsletter

👉 my bet is that it will get going down to the wire

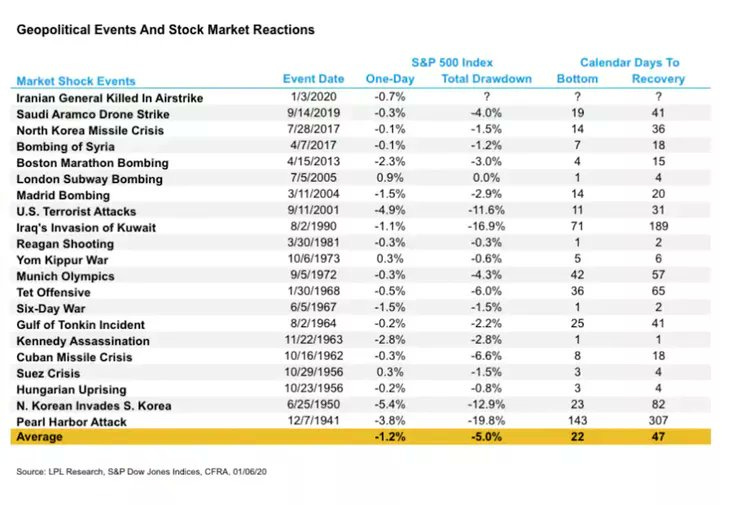

Zooming out more, Geopolitical events across the globe & investing, don’t forget:

👉 average drawdown = 5%

👉 average calendar days to bottom = 22 days

👉 average calendar days to recovery = 47 days

If you try to time those, tricky, but overall = peanuts!

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this extensive research by finding it interesting, saving you time & getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons! That’ll definitely support bringing in more & more independent investment research: from a single individual … not a bank, fund, click-baity media company or so … !

Have a great day!

Mav 👋 🤝

P.S. recall my thing and main take-away for you:

“Compound interest is both the ultimate and biggest natural hedge!” Maverick Equity Research

why bother with alternative investments like Private Equity, Credit via an expensive ETF? When one can just buy the Apollo stock for example?(If you have chance to look at CPI sub item,such as portfolio managmemt service yoy%, you would definitely not be surprised about their corresponding stock outperformance.(investment management is one thing, management/incentive charging is another thing))

Congratulations!! So glad to hear!