✍️ Maverick Charts - Macro & More - October 2023 Edition #12

25 Sleek charts that say 10,000 words ... save precious time & provide insight!

Dear all,

with October ‘closing the books’ soon, your monthly Top 20 Macro & More charts from around the world + 5 Bonus! Before that, from the legend Charlie Munger:

"You don't have to be brilliant, only a little bit wiser than the other guys, on average, for a long, long time." = persistence and consistency wins over > occasional brilliance

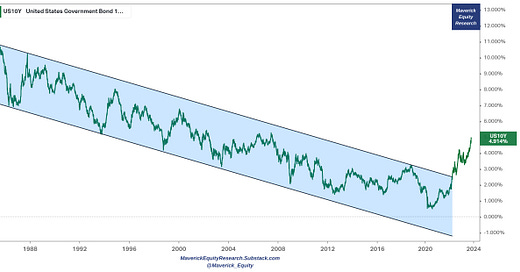

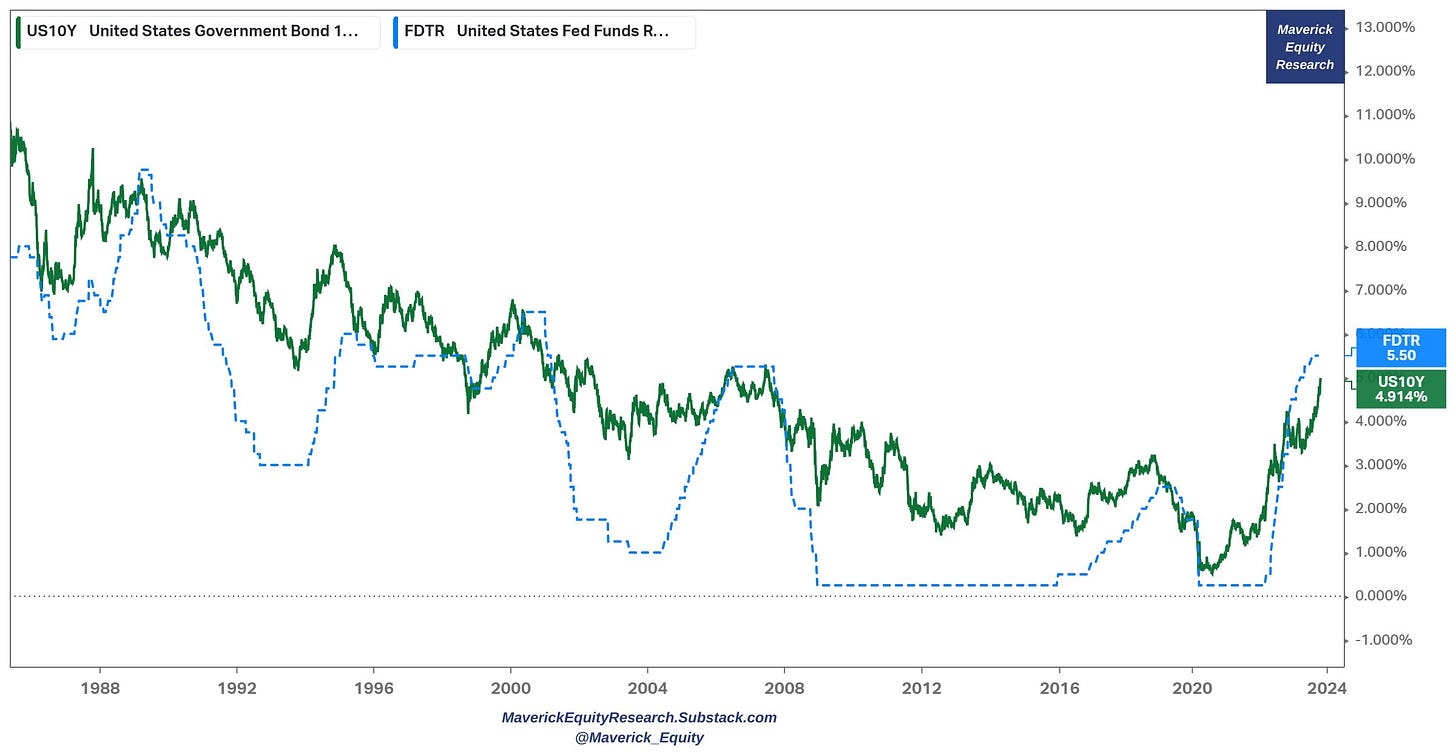

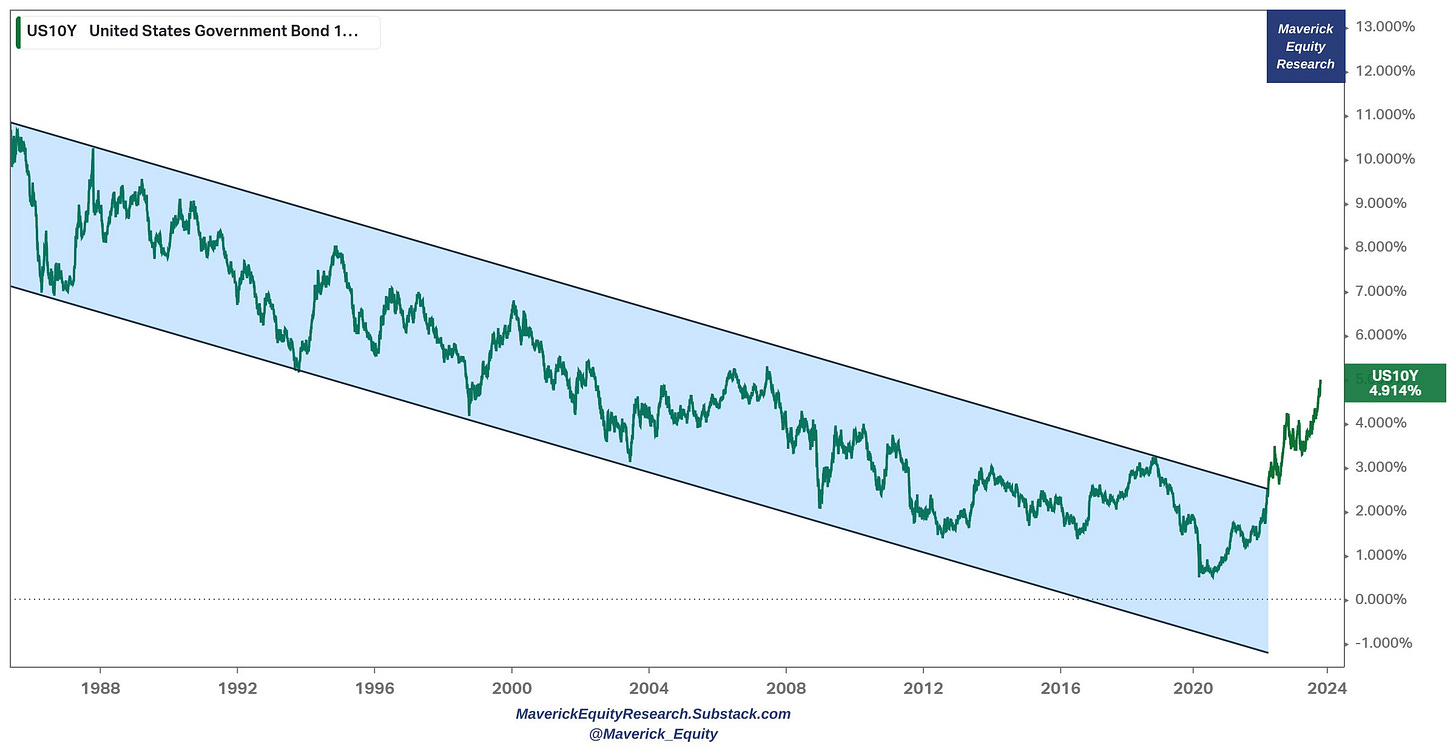

Can the 10-year US yield go to 6% or higher?

👉 5.5% is quite likely, how? See how the 10-year (green) often meets, kisses and even surpasses the FED funds rate (dashed blue)

👉 6%, less likely but possible? yes ... If it goes to 6-7%, would be a great opportunity to lock-in some risk free yield ... especially hunting for a good Yield to Maturity (YTM) across the treasuries curve ... even at this levels goodies are to be found …

N.B. working now on a comprehensive piece about ‘Investing in Bonds’, stay tuned…

After trending down for decades, channel is broken big since the mid of 2022

Who owns the US treasuries market by the way? Some key notes:

👉 the big share of foreign investors since the 2010s

👉 households owning more and more though note a fact quite unknown: in this bucket also hedge funds are included … which is strange if you ask me, can’t find a rationale for that yet … if you do, please let me know

👉 the FED and active mutual funds lowering their holdings lately

Foreign investors holdings side note that:

👉 China has been lowering their holdings since the mid 2010s

👉 which is the lowest level since 2009

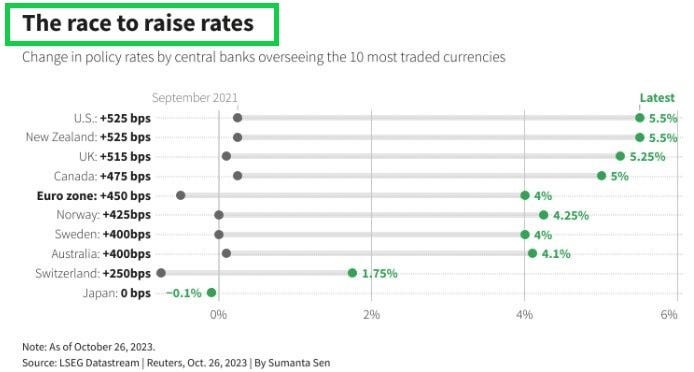

The Race to Raise Interest Rates since 2021 across the world in 1 chart:

👉 one of the fastest hiking cycle in decades - ‘ no wonder bro’ ‘, just check inflation

👉 ‘any good thing with this bro’?’ Yes, cash/bonds pay nowadays, even in real terms

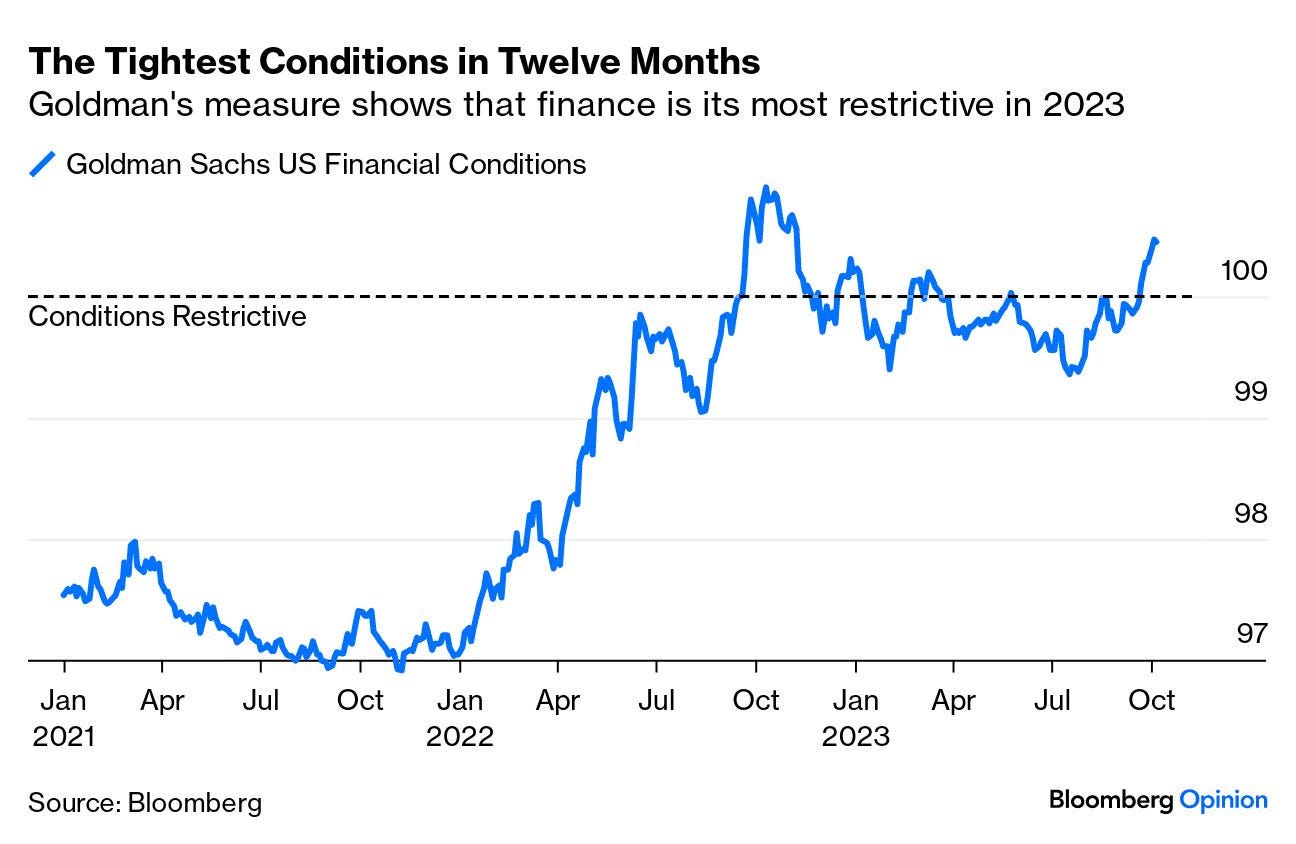

Tight conditions indeed financing wise:

👉 Financial Conditions are in ‘restrictive conditions’ territory as GS model shows

US Yield Curve: % Share of the Yield Curve Inverted

👉 70% now, previously 74%

👉 Key bond yield spreads: 30y/10y, 10y/2y, 10y/3m

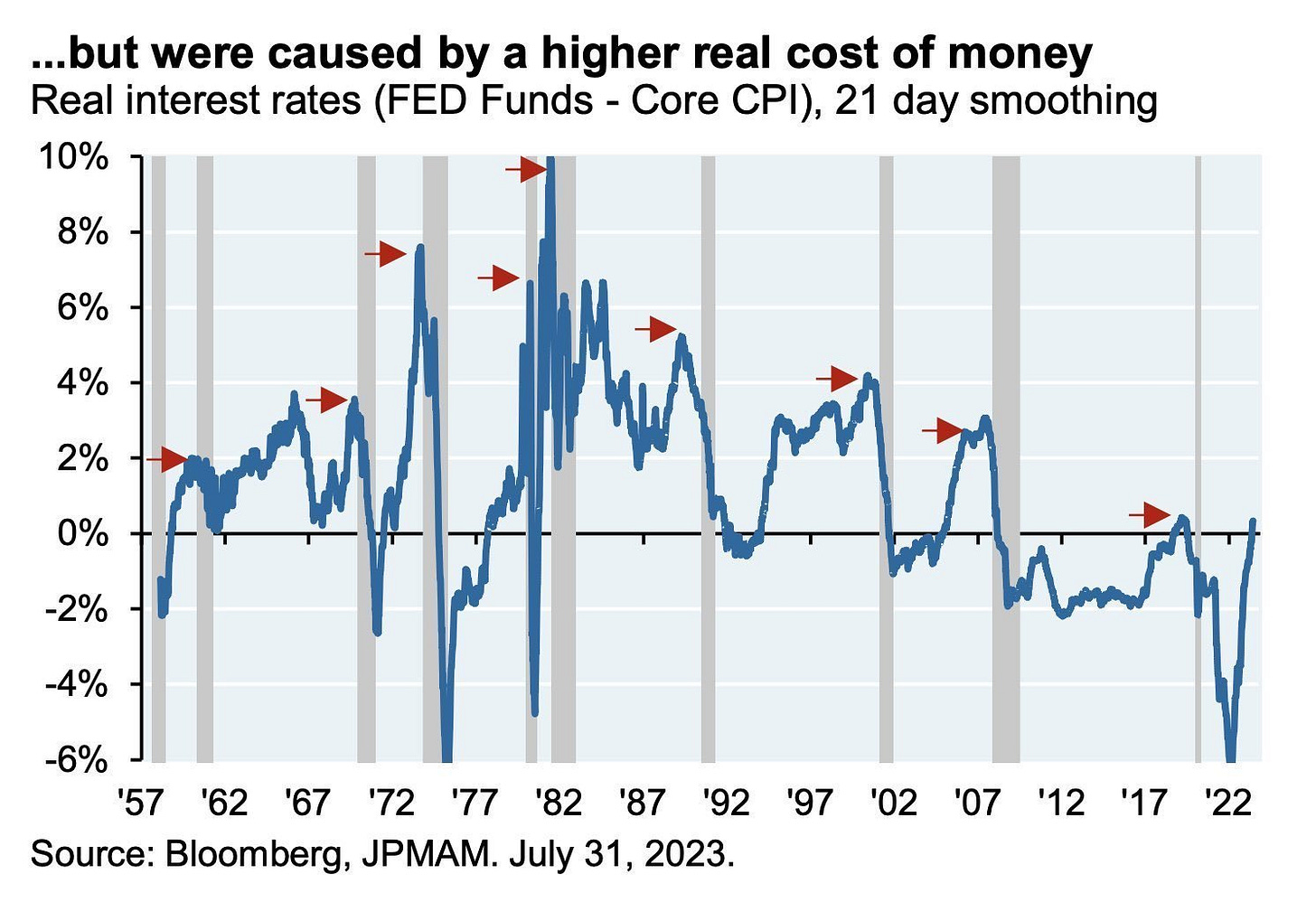

Note how yield curve inversions did precede recessions, yet let this one sink in:

👉 they were caused by a higher real cost of money (FED funds - Core CPI)

👉 which ain't high these days, right?

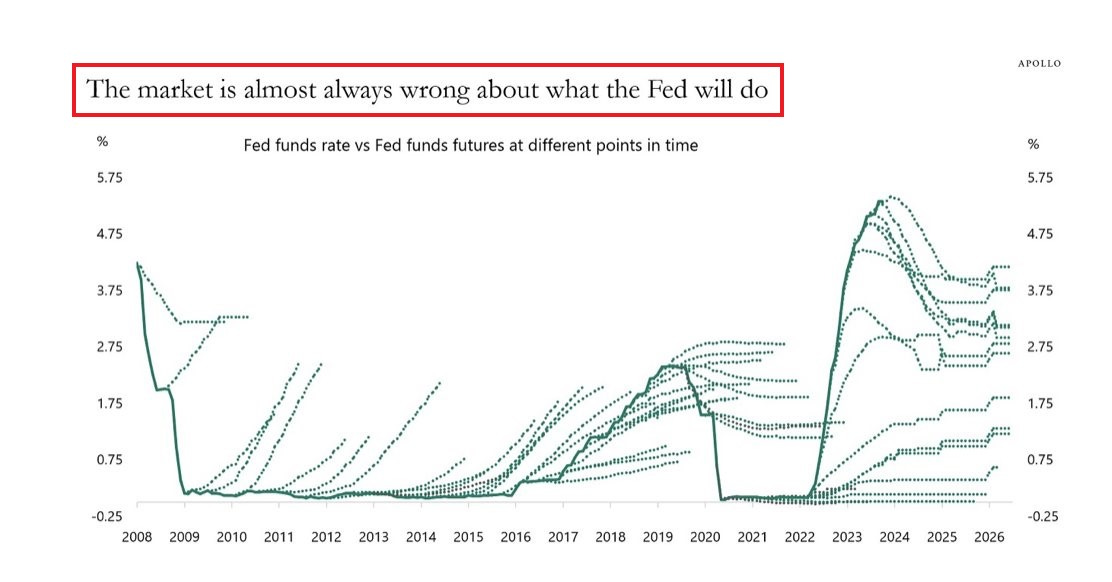

The FED vs The Market on interest rates direction:

👉 across time and especially nowadays, I saw a lot of people (no name calling here) be it more or less qualified to bash the FED, but what what the market as a whole thinking they are ahead of the curve and know what FED will do going forward?

👉 well, guess what, the market overall is almost always wrong about the direction …

👉 take-away: we need to think in terms of probabilistic outcomes, and not in terms of deterministic ones … various scenarios and reaction to it …

Which begs the question, what is the market thinking currently?

👉 via various Taylor rules done by DB, we get a current interest rate path that is LOWER than what is implied currently by the market

Real Rates matter way more as nominal rates are just / ‘just’ nominal:

👉 here we see the 10-year real rate at 2.4% and how historically it hurts parts of the economy and/or investment themes

👉 I would see it as opportunity to get paid in real terms for low risk bond allocations and also a way to clean-up excesses in the economy (bad business models & frauds holding hostage both financial resources and human capital)

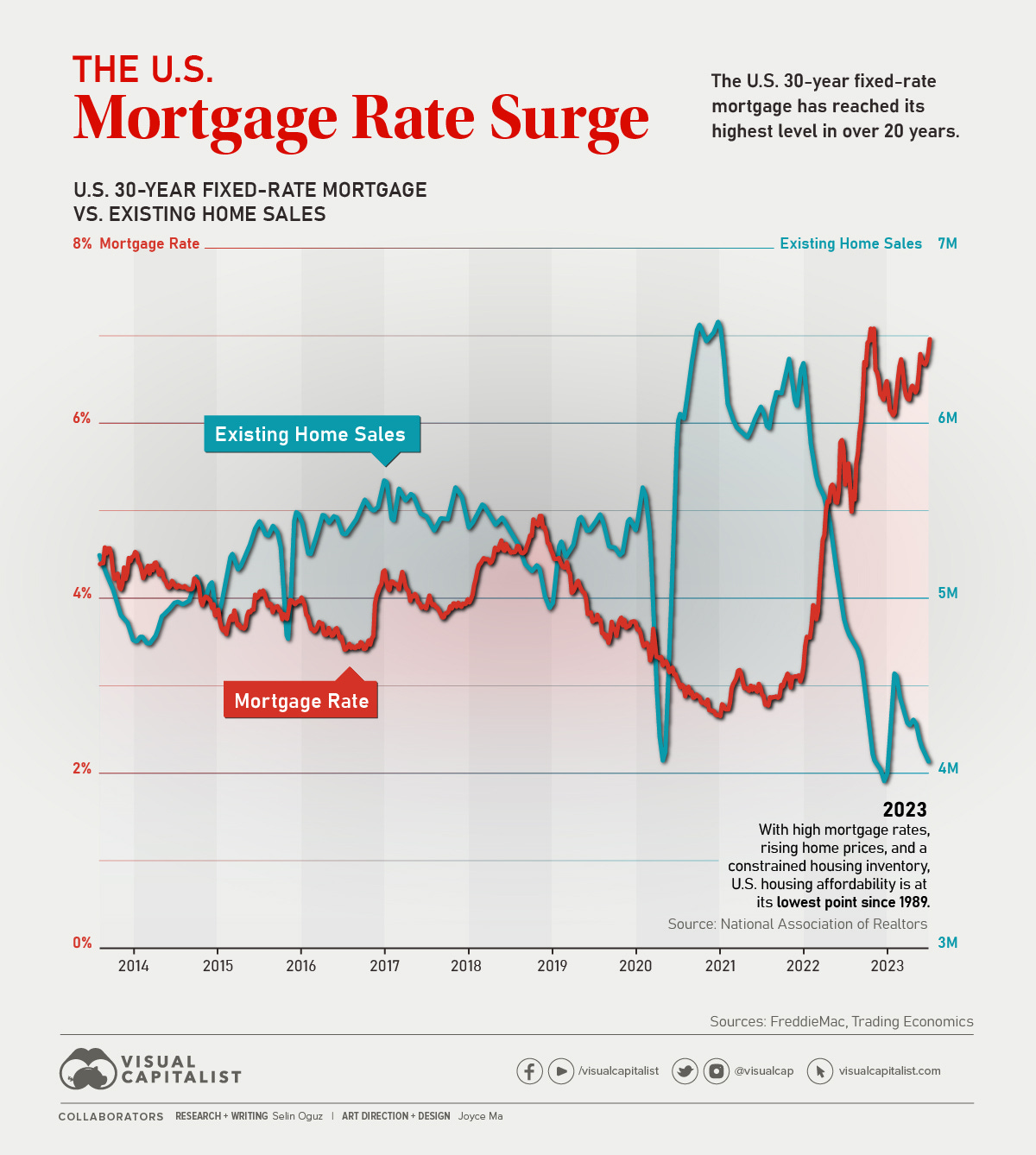

Not all real estate/mortgage markets are created & are equal at any point in time:

👉 Given high interest rates, a natural focus is on the mortgage market and below the distribution of the types of mortgages in the system in various DM countries

👉 US has a big chunk of mortgages with fixed interest rates on the short term which should cool-off a bit the constant doom & gloom headlines with ‘mortgage rates at record levels’ etc …

👉 on cutting rates across the world, one can also say that by looking at this the FED is likely not the first one to blink and cut rates

Sure, high mortgage rates are not good for people planning to take a mortgage for a home, but you know, when rates were low, we had the issue of ‘punishing the savers’ … I guess, one cannot make everybody happy and nor the economy 😉

P.S. on mortgages with distribution by interest rates and more, check my earlier take ✍️ The State of the US Economy in 35 Charts in case you missed it

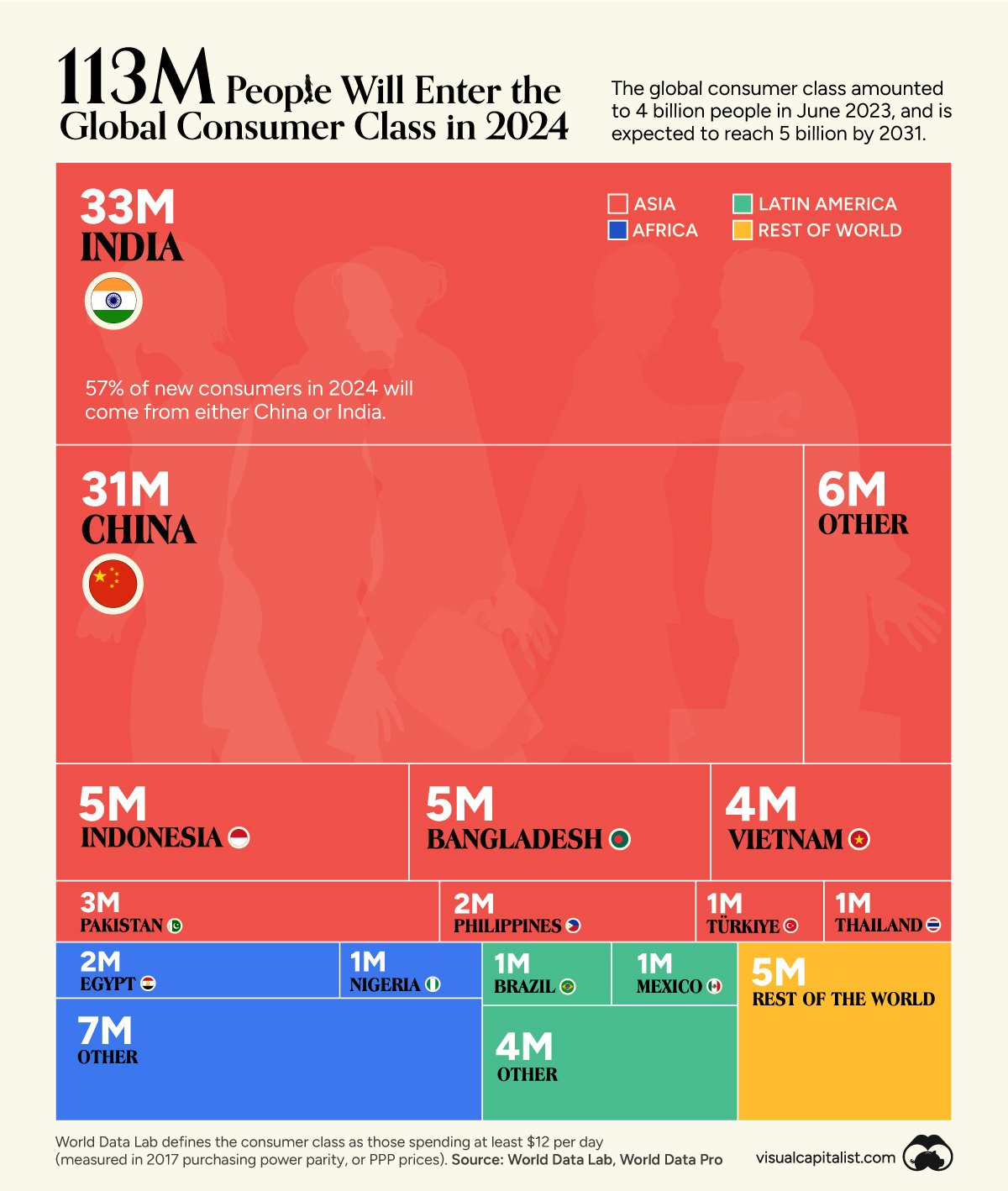

113 Million People Will Join the Global Middle Class in 2024

👉 defined by the World Data Lab as someone who spends at least $12 per day (measured in 2017 purchasing power parity), these individuals are typically rising up in developing regions like Asia and Africa.

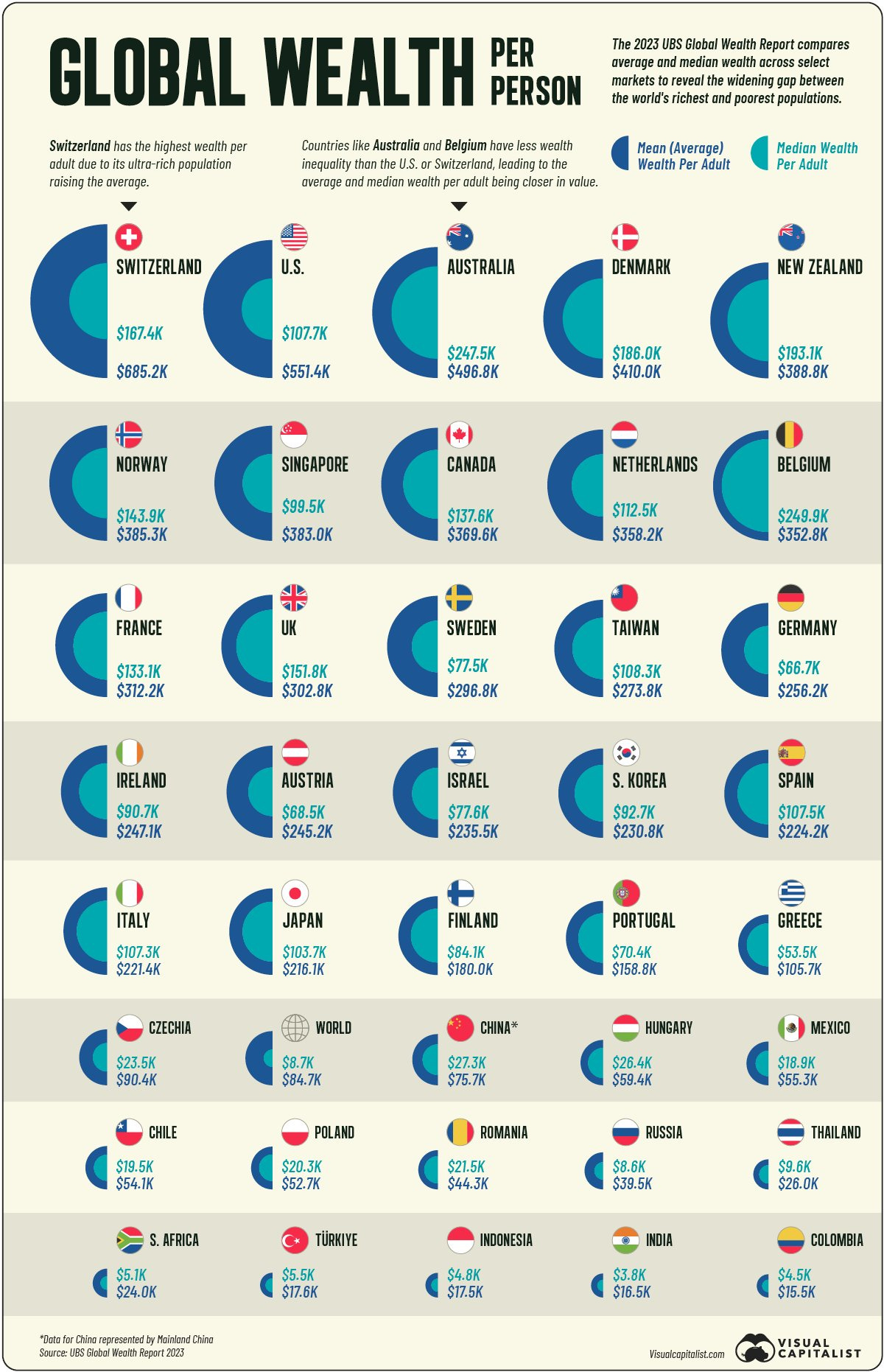

Visualizing the Top Countries by Wealth per Person

👉 check both the mean/average & median values … tells quite something …

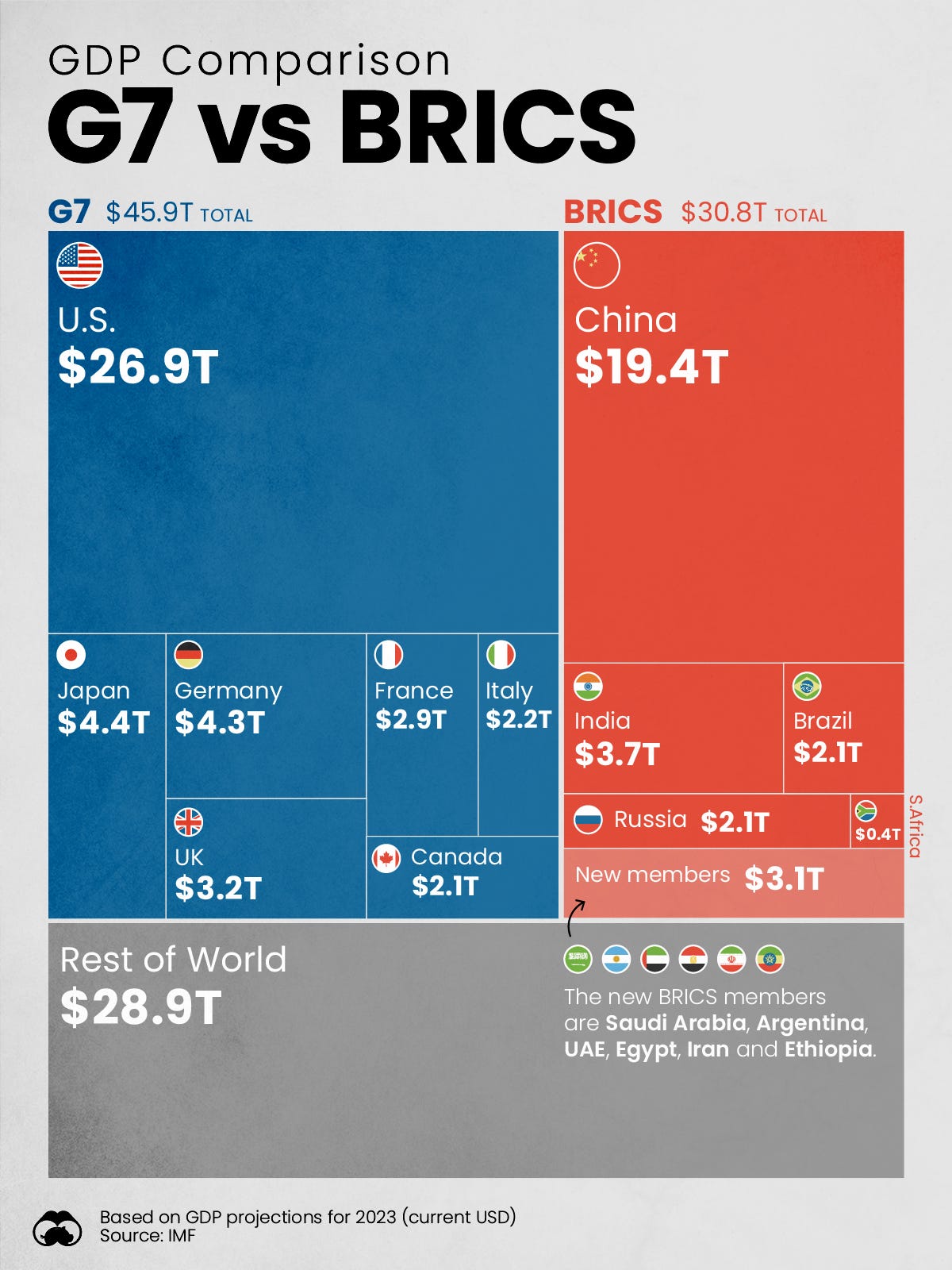

Comparing the GDP of BRICS and the G7 Countries

Which Countries Have the Highest Investment Risk in 2023?

👉 Investment risk is defined here via the big 3:

Political risk: Type of regime, corruption, level of conflict

Legal risk: Property rights protections, contract rights

Economic risk: Diversification of economy

👉 higher returns ‘require’ higher risk in general … with the exception of deep research via spotting asymmetries: human behavior can be emotional and create chaos but in investing also big opportunities …

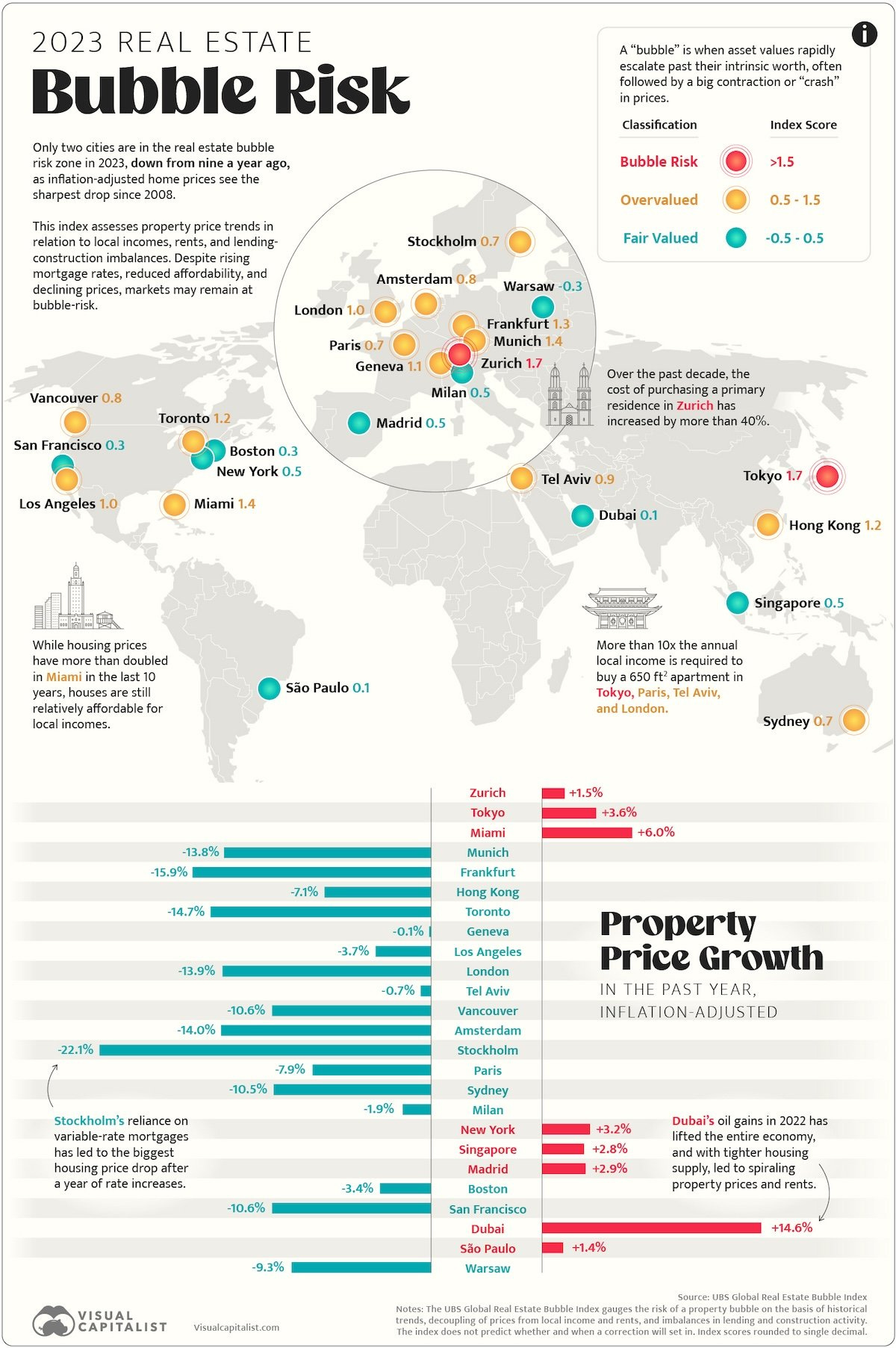

The Cities With the Most Bubble Risk in Their Property Markets

👉 Zurich, Tokyo, Miami, Munich and Frankfurt top 5

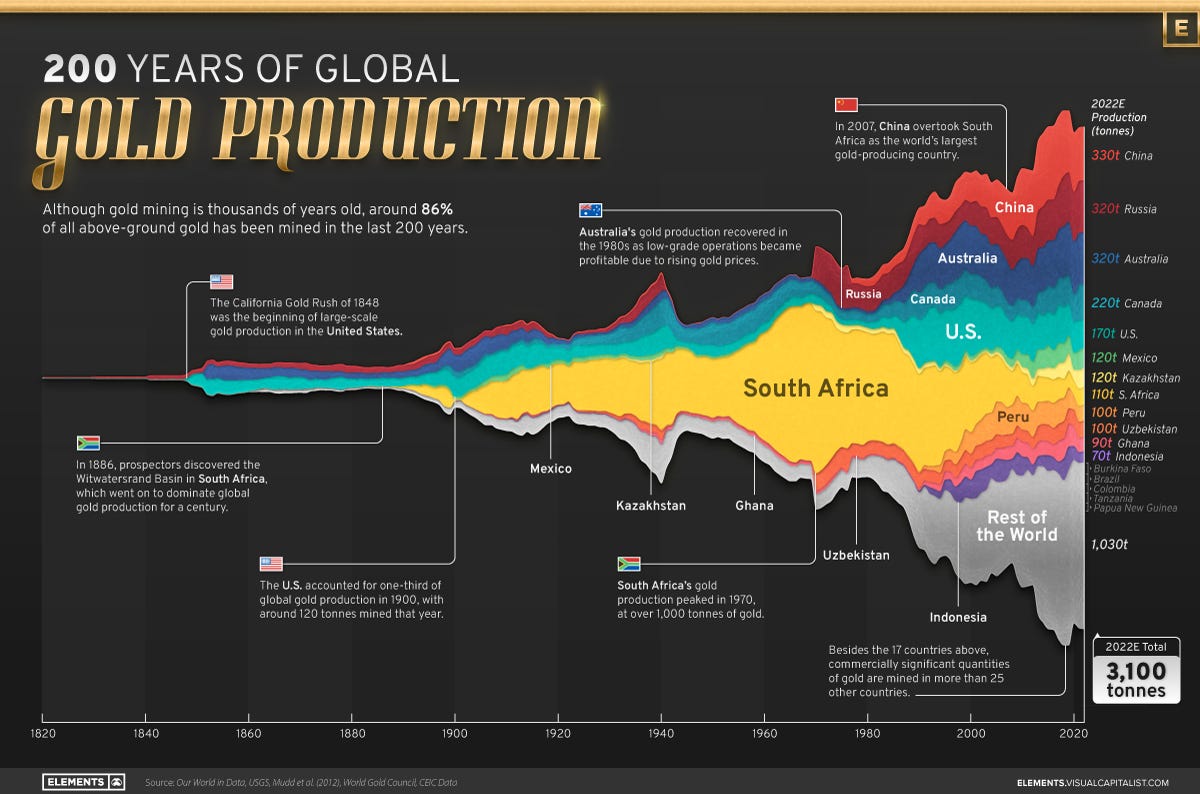

200 years of Global Gold Production (supply) in one chart:

👉 2022 estimates are for 3,100 tones

👉 China the biggest producer as it overtook South Africa in 2007; Russia, Australia, Canada and US follow in the top 5

👉 Gold mining has been around for thousands of years, but note that 86% of all above-ground gold has been mined in just the last 200 years - Let that sink in!

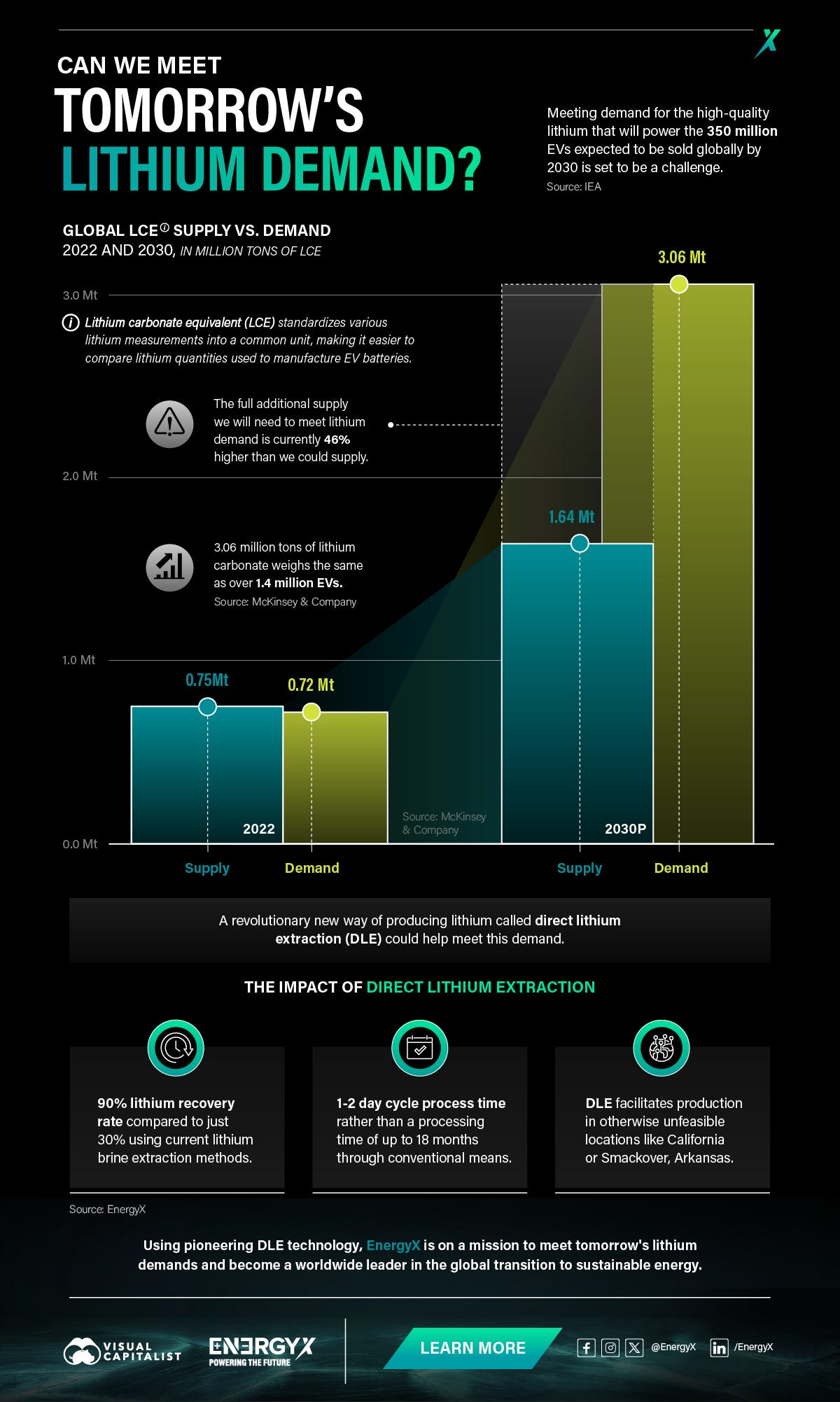

The Lithium Rush: Can We Meet Tomorrow’s Lithium Demand?

👉 Without action, by 2030, there won’t be enough lithium to meet the combined demands of the clean energy transition and the UN’s sustainable development goals.

👉 However, advances in DLE by pioneering companies like EnergyX could help meet the demand and ensure the transition to a more sustainable future

5 Bonus charts:

The Number and the evolution of Democracies Globally

👉 since the end of WW2, the number of democracies overtook the non-democracies

👉 after 2 decades with e clear democracies majority, the world is not evenly split

👉 note the countries where elections got LESS free and MORE free

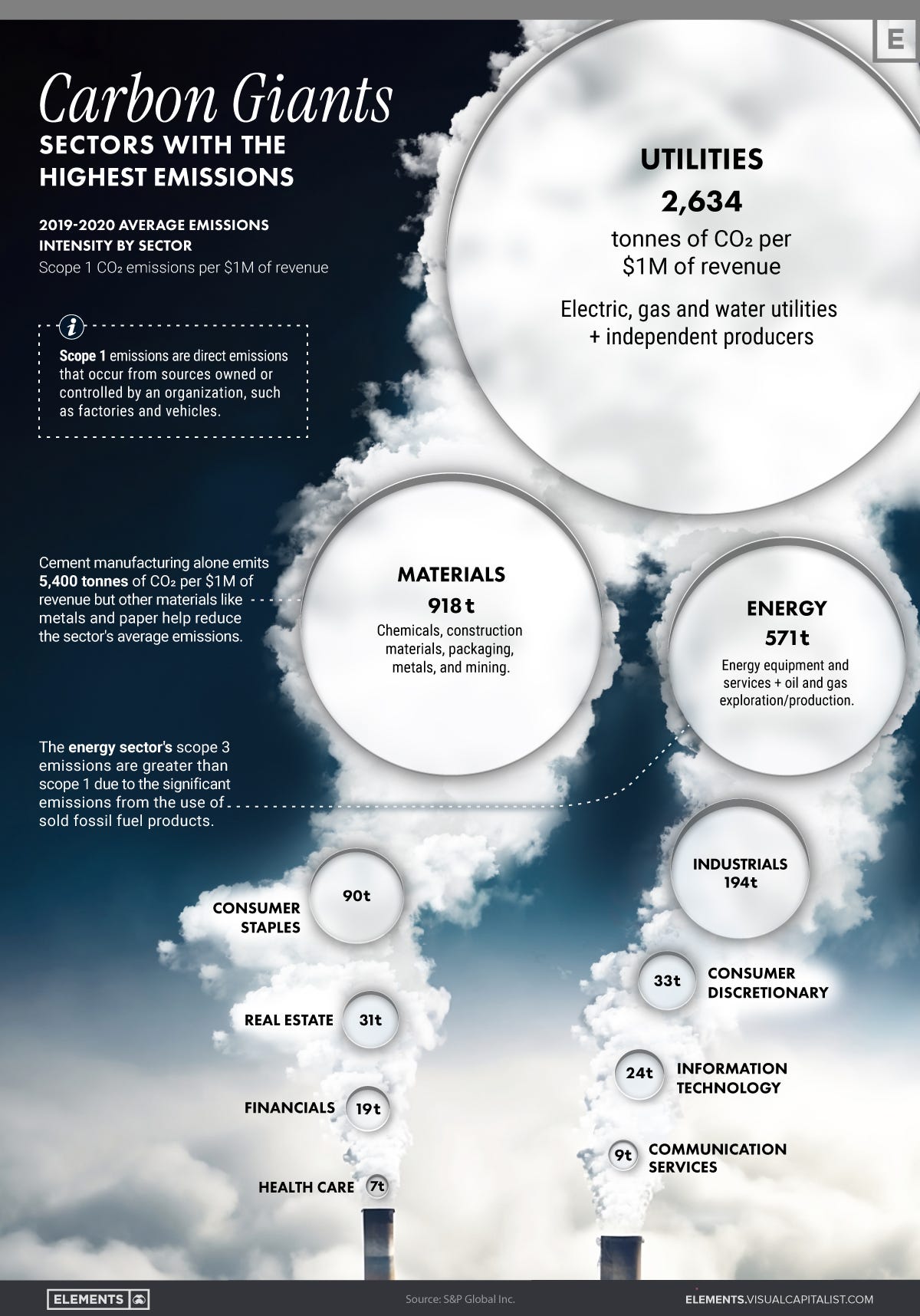

The Most Carbon-Intensive Sectors in the World

👉 utilities, materials, energy, industrials and consumer staples with the biggest carbon footprint

👉 I guess we can’t have our cake and eat it … but for sure a lot can be done by each of us regular folks (food, energy waste etc) and big corporates & governments

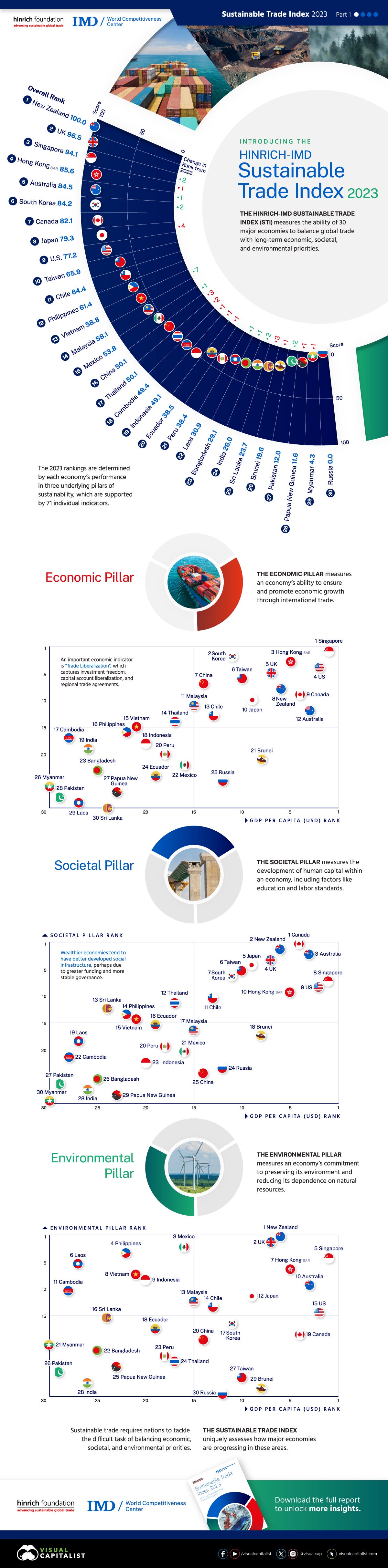

Ranked: The World’s Most Sustainable Economies in 2023

👉 New Zealand, UK, Singapore, Hong Kong and Australia leading the pack

All of the World’s Exports by Country in One Chart

👉 China, US, Germany, Netherlands and Japan the top 5

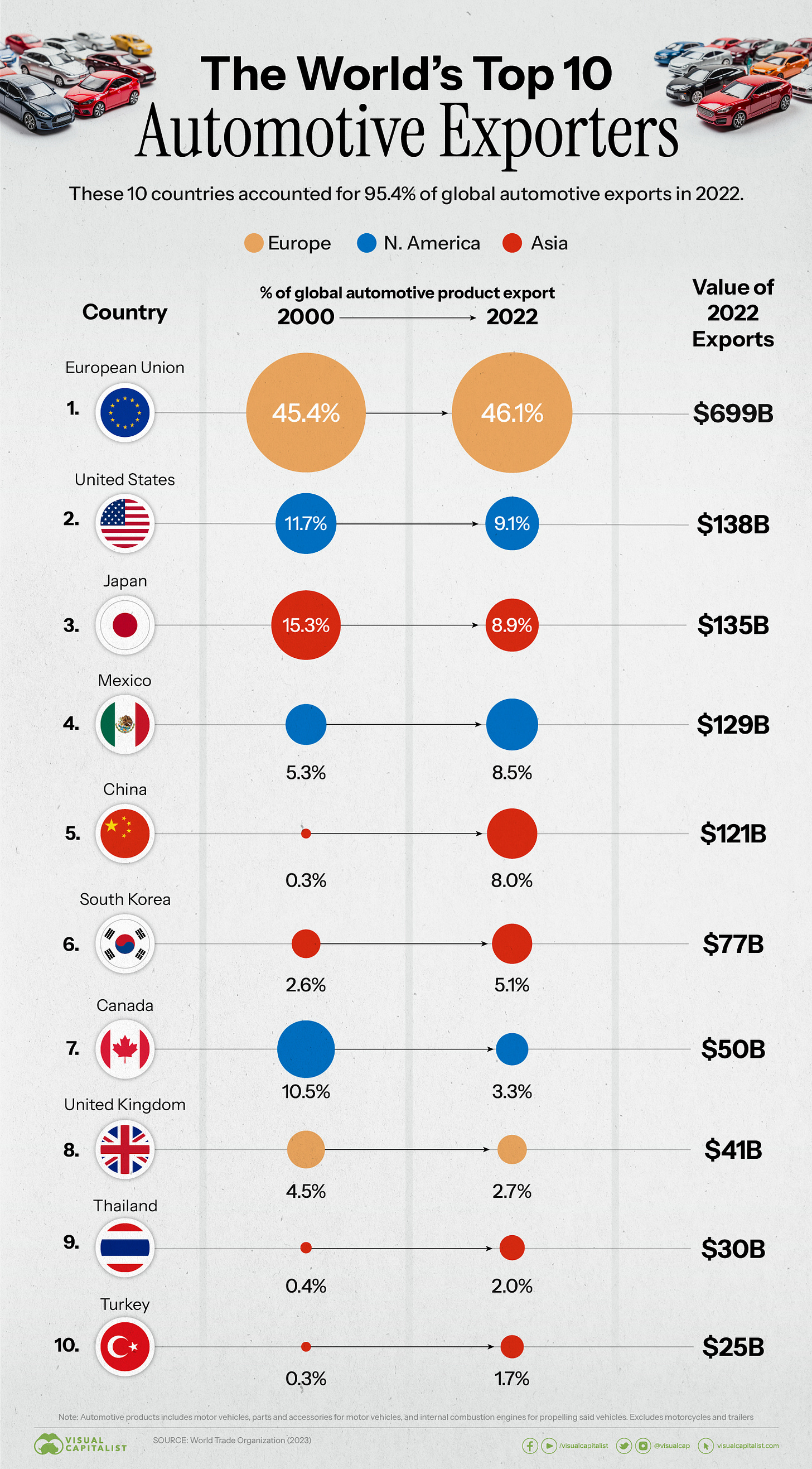

And now top 10 Automotive exporters which account for 95.4% of the global pie

Research is NOT behind a paywall & NO pesky ads. What would be appreciated? Just sharing it around with like-minded people & hitting the ❤️ button. Thank you!

That’s all for October. Have a great next week & next month!

Mav 👋 🤝

Great stuff Mav once again, will be waiting for your "Investing in bonds" series. Also love the chart on when bubbles have burst at peak real rates. Should 10Y bond yields go up to 5.5% or higher, driven by higher risk premia in real rates, this is a high alert metric to watch.

Love the chart!