✍️ Maverick Charts - Macro & More - September 2023 Edition #11

25 Sleek charts that say 10,000 words ... save precious time & provide insight!

Dear all,

your monthly Top 20 Macro & More charts from around the world + 5 Bonus! Enjoy!

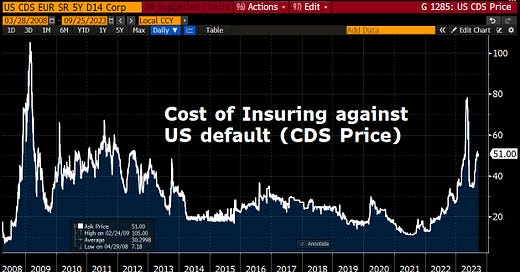

US CDS (Credit Default Swaps) as the cost of insuring against US default:

after the ‘debt ceiling’ debacle to the ‘government shutdown’ debacle, up again …

CDS prices moved not that much by economics, but by each side of the politics spectrum thinking they know better, serve their population better, save the world … errrr sarcasm alert to be sure ;)

The latest from Moody’s (only remaining rating agency with a top AAA rating): “While government debt service payments would not be impacted & a short-lived shutdown would be unlikely to disrupt the economy, it would underscore the weakness of US institutional and governance strength relative to other AAA-rated sovereigns that we have highlighted in recent years”.

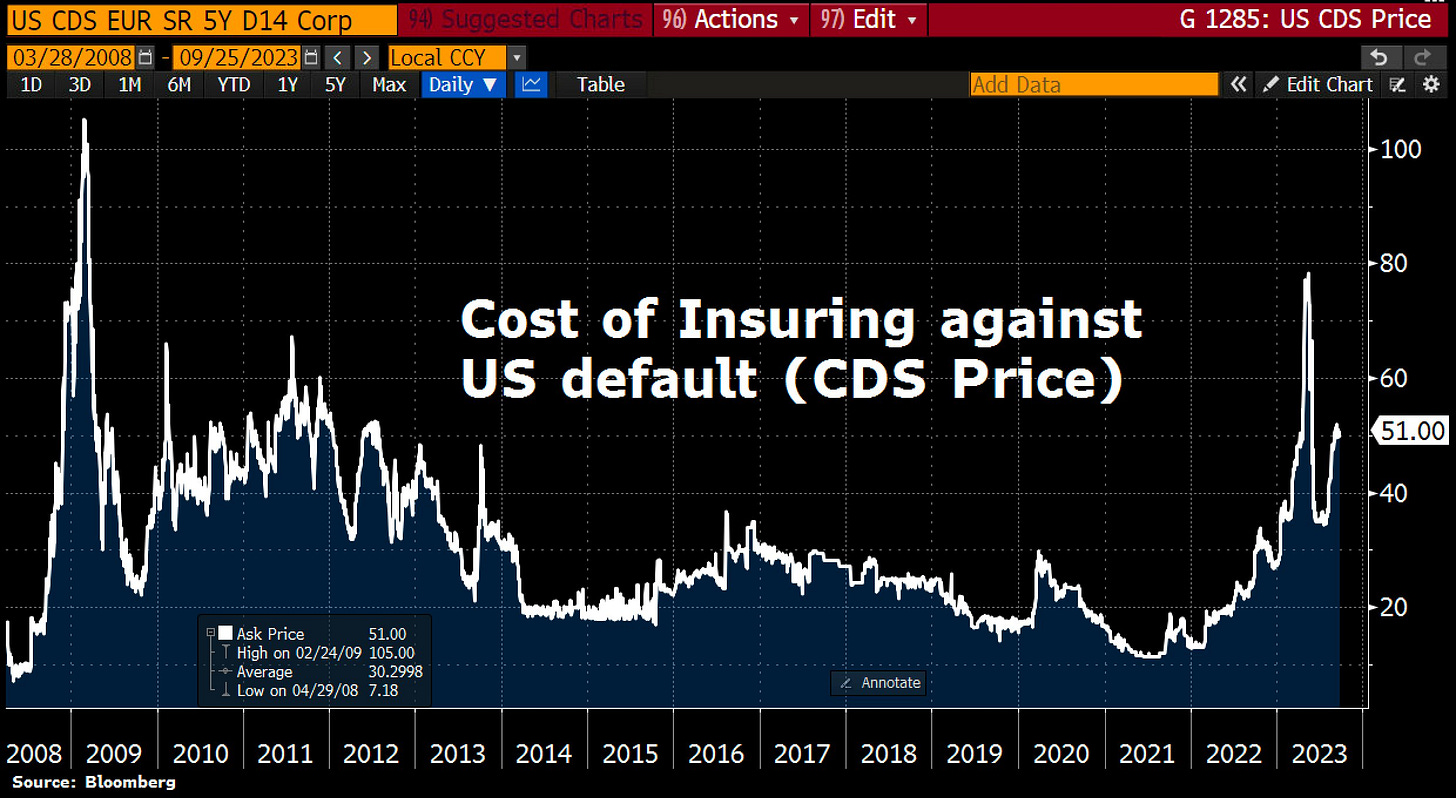

US Corporate profit margins edged higher in 2Q23: only a slight increase to 14.3%, but they remain quite strong relative to history

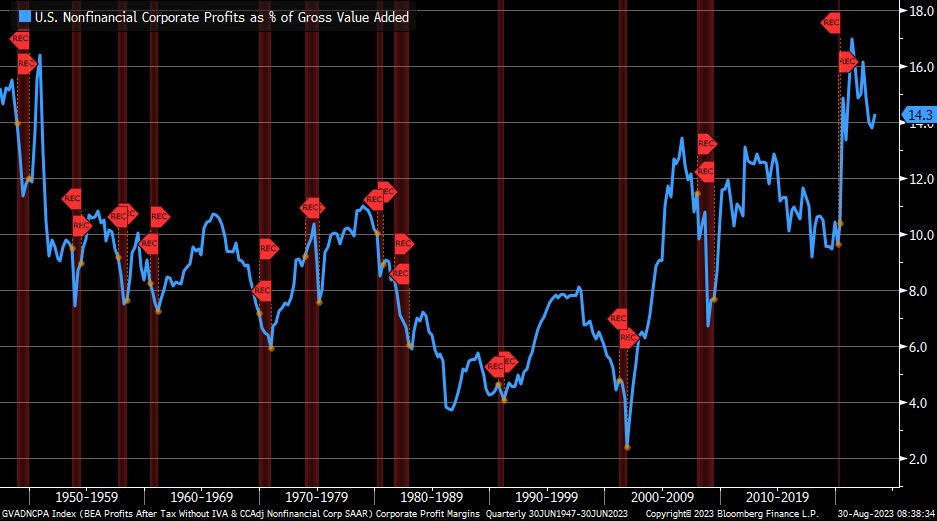

In terms of the current drawdown in US corporate profits:

that is 6.5% from the peak

interestingly, there’s been larger drawdowns and no recession (2015) and drawdowns of similar magnitude with recession (1990)

US economy: landing hard or soft after monetary tightenings? Past 11 cycles:

Possible issue with rising bond yields / interest rates is that:

they typically cause something to brake in the system: what is good this time is that banks have way higher capital levels / cushion unlike the 2007-2009 GFC

so far besides some past banking issues & current weaknesses in CRE & regional banks, things are fine. Yet sure, there is no crystal ball to tell, I remain optimistic

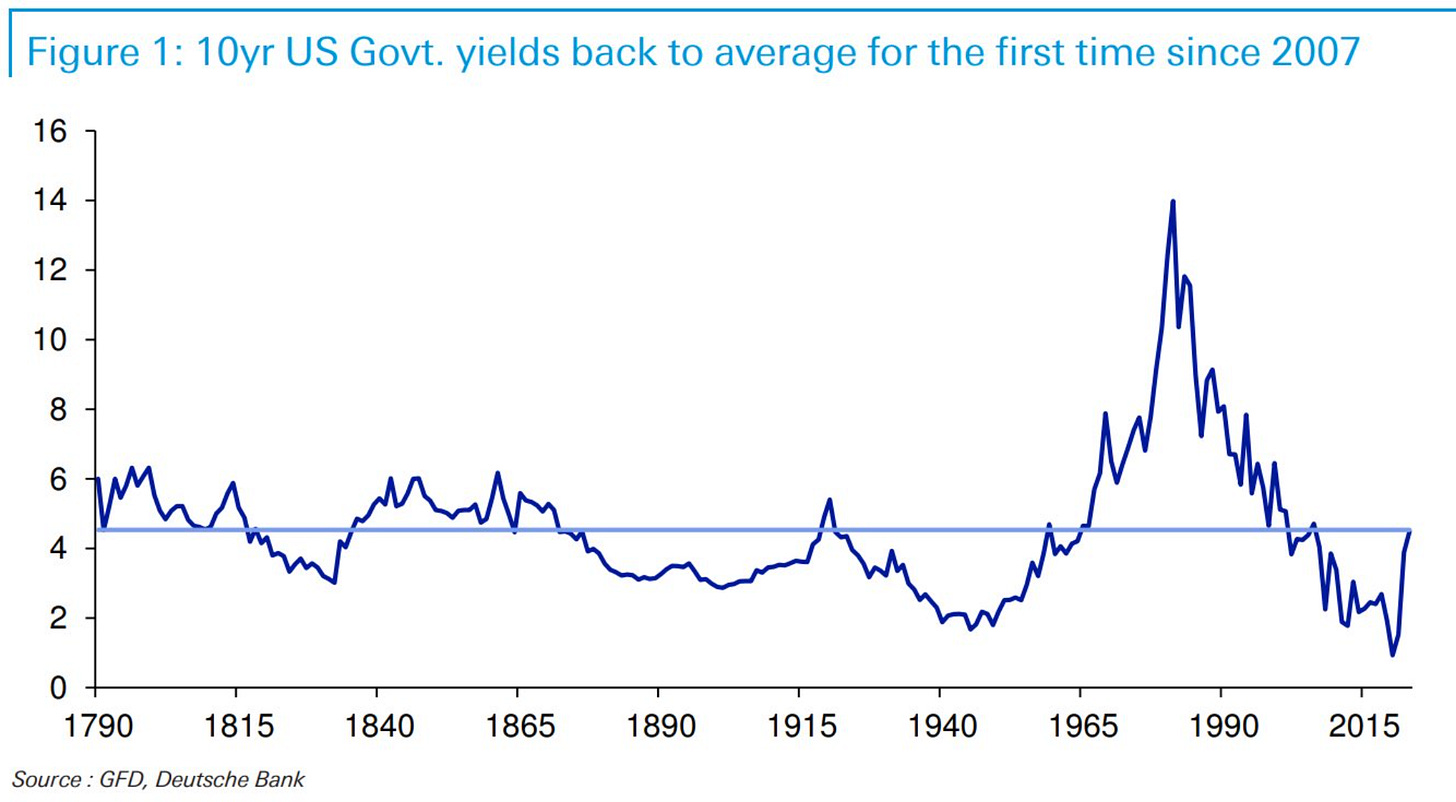

Going back 230 years nonetheless, the US 10-year yields:

are just at their very long term average

note also, it’s the first time back to the average since 2007

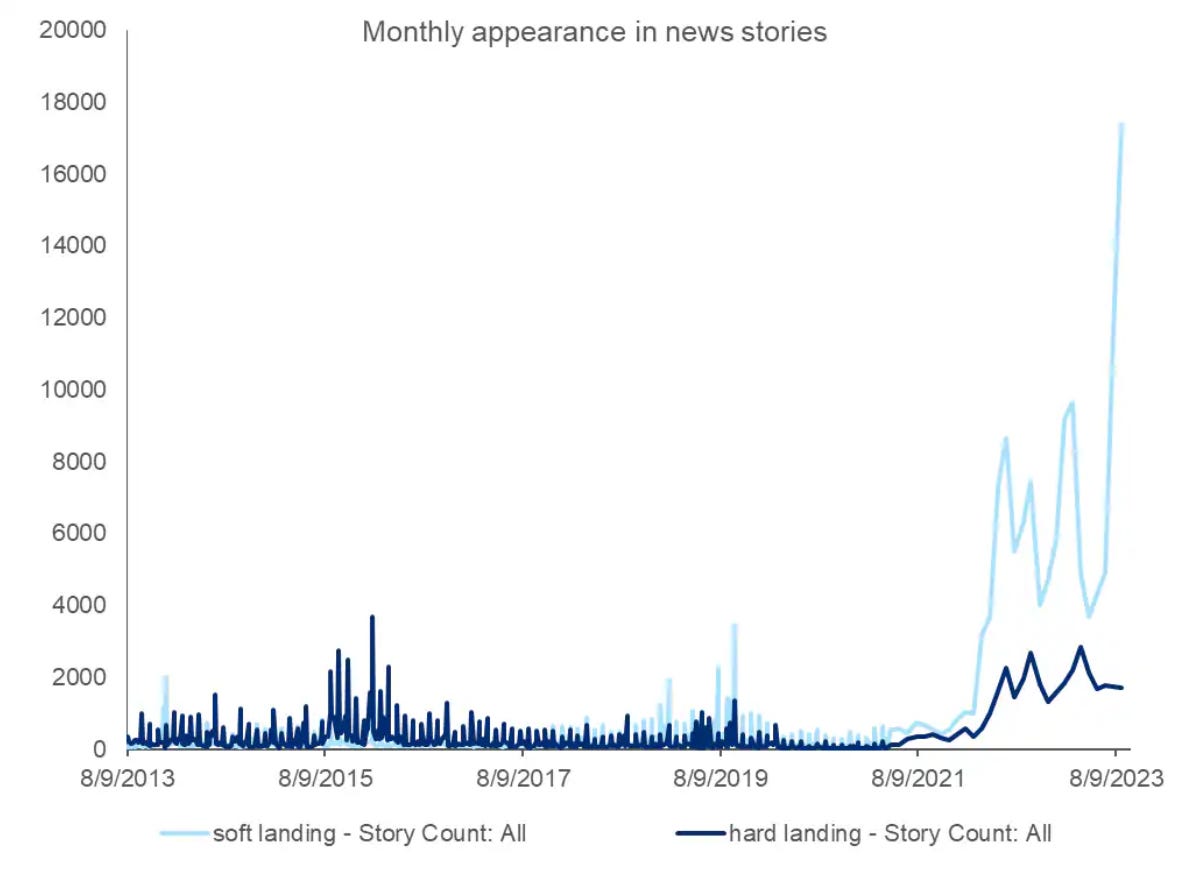

Soft landing scenario is what is priced and anticipated via news stories volume

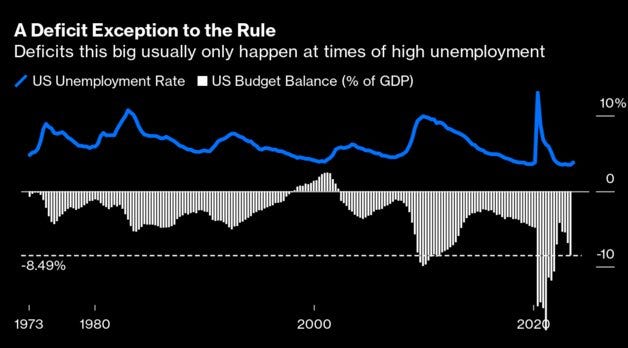

US Unemployment and Budget Balances:

despite record low unemployment, US is running a big 10% deficit …

in a slowdown or recession, naturally US will cut interest rates … hence, bonds will pay less and less … and money shall rotate into other asset classes

until then, treasuries returns (risk-free) are not bad in both nominal & real terms

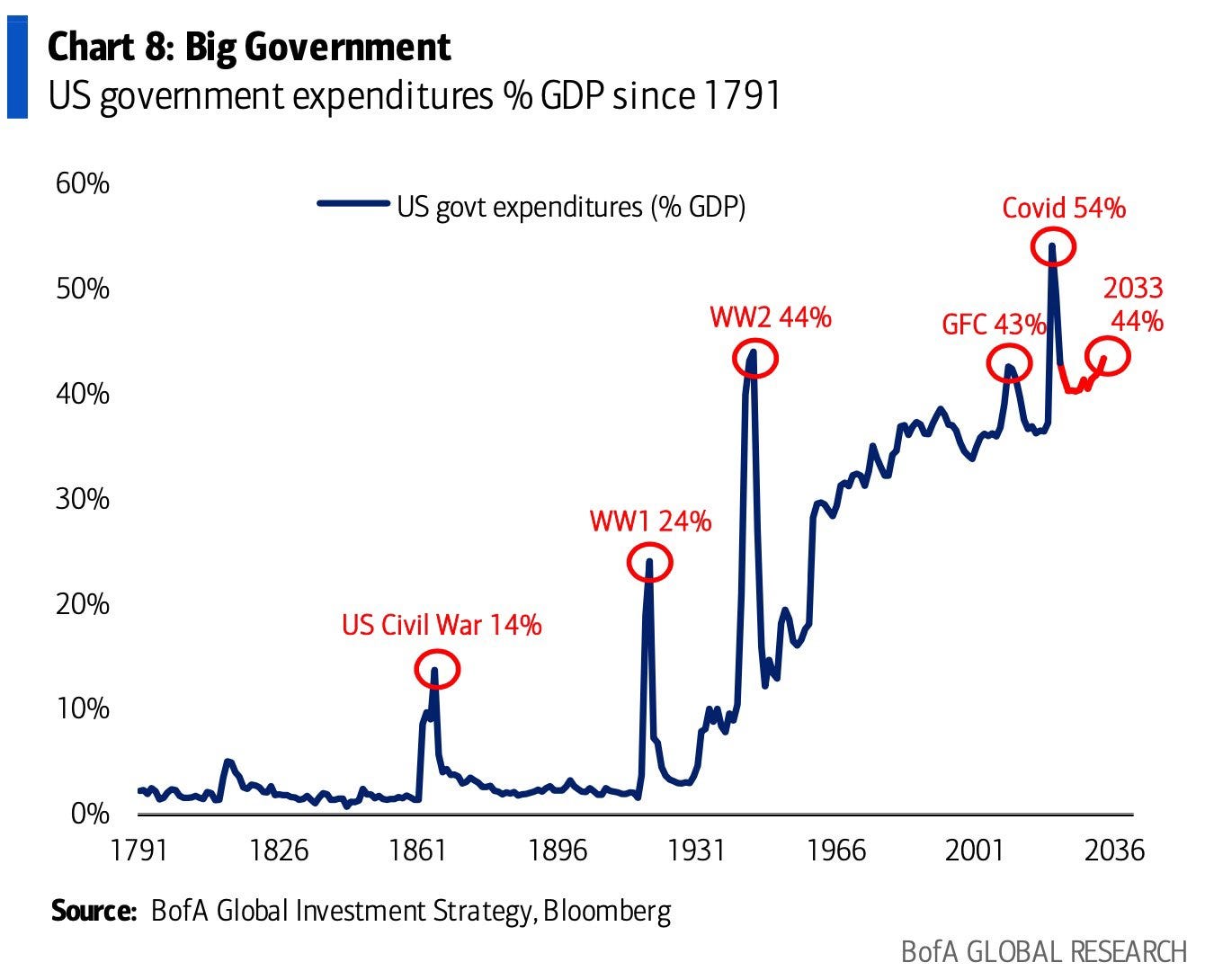

US Government expenditures as % GDP since 1791: with the world USD reserve currency & the biggest economy in the world makes it work since quite a while

Gold & the 10-year real yield relationship broke materially in 2022:

gold as a safe asset with diversification benefits against inflation, recession, war and debt sustainability concerns across the world

central bank gold purchases went parabolic lately, especially since Russia invading Ukraine

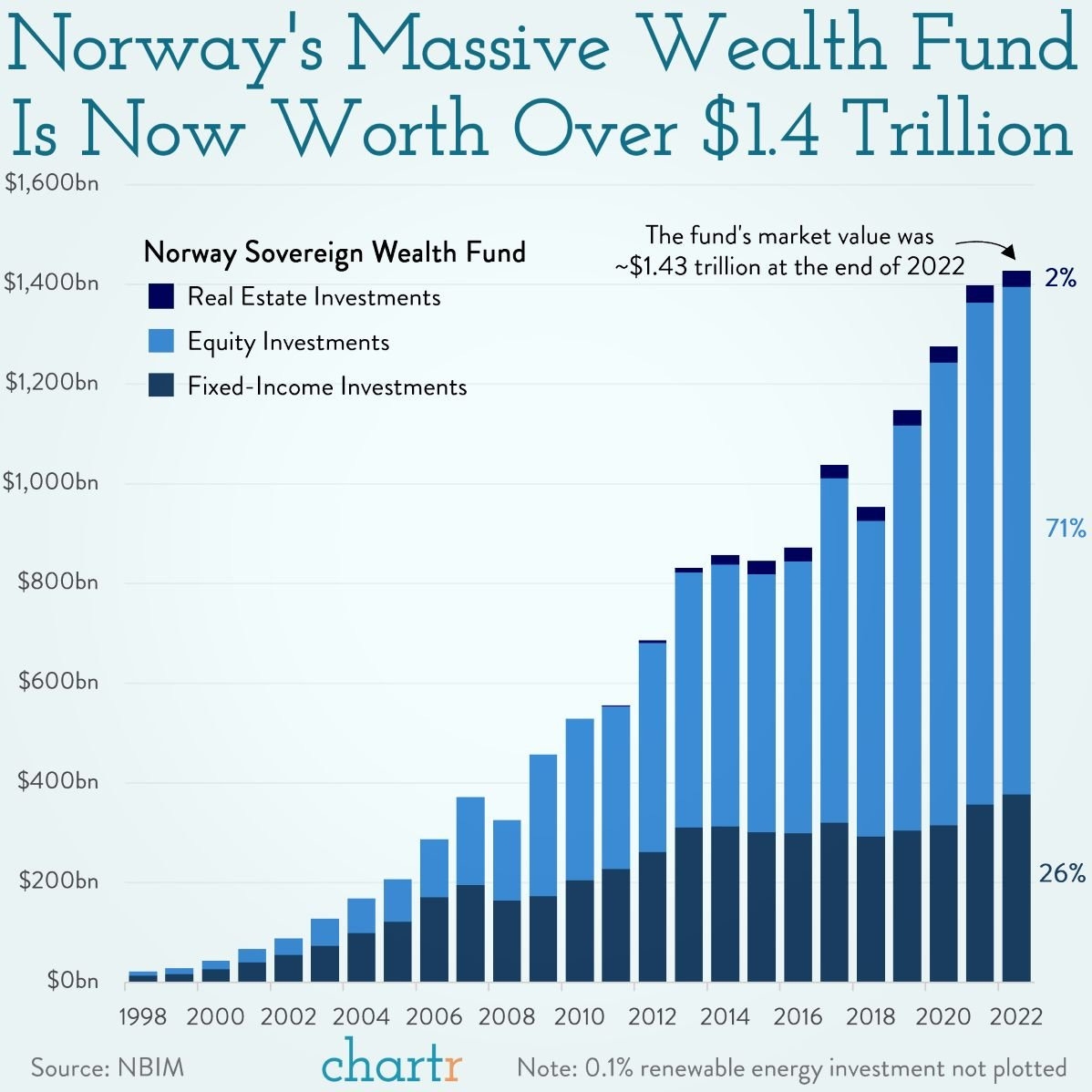

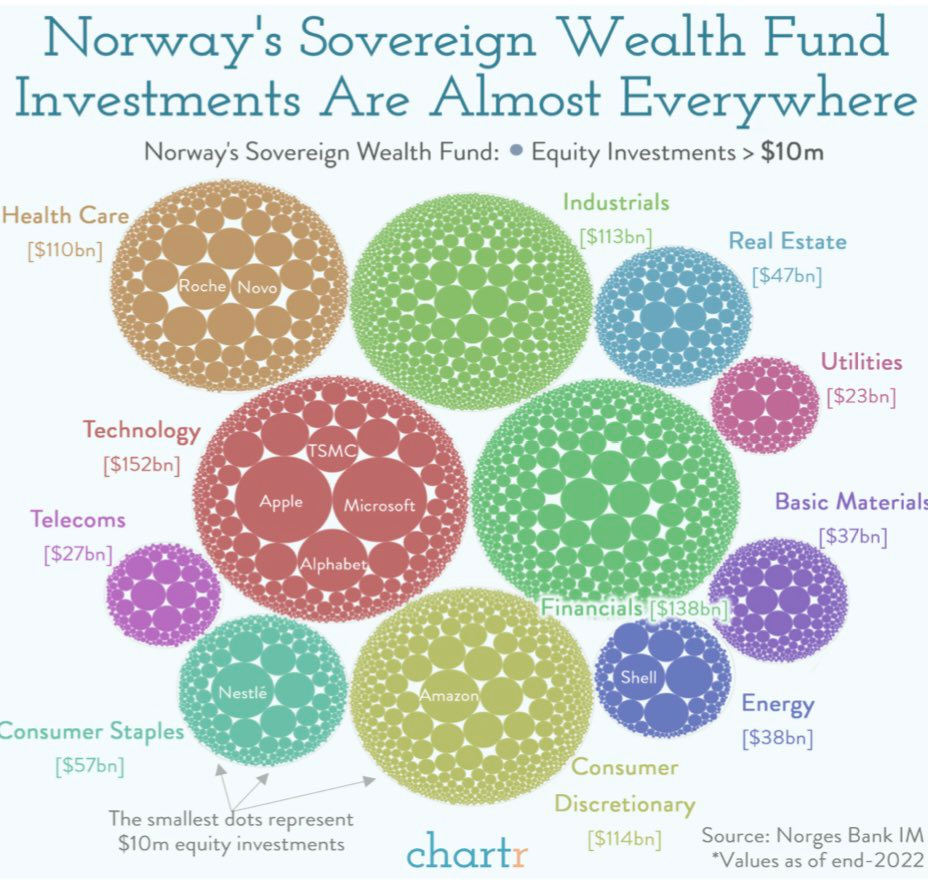

11 & 12. Norway’s Sovereign Wealth Fund (SWF) is the world’s largest:

accounts now to $1.4 trillions with stocks as a top allocation (71%), followed by fixed-income/bonds and some real estate sprinkled with renewable energy

9,000+ stocks, 4 asset classes in 70 countries - quite some diversification, right

fun fact: Norway hit it big by discovering oil in the North Sea back in 1969 = equivalent of hitting the lottery on a country level.

Equity investments distribution, diversified no joke …

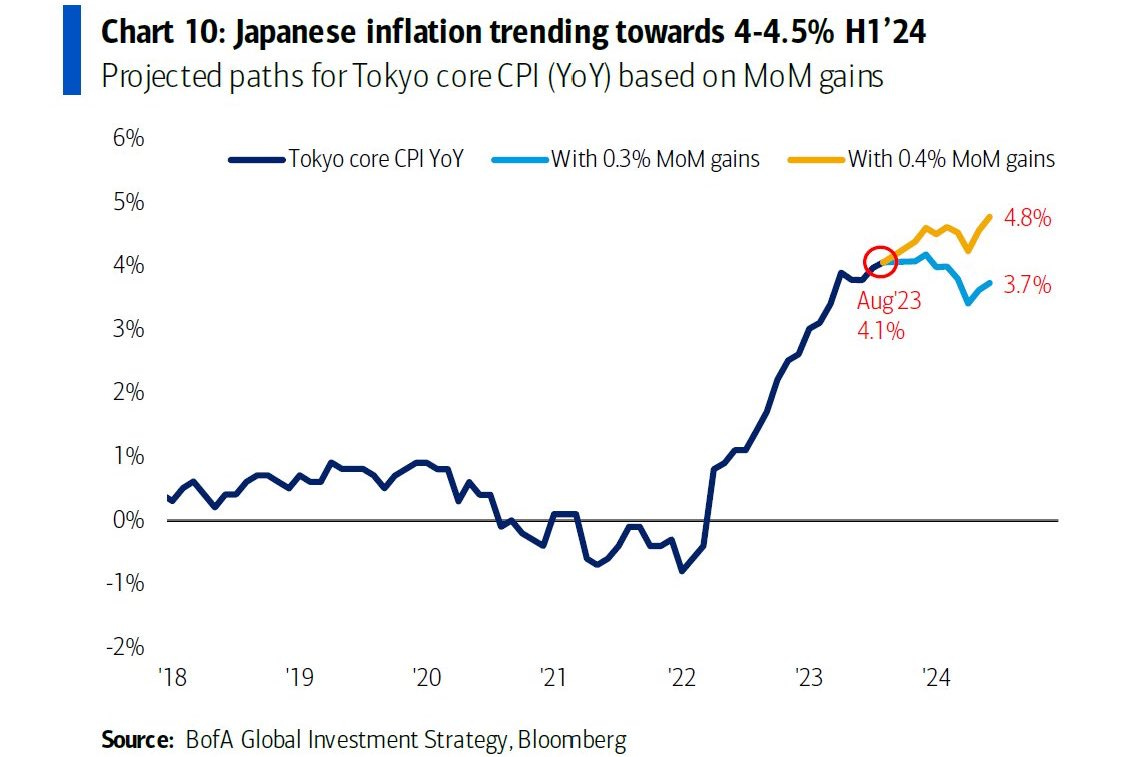

Japanese inflation & bond yields:

inflation trending towards 4-4.5%, yet their bonds yield not much above 0

which is a way to maintain or decrease Debt/GDP ratio

in other words, inflation is a way to deflate one’s debt levels

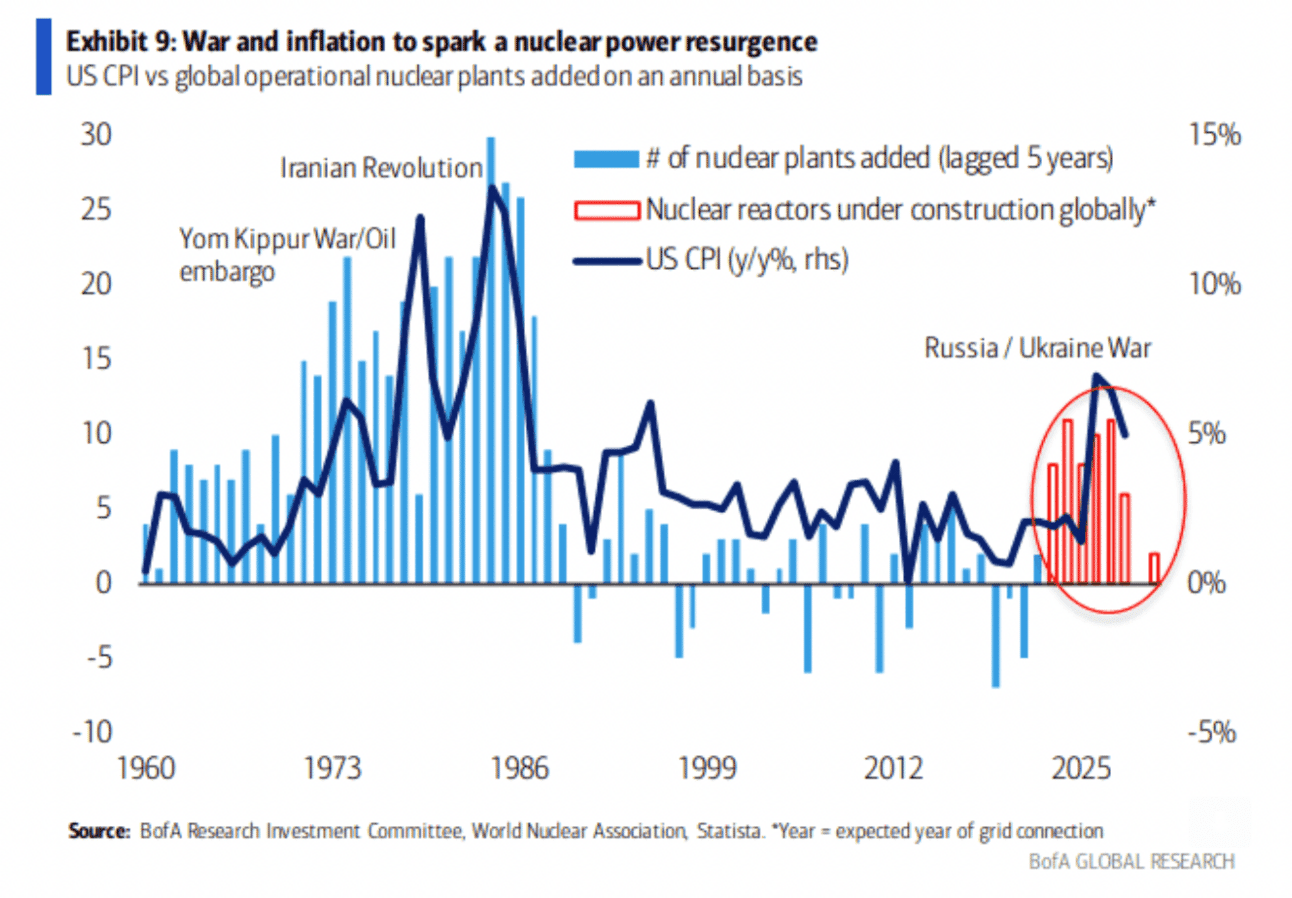

The combo of War & Inflation triggered a nuclear power resurgence

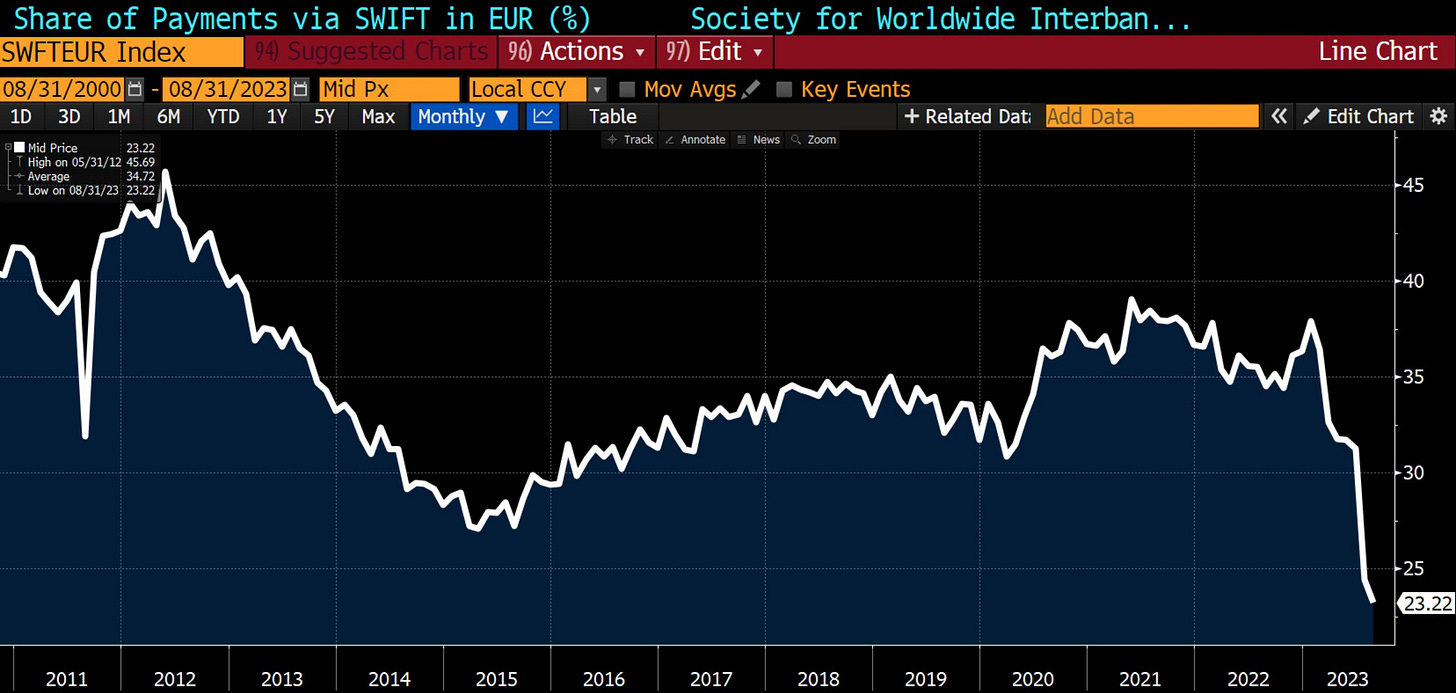

SWIFT international payments:

we keep hearing about de-dollarization, when it fact it is de-euroization as the EUR share dropped from 38% at the beginning of 2023 to 23%

note also that China’s share reached and all-time high of 3.47% in August 2023

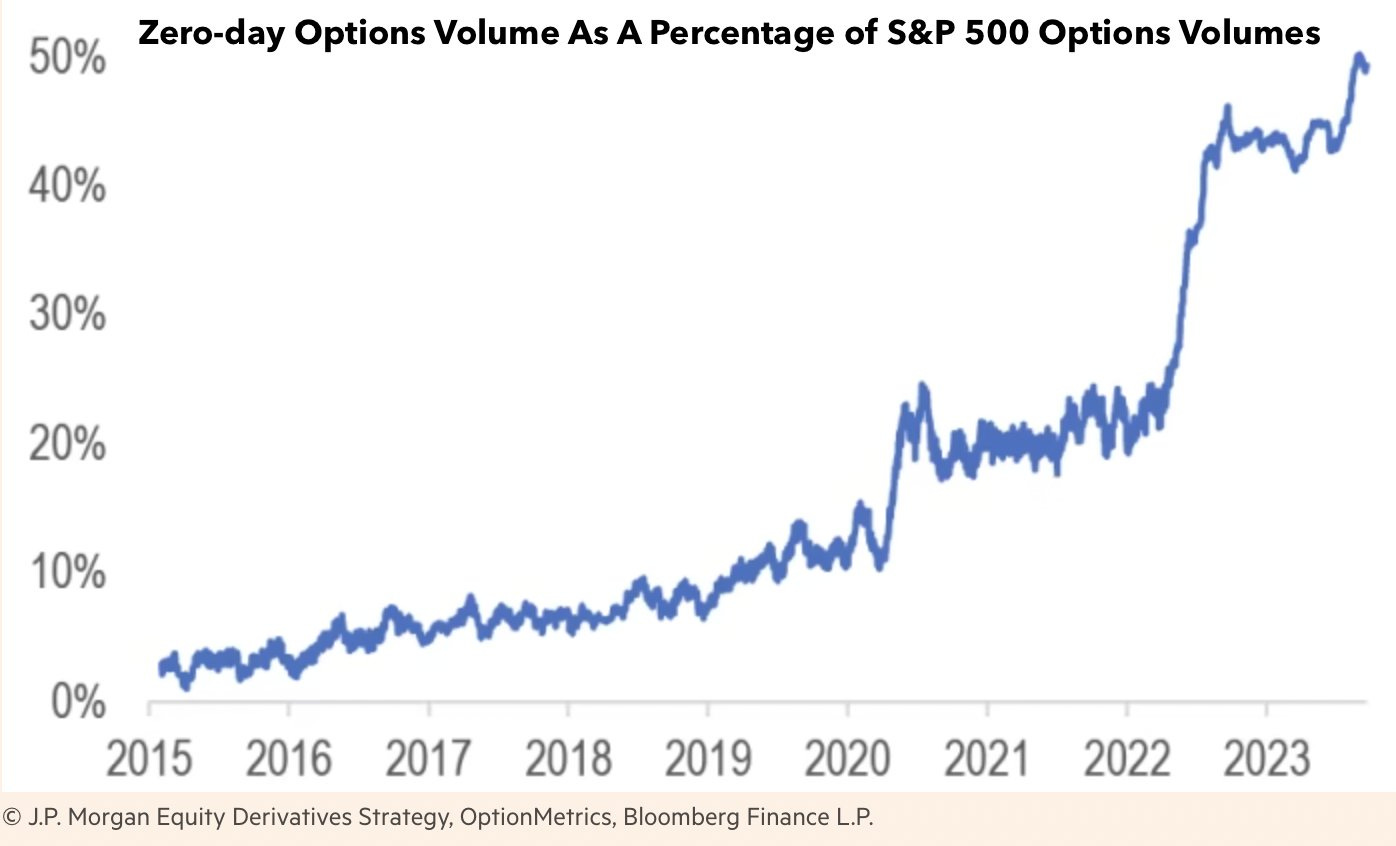

Fun Fact: Zero-day options (ODTE) are now 50% of the S&P 500 options market!

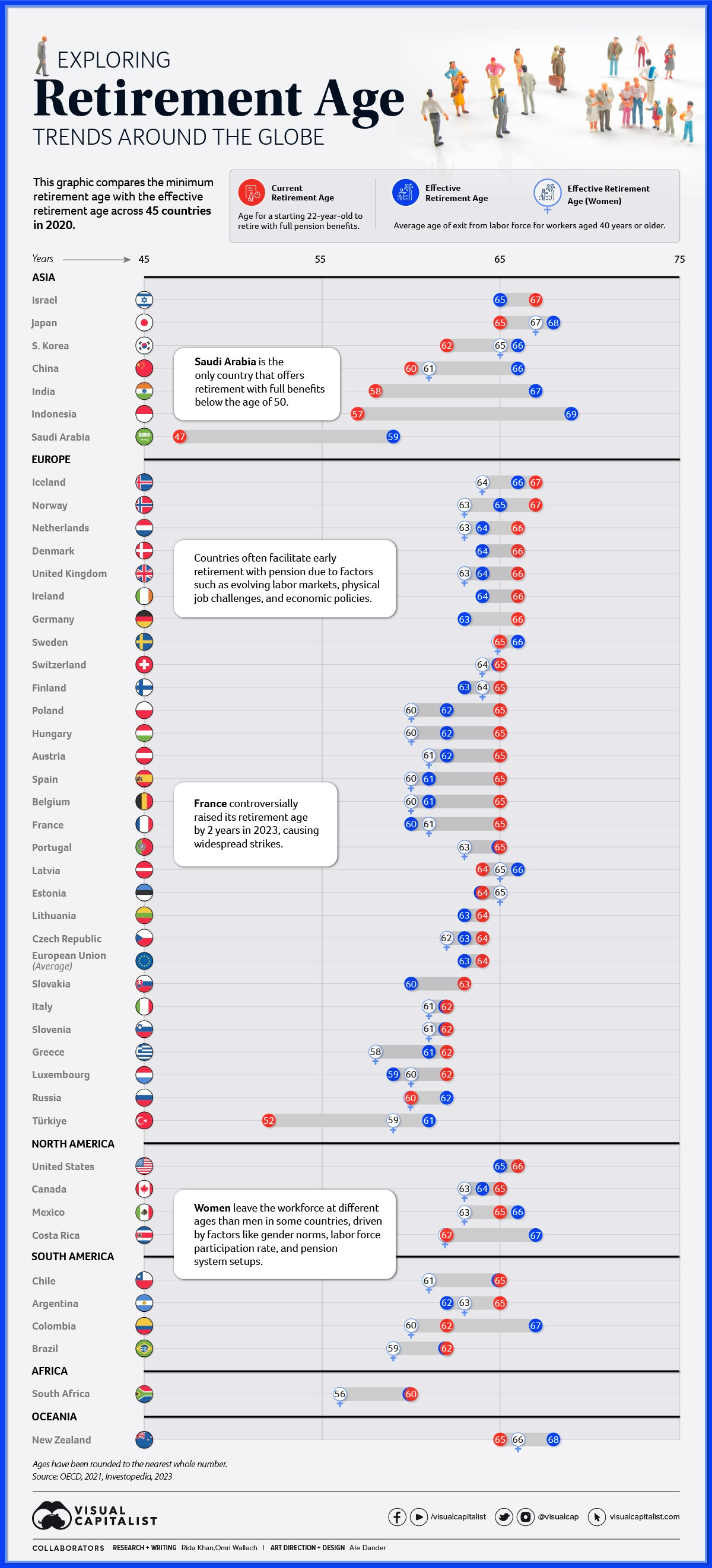

Exploring Retirement Age Trends Around The Globe, some key definitions first:

The current retirement age = age at which individuals can retire without penalty to pension after completing a full career starting from age 22.

The effective retirement age = average age of exit from the labor force for workers aged 40 years or more.

Notable variations across continents and countries, check yours and neighbours …

Complementary table:

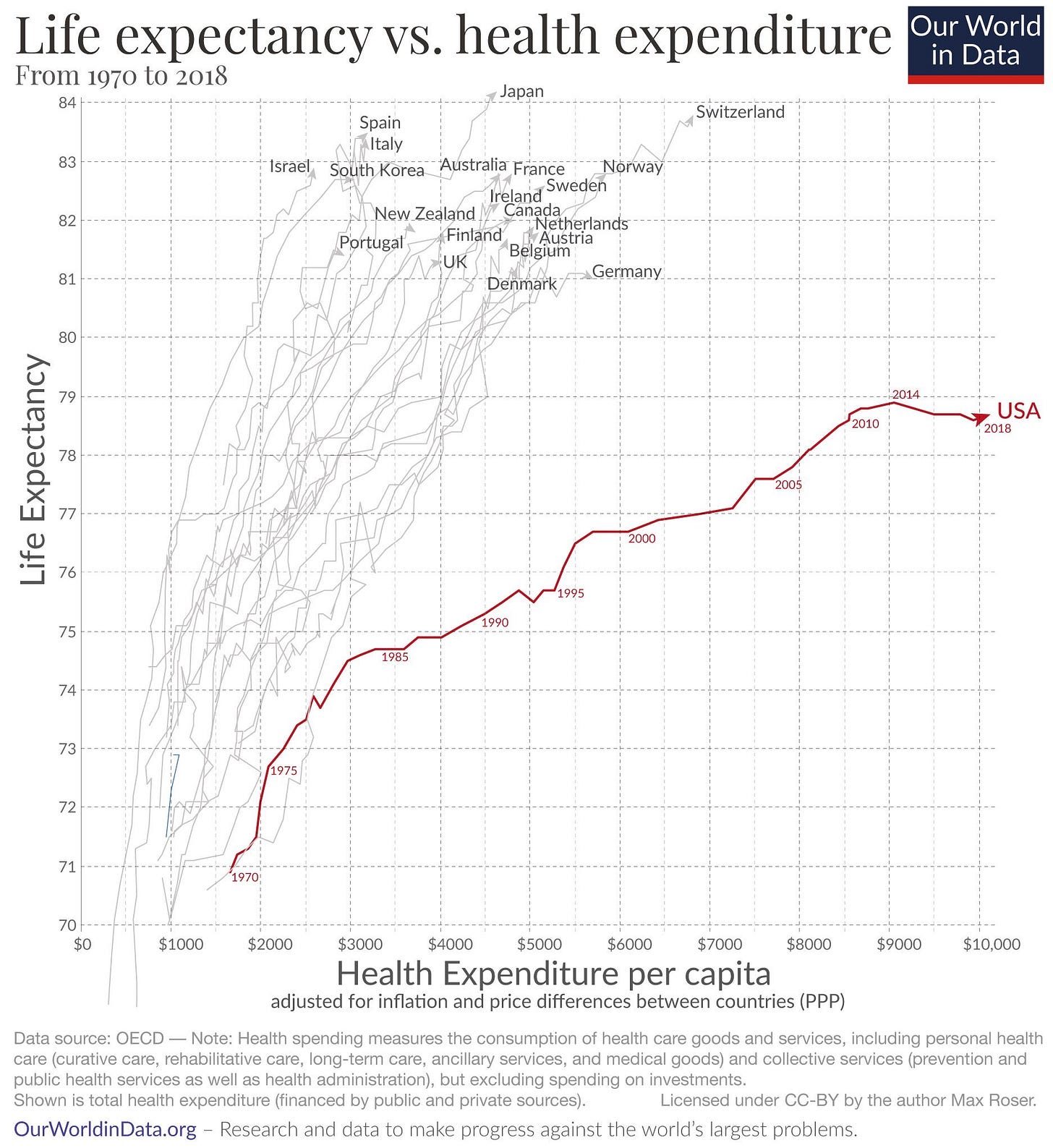

Life expectancy vs healthcare expenditure across the world: US is quite a case …

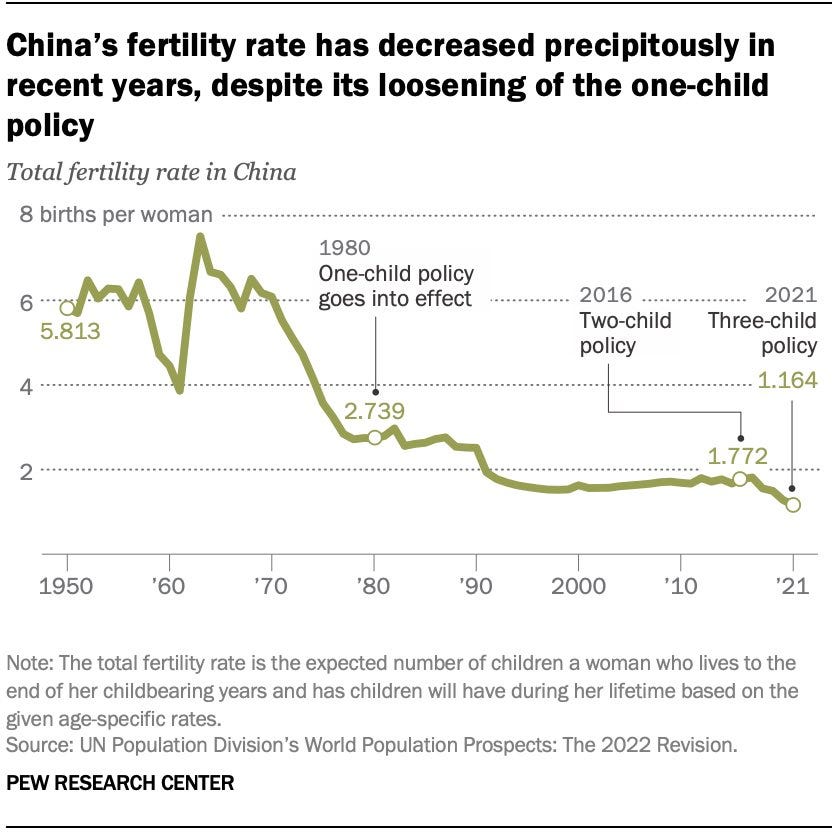

China and their fertility rate: big decrease despite its loosening one-child policy

The Rapid Decline of Birth Rates, hence not just a China topic

5 Bonus charts:

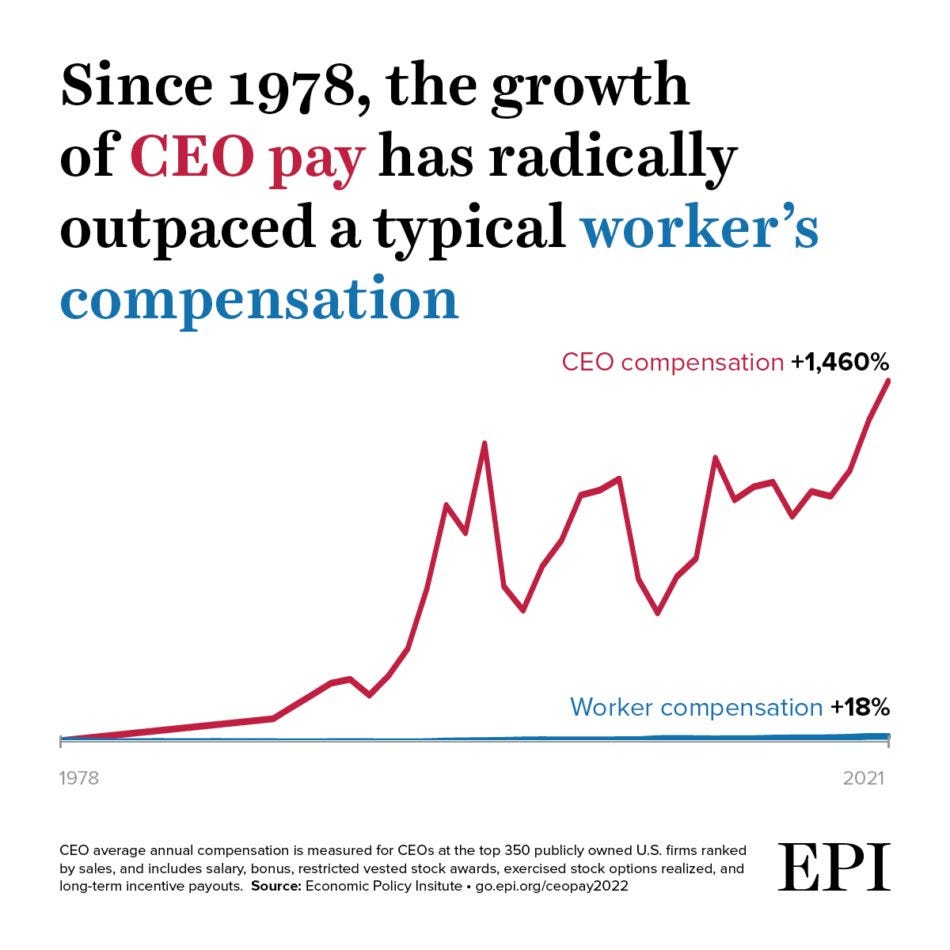

Growth of CEO pays relative to typical worker since 1978

I have yet to find any sound economic reasoning for this … or even anecdotal … would be happy to hear about it if anybody has some interesting takes …

unless founder-led, most CEOs are way way way overpaid, most of them could be replaced easily over night and no, nobody would suffer … would love the experiment where all CEOs of big companies are told their pay is cut in half, guess how many will leave? Close to 0, hence … where is any justified pay?

it’s a myth and aura societies created around CEOs, they are not the know it or do it all or the big transformative get goers that ‘will change everything’ …

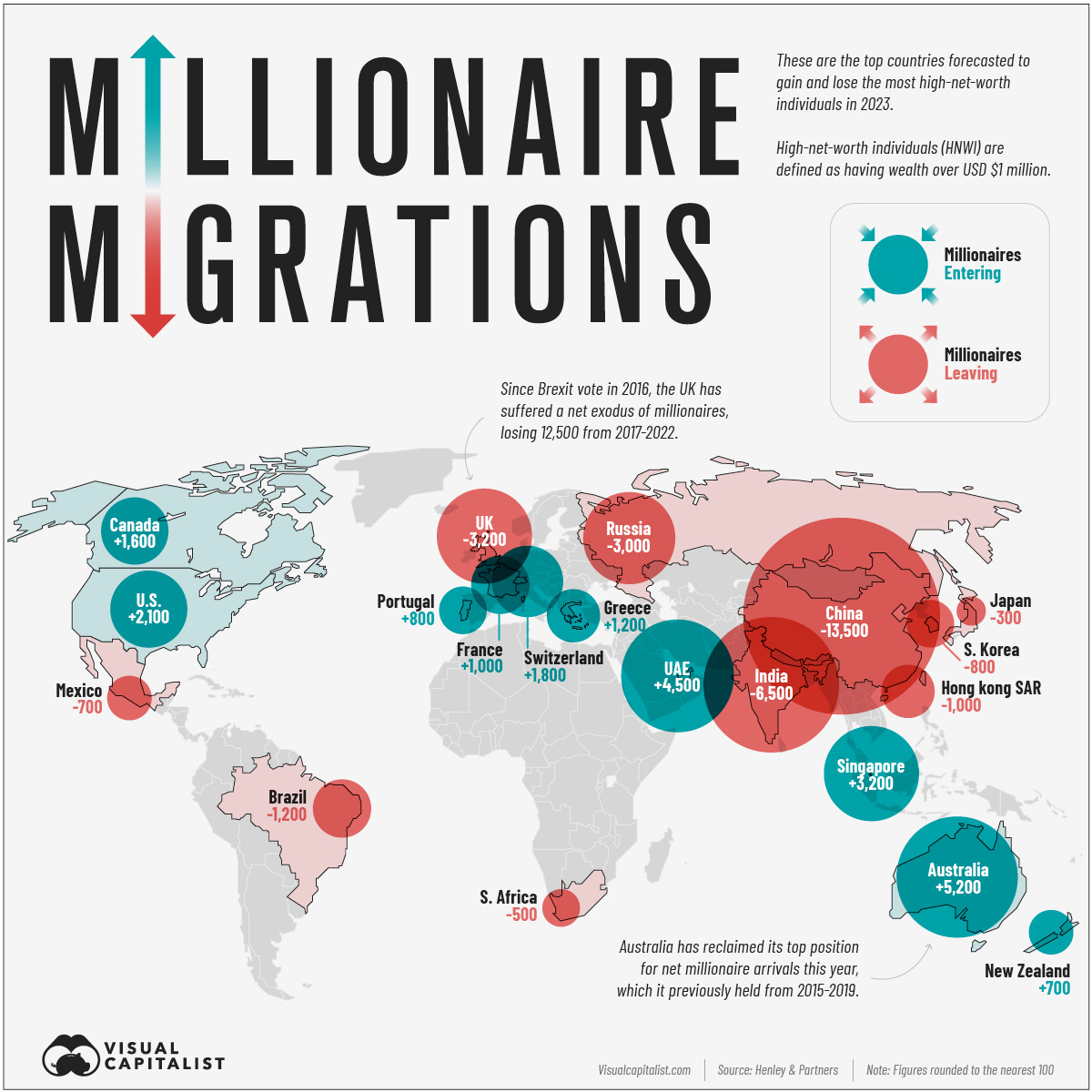

The Migration of the World’s Millionaires in 2023

Australia, Singapore, US, Canada, UAE, Greece & Switzerland millionaires in

China, India, UK, Russia, Brazil, Mexico, South Africa losing millionaires

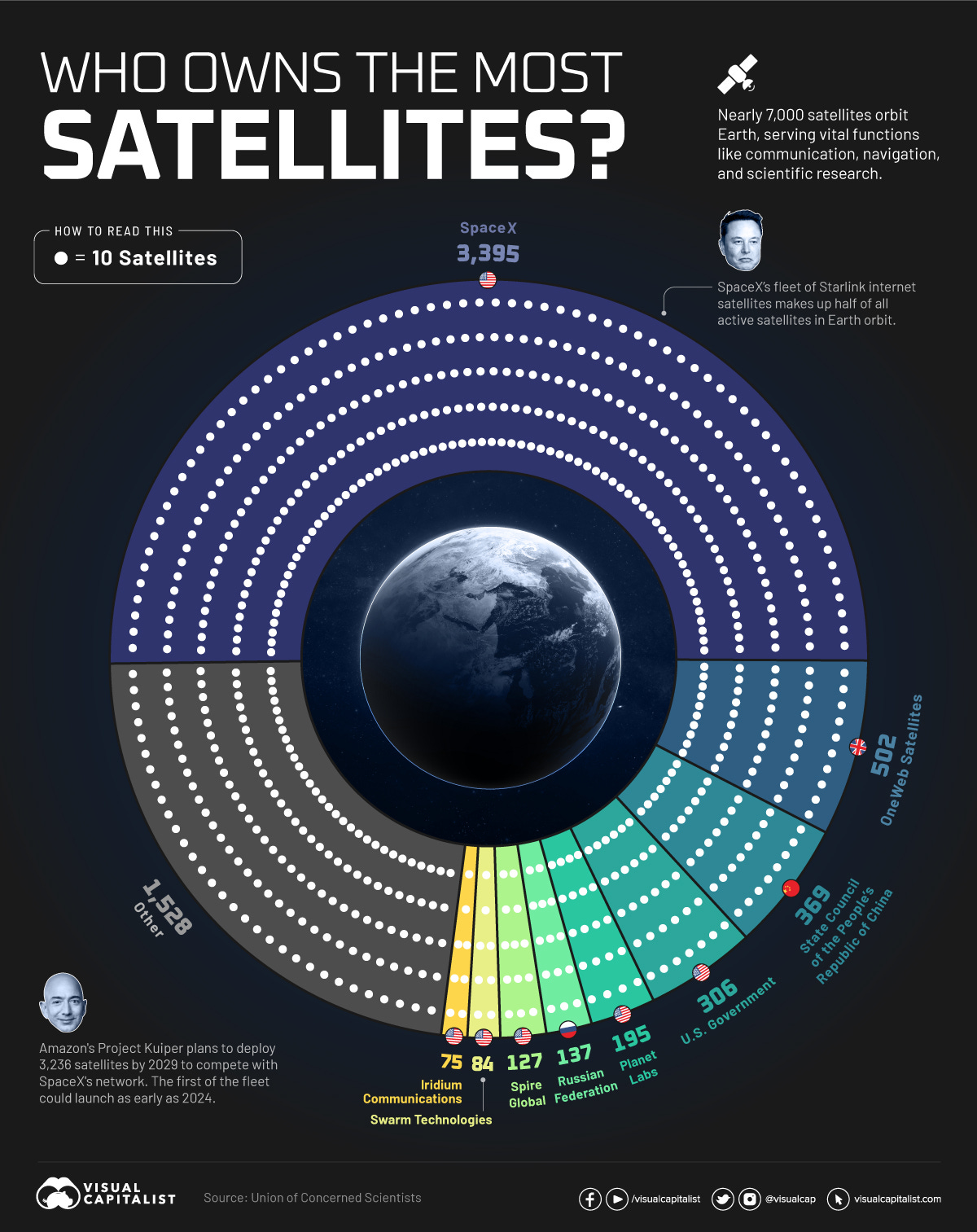

Who owns the most satellites out there?

SpaceX, led by Elon Musk leading the industry with ~50% of the global total.

2023 = 62 missions, surpassing any other company or nation & operates thousands of internet-beaming Starlink spacecraft that provide global internet connectivity

In second place is a lesser-known company, British OneWeb Satellites. London based, counts the UK government among its investors and provides high-speed internet services to governments, businesses & communities. Like many other satellite operators, OneWeb relies on SpaceX to launch its satellites.

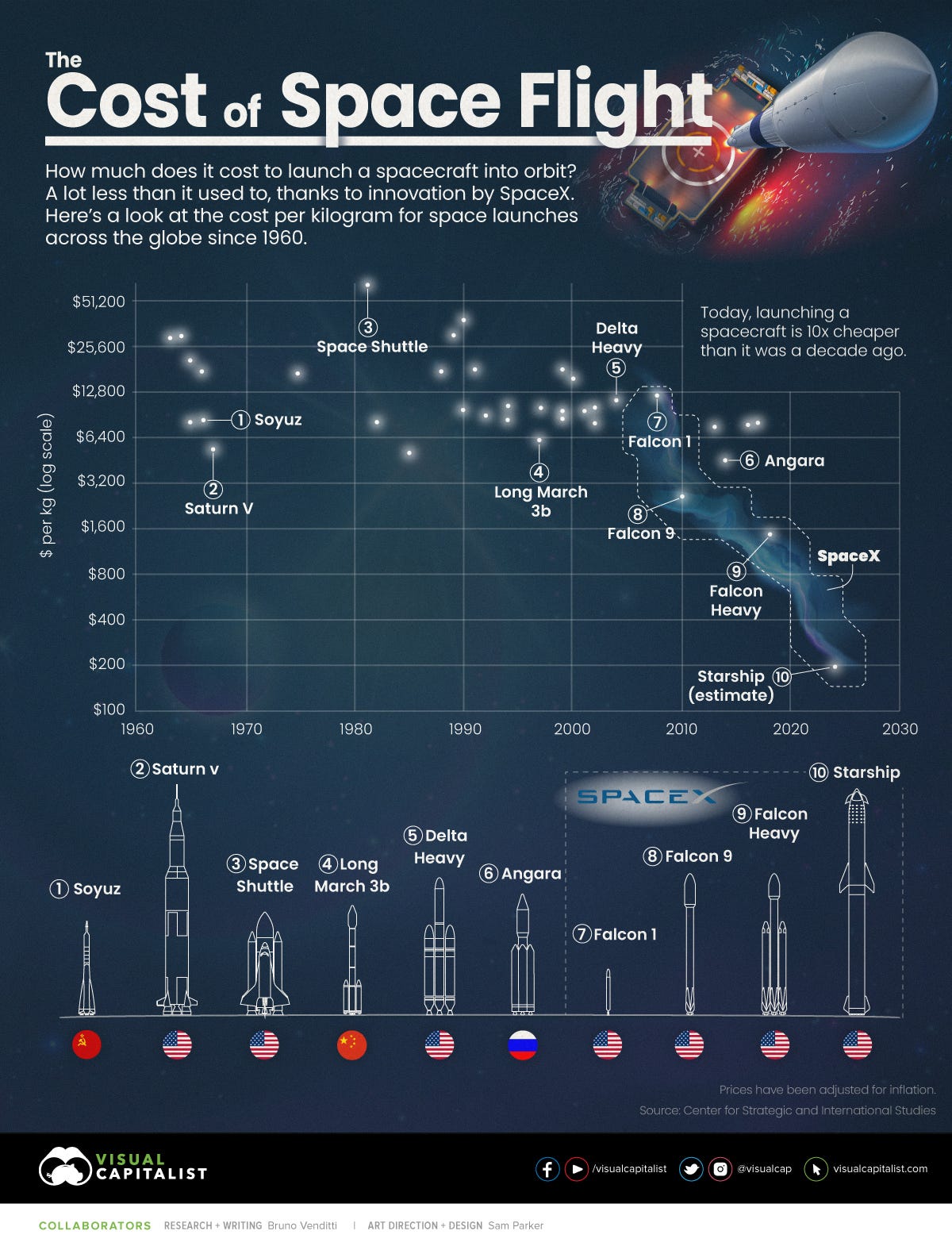

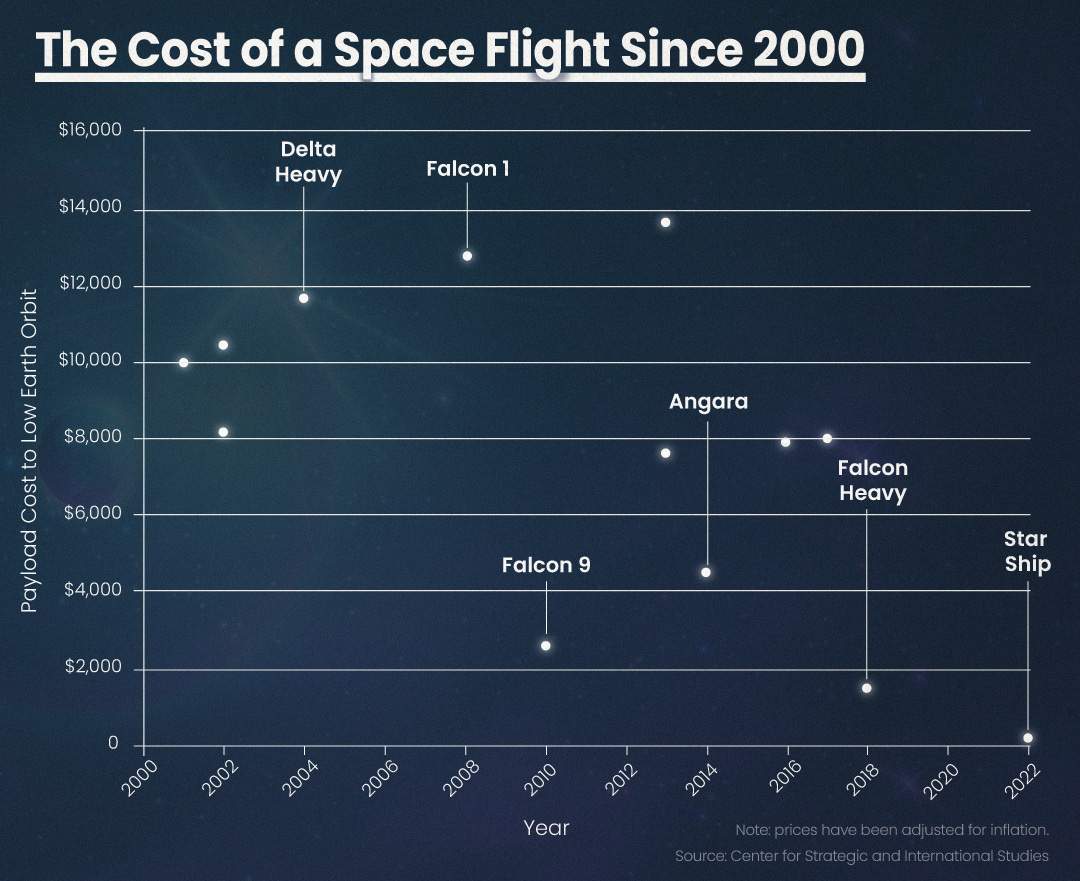

The Cost of Space Flight Before and After SpaceX

in the last two decades, space startup companies have demonstrated they can compete against heavyweight aerospace contractors as Boeing and Lockheed Martin. Today, a SpaceX rocket launching can be 97% cheaper than a Russian Soyuz ride cost in the ’60s.

The key to increasing cost efficiency? SpaceX rocket boosters usually return to Earth in good enough condition that they’re able to be refurbished, which saves money and helps the company undercut competitors’ prices.

Switching gears by Charting the Depths - The World of Subsea Cables

they play a major important role, hence big geopolitical implications …

Research is NOT behind a paywall & no pesky ads here. What would be appreciated?Just sharing it around with like-minded people. In case not already, subscribe to get all the future research straight to your inbox. Twitter thread can be found here.

Thank you & have a great day!

Mav

Thanks a lot, I like a lot this monthly wrap ups, tells what’s to be told and can focus on other stuff instead of being drained into the daily silly and useless headlines. Have a good one!

Lots of great stories hidden in these charts, thanks for the post.