✍️ Maverick Charts of the Week #5: Warren Buffett's Cash Pile Updated

Cash, Stock Buybacks, Outperformance + incoming Maverick-esque research!

Dear all,

last weekend Warren Buffett's Berkshire Hathaway reported the 1st-quarter earnings. With this post I will update the 4 key charts: the cash position and stock buybacks. A separate update will follow with the overall key notes from Buffett that is stepping down as the CEO with Greg Abel to replace him. To get thing started, from the legend:

"I just like the feeling of being trusted. It doesn't have anything to do with money, but you can be kind and the world is better off. I'm not sure that the world will be better off if I'm richer."

Table of contents:

📊 Buffet’s cash pile or better said the 'Berkshire’s STASHaway'

📊 Is Buffett doing Berkshire stock buybacks?

👍 Bonus: Outperforming

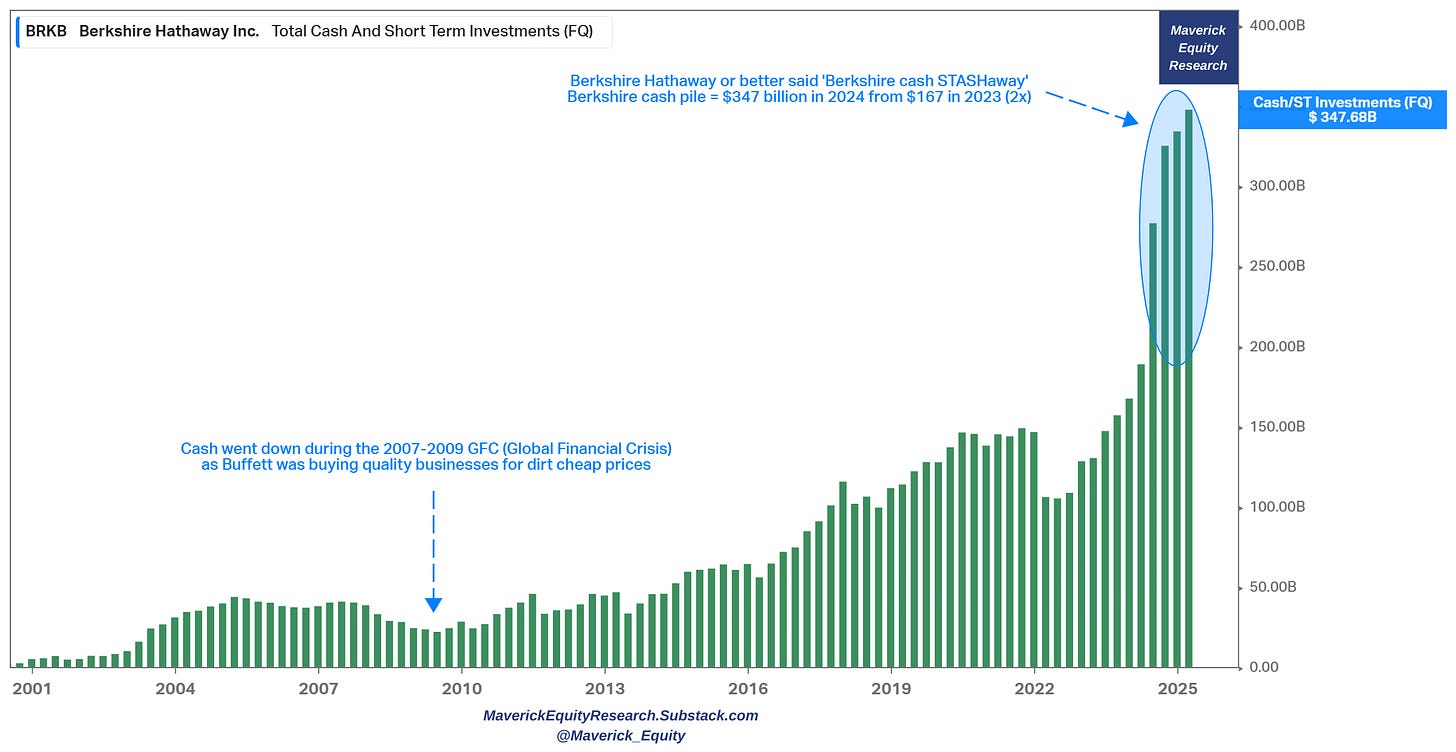

📊 Buffet’s cash pile or better said the 'Berkshire’s STASHaway' 📊

👉 cash pile = record $347.68 billion in 2024 from $167 in 2023, a doubling is the biggie here - yielding around $12-14 billion annually in a risk-free fashion

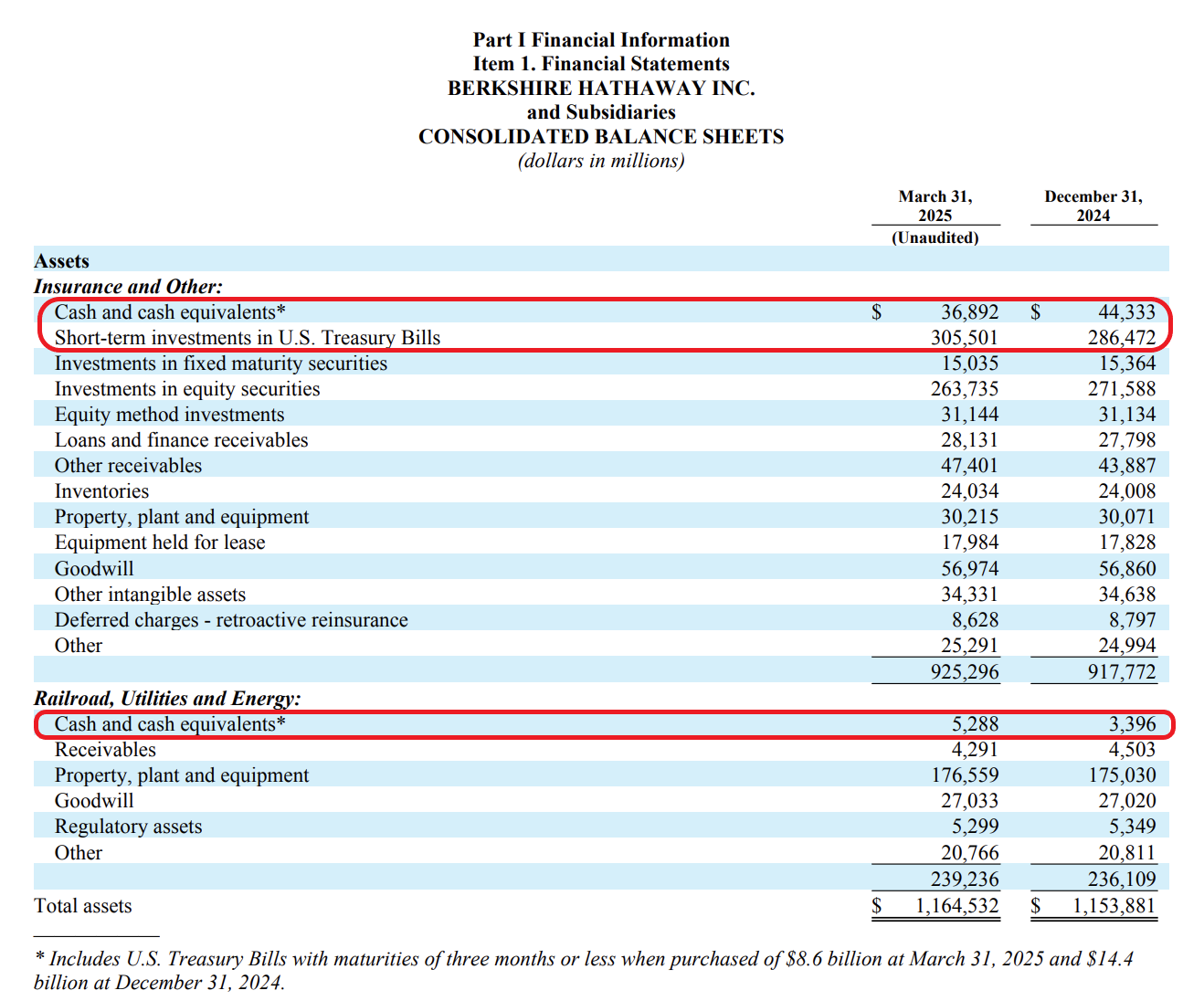

Specifically, the cash position breakdown via the consolidated balance sheet:

👉 $305.5 billion in U.S. Treasury Bills

👉 $36.8 billion in cash & cash equivalents (Bills 3M or less, insurance & other)

👉 $5.2 billion in cash & cash equivalents (Railroad, Utilities and Energy business)

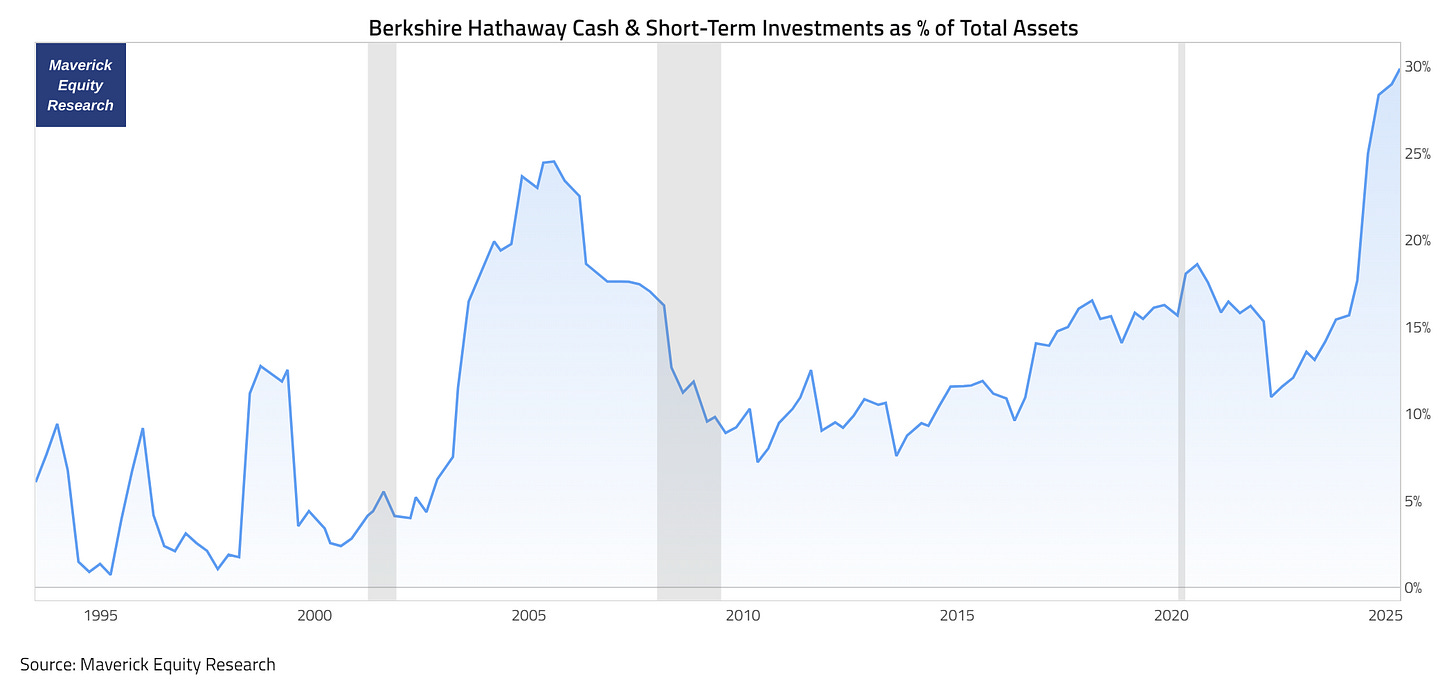

Moving further, let’s look at Buffett's cash pile as a % proportion of total assets:

👉 kept going higher, highest level in +30 years at 29.85% currently

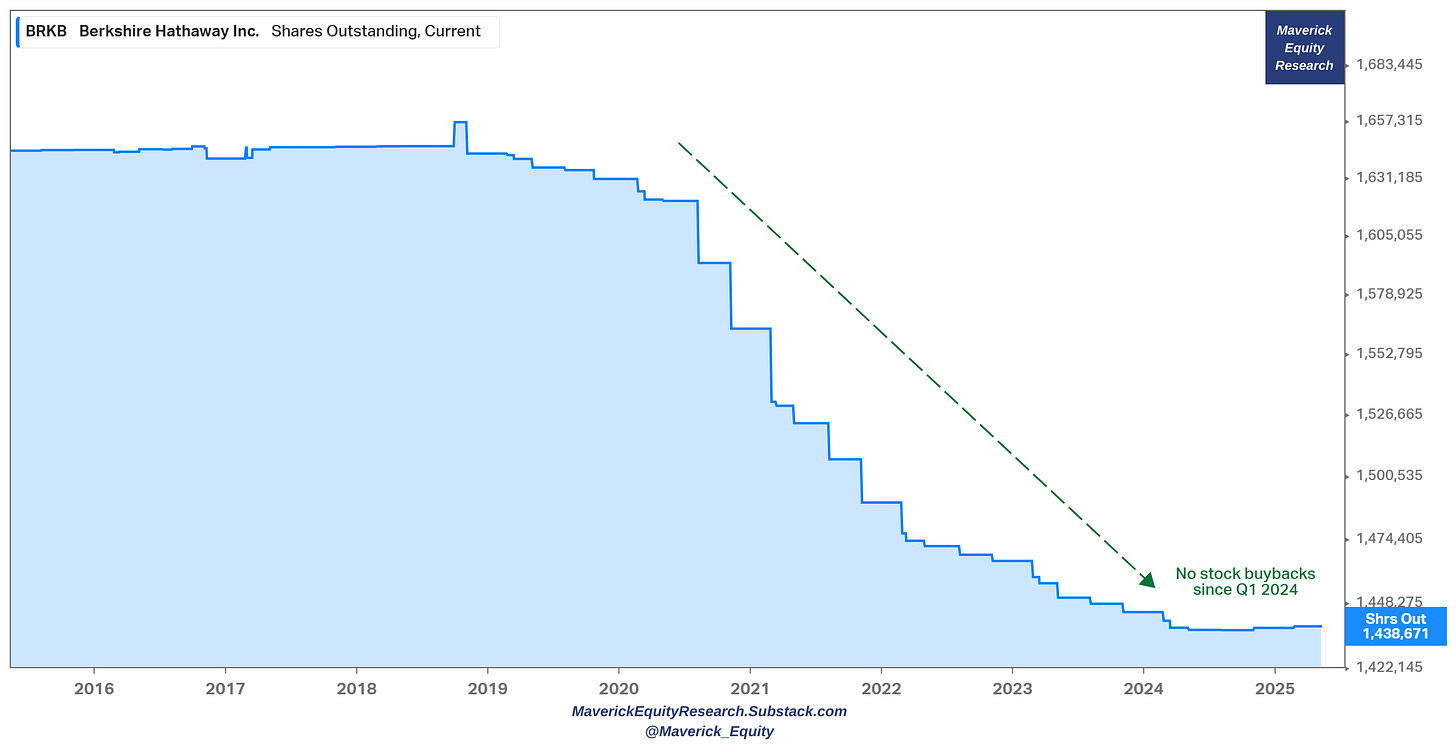

📊 Is Buffett doing Berkshire stock buybacks? 📊

👉 0 buybacks - thank you, but no at these prices, not for now

👉 nothing since Q1 2024 which tells us a mix of the following: Berkshire stock is not undervalued (by much or at all) and/or cash yielding 4% risk free is a good alternative

For the longer interpretation of Berkshire’s latest action, read my February special report - it’s the same one from back then, the updated numbers just confirm it further.

✍️ Maverick Special Report #4: Warren Buffett's Cash Pile ... & More!

👍 Bonus: Outperforming 👍

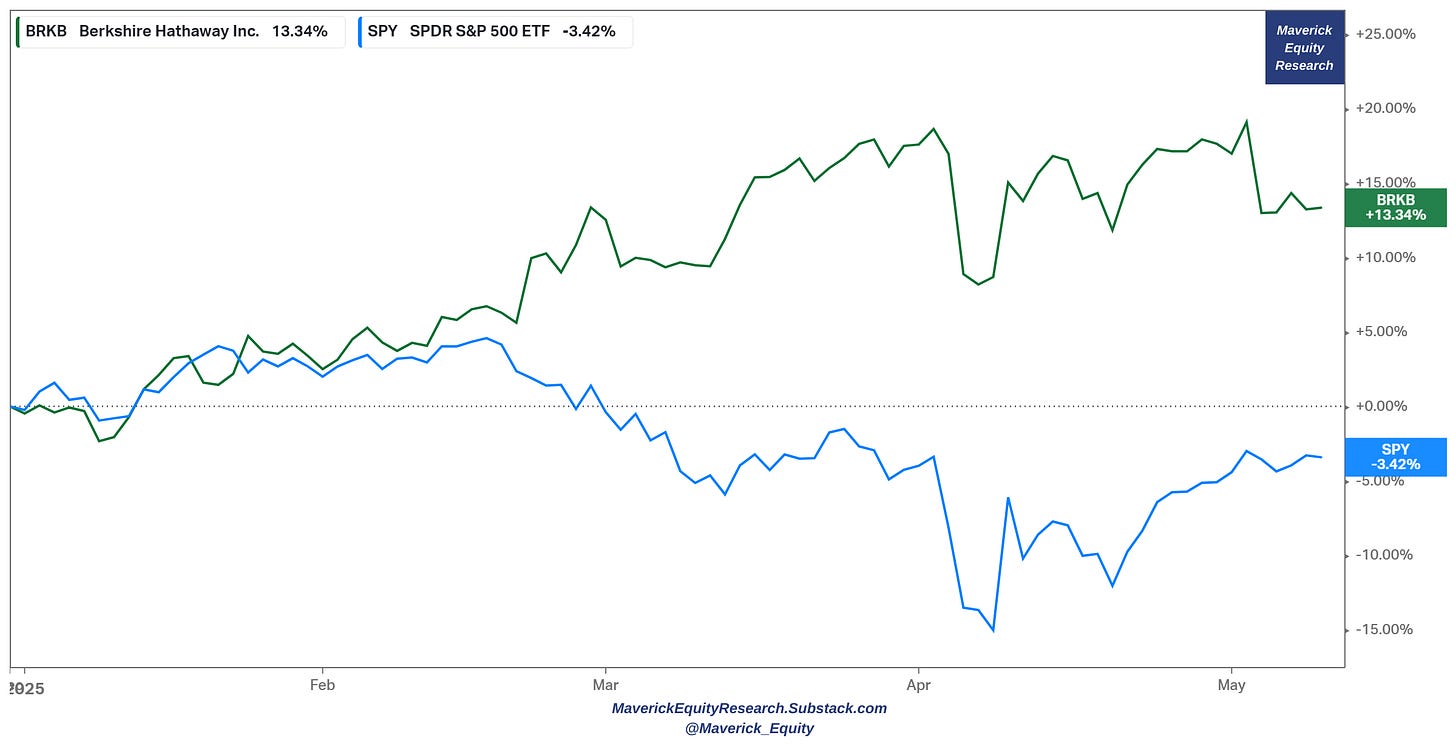

In a very volatile market, especially since April with the POTUS ‘Trade War 2.0’, how is Berkshire doing relative to the market?

👉 Berkshire Hathaway (BRKB, green) outperforming in 2025 the S&P 500 (SPY, blue): not by a bit, but by a wide margin: +13.34% vs. -3.42%, a major 16.76% difference!

Let that one sink in! Your thoughts? Let me know … food for thought for all of us …

For a bit more commentary, check my dedicated piece from March:

✍️ Maverick Charts of the Week #1: Who is Outperforming Big Time in 2025?

What is coming next through the independent investment & economic research here? Many drafts are work in progress - below a few selected ones:

✍️ Full Equity Research: Preview and Framework

section where I will cover in details single businesses/stocks aka deep dives

✍️ Why Independent Investment and Economic Research = Paramount Nowadays!

common sense is not so common, independent research for the win!

✍️ The State of the US Economy in 75 Charts, Edition #4

coming up with further improved coverage charts + recession probability

✍️ S&P 500 Report #6: Valuation, Fundamentals & Special Metrics

coming up with further improved metrics via sleek charts as always

✍️ Maverick Special Report #7: Big Volatility & Drawdowns = Juicy Returns

the price for high returns = digesting and taking advantage of volatility

✍️ Maverick Special Report #8: U.S. Manufacturing = A Bad Wet & Fake Dream

manufacturing is romantic, but not realistic for good reasons for the U.S.

✍️ Maverick Special Report #7: Harvesting Geopolitical Risk Premium Through The 2025 Trade War

taking advantage of the ‘Trade War 2.0’ which drives volatility these days

✍️ Top 50 Maverick Charts to Watch in 2025 and Beyond

sleek Maverick charts with many insights & food for thought for now & the future

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this by finding it interesting, saving you time and getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons! That’ll definitely support bringing in more & more independent investment research: from a single individual … not a corporate, bank, fund, click-baity media or so … !

Like this, the big positive externalities become the name of the game! Thank you!

Have a great day! And never forget, keep compounding: family, friends, hobbies, community, work, independence, capital, knowledge, research and mindset!

Mav 👋 🤝

BRK.B is always a great company to own a piece of

I like the BRK.B total cash chart. Thanks for sharing.