✍️ Maverick Special Report #4: Warren Buffett's Cash Pile ... & More!

Heads One Wins, Tails One Wins! Keep compounding: friends, capital, community, knowledge, research and mindset!

Dear all,

first of all, welcome to the +1,000 new inquisitive minds that subscribed in 2025 to this publication doing independent economic and investment research! Currently delivered to 160 countries and 50 U.S. states to a smooth group of +13,200 people!

2025 research is work in progress, many ideas with a focus on quality over quantity! The next extensive research will cover key topics via sleek visuals for 2025 & beyond:

✍️ Top 50 Maverick Charts to Watch in 2025 & Beyond! ✍️

Until then, the 4th edition from the ‘Maverick Special Report’ series is dedicated to Berkshire Hathaway which just reported its 2024 Annual Report and its 4th-quarter earnings, alongside the renowned letter from the Chairman and CEO Warren Buffett.

My insights & highlights will cover the much debated Buffet’s cash pile, or better said 'Berkshire’s STASHaway', and many other key and useful data points that we can all get!

Report structure for a clear and concise reading:

📊 Performance: $1 trillion and outperforming

📊 Cash pile: heads one wins, tails one wins! Optionality! Keep compounding!

📊 Stock Buybacks: thank you, but no at these prices, not for now

📊 Outlook & Focus: net seller, opportunities, valuation, size issue, U.S. focus

👍 Bonus: Taxes, CEO transition, a message to Washington

Delivery is as always, via the typical Maverick sleek visuals which say 10,000 words! That is because research means data and facts first, opinions only after!

📊 Performance: $1 trillion and outperforming 📊

👉 Berkshire reached in 2024 the $1 TRILLION market capitalisation for the 1st time ever with a current $1 trillion and $32 million which is about the all-time high!

👉 also the 1st company ever to reach 1 trillion outside of the technology sector!

👉 how long did it take? 44 years, 5 months, and 13 days! While Zuckerberg was the fastest with Meta/Facebook with 9 years, 1 month, 10 days, in general, I prefer the slower & steadier yet solid way, than the yes/no focus on any single company

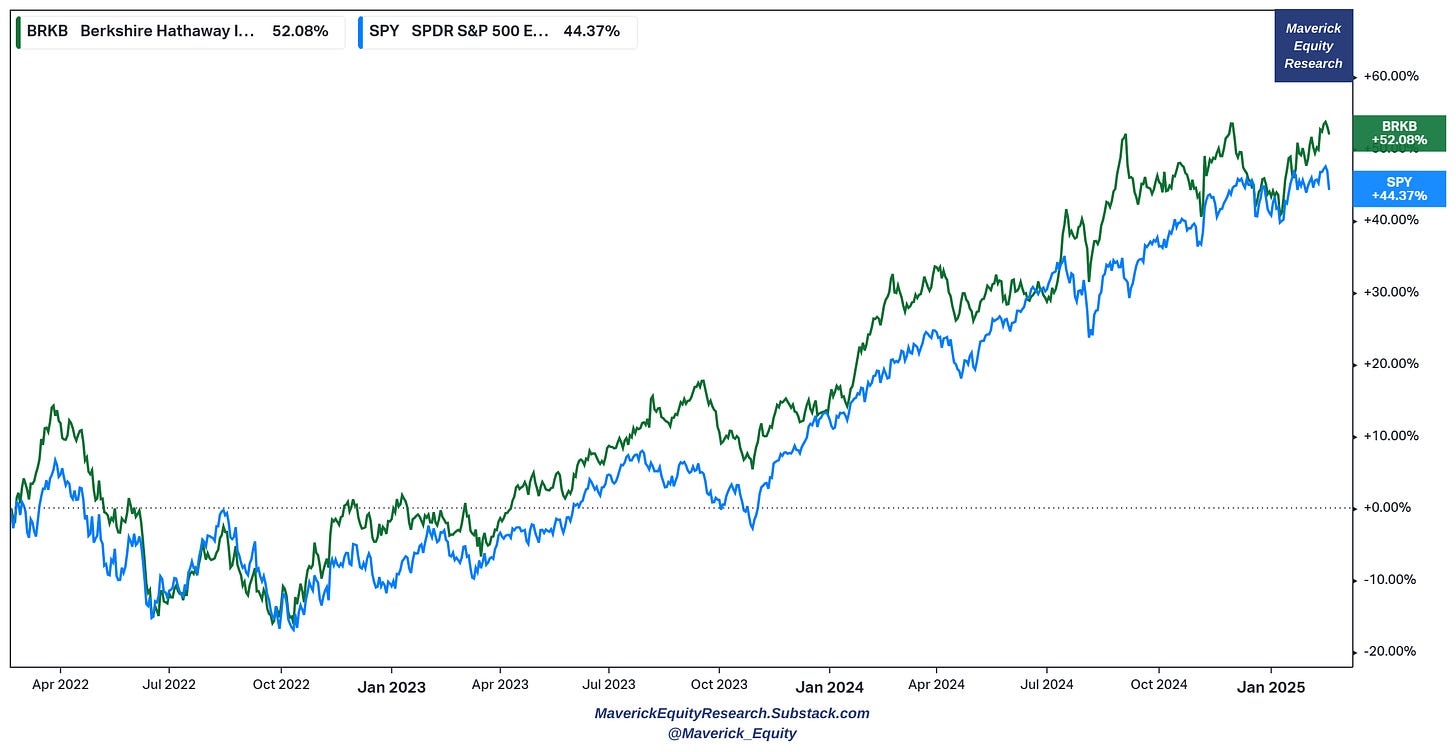

What about Berkshire and the S&P 500, aka ‘the market’? Many did criticise Buffett for not managing to outperform the S&P 500 index, yet not much coverage on how he did in 2024, the last 3 years, or the last 5 years: outperformance despite a value driven portfolio, and overall a rather conservative approach (high cash position, more below)!

👉 2024: 27.09% for Berkshire (green), 24.89% for the S&P 500 (blue)

👉 last 3 years: 52.08% for Berkshire (green), 44.37% for the S&P 500 (blue)

👉 last 5 years: 109.82% for Berkshire (green), 92.05% for the S&P 500 (blue)

👉 Revenues reached $371.4 billion, up from $364.5 billion the prior year

👉 record Operating Earnings of $47.4 billions despite more than half (53%) of the company's operating businesses reporting lower earnings: "In 2024, Berkshire did better than I expected though 53% of our 189 operating businesses reported a decline in earnings,"

📊 Cash pile: heads one wins, tails one wins! Optionality! Keep compounding! 📊

👉 cash pile = record $325 billion in 2024 from $167 in 2023, an almost doubling is the biggie - yielding around $12 billion annually in a risk-free fashion: "We were aided by a predictable large gain in investment income as Treasury Bill yields improved and we substantially increased our holdings of these highly-liquid short-term securities."

👉 contrary to many headlines on the significance of this record cash pile: Buffett is NOT ‘forecasting’ a recession or a market crash, he is not market timing, he is not making some ‘macro’ bet … he said he is not doing that many times!

So, ‘what is he doing Mav?’? Just business as usual, no panic, just a ‘value’ bet:

👉 looking for value, cheap high quality businesses via a risk & return lens - when valuations are high, he rather sells hence taking profits than buying new businesses

👉 after the era of low interest rates, also cash (treasury bills) compounds now at +4%

👉 hence, Buffett is like a cat, no matter what will happen, landing on top & smiling = taking profits and building a huge cash large pile which compounds = heads he wins, tail he wins ... keep compounding! Basically doing the ‘T-bill & Chill’ strategy ...

👉 +Berkshire gets optionality via that cash: buy undervalued companies that they will find or buy the same should we have a correction/recession

👉 note: cash went down during the 2007-2009 Global Financial Crisis as Buffett was buying quality businesses for dirt cheap prices - waited & capitalised properly!

👉 if we get a recession (reminder: sooner or later it will happen, it is just the basic 101 business cycle), what do you think Buffett will do? Same thing again!

Offense and Defense in the same time and at its very best:

Defense = no/low emotional stress which is a big factor in investing

Offense = that defense gives room to one to make the best of incoming opportunities, and all that while being covered from the downside

As the old adage says, ‘watch the downside, the upside will take care of itself!’

Overall, I call this the compounding/getting paid to wait ‘T-bill & Chill’ ‘T-bill & Wait’ strategy: all while hunting for opportunities that always come along sooner or later ... in other words, have a growing war chest waiting to swing at an incoming fat pitch!

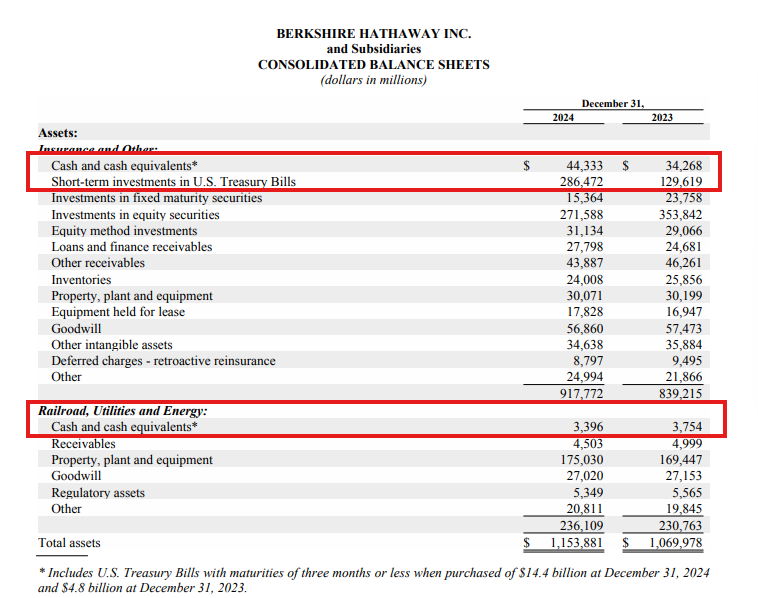

Specifically, the cash position breakdown via the balance sheet:

👉 $286.5 billion in U.S. Treasury Bills

👉 $44.3 billion in the insurance and other businesses

👉 $3.4 billion in the Railroad, Utilities and Energy business

Moving further, let’s look at Buffett's cash pile as a % proportion of total assets:

👉 highest level in +30 years at 28.6% currently

👉 cash pile build-up happened nicely before both the 2001 and 2007-2009 recessions, yet from the moment the cash peaked, it took 1-2 years until the recession came …

👉 hence to me that is not short term market timing, but a question of valuation overall, opportunities to be found, very diligent on capital allocation via a strict risk & return lens, and that is value investing!

👉 we could say though he is doing ‘value/valuation timing’ where patience is key! It could be 3 months, 6, 12, 24 or 3 years until the price will mean a big opportunity, and that is because it is almsot always like this: ‘Price is what you pay, Value is what you get!’

👉 the idea is NOT to time a recession / market correction, but to be in a position that no matter what happens, one will be good anyway … that is key in investing, not short term gains, YOLO, FOMO and all that … that is fun and exciting, but in the very vast majority of cases unsustainable …

2 rare data points on the treasuries holdings:

👉 Buffett = the new FED in terms of treasuries holdings? Buffett holds now more US Treasury Bills than the US Federal Reserve ...

Buffett own $325 Billion = around 5% of all T-Bills issued to the public … VS the Fed owning $195 Billion and tapering as expected …

👉 Berkshire's T-bill holdings and the 2024 U.S. budget deficit:

equal to 16% of the entire deficit

Overall, recall Buffet’s old priceless mantra: "Cash combined with courage in a crisis is priceless." & "Only when the tide goes out do you discover who's been swimming naked."

📊 Stock Buybacks: thank you, but no at these prices, not for now 📊

👉 the great returns lately from the Berkshire stock (and the market overall) really made Buffett wonder about valuation: after buying back his own stock materially since the 2020 covid times, lately no stock buybacks … $0 of stock in Q4 2024 and marking the 2nd straight quarter without any buybacks

👉 that is a clear sign that it would be a capital allocation decision that would NOT bring further value to shareholders - unwilling to pay the highest multiple to book value the stock has traded at in over a decade

👉 in other words, Berkshire stock is either fairly valued or overvalued, and rather use the cash to buy treasuries and keep compounding via the risk free way - cash at more than 4% return + plus the potential for future acquisitions (optionality value) means he likely values that mix more than the current Berkshire stock itself

"The math isn't complicated: When the share count goes down, your interest in our many businesses goes up." … "... IF repurchases are made at VALUE-ACCRETIVE prices."

📊 Outlook & Focus: net seller, opportunities, valuation, size issue, U.S. focus 📊

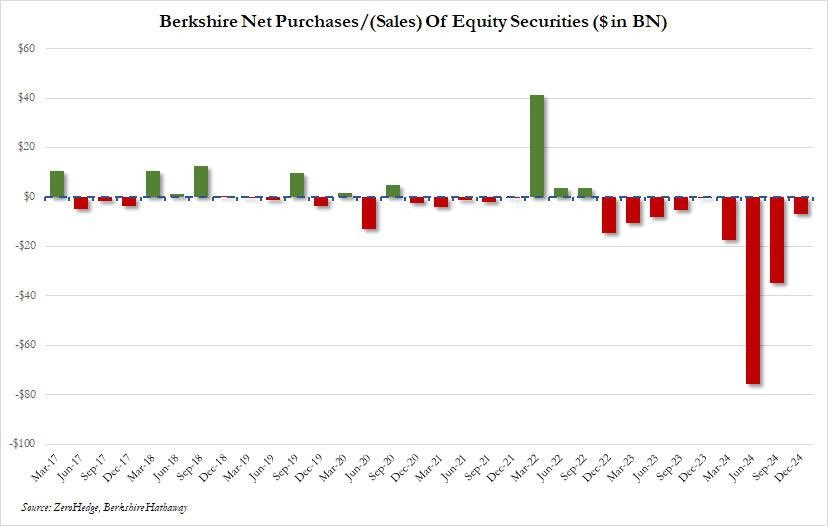

👉 Berkshire has been a net seller of equity securities for 9 straight quarters

👉 notice the material buys made during the 2022 bear market, patience is key!

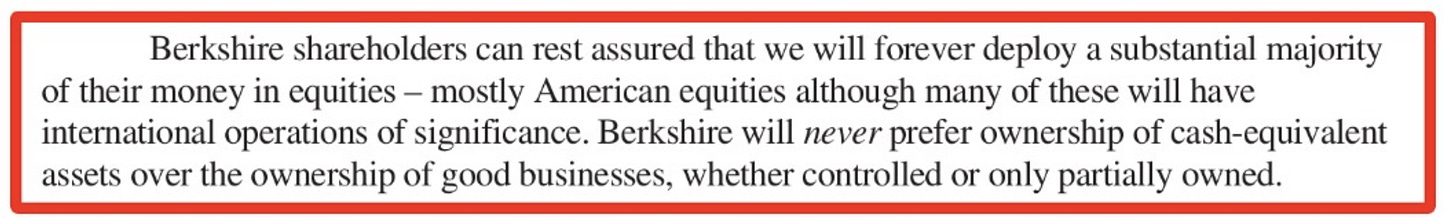

👉 before drawing the wrong take-away, Buffett still owns a lot of equities, a great majority: marketable securities went down, yet the private equities and their related value increased and remans far greater than the value of the listed stocks

In terms of new buys, be it businesses entirely or fractions:

👉 entire great businesses very seldom come along … naturally …

👉 yet, listed stocks very occasionally sell at bargain prices which is the takeaway: patience, patience and patience … and opportunity will come!

👉 ‘Often, nothing looks compelling; very infrequently we find ourselves knee-deep in opportunities’. On this aspect, recall also Charlie Munger’s complementary key note:

"People are trying to be smart - all I'm trying to do is not to be idiotic, but it's harder than most people think. It’s remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent."

👉 recall now also the 2 core notes from Berkshire’s annual meeting from May 2024: “I don’t mind at all, under current conditions, building the cash position” ... “When I look at the alternative of what’s available in the equity markets and I look at the composition of what’s going on in the world, we find it quite attractive.”

The general take-away for me is similar for both the more macro & more micro level:

the market overall is richly valued or even over-valued - therefore, currently it is rather easier to find opportunities to book profits by selling than new investments

in 2024, the S&P 500 was up 23.3%, and booked 2 years in a row with +20% returns - last time that happened? 1998! Hence, we have historically speaking a very strong bull market, yet Buffett does not buy his own stock … valuation baby!

On the general market valuation, the 6th edition of my S&P 500 Report is currently work in progress: the focus is on valuation, earnings, fundaments & special metrics. Before the new improved editions comes out, you can check the previous one:

✍️ S&P 500 Report: Valuation, Earnings & Fundamentals + Special Metrics #Ed 5

when the market is running rather hot, any given decent single stock is going to be more expensive than usual - recall here the aphorism "A rising tide lifts all boats"

On this aspect, I will cover under-covered, smaller and medium sized stocks with a focus on the U.S., Switzerland, Canada and Europe via the dedicated section:

✍️ Full Equity Research will start in 2025, stay tuned!

👉 Buffett reminding about the size issue - size matters and in investing it can become a drawback: he cannot buy small, not even many medium-sized companies, cannot make big sales, exits, buy again, sometimes a year is needed to invest or divest an investment. In other words, value is to be found in smaller stocks, just not for a giant like Berkshire, while naturally the very vast of investors do not have this issue.

👉 Buffett reassuring shareholders that the focus will be kept on U.S. equities

👍 Bonus: Taxes, CEO transition, a message to Washington 👍

Taxes:

👉 Berkshire paid in 2024 $26.8 billion in taxes = 5% of ALL U.S. corporate taxes, and also the most any individual company has ever paid to the U.S. government

👉 $1 million check sent every 20 minutes to the Treasury, and still would not have made it for the entire tax bill in 2024 … let that one sink in!

CEO transition - communication, culture & duty going forward:

A message to Washington:

👉 Buffett urged Washington to spend money “wisely” and support those who draw the “short straws in life.” A call for a “stable currency“ was made also as “paper money can see its value evaporate if fiscal folly prevails“.

👉 one can be republican, democrat, independent … one can agree or not with the current government measures & ways it is done, but one cannot simply ignore the budget deficit issue, or even worse, add or double down on it forever …

👉 how to end the U.S. deficit in 1 go, nothing to add on this one from my side:

Did you enjoy this special report? Found it interesting, saving you time and getting valuable insights? What would be appreciated?

Sharing this around with like-minded people + hitting the 🔄 & ❤️ buttons are key!

That will boost bringing in way more independent economic & investment research! Like this, the big positive externalities become the name of the game! Thank you!

Have a great Sunday and next week! And do not forget, keep compounding: friends, capital, community, knowledge, research and mindset!

Mav 👋 🤝

“Compound interest is both the ultimate and biggest natural hedge!” Maverick Equity Research

P.S. in case you missed the previous ‘Maverick Food For Thought’ 3 editions:

✍️ Maverick Special Report #3: U.S. Presidency - Does It Really & Deeply Matter?

✍️ Maverick Special Report #2: Value vs Growth ... or ... Value & Growth?

P.S. also my latest from the ‘Education’ series:

✍️ Who Is On Your Team in 2025 And Beyond? Maverick Principles & Food For Thought #3

Buffett playing 4D chess while the rest of the market plays checkers. The ‘T-bill & Chill’ strategy is a masterclass in patience, getting paid to wait while optionality builds. That $325B isn’t a bet against the market, it’s dry powder for when the fat pitches come.

Thank You!