✍️ Maverick Special Report #3: U.S. Presidency - Does It Really & Deeply Matter?

+200,000 views of a single Maverick visual ... let that sink in!

Dear all,

there you go with my independent, non-partisan, unbiased, evidence-based take on the U.S. presidency. This approach is UN-emotional, goes against any labeling, polarisation for clicks & views for ad-money which are very prevalent nowadays.

Delivery: via the typical Maverick-esque fashion, via charts that say 10,000 words! Why? ‘If you can't show it via a chart, then it is very likely not true or an empty opinion. Work is a prerequisite for opinions: show me your data and work first, opinions I hear all day from everybody, then we talk and constructively all benefit! Belief is an enemy of knowledge, data & facts counter that in order not to fall into the natural urge to be right, but rather to be closer to the truth. Knowledge is power!’

One visual you’ll see took Twitter/X by storm last week and registered +200,000 views!

In investing and finance, there are many ‘zealots’: value, deep value, growth, hyper growth, GARP, systematic, quant, technical, fundamental … yet those zealots are tiny in comparison with the echo chambers and confirmation bias that politics exhibit - and from there, polarisations, extremes and radicalistic views are not far.

Hence, this should ad you value by ‘just’ taking things as they are, not as I or anyone wishes, and from there derive forward looking logical insights. While definitely there are many nuances on very complex topics like this, overall logic has to beat emotions.

It is enough that for the personal life, it can get quite different right? 😉

Doing independent investment research is quite a rare bird, doing truly independent investment research, even more so! Economic and Investment Research should never be about personally embracing or not any political candidate or party!

This will be an evergreen piece - it will serve as a benchmark in 4 years time also, and the same for the next many elections cycles!

Report structure, 4 parts - Macro to Micro & Micro to Macro + takeaways + bonus:

📊 For Investing: Zoom Out and Always Forward Looking

📊 For Short term, Tactical, Trading, Special Situations, YOLO/FOMO

📊 For the Economy

📊 For the Sovereign Individual

👍 Maverick Food for Thought & Takeaways

👍 Bonus: Maverick Mindset Playbook for Investing but also in General

📊 For Investing: Zoom Out and Always Forward Looking 📊

Maverick punch line to begin with: whoever holds the presidency in any country takes way more credit when things are good, and way more the blame when things are bad! A major asymmetry is present pretty much all the time!

First of all, let’s take the last 2 presidential cycles and the S&P 500:

👉 67.53% return during the 2017-2021 Trump presidency

👉 58.06% return during the 2021-present Biden presidency - add a good year-end with a Christmas rally + January new money flows (as I wrote here in January 2023) and we can be above 60% as well and even closer match the previous

N.B. bonus stats since the last 4 election cycles: +675% since 2008, +400% since 2012, +207% since 2016, +81% since 2020

Second of all, zooming out with the S&P 500 and Down Jones since the 2009 bottom:

👉 Dow Jones from 6,500 to +44,400 last week … for the 1st time in history

👉 S&P 500 from 666 to +6,000 last week … also for the 1st time in history

Let that one sink in … and … bring the sink if you wish …! 😉

Long the stock market = Long owning cash flow = Long the economy = Long humanity fixing problems, long humanity making strides = Long society … !

Third of all, zooming out a bit further with 40 years of S&P 500 yearly returns (price return, not total) recessions and drawdowns:

👉 not nice and smooth, ups and downs, but we get paid to stomach volatility

👉 and not because we voted for X or Y, neither because X or Y is president

Making the big case with a big zoom out, S&P 500 and Presidents’ Parties since 1945 via a very simple message: investing wise, I would not pay too much attention to the circus of politics. Were you afraid of any from the duo ‘KK’ or ‘TTT’? Namely:

👉 ‘Komrad’ Kamala? (KK)

👉 Trump The ‘Terrible’? (TTT)

No need to! The stock market tends to rise no matter who sleeps at the White House, there is no distinct relationship with any president or party. What is quite sure is that political events have a short shelf life in the financial markets!

Now let’s transition from Maverick visuals to Maverick $ numbers, namely:

👉 $45,000 invested 30 years ago via the simple S&P 500 = $1,001,653, so millionaire

👉 adding $250/500/750/1,000 a month would have been way bigger or faster ... I will make some simple simulations like these and visualise them one day …

Casual Maverick reminder:

how many could stick to a simple recipe like this?

how many sold given that ‘There’s Always A Reason To Sell’ (see chart from below)

Voice of the narrator: not many and many ...

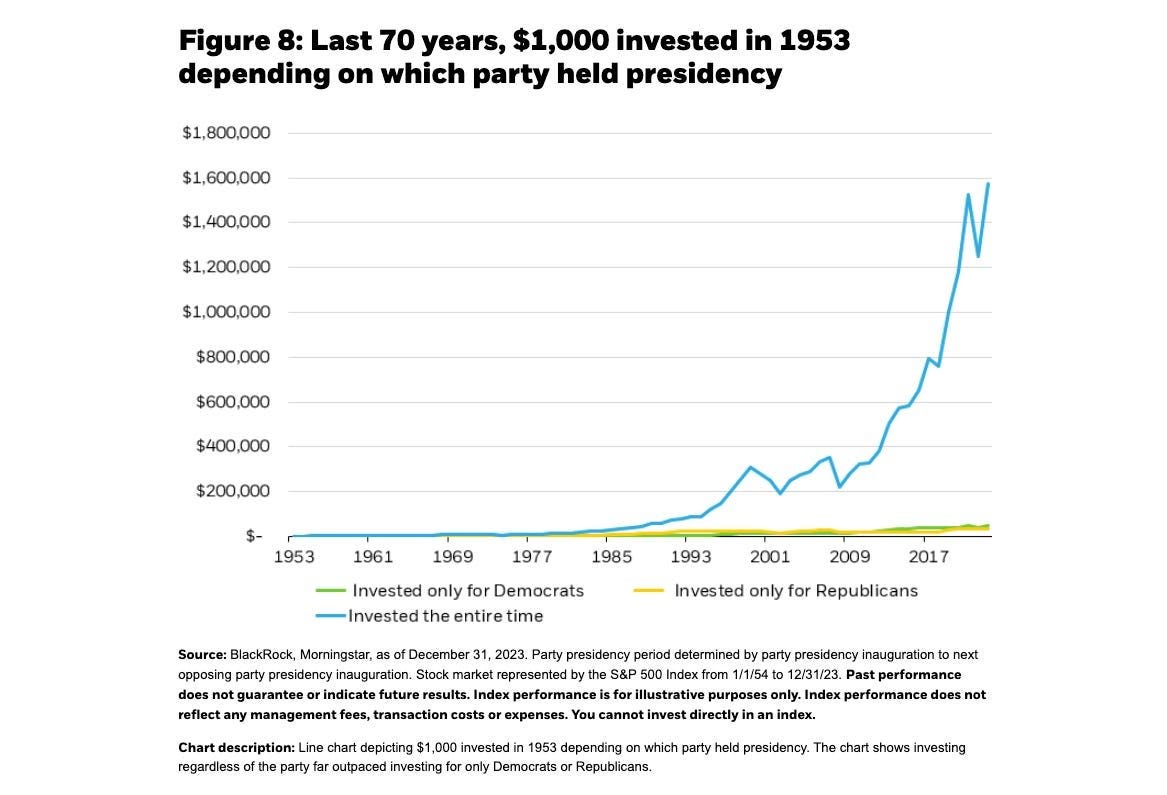

Last 70 years, $1,000 invested since 1953 depending on which party held presidency:

👉 peanuts results invested only when democrats or republicans

👉 ∼$1.6 million if invested the entire time, which ain’t peanuts 😉!

N.B. invested when a Democrat is running is just a bit better, overall irrelevant, hence investing mainly on the US presidency and party = a fool's game

Recall my mantra: “Compound interest is both the ultimate and biggest natural hedge!”.

Recall Charlie Munger: “The first rule of compounding: never interrupt it unnecessarily”.

One more to show how little Presidencies matter for the stock market: how much revenue does the S&P 500 generate internally in the U.S. ?

👉 No, it is not 80-90%, but 59% … 41% international

👉 how much of the 41% from abroad has to do with the Presidency? ‘Peanuts’ no?

What about other markets not just the US? Business has no borders:

👉 publicly traded companies in the U.K., Europe and Japan generate more than half of their revenue from abroad - US with the 41% mentioned and EM with 36%

👉 there are no borders in business, we are inter-connected in a globalised world, hence particular presidencies don’t matter much … except for headlines & emotions …

Politics covered, what about Geopolitics? They are everywhere everyday even if you don’t have a TV. Visualise that also by zooming out with major historical events:

👉 ‘There’s Always A Reason To Sell’, bigger or smaller … only issue many investors sell at the bottom … plenty of empirical data on that, and I saw that myself with client data not once not twice, but many times … it is not a cliche …

Concluding on politics, geopolitics and investing:

👉 having a solid portfolio & staying invested should do well independent of any countries’ political circus and/or showmanship

👉 many geopolitical events came, many will keep coming - staying invested is not just a good idea, but actually geopolitical risk premiums should vastly be harvested

👉 A portfolio is like soap, the more one touches it, the more it shrinks!

Recall also the following:

sovereign wealth funds, mutual funds, private banks, pension funds, Warren Buffett do not unload or load their portfolios based on any presidential election, but they focus on the business, the value creation for clients and valuation

what counts is the success of individual companies via their products & services

I’ll cover myself in the future very interesting businesses via the dedicated section

✍️ Full Equity Research, namely single stock deep dives with a clear structure

📊 For Short term, Tactical, Trading, Special Situations, YOLO/FOMO 📊

For these purposes, yes! US elections and short term effects are there and do matter!

First of all, what was the reaction of Global Assets once Trump was elected:

👉 Top 4: bitcoin, US Dollar, Magnificent 7, US Small Cap

👉 Bottom 4: Chinese equities, WTI Crude Oil, Gold and Euro Area Equities

Second of all, Trump’s 2024 win for his 2nd US Presidency begs 2 key questions:

How did markets react in 2016 when Trump was for the 1st time elected?

How did markets react now in 2024 when Trump was for the 2nd time elected?

Q: Is it even possible to visualise that instead of writing a book? A: Maverick can!

This visual took Twitter/X by storm and registered +200,000 views, let that sink in!

2024 vs 2016 overlay as 'The Trump Trade' until year-end: 12 forward-looking ideas via a single Maverick visual for 10,000 words (blue = current data, grey 2016 data).

➡️ S&P 500 = Up, way stronger reaction in 2024, positive now about par with 2016

➡️ US Equities vs International/RoW = Up & big initially, US outperformed by the highest amount since the GFC (rolling 5-day), about par now with 2016

➡️ Small Cap vs Large Cap = Up initially, more than 2016, now lagging

➡️ Bond Yields = Up like both the Real Yield and Breakeven Inflation - less than 2016, yet higher reflecting Trump’s inflationary program expectations

➡️ US Yield Curve = Up initially like in 2016, now less than 2016 - a steepening curve

➡️ USD = Up in real terms vs TWI (Trade Weighted Index), but less than in 2016 - USD/CNY with the US Dollar appreciating stronger now than in 2016

➡️ Gold = Down in 2024 like in 2016, something I did expect quite strongly given the high starting level of Gold now in 2024

➡️ Chinese equities = mixed initial reactions, down now in 2024 and stronger than in 2016 - tariffs … back to US-China focus and show aka ‘trade war’ circus

➡️ Bitcoin = Up and parabolic, the big winner, pricing in a lot already - $100,000 would be a big milestone - with a Christmas rally and sentiment can happen

Visual overall also a solid candidate for the 2024 U.S. post elections Chart of the Year!

👉 markets’ reaction is quite similar relative to the 2016 Trump victory, pretty much like a Trump re-run - some are even more powerful (‘Trump beta’ higher this term)

👉 the visual with the data is the most updated one possible as of November 15th - I will update you with it as we move along, especially by year end as we track the ‘overlap’ in terms of Trump policies and financial markets reaction function - I will maybe even add more assets and create 2 distinct dashboard (proposals = welcome)

The visual overlay is by year end, but what about going further 1-year ahead? Yes!

➡️ I will not comment much this zoomed out forward looking one … food for thought for you to connect further your own dots via the 12 data series I chose … enjoy!

How closely will markets evolve forward relative to 2016? Which of the 12 ideas?

We have a popular humorous maxim about history usually attributed to Mark Twain:

“History doesn’t repeat itself but it often rhymes”

N.B. naturally, economic & financial conditions are not the same as in 2016, different starting points and levels (e.g interest rates in 2016 and 2024), but you got it! In any case, it is definitely an interesting thought experiment, food for thought … . As well, no one that is sane is building an entire and solid trading thesis around one or two data points, or historical comparisons. It is the nature of the ‘game’!

P.S. on day trading, give it a hard pass, let this one really sink in from Howard Marks: ”The way I see it, day traders considered themselves successful if they bought a stock at $10 and sold at $11, bought it back the next week at $24 and sold at $25, and bought it a week later at $39 and sold at $40. If you can’t see the flaw in this— that the trader made $3 in a stock that appreciated by $30— you probably shouldn’t read the rest of this book.”

📊 For the Economy 📊

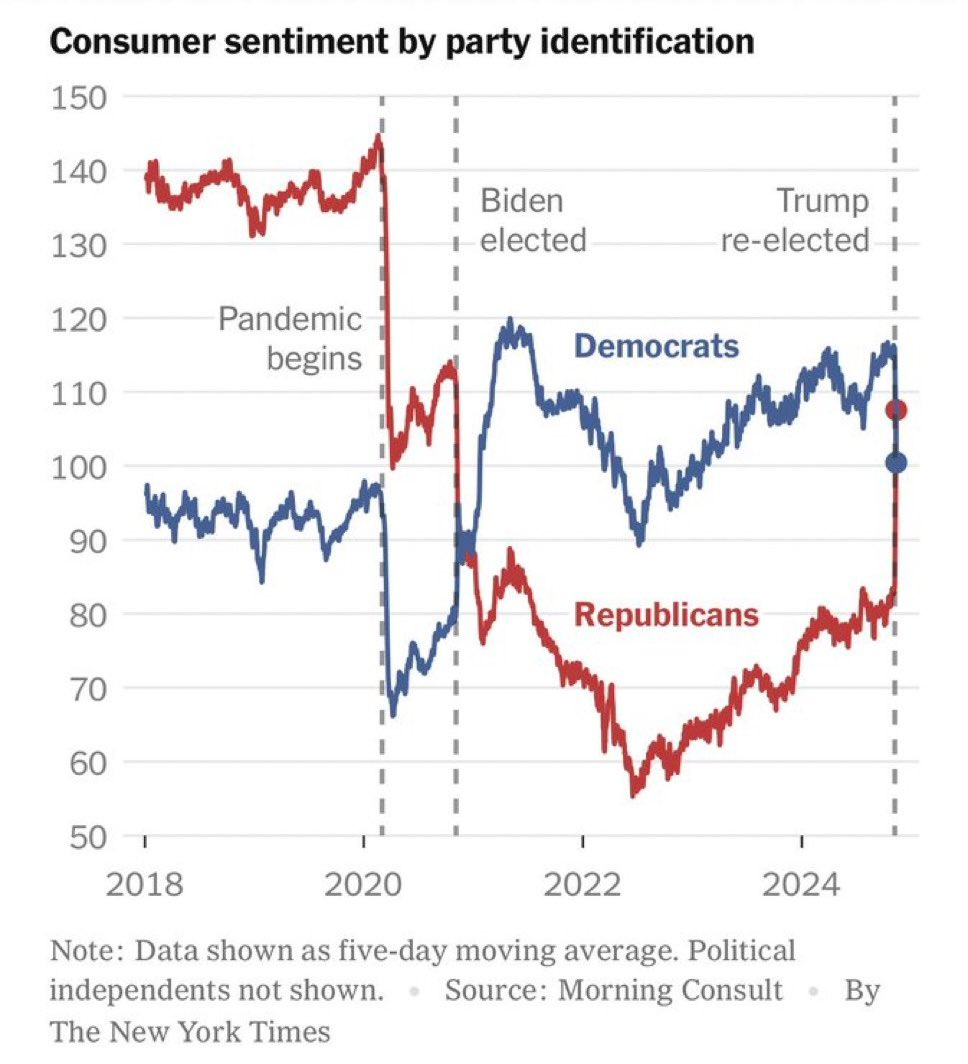

A big issue with the economy and US presidency is neither the economy per se nor the specific US president that currently resides at the White House. But it is the public perception from the citizens on aggregate on whether the economy is ”good” or ”bad” just because it is a Democrat or a Republican ruling.

I make that case via the chart below with consumer sentiment by party identification:

👉 check the big swings in sentiment from BOTH republicans and democrats as a function of: pre-pandemic, 2020 pandemic begins, Biden elected, Trump re-elected

👉 I cannot explain the swings there given that:

they are about a 30 trillion ecosystem economy which is a slow moving giant - it does not change shape or form that fast, yet perception does, especially in our culture of information being instant

on aggregate, the citizens’ current financial standing (job, income, wealth, consumption, affordability etc) is hard to say it shifts over night and entirely based on whomever sleeps at the White House and congress structure

in short, the real economy isn’t what people have it, but what team they’re on - everyone likes to be on the winning team … even if it is not the best team …

in any case, people that changed their views on the economy simply because Trump won and not Kamala, hence via a swing state of mind = ‘no bueno mi amigo’

Maverick recall: open dialogue with solid arguments between opposing viewpoints is vital to a healthy economy and democracy!

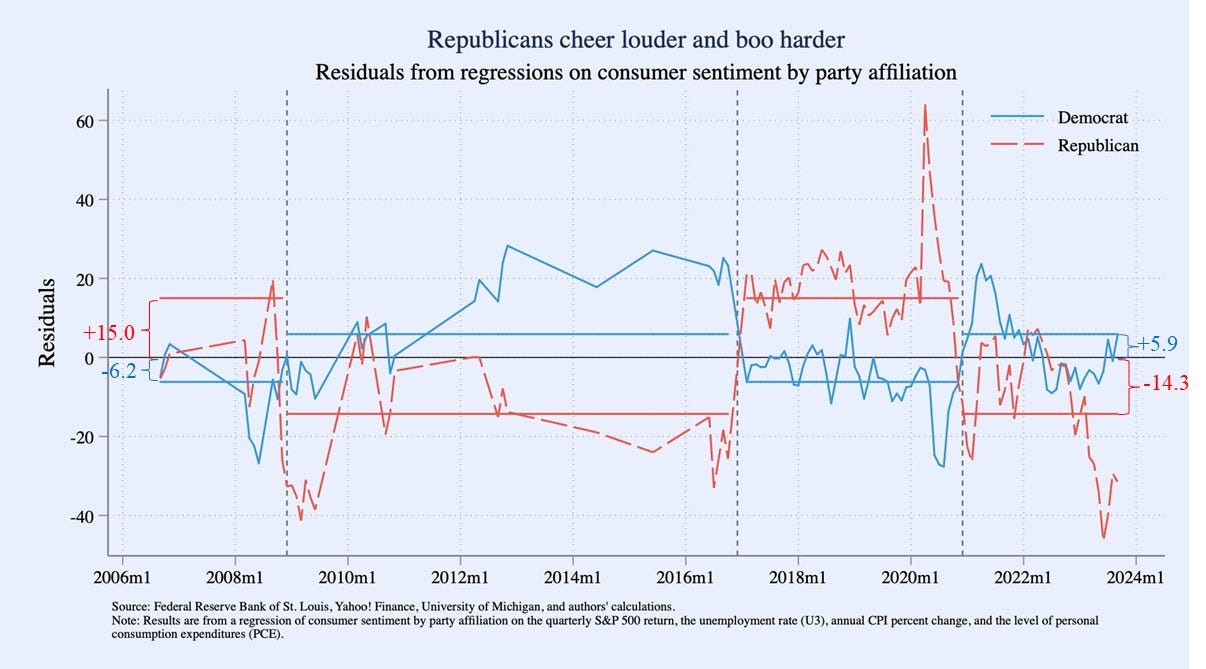

‘But Mav, you are only showing there the last 6 years, that is nothing!’. Yes, hence zooming out since 2006 and a lot has happened since back then:

👉 in general, republicans cheer louder and boo harder - what is hard to explain how could republicans ‘feel’ worse in the last 4 years vs. the 2007-2009 lows of the Great Financial Crisis (GFC) - conversely hard to understand Democrats ‘feelings’ when we corroborate it with hard fundamental data … you got the point!

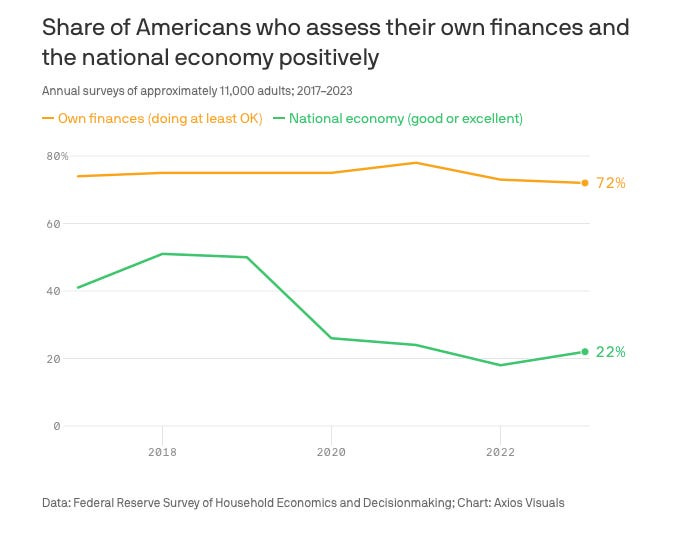

Let’s add another layer by not focusing on politics exactly, but in general regarding how do Americans assess their own finances + the national economy:

👉 72% think their own finances are doing at least OK - note also how pretty constant that is, it is not as volatile as their beliefs on the political leadership

👉 yet, only 22% believe the national economy is good or excellent

Houston, we have a big big personal VS national disconnect here … let that sink in!

There you go also - the U.S. economy quarterly growth rate & recessions since 2006:

👉 we are growing now by 2.8% with the average for the period of 2.05%, and we had the trouble some periods of the 2007-2009 GFC and the 2020 Covid

👉 very hard to argue any were caused by either the Republicans or Democrats, conversely give credit to any for the very good times in between - also, it is hard to corroborate any of the periods with the consumer sentiment by party identification

👉 the problem = the immediate partisan sentiment flip is real, hence individual beliefs are not a great model for how the world works …

Going forward, independent of new policy action, they will take time to be implemented and even more to have its real effects through the economy.

For example, Fiscal policy & Monetary policy:

👉 Fiscal policy takes a long time to be decided, while once done the effects are relatively fast - Monetary policy action is quite fast with some estimates suggesting that it takes between 1 and 2 years to have its maximum planned effect

👉 there is both a clear interplay at work there, but also lagging effects - add that one is the government, one is the independent central bank and sometimes they work against each other and sometimes in the same direction, pro-cyclical: a big example on the latter is the inflation which we got after the 2020-2021 big fiscal bazooka stimulus and very loose monetary policy

Add some more, like many and deep inter-dependencies with the other countries, from neighbors to Europe to far east to China. Independently of who is running the White House, they do inherit the decisions made in the past, be it good ones or bad ones. Not only that, but past decisions have multi-lagged effects: some that are felt for 1 month, 1 year, 4, other for way longer 10, 20 years or even decades.

What is rather valid is that the US economy has proven to be very consistent and flexible over time. When hiccups show up, the recovery happens fairly fast. 2007-2009 as the Great Financial Crisis / Great Recession was the largest economic downturn since the Great Depression of the 1930s. Other than that, things were not that big and for almost 100 years that is not bad at all!

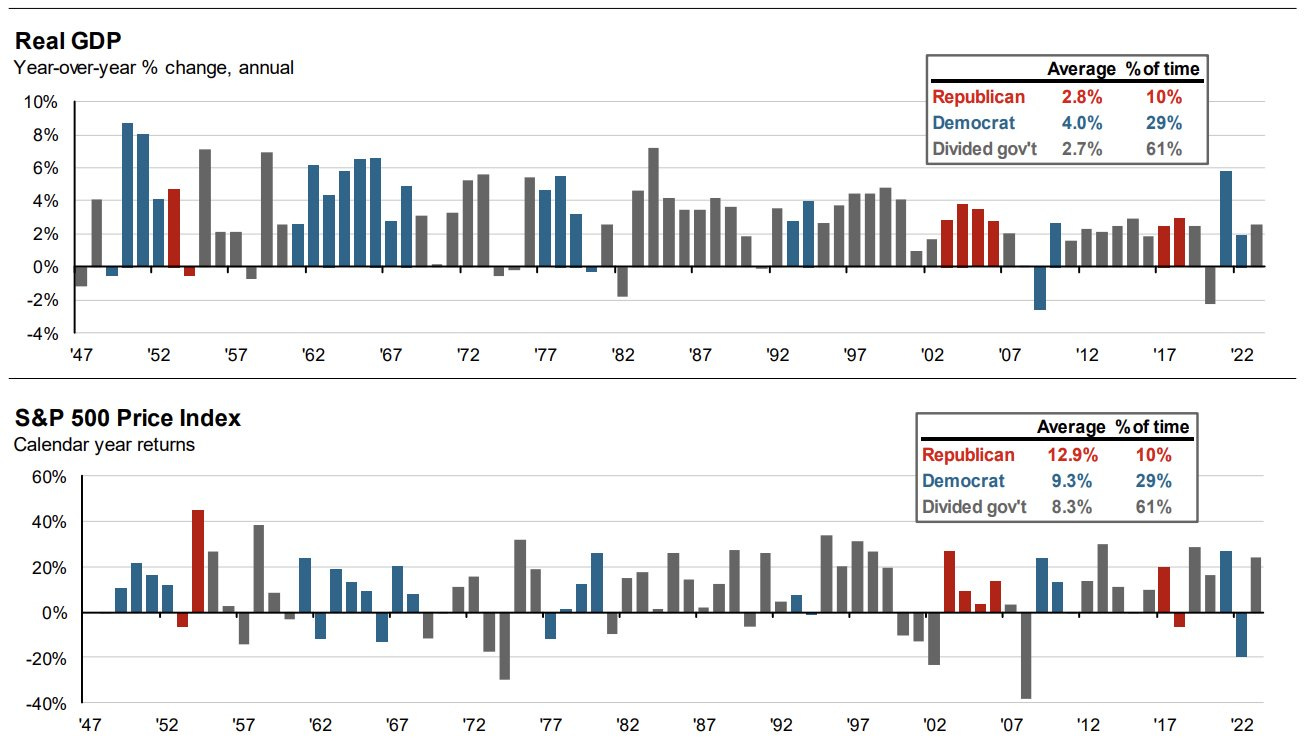

For that, check U.S. GDP since 1945 by President’s parties - no special relationship:

In other words, no single president from any party from any country can simply singlehandedly ‘break’, ‘mage great again’, ‘fix the economy’, 'kill inflation’, ‘create inflation’, impossible, it is a $30 trillion mammoth! No single variable can be the primary reason, clearly an exaggeration. If it was that simple, the solution would be also very simple. We would just have a magic wand, a cook book recipe and every single country would just apply it ‘by the book’, literally. Anybody telling you otherwise, either blinded by politics, hidden agenda or trying to brainwash.

Understanding the level of complexity is the 1st step in order not to be blinded by politics (for votes and own interests), and the path for a further better understanding of the innerworkings and many nuances. Further examples and nuances:

👉 the U.S. public debt and deficit is quite historical, it did not show up over night, neither party is fiscally responsible - food for thought going forward: which president or congress will gain votes by cutting spending? Who will take the pain during their mandate so that the next president and party only to later reap the benefits?

Maverick private sector parallel:

many years ago I was in a relatively big bank and very close with my work to the Board of Directors, CEO and Chairman. Only for people living under a rock it was clear that without digitalisation via omni-channels in order to be the main bank for clients, the path was downfall

However, a digital transformation project for a big and old bank with a ‘spaghetti’ of IT systems and patches, is not an easy task: it is not the IT tech part, but the costs and governance. Who wants to spend a few hundred millions that only show costs for some years, so that when the next game of thrones happens, the new guys only to reap the benefits?

‘Just costs under my mandate? Then not under my mandate …!’. This is an issue in any industry, government or country: interests not aligned medium-long term, and there is no real skin in the game. A big short term orientation fallacy and timing of incentives matter, we like it or not!

On the good side when it comes to the U.S. economy and the last 5 years:

👉 what about the U.S. energy independence? A net total energy exporter since 2019. Latest 2023 numbers, total energy exports exceeded total energy imports by about 7.80 quads, the largest annual margin on record!

👉 what about the fact that no recession since the most recent inflation spike, high interest rates and war in Europe? Actually no recession since 2007-2009 as we can consider 2020 Covid was rather a pause and quick restart

👉 remember 2020 Covid and the related Operation Warp Speed?

Resilience baby!

Going forward, both Trump and Kamala would have inherited all this from the past. Their proposed programs and focus were quite different: from tax policy, housing, healthcare, immigration, energy, financial regulation policy to geopolitical strategies especially with the war. Yes, they are not the same, though neither can massively re-engineer the economy. Somehow, sooner, slower, with more or less issues, it shall be good also this time around for the future.

Sure, leadership and policy matters, the society needs to see and have somebody in command, but also to internalise the following and separate what is what and when:

Recall Charlie Munger: ‘People are trying to be smart - all I'm trying to do is not to be idiotic, but it's harder than most people think.’

To conclude this section for the economy:

👉 while the economy does not change overnight the economic policy changes indeed - yet the issue is the policy change is mistaken for a new actual economic state

👉 as long as one is a realist-optimist and believes human progress will continue, societies will evolve which will all be simply reflected in asset prices - the direction is up, with ups and downs, but trending up!

Thoughts? Would love your take, maybe I’m missing some, many nuances for sure!

N.B. working now also on the 4th edition of the State of the US Economy which will come with further improvements. Until then, check the mid-year 3rd edition update:

✍️ The State of the US Economy in 75 Charts, Edition #3

📊 For The Sovereign Individual 📊

Last but not least, what about politics and the sovereign individual? In the end, each of us play a role via our various beliefs and actions that determine the nature of social structures, institutions and practices.

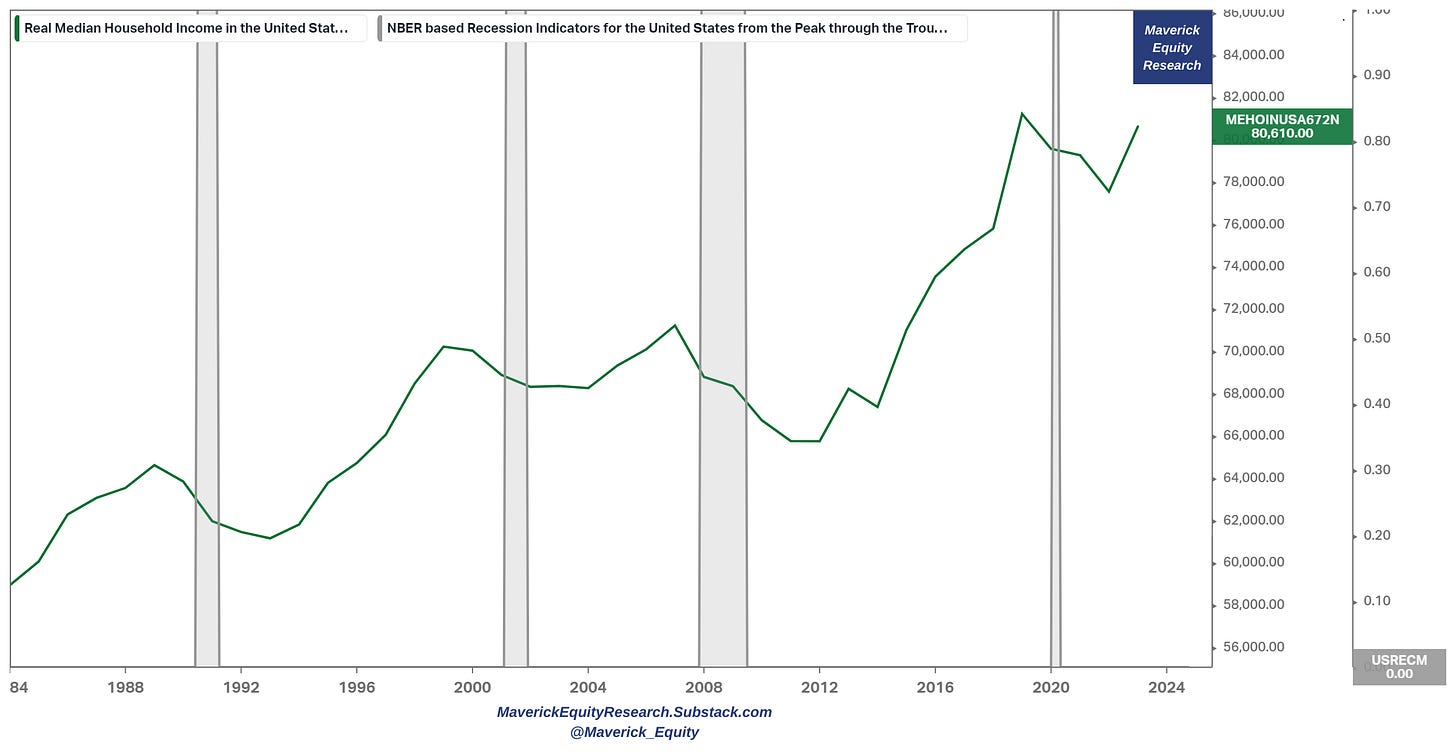

Digging now into the Households level with the Real Median Household Income since 1984 (median values way better than skewed averages):

👉 the usual dips with the business cycle, but clearly trending up: now close to the pre-pandemic levels … back on track, heading up …

Breaking that further for the Real Median Personal Income, also since 1984:

👉 very similar pattern … also close now to the pre-pandemic levels …

👉 on a shorter time frame, the business cycles is the business cycle, every 6-8 years we get a hiccup, and after we go back again upwards & onwards. Only ‘funny people’ always shout ‘the recession is coming’ or ‘the crash is coming’ to back their agenda, and funnily enough, just like even a broken clock is right twice a day, they will be ‘right’ also sooner or later. One can simply be certain to be ‘right’ via that shady ‘strategy’. Even more funny, it often works … for themselves, but not for people.

👉 should one vote? Definitely! How much to expect from politicians? Not much!

some are good & decent, some mediocre, some have no clue, some are a big net positive, some a big negative, just like in every industry … they are ‘us’ in a way!

in one of my former jobs in the headquarters of a bank, we had once a big 20% cost cutting program which all said was impossible to reach ‘without creating waves and destabilising the culture’ - and I just proposed: ‘let’s all just come to the office 4 days a week, I am confident things would still work, if not maybe even better (more rest, more focused work, less useless meetings)’ - everybody gave me the weird and long look … which proved that I was right

same with politicians, if they would come to the office just 4 or 3 days a week would we be all worse off? I would say very likely better off …

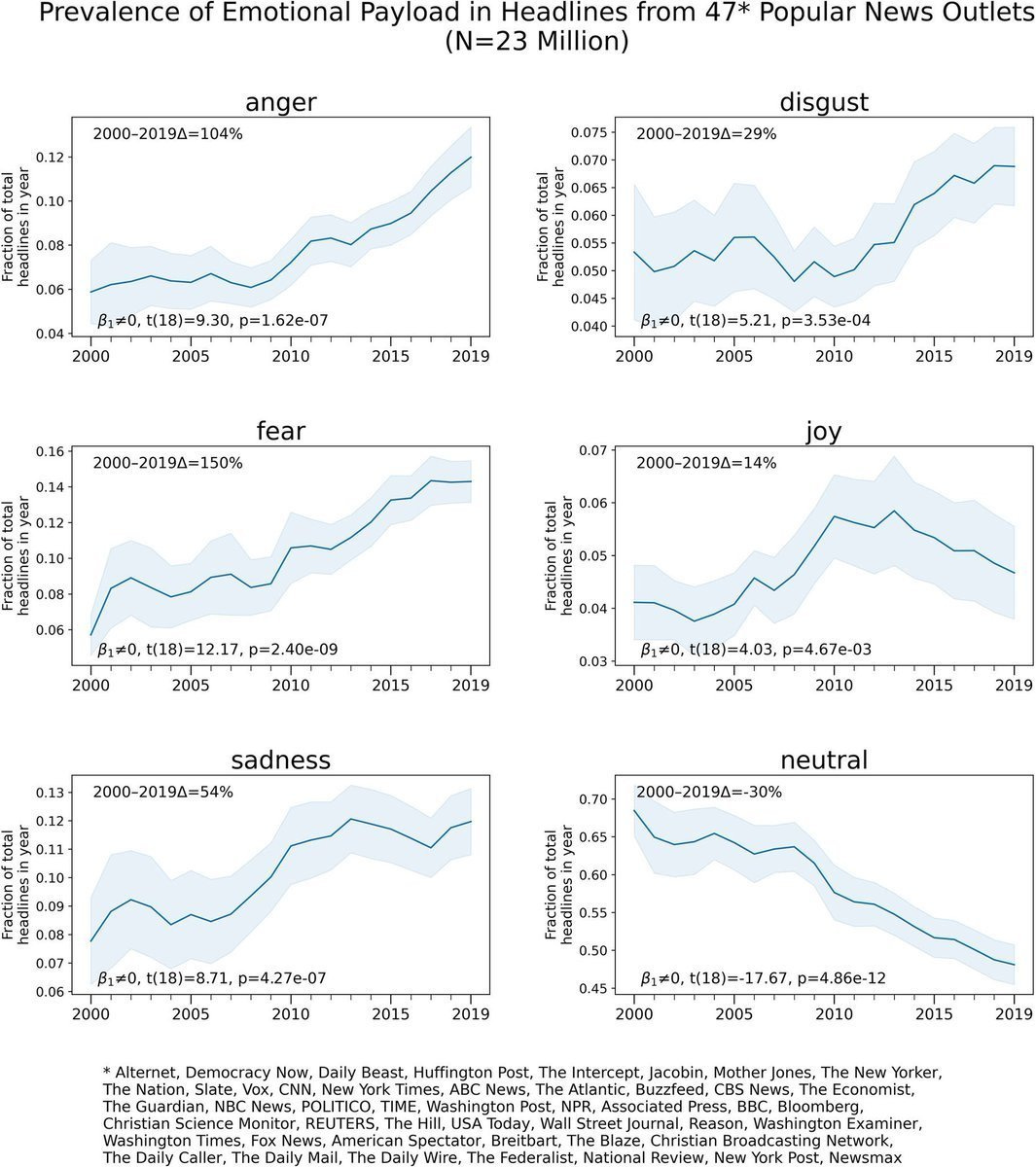

👉 don’t be the product of the rising Negative Media for clicks/views for ads money, a phenomenon which I have witnessed going wild in the last 10 years - I have the data:

2022 study: since 2010, the media massively increased headlines that use fear, anger, disgust, and sadness - it has also decreased articles of neutrality and joy (no surprise that few media outlets are covering this meta point)

👉 how much time to spend with politics? Not much! It is a big opportunity cost!

I had to leave friends behind that were spending at least 10 hours a week on politics, and that in just two 4-year cycles are more than 4,000 hours! The issue was not their political views, but their overall heavy emotions … or … toxicity: ‘Got too much time bud? Heads down, ride an Uber 10 hours/week, see you in 4 years, I’m sure you will be better off!’ - some didn’t listen, some did & thanked me later 😉, and right now they are up to way bigger things, financially & mindset …

there is much out there to learn, do, play, experiment … especially in our age! Even doing nothing is better, not to mention more sleep, more rest which makes for more calmness, tolerance, ideas and forward looking mindset and energy

one is better off on focusing on what one can control, which on the micro level counts a lot, while on the politics/macro level is not much, peanuts, mostly emotions

reading, studying, listening, eating well, sleeping well, exercise, volunteering, charity, anything which is good for the close community - all these compound very well over time, and like this one is a big net positive for themselves, their close communities and also on the macro societal level

“Most people overestimate what they can do in one year and underestimate what they can do in ten years.” Bill Gates

👍 Maverick Food for Thought & Takeaways 👍

This was a long piece so that it is evergreen. It will be very valid also in the next elections, and the ones after and the ones after the after. Have it as reference!

Main highlights as food for thought and takeaways:

👉 both the economy and the stock market tend to fair well under all government configurations = a portfolio is like soap, the more one touches it, the more it shrinks! Political events have a short shelf life in the financial markets and the economy!

Chart with: Real GDP and the S&P 500 since 1947: growth/returns by government in charge, averages and % of time in power - kind of ‘says it all’!

👉 the US Economy is like a serious train, once started it has a few pauses and hiccups along the way, but it does not stop - most political regimes have not much effect on short-term economic performance (be it good or bad), though policy in aggregate has a considerable large long term effect which is mostly positive

👉 the economy’s state for people is mostly a function of their own financial and personal situation at a given time (how happy/sad) and their perception about it. It is rarely much about how it is per se - we need to focus on the medium-long term large scale background shifts, not on the entertainment of the noisy daily news & headlines

👉 investing mindset: Bears Make Headlines & Lose Money, Bulls Make Money! Investing is about the future, inherently forward-looking, hence the engrained belief is that tomorrow will be better than today. It takes an optimist to be an investor!

👉 investors of all kinds: don’t let how you feel about politics overrule how you think about investing, zooming out & logical thinking is key, while emotions are the enemy! Investing is not hard otherwise, given that compound interest does not only not care about politics, but it beats the hell out of it!

👉 volatility is your friend: I am always puzzled by how investors can be impacted by some 2-5% variability - I don’t know about you, but I rarely wake up each day with a lower variability than that

👉 short term traders need to have a very solid thesis considering many variables and nuances which change quite fast in terms of driving factors

👉 don’t expect much from politicians, don’t waste much time with it, focus on what you can control: your time, your skills, your investing, your effort, your community

👉 negativity drives online news consumption - don’t be the product of it

👉 detachment and logic is key! Seeing the world accurately and rationally is prime, particularly for me doing independent investment research - going down any political rabbit hole is a big big No Go

👉 ‘just’ taking things and data as they are, infer from there for the best insights and forward looking outcomes given the situation - detachment is easier to be said than done by anybody, but it is very important:

‘Detach, detach, detach … !‘ … and then logically … ‘Act, and make the best out of it … !‘

Going forward I am very bullish medium-to-long term on:

the economy, consistent and fluid bringing home the goodies: products & services

the stock market, ownership of cash flow, creator and compounder of wealth

the start-ups, the small-medium companies, innovators and solopreneurs

the sovereign individual: the dreamers, go getters, risk takers, the ‘crazy’ ones challenging the status quo - failure is okay when it happens, actually it is a condition for any meaningful human achievement …

"Those who keep learning, will keep rising in life!" by Charlie Munger

“If you have a zero-sum mindset, the only way to get ahead is by taking things from others. If the pie is fixed, the only way to have more pie is to take someone else's pie. But this is false. The economic pie has grown dramatically over time” by Elon Musk on value creation

“No pessimist ever discovered the secrets of the stars, or sailed to an uncharted land, or opened a new heaven to the human spirit” by Helen Keller

"There are risks and costs to a program of action, but they are far less than the long-range risks and costs of comfortable inaction." by John F. Kennedy

"Slow success builds character, fast success builds Ego" by Ratan Tata

👍 Bonus: Maverick Mindset Playbook for Investing but also in General 👍

The following are useful evergreen reminders when needed, and a list that will further keep developing as I trial & error, learn and evolve. They developed from both my former athlete days & professional finance experience. You might like it & add to it:

play, forgive, apologise: play hard, forgive fast, and when wrong do apologise

preparation: if you are prepared you do not panic, if not prepared, work to be prepared, keep going forward - things happen left or right, yet they turn out best for the individuals that are able to make the best out of the way things turn out - opportunity comes to the prepared mind

goals: have structured goals, short and long term ones - many will not be reached exactly and become moving targets, but once you start your own train, it will be headed into the right direction - without goals clarity, it’ll be down to luck - luck is needed also, but usually luck shows up where conditions for it were prepared

improving & success: question yourself, even in the best of times when you tend to forget that, yet that is the best time to do it - be your own stress test as like this when envy and critiques will come, both good and bad, they’ll not be a surprise to you and you’ll be able to separate fast which is fair & square and which are BS

making mistakes: only people that do not work or learn never make mistakes, you learn more from your mistakes than your successes

‘Thank You’! being polite and grateful by just saying thank you can go a long way

character, reputation and mistakes: character is what you really are, reputation is just what others think you are - making mistakes doesn’t mean a lack of character, they are part of developing a character - there’ll be people using your mistakes to damage your reputation, yet mostly that says more about them than about you - character and reputation do converge nicely on the medium-long term in any case

you and others: good or bad, don’t rush and place a big label to somebody after a few interactions - you might be wrong with your initial perception - in time the true view will converge

talent & luck: nice to have, not must to have, hard work & consistency for the win

downside and upside: watch the downside, the upside will take care of itself

work life balance: finding it is possible - disconnect, charge the battery, not a sprint but a marathon, find the right balance between fire and ice

help others, give back, have an impact: in your closer community, not necessarily financially, but offer your time, expertise, learnings from mistakes, inspirational, or just listening can go a long long way, in many cases way more than money - don’t expect anything back, just pay it forward

All in all, via your energy & skills be a net positive for your community and society!

As I did not take a political side, some of you might not ‘like’ this given how controversial and emotional it is - will unsubscribe, and that is okay - while most of you will see the value exactly in that given the evidence based big picture view.

I am not catering to the audience’s wishes to what they ‘want’ to hear, nor writing to engage into controversy and polarisation, that is the ‘media’ business for clicks & views & ad money (there are no ads or sponsors here).

My research is evidence based because that is what people ‘need’ to hear - that is the value that I should bring in the end of the day - and ‘need’ is not at all in order to change one’s mind, but it is about another perspective where one does not need to agree, but to agree to disagree … and we all win like this via big positive externalities!

And this is how and where I can add value via the research that I do, and likely one reason why YOU as almost 12,000 people from across the world subscribed!

If the evidence is strong and you get a different perspective, food for thought and valuable insights, then it means I am doing a good job. You are the judge … 😉.

What would be appreciated from your side?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons! That’ll definitely support bringing in more & more independent investment research: from a single individual … not a bank, fund, nor a click-baity media company or so … ! Like this, the big positive externalities become the name of the game! Thank you!

A general evergreen key takeaway for your investing journey:

‘Compound interest is the ‘secret sauce’ for compounding wealth over time, and that is the amazing miracle of finance. Thing is, it gets lost by many in the daily distractions of the markets: news, headlines, politics and hot takes. The ticker moving is one thing, the underlying business value is another. Just do not let moving prices on a screen and public emotions take advantage of you, but use the public markets to your advantage! Keep compounding!

Maverick Equity Research

Have a great week!

Mav 👋 🤝

P.S. in case you missed the 1st Maverick Food For Thought edition, check it out:

✍️ Maverick Food for Thought #1: Value vs Growth ... or ... Value & Growth?

Great research, top notch! Thank you!

Thank you!