✍️ Maverick Charts of the Week #9: Consumer Confidence, Gold, Nasdaq-100, A.I. adoption, Rise of the Negative Media

15 Maverick charts that say 10,000 words + incoming Maverick-esque research

Dear all,

10 + 5 Maverick Charts of the Week that I diligently cherry picked for both data-driven insights + valuable food for thought!

Table of contents:

📊 Maverick Charts: Consumer Confidence, Gold, Nasdaq-100 Seasonality, J.P. Morgan tech investment, AI adoption by U.S. businesses

📊 Bonus charts: Rise of the Negative Media, Global Military Spending as % of GDP, European Fertility Rates & Travel Safety Advice

✍️ Incoming Maverick-esque research!

Delivery is in typical fashion, via Maverick charts that say 10,000 words or more!

📊 Maverick Charts: Consumer Confidence, Gold, Nasdaq-100 Seasonality, J.P. Morgan tech investment, AI adoption by U.S. businesses 📊

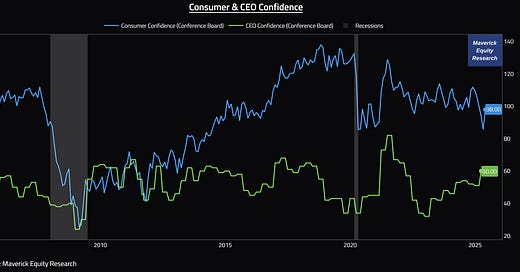

Consumer Confidence (Conference Board index):

👉 significant rebound in May after 5 consecutive months of decline = index jumped by 12.3 points, rising from 85.7 in April to 98.0 in May, marking the first material increase since the onset of a downward trend that began late in 2024

👉 rationale: May rebound due to easing trade tensions between the U.S. and China- particularly after the tariffs pause announced on May 12

N.B. CEO confidence also had lately an uptick - I’ll update it as soon as the data is out

Gold and S&P 500 performance in 2025:

👉 Gold (orange) with a mega +24.79% rally in 2025 while the S&P 500 (blue) +0.58% which makes for a big divergence …

Complementary in case you missed my recent Gold Special Situation, 100% win rate for the past 10 years, 2.79% average return in just 2 weeks - next year you know the setup ✍️ Maverick Special Situation #6: 🪙 Gold Special Seasonality Pattern

N.B. Maverick Gold Special Report = work in progress - until then, enjoy the 5 charts!

Gold technicals:

👉 Gold sitting materially above both the 50 and 200 daily moving average

Gold seasonality:

👉 given the mega rally recently, sitting materially above the average seasonal pattern

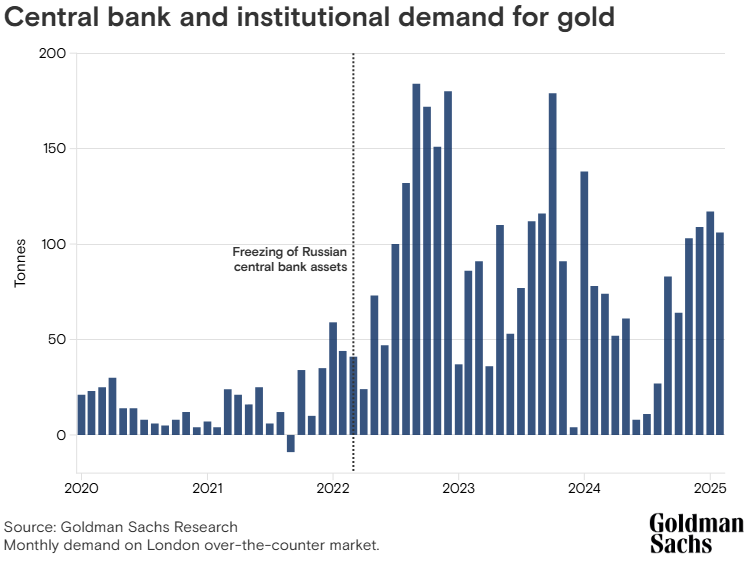

Gold: central bank and institutional demand

👉 their purchases have been the primary factor driving up gold prices in recent years as Russia's war in Ukraine marked a turning point for gold

What about Gold as a % share of central banks reserves?

👉 Developed market central banks tend to have larger gold holdings, partly as a legacy of the gold standard era when sovereign money supplies were linked to gold

for example, China holds less than 10% of its reserves in gold, compared with about 70% or more for the US, Germany, France, and Italy

“The global average is roughly 20%, which we view as a plausible medium-term target for large emerging central banks”

Bonus: Gold quiz - a very interesting one on the demand side via GS:

👉 Central banks bought a monthly average of 17 tonnes of gold between January 2006 and January 2022, and Goldman Sachs Research estimates that these institutions’ gold purchases have increased considerably since then.

What was the monthly average for gold purchases by central banks between February 2022 and January of this year?

A) 34

B) 51

C) 70

D) 85

Answer … give it your best educated guess … 85 tonnes!

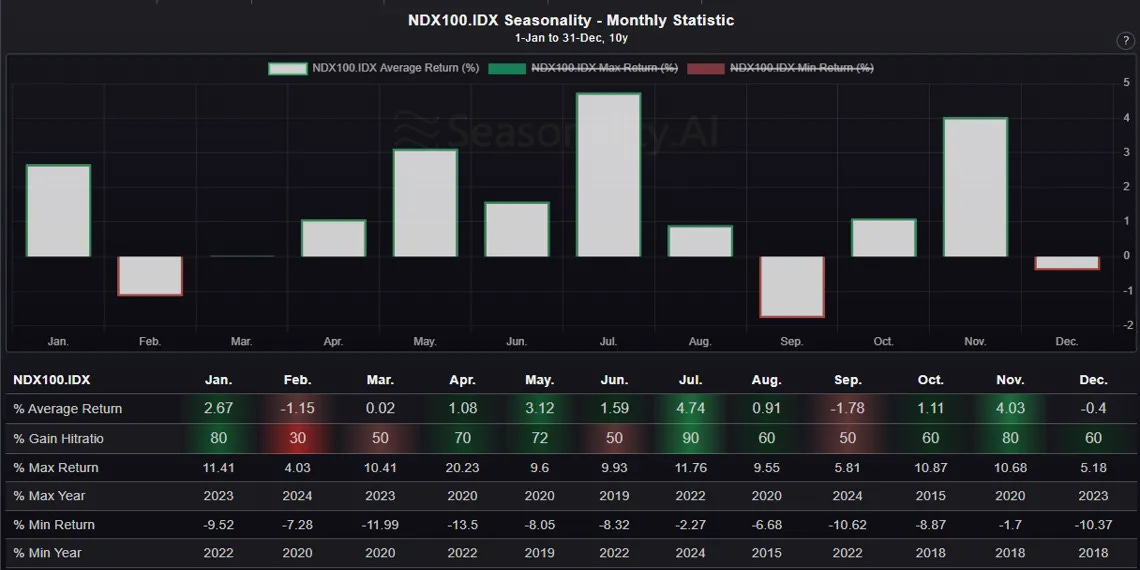

Nasdaq-100 seasonality:

👉 seasonal pattern looks good for the next 30 days

Zooming out for the seasonal patters for the 12 months:

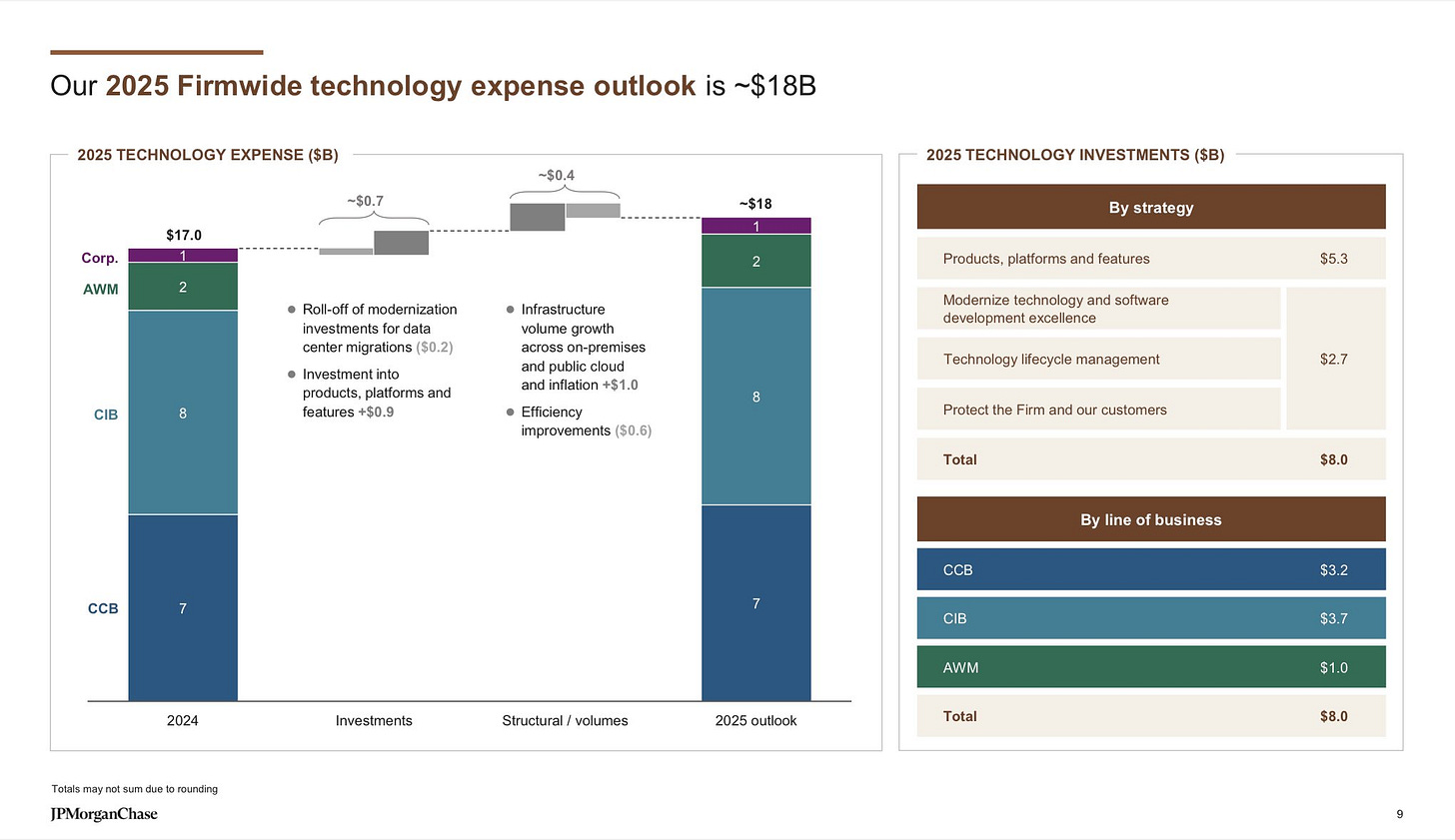

J.P. Morgan (JPM) technology expense outlook = a whooping $18 billion:

👉 “Our outlook for total technology spend this year is approximately $18 billion, up about $1 billion year-on-year. We are now probably past the point of peak modernization spend.”

AI overall adoption rate by U.S. businesses since 2023 via paid subscriptions to AI models, platforms and tools - a significant and accelerating increase:

👉 U.S. government estimate = 8% (from the 3.2% October 2023 estimate)

👉 Ramp AI Index = 40.1% (from the 6.2% January 2023 estimate)

📊 Bonus charts: Rise of the Negative Media, Global Military Spending as % of GDP, European Fertility Rates & Travel Safety Advice 📊

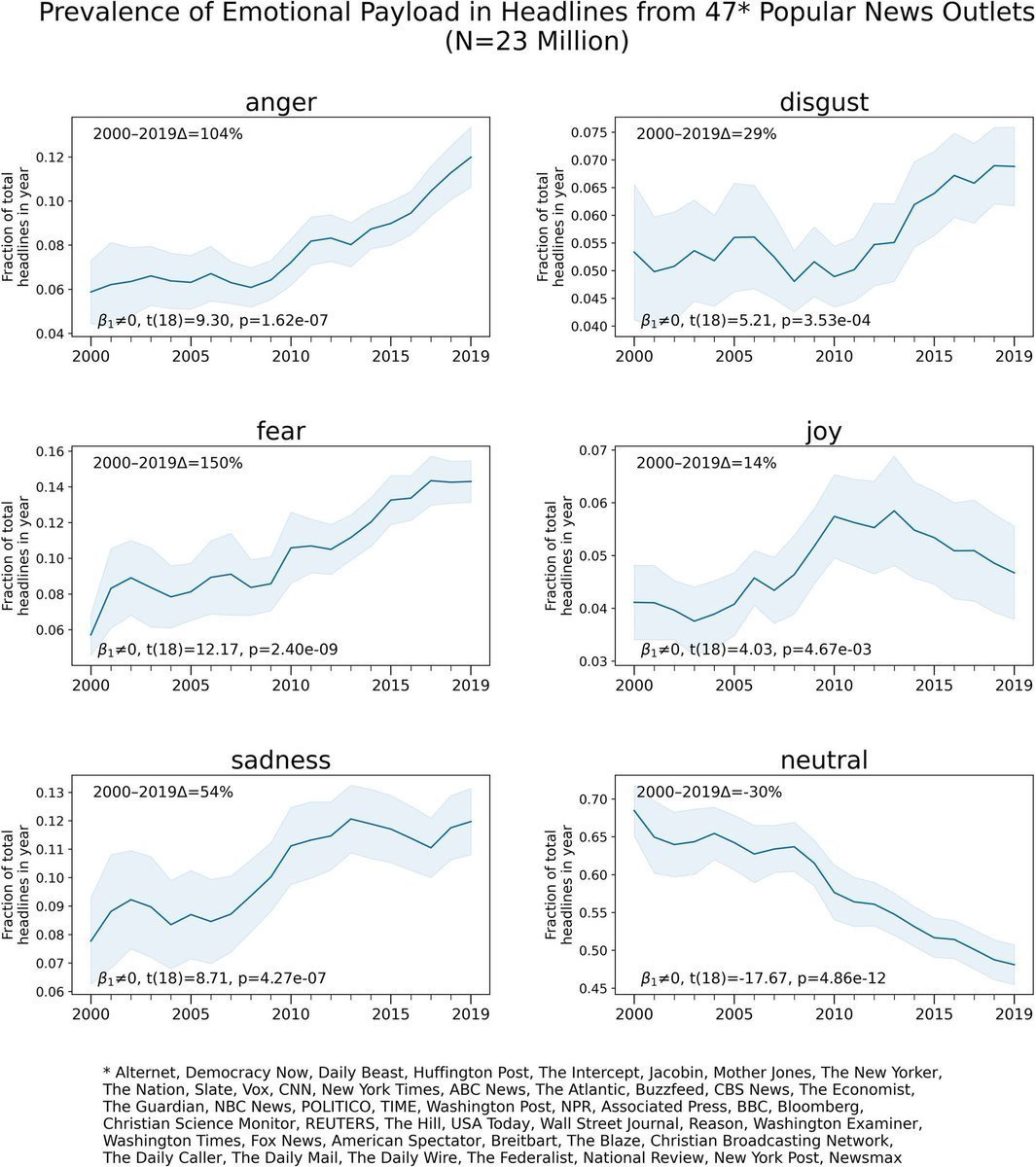

Watchout for the Rise of Negative Media:

👉 frequency of words related to prejudice such as "racism", "sexism", "homophobia", "transphobia", "islamophobia", "antisemitism" via data drawn from a wide range of prominent news outlets in each country

👉 why? For clicks & views for advertising money, and that is because the algos are made as such, that is what attracts views! As always, I have empirical data on that not just some empty or random opinion:

👉 marked increase since 2010: most countries show a significant rise in their news media starting around 2010, with some acceleration after 2015

👉 global pattern: trend is visible across North America, Europe, parts of Asia, Africa, and Latin America, indicating a broad international shift in media discourse

I did post this one before, but just in case you missed it / new to the research here:

👉 there is a huge negative news positive bias, and a big positive news negative bias. Since 2010, the media massively increased headlines that use fear, anger, disgust, and sadness. Correspondingly, it has also decreased articles of neutrality and joy.

👉 it's no surprise that few media outlets are covering this meta point, isn’t it?

Global Military Spending as a % Share of GDP in 2024:

👉 in 2024 the world spent 2.5% of its GDP, around $2.7 trillion on the military

👉 Ukraine had the highest economic military burden in 2024 at 34% of its GDP, a significant increase from 3.4% in 2021 (pre-Russia-Ukraine conflict)

👉 Poland topped all NATO members with military expenditures with 4.2% of GDP

👉 U.S. which made up 66% of NATO spending, spent 3.4% or nearly $1 trillion on its military - it was the single-largest military spender in 2024, accounting for over 1/3 of global military expenditure

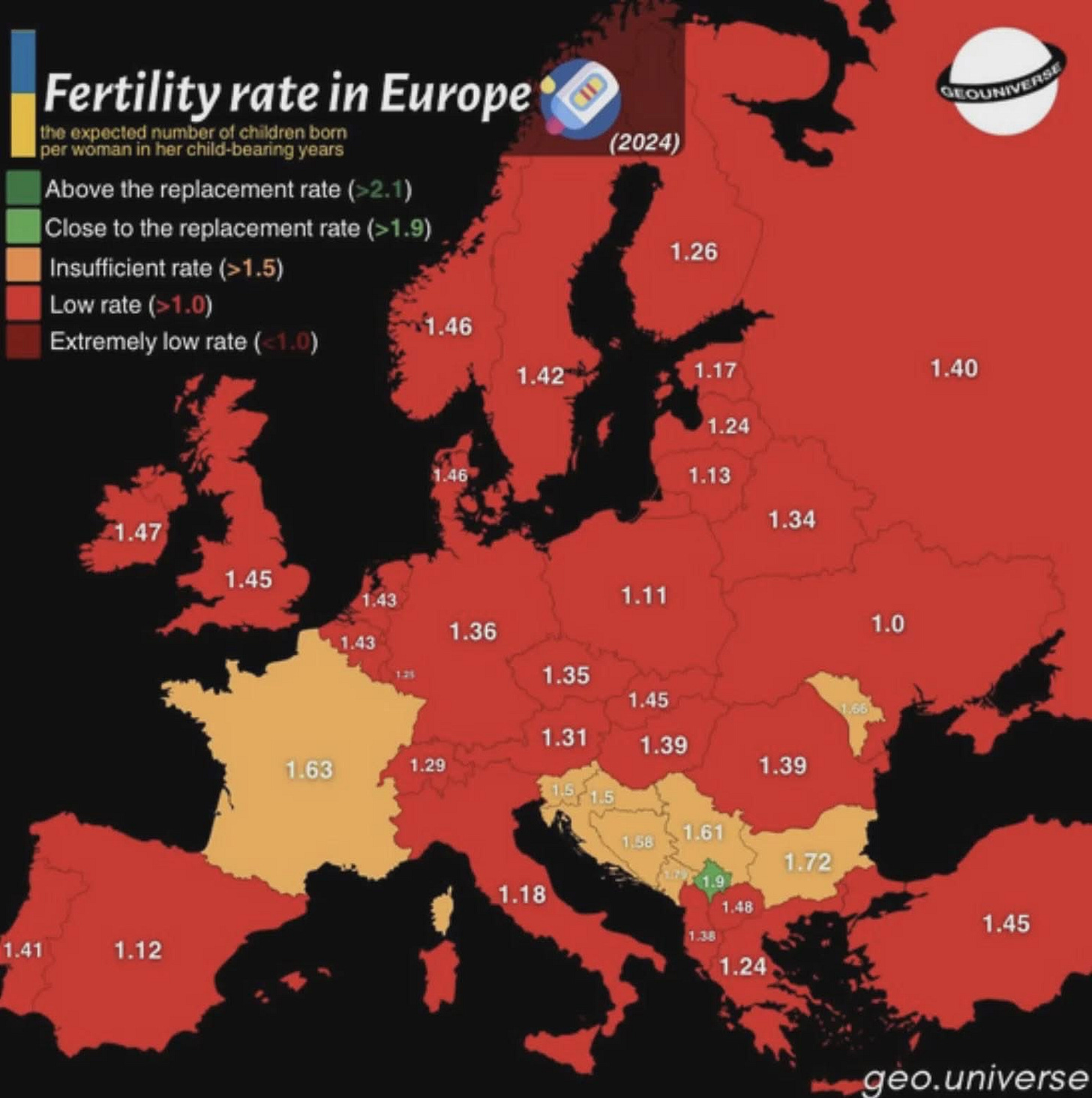

Fertility rates in Europe:

👉 Europe similarly too much of the world is facing a demographic crunch:

Most EU countries sit well < below the 2.1 Children/Woman replacement rate

for comparison: Japan at 1.30, China: 1.10, South Korea 0.78, United States: 1.60, thanks in part to higher fertility among immigrants

European travel safety via U.S. government travelling advisory:

👉 Eastern Europe is now a safer place to visit than Western Europe

✍️ Incoming Maverick-esque research! ✍️

What is coming next through the independent investment & economic research here? Many drafts are work in progress - below a few selected ones:

✍️ Full Equity Research

section start where I will cover in details single businesses/stocks aka deep dives

✍️ Why Independent Investment and Economic Research = Paramount Nowadays!

common sense is not so common, independent research for the win!

✍️ The State of the US Economy in 75 Charts, Edition #4

coming up with further improved coverage charts + recession probability metrics

✍️ Maverick Special Situation #7

how to hedge, lock in the gain or speculate on a very popular stock nowadays

✍️ S&P 500 Report #6: Valuation, Fundamentals & Special Metrics

coming up with further improved metrics via sleek Maverick charts as always

✍️ Maverick Special Report #7: Big Volatility & Drawdowns = Juicy Returns

the price for high returns = digesting and taking advantage of volatility

✍️ Maverick Special Report #8: U.S. Manufacturing = A Bad Wet & Fake Dream

manufacturing is romantic, but not realistic for good reasons for the U.S.

✍️ Maverick Special Report #7: Harvesting Geopolitical Risk Premium Through The 2025 Trade War

taking advantage of the ‘Trade War 2.0’ which drives volatility these days

✍️ Top 50 Maverick Charts to Watch in 2025 and Beyond

sleek Maverick charts with many insights & food for thought for now & the future

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this by finding it interesting, saving you time and getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons! That’ll definitely support bringing in more & more independent investment research: from a single individual … not a corporate, bank, fund, click-baity media or so … !

Like this, the big positive externalities become the name of the game! Thank you!

Have a great day! And never forget, keep compounding: family, friends, hobbies, community, work, independence, capital, knowledge, research and mindset!

With respect,

Mav 👋 🤝

great charts.

Have you ever considered a Marverick Insta account? I see some guys like Pari Passu killing it in there

All great info. Thanks 🙏🙏🙏 Will get back into gold around 3100 but I don't know we get there. Still in pltm after holding for a year, haha.