✍️ Maverick Charts - Stocks & Bonds - July 2023 Edition #9

25 Sleek charts that say 1,000 words ... save precious time & provide insight!

Dear all,

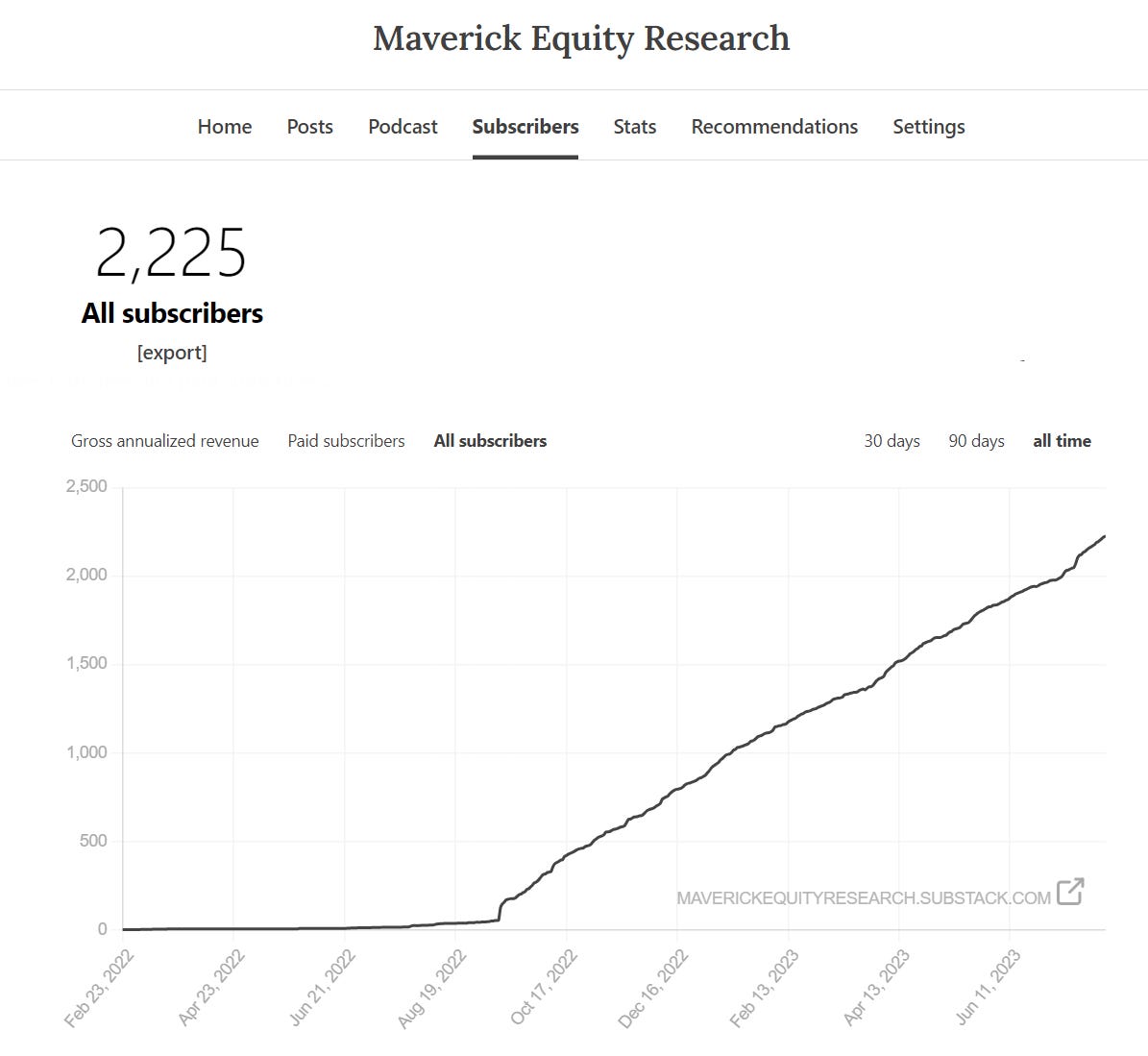

first of all, welcome to the new subscribers as recently we crossed the 2,200 milestone!

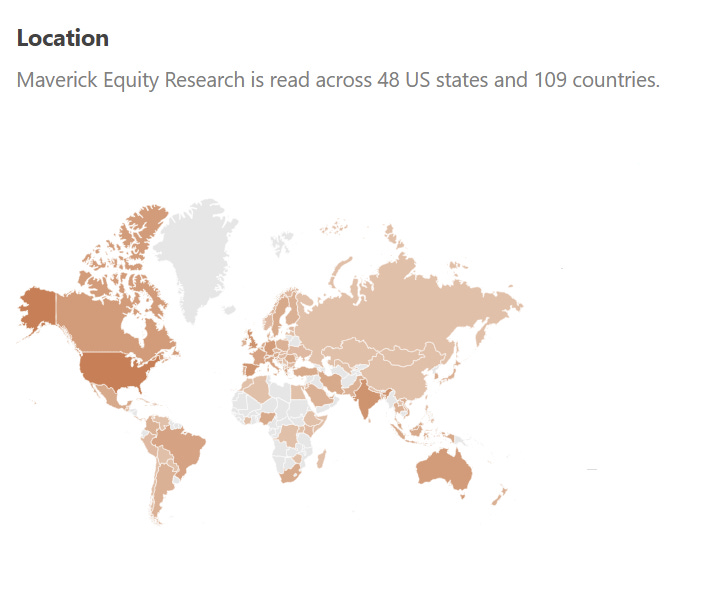

Maverick Equity Research is read across 48 US states & 109 countries worldwide!

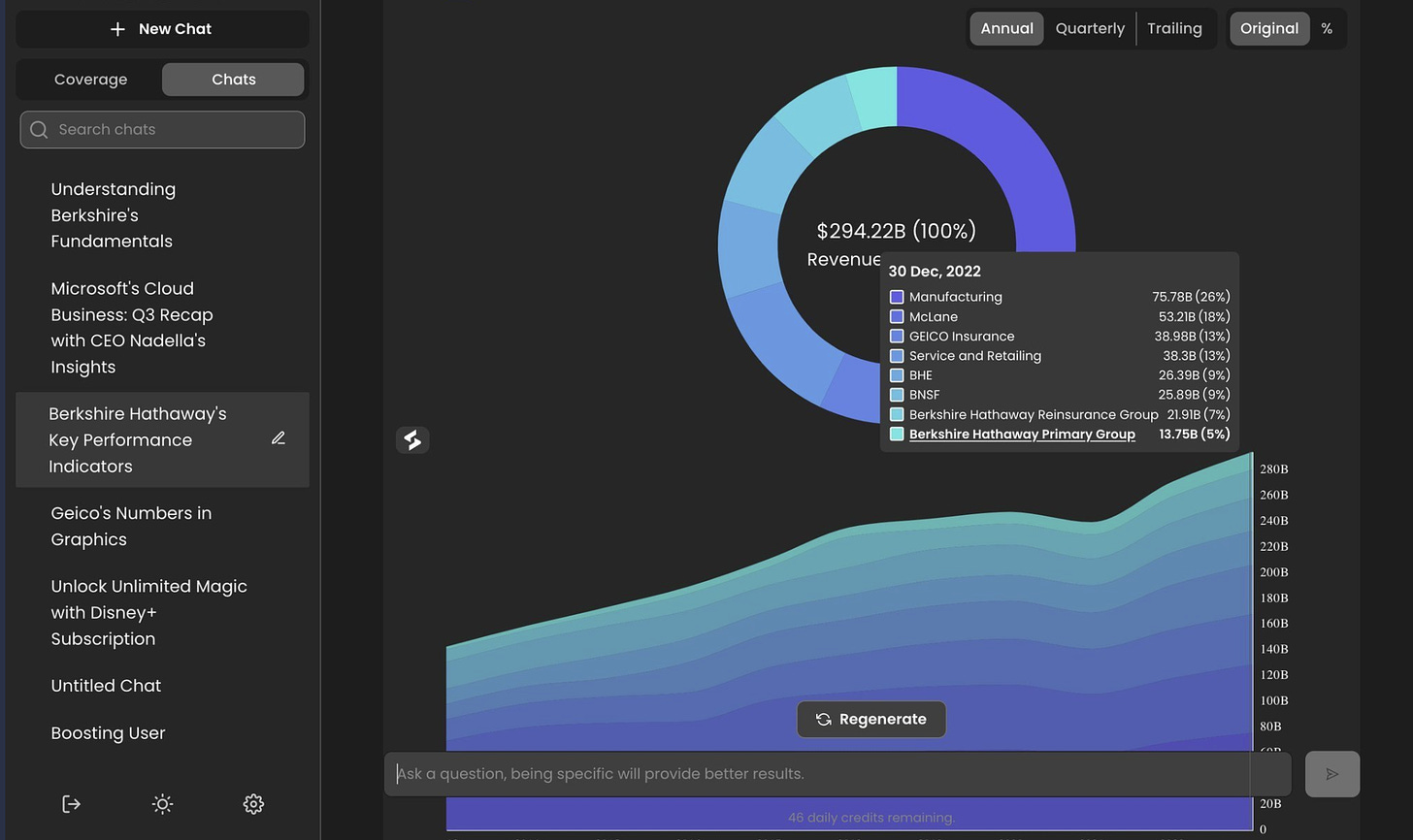

Stocks charts pack likely new & special for most of you: Business Segments & KPIs (Key Performance Indicators) in focus and powered by FinChat AI & Stratosphere. In case you missed my overview on this valuable research tool that I use, check it & test it yourself. Note also that they increase prices tomorrow given the incoming upgrades!

✍️ Which Research Tools Do I Use? FAQ answered: AI powered research tool! ✍️

I made also a Twitter thread & the one & only legend Howard Lindzon also enjoyed it!

Source: https://twitter.com/howardlindzon/status/1686768371373912064

Here we go with Top 15 Stocks & Bonds charts from around the world + 10 Bonus!

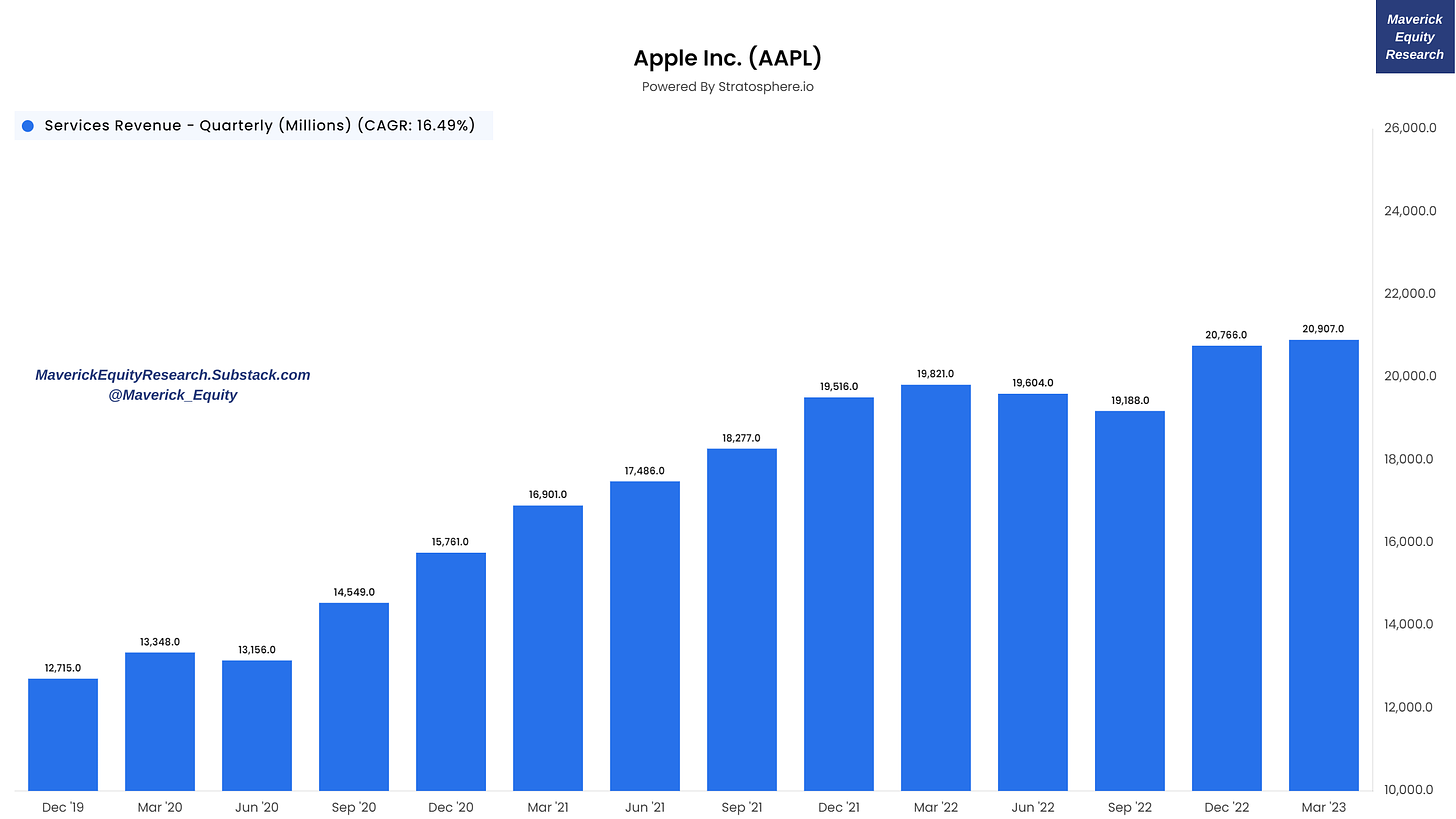

Apple Services revenue ... monster!

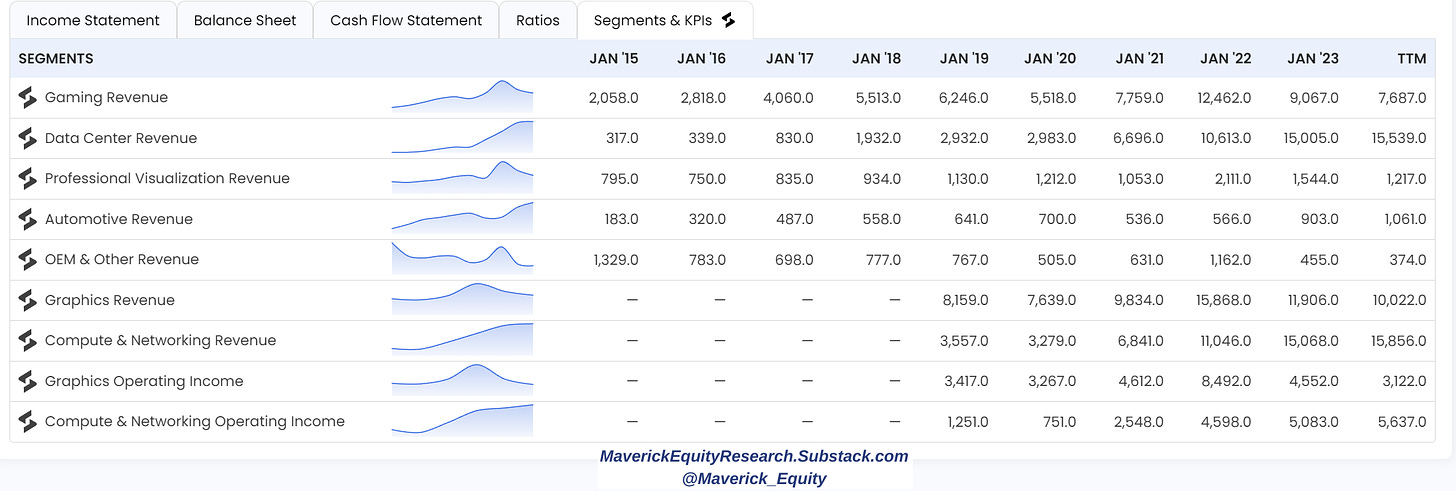

2 & 3. Nvidia (NVDA) Business segments overview: which one jumps out to you?

Data Centers revenue … going parabolic, like the price … key segment to watch imo:

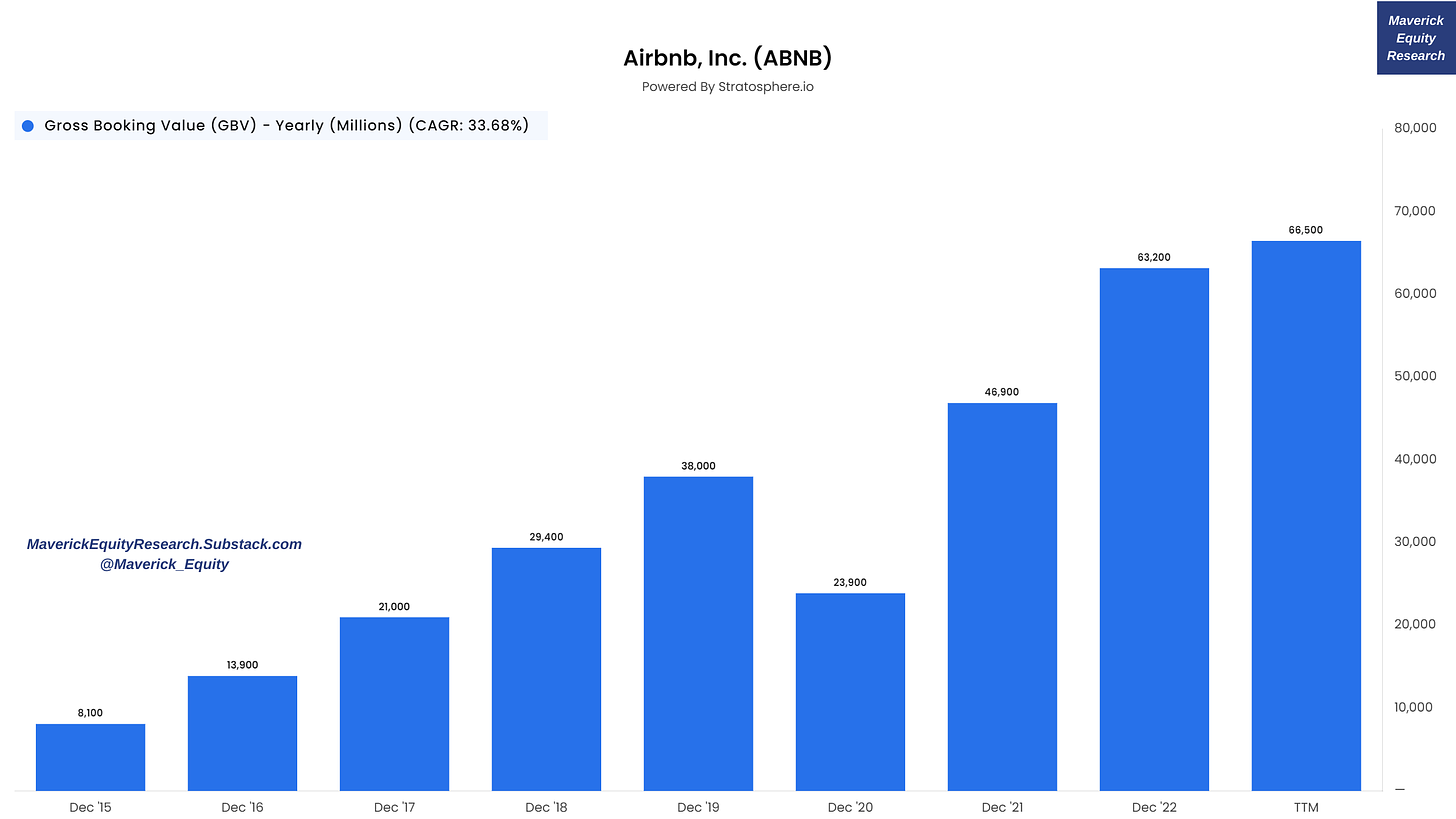

4 & 5. AirBnb’s (ABNB) two KPIs since 2015:

Gross Booking Value (GBV) with a 33.68% CAGR

Nights and Experiences Booked with a 27.13% CAGR

Wise Plc (WISE) Active Business Customers: B2B payments ramping up fast

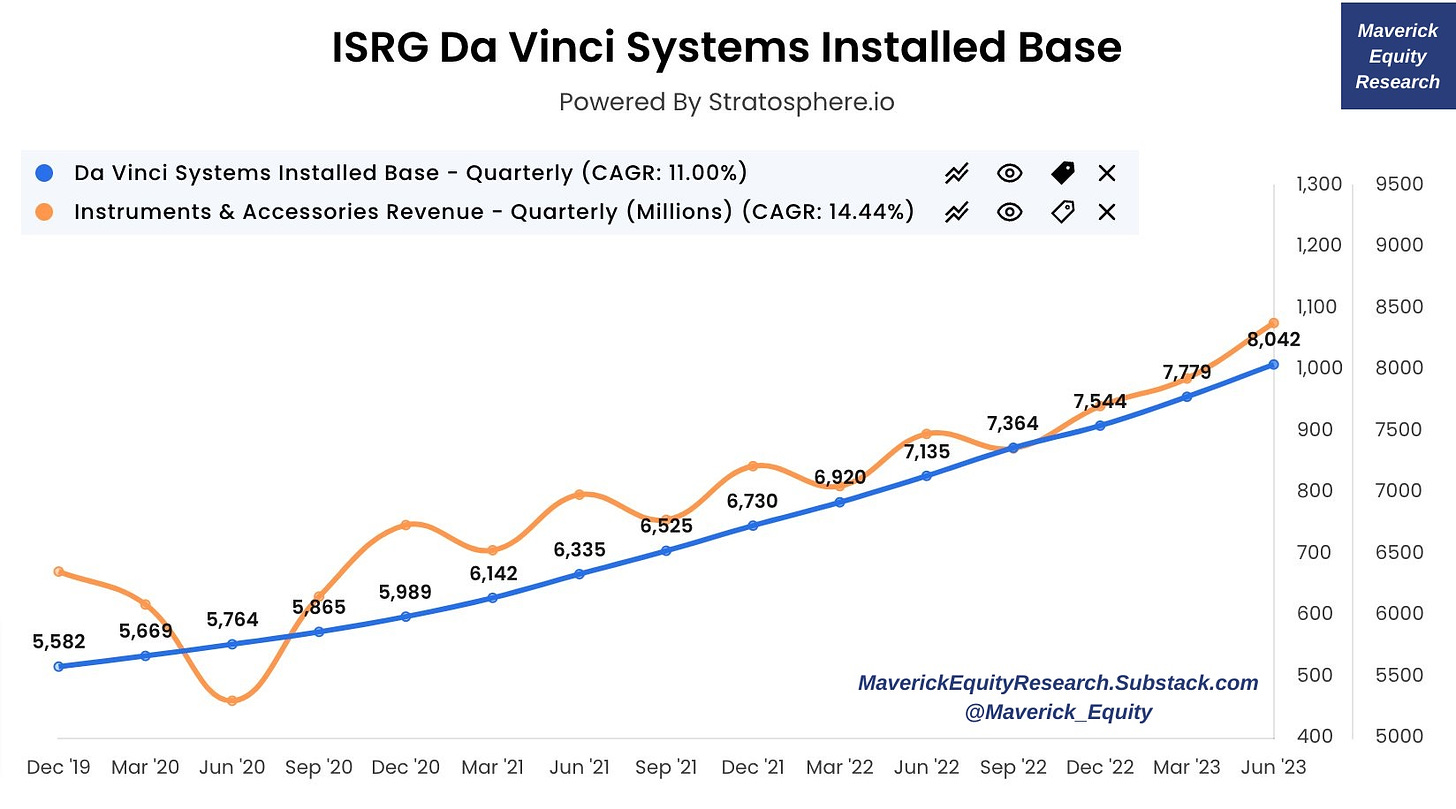

Intuitive Surgical (ISRG), quarterly since 2019:

Systems installed (blue) over 8,000 for a 11% CAGR

Instruments & Accessories revenue (orange) for a 14.44% CAGR

Becoming a ‘Picks & Shovels’ type of business …

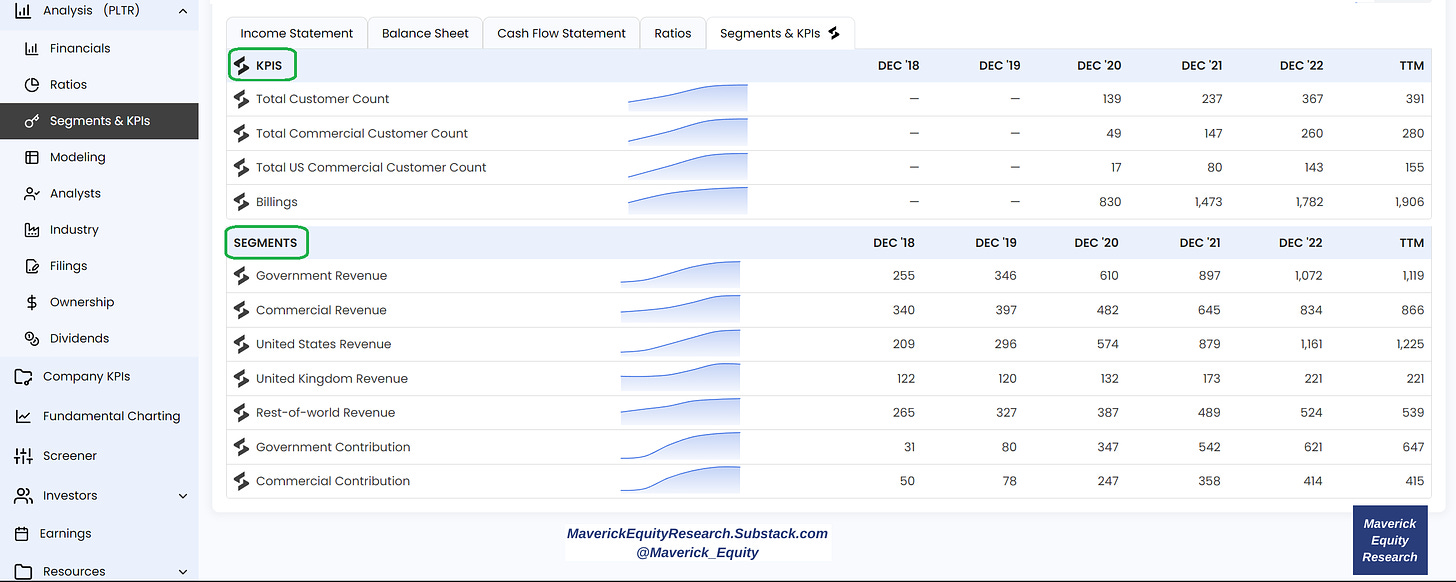

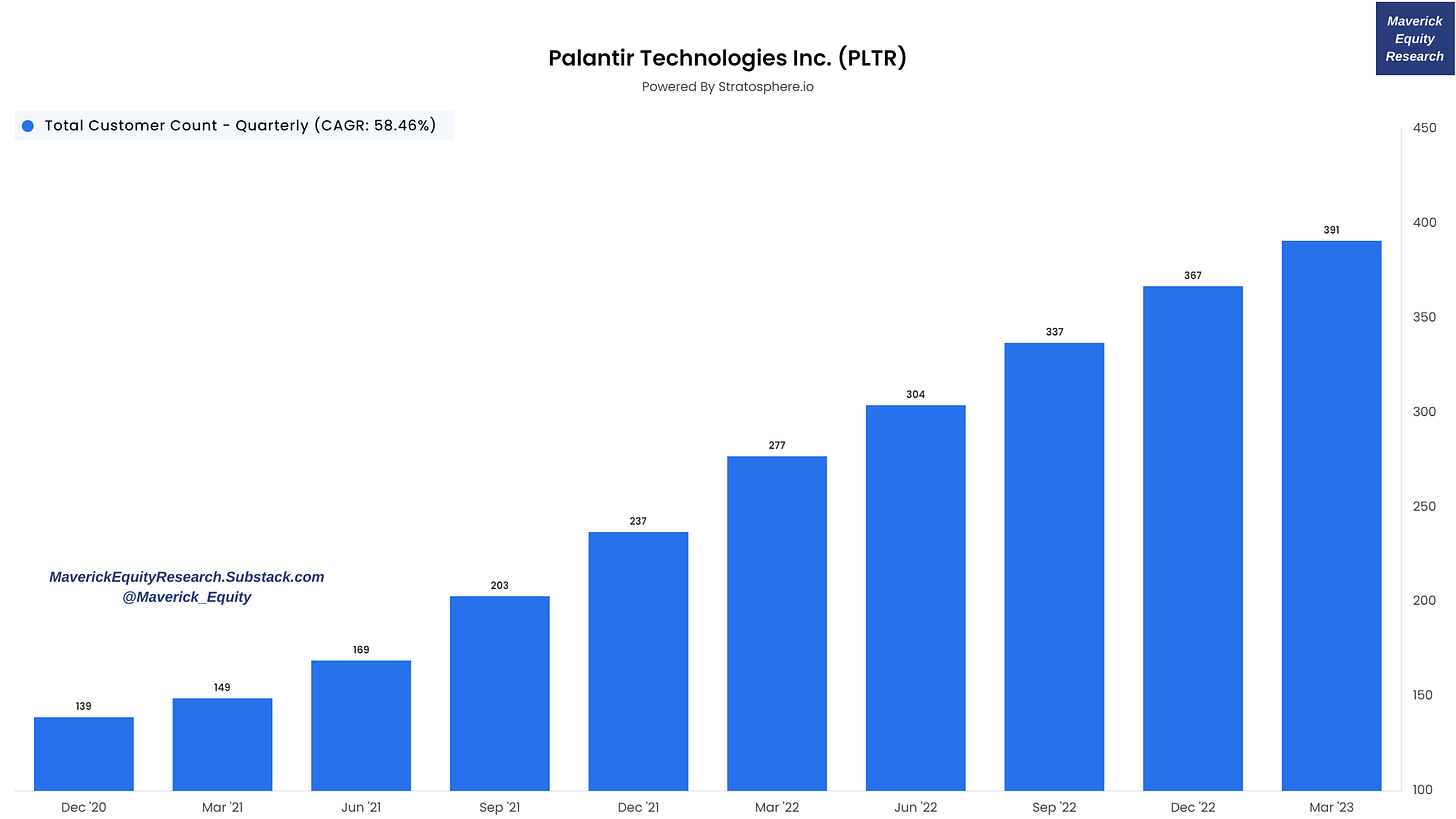

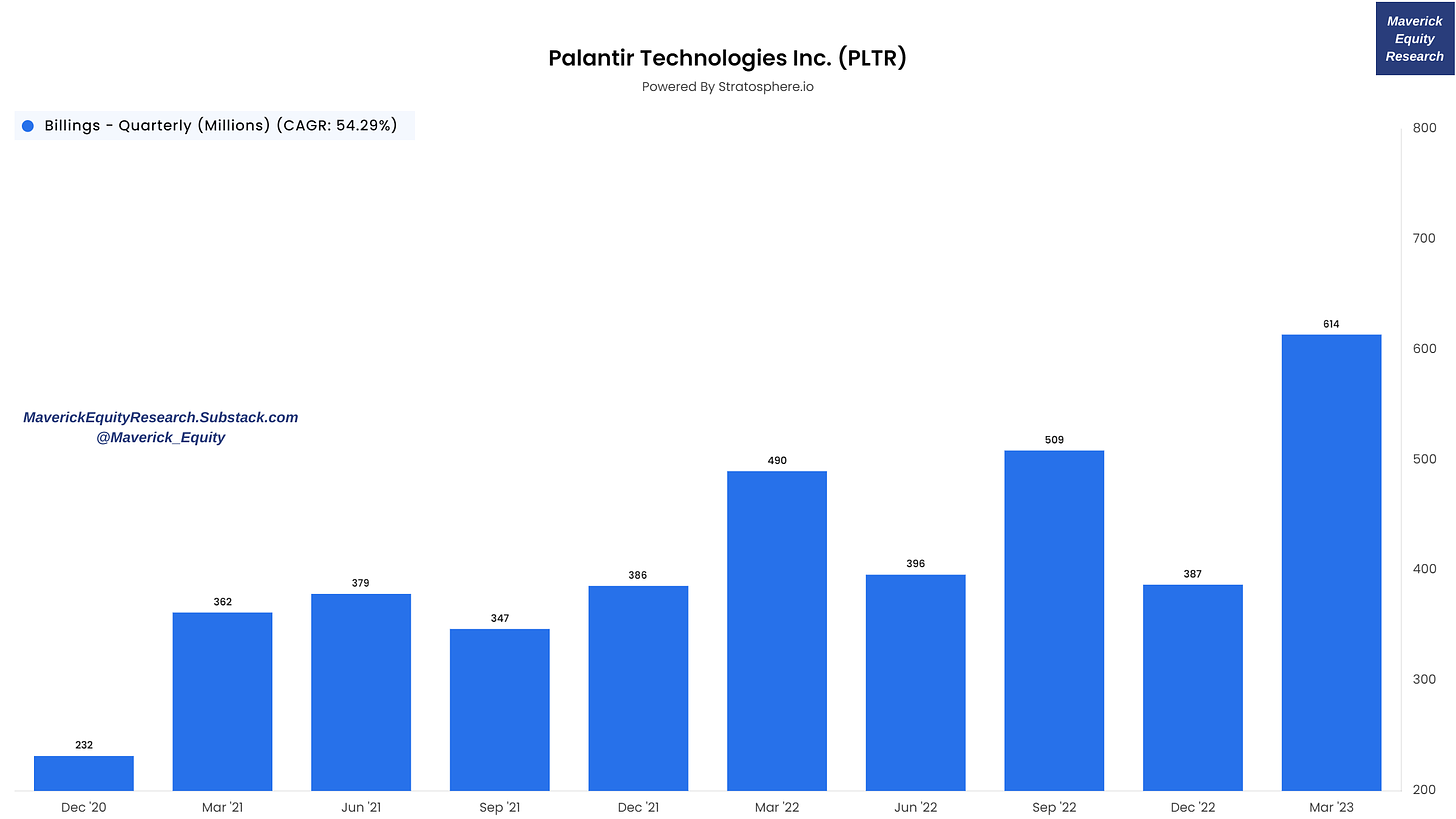

8, 9 & 10. Palantir Technologies (PLTR) business segments & KPIs since public:

Taking from there my favourite 2 KPIs and charting them:

Total Customer Count, quarterly for a 58.46% CAGR:

Billings, quarterly values for a 54.29% CAGR:

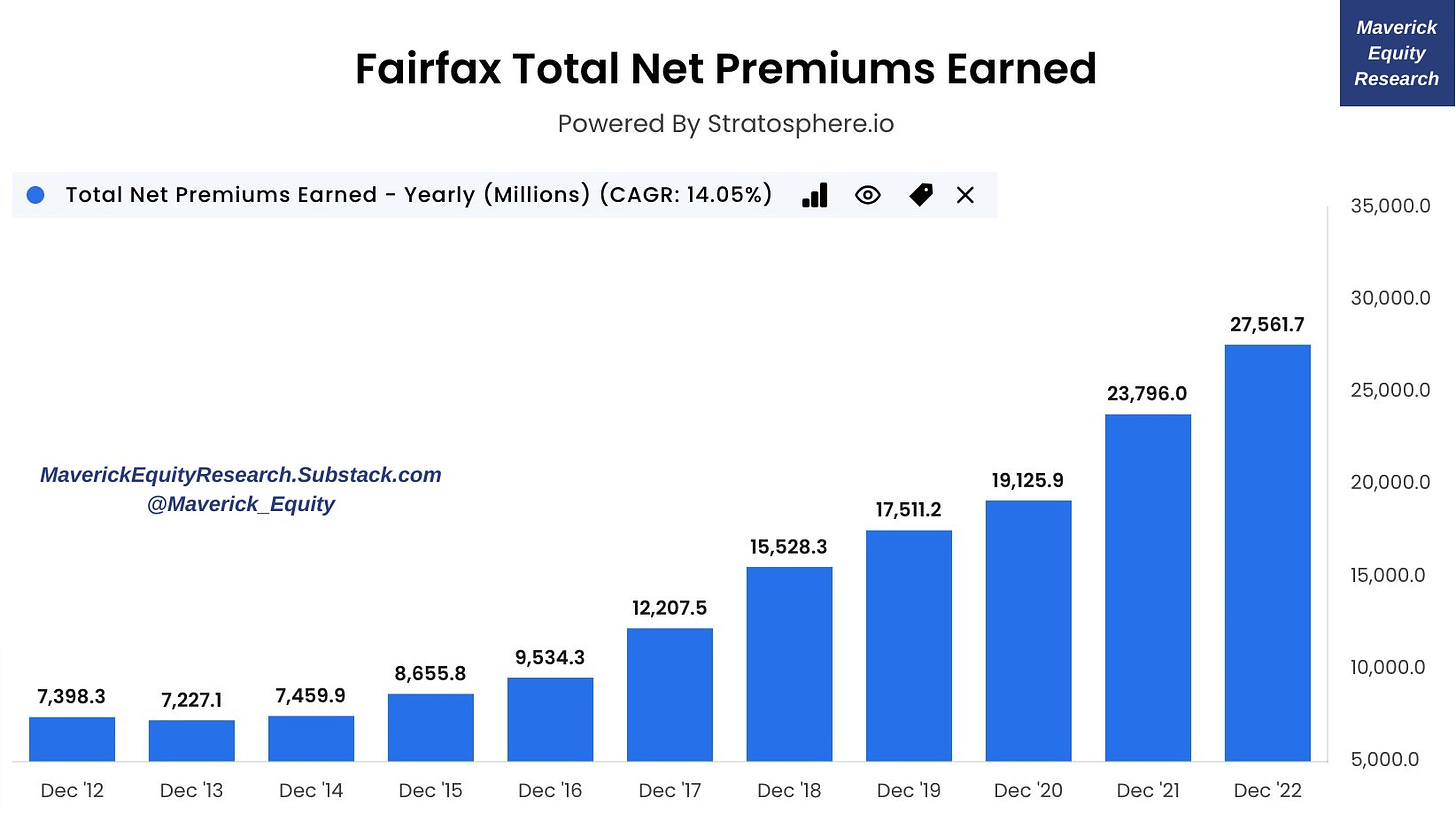

Fairfax (FFH.TO) Total Net Premiums Earned with a 14.05% CAGR since 2012:

Thermo Fisher Scientific (TMO) Lab Products & Biopharma segment revenues:

Spotify (SPOT) Total Monthly Active Users (MAU) & Premium Subscribers:

BRK Revenue breakdown via just 1-click:

Netflix (NFLX) employees & management are not chilling at all given they are very busy growing the Total Average Paying Memberships:

10 Bonus charts:

Guess the best performing stocks from the S&P 500 since 2000? No need to:

How many are popular and barely covered even nowadays, how many are not?

Lesson: great returns in the future are very unlikely to be found with already popular names ... Need to dig where the other players are not ... can't win a tennis or football match with the same basic shots & moves (when you hear anybody talking about 10-baggers or compounders for names that already are big caps and popular names ... give it some further thought)

Nasdaq-100 (QQQ) & drawdown ... very close to guess what? All time highs!

The mighty techie geeky Nasdaq-100 (QQQ) +42% in 2023 with the note via return attribution analysis: 80% of returns are driven by the top 10 contributors

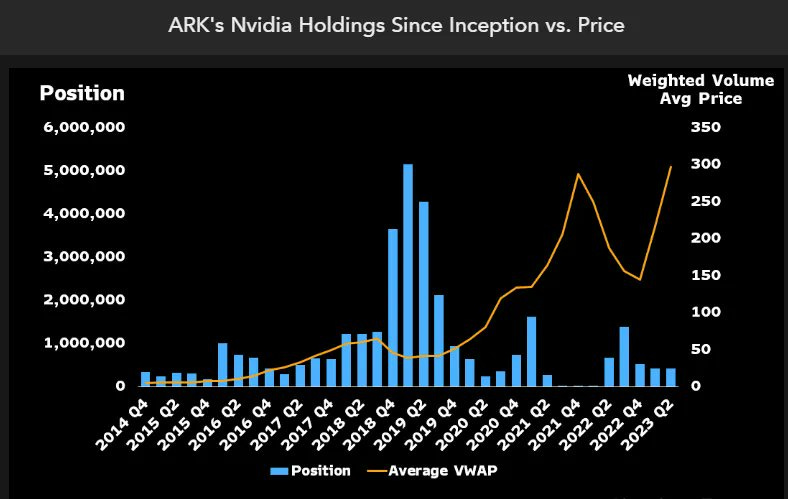

Nvidia (NVDA) and Ark Invest (ARKK), a lot of controversial coverage out there. Let me clear the skies via Ark holding of Nvidia since 2014 inception:

👉 WAS a top holding in 2014 when ARKK launched

👉 IS the 4th biggest contributor to returns overall

👉 SOLD indeed before the recent crazy run, but overall did get quite some out of it

Ark Short & Squeeze Report 4th edition coming out to town this month by the way …

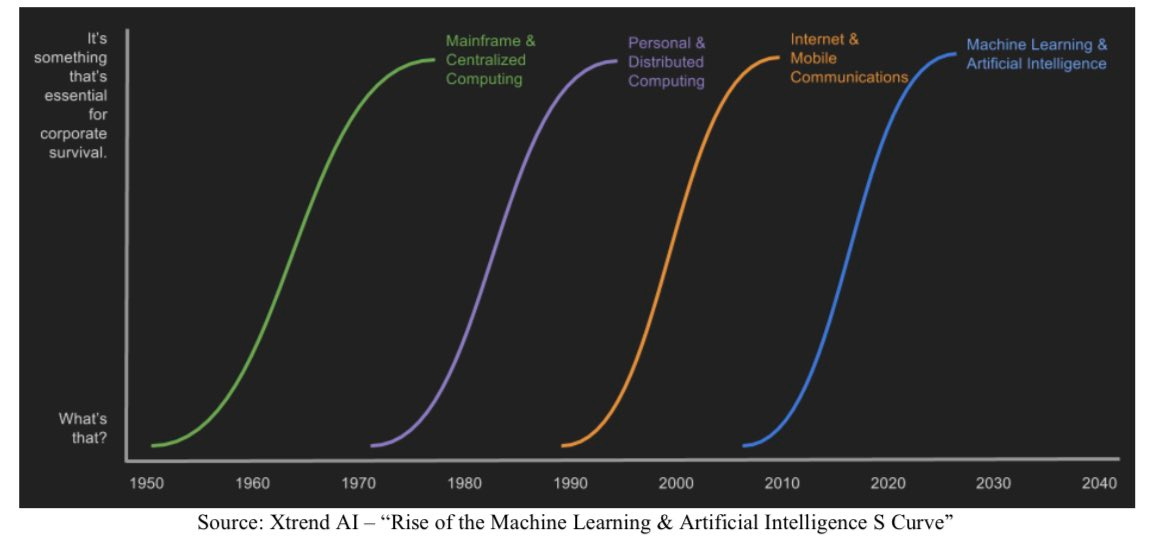

S-curves in tech: "multi-year" ramp up with AI & ML the new wave

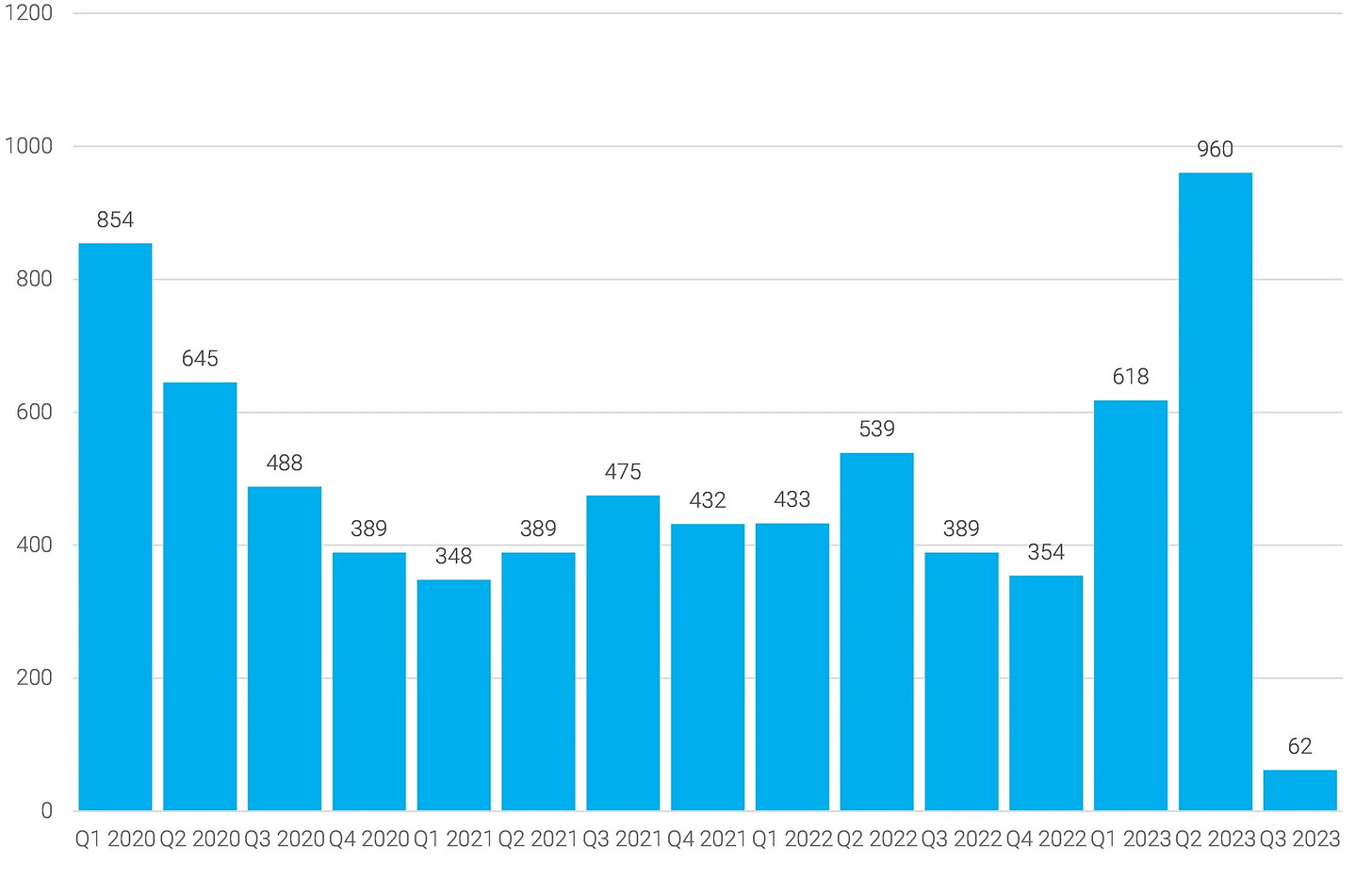

Insider buying at banks is a bullish indicator: nearly 1,000 bank industry insiders made purchases in 2Q23 = materially more than even during the Covid panic

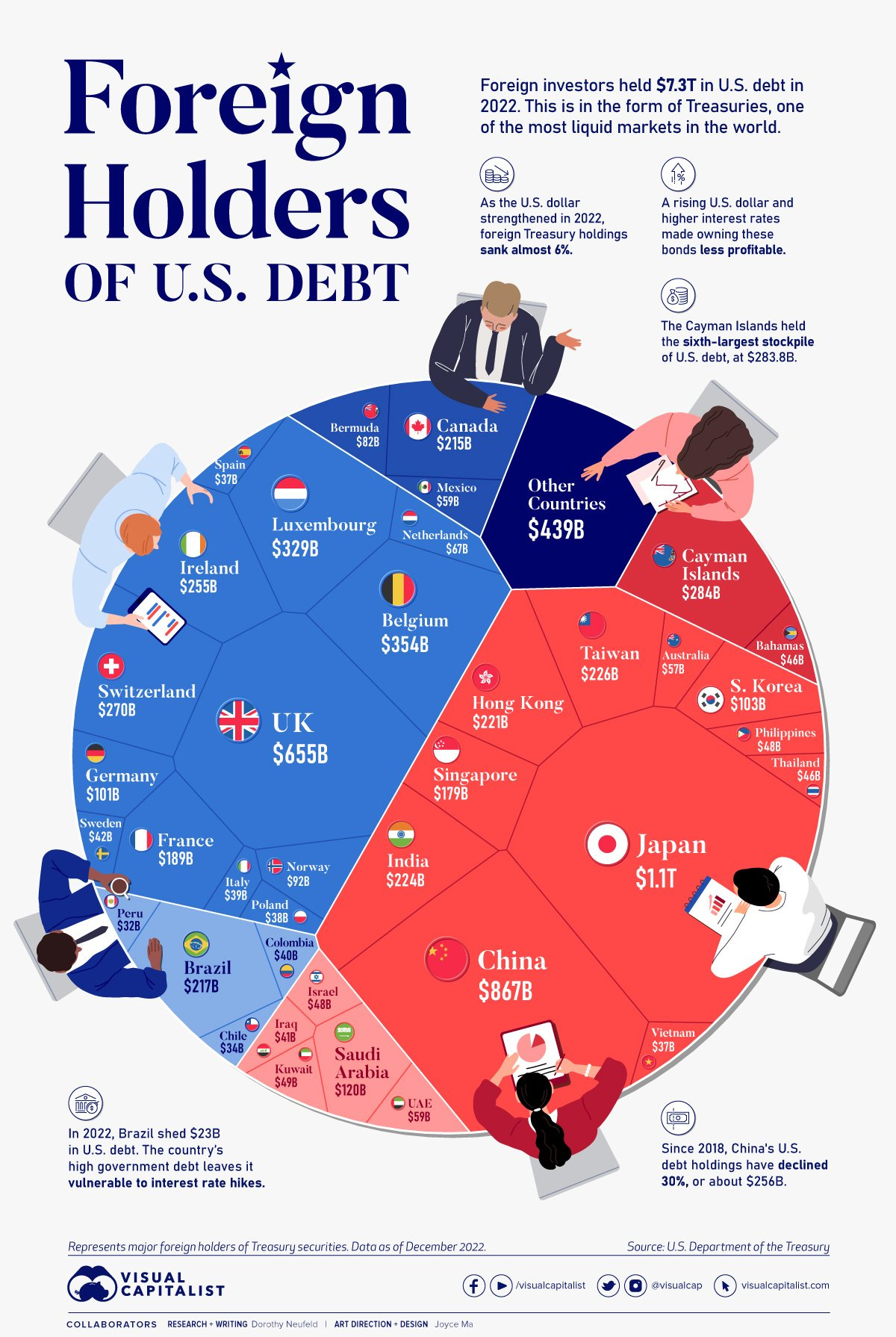

Which Countries Hold Most U.S. Bonds? China & Japan with > 25% from total

Every time you hear doom & gloom US-China spooky headlines, give it a pass. Where do you think Chinese stimulus money & reserves will also end up on & on?

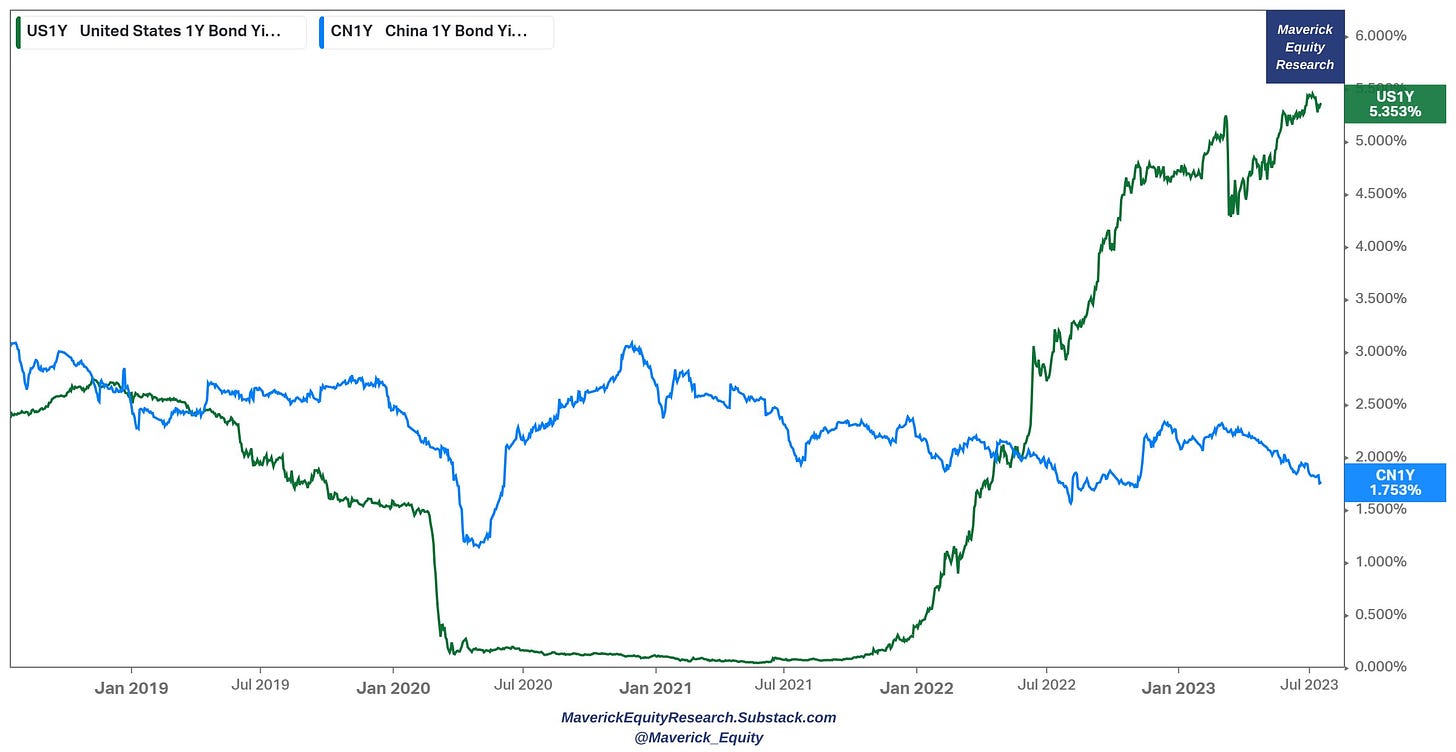

US & Chinese 1-year government bonds chart: with FED hiking still, lowering inflation, Chinese money will be parked into >5% US treasuries paying a very decent risk free return ...

Via export/imports & human capital dynamics, their economies have never been more interconnected which creates dependency … which lowers ‘war’ probability

Don't be ‘the product’ and get click baited for views and ad revenue via rocky & gloomy US Chinese headlines year after year after year … 'trade wars' 'US-China tensions' ‘US President said this VS China President said that’ lulu-lala-lulu-lala…

Oh and by the way, kind reminder: even within families there are natural tensions every now and then (or more often), what about politicians having to showboat to their voters that they are 'doing something' to 'protect the interests of our citizens'? Let that sink in & bring the sink! ;)

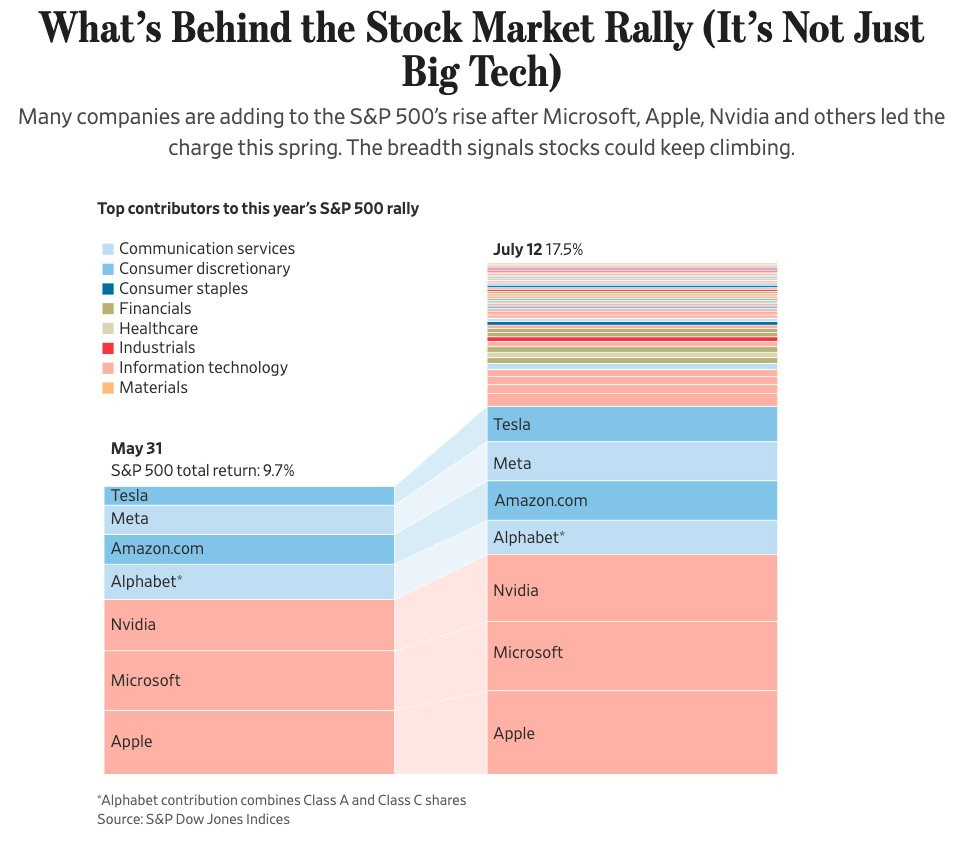

S&P 500 Market breadth is broadening:

over 80% of the index is now trading above 50-day MA

all sectors of S&P 500 have climbed since the end of May

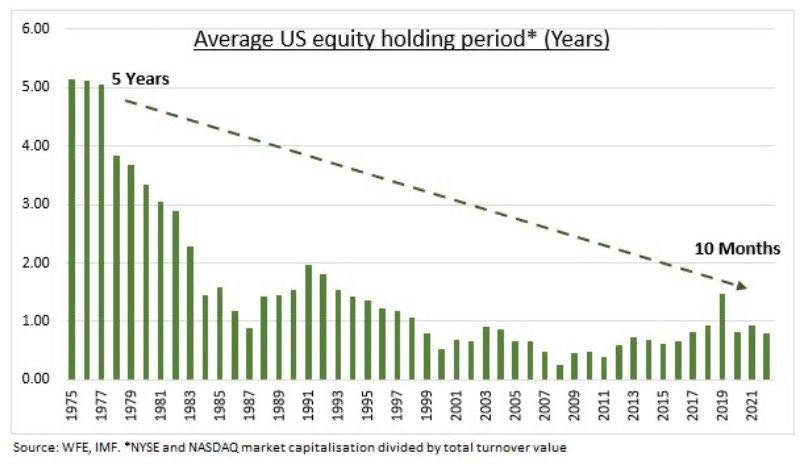

Average holding period for US equities is down from 5 years to just 10 months! Let that sink in! My take is that should be seen as an opportunity via Buffet’s take:

“The stock market is a device for transferring money from the impatient to the patient”

“Time is the friend of the wonderful business, the enemy of the mediocre”

Should you have found this interesting & valuable, share it around with like-minded people and subscribe to get all the research straight to your inbox. Thank you!

Have a great day!

Mav

Thank you !