✍️ Maverick Macro Charts of the Week #14: U.S. GDP, R(ecession) talk, FED Projections, Consumer Expectations + Bonus

Maverick Charts that say 10,000 words

Dear all,

1st of all, Happy 4th of July for all the U.S. folks reading here independent research!

2nd of all, a small admin change:

Maverick Charts section covers Macro & Equities for top-down/bottom-up investing frameworks

going forward, for enhanced clarity, focus and structure it will be split into two as myself and many of you switch back and forth between ‘Macro’ and ‘Micro’ mode, and from there ultimately connecting the dots to valuation and decision-making

✍️ Maverick Macro Charts of the Week (MMCW)

✍️ Maverick Equities Charts of the Week (MECW)

5 cherry picked Maverick Charts of the week say 10,000 words or more = the ‘How’!

Table of contents = the ‘What’:

📊 Maverick Charts: U.S. GDP, R(ecession) talk, FED Projections, Consumer Expectations & Personal Savings Rate

📊 Bonus: Crypto Sentiment

✍️ Incoming Maverick-esque research!

Objective: both data-driven insights + valuable food for thought = the ‘Why’!

📊 U.S. GDP, R(ecession) talk, FED Projections, Consumer Expectations & Savings

U.S. Q2 2025 real GDP tracking via Atlanta Fed's GDPNow (latest from 3rd July):

👉 a decent 2.6% print from the previous 2.4% reading

Very latest from the ‘Trade War 2.0’: just 3 days before the POTUS administration’s initial July 9 deadline for tariffs to return, Treasury Secretary said tariffs will revert back to their April 2 rates on Aug. 1 for countries that fail to set new trade deals

👉 in simple terms, July 9th deadline is basically August 1st now - hence tomorrow on Monday 7th of July and next week = green and new all-time highs are in the cards

👉 therefore after the initial TACO (Trump Always Chickens Out), we now have a more smooth and slim TACO, but still a TACO 😉

In case you missed my TACO vs MATT (Maverick Ate The Taco) chart (which I will update soon), check the Bonus section from ✍️ Maverick Charts of the Week #10: U.S. GDP, Deficit, Household Debt, Cash Allocation, Inflation + Bonus = TACO 🌮

The media R(ecession) talk:

👉 driven by tariffs crashing the economy are cooling off lately, yet still high relatively to the good (not great) state of the U.S. economy

👉 to be sure, coverage regarding tariffs or other policy decisions that are detrimental to the economy is good, though I think the narrative is way too gloom & doom style: because what else gets more clicks for ad-money than fear mongering & polarisation?

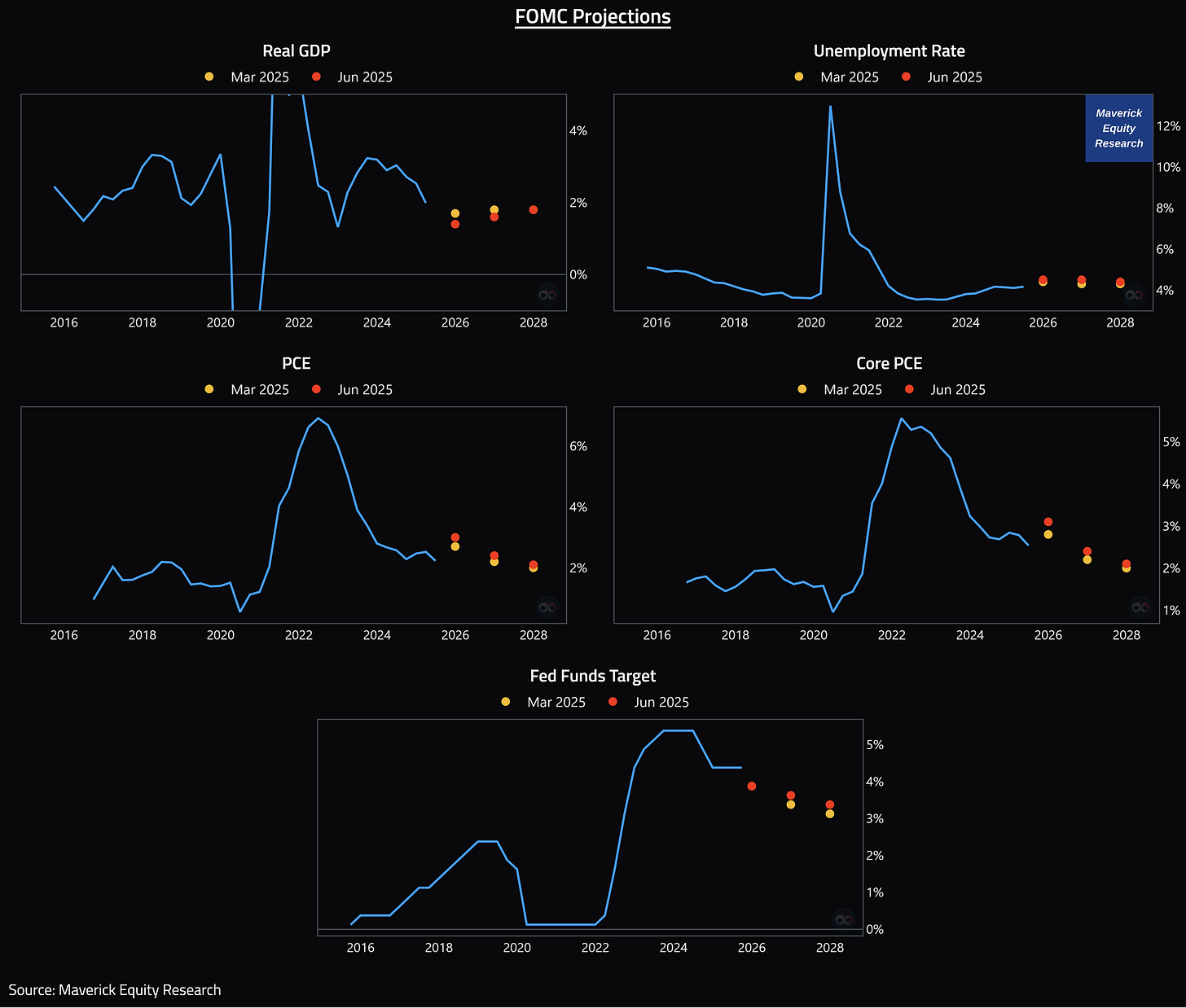

FOMC/FED Summary of Economic Projections (SEP) - March 2025 vs June 2025:

👉 FED downgraded a bit its growth outlook, raised a bit its inflation and unemployment rate forecasts, and penciled in fewer rate cuts for 2026 and 2027

What about Consumer Expectations? Let’s check the NY FED survey:

👉 Probability of Losing a Job (mean): dropped to 14.8% from 15.7%

👉 Probability That Unemployment Rate Will Be Higher One Year from Now (mean): dropped to 40.8% from from a high 44%

U.S. Personal Savings Rate:

👉 good news = rose 60 bps to 4.9%

👉 still below the 7.34% average since 1975 and it would be great if U.S. folks spend just a bit more to save a bit more

Way more on the U.S. economy via my dedicated & extensive macro research. Besides the key macro variables, I will cover also leading indicators & recession probabilities.

The 4th materially enhanced edition is currently work in progress! Stay tuned!

✍️ The State of the US Economy in 75 Charts, Edition #4

📊 Bonus: Crypto Sentiment

Crypto Fear & Greed Index = 66, still below my 80 discretionary threshold

👉 surprisingly crypto bros’ are not that bonkers yet … just give it some time, they will, they always do … I mean it is the most ‘YOLO-esque’ asset on planet earth …

Maverick’s net take:

👉 in general & going forward for a Maverick-esque contrarian approach, consider the 20 (green) & 80 (red) discretionary levels for ‘Buying Fear’ and ‘Selling Greed’ …

👉 coupled naturally with other key metrics/indicators + a good Macro understanding

✍️ Incoming Maverick-esque research!

What is coming next through the independent investment & economic research here What’s next for you? Many drafts are work in progress - below a few selected ones:

✍️ Why Independent Investment and Economic Research = Paramount Nowadays!

common sense is not so common, conflicts of interest are very common, hence independent research for the win!

✍️ Full Equity Research

section start where I will cover in details single businesses/stocks aka deep dives

✍️ S&P 500 Report #6: Valuation, Fundamentals & Special Metrics

coming up with further improved metrics via sleek Maverick charts as always

✍️ The State of the US Economy in 75 Charts, Edition #4

major improvements: leading indicators + recession probability metrics

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this by finding it interesting, saving you time and getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons! That’ll definitely support bringing in more & more independent investment research: from a single individual … not a corporate, bank, fund, click-baity media or so … !

Like this, the big positive externalities become the name of the game!

Have a great day! And never forget, keep compounding: family, friends, hobbies, community, work, independence, capital, knowledge, research and mindset!

With respect,

Mav 👋 🤝

Thank You!