✍️ Maverick Valuations #1 - Canada

Sleek visuals & analytics via Price & Valuation scatterplots … because they say 1,000 words ... and ... further food for thought ...

Dear all,

welcome to the 1st edition of the ‘Maverick Valuations’ report covering Canada via the MSCI Canada ETF (EWC). Sleek visuals & analytics via Price and Valuation scatterplot … because they say 1,000 words.

I plan to expand the Canadian coverage down the road as soon as I get good financial data so that I cover the main Canadian stock indices, equivalent how I did it for US.

Report is NOT behind a paywall & there are no pesky ads here. It would only be highly appreciated if you just spread the word around to likely interested people.

Report structure is the following:

📊 MSCI Canada ETF (EWC) 📊

🏦 Bonus Charts 🏦

What are the various likely use cases provided by this report & visual analytics? Research for market leaders & laggards, likely un/warranted cheap or expensive stocks, peers analysis, stock screener, outliers, positive or negative momentum, relative strength, full equity research on single stocks & general market assessment.

My favorite use cases:

finding future winners via further deep dives / full equity research

finding stocks that did well across past tough times, hence resilient winners … which are likely also going forward to be future winners

finding ‘Pick & Shovel’ businesses that span across industries with many use cases which can make tick 2 boxes in the same time: limited downside risk though still keeping good potential upside

Great to have at hand at least 8 times per year: before & after each of the 4 quarterly earnings. An overall yearly recap is also very interesting. Let’s see after most Q4 2022 earnings are out & usefully compare going forward with the future editions. Check your stocks & also outliers in the scatterplots, it can get interesting & food for thought.

📊 MSCI Canada ETF 📊

Let’s dive into the MSCI Canada ETF (EWC) which was created in 1996 & consists of 95 large & mid-cap stocks (including those in the main S&P/TSX 60 index). It covers diversified sectors & covers both growth & value stocks. For more info, the ETF constituents by name, ticker and sector can be found here while the factsheet here.

10 visuals total now from my side:

Introduction before anything, the overall 5 year Total Return:

Note: EWC has a 0.5% fee / year, hence on the medium-long term it can be a material dragger on the compound interest for investors vs buying the individual names.

Price action views:

2023 YTD Winners & Rebounders from their 52-week low

2023 YTD Winners & Total Return for 2022 to answer the research question: which stocks were positive both in the 2022 bear market and up to today in 2023?

Valuation views via:

Sales/Revenue aka ‘Top-line’ view: P/S multiple & Revenue growth (next year estimates). Interpretation: Forward P/S multiple the stock is trading at for the given level of estimated Sales growth

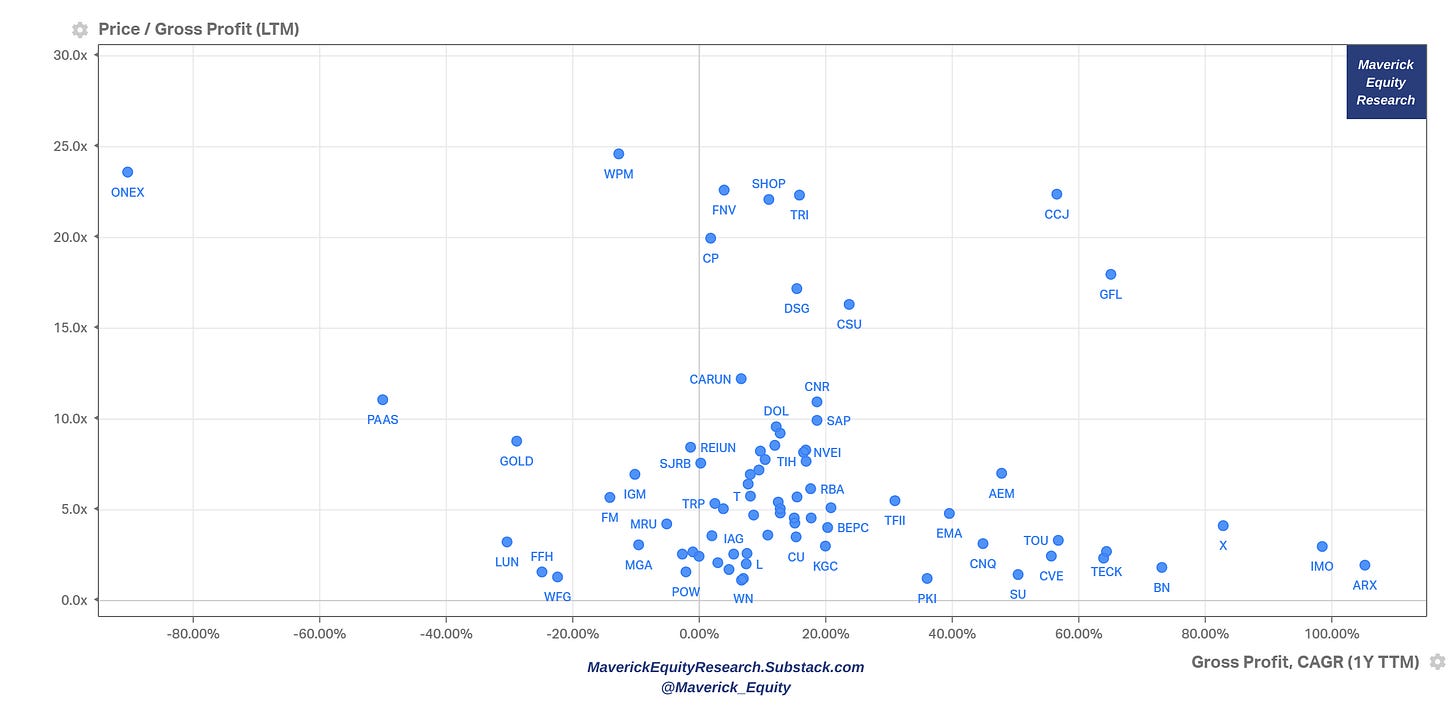

Gross Profit aka ‘gross’ view: P/GP multiple & Gross Profit CAGR (last twelve months). Interpretation: P/GP multiple the stock is trading at for the given level of Gross Profit growth

Profitability aka ‘Bottom-line’ view: P/E multiple & Earnings/EPS growth (next year estimates). Interpretation: Forward P/E multiple the stock is trading at for the given level of estimated Earnings/EPS growth

Free Cash flow aka ‘cash’ view: P/FCF multiple & FCF/Share (last twelve months). Interpretation: P/FCF multiple the stock is trading at for the given level of FCF/Share

Lastly via a side angle, 2 Enterprise Value (EV) multiples: EV/EBITDA & EV/EBIT

EBITDA view aka loose proxy for Cash Flow from Operations (CFO): EV/EBITDA & EBITDA growth (next full year forward estimates)

EBIT view aka core operations aka operating profit view: EV/EBIT & EBIT growth (next full year forward estimates)

Side note visual for Sales to EBITDA … to Net Profit. Naturally, more to the story once going into specific industries, sectors and single names … comparability is key.

🏦 Bonus Charts 🏦

Have you ever wondered about the combined Short Interest & Total Return on these big Canadian basket of stocks? 3 visuals total and a takeaway: stocks with high return & low short interest can be seen as carrying positive sentiment & resilient winners.

Total Return in 2023 vs Short Interest: some short could have worked

Total Return for the past 12 months vs Short Interest: given the 2022 bear market, some more shorts could have worked

Total Return for the past 3 years vs Short Interest: but it’s hard to stop a moving train & shorting blue chips from essentially any market, will likely result in losses the more one holds the position … unless short term & super due diligent, very hard business.

I hope you enjoyed this research & it would be great to hear your feedback! Should you have found this interesting and valuable, just subscribe & share it around with likely interested people as well. Twitter post can be found here. Thank you!

Have a great day!

Maverick Equity Research

‘which stocks were positive both in the 2022 bear market and up to today in 2023?’, thank you, that was great insight … very interesting overall

thanks, great to see also some Canadian coverage ... cheaper market than US overall ...