✍️ Maverick Charts & Markets - April 2024 Edition #17

US Manufacturing, Apple, Google, Meta, Mag 7, Tesla and Berkshire, Small Caps, Bonds, Bitcoin and MicroStrategy, Gold, Money Market Assets and ... AI!

Dear all,

Happy Easter to all the Christian Orthodox people (like me) who celebrate now the Easter holiday! Wishing you all a season filled with peace, joy, and beautiful weather!

There you go with April’s 25 charts + bonus that say 10,000 words covering Macro, Stocks, Bonds & More which also naturally connects the many dots with Geopolitics. The way this monthly wrap ups are done is so that many can connect their own dots!

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons! That’ll definitely support bringing in more & more independent investment research!

First of all, the quote of the weekend is coming from the one and only, Warren Buffett:

"I think that the most important investment you can make is in yourself."

"I read everything: Annual reports, 10-Ks, 10-Qs, biographies, histories, five newspapers a day. On airplanes I read the instructions on the backs of the seats. Reading is key. Reading has made me rich over time."

From the world of Macro

You will never guess this Macro Chart of The Week which is rarely pointed out!

US Manufacturing Construction Spending since 2020

👉 soon 3x since 2020, let that sink in! Quite a why the economy is doing well imho

👉 note: JPM's Jamie Dimon on the US economy said recently “Basically, it's booming.”

N.B.✍️ The State of the US Economy in 45 Charts, Edition #3 is work in progress from my side ... for the 1st and 2nd editions just check them out in the ‘Macro’ section

From the world of Stocks

Tesla (TSLA) and Berkshire (BRK)

👉 in 2021 Tesla was 2x the value of Berkshire which compounded like nobody else for 6 decades via legendary investors Buffett and Munger ... bonkers!

👉 Berkshire is back and 50% more valuable than Tesla ... which is rather fair via my (subjective) eyes ... I always said when Tesla was 2x the value that something is off there ... no matter how good the business is ...

3 & 4. Apple (AAPL) time:

👉 they announced a huge $110B stock buyback program = the LARGEST in history (not just Apple’s own history, but in the history of capital markets)

👉 an Apple buy-back a day, keeps one's returns not away ... to make a fun word-play

👉 chart shows the quarterly buybacks since almost 15 years … a lot …

Apple, Apple … and what about their suppliers?

👉 there you go with a sleek GS basket and their performance with top weightings: AVGO: 21%, MU: 12%, TSM: 9%, QCOM: 9%, APH: 8%

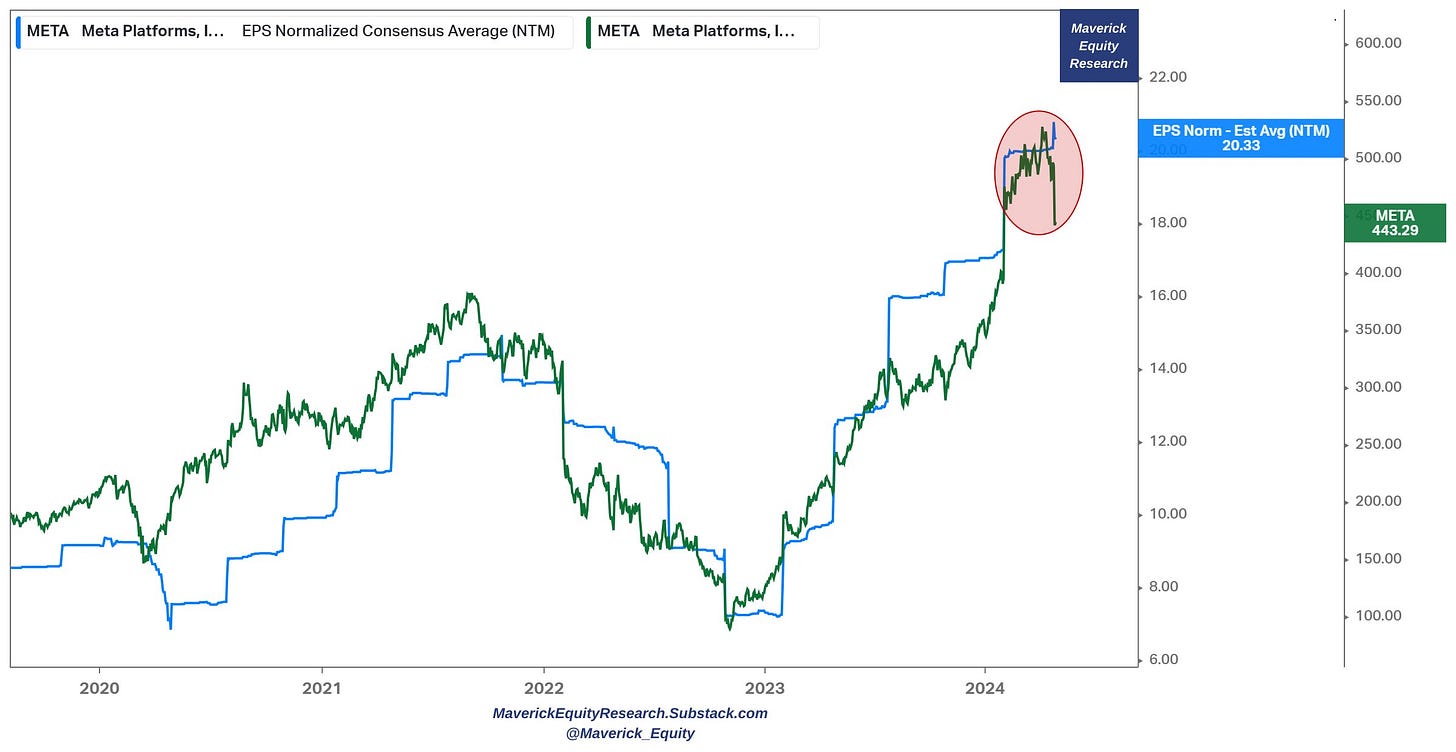

Meta/Facebook (META) earnings: price DOWN, though EPS estimates UP …

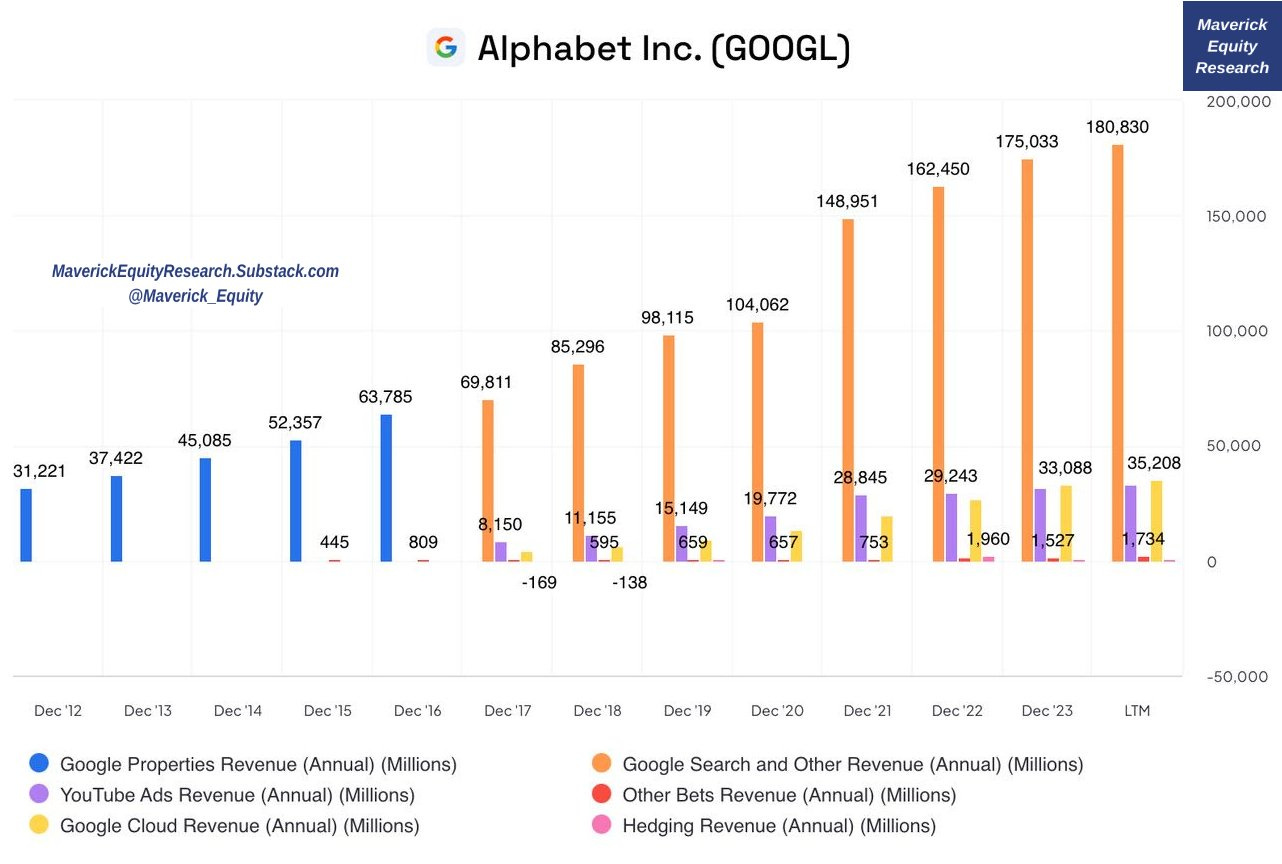

Google (GGOGL) time via its various KPIs as Revenue:

👉 Google search rocks the world as we know it since years ...

👉 note: YouTube Ads revenue expanding more and more, 11% of revenue now ... content creator economy is big ... (Google bought YouTube for $1.65B in October 2006 ... not bad, ha?)

👉 the latest key note from the CEO Pichai: Google has managed to lower the cost of showing artificial intelligence–generated answers to queries 80% over the last year

7-10. Techie "Magnificent 7", the S&P 500 & rates - 4 charts that say 10,000 words!

👉 the technology sector historically the least regulated of the sectors and in past 12 months the average tax rate was 15% vs 21% for rest of S&P 500

👉 they are back above 30% of the S&P 500 total market cap … quite a stat …

👉 Sales growth & Net margins since 2013 + estimates: higher and higher

The Mag 7 were once seen a play on low interest rates, now they are the opposite also

Small Cap Valuations Remain Low

👉 Large cap stocks outperformed small cap stocks in 2023

👉 Small cap stocks continue to trade at low valuations relative to their long-term history versus large cap stocks

Small caps indeed is what I will cover among others via my independent investment research publication. The dedicated section will be 'Full Equity Research’.

S&P 500 returns in 2024 (chart 1) and EPS growth for the past 5 years (chart 2) via the biggest single names in the 11 sectors and the 24 industries

👉 great returns via very solid earnings growth ...

👉 spot the positive and negative outliers + your top names ... and connect the dots ...

👉 which ones jump to you, you own and/or find interesting? ... food for thought ...

N.B. in case you missed my S&P 500 two distinct deep dives reports, there you go:

✍️ The S&P 500 Report: Performance, Profitability, Sentiment & More - #Ed 5

✍️ The S&P 500 Report: Valuation, Earnings & Fundamentals + Special & Alternative Metrics - #Ed 5

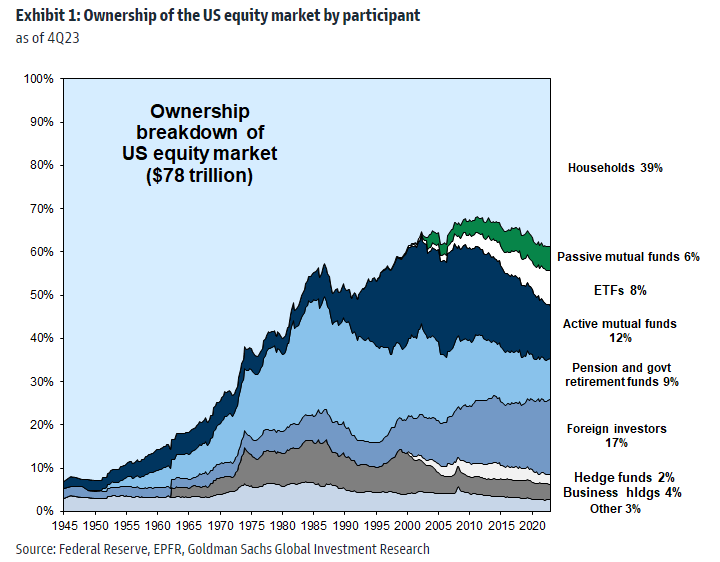

Who owns the US stock market ? Breakdown by investor type:

👉 households 1st with 39% of the share

👉 foreign investors 2nd with 17%

👉 active mutual funds 12%

👉 pension and gov retirement funds 9%

👉 ETFs 8%

👉 passive mutual funds 6%

👉 Rest is quite peanuts, does not matter much ...

Main take away ? Market is structurally net long ... it's hard to stop this moving train ... put that into memory as an investor ...

The Biggest Passive Hedge Fund in the World has 2,500+ stocks with a market value of $136 billion ... top position = Apple ... well, the Mag 7 actually: Apple, Microsoft, Amazon, Nvidia, Google, Meta and Tesla. Just joking ... :

👉 this is the Swiss National Bank with hedge fund / mutual fund level of assets ...

👉 not active ... just tracks MSCI World approx ... with a 80/20 allocation between bonds & stocks (algorithmically rebalanced)

From the world of Bonds/Cash/Credit

15-19. There is a decent alternative now to stocks, and that is short-term bonds!

👉 the 2-year is yielding 4.8% while the S&P 500 yield is 1.3% = the biggest gap since the 200s Dotcom bubble

👉 before the 2007-2009 GFC we also saw this pattern as interest rose … and since then, low yields (low cost of capital) made for a great decade+ rally in stocks

👉 The 'FED/Greenspan model' is back one could say = higher yields on bonds would require a higher earnings yield (the inverse of the price/equity multiple) from stocks ... and for the 1st time in 22 years, the FED model points to treasuries ...

👉 the economy & stock market are doing fine, no big issues from high interest rates … and sure, the S&P 500 has also price appreciation, earning yields but still … we have an alternative now which pays … getting paid to chill

Is that seen in Money Market Assets? Yes!

👉 ATH above $6 trillion with $23.6 billion flowed in the week through May 1st

High interest rates (shown via the Fed Funds Rate in red), make for higher & higher money market assets! While where you think it would go when we have lower & lower interest rates? Stocks! Why? the mechanism you might ask?

👉 money markets funds will pay less and less

👉 stocks will benefit from a lower cost of capital / discount rate more and more

Short term bonds (BIL ETF) VS long term bonds (TLT & ZROZ ETFs) since 2021

👉 strong hiking interest rates made T-bills pay more and more and more

👉 while making long term bonds going down big time - e.g. ZROZ ETF has a duration of 25 years which = if interest rates go UP 1%, value drops 25%

By the way, who owns the $25 Trillion US Treasuries market?

👉 foreigners (Japan 1st, China 2nd)

👉 mutual funds

👉 and the … FED

N.B. if you missed it, my 2-part series on cash/credit/bonds:

✍️ My name is Bond, Yield Bond! The Return of Yield! Getting Paid to Chill ... (I)

✍️ My name is Bond, Yield Bond! The Return of Yield! T-Bill & Chill ... T-Bond & Long (II)

From the world of Bitcoin

20 - 23. Bitcoin and its drawdowns for the past 10 years

👉 70-80% drawdowns are not uncommon, quite a patter actually: 3 times in 10 years

Bitcoin and MicroStrategy (MSTR):

👉 Short MicroStrategy with Long Bitcoin has been working very well and more room to close the 'gap .... or just short MicroStrategy ...

👉 usually Bitcoin is that overshoots not MSTR 'tracker' which holds 214,246 Bitcoins

👉 and where CEO keeps selling shares to buy more bitcoin to keep the machine working and to put real dollars into his pocket ... heads I win, tails I win ...

👉 not a bad business model at all ... but I wonder how good for bitcoin investors ... cause for bitcoin traders I know they are 99%+ losing money

Bitcoin Average Mining Costs

👉 Bitcoin price = $62,000 … vs … Average Mining Costs = whooping $96,000

👉 no wonder the Bitcoin Miners aren't experiencing the same euphoria as Bitcoin

From the world of Gold

24 & 25. What about Gold and the 10-year treasury?

👉 historically, Gold exhibits an inverse relationship with the 10-year treasury

👉 note though, since the beginning of 2020 Gold and the 10-year treasury have both been trending upwards …

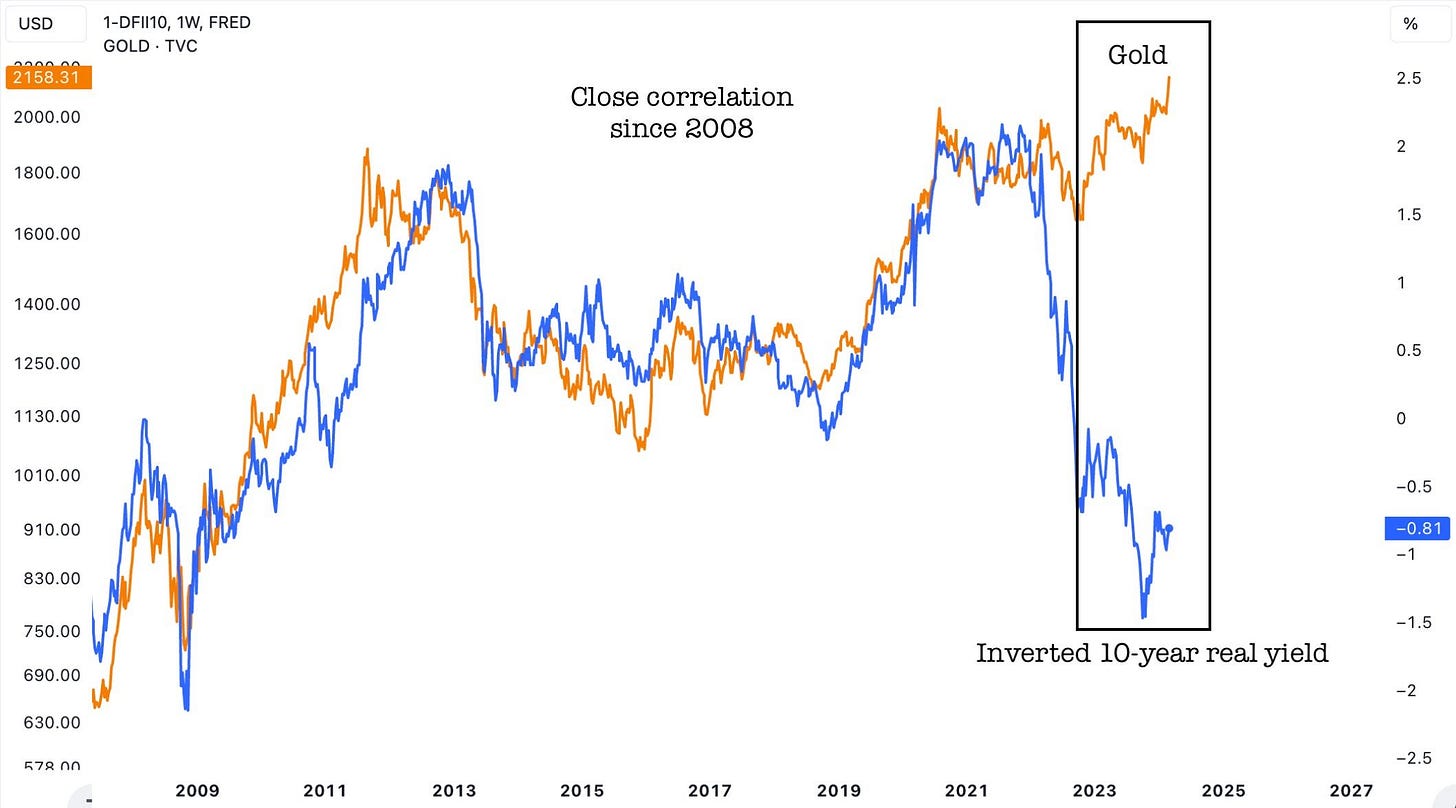

Complementary, gold and the 10-year real yield (inverted):

👉 a very good correlation since 2008 ...

👉 yet since 2022 or so, decoupled materially, hence defying a 13-year relationship

Takeaway: gold is strong ... went up despite the real yields moving higher …

👍 Bonus charts - AI edition!

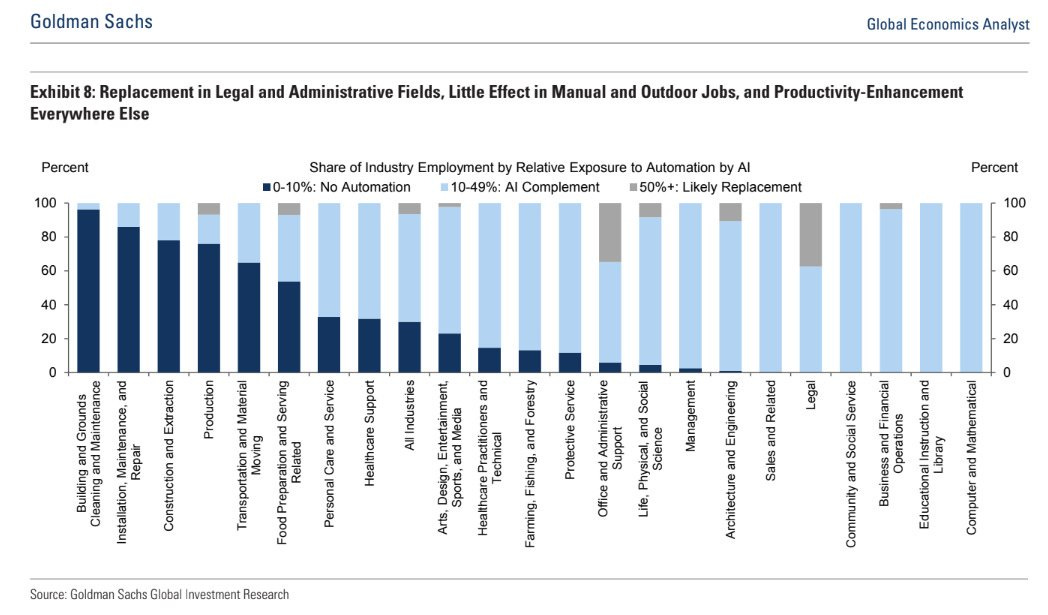

AI impact on jobs

👉 legal and admin fields the most, manual and outdoor jobs the least ...

👉 productivity-enhancement everywhere

The AI Factor

👉 at present, around 4% of all US firms have adopted generative AI, but Goldman Sachs Research expects that figure to rise to 7% over the next six months ...

👉 the adoption will be led by some sectors more than others: in information services, for instance, the adoption rate is forecast to rise from 16% to 23% in 6 months

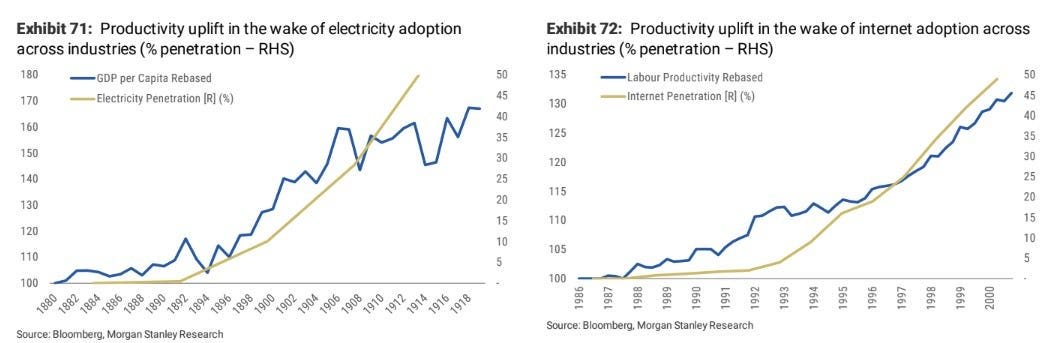

Historical throwback on innovations and adoptions

👉 productivity gains in the wake of electricity and internet adoption

👉 how curvy will be the AI curve? Parabolic, somehow 'Curvilcious' or slow?

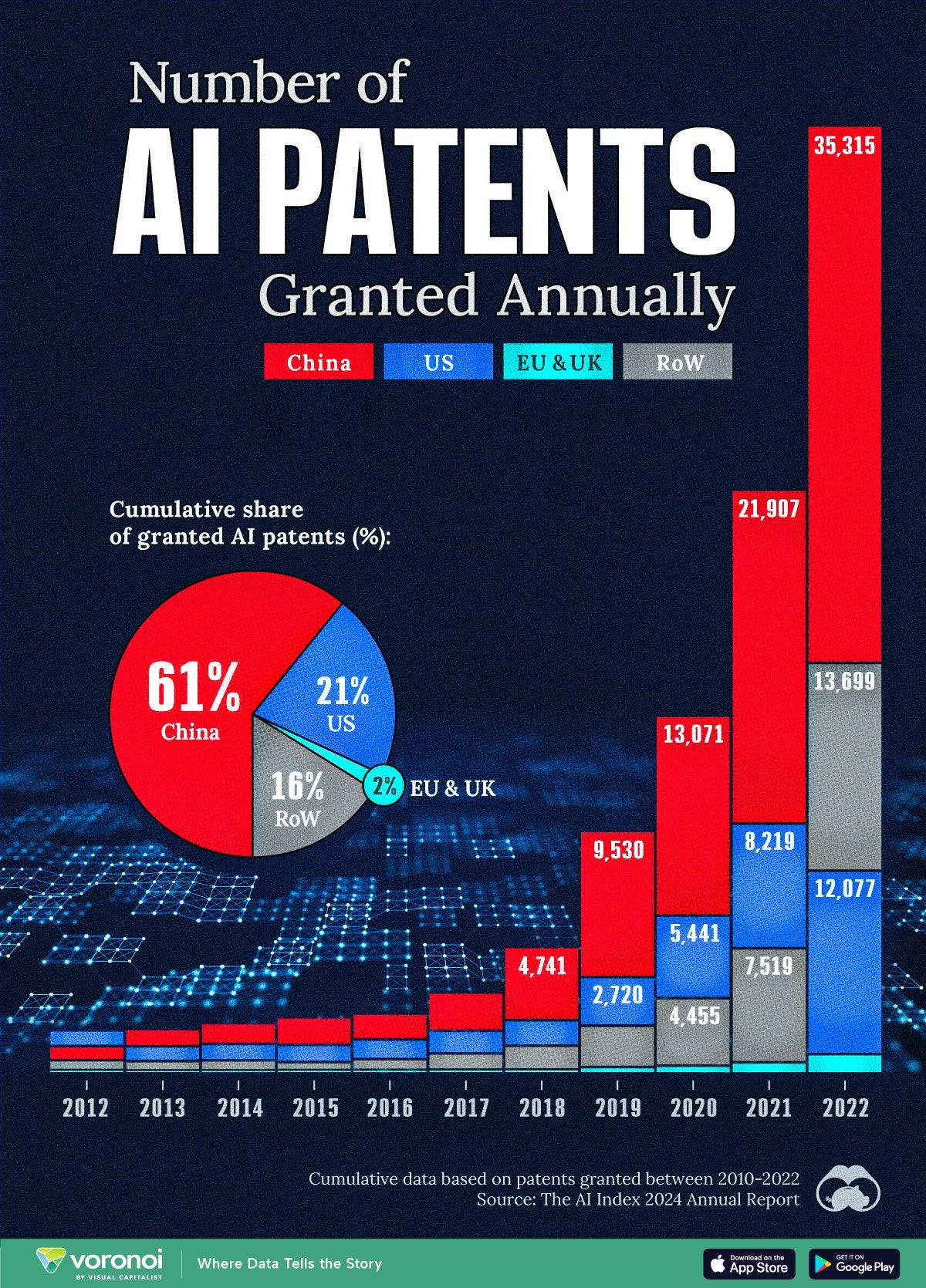

Visualizing AI Patents by Country by each year from 2012 to 2022

👉 China first overtook the U.S. in 2013. Since then, the country has seen enormous growth in the number of AI patents granted each year

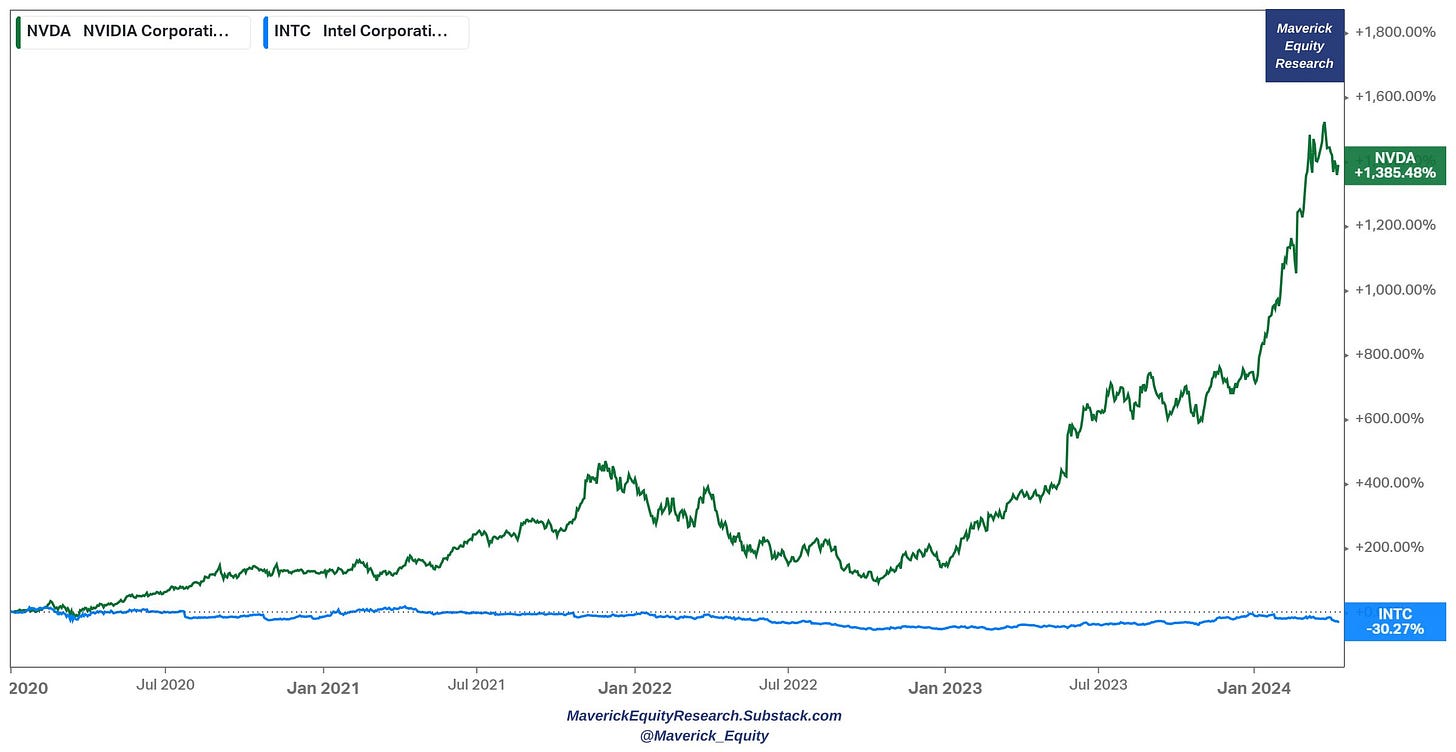

Semiconductor Companies by Industry Revenue Share

👉 Market leader & industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50bn in 2023, or 10% of the broader industry’s topline

👉 Meanwhile, Nvidia is close to overtaking Intel, after $49 billion in 2023 = more than 2x its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%

👉 Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year

Nvidia and Intel stock performance, not much to comment … let that sink in!

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this extensive research by finding it interesting, saving you time & getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons! That’ll definitely support bringing in more & more independent investment research: from a single individual … not a bank, fund, click-baity media or so … !

Have a great weekend!

Mav 👋 🤝

Happy Easter man! Thank you for your always solid work!

Happy Easter