✍️ Maverick Charts & Markets - February 2025 Edition #23

U.S. Economy CAPEX, S&P 500, Warren Buffet's record cash pile, META, ASML, Amazon, Monster, Spotify, Big Tech CAPEX, Booking Holdings, AirBnB, Expedia, Alibaba, NuBank, MercadoLibre & Russia-Ukraine

Dear all,

there you go with February’s 20 charts + 5 bonus that I carefully did & cherry picked.

Report structure is as always:

📊 Maverick Charts & Insights

👍 Bonus charts: 3 years of Russia-Ukraine war - key stats and questions answered

Delivery is in typical Maverick fashion, via charts that say 10,000 words covering Macro, Stocks, Bonds & more which also naturally connects the Geopolitics dots.

📊 Maverick Charts & Insights 📊

Firstly, Happy International Women’s Day for the 8th of March celebration! 💐

👉 Warren Buffett on women’s careers, contribution & role in the workforce overall:

“Start with the fact that our country’s progress since 1776 has been mind-blowing, like nothing the world has ever seen. Our secret sauce has been a political and economic system that unleashes human potential to an extraordinary degree. As a result Americans today enjoy an abundance of goods and services that no one could have dreamed of just a few centuries ago.

But that’s not the half of it – or, rather, it’s just about the half of it. USA has forged this success while utilizing, in large part, only half of the country’s talent. For most of our history, women – whatever their abilities – have been relegated to the sidelines. Only in recent years have we begun to correct that problem. When I look at what we have accomplished using half our talent for a couple of centuries, and now I think of doubling the talent that is effectively employed or at least has the chance to be it makes me very optimistic about this country”.

👉 A special and rare Maverick-esque chart - Women in the S&P 500 Leadership: big progress has been made with 8.2% of the S&P 500 companies having female CEOs

Maverick’s take: male/female, local/foreigner, tall/short, fat/skinny, white/black … you name it … all this is irrelevant, all what truly matters are values, respect, going for the win-win mindset, kindness, skin in the game and bringing value to ones community. What defines ‘value’ can be different from person to person, from context to context, but overall the principles above are a common denominator imho. The most important thing is NOT equality of outcome, but equality of opportunity.

Maybe for me it is easier to really get that as I lived and worked in 7 countries and 2 continents (from very emerging to very developed societies), but I truly believe humans are made for progress, problem solving, and for adding to the overall pie.

"Take a heroic route for the benefit of the collective. As narrowly or broadly defined as you want. So long as it's someone else. You are as good as what you do to other members. So, virtue is inseparable from courage .So, we had to take some risks (personal, financial, whatever) for the sake of others. That’s success. That’s honor!" via Nassim Taleb

“You must live for another if you wish to live for yourself.” via Seneca

“Every person must decide at some point, whether they will walk in the light of creative altruism or in the darkness of destructive selfishness.” via Martin Luther King Jr

For more on that, in case you missed my previous take:

✍️ Who Is On Your Team in 2025 And Beyond? Maverick Principles & Food For Thought #3

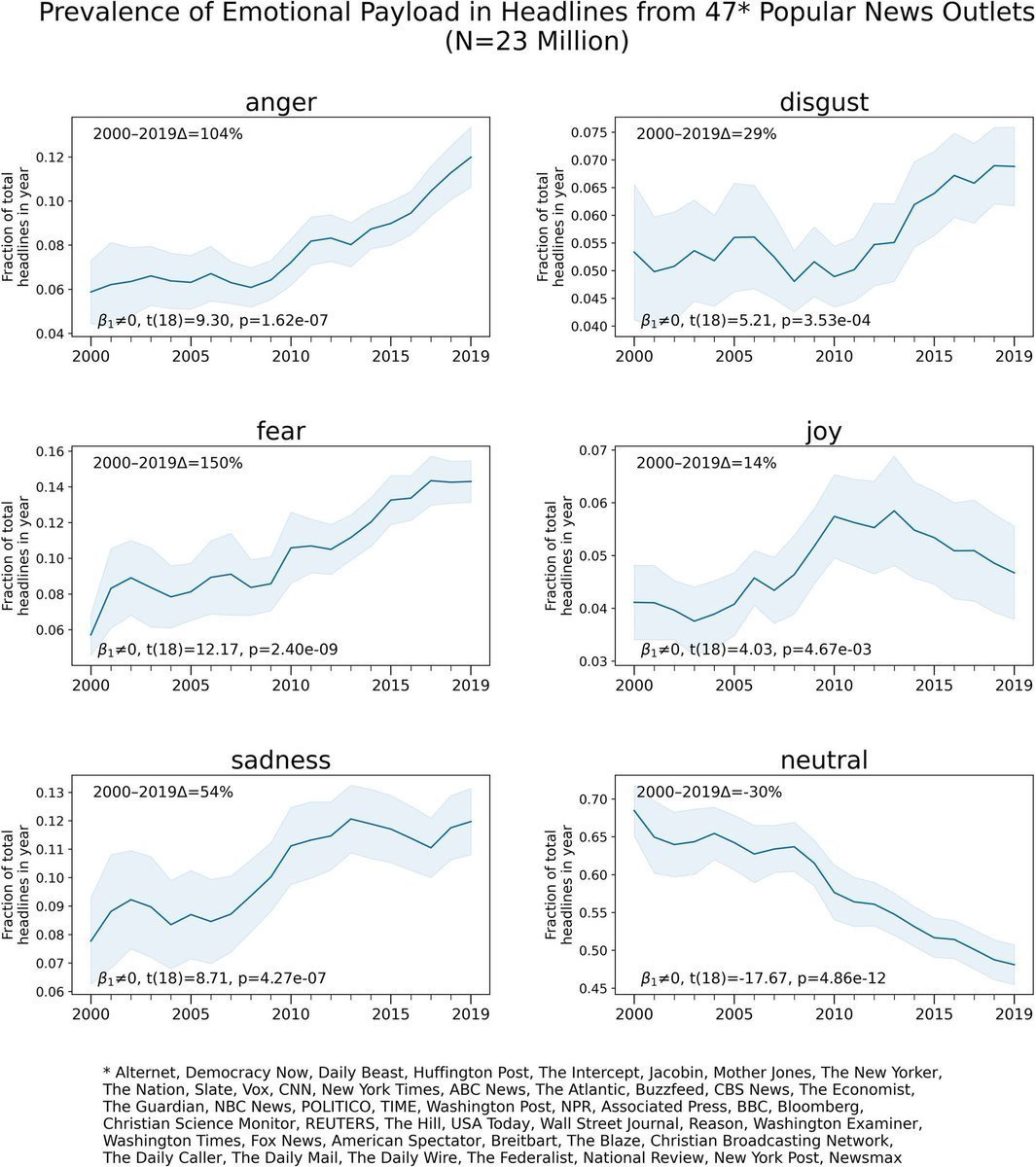

Transitioning from a personal view to a data based macro view: recall my take on ‘The Rise of Negative Media’ for clicks & views for advertising money, and that is because the algos are made as such, that is the way it attracts views (not insights)!

👉 there is a huge negative news positive bias, and a big positive news negative bias: since 2010, the media massively increased headlines that use fear, anger, disgust, and sadness. Correspondingly, it has also decreased articles of neutrality and joy

👉 it's no surprise that few media outlets are covering this meta point, isn’t it?

👉 hence, this is by far the reality on the state of the world & people’s behaviours … don’t let this circus take over and influence your view of the world …

From principles, mindset and philosophy to economics, finance and investments:

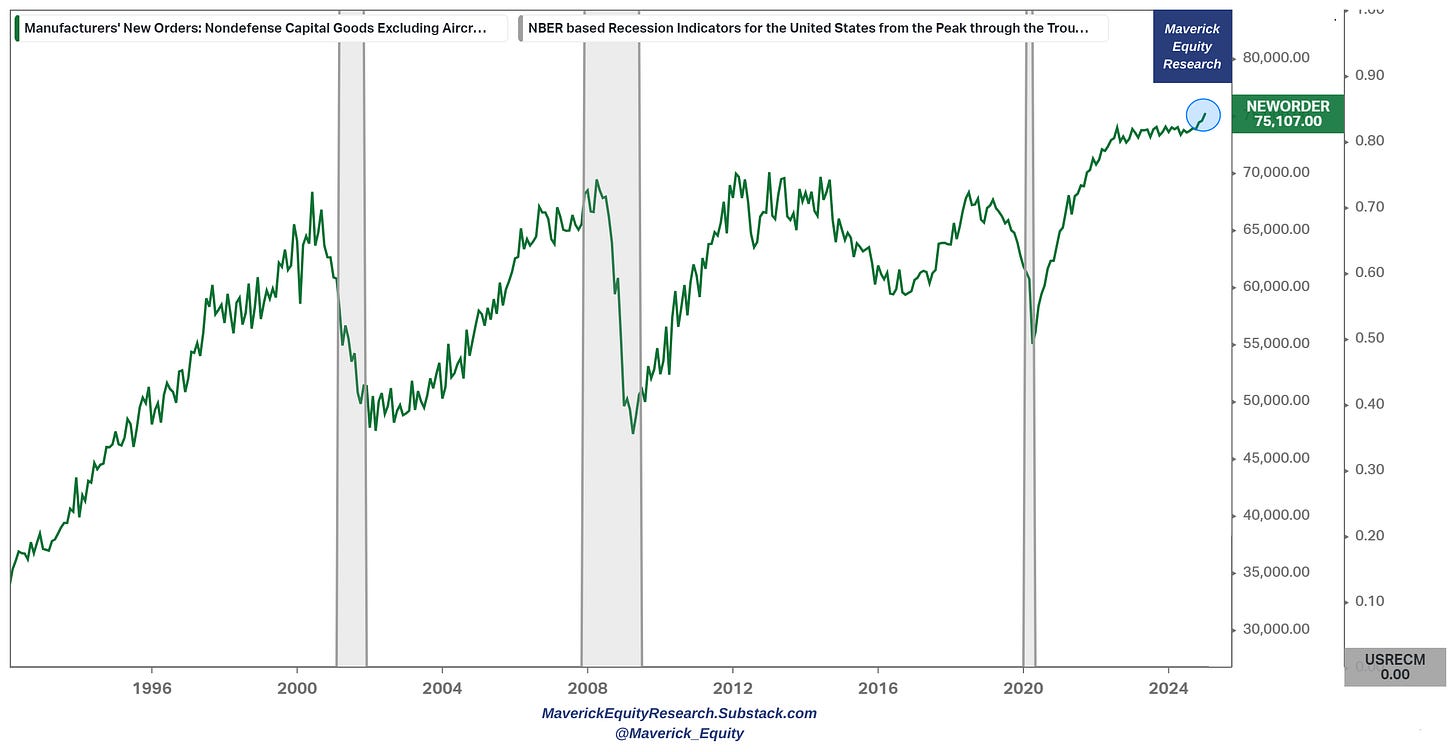

U.S. Economy special chart - business investment activity via ‘core CAPEX’:

👉 with the headlines about the DOGE (Department of Government Efficiency) running around like there is no tomorrow, a key data point you do not see around is on the business investment activity trend

👉 Manufacturers' New Orders for Non-Defense Capital Goods (excluding aircraft) with a very sharp rebound since the 2020 pandemic, and currently at a high level of $75.1 billion

👉 between 2022-2023 it was already at a high level of $73 billion, hence the latest uptick since the 4th quarter of 2024 is more than great to see - it signals strong confidence, hence a positive outlook & economic strength for the months to come

N.B. Manufacturers' New Orders for Non-Defense Capital Goods is also known as ‘core CAPEX’ or simply put ‘business investment’ … so that you can connect the dots and/or do not get confused with other research or media reports

N.B. core CAPEX is regarded as a key factor driving the economy and one of the leading indictors of business activity / business CAPEX - hence to be monitored for any big swings be it up or down (see how it related to the business cycle with the grey bars showing the recession periods)

✍️ The State of the US Economy in 75 Charts, Edition #4 ✍️ is work in progress and coming with further improvements: that and a lot more will be covered in detail with many insights driven by data and delivered via sleek visuals that say 10,000 words.

You can check the 3rd edition as reference:

✍️ The State of the US Economy in 75 Charts, Edition #3

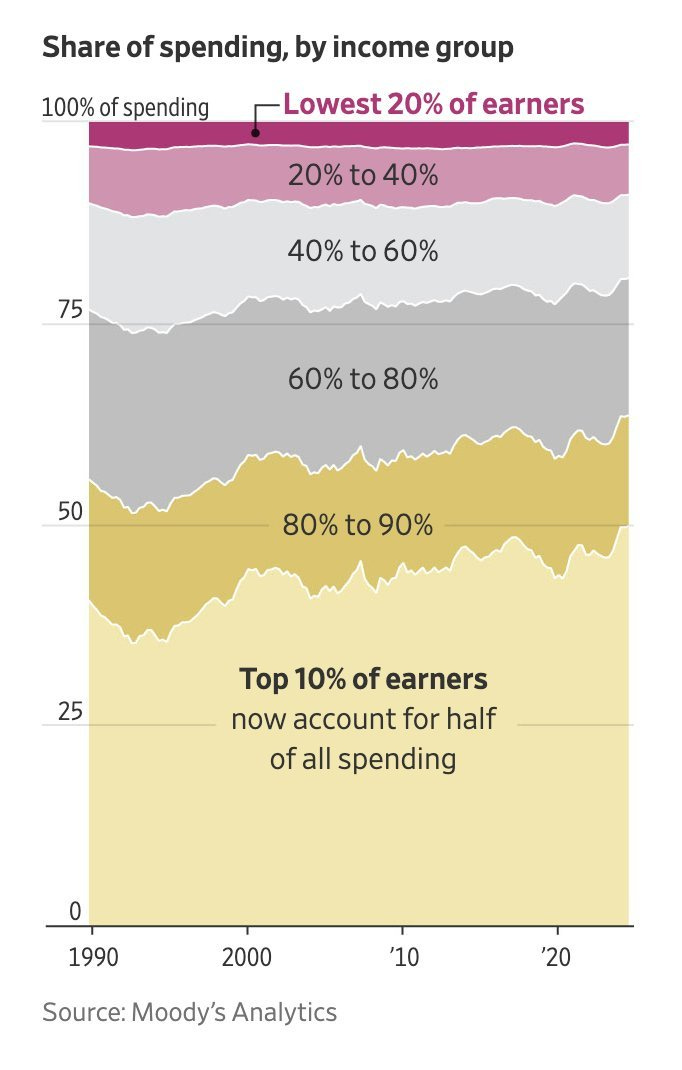

Stock market concentration is NOT a big issue in general, but share of spending in the economy can become a real issue sooner or later:

👉 the U.S. economy depends more than ever on rich people, namely: top 10% of American earners (households making about $250,000 a year or more) account for 49.7% of all spending - they have increased their spending far beyond inflation while everyone else hasn’t

👉 three decades ago, the top 10% accounted for about 36% of spending

S&P 500 Q4 2024 earnings scorecard update as of March 7th:

👉 earnings growth +17.2% (not bad ... at all ...)

👉 revenue growth +5.2% (not bad ... at all either ...)

N.B. in 2025 my distinct S&P 500 reports will get further improved, and this time quite materially with some special metrics you rarely see. Previous editions:

✍️ The S&P 500 Report: Performance, Profitability, Sentiment & More - (5th edition)

Warren Buffett's Cash Pile reached a record $325 billion in 2024 from $167 in 2023, an almost doubling - yielding $12 billion annually in a risk-free fashion

For way more on that, in case you missed my previous take:

✍️ Warren Buffett's Cash Pile ... & More! Maverick Food for Thought #4

Custom metrics as an equities Maverick special:

META/Facebook Family of Apps Profit Margin

👉 despite all the AI investments Meta has made into improving its core products (Facebook, Instagram, & WhatsApp), its family of apps business hit 60% operating margins this quarter

ASML Holding NV (ASML): a single EUV machine from ASML costs $189 million on average = that's 4x what their machines cost in 2012

Amazon (AMZN) AWS operating margin: already a great 30% in 2020, while nowadays a big 37% … for a segment that is naturally growing very well …

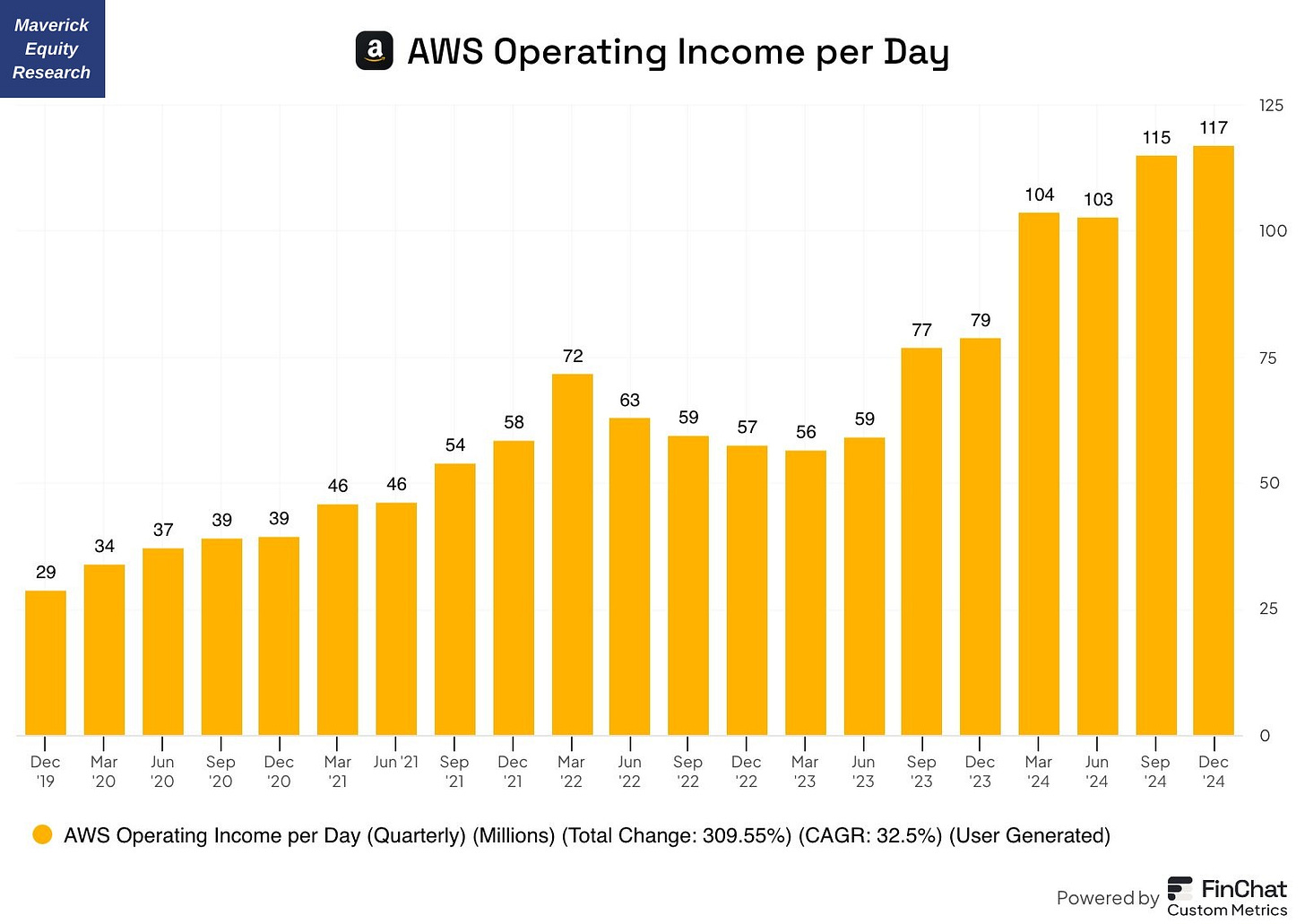

AWS Operating Income per Day: in 2008, a reporter asked Jeff Bezos: "How much money are you willing to lose on AWS?". AWS now generates $117 million in operating income every single day. Quite amazing …

CapEx time: Amazon spends more on CapEx than any other company in the world. Of the $60 billion, more than 50% is dedicated to AWS, let that one sink in!

Amazon (AMZN) Advertising Services revenue channel:

AWS segment getting most of the attention, but check also this highly under-covered segment: revenues from … quite a profit driver …

silently becoming a beast: $56B in revenue with 24% CAGR is very serious

Amazon with not one but 3 money-printing machines: AWS, Ads and E-commerce).

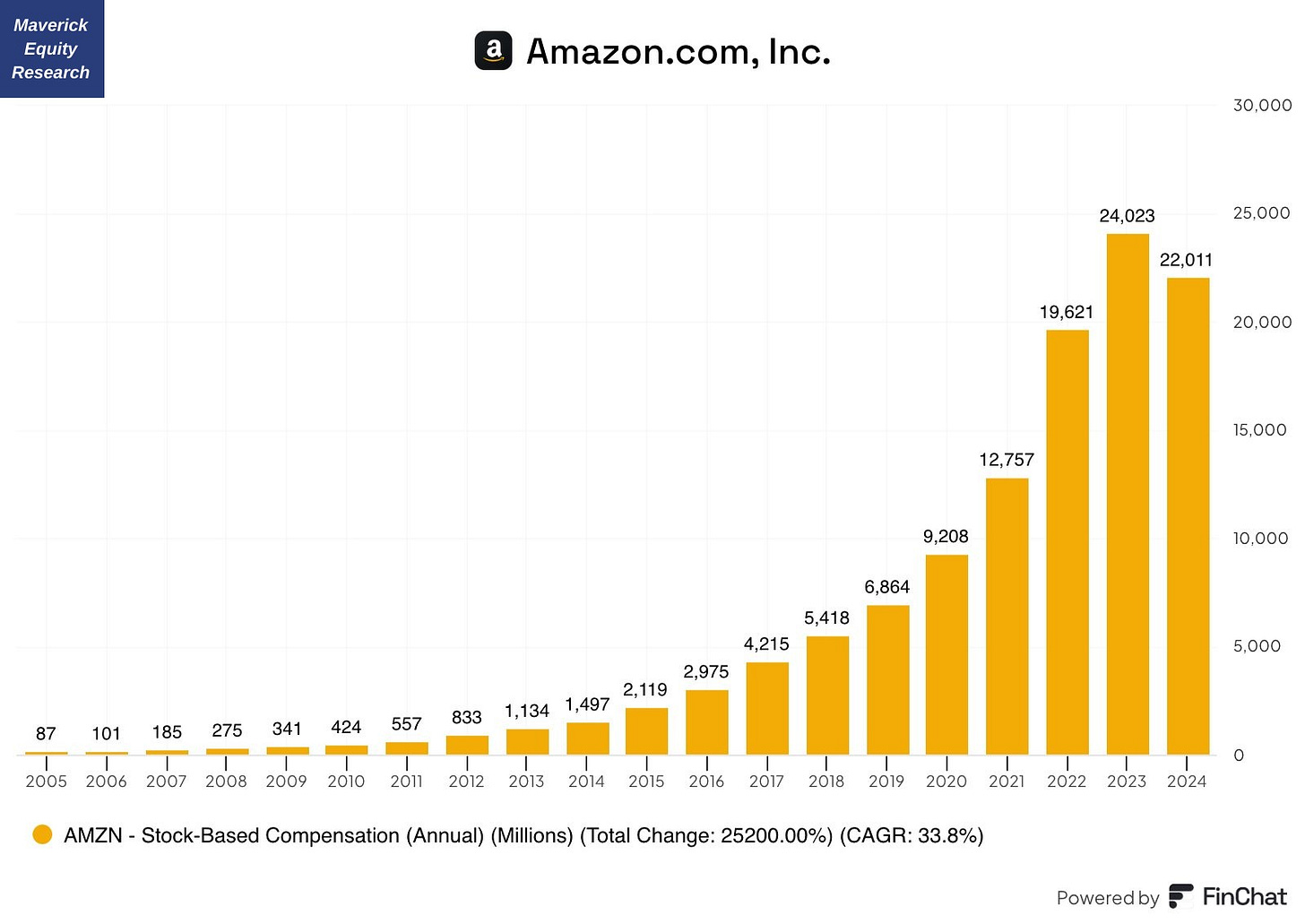

In 2024, Amazon's stock-based compensation (SBC) declined for the 1st time ever:

Switching gears to cherry picked chats from the current Q4 earnings season:

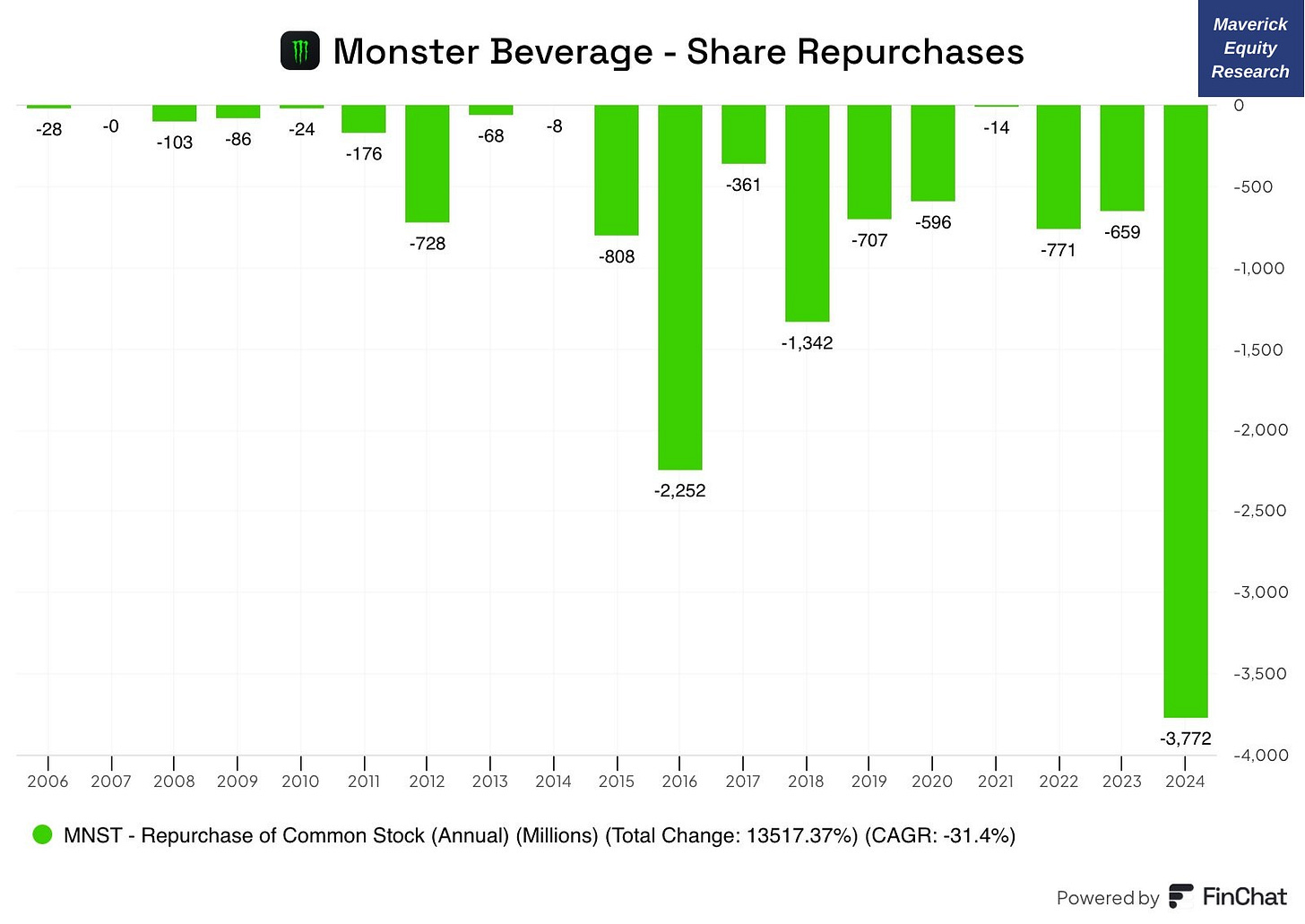

Monster (MNST) - doing ‘Monster’ Buybacks: in a year when Monster's competitive advantages have been called into question, Monster's management made their feelings around the stock clear: the energy drink giant repurchased $3.8B in stock, primarily through a Dutch auction tender offer

Spotify (SPOT) Free Cash Flow: the largest audio streaming company in the world increased profit margins to a level that few investors thought possible

U.S. Big Tech (Amazon, Microsoft, Google, Meta) & Investing: as the proliferation of AI increases the need for more compute power, the big tech giants grew their CapEx (Capital Expenditure) at a very rapid pace

Booking Holdings (BKNG), AirBnB (ABNB) and Expedia (EXPE): despite already being the largest OTA (Online Travel Agency), Booking Holdings is still growing its booking volumes faster than both AirBnB and Expedia

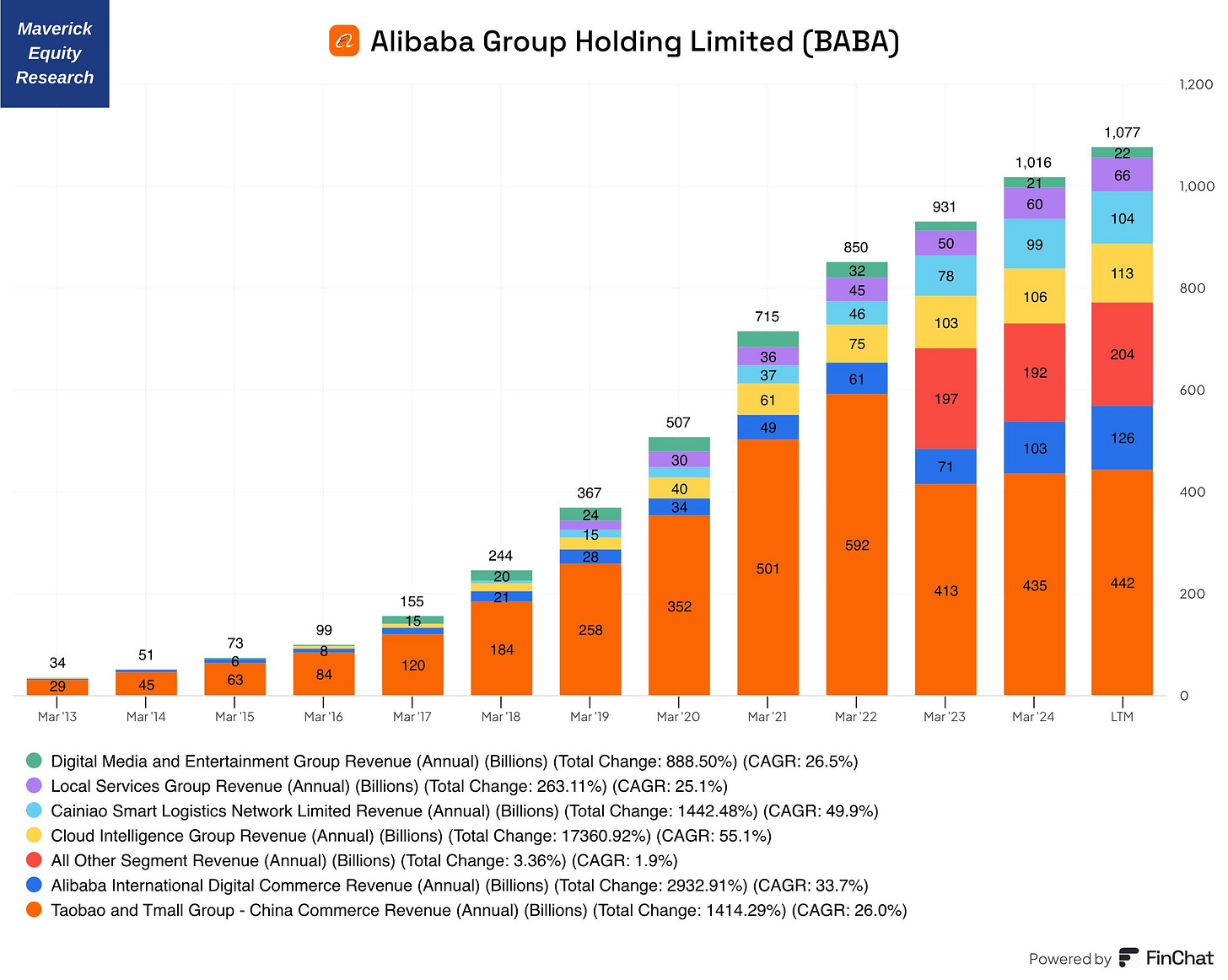

Alibaba (BABA) - Revenue by Category: the Chinese conglomerate faced both regulatory and competitional headwinds, but continues to grow its revenue thanks to introduction of new business lines

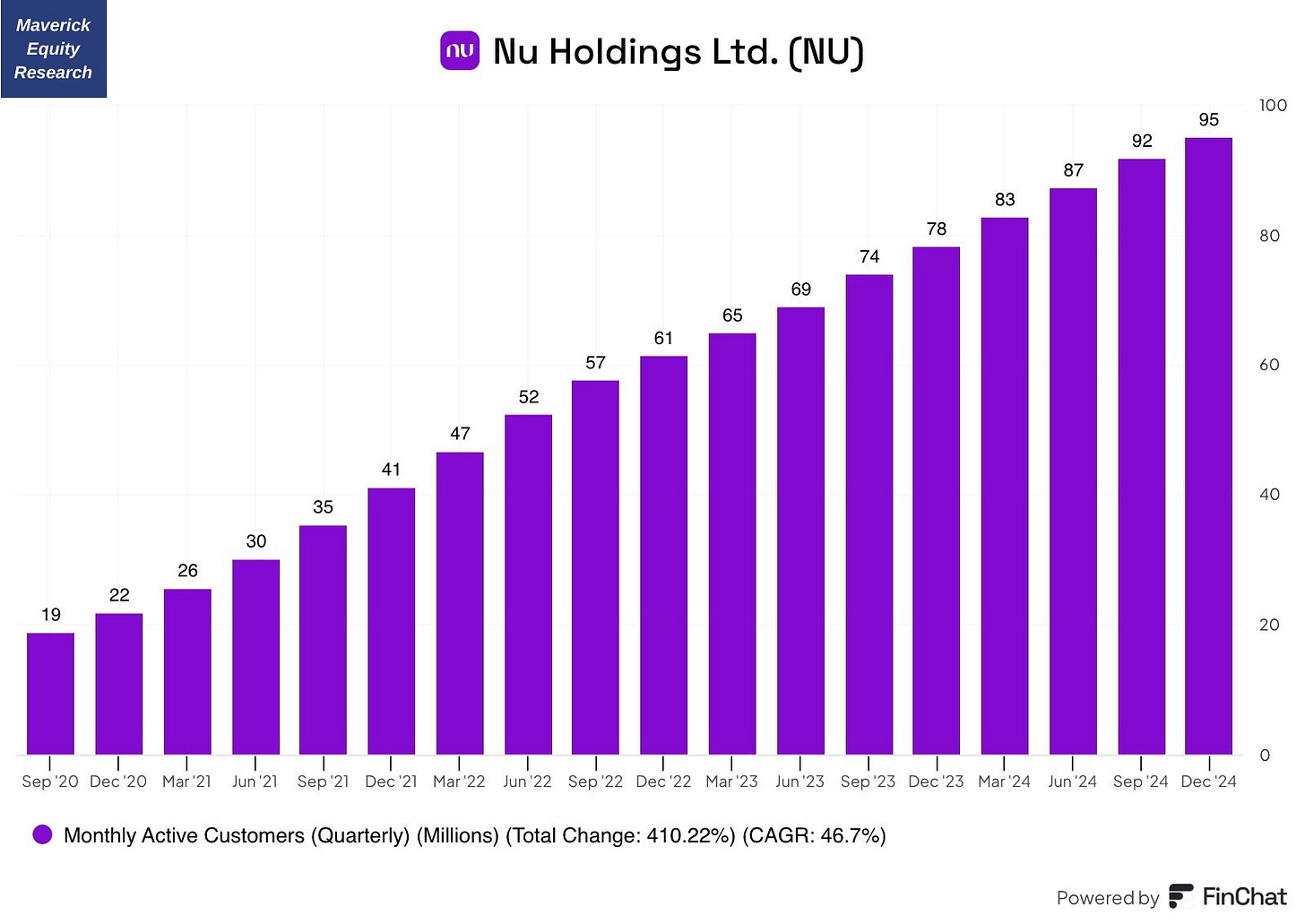

NuBank (NU): the Latin American digital banking app now reaches 95 million monthly active users, which is up 5-fold in just over 4 years …

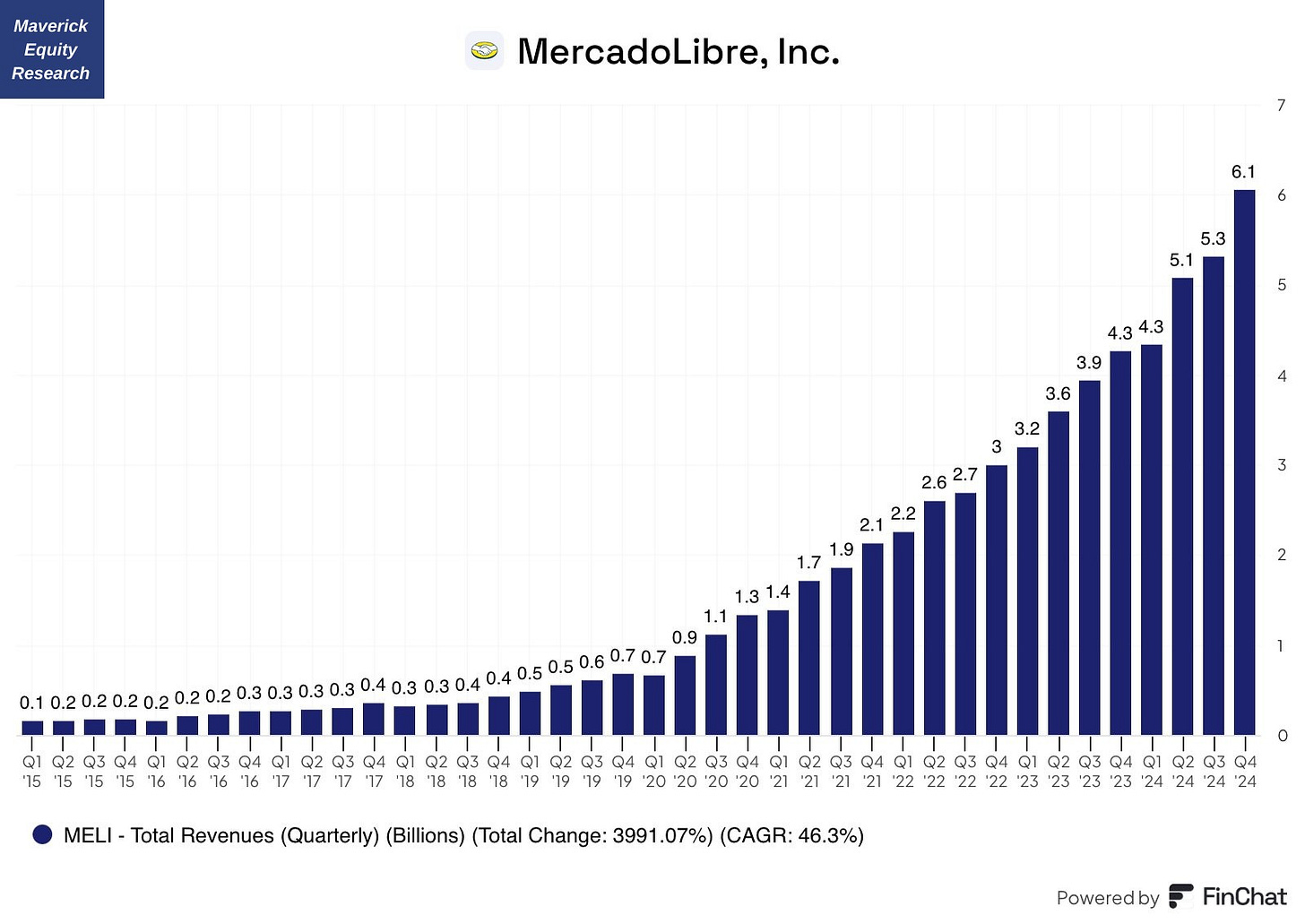

MercadoLibre (MELI) Revenue: South American e-commerce giant has grown revenue at an astounding pace as it has attracted more customers and driven success with its fintech app …

👍 Bonus charts: 3 years of Russia-Ukraine war - key stats and questions answered

I am an optimist-realist, and my base case is that in 2025 the cease fire will happen. Until then, key data points that will serve as food for though and clear confusions.

How many casualties in total over the last 3 years? Over 1.1 million.

👉 70,000 Ukrainian soldiers killed (14%), 190,000 Russian ones (14.2% fighting force)

👉 390,000 Ukrainian wounded, 500,000 Russian (low estimate), 50% return to battle

👉 historical comparative conflicts outlined as well

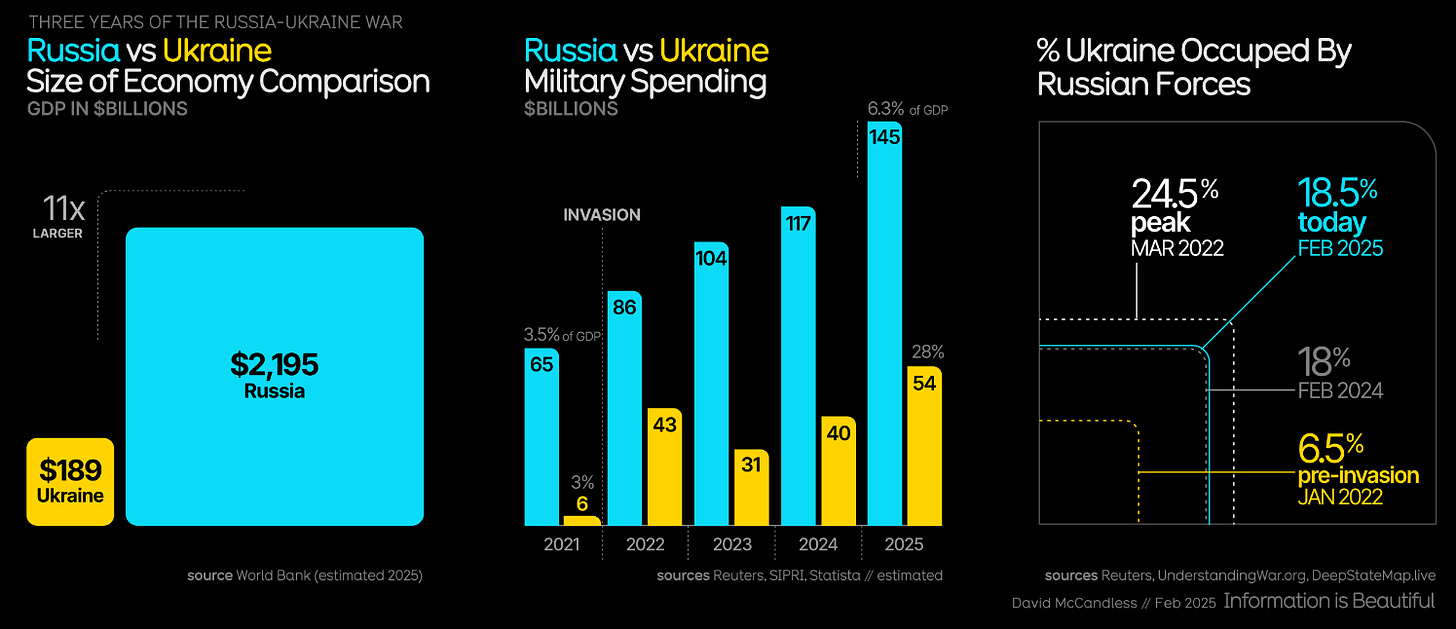

What % of Ukraine does Russia occupy + economy size and military spending

👉 18.5% today: from 6.5% pre-invasion in January 2022, 18% February in 2024 and 24.5% from the peak March 2022

👉 Size of the economies and military spending with Russia off the charts: Russian economy 11x larger, and spending $145 billion (6.3% of GDP) relative to the $54 billion (28% of GDP) from the Ukrainian side

3. Military Aid - Europe has spent as much as the USA on support & aid

👉 USA spent $69 billion, Europe $66 billion

👉 as a % of GDP, USA is #15, a surprising stat for many I am quite sure

👉 going beyond military aid, other aid and to be allocated: Europe’s position is clear!

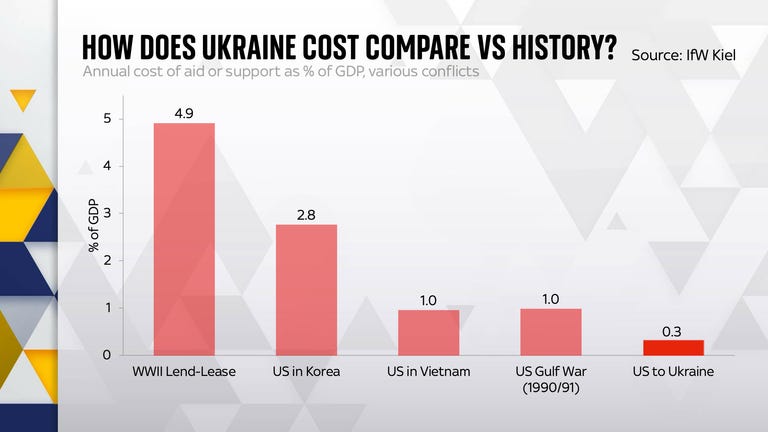

USA aid as % of GDP to Ukraine relative to historical conflicts

👉 0.3% of GDP from USA to Ukraine this time around, way less than previous wars

Ranking the 15 Largest Defense Budgets in the World

👉 America’s defense budget towers over the rest: almost $1 trillion ($996 billion) in 2024 alone (3.4% GDP), 2nd place followed by China by a big margin with $235 billion

👉 NATO members in Europe and Canada spent an average of 2% of GDP on defense. While NATO’s defense budgets have declined since the Cold War, Russia’s military spending has surged by 227% since 2000, and China’s has skyrocketed by 566%.

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this extensive research by finding it interesting, saving you time & getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons! That’ll definitely support bringing in more & more independent investment research!

Like this, the big positive externalities become the name of the game! Thank you!

Have a great day!

Mav 👋 🤝

P.S. the next research will cover key topics via sleek visuals for 2025 & beyond:

✍️ Top 50 Maverick Charts to Watch in 2025 & Beyond! ✍️

Good evening, greetings from Colombia. As always, it is a pleasure to read you. Thank you for your time, the charts, the reflection and, in general, all the education. Good luck and I hope to continue reading you.

Very very good via great visuals as always! THX!