✍️ Maverick Charts of the Week #4: S&P 500, Buffett & Berkshire, U.S. GDP, Unemployment & Federal Interest Payments, Gold

10 sleek Maverick charts that say 10,000 words!

Dear all,

10 charts of the week this time and many with both insight + food for thought! Enjoy!

U.S. Federal Interest Payments = an ugly topic, but some good news just came in (not joking as you might be surprised to see good news on that topic)

👉 $1.11085 trillion in Q1 2025: it is a decline since Q4 & the first decline since 2020

👉 as a % of GDP: 3.71% now, a decline from the 3.8% from Q3 2024

P.S. in case you missed my special report that was dedicated to the U.S. public debt:

✍️ Maverick Special Report #6: U.S. Public Debt Reduction = Hard but Feasible

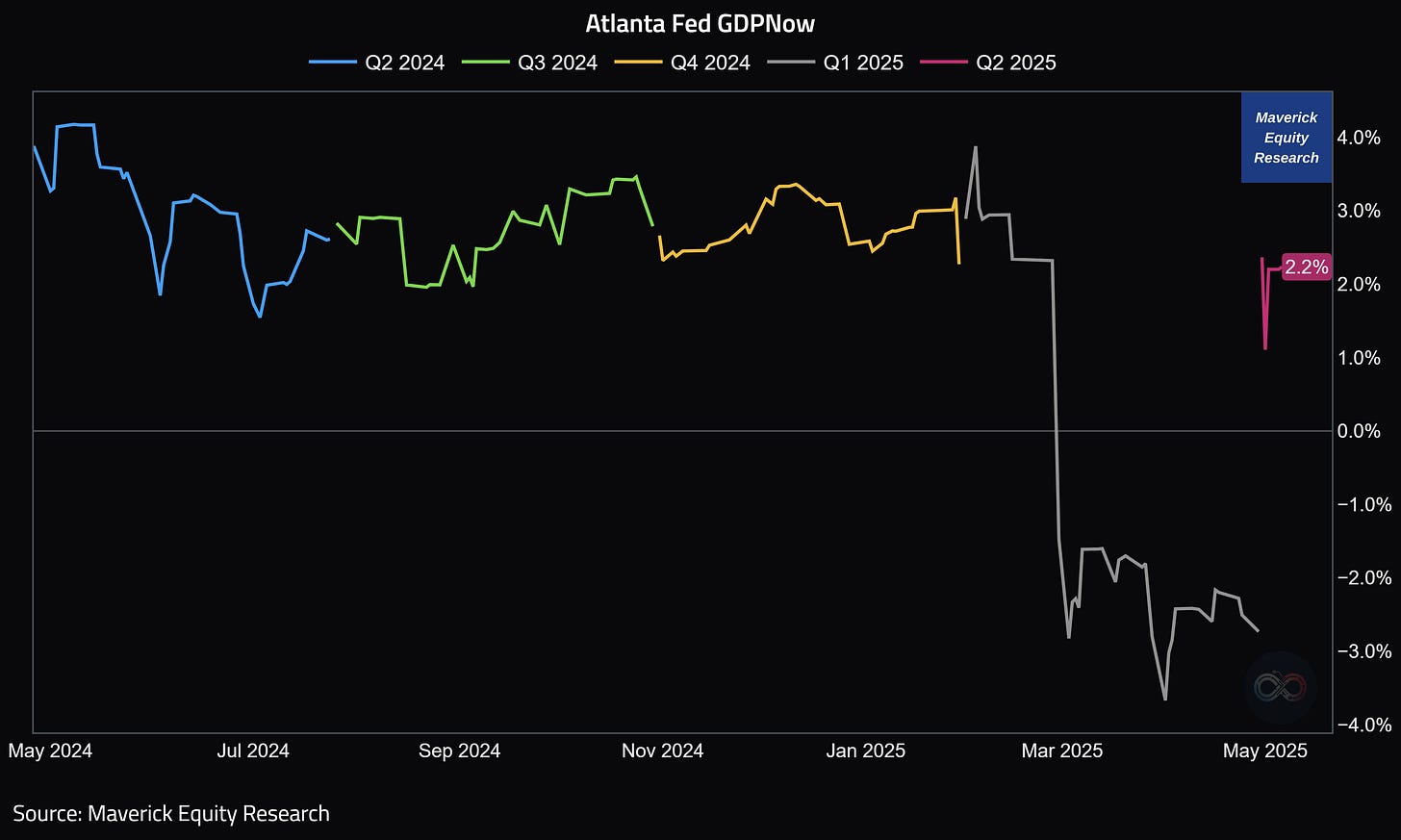

U.S. GDP tracking:

👉 real GDP growth at 2.2% (up from 1.1% on May 1) via Atlanta Fed's latest GDPNow

P.S. way more on the U.S. economy via my dedicated extensive research - 4th edition is work in progress and coming with major improvements - in case you missed the 3rd edition (from 2024), there you go:

✍️ The State of the US Economy in 75 Charts, Edition #3

U.S. Unemployment Rate:

👉 unchanged at 4.2% and below the 36-month moving average of 3.8%

Warren Buffett announced on Saturday that he will be stepping down as Berkshire Hathaway CEO with Canadian Greg Abel to replace him

👉 Berkshire stock (BRKB) down -5.12% on Monday

👉 I heard many opinions across the years: stock to drop 15-25% when that moment will come, some said it will do like the market : my base case scenario was that this was expected hence priced in given he is 94, hence no material drop - I was wrong given 5% down, but being wrong is good sometimes as it means one can buy cheaper …

P.S. in case you missed my takes on on Berkshire, there you go:

✍️ Maverick Special Report #4: Warren Buffett's Cash Pile ... & More!

✍️ Maverick Charts of the Week #1: Who is Outperforming Big Time in 2025?

S&P 500 rose for 9 consecutive days (until yesterday):

👉 after a rollercoaster April with massive volatility who would have thought that?

👉 made it for the longest winning streak since 2004!

S&P 500 Earnings - Actuals:

👉 earnings growth +15.4% (not bad at all ... )

👉 revenue growth +4.7% (not bad either ...)

S&P 500 Earnings - Estimates:

👉 down only 3% in 2025 which is surprising given that April had the Tariff day saga

‘So what is the takeaway Mav?’

👉 the only rationale I have is that analysts do not believe POTUS will/can follow through with the trade war threats

👉 U.S. backed up and started to negotiate quite fast … as I foresaw and tweeted about on April 5th (just 3 days after Liberation Tariff day)

S&P 500 Net Profit Margin (NPM):

👉 above 12% for the 4th straight quarter

👉 also analysts see NPMs improving through the rest of 2025: the estimated NPMs for Q2 2025 through Q4 2025 are 12.5%, 12.9%, and 13.0% respectively

Way more on the S&P 500 via my distinct S&P 500 reports which will get further improved, and this time quite materially with some special metrics you rarely see.

You can check the previous edition:

✍️ The S&P 500 Report: Performance, Profitability, Sentiment & More - (5th edition)

Gold Seasonality Performance (based on Futures) since 1974

👉 the current path/performance is on the very top end of the average/usual path

P.S. in case you missed my Special Situation trading Gold from March which also this year for 11 years in a row had a 100% win rate (I’ll make a dedicated update on it soon):

✍️ Maverick Special Situation #6: 🪙 Gold Special Seasonality Pattern

'Buying Gold' google trend search percentile rank (right) & Gold (left)

👉 Parabolic moves ... need to cool-off a bit sooner or later ... at least for a while

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this by finding it interesting, saving you time and getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons! That’ll definitely support bringing in more & more independent investment research: from a single individual … not a corporate, bank, fund, click-baity media or so … !

Like this, the big positive externalities become the name of the game! Thank you!

Have a great day! And never forget, keep compounding: family, friends, hobbies, community, work, independence, capital, knowledge, research and mindset!

Mav 👋 🤝